Global Market Comments

May 18, 2022

Fiat Lux

Featured Trade:

(WEDNESDAY JUNE 29, 2022 LONDON STRATEGY LUNCHEON)

(HOW “HIGH” CAN MARIJUANA STOCKS GO?)

(TLRY), (CGC), (TOKE)

(TESTIMONIAL)

I called one of my long-time northern Nevada clients the other day to find out why he hadn’t renewed his subscription.

He told me he was quitting the stock market for good and going into the marijuana business. There were no values to be had in stocks anymore and fortunes were to be made growing pot on an industrial scale.

Then what I learned was astonishing.

In the last year, marijuana cultivation in Nevada has soared from 1,000 to 5,000 acres. The number of licensed growers has rocketed from 11 to 220. The industry now injects $50 million a year into the Reno economy. You can’t go anywhere in town without running into a pot shop.

A big impetus was the passage of the 2018 US farm bill which largely decriminalized marijuana at the federal level. States have been legalizing weed for a decade. Local banks are now allowed to accept the proceeds of marijuana sales without getting hit with money laundering charges.

And here’s the real shocker. Pot growers can now get federal crop insurance for growing weed, eliminating much of the risk for farmers! Industry associations expect marijuana to become a $25 billion a year industry by 2023. It’s all proof that if you live long enough, you see everything.

Marijuana is actually quite hard to grow. Not only do fields have to be weeded every day, requiring a large labor input, marijuana is unusually sensitive to literally hundreds of plant viruses. One virus can wipe out an entire crop in three days.

The opioid epidemic has become a major factor in the explosive growth of the pot industry. Thanks to crackdowns at the federal and state level, it is almost impossible to get Vicodin any longer. In Nevada you are tracked like a dope dealer, requiring monthly urine tests to prove you’re actually using and not selling it.

However, the pain is still there. As the baby boomer generation ages (boomers are now 58-74), arthritis is becoming rampant, as are other painful maladies. Since marijuana research has been a career killer for scientists for 100 years, very little is known about the potential benefits. Today, it is being applied to migraine headaches, aching joints, and chemotherapy (it’s a great appetite builder).

When the state of Colorado legalized pot a decade ago, every family in the United States with a child afflicted by certain types of juvenile epilepsy moved there. It was the only cure.

Early during the marijuana boom, I met with the CEO of Tilray (TLRY), the largest publicly listed marijuana company, to see if there was a real trade there.

There wasn’t.

All I heard was pie in the sky predictions, rosy forecasts, and unrealistic business models. What he didn’t mention is that the listed companies still suffer from massive competition from the black market, where prices are 40% lower (it’s tax-free).

