Thank you for the analysis of Nvidia (NVDA). I wouldn't have looked at them without your analysis.

I got in NVDA at $69 Nov 2 after it dipped 3-5% from the recent top, it exploded up on the 11th Nov, +29% to $88, and eventually made it to $290!

More trade alerts to the people :)

Best Regards

Per

The Netherlands

Geneva, Switzerland 1968

Global Market Comments

May 12, 2022

Fiat Lux

Featured Trade:

(FRIDAY, JUNE 20 SAN FRANCISCO STRATEGY LUNCHEON)

(IS USA, INC. A SHORT?)

With covid cases down 98% in two months and headed much lower, it is time for me to re-introduce the Mad Hedge Seminar at Sea. I firmly believe that the pandemic will be over by the summer, and what better way to celebrate than with an elegant Norwegian fiord cruise.

Come join me on Cunard Line’s luxurious Queen Victoria on a seven-day Norwegian Fiord Cruise.

For the first time in ten years, I am hosting a Seminar at Sea. I had planned to do this earlier but ran head-on into the pandemic. On the last Seminar at Sea, I and a group of subscribers crossed the Atlantic Ocean on the Queen Mary 2, passing over the Titanic wreck and tooting the ship’s horn.

The Queen Victoria departs Southampton, England at 12:00 noon on July 3, 2022, and returns to Southampton on July 10. There I will be conducting the Mad Hedge Fund Trader’s Strategy Update, a three-hour discussion on the global financial markets. You will have to get to Southampton under your own steam, which is about an hour south of Victoria Station by train.

I’ll be giving you my up-to-date view on stocks, bonds, currencies, commodities, precious metals, Bitcoin, and real estate. I’ll highlight the best long and short opportunities. And to keep you in suspense, I’ll be tossing a few surprises out there too. Enough charts, tables, graphs, and statistics will be thrown at you to keep your ears ringing for a week.

Tickets are available for $499 for the seminar only.

Attendees will be responsible for booking their own cabins through Cunard., which is offering staterooms for this cruise for as little as $959 a person. To book your cruise please click here at https://www.cunard.com/en-us . The cruise you need to book is no. V216. The Queen Victoria has not sailed for two years and this will be one of the first post-pandemic voyages.

To get the details of the cruise please click here at https://www.cunard.com/en-us/find-a-cruise/V216/V216. The July 9 seminar will be held in the ship's owner’s suite while we are crossing the North Sea in of the most elegant accommodations afloat on the seven seas. For a video of the owner’s suite please click here at https://www.youtube.com/watch?v=vJhgleugNho

Just visit Cunard’s website at http://www.cunard.com/, or call them directly at 800-528-6273 to make your own arrangements.

The weather this time of year can range from balmy to tempestuous, depending on our luck. A brisk walk three times around the boat deck adds up to a mile. Full Internet access will be available for a price to follow the markets. Every dinner during the voyage will be black tie, so you might want to stop at Saks Fifth Avenue in Manhattan to get fitted for a second tux. I have arranged a few dinners with the captain for myself and will pass on any nuggets I gain in a future letter.

Don’t forget to bring your Dramamine and sea legs, although the 90,049 tonnes, 964.5-foot long billion-dollar ship is so big, I doubt you’ll need them. Her facilities include seven restaurants, thirteen bars, three swimming pools, a ballroom, and a theatre. I spend most of my time on these cruises writing deep research pieces, although I might take a few fencing classes.

Cunard is requiring covid vaccination cards of all passengers, and so am I. They may also require a negative covid test within three days of departure, as are most cruise lines these days. We’ll be sailing all the way up to 61 degrees, 81 minutes north latitude, about the same latitude as Anchorage, Alaska.

I look forward to meeting you and thank you for supporting my research. To purchase tickets for the seminar alone, please go to my online store at https://www.madhedgefundtrader.com/luncheons/.

Global Market Comments

May 11, 2022

Fiat Lux

Featured Trade:

(JOIN ME ON CUNARD’S MS QUEEN VICTORIA

FOR MY JULY 9, 2022 SEMINAR AT SEA)

Global Market Comments

May 10, 2022

Fiat Lux

Featured Trade:

(MAY 4 BIWEEKLY STRATEGY WEBINAR Q&A),

(SPY), (ROM), (ARKK), (LMT), (RTN), (USO), (AAPL), (BRKB), (TLT), (TBT), (HYG), (AMZN)

Below please find subscribers’ Q&A for the May 4 Mad Hedge Fund Trader Global Strategy Webinar broadcast from Silicon Valley.

Q: How confident are you to jump into stocks right now?

