Global Market Comments

October 25, 2022

Fiat Lux

Featured Trade:

(FRIDAY, NOVEMBER 4, 2002 LAS VEGAS, NEVADA GLOBAL STRATEGY LUNCHEON)

Global Market Comments

October 24, 2022

Fiat Lux

Featured Trade:

(MARKET OUTLOOK FOR THE WEEK AHEAD, or MY SECRET MARKET INDICATOR),

(SPY), (USO), (TSLA), (TBT), (NFLX), (FXY), (SNAP)

I have access to inside information that is worth far more than any other technical or fundamental data out there.

It is almost always right and has made fortunes for me over the year, the dreams of avarice.

If the SEC knew about it, they would lock me up and throw away the key.

Here it is. But first, let me tell you about the performance it has delivered.

With some of the greatest market volatility in market history, my October month-to-date performance ballooned to +6.55%.

I used last week’s option expiration to take profits on my longs in JP Morgan (JPM), Visa (V), and Tesla (TSLA), and my one short in the S&P 500 (SPY). That leaves me with only one short in the (SPY) and 90% cash.

My 2022 year-to-date performance ballooned to +76.23%, a new high. The Dow Average is down -14.37% so far in 2022.

It is the greatest outperformance on an index since Mad Hedge Fund Trader started 14 years ago. My trailing one-year return maintains a sky-high +76.50%.

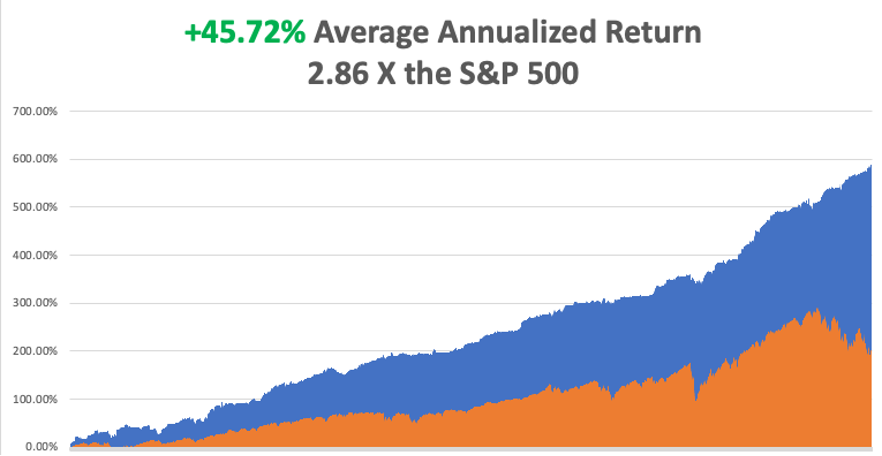

That brings my 14-year total return to +586.79%, some 2.86 times the S&P 500 (SPX) over the same period and a new all-time high. My average annualized return has ratcheted up to +45.72%, easily the highest in the industry.

So here is my unfair advantage:

I get to see what my own customers do, and I’m the only one who sees it.

For my own subscribers are among the most highly trained and disciplined in the market. 50% a year profits are common and every year, I learn of a couple of 1,000% profits (or 10X returns).

And here is what my customers are telling me today.

The end of the bear market is near. In fact, a “Big Turn” across all asset classes may be upon us.

Bonds are about to bottom out and yields peak. The US dollar may be double-topping. Commodities are crawling off a bottom. Price earnings multiples for stocked have just cratered from 21X to a decade low of 16X. Many stocks, like Tesla are trading at the lowest multiples in their lives.

Thus, the demand for LEAPS recommendations that offer tenfold two-year returns on far more modest equity appreciation has been skyrocketing.

I can’t blame them.

A final capitulation in the bond market is fast approaching. The United States Treasury Bond Fund (TLT) has collapsed by $88, from $180 to $92, or some 48.89%, covering the last six points in two days.

Ten-year yields have rocketed from 2.55% to 4.43% since August. The 2X short bond ETF (TBT) has spiked from $14 to $39 in a year. If you don’t cover the bond market on a daily basis, you may not know this.

It just so happens that I do.

It's an old investment nostrum that if you want to know what stocks are going to do, then take a close look at the bond market.

As Winston Churchill once said, “This is not the end. It is not even the beginning of the end. But it is, perhaps, the end of the beginning.”

If you believe that the last interest rate hike in this cycle is only two months off, and we see interest rate cuts after that, then you need to be buying stocks now. You may be risking 10% of downside if you do, but miss out on 100% of upside if you don’t.

Here's another market old reliable. Markets always move more than you expect.

These may all sound like bold predictions. But then my followers are coming off of the best year for trading and investment in their entire lives. Confidence begets confidence.

If you are searching for global contagion, you don’t have far to look. The Japanese yen has cratered some 24% this year and is down by half from its last peak. That’s because the Bank of Japan, one of my old haunts, remains stubbornly insistent that ten-year JBG yields remain pegged at 0.25% while the US was raising from 0.25% to 4.43%.

You have to wonder what they are smoking in the Land of the Rising Sun. Their goal was to create a massive export boom with an ultra-cheap currency and runaway inflation with all the money printing. So far it hasn’t happened. GDP growth in Japan is stuck at snail-like 1.7%, while inflation remains a lowly 3.00%.

