Of course, I sent the check out to renew my concierge service to your PO Box. You should receive it this week. Only a fool wouldn't re-up. Thanks, and have another great year.

John

New Jersey

The world will never be the same again.

Not only is the old world rapidly disappearing before our eyes, the new one is kicking down the front door with alarming speed.

In short: the future is happening fast, very fast.

To a large extent, long-term economic trends already in place have been given a turbocharger. Quite simply, you just take out the people. Human contact of any kind has been minimized.

I’ll tick off some of the more obvious changes.

To say that we are merely fatigued from a nearly three-year quarantine would be a vast understatement. Climbing the walls is more like it.

As I write this, US Covid-19 deaths have topped one million and cases have surpassed 95 million. China peaked at over 5,000 deaths with four times our population. The difference was leadership issue. China welded the doors shut of early Covid carriers.

Here, it said it was a big nothing and would “magically” go away.

The magic didn’t work, nor did bleach injections.

In the meantime, you better get used to your new life. You know that home office of yours you’ve been living in? It is now a permanent affair for many of you, as your employer figured out they can make more money and earn a high stock multiple with you at home.

Besides, they didn’t like you anyway.

Many employees are never coming back, preferring to avoid horrendous commutes, $5.40 a gallon gasoline, mass transit, lower costs, and yes, future pandemic viruses. GoToMeeting (LOGM) and Zoom (ZM) are now a permanent aspect of your life.

Commerce has changed beyond all recognition. Did you do a lot of shopping on Amazon (AMZN) like I do? Now, you’re really going to pour it on.

Amazon hired a staggering one million new distribution and delivery people in 2020 and 2021 to handle the surge in business, the most by any organization since WWII. I can’t believe the stock is only at $122. It is worth double that, especially if they break up the company.

The epidemic really hammered the mall, where a fatal disease is only a sneeze away. Mall REITs have since taken off like a rocket, once it was clear that the virus was coming under control.

And how are you going to pay for that transaction? Guess what one of the most efficient transmitters of disease is? That would be US dollar bills. Something like 50% of all US paper money already test positive for drugs, according to one Fed study. While in Scandinavia last summer, I learned that physical money has almost completely phased out.

Take paper money in change and you are not only getting contact from the sales clerk, but the last dozen people who handled the money. You are crazy now to take change and then not go swimming in Purell afterwards.

Personally, I leave it all as a tip.

Contactless payment deals with this nicely and is now here to stay. Next to come is simply scanning people when they walk in the store, as with some Whole Foods shops owned by Amazon.

Conferences?

They are now a luxury. All of my public speaking events around the world have been cancelled. Webinars now rule. They offer lower conversion rates but include vastly cheaper costs as well. I can reach more viewers for $1,100 a month on Zoom (ZM) than the Money Show could ever attract to the Las Vegas Mandalay Bay for $1 million.

At least I won’t have 18 hours of jet lag to deal with anymore on my Australia trips. I’m sure Qantas will miss those first-class ticket purchases and I’ll miss the free Champaign.

Entertainment is also morphing beyond all recognition. Streaming is now the order of the day. Disney+ (DIS) was probably the best-timed launch in business history, coming out just two months before the pandemic.

They earned enough to cancel out most of the losses from the closure of the theme parks. Again, this has been a long time coming and the other major movie producers will soon follow suit.

Movie theaters, which have been closed for years, may also never see their peak business again (CNK), (AMC), (IMAX). The theaters that survive will do so by only accumulating so much debt that they won’t be attractive investments for a decade.

The same is true for cruise lines (CCL), (RCL), (NCLH). But that won’t forestall dead cat bounces that are worth a double in the meantime, as they are coming off of such low levels. No vaccination, no cruise.

Exercise has changed overnight. All gyms and health clubs closed, and are only just now slowly reopening. Working out will become a solo exercise far away on a high mountain. I have already been doing this for 30 years, so piece of cake here.

Friends with yoga classes are now doing them in the living room, streaming their instructors online. The economics of online yoga classes are so compelling, with hundreds attending online classes at once. The old model may never come back.

If you are having trouble getting your kids to comply with social distancing requirements, have a family movie night and watch Gwyneth Paltrow and Cate Winslet die horrible deaths in Contagion. It has been applauded by scientists as the most accurate presentation of the kind of out-of-control pandemic we have been dealt with.

It is bone-chilling.

