Thank you for all the good work and the exceptional work you do. Your webinars give us a wonderful understanding of what is happening in the markets and undergirds, enhances, and makes your recommendations so meaningful.

It opens up our understanding and confidence in trading. Also, all of your interesting pictures and your travels make me think I know you, which further increases my understanding of all you do and ties me into your work.

You are a gem.

Best Regards,

Bill

Seminole, Florida

I Am Not Worthy

Global Market Comments

April 5, 2021

Fiat Lux

Featured Trade:

(MARKET OUTLOOK FOR THE WEEK AHEAD, or A SUPERCHARGED ECONOMY IS SUPERCHARGING THE STOCK MARKET),

(SPX), (LRCX), (AMAT), (VIX), (BA), (LUV), (AKL), (TSLA), (DAL)

Stocks have risen at an annualized rate of 40% so far in 2021. If that sounds too good to be true, it is.

But then, we have the greatest economic and monetary stimulus of all time rolling out also.

Of the $10 trillion in government spending that has or is about to be approved, virtually none of it has been spent. There hasn’t been enough time. It turns out that it is quite hard to spend a trillion dollars. Corporate America and its investors are salivating.

The best guess is that the new spending will create five million jobs for the economy over eight years, taking the headline Unemployment Rate down to a full employment 3-4%. The clever thing about the proposal is that it is financed over 15 years, which takes advantage of the current century's low interest rates.

That is something many strategists have been begging the US Treasury to do for years. Take the free money while it is on offer.

There is something Rooseveltean about all this, with great plans and huge amounts of money, like 10% of GDP on the table. But then we did just come out of a Great Depression, with unemployment peaking at 25 million, the same as in 1933.

The package is so complex that it is unlikely to pass by summer. Until then, stocks will probably continue to rally on the prospect.

It makes my own forecast of a 30% gain in stocks and a Dow Average of 40,000 for 2021 look overly cautious, conservative, and feeble (click here). But then, you have to trade the market you have, not the one you want.

And here is the really fun part. After a grinding seven-month-long correction, technology stocks have suddenly returned from the dead. All the best names gained 10% or more in the previous four-day holiday-shortened week. Clearly, investors have itchy trigger fingers with tech stocks at these levels.

In the meantime, technology stock prices have fallen 20-50% while earnings have jumped by 20% to 40%. What was expensive became cheap. It was a setup that was begging to happen.

This is great news because technology stocks are the core to all non-indexed retirement funds.

The S&P 500 (SPX) blasted through 4,000, a new all-time high, off the back of one of the largest infrastructure spends in history. Job creation over the next eight years is estimated at 5 million. Corporate earnings will go through the roof. Tech is back from the dead. Leaders were semiconductor equipment makers like my old favorites, Applied Materials (AMAT) and Lam Research (LRCX). The Volatility Index (VIX) sees the $17 handle, hinting at much higher to come. The next leg up for the Roaring Twenties has begun!

Biden Infrastructure Bill Tops $2.3 Trillion. Of course, some of it isn’t infrastructure but other laudable programs that starved under the Trump administration, like spending on seniors (I’m all for that!). Still, spending is spending, and this will turbocharge the economy all the way out to say….2024. The impact on interest rates will be minimal as long as the Fed keeps overnight rates near zero, as they have promised to do for nearly three years. Making the power grid carbon-free by 2035 is a goal and would require a 50% increase in solar national installations. Infrastructure spending is always a win-win because the new tax revenues it generates always pay for it in the end.

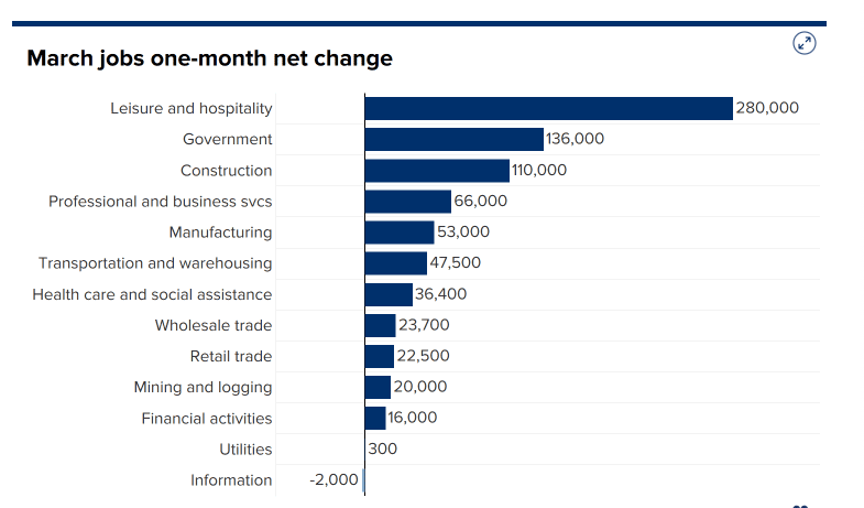

March Nonfarm Payroll Report exploded to the upside, adding a near record 917,000 jobs, and taking the headline Unemployment Rate down to 6.0%. Employers are front running Biden’s infrastructure plans, hiring essential workers while they are still available. Look for labor shortages by summer, especially in high paying tech. Leisure & Hospitality was the overwhelming leader at a staggering 280,000, followed by Government at 136,000 and Construction at 110,000.