Go to Japan for the sushi, the public baths, and the Kurosawa samurai movies, not for inspiration on economic policy, which has been a disaster for 45 years. It’s tough to prosper against a gail-force demographic headwind.

Foreign exchange markets are easy to trade. You just follow the money and pile into the currency with the best yield advantage. Right now, that happens to be the US dollar (UUP).

Why wasn’t I selling short the Japanese yen (FXY) earlier this year? Because there were far better opportunities selling short US stocks, which I amply took advantage of.

It’s all in my numbers.

UK Government Collapses, with the resignation of prime minister Liz Truss in the shortest government in history. A new conservative leader will be elected next week. Truss took over a sinking ship. Her promised tax cuts delivered a fall in the British pound to a 40-year low. No matter what any future leader does, the UK standard will drop by half in the coming years, thanks to Brexit. THE HEAD OF LETTUCE WON!

30-Year Fixed Rate Mortgage Hits an Eye-popping 7.4%, in a clear Fed effort to shut down the real estate market. If this doesn’t kill the economy, nothing will. But home prices are nowhere near to 50%-70% declines seen in 20098-2011.

Existing Home Sales Plunge 23.8% YOY, in September, in the eighth straight month of sales declines. There are 1.2 million homes for sale, a six-month supply. The median home prices rose to $384,800.

Housing Starts Hit Two-Year Low, as the luxury end takes a hit. Starting families can no longer buy more houses than they can afford.

US Budget Deficit Drops by Half, after the sharpest decline in government spending in history. The red ink shrank from $2.78 trillion to only $1.38 trillion. It’s why I think the bond market may soon be bottoming out, with the (TLT) at $92 and the (TBT) at $38. A trillion here, a trillion there, and sooner or later, it adds up to a lot of money.

Ten-Year US Treasury Yields Hit 20-Year High, at 4.43%. If you’re waiting for rates to peak before buying stocks, it’s not yet. I’m looking for 4.50% before the crying is all over.

Fed Beige Book Says the Economy is Growing Modestly, an improvement from the last one. Travel & tourism is booming, auto sales are sluggish, and retail spending is flat. Manufacturing is steady, thanks to easing supply chain problems. High mortgage rates are a problem. Labor is still tight. It’s a very mixed report.

Tesla Earnings Beat Estimates for the 13th consecutive quarter profitability, taking the shares down 5%. Revenues came in at 24 billion, while units sold hot 340,000. The strong dollar is weakening Chinese and European sales. Tesla is still a decade ahead of the competition and boasts a global footprint. Production could hit 450,000-500,000 in Q4 once Austin and Berlin go to full production. The only competition will come from China. The Cybertruck comes out in 2023 and already has a million orders.

Netflix Earnings Blow Out, taking the stock up 15%, after a massive crackdown on password sharing. Some 30 million views are still watching the streaming channel for free. Some 2.41 new subscribers joined in Q3. The shift to advertising is next. Buy (NFLX) on dips.

SNAP Dives by 25%, thanks to a horrific earnings shortfall. Advertising Demand went from overwhelming to non-existent practically overnight. Small-cap growth is still being punished severely for any disappointments. The company is cutting 20% of its staff. Avoid (SNAP).

Supply Chain Problems are Disappearing, as two years of port congestion ease. A slowing economy is helping. After a year, I finally got my sofa from Vietnam. Overorders are coming back to haunt big retailers.

My Ten-Year View

When we come out the other side of the recession, we will be perfectly poised to launch into my new American Golden Age, or the next Roaring Twenties. With the economy decarbonizing and technology hyper-accelerating, there will be no reason not to. The Dow Average will rise by 800% to 240,000 or more in the coming decade. The America coming out the other side will be far more efficient and profitable than the old. Dow 240,000 here we come!

On Monday, October 24 at 8:30 AM, the S&P Global Flash PMI for September is released.

On Tuesday, October 25 at 7:00 AM, the S & P Case Shiller National Home Price Index for July is out.

On Wednesday, October 26 at 8:30 AM, New Home Sales for September are published.

On Thursday, October 27 at 8:30 AM, Weekly Jobless Claims are announced. US Q3 GDP is also announced.

On Friday, October 28 at 8:30 AM US Personal Income & Spending is printed. At 2:00 the Baker Hughes Oil Rig Count is out.