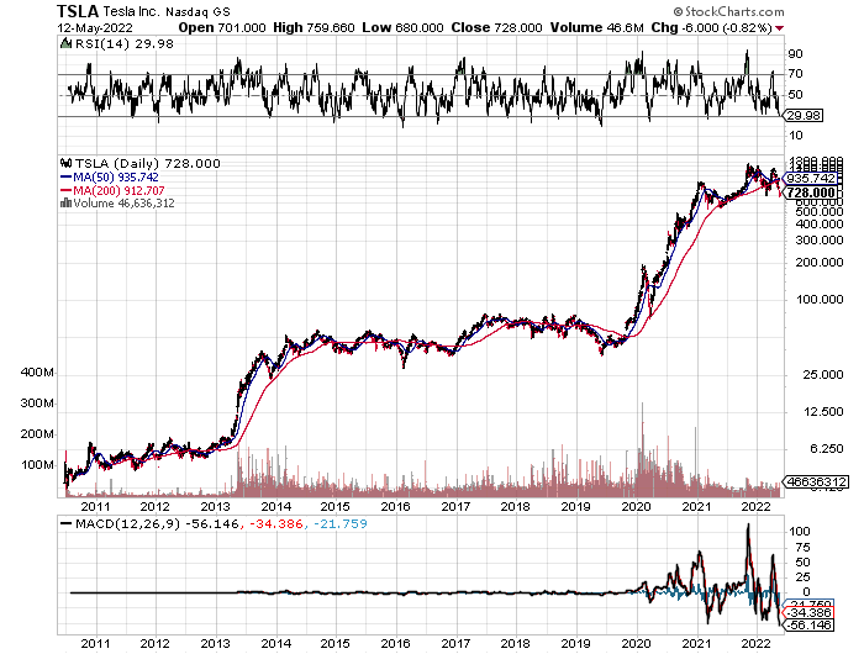

I ran a mile, deciding instead to buy more Apple (AAPL) and Tesla (TSLA). That worked. The market has heartily agreed with my analysis, taking (TLRY) down a gut-punching 98% since that meeting. Nice miss!

I talked to my own doctor to see if there was any value in the hundreds of the marijuana-based medicinal products now flooding the market. His assessment was that most products were so diluted that it was impossible to assess whether the active ingredient in marijuana, CDB or cannabidiol, was effective or not. Some contained little more than green food coloring.

We may not know the true effects of CBD for years until years of research has taken place, which is only just now getting started.

As for the public investment opportunities in marijuana, it’s another one of those industries where it’s better to use the product than buy the stock.

Avoid pot stocks like a bad trip.

Investment Opportunity?

Global Market Comments

May 17, 2022

Fiat Lux

Featured Trade:

(JULY 28 VENICE, ITALY STRATEGY LUNCHEON)

(WHY OUR BOND SHORTS ARE AT RISK),

(TLT), (TBT), (AAPL), (NVDA)

Our Bond Shorts are at Risk, thanks to a US Budget Deficit in Free Fall. I shall mourn this development as the loss of a close relative, particularly a rich uncle who writes me a check once a month, as selling short bonds and betting that interest rates will rise has been a huge moneymaker for me for years.

Since November, we have captured an eye-popping $42 points of downside in the United States Treasury Bond Fund (TLT). In two years, we have seized a mind-blowing $67 points. Don’t thank me, I’m just doing what you paid me to do.

While Trump was president, the national debt exploded by $4 trillion, a dream come true for bond short sellers. Trump spent a lifetime sticking lenders with hefty bills and the US government is no exception.

But all good things must come to an end. Since Biden became president, the annual budget deficit has vaporized, from $3.1 trillion in Trump's final year to a mere $360 billion for the first seven months of fiscal 2022, and we could approach zero by yearend.

An exploding economy and record employment have sent tax revenues soaring. The unemployment rate has shrunk from 25% to 3.6%. And taxpayers still had to pay a gigantic bill for last year’s monster capital gains in the stock market.

Covid spending, in the hundreds of billions last year, has been whittled down to near nothing. Biden has also been unable to get many spending bills through the Senate, where he lacks a clear majority.

Pare down government spending in a major way and you get new support for the bond market, the first since Clinton balanced the budget in 1999. Some investors are wondering if the 3.12% peak for the ten-year US Treasury bond seen last week could even be the top for this cycle. With the futures market already pricing in a 200 basis points in rate hikes this year, it’s entirely plausible.

I think we may have a shot at a 3.50% yield by next year. That equates to a (TLT) of around $100. But let’s face it, we are approaching the tag ends of this trade. Time to find better fish to fry. NVIDIA (NVDA) at $120 or Apple (AAPL) at $135 anyone?

We are seeing the same scenario play out at the state level. California saw a staggering $75 billion surplus last year. Among the luxuries Sacramento is considering are gas tax rebates for California drivers, undergrounding 20,000 miles of powerlines to prevent wildfires, and construction of a second transbay BART line.

Of course, all of this surplus wealth is temporary, as it always is. But “Laissez le bon temps roller.”

“It’s a comfort to become a tourist in my old age and enjoy my irrelevance,”

said the famed radio entertainer, Garrison Keillor.