Goldilocks lives on, with a 1.0% drop in Consumer Spending in February, keeping inflation close to zero. The Midwest big freeze is to blame. You can’t buy anything when there’s no gas for the car and no electricity once you get there, as what happened in Texas. The $1,400 stimulus checks have yet to hit much of the country, although I got mine. It couldn’t be a better environment for owning stocks. Keep buying everything on dips.

Consumer Confidence soared, up 19.3 points to 109 in February, according to the Conference Board. It’s the second-biggest move on record. A doubling of the value of your home AND your stock portfolio in a year is making people feel positively ebullient. Oh, and free money from the government is in the mail.

The Suez Canal reopened, allowing 10% of international trade to resume. A massive salvage effort that freed the 200,000 ton Ever Given. The ship will be grounded for weeks pending multiple inspections. Somebody’s insurance rates are about to rachet up. It all shows how fragile is the international trading system. Deliveries to Europe will still be disrupted for months. It puts a new spotlight on the Arctic route from Asia to Europe, which is 4,000 nm shorter.

Boeing (BA) won a massive order, some 100 planes from Southwest Air (LUV), practically the only airline to use the pandemic to expand. Boeing can fill the order almost immediately from 2020 cancelled orders for the $50 million 737 MAX. Keep buying both (BA), (LUV), and (AKL) on dips.

Tesla blows away Q1 deliveries, with a 184,400 print, or 47.5% high than the 2021 rate. That is without any of the new Biden EV subsidies yet to kick in. Lower priced Model 3 sedans and Model Y SUVs accounted for virtually all of the report. The Shanghai factory is kicking in as a major supplier to high Chinese demand. The one million target for 2021 is within easy reach. Traders saw this coming (including me) and ramped the stock up $100. Buy (TSLA) on dips. My long-term target is $10,000.

United Airlines hires 300 pilots to front-run expected exposure summer travel. CEO Scott Kirby says domestic vacation travel has almost completely recovered. Keep buying (LUV), (AKL), and (DAL) on dips.

When we come out the other side of pandemic, we will be perfectly poised to launch into my new American Golden Age, or the next Roaring Twenties. With interest rates still at zero, oil cheap, there will be no reason not to. The Dow Average will rise by 400% to 120,000 or more in the coming decade. The American coming out the other side of the pandemic will be far more efficient and profitable than the old. Dow 120,000 here we come!

My Mad Hedge Global Trading Dispatch profit reached 0.38% gain during the first two days of April on the heels of a spectacular 20.60% profit in March.

I used the Monday low to double up my long in Tesla. After that, it was off to the races for all of tech. I caught a $100 move on the week.

My new large Tesla (TSLA) long expires in 9 trading days.

That leaves me with 50% cash and a barrel full of dry powder.

My 2021 year-to-date performance soared to 44.47%. The Dow Average is up 9.40% so far in 2021.

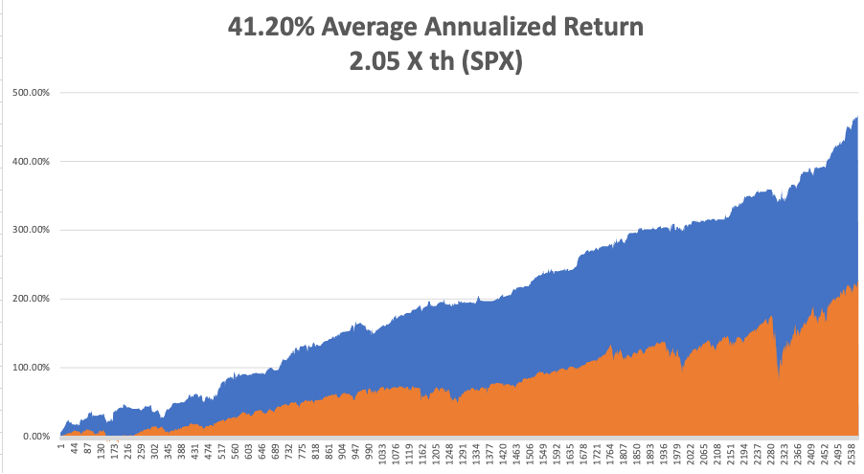

That brings my 11-year total return to 467.02%, some 2.08 times the S&P 500 (SPX) over the same period. My 11-year average annualized return now stands at an unbelievable 41.20%, the highest in the industry.