A: Not confident at all. If you look at all of my positions, they’re very deep in the money and fully hedged—I have longs offsetting my shorts—and everything I own expires in 12 days. So, I’m expecting a little rally still here—maybe 1,000 points after the Fed announcement, and then we could go back to new lows.

Q: Would you scale into ProShares Ultra Technology ETF (ROM) if you’ve been holding it for several years?

A: I would—in the $40s, the (ROM) is very tempting. On like a 5-year view, you could probably go from the $40s to $150 or $200. But don’t expect to sleep very much at night if you take this position, because this is volatile as all get out. It's not exactly clear whether we have bottomed out in tech or not, especially small tech, which the (ROM) owns a lot of.

Q: Is it time to buy the Ark Innovation ETF (ARKK) with the 5-year view?

A: Yes. I mentioned the math on that a couple of days ago in my hot tips. Out of 10 positions, you only need one to go up ten times to make the whole thing worth it, and you can write off everything else. Again, we’re looking at venture capital type math on these leverage tech plays, and that makes them very attractive; however I’m always trying to get the best possible price, so I haven’t done it yet.

Q: We’ve been hit hard with the tech trade alerts since March. Any thoughts?

A: Yes, we’re getting close to a bottom here. The short squeeze on the Chinese tech trade alerts that we had out was a one-day thing. However, when you get these ferocious short covering rallies at the bottom—we certainly got one on Monday in the S&P 500 (SPY) —it means we’re close to a bottom. So, we may go down maybe 4%-6% and test a couple more times and have 500- or 1000-point rallies right after that, which is a sign of a bottom. There’s a 50% chance the bottom was at $407 on Monday, and 50% chance we go down $27 more points to $380.

Q: Is the Roaring 20s hypothesis still on?

A: Yes absolutely; technology is still hyper-accelerating, and that is the driver of all of this. And while tech stocks may get cheap, the actual technology underlying the stocks is still increasing at an unbelievable rate. You just have to be here in Silicon Valley to see it happening.

Q: Do you like defense stocks?

A: Yes, because companies like Lockheed Martin (LMT) and Raytheon (RTN) operate on very long-term contracts that never go away—they basically have guaranteed income from the government—meeting the supply of F35 fighters for example, for 20 years. Certainly, the war in Ukraine has increased defense spending; not just the US but every country in the world that has a military. So all of a sudden, everybody is buying everything—especially the javelin missiles which are made in Florida, Georgia and Arizona. The Peace Dividend is over and all defense companies will benefit from that.

Q: Is Buffet wrong to go into energy right now? How will Berkshire Hathaway Inc. (BRK.B) perform if energy tanks?

A: Well first of all, energy is only a small part of his portfolio. Any losses in energy would be counterbalanced by big gains in his banking holdings, which are among his largest holdings, and in Apple (AAPL). Buffet does what I do, he cross-hedges positions and always has something that’s going up. I think Berkshire is still a buy. And he's not buying oil, per say; he is buying the energy producing companies which right now have record margins. Even if oil goes back down to $50 a barrel, these companies will still keep making money. However, he can wait 5 years for things to work for him and I can’t; I need them to work in 5 minutes.

Q: You must have suffered big oil (USO) losses in the past, right?

A: Actually I have not, but I have seen other people go bankrupt on faulty assumptions of what energy prices are going to do. In the 1990s Gulf War, someone made an enormous bet that oil would go up when the actual shooting started. But of course, it didn’t, it was a “buy the rumor, sell the news” situation. Energy prices collapsed and this hedge fund had a 100% loss in one day. That is what keeps me from going long energy at the top. And the other evidence that the energy companies themselves believe this is true is that they’re refusing to invest in their own businesses, they won’t expand capacity even though the government is begging them to do so.

Q: Why should we stay short the iShares 20 Plus Year Treasury Bond ETF (TLT) instead of selling out for a profit or holding on due to your statement that the TLT will go down to $105/$110?

A; If you have the December LEAPS, which most of you do, there’s still a 10% profit in that position running it seven more months. In this day and age, 7% is worth going for because there isn’t anything else to buy right now, except very aggressive, very short term, front month options, which I've been doing. So, the only reason to sell the TLT now and take a profit—even though it’s probably the biggest profit of your life—is that you found something better; and I doubt you're finding anything better to do right now than running your short Treasuries.

Q: Are you still short the TLT?

A: Yes, the front months, the Mays, expire in 8 days and I’m running them into expiration.

Q: What will Bitcoin do?

A: It will continue to bounce along a bottom, or maybe go lower as long as liquidity in the financial system is shrinking, which it is now at roughly a $90 billion/month rate. That’s not good for Bitcoin.