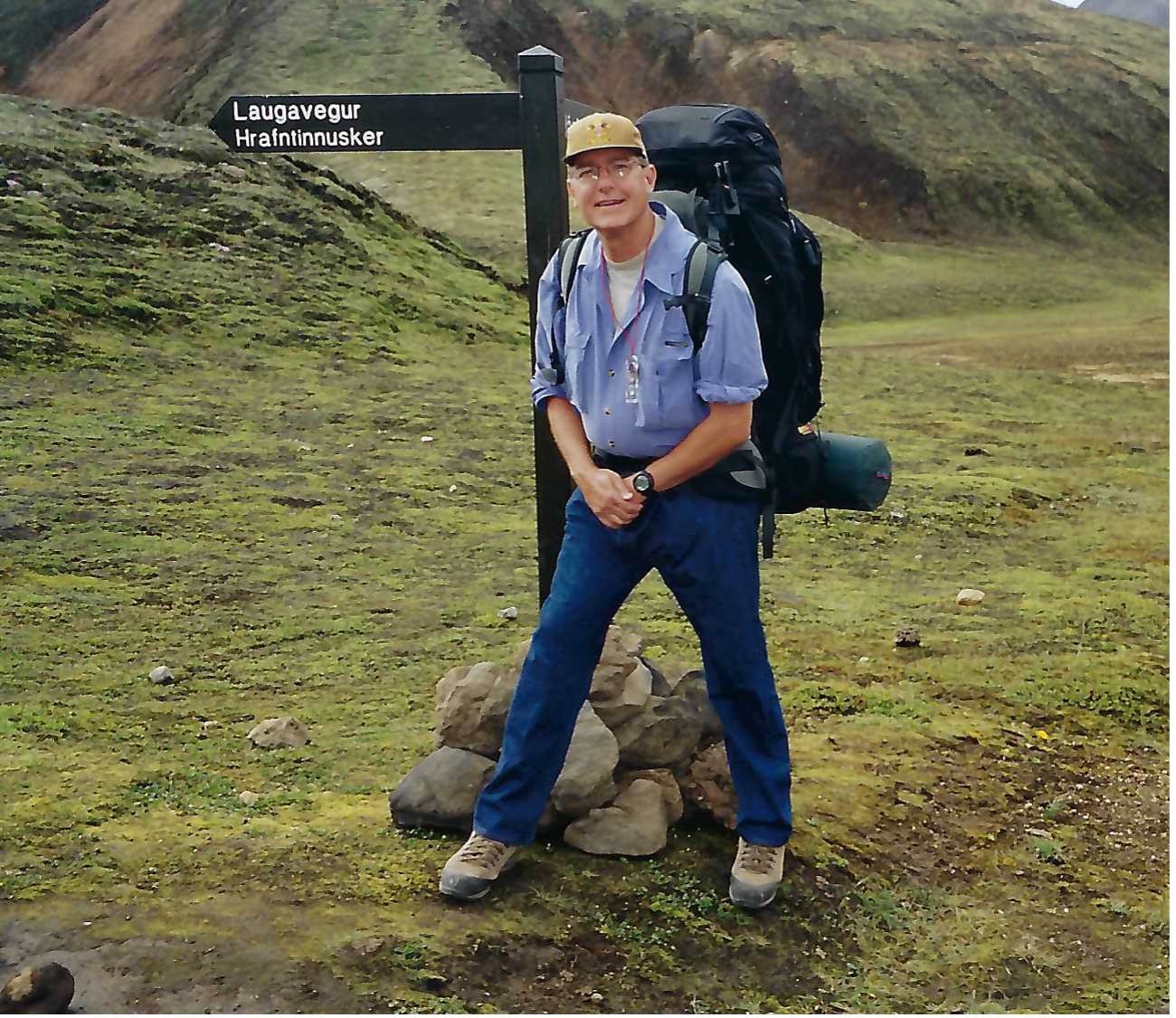

As for me, back in 2002, I flew to Iceland to do some research on the country’s national DNA sequencing program called deCode, which analyzed the genetic material of everyone in that tiny nation of 250,000. It was the boldest project yet in the field and had already led to several breakthrough discoveries.

Let me start by telling you the downside of visiting Iceland. In the country that has produced three Miss Universes over the last 50 years, suddenly you are the ugliest guy in the country. Because guess what? The men are beautiful as well, the decedents of Vikings who became stranded here after they cut down all the forests on the island for firewood, leaving nothing with which to build long boats. I said they were beautiful, not smart.

Still, just looking is free and highly rewarding.

While I was there, I thought it would be fun to trek across Iceland from North to South in the spirit of Shackleton, Scott, and Amundsen. I went alone because after all, how many people do you know who want to trek across Iceland? Besides, it was only 150 miles, or ten days to cross. A piece of cake really.

Near the trailhead, the scenery could have been a scene from Lord of the Rings, with undulating green hills, craggy rock formations, and miniature Icelandic ponies galloping in herds. It was nature in its most raw and pristine form. It was all breathtaking.

Most of the central part of Iceland is covered by a gigantic glacier over which a rough trail is marked by stakes planted in the snow every hundred meters. The problem arises when fog or blizzards set in, obscuring the next stake, making it too easy to get lost. Then you risk walking into a fumarole, a vent from the volcano under the ice always covered by boiling water. About ten people a year die this way.

My strategy in avoiding this cruel fate was very simple. Walk 50 meters. If I could see the next stake, I proceeded. If I couldn’t, I pitched my tent and waited until the storm passed.

It worked.

Every 10 kilometers stood a stone rescue hut with a propane stove for adventurers caught out in storms. I thought they were for wimps but always camped nearby for the company.

One of the challenges in trekking near the north Pole is getting to sleep. That because the sun never sets and its daylight all night long. The problem was easily solved with the blind fold that came with my Icelandic Air first class seat.