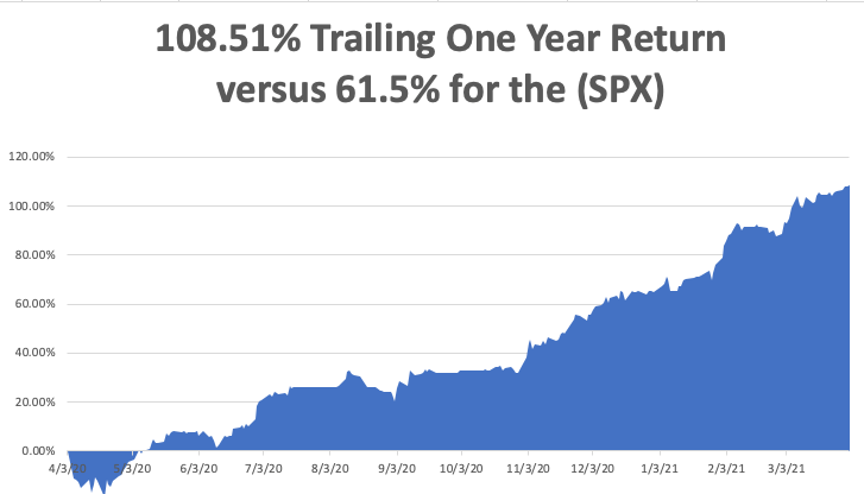

My trailing one-year return exploded to positively eye-popping 108.51%. I truly have to pinch myself when I see numbers like this. I bet many of you are making the biggest money of your long lives.

We need to keep an eye on the number of US Coronavirus cases at 30.6 million and deaths topping 555,000, which you can find here.

The coming week will be dull on the data front.

On Monday, April 5, at 10:00 AM, the ISM Non-Manufacturing Index for March is released.

On Tuesday, April 6, at 10:00 AM, US Consumer Inflation Expectations for March are published.

On Wednesday, April 7 at 2:00 PM, the minutes of the last Federal Open Market Committee Meeting are published.

On Thursday, April 8 at 8:30 AM, the Weekly Jobless Claims are printed.

On Friday, April 9 at 8:30 AM we get the Producer Price Index for March. At 2:00 PM, we learn the Baker-Hughes Rig Count.

As for me, I recently turned 69, so I used a nice day to climb up to the Lake Tahoe High Sierra rim at 9,000 feet, found a nice granite boulder sit on to keep dry, and tried to figure out what it was all about.

I’ve been very lucky.

I had a hell of a life that I wouldn’t trade for anything. I wouldn’t change a bit (well, maybe I would have bought more Apple shares at a split-adjusted 30 cents in 1998. I knew Steve was going to make it).

Since I’ve always loved what I did, journalist, trader, combat pilot, hedge fund manager, writer, I don’t think I have “worked” a day in my life.

I fought for things I believed in passionately and won, and kept on winning. It’s good to be on the right side of history.

I have loved and lost and loved again and lost again, and in the end outlived everyone, even my younger brother, who died of Covid-19 a year ago. The rule here is that it is always the other guy who dies. My legacy is five of the smartest kids you ever ran into. They’re great traders as well.

So I’ll call it a win.

I visited my orthopedic surgeon the other day to get a stem cell top-up for my knees and she asked how long I planned to keep coming back. I told her 30 years, and I meant it.

There’s nothing left for me to do but to make you all savvy in the markets and rich, something I leap out of bed every morning at 5:00 AM to accomplish.

Enjoy your weekend.

Stay healthy.

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader

Global Market Comments

April 2, 2021

Fiat Lux

Featured Trade:

(WHY CONSUMER STAPLES ARE PEAKING),

(XLP), (PG), (PEP), (PM), (WMT), (AMZN),

(WHY YOUR OTHER INVESTMENT NEWSLETTER IS SO DANGEROUS)

Everyone always needs toilet paper, right?

Wrong. At least stock investors don’t.

Once considered one the safest stock market sectors in which to hide out during bear markets and more recently pandemics, Consumer Staples no longer offer the hideout they once did.

Who needs a hideout anyway now that the Roaring Twenties are on and may make another decade to run.

Take a look at the Consumer Staples Select Sector SPDR ETF (XLP). It’s top five holdings include Proctor & Gamble (PG) (11.13%), Coca-Cola (KO) (10.07%), PepsiCo, Inc. (PEP) (8.7%), Philip Morris (7.80%) (PM), and Walmart (WMT).

Its only remaining attraction is that it has a 30-day SEC yield of 2.67%.

The (XLP) has recently been one of the best performing ETFs. However, costs are rising dramatically, and the bloom is coming off the rose.

In short, the industry is caught in a vice.

In the meantime, ferocious online competition from the likes of Amazon (AMZN) makes it impossible for consumer staples to pass costs on to consumers as they did in past economic cycles.

In fact, the prices for many consumer staples are falling thanks to the world’s most efficient distribution network. And if you are an Amazon Prime member, they will deliver it to your door for free. I just bought a pair of Head Kore 93 skis in Vermont, and they were delivered in two days.

It gets worse. The largest sector of the consumer staples market, the poor and working middle class are seeing the smallest wage gains, the worst layoffs, and the slowest pandemic recovery. Almost all pay increases are now taking place at the top of the wage ladder.

AI specialists and online marketing experts, yes, Safeway checkout clerks and fast food workers, no.

This also will get a lot worse as some 50% of all jobs will disappear over the next 20 years, mostly at the low end.

Blame technology. There is even a robot now that can assemble Ikea furniture. And there goes my side gig!

So, if your friend at the country club locker room tells you it’s time to load up on Consumer Staples because they are cheap, safe, and high-yielding, ignore him, delete his phone number from your contact list, and unfriend him on Facebook.

If anything, the sector is a great “sell short on rallies” candidate.

As I never tire of telling followers, never confuse “gone down a lot” with “cheap.”

Eventually, the sector will fall enough to where it offers value. But that point is not now. There has to be a bottom somewhere.

After all, everyone needs toilet paper, right? Or will a robot soon take over that function as well? They already have in Japan.

Global Market Comments

April 1, 2021

Fiat Lux

Featured Trade:

(MARCH 31 BIWEEKLY STRATEGY WEBINAR Q&A),

(FB), (ZM), ($INDU), (X), (NUE), (WPM), (GLD), (SLV), (KMI), (TLT), (TBT), (BA), (SQ), (PYPL), (JNP), (CP), (UNP), (TSLA), (GS), (GM), (F)

Below please find subscribers’ Q&A for the March 31 Mad Hedge Fund Trader Global Strategy Webinar broadcast from frozen Incline Village, NV.

Q: Would you buy Facebook (FB) or Zoom (ZM) right here?

A: Well, Zoom was kind of a one-hit wonder; it went up 12 times on the pandemic as we moved to a Zoom economy, and while Zoom will permanently remain a part of our life, you’re not going to get that kind of growth in stock prices in the future. Facebook on the other hand is going to new highs, they just announced they’re laying a new fiber optic cable to Asia to handle a 70% increase in traffic there. So, for the longer term and buying here, I think you get a new high on Facebook soon; there's maybe another 20-30% move in Facebook this year.

Q: I can’t really chase these trades here, right?

A: Correct; if you wait any more than a day or 2 on executing a trade alert, you’re missing out on all of the market timing value we bring to the game. So that's why I include an entry price and the “don’t pay more than” price. And we never like to chase, except last year, when we did it almost all the time. But last year was a chase market, this year not so much.

Q: How are LEAP purchase notifications transmitted?

A: Those go out in the daily newsletter Global Trading Dispatch when I see a rare entry point for a LEAP, then we’ll send out a piece and notify everybody. But it’s very unusual to get those. Of course, a year ago we were sending out lists of LEAPS ten at a time when the Dow Average ($INDU) is at 18,000. But that is not now, you only wait for those once or twice a year. On huge selloffs to get into two-year-long options trades, and that is definitely not now. The only other place I've been looking out for LEAPS right now are really bombed out technology stocks begging for a rotation. Concierge members get more input on LEAPS and that is a $10,000 a year upgrade.

Q: What are your thoughts on silver (SLV) and long-term gold (GLD)?

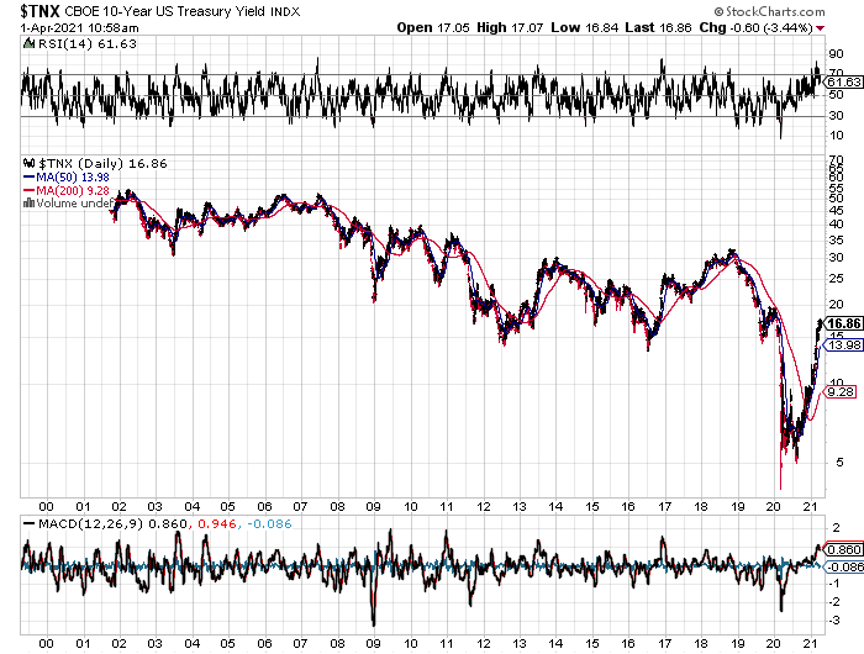

A: I see silver going to $50 and eventually $100 in this economic cycle, but it's out of favor right now because of rising interest rates. So, once we hit 2.00% in the ten years, it’s not only off to the races for tech but also gold and silver. Watch that carefully because your entry point may be on the horizon. That makes Wheaton Precious Metals (WPM) a very attractive “BUY” right now.

Q: Are you going to trade the (TLT)?

A: Absolutely yes, but I’m kind of getting picky now that I’m up 42% on the year; and I only like to sell 5-point rallies, which we got for about 15 minutes last week. And I also only like to buy 5- or 10-point dips. Keep your trading discipline and you’ll make a ton of money in this market. Last year we made about 30% trading bonds on about 30 round trips.

Q: How much further upside is there for US Steel (X) and Nucor Corp. (NUE)?

A: More. There's no way you do infrastructure without using millions of tons of steel. And I kind of missed the bottom on US Steel because it had been a short for so long that it kind of dropped off the radar for me. I think we have gone from $4 to 27 since last year, but I think it goes higher. It turns out the US has been shutting down steel production for decades because it couldn't compete with China or Japan, and now all of a sudden, we need steel, and we don’t even make the right kind of steel to build bridges or subways anymore—that has to be imported. So, most of the steel industry here now is working for the car industry, which produces cold-rolled steel for the car body panels. Even that disappears fairly soon as that gets taken over by carbon fiber. So enough about steel, buy the dips on (X) and (NUE).

Q: What stocks should I consider for the infrastructure project?

A: Well, US Steel (X) and Nucor Corp (NUE) would be good choices; but really you can buy anything because the infrastructure package, the way it’s been designed, is to benefit the entire economy, not just the bridge and freeway part of it. Some of it is for charging stations and electric car subsidies. Other parts are for rural broadband, which is great for chip stocks. There is even money to cap abandoned oil wells to rope in Texas supporters. All of this is going to require a massive upgrade of the power grid, which will generate lots of blue-collar jobs. Really everybody benefits, which is how they get it through Congress. No Congressperson will want to vote against a new bridge or freeway for their district. That’s always the case in Washington, which is why it will take several months to get this through congress because so many thousands of deals need to be cut. I’ve been in Washington when they’ve done these things, and the amount of horse-trading that goes on is incredible.

Q: Is it a good thing that I’ve had the United States Treasury Bond Fund (TLT) LEAPS $125 puts for a long time.

A: Yes. Good for you, you read my research. Remember, the (TLT) low in this economic cycle is probably around $80, so you probably want to keep rolling forward your position….and double up on any ten-point rally.

Q: Do you think we get a pop back up?

A: We do but from a lower level. I think any rallies in the bond market are going to be extremely limited until we hit the 2.00%, and then you’re going to get an absolute rip-your-face-off rally to clean out all the short term shorts. If you're running put LEAPS on the (TLT) I would hang on, it’s going to pay off big time eventually.

Q: If we see 3.00% on the 10-year this year, do you see the stock market crashing?

A: I don’t think we’ll hit 3.00% until well into next year, but when we do, that will be time for a good 10% stock market correction. Then everyone will look around again and say, “wow nothing happened,” and that will take the market to new highs again; that's usually the way it plays out. Remember, then year yields topped all the way up at 5.00% when the Dotcom Bubble topped in April 2020.

Q: Has the airline hospitality industry already priced in the reopening of travel?

A: No, I think they priced in the hope of a reopening, but that hasn’t actually happened yet, and on these giant recovery plays there are two legs: the “hope for it” leg, which has already happened, and then the actual “happening” leg which is still ahead of us. There you can get another double in these stocks. When they actually reopen international travel to Europe and Asia, which may not happen this year, the only reopening we’re going to see in the airline business is in North America. That means there is more to go in the stock price. Also coming back from the brink of death on their financial reports will be an additional positive.

Q: Do you think a corporate tax increase will drive companies out of the US again and raise the unemployment rate?

A: Absolutely not. First of all, more than half of the S&P 500 don’t even pay taxes, so they’re not going anywhere. Second, I think they will make these offshoring moves to tax-free domiciles like Ireland illegal and bring a lot of tax revenues back to the US. And third, all Biden is doing is returning the tax rate to where it was in 2017; and while the corporate tax rate was 35%, the stock market went up 400% during the Obama administration, if you recall. So stocks aren't really that sensitive to their tax rates, at least not in the last 50 years that I’ve been watching. I'm not worried at all. And Biden was up on the polls a year ago talking about a 28% tax rate; and since then, the stock market has nearly doubled. The word has been out for a year and priced in for a year, and I don't think anybody cares.

Q: What about quantum computers?

A: I’m following this very closely, it’s the next major generation for technology. Quantum computers will allow a trillion-fold improvement in computing power at zero cost. And when there's a stock play, I will do it; but unfortunately, it’s not (IBM), because we’re not at the money-making stage on these yet. We are still at the deep research stage. The big beneficiaries now are Alphabet (GOOGL), Microsoft (MSFT), and Amazon (AMZN).

Q: Is it time to buy Chinese stocks?

A: I would say yes. I would start dipping in here, especially on the quality names like Tencent (TME), Baidu (BIDU), and Alibaba (BABA), because they’ve just been trashed. A lot of the selloff was hedge fund-driven which has now gone bust, and I think relations with China improve under Biden.

Q: Your timing on Tesla (TSLA) has been impeccable; what do you look for in times of pivots?

A: Tesla trades like no other stock, I have actually lost money on a couple of Tesla trades. You have to wait for things to go to extremes, and then wait two more days. That seems to be the magic formula. On the first big selloff go take a long nap and when you wake up, the temptation to buy it will have gone away. It always goes up higher than you expect, and down lower than you expect. But because the implied volatilities go anywhere from 70% to 100%, you can go like 200 points out of the money on a 3-week view and still make good money every month. And that’s exactly what we’re going to do for the rest of the year, as long as the trading’s down here in the $500-$600 range.

Q: Is Editas Medicine (EDIT), a DNA editing stock, still good?

A: Buy both (EDIT) and Crisper (CRSP); they both look great down here with an easy double ahead. This is a great long-term investment play with gene editing about to dominate the medical field. If you want to learn more about (EDIT) and (CRSP) and many others like them, subscribe to the Mad Hedge Fund Biotech & Healthcare Letter because we cover this stuff multiple times a week (click here).

Q: Is the XME Metals ETF a buy?

A: I would say yes, but I'd wait for a bigger dip. It’s already gone up like 10X in a year, but the outlook for the economy looks fantastic. (XME) has to double from here just to get to the old 2008 high and we have A LOT more stimulus this time around.

Q: What about hydrogen?

A: Sorry, I am just not a believer in hydrogen. You have to find someone else to be bullish on hydrogen because it’s not me. I've been following the technology for 50 years and all I can say is: go do an image Google for the name “Hindenburg” and tell me if you want to buy hydrogen. Electricity is exponentially scalable, but Hydrogen is analog and has to be moved around in trucks that can tip over and blow up at any time. Hydrogen batteries are nowhere near economic. We are now on the eve of solid-state lithium-ion batteries which improve battery densities 20X, dropping Tesla battery weights from 1,200 points to 60 pounds. So “NO” on hydrogen. Am I clear?

Q: Why do you do deep-in-the-money call and put spreads?

A: We do these because they make money whether the stock goes up down or sideways, we can do them on a monthly basis, we can do them on volatility spikes, and make double the money you normally do. The day-to-day volatility on these positions is very low, so people following a newsletter don’t get these huge selloffs and sell at bottoms, which is the number one source of retail investor losses. After 13 years of trade alerts, I have delivered a 40.30% average annualized return with a quarter of the market volatility. Most people will take that.

Q: Is ProShares Ultra Short 20 Year Plus Treasury ETF(TBT) still a play for the intermediate term?

A: I would say yes. If ten-year US Treasury bonds Yields soar from 1.75% to 5.00% the (TBT) should rise from $21 to $100 because it is a 2X short on bonds. That sounds like a win for me, as long as you can take short term pain.

Q: What is the timing to buy TLT LEAPS?

A: The answer was in January when we were in the $155-162 range for the (TLT). Down here I would be reluctant to do LEAPS on the TLT because we’ve already had a $25 point drop this year, and a drop of $48 from $180 high in a year. So LEAP territory was a year ago but now I wouldn’t be going for giant leveraged trades. That train has left the station. That ship has sailed. And I can’t think of a third Metaphone for being too late.

Q: Would you buy Kinder Morgan (KMI) here?

A: That’s an oil exploration infrastructure company. No, all the oil plays were a year ago, and even six months ago you could have bought them. But remember, in oil you’re assuming you can get in and out before it crashes again, it’s just a matter of time before it does. I can do that but most of you probably can’t, unless you sit in front of your screens all day. You’re betting against the long-term trend. It works if you’re a hedge fund trader, not so much if you are a long-term investor. Never bet against the long-term trend and you always have a tailwind behind you. All surprises work to your benefit.

Q: If you get a head and shoulders top on bitcoin, how far does it fall?

A: How about zero? 80% is the traditional selloff amount for Bitcoin. So, the thing is: if bitcoin falls you have to worry about all other investments that have attracted speculative interest, which is essentially everything these days. You also have to worry about Square (SQ), PayPal (PYPL), and Tesla (TSLA), which have started processing Bitcoin transactions. Bitcoin risk is spread all over the economy right now. Those who rode the bandwagon up will ride it back down.

Q: Is Boeing (BA) a long-term buy?

A: Yes, especially because the 737 Max is back up in the air and China is back in the market as a huge buyer of U.S. products after a four-year vacation. Airlines are on the verge of seeing a huge plane shortage.

Q: What about Ags?

A: We quit covering years ago because they’re in permanent long-term downtrends and very hard to play. US farmers are just too good at their jobs. Efficiencies have double or tripled in 60 years. Ag prices are in a secular 150-year bear market thanks to technology.

Q: Is this recorded to watch later?

A: Yes, it goes on our website in about two hours. For directions on where to find it, log in to your www.madhedgefundrader.com account, go to “My Account,” and it will be listed under there, as are all the recorded webinars of the last 12 years.

Q: Would you buy Canadian Pacific (CP) here, the railroad?

A: No, that news is in the price. Go buy the other ones—Union Pacific (UNP) especially.

Q: What are your thoughts on Bitcoin?

A: We don’t cover Bitcoin because I think the whole thing is a Ponzi scheme, but who am I to say. There is almost ten times more research and newsletters out there on Bitcoin as there is on stock trading right now. They seem to be growing like mushrooms after a spring storm. There are always a lot of exports out there at market tops, as we saw with gold in 2010 and tech stock in 2000.

Q: What do you think about Juniper Networks (JNP)?

A: It’s a Screaming “BUY” right here with a double ahead of it in two years. I’m just waiting for the tech rotation to get going. This is a long-term accumulate on dips and selloffs.

Q: Did the Archagos Investments hedge fund blow threaten systemic risk?

A: No, it seems to be limited just to this one hedge fund and just to the people who lent to it. You can bet banks are paring back lending to the hedge fund industry like crazy right now to protect their earnings. I don’t think it gets to the systemic point, but this is the Long Term Capital Management for our generation. I was involved in the unwind of the last LTCM capital, which was 23 years ago. I was one of the handful of people who understood what these people were even doing. So, they had to bring me in on the unwind and huge fortunes were made on that blowup by a lot of different parties, one of which was Goldman Sachs (GS). I can tell you now that the statute of limitations has run out and now that it's unlikely I'll ever get a job there, but Goldman made a killing on long-term capital, for sure.

Q: Will Tesla benefit from the Biden infrastructure plan?

A: I would say Tesla is at the top of the list of companies the Biden administration wants to encourage. That means more charging stations and more roads, which you need to drive cars on, and bridges, and more tax subsidies for purchases of new electric cars. It’s good not just Tesla but everybody’s, now that GM (GM) and Ford (F) are finally starting to gear up big numbers of EVs of their own. By the way, I don't see any of the new startups ever posing a threat to Tesla. The only possible threats would be General Motors, Ford, and Volkswagen, which are all ten years behind.

Q: Would you put 10% of your retirement fund into cryptocurrencies?

A: Better to flush it down the toilet because there’s no commission on doing that.

Q: Is growing debt a threat to the economy? How much more can the government borrow?

A: It appears a lot more, because Biden has already indicated he’s going to spend ten trillion dollars this year, and the bond market is at a 1.70%—it’s incredibly low. I think as long as the Fed keeps overnight rates at near-zero and inflation doesn't go over 3%, that the amount the government can borrow is essentially unlimited, so why stop at $10 or $20 trillion? They will keep borrowing and keep stimulating until they see actual inflation, and I don’t think we will see that for years because inflation is being wiped out by technology improvements, as it has done for the last 40 years. The market is certainly saying we can borrow a lot more with no serious impact on the economy. But how much more nobody knows because we are in uncharted territory, or terra incognita.

To watch a replay of this webinar just log in to www.madhedgefundtrader.com , go to MY ACCOUNT, click on GLOBAL TRADING DISPATCH, then WEBINARS, and all the webinars from the last ten years are there in all their glory.

Good Luck and Stay Healthy.

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader

Global Market Comments

March 31, 2021

Fiat Lux

Featured Trade:

(HERE’S AN EASY WAY TO PLAY ARTIFICIAL INTELLIGENCE),

(BOTZ), (NVDA), (ISRG)

We are now seven months into the tech correction, and it may come to an end in a month or two. That turn will be dictated by the topping in the ten-year US Treasury bond somewhere around the 10% yield.

So, generational opportunities are starting to open up in some of the best long-term market sectors. It’s time to start building your list of names for when the sun, moon, and stars line up.

Suppose there was an exchange-traded fund that focused on the single most important technology trend in the world today.

You might think that I was smoking California’s largest export (it’s not grapes). But such a fund DOES exist.

The Global X Robotics & Artificial Intelligence ETF (BOTZ) drops a golden opportunity into investors’ laps as a way to capture part of the growing movement behind automation.

The fund currently has an impressive $2.6 billion in assets under management.

The universal trend of preferring automation over human labor is spreading with each passing day. Suffice to say there is the unfortunate emotional element of sacking a human and the negative knock-on effect to the local community like in Detroit, Michigan.

But simply put, robots do a better job, don’t complain, don’t fall ill, don’t join unions, or don’t ask for pay rises. It’s all very much a capitalist’s dream come true.

Instead of dallying around in single stock symbols, now is the time to seize the moment and take advantage of the single seminal trend of our lifetime.

No, it’s not online dating, gambling, or bitcoin, it’s Artificial Intelligence.

Selecting individual stocks that are purely exposed to A.I. is challenging endeavor. Companies need a way to generate returns to shareholders first and foremost, hence, most pure A.I. plays do not exist right now.

However, the Mad Hedge Fund Trader has found the most unadulterated A.I. play out there. A real diamond in the rough.

The best way to expose yourself to this A.I. trend is through Global X Robotics & Artificial Intelligence ETF (BOTZ).

This ETF tracks the price and yield performance of ten crucial companies that sit on the forefront of the A.I. and robotic development curve. It invests at least 80% of its total assets in the securities of the underlying index. The expense ratio is only 0.68%.

Another caveat is that the underlying companies are only derived from developed countries. Out of the 10 disclosed largest holdings, seven are from Japan, two are from Silicon Valley, and one, ABB Group, is a Swedish-Swiss multinational headquartered in Zurich, Switzerland.

Robotics and A.I. walk hand in hand, and robotics are entirely dependent on the germination prospects of A.I. Without A.I., robots are just a clunk of heavy metal.

Robots require a high level of A.I. to meld seamlessly into our workforce. The stronger the A.I. functions, the stronger the robot’s ability, filtering down to the bottom line.

A.I. embedded robots are especially prevalent in military, car manufacturing, and heavy machinery. The industrial robot industry projects to reach $80 billion per year in sales by 2024 as more of the workforce gradually becomes automated.

The robotic industry has become so prominent in the automotive industry that they constitute greater than 50% of robot investments in America.

Let’s get the ball rolling and familiarize readers of the Mad Hedge Technology Letter with the top 5 weightings in the underlying ETF (BOTZ).

Nvidia (NVDA)

Nvidia Corporation is a company I often write about as their main business is producing GPU chips for the video game industry.

This Santa Clara, California-based company is spearheading the next wave of A.I. advancement by focusing on autonomous vehicle technology and A.I. integrated cloud data centers as their next cash cow.

All these new groundbreaking technologies require ample amounts of GPU chips. Consumers will eventually cohabitate with state-of-the-art IOT products (internet of things), fueled by GPU chips, coming to mass market like the Apple Homepod.

The company is led by genius Jensen Huang, a Taiwanese American, who cut his teeth as a microprocessor designer at competitor Advanced Micro Devices (AMD).

Nvidia constitutes a hefty 8.70% of the BOTZ ETF.

To visit their website, please click here.

Yasakawa Electric (Japan)

Yasakawa Electric is the world's largest manufacturer of AC Inverter Drives, Servo and Motion Control, and Robotics Automation Systems, headquartered in Kitakyushu, Japan.

It is a company I know well, having covered this former zaibatsu company as a budding young analyst in Japan 45 years ago.

Yaskawa has fully committed to improve global productivity through Automation. It comprises the 2nd largest portion of BOTZ at 8.35%.

To visit Yaskawa’s website, please click here.

Fanuc Corp. (Japan)

Fanuc was another one of the hot robotics companies I used to trade in during the 1970s, and I have visited their main factory many times.

The 3rd largest portion in the (BOTZ) ETF at 7.78% is Fanuc Corp. This company provides automation products and computer numerical control systems, headquartered in Oshino, Yamanashi.

They were once a subsidiary of Fujitsu, which focused on the field of numerical control. The bulk of their business is done with American and Japanese automakers and electronics manufacturers.

They have snapped up 65% of the worldwide market in the computerized numerical device market (CNC). Fanuc has branch offices in 46 different countries.

To visit their company website, please click here.

Intuitive Surgical (ISRG)

Intuitive Surgical Inc (ISRG) trades on Nasdaq and is located in sun-drenched Sunnyvale, California.

This local firm designs, manufactures, and markets surgical systems and is completely industriously focused on the medical industry.

The company's da Vinci Surgical System converts surgeon's hand movements into corresponding micro-movements of instruments positioned inside the patient.

The products include surgeon's consoles, patient-side carts, 3-D vision systems, da Vinci skills simulators, da Vinci Xi integrated table motions.

This company comprises 7.60% of BOTZ. To visit their website, please click here.

Keyence Corp (Japan)

Keyence Corp is the leading supplier of automation sensors, vision systems, barcode readers, laser markers, measuring instruments, and digital microscopes.

They offer a full array of service support and closely work with customers to guarantee full functionality and operation of the equipment. Their technical staff and sales teams add value to the company by cooperating with its buyers.

They have been consistently ranked as the top 10 best companies in Japan and boast an eye-opening 50% operating margin.

They are headquartered in Osaka, Japan and make up 7.54% of the BOTZ ETF.

To visit their website, please click here.

(BOTZ) does have some pros and cons. The best AI plays are either still private at the venture capital level or have already been taken over by giant firms like NVIDIA.

You also need to have a pretty broad definition of AI to bring together enough companies to make up a decent ETF.

However, it does get you a cheap entry into many for the illiquid foreign names in this fund.

Automation is one of the reasons why this is turning into the deflationary century and I recommend all readers who don’t own their own robotic-led business, pick up some Global X Robotics & Artificial Intelligence ETF (BOTZ).

And by the way, the entry point right here on the charts is almost perfect.

To learn more about (BOTZ), please visit their website by clicking here.

Global Market Comments

March 30, 2021

Fiat Lux

Featured Trade:

(HOW THE MAD HEDGE MARKET TIMING ALGORITHM TRIPLED MY PERFORMANCE)