Global Market Comments

May 16, 2022

Fiat Lux

Featured Trade:

(MARKET OUTLOOK FOR THE WEEK AHEAD, or SIFTING THROUGH THE WRECKAGE),

(SPY), (TLT), (TBT), (GOOGL), (AAPL), (MSFT), (BRKB), (NVDA), (JPM), (BAC), (WFC), ($BTCUSD)LA),

I have many superpowers, but one of the most useful ones is picking market bottoms. It looks like another one is at hand.

The past week has been one of epic wreckage in the stock market. It’s as if Hurricanes Sandy and Katrina both hit at the same time and were followed by a good old California earthquake.

Your favorite share prices have gone from mildly irritating to disappointing to absolutely gobsmackingly awful in only five months.

As a result, some of the best buying opportunities of the decade are setting up, the kind that you will be able to will on to your grandchildren. This is when mortgages get paid off, college debt is retired, and retirements financed.

There are a couple of key measurements here to watch. When the number of stocks above their 200-day moving averages falls below 20%, it always signifies an important market bottom. At the Thursday low, we were at 15% for the (SPY) and 12% for NASDAQ. It’s just another technical indicator among the hundreds, but a useful one, nonetheless.

Another one that helps is that on Friday, we also saw the first 90% advancing day since June 2020. All correlations went to one last week, meaning that all asset classes went down in unison.

That puts the bottom for the S&P 500 at $3,800 with an initial upside target of $4,200. We are way overdue for an 8%-12% relief rally. If I am wrong, we are only dropping another 200 points, or 5%.

Except that this time, it’s different.

At $3,600, down 25% from the January high, the market will have fully discounted a fairly severe recession that isn’t going to happen. Amazing as it may seem, some of the stocks having the biggest falls are still seeing earnings grow nicely. They are simply being sold because they are widely owned. That snares them in all of the algorithm-driven high-frequency trading that is going on.

I know I’ve said this a million times, but you use markets like this to buy Rolls Royces at Volkswagen prices. I’m talking about Alphabet (GOOGL), Microsoft (MSFT), and Apple (AAPL).

These companies are solid as the Rock of Gibraltar, with massive cash flows, huge cash balances, unassailable moats, and steady, if not spectacular earnings prospects. People have not suddenly abandoned Google as a search engine, Microsoft still has a near-monopoly in PC operating software, and Apple will sell more new and more expensive iPhones than ever.

The other baby that is being thrown out with the bathwater here are the banks. Recession fears have given these shares a haircut by a third by recession fears that damage the credit quality of their loan books.

What if there is no recession? Then the bear market in banks goes up in a puff of smoke. It helps that this time, there is no liquidity or capital crisis to be seen whatsoever. Add JP Morgan (JPM), Bank of America (BAC), and Wells Fargo (WFC) to your growing “BUY” lists.

Buying the best stocks with a recession already baked in the price? Sounds like a winner to me.

As for the smaller tech stocks, I’d take a pass, at least for now. Most of these companies, which never made any money, now have shares down 70% to 90% and are not coming back. They provided to be perfect money destruction machines. Never confuse “gone down a lot” with “cheap.” Take away the punch bowl and suddenly the party becomes very boring.