Q: Is now the time for Nvidia Corporation (NVDA)?

A: Yes, it’s definitely time to nibble here. It’s one of the best companies in the world that’s dropped more than 50%. I think we’d have a final bottom, and then we’re entering a new long term bull market where we’d go into 1-2 year LEAPS.

Q: What do you think of buying the iShares iBoxx $ High Yield Corporate Bond ETF (HYG) junk bond fund here for 6% dividend?

A: If you’re happy with that, I would go for it. But I think junk is going to have a higher dividend yet still. This thing had a dividend in the teens during the financial crisis; I don’t think we’ll get to the teens this time because we don’t have a financial crisis, but 7% or 8% are definitely doable. And then you want to look at the 2x long junk bond special ETFs, because you’re going to get a 16% return on a very boring junk bond fund to own.

Q: What do you think about Amazon (AMZN) at this level?

A: I think it’s too early and it goes lower. Not a good stock to own during recession worries. At some point it’ll be a good buy, but not yet.

Q: Energy is the best sector this year—how long can it keep going?

A: Until we get a recession. By the way, if you want evidence that we’re not in a recession, look at $100/barrel oil. When you get real recessions, oil goes down to 420 or $30….or negative $37 as it did in 2020. There’s a lot of conflicting data out in the market these days and a lot of conflicting price reactions so you have to learn which ones to ignore.

Q: Should we stay short the (TLT)?

A: Yes, we should. I’m looking for a 3.50% yield this year that should take us down to $105.

To watch a replay of this webinar with all the charts, bells, whistles, and classic rock music, just log in to www.madhedgefundtrader.com , go to MY ACCOUNT, click on GLOBAL TRADING DISPATCH, then WEBINARS, and all the webinars from the last 12 years are there in all their glory.

Good Luck and Stay Healthy

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader

"20 years ago, I could read the Wall Street Journal every morning and feel that I knew enough to at least start my day. That is no longer true," said technology guru and venture capital investor, Roger McNamee.

Global Market Comments

May 9, 2022

Fiat Lux

Featured Trade:

(MARKET OUTLOOK FOR THE WEEK AHEAD, or HEADED FOR THE LEPER COLONY),

(SPY), (TLT), (TBT), (BRKB), (TSLA), (GLD), (AAPL), (GOOGL), (MSFT), (NVDA)

My worst-case scenario for the S&P 500 this year was a dive of 20%. We are now off by 14%. And of course, most stocks are down a lot more than that.

Which means that we are getting close to the tag ends of this move. The kind of wild, daily 1,000-point move up and down we saw last week is typical of market bottoms.

Some $7 trillion in market capitalization lost this year. That means we could be down $10 trillion from a $50 trillion December high before this is all over. That’s a heck of a lot of wealth to disappear from the economy.

So, it may make sense to start scaling into the best quality names on the bad days in small pieces, like Apple (AAPL), Alphabet (GOOGL), Microsoft (MSFT), and NVIDIA (NVDA).

Whatever pain you may have to take what follows, the twofold to threefold gain that will follow over the next five years will make it well worth it. Is a 20% loss upfront worth a long-term gain of 200%? For most people, it is.

Bonds may also be reaching the swan song for their move as well. The United States Treasury Bond Fund (TLT) at $113 has already lost a gobsmacking $42 since the November $155 high.

The markets have already done much of the Fed’s work for it, discounting 200 basis points of an anticipated 350 basis points in rate rises in this cycle. Therefore, I wouldn’t get too cutesy piling on new bond shorts here just because it worked for five months.

Yes, there is another assured 50 basis point rise in six weeks towards the end of June. Jay Powell has effectively written that in stone. We might as well twiddle our fingers and keep playing the ranges until then. We have in effect been sent to the trading leper colony.

The barbarous relic (GLD) seems to be looking better by the day. Q1 saw a massive 551 metric tonnes equivalent pour into gold ETF equivalents, an increase of 203%. Of course, we already know of the step-up in Russian and Chinese demand to defeat western sanctions.

But the yellow metal is also drawing more traditional investment demand. Gold usually does poorly during rising interest rates. This time, it's different. An inflation rate of 8.5% minus an overnight Fed rate of 1.0%, leaving a real inflation rate of negative -7.5%. That means gold has 7.5% yield advantage over cash equivalents.

Gold’s day as an inflation hedge is back!

The April Nonfarm Payroll Report came in near-perfect at 459,000, holding the headline Unemployment Rate at 3.5%. It’s proof that a recession is nowhere near the horizon. A record 2 million workers have recovered jobs during the last four months and 6.6 million over the past 12.