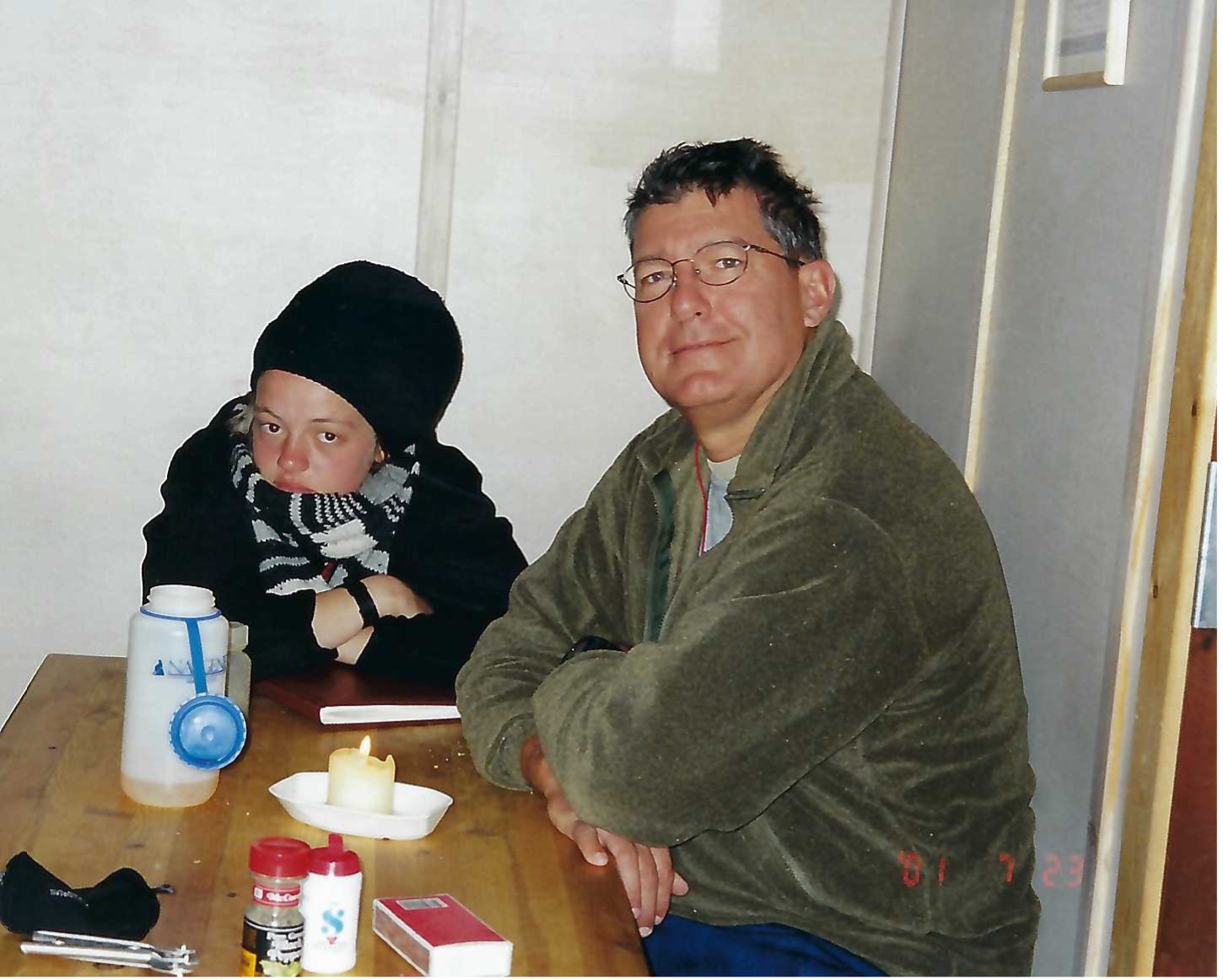

I was 100 miles into my trek, approached my hut for the night and opened the door to say hello to my new friends.

What I saw horrified me.

Inside was an entire German Girl Scout Troop spread out in their sleeping bags all with a particularly virulent case of the flu. In the middle was a girl lying on the floor soaking wet and shivering, who had fallen into a glacier-fed river. She was clearly dying of hypothermia.

I was pissed and instantly went into Marine Corp Captain mode, barking out orders left and right. Fortunately, my German was still pretty good then, so I instructed every girl to get out of their sleeping bags and pile them on top of the freezing scout. I then told them to strip the girl of her wet clothes and reclothe her with dry replacements. They could have their bags back when she got warm. The great thing about Germans is that they are really good at following orders.

Next, I turned the stove burners up high to generate some heat. Then I rifled through backpacks and cooked up what food I could find, force-fed it into the scouts, and emptied my bottle of aspirin. For the adult leader, a woman in her thirties who was practically unconscious, I parted with my emergency supply of Jack Daniels.

By the next morning, the frozen girl was warm, the rest were recovering, and the leader was conscious. They thanked me profusely. I told them I was an American “Adler Scout” (Eagle Scout) and was just doing my job.

One of the girls cautiously moved forward and presented me with a small doll dressed in a traditional German Dirndl which she said was her good luck charm. Since I was her good luck, I should have it. It was the girl who was freezing to death the day before.

Some 20 years later, I look back fondly on that trip and would love to do it again.

Anyone want to go to Iceland?

Stay Healthy,

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader

Iceland 2001 with German Girl Scout

If a cluttered desk is a sign of a cluttered mind, what is an empty desk a sign of?” asked Albert Einstein.

Global Market Comments

October 21, 2022

Fiat Lux

Featured Trade:

(OCTOBER 19 BIWEEKLY STRATEGY WEBINAR Q&A),

(BAC), (USO), (SPY), (TSLA), (NFLX), (TBT), (PLTR), (SNOW)

Below please find subscribers’ Q&A for the October 21 Mad Hedge Fund Trader Global Strategy Webinar broadcast from Silicon Valley in California.

Q: Bank of America (BAC) said the US consumer is strong and lending is robust. Does this mean no recession in 2023?

A: It could, because remember that while some sectors are clearly in recession, like real estate and automakers, and have been for a while, others are absolutely booming, like the airline business, and the banking business. There may not be a recession in here, or if there is one, it’s a very slight one. Count on the market to first discount a severe recession which would take the S&P 500 down to $3,000-$3,200 or so; and that’s what markets do, always overly pessimistic at the bottom and overly euphoric at tops. You can make your living off of this.

Q: What do you think about OPEC's behavior (USO) and its influence on the price of oil?

A: Clearly, they’re trying to influence the midterm elections and get an all-republican pro-oil Congress, which will be nicer to OPEC. That’s certainly what they got with the last administration and it’s safe to say that the pro-climate administration of Biden and the Saudis get along like oil and water. But long term, OPEC knows it’s going to zero, and in fact, Saudi Arabia has plans to turn their entire oil supply into hydrogen which can be exported and burned cleanly. I know the team here at UC Berkeley that’s working on that with the Saudi government. Cheap hydrogen also means airships come back, how about that? Hindenburg anyone?

Q: Will draining the Strategic Petroleum Oil Reserve (SPR) backfire, meaning deflation for the US economy and administration?

A: No, the SPR outlived its usefulness maybe 30 years ago—it’s essentially a government subsidy for Texas and Louisiana, and for the oil industry, that has taken on a life of its own. When we started the SPR in 1975, the US got more than half of its oil from the Middle East. Now, it’s almost zero. It goes to China instead. If we are a net energy producer and we have been for over 5 years, why do we even need a petroleum reserve? So no, I think we should shut it down and sell all the oil that’s in there. And it becomes even less relevant as more of the US economy turns over to alternatives.

Q: How do we operate our military with no oil?

A: The pentagon is working on a no-oil future, developing alternative fuels for all kinds of things that you wouldn’t imagine are possible. For example, instead of using diesel, jet fuel, or gasoline for our vehicles, you outfit them with electric batteries, and when the batteries go dead you just air drop new fully charged ones. It’s much better than trying to transport gasoline across the desert in a giant fuel bladder, which can be taken out by a single bullet and is what they do now. Take the pilots out of fighters and they become so light they can operate on battery power. So yes, the pentagon has actually been in the forefront of using every alternative technology they can get their hands on from the early days. Better they get them first before an enemy does.

Q: We will almost always need petroleum; far too many products use it as an ingredient.

A: That is absolutely right. Some will probably never be replaced, like asphalt, feedstock, or plastic. However, those represent less than 10% of the current oil demand. So yes, there always will be an oil industry, it just might be a heck of a lot smaller than it is now. You eliminate cars from the picture, and that’s half of all oil demand in the United States right there. And in most places in the United States, it will be illegal to sell a car that uses gasoline in 12 years. And do you make 30-year investments based on demand for your product dropping by half in 12 years? No, you don’t, which is why the oil companies themselves won’t invest in their own industries anymore. They’re only paying out profits as dividends and buying back shares, which they never used to do.

Q: Do you think the Standard & Poor’s 500 Index (SPX) $3,500 was the bottom?

A: No, we actually did get a little bit lower than that. We will be in a bottoming process over the next several months, but the pattern will be the same. Tiny marginal new bottoms, maybe 100 points lower than the last, and then these gigantic rallies. If we do make bottoms they will only be for seconds, so the way to deal with that is to only put in really low-limit orders to buy stuff, assuming 1,000 points down, and just keep entering the order every day. Eventually, you’ll get one of these throw-away fills when the algorithms panic and a bunch of market orders hit the market. That's the way to deal with that.

Q: I would say that Biden is trying to influence the elections by releasing oil reserves.

A: Absolutely he is, but then so is the oil industry, taking half of the refineries off stream 2 months before the elections, and spiking oil prices. So it’s a battle of the oil price going on here. No love lost between the oil industry and Biden, and US consumers for that matter. I don’t care if gasoline is $7 a barrel because I never buy it; I am all electric. But for a lot of working people, that’s definitely a lot of money.

Q: How concerned are you about the US going to a cashless currency?

A: I’m not worried because I pay my taxes and I don’t break any laws. If you don’t pay taxes and do break laws, like engaging in drug dealing or bribery, you should be extremely worried, as that would be the eventual goal of a cashless economy. That and the fact that the government has to spend $300 million a year printing paper money, which they’d love to get rid of. And of course, it’s cheaper for businesses to use digital currencies. Most countries in Europe don’t use physical currency anymore—it’s credit cards only.

Q: Do you expect Tesla (TSLA) to pop after earnings?

A: I have no idea; it depends on what the report says but suffice it to say that Tesla is historically cheap. It has the lowest PE multiple now than it has in the entire 13-year history of the company. Scale in on the LEAPS with Tesla—that’s what I’d be doing down here.

Q: Could the US debt situation spiral into something that gets out of hand?

A: No, because the purchasing power of debt is now deflating at an 8.4% annual rate, which means that it goes to zero in about 8.57 years. This is how the government always wins when issuing debt. It’s been going on since the French first issued government debt 300 years ago. Who pays for that? Bond investors. Anybody who owns bonds now has seen their purchasing power go up in smoke. That’s why it’s been a one-way zero bid market for two and a half years—they’ve been dumping like crazy.

Q: Should I buy debt here or sell it?

A: We’re actually getting close to a bottom in the junk debt market, which means you’re going to be yielding around 10%. That means the value of your holding doubles in 6 years, and the default rates never reach the high levels predicted by analysts in junk bonds. That has always been the key to junk bonds in the whole 50 years that I've been following this market. My neighbor up in Tahoe, Mike Milliken, made billions off that assumption.

Q: What do you think about Netflix (NFLX)?

A: Well, my advice was to buy it, to a lot of people. They’re clearly changing their business model for the better—they’re going to start picking up ad revenues, they’re cracking down on password sharing, and they delivered a 20% return in stocks. Plus their share price has just dropped down from $700 to $165. Great LEAP candidate here.

Q: What kind of position is best if a recession hits?

A: Cash. Cash is now yielding 4.4%. The best cash alternative is 90-day T-bills issued by the US Treasury. Execution costs almost zero, and liquidity is essentially infinite; but, remember also that bull markets start 6 to 9 months before recessions end. You just have to watch your timing. Which means that if the recession ends in say July, you have to be buying stocks today. Just keep that in mind, ladies and gentleman.

Q: How do you see the futures of semis?

A: Anything you buy here now will triple in three years, but it becomes a question of how much pain you want to take in the meantime. Everyone in the investment management industry thinks the same, and it really is a classic “catch-a-falling-knife” situation— knowing that the payoff down the road is enormous. Virtually all companies are designing new semis into their products at an exponential rate.

Q: Are LEAPS part of the service?

A: Yes, they are. I will send you one tomorrow. But concierge customers get first priority because that’s what they’re paying for.

Q: How far out should we go?

A: On LEAPS, always take the maximum maturity, which is usually 2 years and 4 months. And the reason is that the second year is almost free—they charge you almost nothing for going out to maximum maturity. And if we have a recession that does last longer than people think, that extra year of maturity will be worth its weight in gold. It’ll be the difference between a zero return and a 10x return.

Q: Can we go back into the ProShares UltraShort 20+ Year Treasury (TBT)?

A: No, it would be a horrible idea to buy the (TBT) here after it just moved from $14 to $36. That’s what you buy before it goes from $14 to $36. We’re topping out in all of these short bond plays, so avoid them like the plague.

Q: How much is the Concierge Service?

A: It’s $12,000 a year—and a bargain price at that! Almost everybody ends up covering that on their first trade, and you get an entire portfolio of LEAPS and a dedicated LEAPS website with the service. You also get my personal cell phone number so you can call me while I'm either on the beach in Hawaii or on the ski slopes of Lake Tahoe. If anyone has questions about the concierge service, contact customer support at support@madhedgefundtrader.com.

Q: What are your thoughts on data analytics companies Snowflake (SNOW) and Palantir (PLTR)?

A: Love Snowflake, hate Palantir because the CEO isn’t interested in promoting a share price. With (SNOW), you have Warren Buffet as a major holder, so that’s all you need to know there. (SNOW) also has a 75% fall behind it.

Q: Thoughts on the Ukraine/Russia war?

A: It’ll drag on well into next year, and obviously the Iranian drones are the new factor here. I wouldn’t be surprised if there were suddenly an accident at a certain factory in Iran; that’s what happens when these things play out.

Q: Is Snowflake (SNOW) a buy right now?

A: It’s like all the rest of tech. High volatility, could have lower lows, but long-term gains are at least a triple from here. You know how much risk you can take.

To watch a replay of this webinar with all the charts, bells, whistles, and classic rock music, just log in to www.madhedgefundtrader.com, go to MY ACCOUNT, click on GLOBAL TRADING DISPATCH, then WEBINARS, and all the webinars from the last 12 years are there in all their glory.

Good Luck and Stay Healthy,

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader

Dungeon in Montreux Castle on Lake Geneva in Switzerland

The 40-year bull market in bonds is over,” said Dr. Jeremy Siegal of the Wharton School of Business. I agree heartily.

Global Market Comments

October 20, 2022

Fiat Lux

Featured Trade:

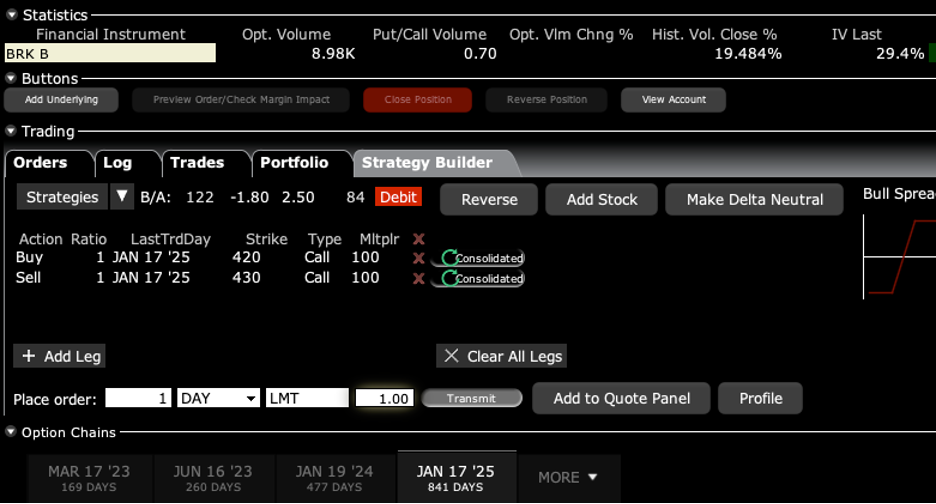

(Berkshire Hathaway B Shares (BRKB) January 2025 $420-$430

deep out-of-the-money vertical Bull Call spread LEAPS)

(BRKB)

BUY the Berkshire Hathaway B Shares (BRKB) January 2025 $420-$430 deep out-of-the-money vertical Bull Call spread LEAPS at $1.00 or best

Opening Trade

10-20-2022

expiration date: January 17, 2025

Number of Contracts = 1 contract

You don’t necessarily need to enter this position today. A big selloff would be ideal. But Berkshire Hathaway should be at the core of any long-term LEAPS portfolio.

If you are looking for a lottery ticket, then here is a lottery ticket.

While the chance of winning a real lottery is something like a million to one, this one is more like 2:1 in your favor. And the payoff is 9:1. That is the probability that (BRKB) shares will double over the next two years and four months.

We have one of the greatest double bottoms on the charts of all time setting up for Berkshire Hathaway right here.

With the Volatility Index (VIX) above $32 today, it’s time to start loading the boat with risk again.

Berkshire Hathaway is the investment vehicle managed by Oracle of Omaha Warren Buffet. The 40-year average annualized increase in book value is 19.0%. It is heavily weighted in high cash flow financials and domestic recovery stocks. Its sole major technology stock is Apple, which it has recently been selling.

The top holdings of (BRKB) are Apple (AAPL), Bank of America (BAC), Coca-Cola (KO), American Express (AXP), and Kraft Heinz (KHC).

Berkshire Hathaway “B” shares are the seventh largest component of the S&P 500 (SPY) with a market capitalization of $609 billion, and the only class of shares that trade options. It is a great play on the domestic cyclical recovery half of the US economy. For more about Berkshire Hathaway, please read my extended research piece below.

To learn more about the company, please visit their website at https://berkshirehathaway.com.

I am therefore buying the Berkshire Hathaway B Shares (BRKB January 2025 $420-$430 deep out-of-the-money vertical Bull Call spread LEAPS at $1.00 or best.

Don’t pay more than $1.50 or you’ll be chasing on a risk/reward basis.

January 2025 is the longest expiration currently listed. Please note that these options are illiquid, and it may take some work to get in or out. Executing these trades is more an art than a science.

Let’s say the Berkshire Hathaway B Shares (BRKB) January 2025 $420-$430 deep out-of-the-money vertical Bull Call spread LEAPS are showing a bid/offer spread of $0.50-$1.50, which is typical. Enter an order for one contract at $0.50, another for $0.60, another for $0.70, and so on. Eventually, you will enter a price that gets filled immediately. That is the real price. Then enter an order for your full position at that real price.

Notice that the day-to-day volatility of LEAPS prices is miniscule since the time value is so great. This means that the day-to-day moves in your P&L will be small. It also means you can buy your position over the course of a month just entering new orders every day. I know this can be tedious but getting screwed by overpaying for a position is even more tedious.

Look at the math below and you will see that a mere 60% rise in (BRKB) shares will generate a 900% profit with this position, such is the wonder of LEAPS. That gives you an implied leverage of 9:1 across the $420-$430 space.

Only use a limit order. DO NOT USE MARKET ORDERS UNDER ANY CIRCUMSTANCES. Just enter a limit order and work it.

This is a bet that (BRKB) will not fall below $430 by the January 17, 2025 options expiration in 2 years and 3 months.

Here are the specific trades you need to execute this position:

Buy 1 January 2025 (BRKB) $420 calls at………….………$7.00

Sell short 1 January 2025 (BRKB) $430 calls at…………$6.00

Net Cost:………………………….………..…………...........….....$1.00

Potential Profit: $10.00 - $1.00 = $9.00

(1 X 100 X $9.00) = $900 or 900% in 2 years and 3 months.

If you are uncertain on how to execute an options spread, please watch my training video by clicking here.

The best execution can be had by placing your bid for the entire spread in the middle market and waiting for the market to come to you. The difference between the bid and the offer on these deep in-the-money spread trades can be enormous.

Don’t execute the legs individually or you will end up losing much of your profit. Spread pricing can be very volatile on expiration months farther out.

Keep in mind that these are ballpark prices at best. After the alerts go out, prices can be all over the map.

The Barbell Play with Berkshire Hathaway

It’s time to give myself a dope slap.

I have been pounding the table all year about the merits of a barbell strategy, with equal weightings in technology and domestic recovery stocks. By owning both, you’ll always have something doing well as new cash flows bounce back and forth between the two sectors like a ping-pong ball.

After all, nobody gets sector rotation right, unless they have been practicing for 50 years, like me.

Full disclosure: I have to admit that after 50 years of following him, I love Buffet. He was one of the first subscribers to my newsletter when it started up in 2008. Some of his best ideas have come from the Mad Hedge Fund Trader, like buying Bank of America for $5 in 2008.

Oh, and he hates Wall Street for constantly fleecing people. Ditto here.

In reading Warren Buffet’s annual letter (click here for the link), it occurred to me that his Berkshire Hathaway (BRKB) shares were in effect a one-stop barbell investment.

For a start, Warren owns a serious slug of Apple (AAPL), some $120 billion worth, or 2.5% of the total fund. That gives (BRKB) some technology weighting. It cost him only $20 billion. The dividends he received entirely paid for the initial cost. So he owns 4% of Apple for free.

I remember the battle over the initial “BUY” five years ago. Warren fought it, insisting he didn’t understand the smartphone business. In the end, he bought Apple for its global brand value alone.

That is Warren Buffet to a tee.

The next five largest publicly listed holdings are Bank of America (BAC), Coca-Cola (KO), American Express (AXP), and Verizon Communications (VZ). These are your classic domestic recovery sectors. And with a heavy weighting in other banks (BK) (USB), Buffet is effectively short the bond market (TLT), another position I hugely favor.

Also included in the package is a liberal salting of pharmaceuticals, Merck (MRK) and AbbVie (ABBV). He has a small energy weighting with Chevron (CVX). He even has a position in old heavy metal America with General Motors (GM).

Berkshire is also one of the world’s largest property & casualty insurance owners. Its current “float” is $138 billion. You all know his flagship holding, GEICO. And the gecko mascot isn’t going anywhere as long as Warren lives. It was Warren’s idea.

It all seems to work for Warren. In 2020, he earned a staggering $42.5 billion. All told, Berkshire’s businesses employ 360,000, second to only Amazon (AMZN), and is the largest taxpayer in the United States, accounting for 3% of government revenues. Berkshire is also the largest owner of capital goods & equipment in the US worth $156 billion, topping (AT&T).

Many of Warrens's early 1956 $1,000 investors are millionaires many times over….and over 100 years old, prompting him to muse if ownership of his shares extended life.

Warren’s annual letter, which he spends practically the entire year working on, is always one of the best reads in the financial markets. There isn’t a better 50,000-foot view out there. He also admits to his mistakes, such as his disastrous purchase of Precision Castparts (PCC) in 2016 for $37 billion, which later suffered from the crash in the aerospace industry. In 2020, Buffet wrote off $11 billion of that acquisition.

He can do worse. In 1993, he bought the Dexter Shoe Company for $433 million worth of Berkshire stock. The company went under, but the Berkshire stock today is worth $8.7 billion.

Buffet’s letters always refer back to some of his “greatest hits,” today legends in the business history of the United States: GEICO, Furniture Mart, Berkshire Hathaway Energy, and See’s Candies, one of the largest employers of women in the US using 150-year-old recipes. Its peanut brittle is to die for.

In 2009, Buffet snatched away from me BNSF for a song, now the most profitable railroad in the country, an amalgamation of 360 railroads over 170 years. I say “snatched away” because it was my favorite railroad trading vehicle for decades until he bought the entire company. I hear its trains run by my home every night as a grim reminder.

Another benefit to owning (BRKB) is that Buffet is far and away the largest buyer of his own shares, soaking up $25 billion worth in 2020. And he is buying the shares of other companies that are also aggressively buying their own shares, like Apple ($200 billion last year). It all sounds like the perfect money-creation machine to me.

It gets better. Berkshires “B” shares trade options, meaning you can buy LEAPS (Long Term Equity Anticipation Securities), which by now, you all know and love. I’ll run some numbers for you.

With (BRKB) now trading at $254, you can buy the January 2023 $300-$310 call spread for $2.50. If the shares close anywhere over $310 by the 2023 expiration, the position will be worth $10.00, giving you a gain of 300%. And you only need an appreciation of $56, or 22% in the shares to capture this blockbuster profit, giving you upside leverage of an eye-popping 13.63X in the best-run company in America.

See, I told you you’d like it.

This is how poor people become rich. In fact, my target for (BRKB) is $300 for end of 2021 and $400 for 2022, right when the two-year LEAPS expire.

One question I often get about Berkshire is what happens when Warren Buffet goes to his greater reward, not an impossible concept given that he is 90 years old.

I imagine the shares will have a bad day or two, and then recover. Buffet has been hiring his replacements for a decade or more, and he handed off day-to-day operation years ago (I didn’t want to move to Omaha, no mountains).

When that happens, it will be the best buying opportunity of the year. And another chance to load up on those LEAPS.

Global Market Comments

October 19, 2022

Fiat Lux

Featured Trade:

(THE BARBELL PLAY WITH BERKSHIRE HATHAWAY),

(BRKA), (BRKA), (BAC), (KO), (AXP), (VZ), (BK) (USB),

(MRK), (ABBV), (CVX), (GM), (PCC), (BNSF), (TLT), (AAPL)