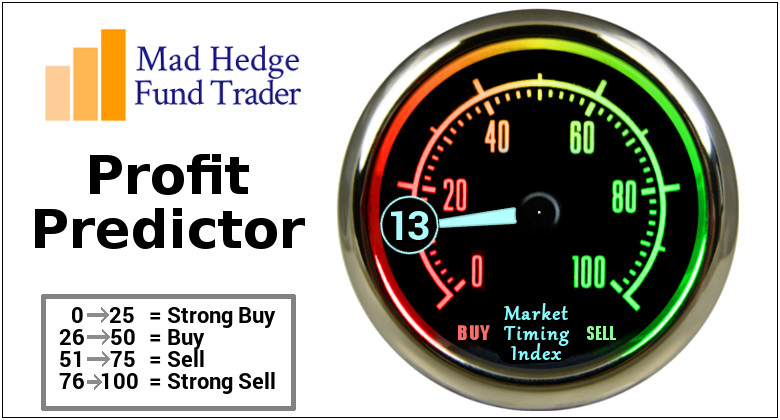

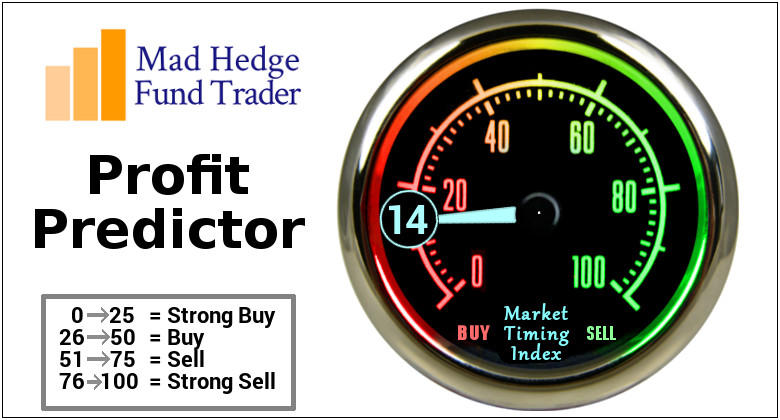

The Mad Hedge Market Timing Index certainly earned its weight in gold last week. We saw a multi-year low of 6 on Thursday and I was sending out trade alerts to “BUY” as fast as I could write them. A 1,200-point snap-back rally ensued, setting up a bottom that could last for weeks, if not forever.

The other great thing to come out of this selloff is that we learned what a fantastic leading indicator of risk-taking Bitcoin has become. While the S&P 500 plunged by 20%, Bitcoin absolutely cratered by 60%. We saw the correlation on both the upside and the downside.

Bitcoin is basically the (SPY) X 3. Ignore Bitcoin at your peril, even if you think the whole thing is a scam. And keep reading your Mad Hedge Bitcoin Letter.

Was this the grand finale? Big tech stocks like Apple (AAPL) and Microsoft (MSFT) stubbornly held their ranges for months, supporting the market as a whole. That ended last week on no news with the decisive breakdown of the key names. Apple has lost a staggering $350 billion in market cap in a week. Does this signal the final washout of this correction? It could. The Volatility Index (VIX) has ceased rising, and bonds have begun a short-covering countertrend rally.

Jay Powell warns of more 50-basis point rate rises if the economic conditions justify it. He also can’t guarantee a soft landing for the economy. Thanks for telling us precisely nothing. The comments were made on NPR Radio’s marketplace program and immediately tanked Dow futures by 100 points.

Core Inflation moderates slightly, down from 8.5% to 8.3% in April, sparking a stock market rally. That is 0.2% lower than last month’s 8.5% print, hence the bond rally. It was the first decline in the inflation rate in seven months. The probability of a peak in inflation is increasing.

Producer Price Index soars 11.0% YOY and 0.5% in April alone. It is a red-hot number showing that inflation is getting worse. The Producer Price Index (PPI) program measures the average change over time in the selling prices received by domestic producers for their output.

Goldman Sachs quit the SPAC Market, citing unmanageable liability. More likely, they don’t want to get stuck with illiquid longs on SPACS they brought to the market. I warned you this was a roach motel market; you can check in but you can never check out. I have to admit that I never believed in this asset class for two seconds, regarding it as nothing more than a license to steal money from investors.

Bitcoin drops below $28,000, taking the cryptocurrency down to more than half its November peak. It’s acting more like a small-cap tech stock every day, not the thing to be right now. With the Fed shrinking liquidity at a record rate, this is not a favorable backdrop either.

Another crypto bites the dust, as the free fall continues. Tether, a stablecoin tied to the US dollar, has fallen to 69% of its face value. It turns out that backing by the US government is more reliable than support from a PO Box in the Cayman Islands. Expect more to fail. Avoid crypto at all cost.

Ford to unload 8 million Rivian shares, once a lockup expires. Other pick institutional blocks are waiting in the wings. The EV truck is smoking hot on the road, but the shares have been dead as a doorknob, down 85% from the peak and 16% on the day. Avoid (RIVN) while the sector is death warmed over.

Biden mulling dropping Chinese Tariffs to make a dent in inflation. It might help a bit. It just depends on what we might get in return. Such a move wouldn’t exactly protect American workers, a top Biden priority. Relations with China are still fraught at best.

US Dollar blasts through to 20-year high, but a cooling inflation number on Wednesday may signal the top. Soaring interest rates, a strong economy, and a weak Europe and Japan are the drivers. There’s a short play here someday, but not yet.

Housing Supply improves for the first time in three years. Supply of mid-sized single-family loans takes the lead. Inventories are showing smallest declines in a year. Finally, the buyers get a break….now that prices are falling. Almost all new loans are 5/1 ARMS.

Air Ticket Prices are through the roof and were the biggest single factor keeping the CPI inflation figure sky-high yesterday. Buyers cite as reasons a long time since visiting relatives, desperation to get outdoors, and a rush to travel before the next Covid wave hits. It may be a one-time pop only, as used car prices were in previous months.

30-Year Fixed Rate Mortgages Top 5.5% in the fastest rate rise in history. The housing market is still hot, now fueled by exploding adjustable-rate mortgages 1.5% cheaper. Refi’s, however, have gone to zero.

My Ten-Year View

When we come out the other side of pandemic, we will be perfectly poised to launch into my new American Golden Age, or the next Roaring Twenties. With interest rates still historically cheap, oil peaking out soon, and technology hyper accelerating, there will be no reason not to. The Dow Average will rise by 800% to 240,000 or more in the coming decade. The America coming out the other side of the pandemic will be far more efficient and profitable than the old. Dow 240,000 here we come!

With some of the greatest market volatility seen since 1987, my May month-to-date performance recovered to +0.91%. Friday was up +5.12%, the biggest one-day gain in the 14-year history of the Mad Hedge Fund Trader.

My 2022 year-to-date performance exploded to 31.09%, a new high. The Dow Average is down -12.67% so far in 2022. It is the greatest outperformance on an index since Mad Hedge Fund Trader started 14 years ago. My trailing one-year return maintains a sky-high 58.48%.

I used last week’s meltdown to cover shorts in the (SPY) and bonds (TLT) and to buy new longs in technology like (AAPL), (NVDA), and (BRKB). I would have sent out more trade alerts if I had more time and didn’t have Covid and a 102 degrees temperature.

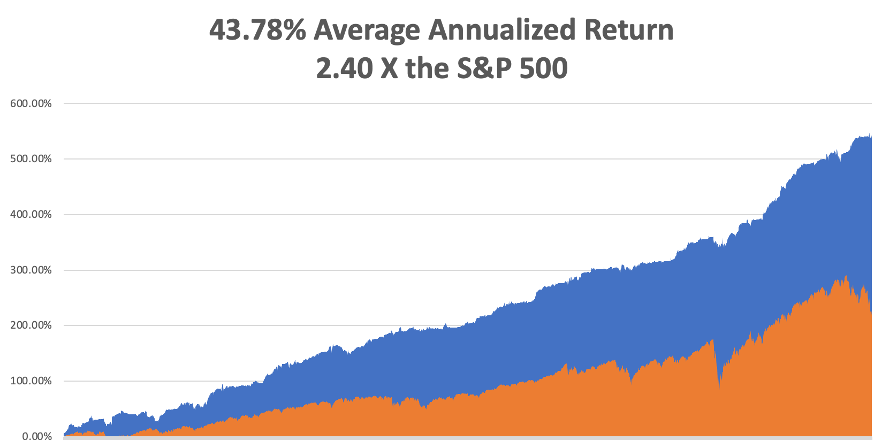

That brings my 14-year total return to 543.65%, some 2.40 times the S&P 500 (SPX) over the same period and a new all-time high. My average annualized return has ratcheted up to 43.78%, easily the highest in the industry.

We need to keep an eye on the number of US Coronavirus cases at 82.5 million, up 300,000 in a week, and deaths topping 1,000,000 and have only increased by 2,000 in the past week. You can find the data here.