Warren Buffet is Buying Stocks, some $51 billion in Q1. That includes $26 billion into California energy major Chevron (CVX), followed by a big bet on Occidental Petroleum (OXY). These are clearly a bet that oil will remain high for at least five more years. That has whittled his cash position down from $147 billion to only $106 billion. Buffet likes to keep a spare $100 billion on hand so he can take over a big cap at any time. Warren clearly eats his own cooking, buying $26 billion worth of his own stock in 2021. If you can’t afford the lofty $4,773 price for the “A” shares, try the “B” shares at $322.83, which also offer listed options on NASDAQ and in which Mad Hedge Fund Trader currently has a long position.

Elon Musk Crashes His Own Stock, selling $8.4 billion worth last week. His Twitter purchase has already been fully financed, so what else is he going to buy. The move generates a massive Federal tax bill, but Texas, his new residence, is a tax-free state. It continues a long-term trend of billionaires piling fortunes in high tax states, like Jeff Bezos in Washington, and then realizing the gains in tax-free states.

Adjustable-Rate Mortgages are Booming, replacing traditional 30-year fixed-rate mortgage at a rapid pace. Interest rates are 20% lower, but if rates skyrocket to double digits or more in five years, you have a really big problem. ARMs essentially take the interest rate risk off the backs of the lenders and place it firmly on the shoulders of the borrowers.

Travel Stocks are On Fire, with all areas showing the hottest numbers in history. Average daily hotel rates are up 20% YOY, stayed room nights 52%, airfares 39%, and airline tickets sold 48%. Expect these numbers to improve going into the summer.

JOLTS Hits a Record High, with 11.55 million job openings in March, up 205,000 on the month. There are now 5.6 million more jobs than people looking for them. No sign of a recession here. It augurs for a hot Nonfarm Payroll report on Friday.

Natural Gas Soars by 9% in Europe as the continent tries to wean itself off Russian supplies. In the meantime, US producers are refusing to boost output for a commodity that may drop by half in a year, as it has done countless times in the past. If the oil majors are avoiding risk here, maybe you should too.

My Ten-Year View

When we come out the other side of pandemic, we will be perfectly poised to launch into my new American Golden Age, or the next Roaring Twenties. With interest rates still historically cheap, oil peaking out soon, and technology hyper accelerating, there will be no reason not to. The Dow Average will rise by 800% to 240,000 or more in the coming decade. The America coming out the other side of the pandemic will be far more efficient and profitable than the old. Dow 240,000 here we come!

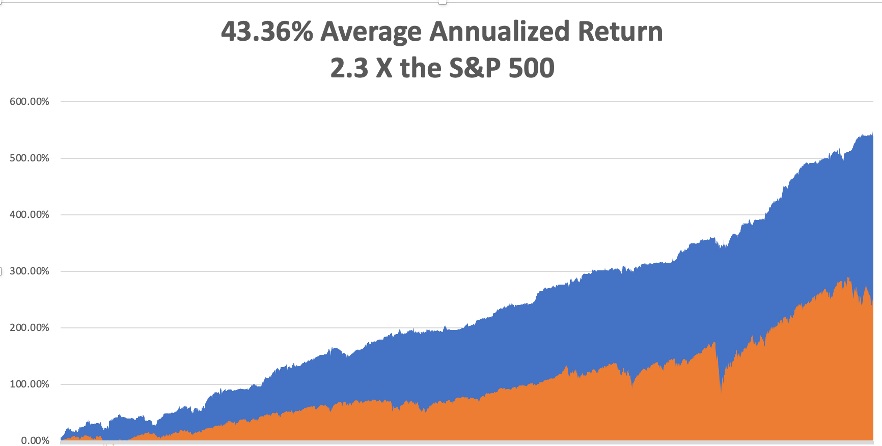

With some of the greatest market volatility seen since 1987, my May month-to-date performance lost 4.27%. My 2022 year-to-date performance retreated to 25.91%. The Dow Average is down -9.3% so far in 2022. It is the greatest outperformance on an index since Mad Hedge Fund Trader started 14 years ago. My trailing one-year return maintains a sky-high 56.62%.

On the next capitulation selloff day, which might come with the April Q1 earnings reports, I’ll be adding long positions in technology, banks, and biotech. I am currently in a rare 50% cash position awaiting the next ideal entry point.

That brings my 13-year total return to 538.47%, some 2.30 times the S&P 500 (SPX) over the same period. My average annualized return has ratcheted up to 43.36%, easily the highest in the industry.

We need to keep an eye on the number of US Coronavirus cases at 81.9 million, up 500,000 in a week, and deaths topping 998,000 and have only increased by 5,000 in the past week. You can find the data here.