I hope you learned from the last pandemic because the next one may be just around the corner, thanks to globalization. In 1918, it took three months for an enhanced mutated flu virus to get from Europe to the US. This time, it took a day to get from China.

Stay healthy.

“It’s not like stocks are so compelling. It’s that there is nowhere else to put your cash. There’s a ton of capital coming in here. When it feels this easy, it’s usually time to be cautious,” said Barry Sternwood, CEO of the Starwood Capital Group.

Global Market Comments

September 15, 2022

Fiat Lux

Featured Trade:

(ON EXECUTING MY TRADE ALERTS)

From time to time, I receive an email from a subscriber telling me that they are unable to get prices on trade alerts that are as good as the ones I get.

There are several possible reasons for this:

1) Markets move, sometimes quite dramatically so. That’s why I include a screenshot of my personal trading account with every trade alert to reliably source the price for the readers.

2) Your Trade Alert email was hung up on your local provider’s server, getting it to you late. This is a function of your local provider’s lack of adequate capital investment in their own network and is totally outside our control.

3) The spreads on deep-in-the-money options spreads can be quite wide. This is why I recommend that readers only place limit orders to work in the middle market. Make the market come to you. Never buy at market or pay the offered side of the market unless you are in a stop-loss situation.

4) Hundreds of market makers read Global Trading Dispatch and many have attached algorithms to my service. The second they see one of my Trade Alerts, they adjust their markets accordingly. You may be fast, but you’re not as fast as an algorithm.

This is especially true for deep-in-the-money options. A spread can go from totally ignored to a hot item in seconds. I have seen daily volume soar from 10 contracts to 10,000 in the wake of my Trade Alerts.

On the one hand, this is good news, as my Trade Alerts have earned such credibility in the marketplace, with a 95% success rate. It is a problem for readers encountering sharp elbows when attempting executions in competition with market makers.

5) Occasionally, emails just disappear into thin air. We use cutting-edge technology, and sometimes it just plain doesn’t work.

This is why I strongly recommend that readers sign up for my free Text Alert Service as a backup. Trade Alerts are also always posted on the website as a secondary backup and show up in the daily P&L as a third. So, we have triple redundancy here. To sign up for the text alert service, please email support@madhedgefundtrader.com and put Text Alert Service in the subject line.

6) Options trades are now executed on 11 different exchanges. With two-legged spreads, one leg can be filled on one exchange while the second is filled on another. As a result, one online broker can show a spread trading through your limit other, while at another, it is ignored. I know this can be frustrating, but it is a fact of modern life.

The bottom line for all of this is that the prices quoted in my Trade Alerts are just ballpark ones with the intention of giving traders some name-picking and directional guidance. I pick the name and the direction and that is the heavy lifting when picking winning trades.

You have to exercise your own judgment as to whether the risk/reward is sufficient with the prices you are able to execute yourself.

Sometimes it is better to pay up by a few cents rather than miss the big trend. The market rarely gives you second chances.

Good luck and good trading.

John Thomas

“We have the intelligence of a moss growing on a rock compared to nature as a whole…Don’t get hung up on your views of how things should be because you’ll miss out on learning how they really are,” said hedge fund legend Ray Dalio.

Global Market Comments

September 14, 2022

Fiat Lux

Featured Trade:

(WHAT EVER HAPPENED TO THE GREAT DEPRESSION DEBT?),

($TNX), (TLT), (TBT)

When I was a little kid during the early 1950s, my grandfather used to endlessly rail against Franklin Delano Roosevelt.

The WWI veteran, who was mustard gassed in the trenches of France and was a lifetime, died in the wool Republican, said the former president was a dictator and a traitor to his class, who trampled the constitution with complete disregard.

Republican presidential candidates Hoover, Landon, and Dewey would have done much better jobs.

What was worse, FDR had run up such enormous debts during the Great Depression that, not only would my life be ruined, so would my children’s lives.

As a six-year-old, this disturbed me deeply, as it appeared that just out of diapers, my life was already going to be dull, brutish, and pointless.

Grandpa continued his ranting until a three pack a day Lucky Strike non-filter habit finally killed him in 1977.

He insisted until the day he died that there was no definitive proof that cigarettes caused lung cancer, even though during his war, they referred to them as “coffin nails.”

He was stubborn as a mule to the end. And you wonder whom I got it from?

What my grandfather’s comments did do was spark in me a lifetime interest in the government bond market, not only ours, but everyone else’s around the world.

So, what ever happened to the despised, future destroying Roosevelt debt?

In short, it went to money heaven.

And here I like to use the old movie analogy. Remember, when someone walked into a diner in those old black and white flicks? Check out the prices on the menu on the wall. It says “Coffee: 5 cents, Hamburgers: 10 cents, Steak: 50 cents.”

That is where the Roosevelt debt went.

By the time the 20 and 30-year Treasury bonds issued in the 1930’\s came due, WWII, Korea, and Vietnam happened, and the great inflation that followed.

The purchasing power of the dollar cratered, falling roughly 90%. Coffee is now $1.00, a hamburger at McDonald’s is $5.00, and a cheap steak at Outback cost $12.00.

The government, in effect, only had to pay back 10 cents on the dollar in terms of current purchasing power on whatever it borrowed in the thirties.

Who paid for this free lunch?

Bond owners who received minimal and often negative real inflation-adjusted returns on fixed income investments for three decades.

In the end, it was the risk avoiders who picked up the tab. This is why bonds became known as “certificates of confiscation” during the seventies and eighties.

This is not a new thing. About 300 years ago, governments figured out there was easy money to be had by issuing paper money, borrowing massively, stimulating the local economy, creating inflation, and then repaying the debt in devalued future paper money.

This is one of the main reasons why we have governments, and why they have grown so big. Unsurprisingly, France was the first, followed by England and every other major country.

Ever wonder how the new, impoverished United States paid for the Revolutionary War?

It issued paper money by the bale, which dropped in purchasing power by two thirds by the end of conflict in 1783. The British helped too by flooding the country with counterfeit paper Continental money.

Bondholders can expect to receive a long series of rude awakenings sometime in the future.

No wonder Bill Gross, the former head of bond giant PIMCO, says he will get ashes in his stocking for Christmas next year.

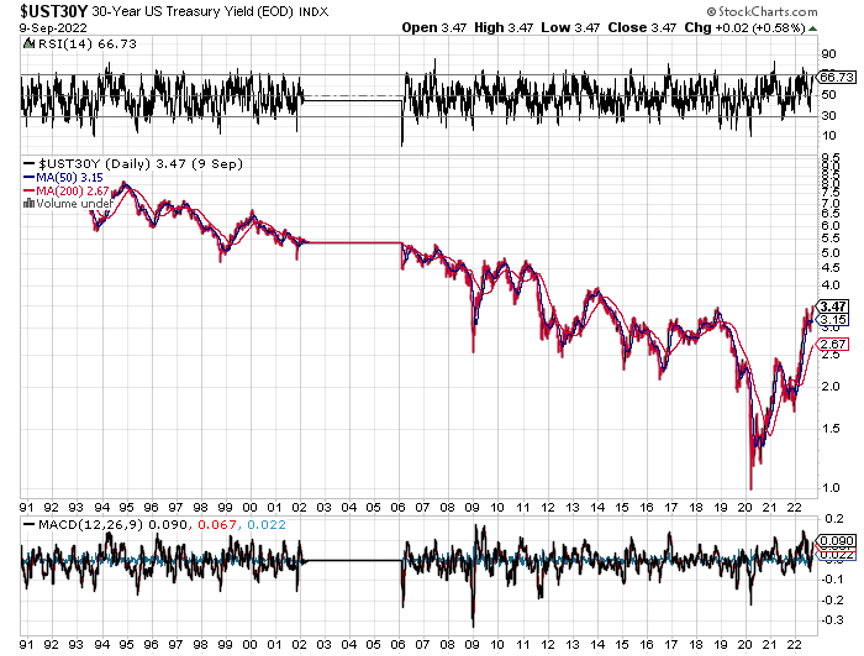

The scary thing is that eventually, we will enter a new 30-year bear market for bonds that lasts all the way until 2049. However, after last month’s frenetic spike up in bond prices and down in bond yields, that is looking more like a 2022 than a 2019 position.

This is certainly what the demographics are saying, which predicts an inflationary blow-off in decades to come that could take short term Treasury yields to a nosebleed 12% high once more.

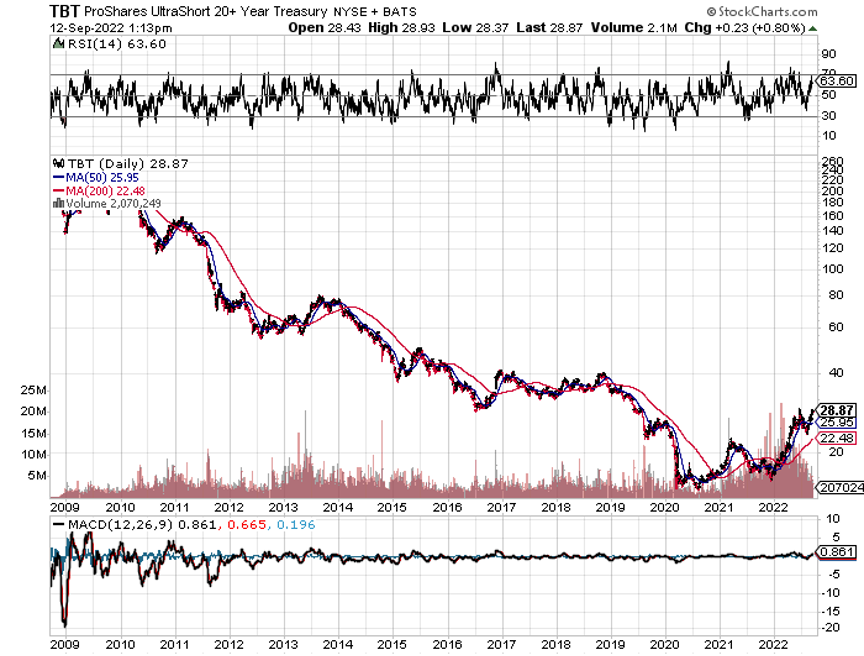

That scenario has the leveraged short Treasury bond ETF (TBT), which has just cratered down to $23, double to $46, and then soaring all the way to $200.

If you wonder how yields could get that high in a decade, consider one important fact.

The largest buyers of American bonds for the past three decades have been Japan and China. Between them, they have soaked up over $2 trillion worth of our debt, some 12% of the total outstanding.

Unfortunately, both countries have already entered very negative demographic pyramids, which will forestall any future large purchases of foreign bonds. They are going to need the money at home to care for burgeoning populations of old age pensioners.

So who becomes the buyer of last resort? No one, unless the Federal Reserve comes back with QE IV, V, and VI. QE IV, in fact, has already started.

There is a lesson to be learned today from the demise of the Roosevelt debt.

It tells us that the government should be borrowing as much as it can right now with the longest maturity possible at these ultra-low interest rates and spending it all.

With real, inflation adjusted 10-year Treasury bonds now posting negative yields, they have a free pass to do so.

In effect, the government never has to pay back the money. But they do have the ability to reap immediate benefits, such as through stimulating the economy with greatly increased infrastructure spending.

Heaven knows we need it.

If I were king of the world, I would borrow $5 trillion tomorrow and disburse it only in areas that create domestic US jobs. Not a penny should go to new social programs. Long-term capital investments should be the sole target.

Here is my shopping list:

$1 trillion – new Interstate freeway system

$1 trillion – additional infrastructure repairs and maintenance

$1 trillion – conversion of our energy system to solar

$1 trillion – construction of a rural broadband network

$1 trillion – investment in R&D for everything

The projects above would create 5 million new jobs quickly. Who would pay for all of this in terms of lost purchasing power? Today’s investors in government bonds, half of whom are foreigners, principally the Chinese and Japanese. Notice that I am not committing a single dollar in spending on any walls.

How did my life turn out? Was it ruined, as my grandfather predicted?

Actually, I did pretty well for myself, as did the rest of my generation, the baby boomers.

My kids did OK too. One son just got a $1 million, two year package at a new tech startup and he is only 30. Another is deeply involved in the tech industry, and my oldest daughter is working on a PhD at the University of California. My two youngest girls became the first ever female eagle scouts.

Not too shabby.

Grandpa was always a better historian than a forecaster. But he did have the last laugh. He made a fortune in real estate, betting correctly on the inflation that always follows big borrowing binges.

You know the five acres that sits under the Bellagio Hotel in Las Vegas today? That’s the land he bought in 1945 for $500. He sold it 32 years later for $10 million.

Not too shabby either.

32 Years of 30-Year Bond Yields

Not Too Shabby for $500

"There is no more powerful thing than a free market that changes its mind," said Art Cashin, UBS Director of Floor Operations.

Global Market Comments

September 13, 2022

Fiat Lux

Featured Trade:

(THE NEXT COMMODITY SUPERCYCLE HAS ALREADY STARTED),

(COPX), (GLD), (FCX), (BHP), (RIO), (SIL),

(PPLT), (PALL), (GOLD), (ECH), (EWZ), (IDX)