On Monday, May 16 at 8:30 AM EST, the New York Empire State Manufacturing Index is released.

On Tuesday, May 17 at 8:30 AM, Retail Sales for April are released.

On Wednesday, May 18 at 8:30 AM, Housing Starts and Building Permits for April are published.

On Thursday, May 19 at 8:30 AM, Weekly Jobless Claims are disclosed. Existing Home Sales for April are printed.

On Friday, May 20 at 8:30 AM, the Baker Hughes Oil Rig Count is out.

As for me, the 1980s found me heading the Japanese equity warrant trading department for Morgan Stanley in London, a unit which eventually produced 80% of the company’s equity division profits. It was like running a printing press for $100 bills.

My east end kids in their twenties were catapulted from earning $10,000 a year to a half million. After buying West End condos, the latest Ferrari or Jaguar, and picking up fashion model girlfriends, they ran out of ideas on how to spend the money.

Maybe it was time to upgrade from pints of Fosters at the local pub to fine French wines?

The problem was that no one knew what to buy. Bordeaux alone produced 5,000 labels, and Burgundy a further 7,000. France had 360 appellations in 11 major wine-growing regions. Worse yet, all the names were in French!

Following a firmwide search, it was decided that I should become the in-house wine connoisseur. After all, I was from a wine-growing region in California, spoke French, and was part-French. How could they lose?

As with everything I do, I intensively threw myself into research. It turns out that the insurance exchange, Lloyds of London, was suffering the first of its claims in its history. US asbestos-related insurance claims were exploding. Then, a giant offshore natural gas rig, Piper Alpha, blew up. Suddenly Lloyd’s syndicates were getting their first-ever cash calls.

These syndicates were sold to members as guaranteed risk-free cash flow. Suddenly many members had to come up with $250,000 each in months. No one was ready. How did many meet their cash calls? By selling off 100-year-old wine cellars through auctions at Sotheby’s in London.

Now let me tell you about the international wine auction business. Single cases of the first growth wines, like the 1983 Chateaux Laffite Rothchild, are traded on open markets like any other investment. They appreciate in value like bonds, about 5% a year. However, mixed cases filled with odds and ends from different wineries and different years, have no investment value and traded at enormous discounts.

I found my market!

In short order, I put together a syndicate of 20 new wine consumers and went to work.

To separate out the sheep from the goats, I relied on a wine guide that The Economist magazine included at the back of every wallet diary. As each auction catalog came out, I rated every bottle in the mixed cases coming for sale. I then showed up at the bi-monthly auctions and bought every case.

It wasn’t long before I became the largest buyer of wine at Sotheby’s, picking up 20 cases per auction. The higher the Japanese stock market rose, the more money the traders made, and the more they had to spend on better French wines.

It wasn’t long before Morgan Stanley became famed for being a firm of wine authorities. Our guys were getting invited to high-end dinners just so they could pick the wines, including me.

Sotheby’s took note, and set me up with their in-house wine expert, the famed Serena Sutcliffe. I became her favorite customer. Serena knew everyone in Bordeaux. Who is the most popular person in any wine-growing area? Not the one who makes the wine but the one who sells it.

It wasn’t long before Serena set me up with private tours of the top Bordeaux wineries. I’m talking about Laffite Rothchild, Haut-Brion, Yquem (once owned by US Treasury Secretary C. Douglas Dillon), Chateaux Margaux, and Pomerol. I then flew the two of us down to Bordeaux in my twin-engine Cessna 340 for the wine tasting opportunity of a lifetime. I came back full up, with about 10 cases per flight.

I was guided through ancient, spider web-filled, fungus-infused caves and invited to drink their prime stock. Let me tell you that the 1873 Laffite Rothchild is to die for but is bested by the 1848 Chateaux Yquem.

The stories I heard were incredible. During WWII, one winery dumped its entire stock in a nearby pond to keep the Germans from getting it. But the labels floated to the surface. After the war, they fished out the bottles. But they couldn’t identify them until they opened the bottles, where the vintage was printed on the cork. It was free fishing for years for the locals and there are probably a few bottles still in there.

In sommelier school, you have to taste 5,000 wines to graduate. They tell you up front that it will change your life. After my experience as the biggest wine buyer in London for five years, I can tell you this is true.

One of my treasured buys was a bottle of 1952 Laffite Rothchild, the year I was born. Then it was only 40 years old and went down well with a fine dinner of Beef Wellington. I had the bottle for years until a cleaning lady found it on a shelf after a party and put it in the recycling bin.

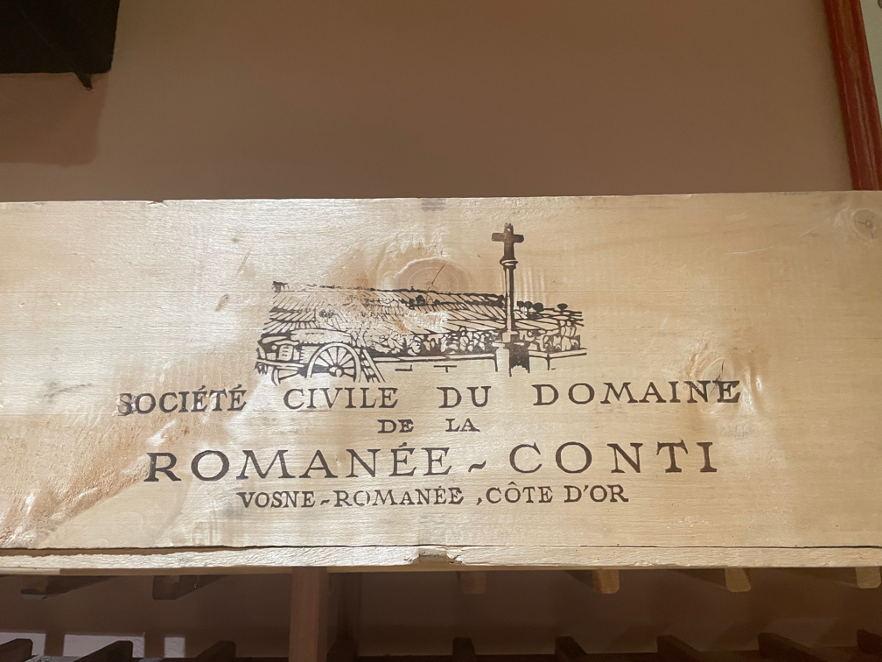

A few months ago, I was at the Marin French Antique Show browsing for hidden treasures. What did I find but an empty case of 1985 Romanee Conti, the greatest Burgundy of France. The vendor had no idea what he had. To him, it was just a wood box. I offered him $10. He said thanks. It now adorns a place of honor in my own wine cellar to remind me of this grand experience.

And if we ever meet for dinner, don’t bother with the wine list. I’ll be making the pick.

Stay Healthy,

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader

Fill Her Up with Bordeaux

Come join me for the Mad Hedge Fund Trader’s Global Strategy Luncheon, which I will be conducting on the Grand Canal in Venice, Italy. You can meet me at 12:00 PM on Thursday, July 28, 2022.

An open discussion on the crucial issues facing investors today will take place. The lunch will take place at one of the outstanding restaurants in Italy within walking distance from the Palace of the Doges. Bring a hat, expect it to be hot, but the view will be fantastic.

I’ll be giving you my up-to-date view on stocks, bonds, foreign currencies, commodities, precious metals, energy, and real estate. And to keep you in suspense, I’ll be throwing a few surprises out there too. Tickets are available for $379.

I’ll be arriving early and leaving late in case anyone wants to have a one-on-one discussion, or just sit around and chew the fat about the financial markets.

I look forward to meeting you, and thank you for supporting my research.

To purchase tickets for this luncheon, please click here.

Global Market Comments

May 13, 2022

Fiat Lux

Featured Trade:

(JULY 22 ZERMATT, SWITZERLAND STRATEGY SEMINAR)

(HOW TO GET A FREE TESLA), (TSLA),

(TESTIMONIAL)

I have assiduously instructed readers how to earn boatloads of money over the past 14 years.

Now I am going to teach you how to spend it wisely.

Tesla was once again at $680 a share at yesterday’s low and history has shown that it is time to pay attention.

How would you like to drive a vehicle whose technology is from ten years in the future, will be the envy of your neighbors, and leaves zero carbon footprint? It is also the fastest production car ever built. Sounds pretty good, doesn’t it?

I bet if I told you that the car was available for free, you’d be even more interested.

Here’s how it goes.

Buried in the tax bill signed into law in December 2017 is a provision for “bonus depreciation.” It allows companies the depreciation of the entire cost of a new car for business use over 5 years. All of this is tax deductible.

In addition, you get to deduct all of the annual interest on any loan taken out to purchase the vehicle. Also coming off the bottom line is any insurance and maintenance expenses which, in my experience, come to about $6,000 a year.

If you spend $125,000 for the new model, total deductions over a five-year period is about $155,000,

In five years, the car will have a residual value of $70,000, and the $85,000 in additional costs is covered by the tax breaks, taking the bottom-line after-tax cost of your new mid-life crisis to zero.

If all of this sounds impossible don’t worry. I’ve done it three times.

Now, here’s how to get a better deal.

Call Tesla and ask if they have any used 2022 showroom cars they want to get rid of before the new model year begins. In my case, I was able to find in Los Angeles a 2022 Model X P100 D SUV with just 800 miles on the odometer for a $25,000 discount to the $125,000 list price.

It was a total LA car, silver with black wheels and a black leather interior. They added on a $5,000 advanced navigation system and a $3,000 seven-seat configuration for free.

Tesla lists their used car inventory at https://www.tesla.com/inventory/used/ms. You may have to get a live Tesla salesman on the line to find the 2022 showroom cars.

For those of you who own your own companies or work through single-member LLCs, this is a no-brainer. If you work for a big company, it may be tougher to pull off. Talk to your accountant before you do anything.

This is exactly what I did which led me to pick up a brand-new Tesla during a torrential rainstorm. It was then that I truly learned what Elon Musk has recently referred to as “Logistics Hell.”

For a start, my car was supposed to be delivered to me at my lakefront estate in Incline Village, Nevada. But Tesla could only get it from Los Angeles to as far as the Fremont factory before the logistics system completely broke down. I agreed to pick it up at Fremont to cut a week off the delivery time and before the heavy snow hit.

When I arrived at the showroom, it was completely empty so I had to wait an hour. Out front were 100 parking spaces filled mostly with Tesla 3’s, and animated technicians showing new owners how to operate them. I was told that the parking lot is completely filled and then emptied out three times a day. (TSLA) is now producing 1,000 Tesla 3’s a day now.

When I finally got my turn, I discovered to my horror that the car was registered in the wrong name. When the Nevada Department of Motor Vehicles was told that the new registered owner was “Mad Hedge Fund Trader,” they were somewhat taken aback.

The tow hitch I ordered was missing so the tech pulled one from a back room. The same happened with the second set of keys which are very expensive. I had to Google the tire specs which required me to crawl under the car and get soaked to make sure they were all season because no one there knew.

In the end, I was sent off with my $125,000 car, a box of parts, and a vague promise that a mechanic would visit me someday and put it all together.

This was not the experience I had when I picked up my Tesla in 2010 and 2016 when I was treated like visiting royalty. But I love the car anyway.

Then it really got interesting!

What is the first thing a new Tesla owner wants to try out? The monstrous zero to 60 mph acceleration in 2.9 seconds. And they do this the second they drive out of the parking lot. So, I was treated to dozens of aspiring Indy 500 drivers with giant smiles on their faces zipping around on rain-slick roads. I felt like I was in a shooting gallery.

Thank goodness I brought an extra supply of airline airsick bags!

My 400 Bagger