The coming week is a big one for jobs reports.

On Monday, May 9 at 8:00 AM EST, US Consumer Inflation Expectations are released.

On Tuesday, May 10 at 7:00 AM, the NFIB Business Optimism Index is confirmed.

On Wednesday, May 11 at 8:30 AM, the Core Inflation Rate for April is printed.

On Thursday, May 12 at 8:30 AM, Weekly Jobless Claims are disclosed. Conoco Phillips (COP) reports. We also get the Producer Price Index.

On Friday, May 13 at 8:30 AM, the University of Michigan Consumer Price Index for May is disclosed. At 2:00 PM, the Baker Hughes Oil Rig Count is out.

As for me, not just anybody is allowed to fly in Hawaii. You have to undergo special training and obtain a license endorsement to cope with the Aloha State’s many aviation challenges.

You have to learn how to fly around an erupting volcano, as it can swing your compass by 30 degrees. You must master the fine art of getting hit by a wave on takeoff since it will bend your wingtips forward. And you’re not allowed to harass pods of migrating humpback whales, a sight I will never forget.

Traveling interisland can be highly embarrassing when pronouncing reporting points that have 16 vowels. And better make sure your navigation is good. Once a plane ditched interisland and the crew was found months later off the coast of Australia. Many are never heard from again.

And when landing on the Navy base at Ford Island, you were told to do so lightly, as they still hadn’t found all the bombs the Japanese had dropped during their Pearl Harbor attack.

You are also informed that there is one airfield on the north shore of Molokai you can never land at unless you have the written permission from the Hawaii Department of Public Health. I asked why and was told that it was the last leper colony in the United States.

My interest piqued, the next day found me at the government agency with application in hand. I still carried my UCLA ID which described me as a DNA researcher which did the trick.

When I read my flight clearance to the controller at Honolulu International Airport, he blanched, asking if a had authorization. I answered that yes, I did, I really was headed to the dreaded Kalaupapa Airport, the Airport of no Return.

Getting into Kalaupapa is no mean feat. You have to follow the north coast of Molokai, a 3,000-foot-high series of vertical cliffs punctuated by spectacular waterfalls. Then you have to cut your engine and dive for the runway in order to land into the wind. You can only do this on clear days, as the airport has no navigational aids. The crosswind is horrific.

If you don’t have a plane, it is a 20-mile hike down a slippery trail to get into the leper colony. It wasn’t always so easy.

During the 19th century, Hawaiians were terrified of leprosy, believing it caused the horrifying loss of appendages, like fingers, toes, and noses, leaving bloody open wounds. So, King Kamehameha I exiled them to Kalaupapa, the most isolated place in the Pacific.

Sailing ships were too scared to dock. They simply threw their passengers overboard and forced them to swim for it. Once on the beach, they were beaten a clubbed for their positions. Many starved.

Leprosy was once thought to be the result of sinning or infidelity. In 1873, Dr. Gerhard Henrik Armauer Hansen of Norway was the first person to identify the germ that causes leprosy, the Mycobacterium leprae.

Thereafter, it became known as Hanson’s Disease. A multidrug treatment that arrested the disease, but never cured it, did not become available until 1981.

Leprosy doesn’t actually cause appendages to drop off as once feared. Instead, it deadens the nerves and then rats eat the fingers, toes, and noses of the sufferers when they are sleeping. It can only be contracted through eating or drinking live bacteria.

When I taxied to the modest one-hut airport, I noticed a huge sign warning “Closed by the Department of Health.” As they so rarely get visitors, the mayor came out to greet me. I shook his hand but there was nothing there. He was missing three fingers.

He looked at me, smiled, and asked, “How did you know?”

I answered, “I studied it in college.”

He then proceeded to give me a personal tour of the colony. The first thing you notice is that there are cemeteries everywhere filled with thousands of wooden crosses. Death is the town’s main industry.

There are no jobs. Everyone lives on food stamps. A boat comes once a week from Oahu to resupply the commissary. The government stopped sending new lepers to the colony in 1969 and is just waiting for the existing population to die off before they close it down.

Needless to say, it is one of the most beautiful places on the planet.

The highlight of the day was a stop at Father Damien’s church, the 19th century Belgian catholic missionary who came to care for the lepers. He stayed until the disease claimed him and was later sainted. My late friend Robin Williams made a movie about him but it was never released to the public.

The mayor invited me to stay for lunch, but I said I would pass. I had to take off from Kalaupapa before the winds shifted.

It was an experience I will never forget.

Stay Healthy,

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader