Global Market Comments

April 22, 2025

Fiat Lux

Featured Trade:

(THE GOVERNMENT’S WAR ON MONEY)

(TESTIMONIAL)

"Sometimes we stare so long at a door that is closing that we see too late the one that is open," said Alexander Graham Bell, inventor of the telephone.

Global Market Comments

April 21, 2025

Fiat Lux

Featured Trade:

(MARKET OUTLOOK FOR THE WEEK AHEAD, or IN SEARCH OF THE LOST MARKET BOTTOM),

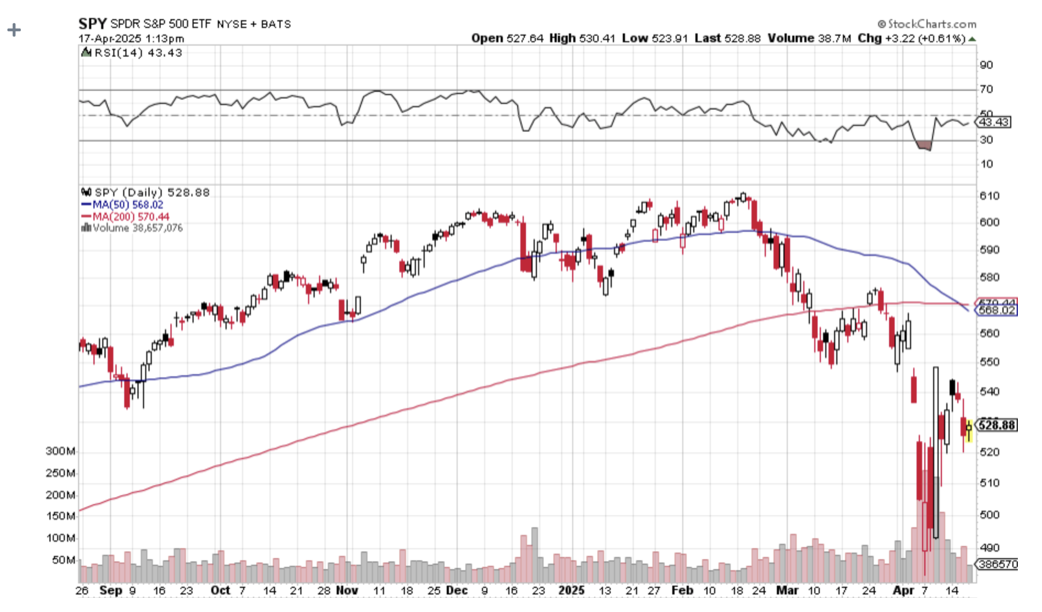

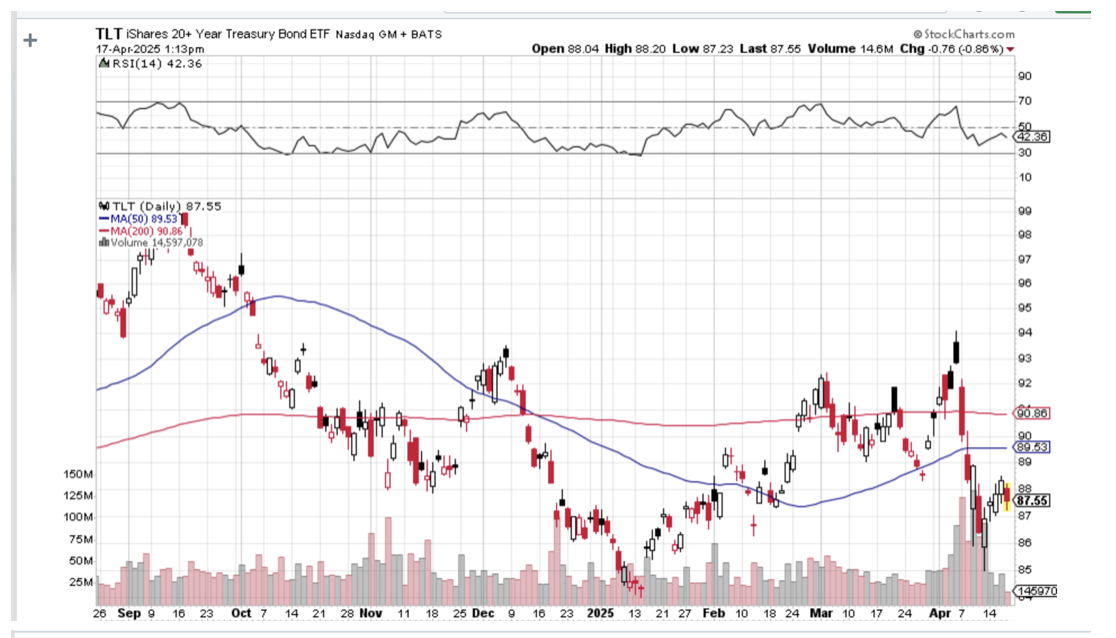

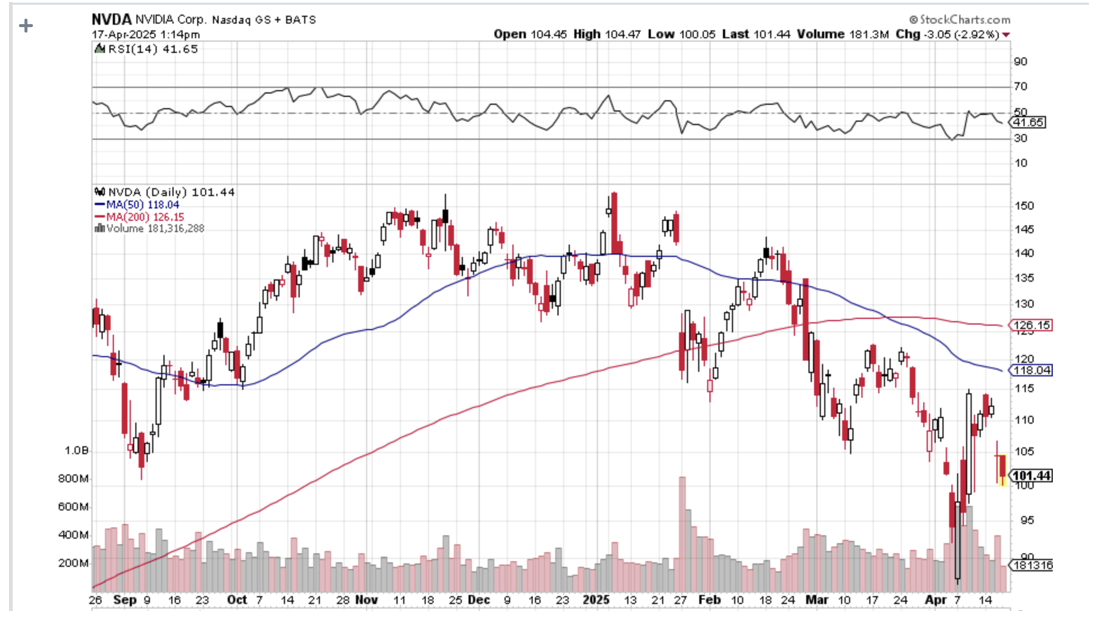

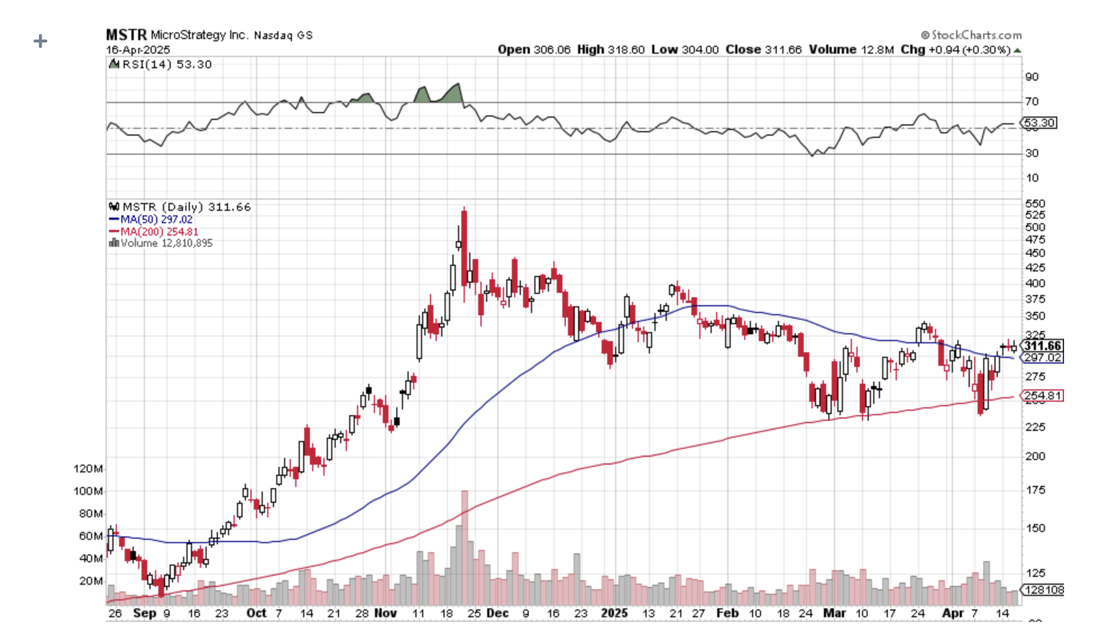

(SPY), (TLT), (NFLX), (COST), (NVDA), (TSLA), (MSTR)

Back in 1977, I met Chinese Premier Deng Xiaoping for the first time at the Foreign Correspondents Club of Japan. He was a cherubic 4’10” and I was a lanky 6’4” and when we shook hands, he craned his neck and laughed. When he asked me my name, I answered “Shorty” and we laughed again.

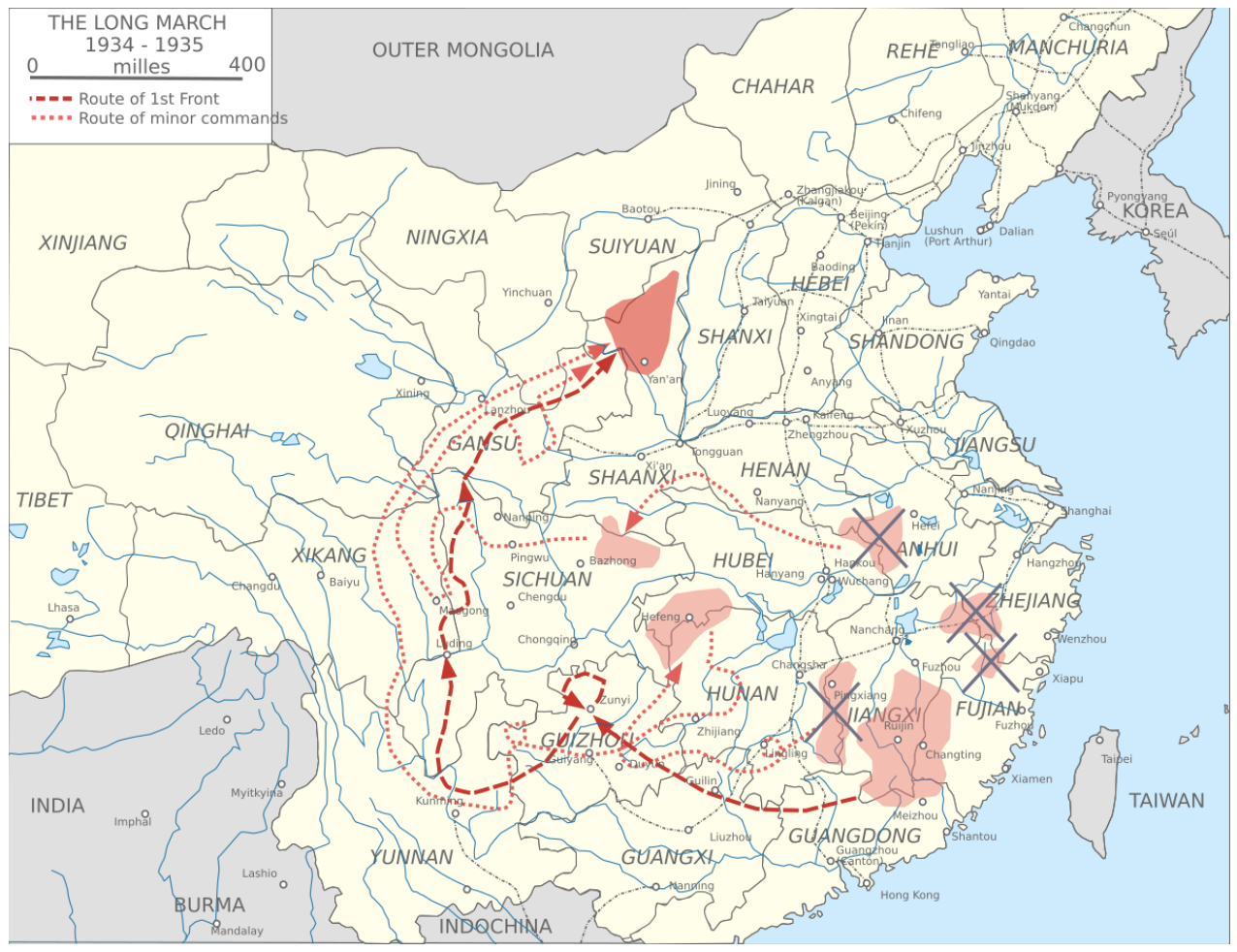

I know for a fact that Deng had survived the 1934 Long March. That was when the forces of Chiang Kai-shek chased the communists 5,000 miles across China in an attempt to wipe them out. The communists blew up bridges to stay ahead, starved, and gave away children to peasant families because they couldn’t feed them. The communist forces shrank from 100,000 to only 8,000 before they reached the safety of distant Yunnan province.

The lesson here? The Chinese can be tough, really tough.

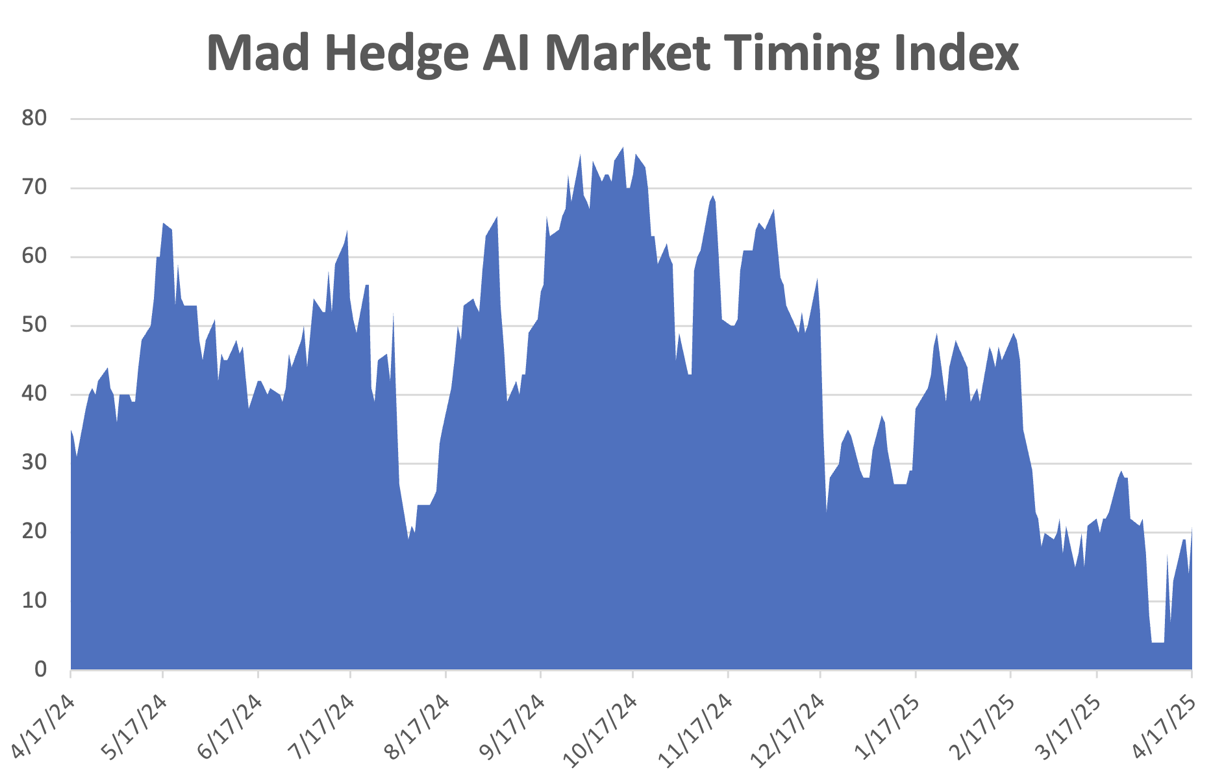

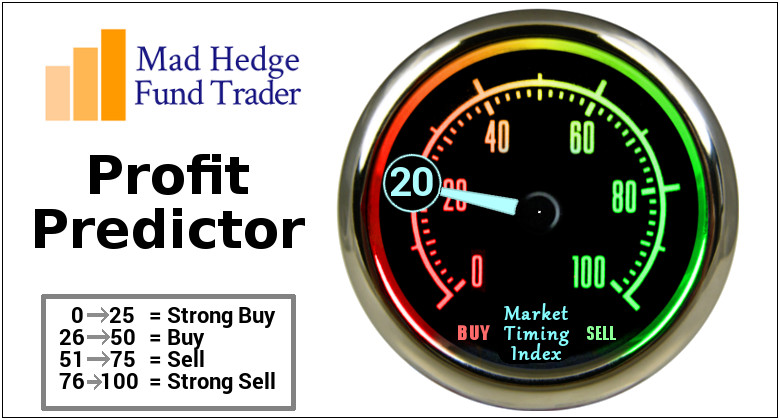

Like everyone else, we here at Mad Hedge Fund Trader have no idea what is going to happen in the markets moment to moment. With trade policy changing by the hour, markets are basically untradable. The goal here is preservation of capital until better days arrive, no matter how long that may take, even if it's four years.

However, I DO know what a 3,000-point move in the Dow Average looks like. For the time being, I will be selling 3,000-point rallies and buying 3,000-point dips until Mr. Market tells me otherwise.

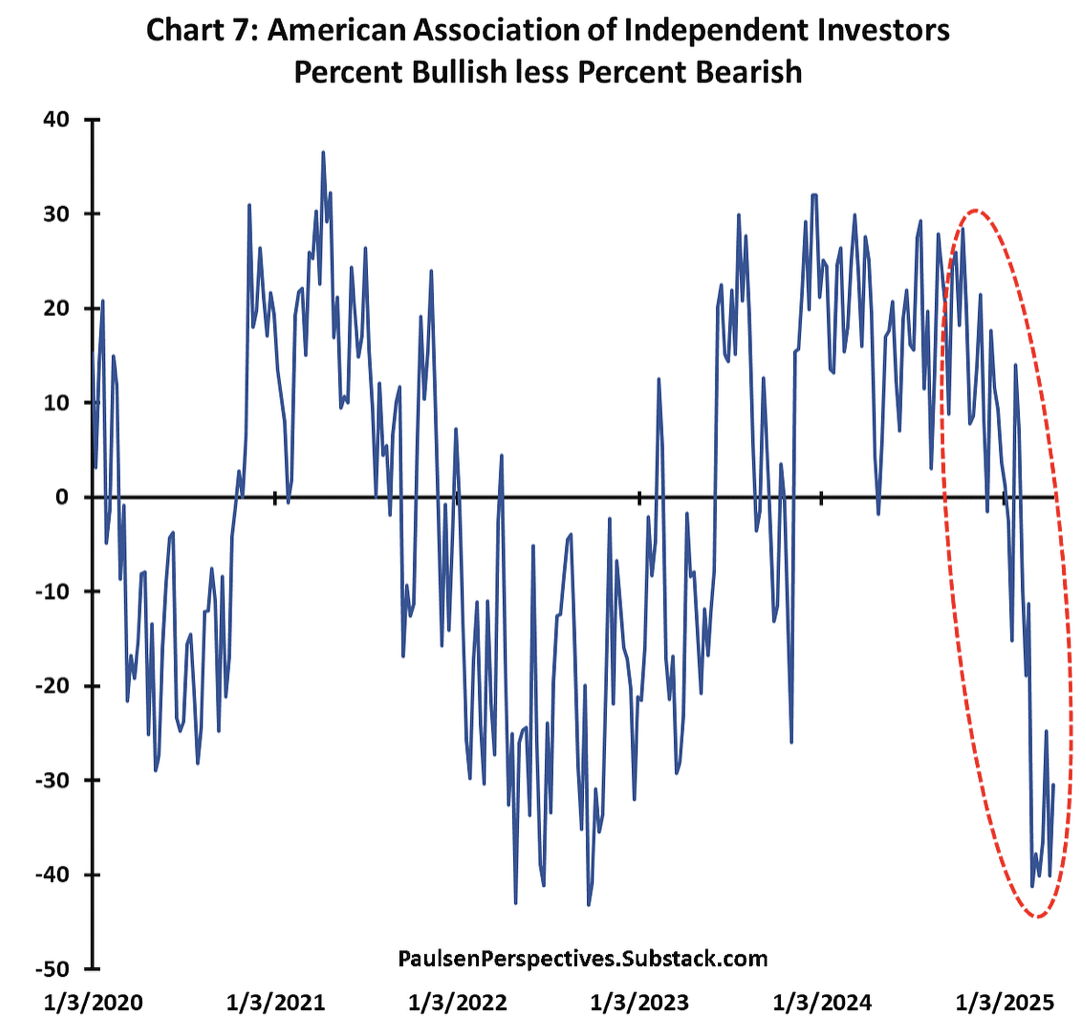

We have seen the biggest collapse in confidence in my lifetime, on par with the two oil shocks in the 1970s, the 1987 stock market crash, 9/11, the Great Recession, and the Pandemic. It’s not a great risk-taking environment.

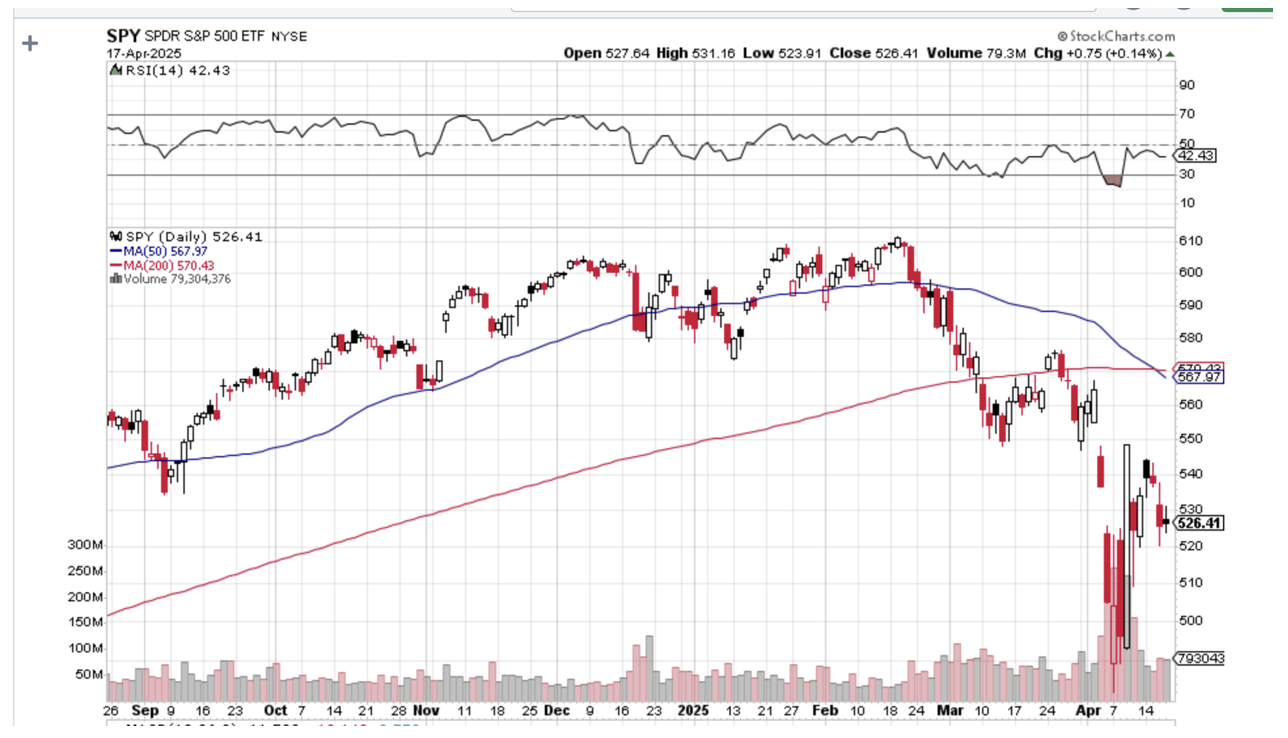

As hard as it may be to believe, even after the carnage of the last two months, stocks are still historically expensive. The S&P 500 multiple is back up to 20X against a long-term average of 14X. In fact, earnings multiples are rising again because corporate earnings forecasts are being slashed.

At this point, the best-case scenario is that the government negotiates China tariffs down from 145% to only 50%. That still cuts 1% off of US GDP growth, which brings an automatic 4% corporate earnings growth.

Last year, the S&P 500 earned $240 a share, and analysts are chopping the 2025 forecast like an Alaskan lumberjack on steroids. Zero earnings growth this year at the current historically high multiple of 20X gets you a (SPX) of $4,800, where are lot of downside targets are bunching up right now. We almost got there on April 9.

But just as strategists like to competitively raise targets in bull markets, they also competitively lower them in bear markets. Zero earnings growth at an 18X multiple gets you to $4,320, and 16X gets you to $3,840. At 14X, $240 a share gets you to $3,360, where a lot of worst-case scenarios are congregating now.

If I started shouting a $3,360 target from the rooftops now, readers will assume that I‘ve become a permabear on the order of a Joe Granville, who in 1982 expected the S&P 500 Average to fall to 40.

And then what happens if earnings actually go negative this year? You can ratchet all these forecasts downward. What if China chooses not to negotiate, but waits out the trade war until a new president comes along, as most American companies are doing? Then we have four years of the Great Depression. In fact, these days, worst-case scenarios are a dime a dozen. While Republicans are swearing bullets over the mid-term elections in 18 months, the Chinese are as relaxed as ever. They don’t have elections, and if you disagree, you get shot.

The bottom line here is that the Chinese can take far more pain than we can.

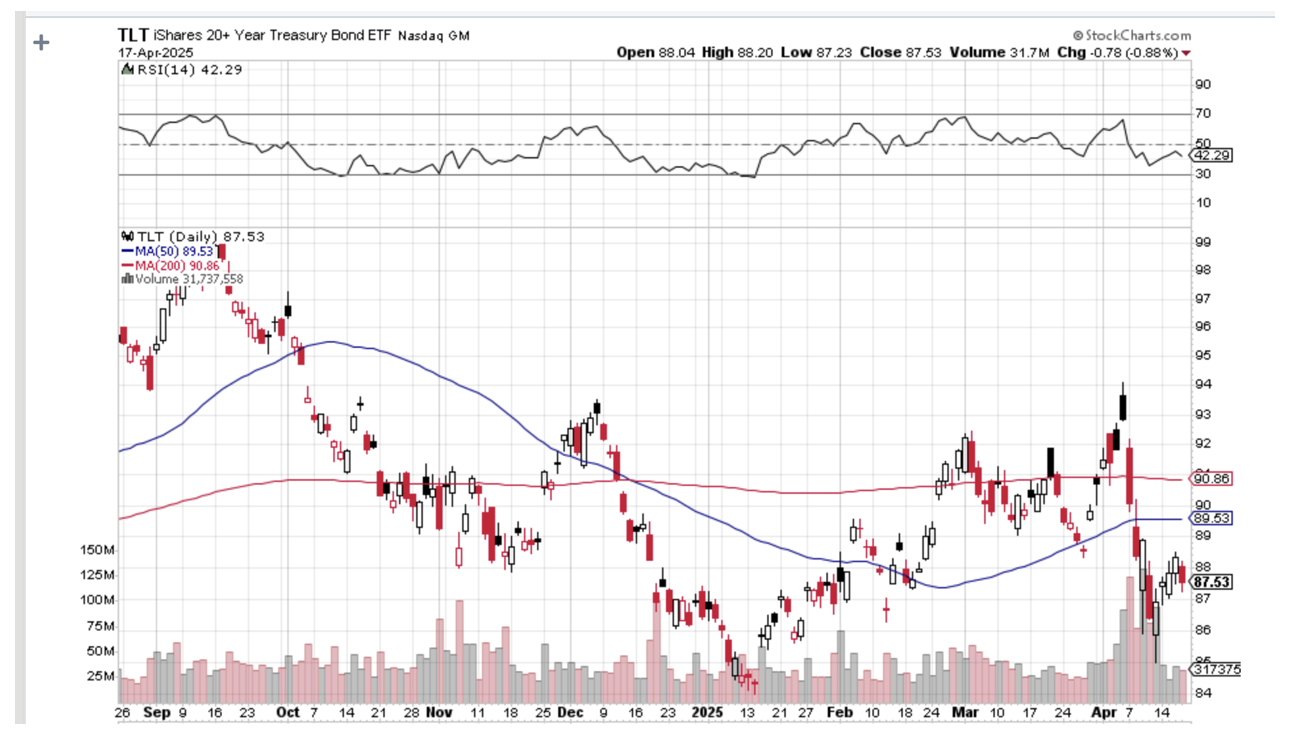

The trade war is not the only thing dragging stock prices down right now. When most of the world is willing to buy unlimited amounts of your debt, a $37 trillion national debt is no problem. If they aren’t, it is a big problem. Suddenly, interest rates rise as government borrowing crowds out the private sector, as does the cost of debt service. The US Treasury has to refinance $9.2 trillion in maturing debt this year, as last week’s bond market crash may only be the opening chapter in THIS crisis.

If you’re not confused enough already, the Fed’s dual mandate is now diametrically opposed to each other. Inflation is going up, pushing it to raise interest rates. But there is no doubt that the economy is slowing and unemployment is rising, encouraging a cut. Let me know how this works out. As the Fed has always been a 100% backward-looking organization, the end of the year is the earliest the Fed can cut interest rates. Serious inflation hasn’t even started yet, and the Fed doesn’t anticipate things.

Speaking to several CEO’s this week, it’s clear that companies plan to spread out tariff-driven price increases over three years. Unfortunately for the Fed, that means prices will start rising now and continue indefinitely.

A collapsing economy, soaring interest rates, a trade war, inflation about to take off, and a crisis in confidence in the US do not argue for higher stock prices or multiples to me. If the US Treasury bill market is offering to pay you 4.3% to stay away, I would take it.

A concierge client asked me what would cause me to change my mind and turn 100% bullish. A declaration that all tariffs worldwide will be taken down to zero, ending the trade war. We may actually get several of these declarations, even if no real action is taken.

Once confidence is lost, it takes a really long time to get it back. Trump may have permanently broken America’s ability to borrow abroad.

As for me, I’m not holding my breath.

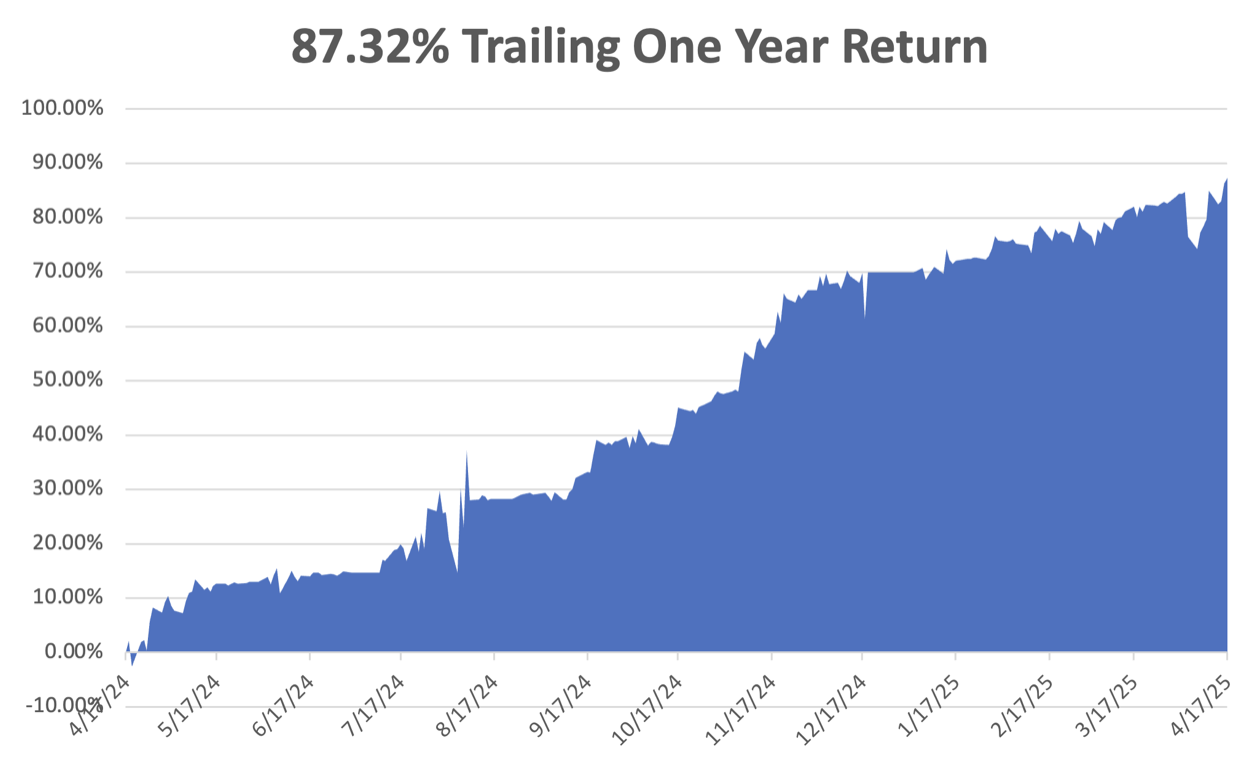

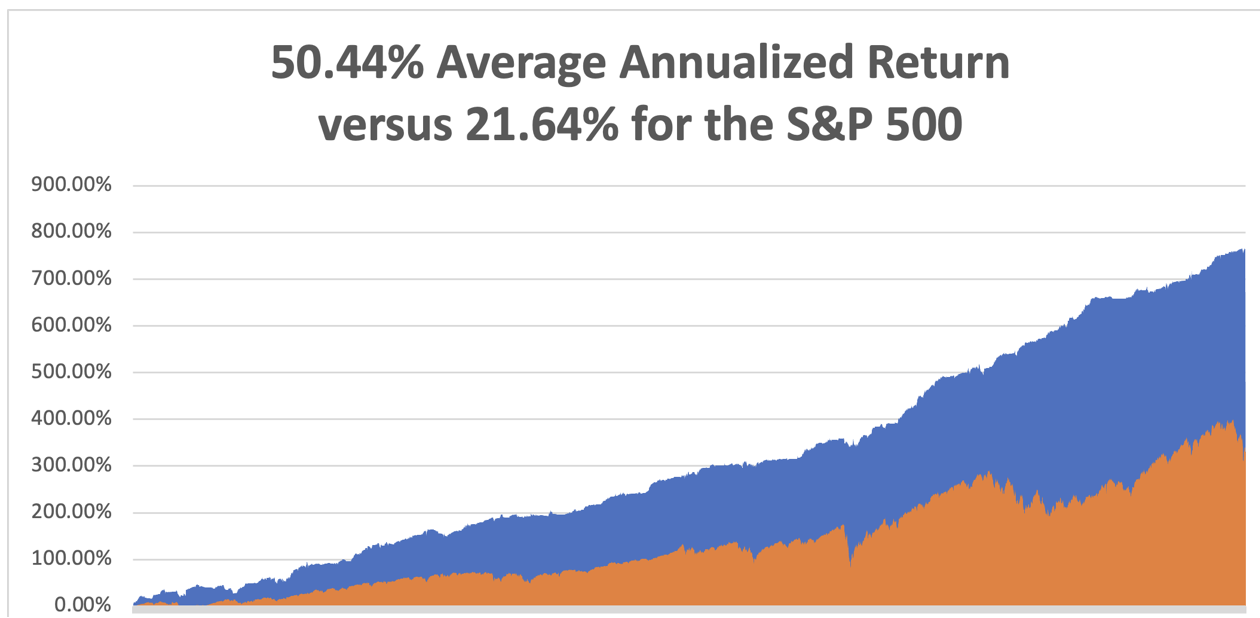

April is now up by +2.19% with our entire remaining portfolio expiring at max profit with the April 17 options expiration. That takes us to a year-to-date profit of +17.35% so far in 2025. My trailing one-year return stands at a spectacular +87.32%. That takes my average annualized return to +50.44% and my performance since inception to +769.24%, a new all-time high.

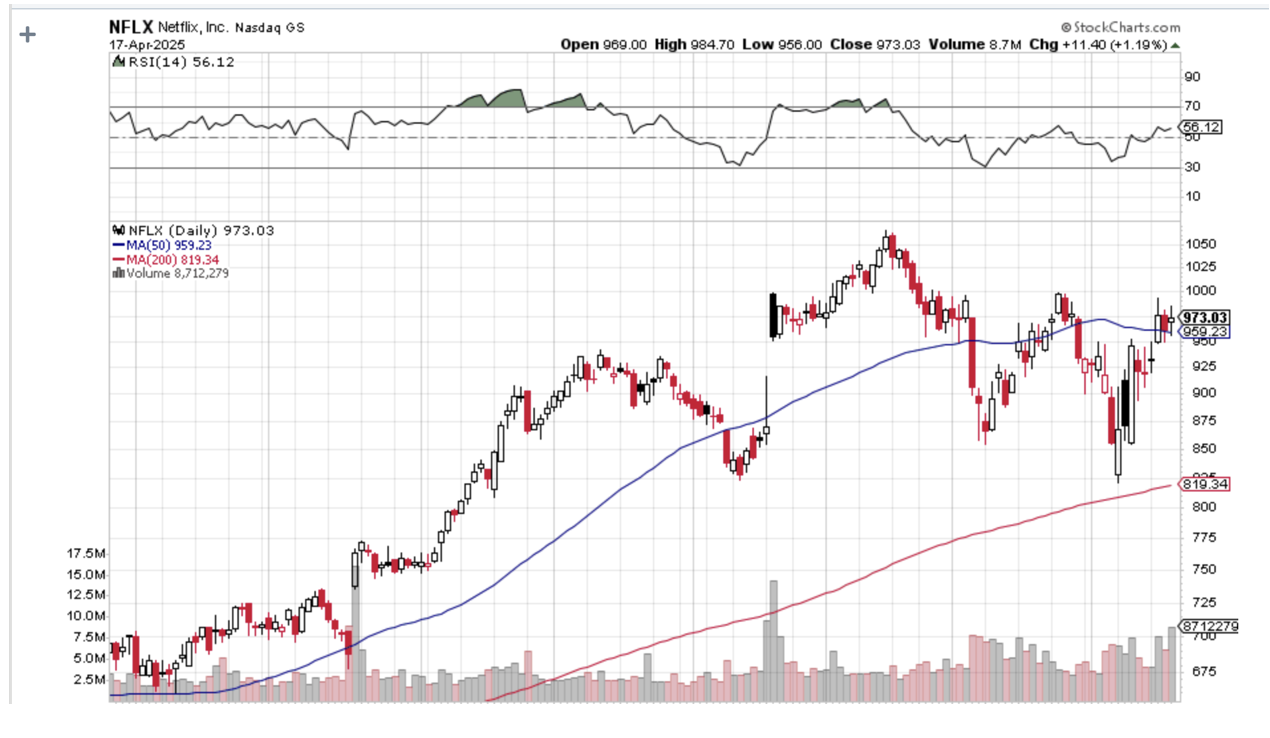

It has been another wild week in the market. I had the good fortune to have five options positions expire at Max profit in (NFLX), (COST), (NVDA), (TSLA), (MSTR). I added both longs and shorts in the leveraged long Bitcoin play (MSTR), betting that it will not rise or fall more than $100 in the next 19 days. I also use the collapse in the Volatility Index ($VIX) from $54 to $30 to take profits in the Proshares Short Vix Short Term Futures ETN (SVXY). Unusual times call for unusual trades.

Some 63 of my 70 round trips, or 90%, were profitable in 2023. Some 74 of 94 trades have been profitable in 2024, and several of those losses were really break-even. That is a success rate of +78.72%.

Try beating that anywhere.

Jay Powell Hints at No Rate Cuts This Year, due to the inflationary impact of the biggest tariff increases in history, sending markets crashing. Gold is through the roof. The Fed is also turning bearish on the economy.

US Inflation Expectations Hits 44-Year High. Sharply rising interest rates are now a new factor pushing prices up, with the bond market suffering its worst week in 25 years. The University of Michigan on Friday showed that Inflation Expectations had soared to 6.7% in the wake of Trump's April 2 reciprocal tariffs announcement.

Antitrust Case Proceeds Against Meta, with the FTC attempting to force the company to divest WhatsApp and Instagram. Other antitrust cases are proceeding against Alphabet (GOOGL) and Amazon (AMZN). Not only is Trump wrecking the US economy, but he is also dismantling the largest West Coast profit earners.

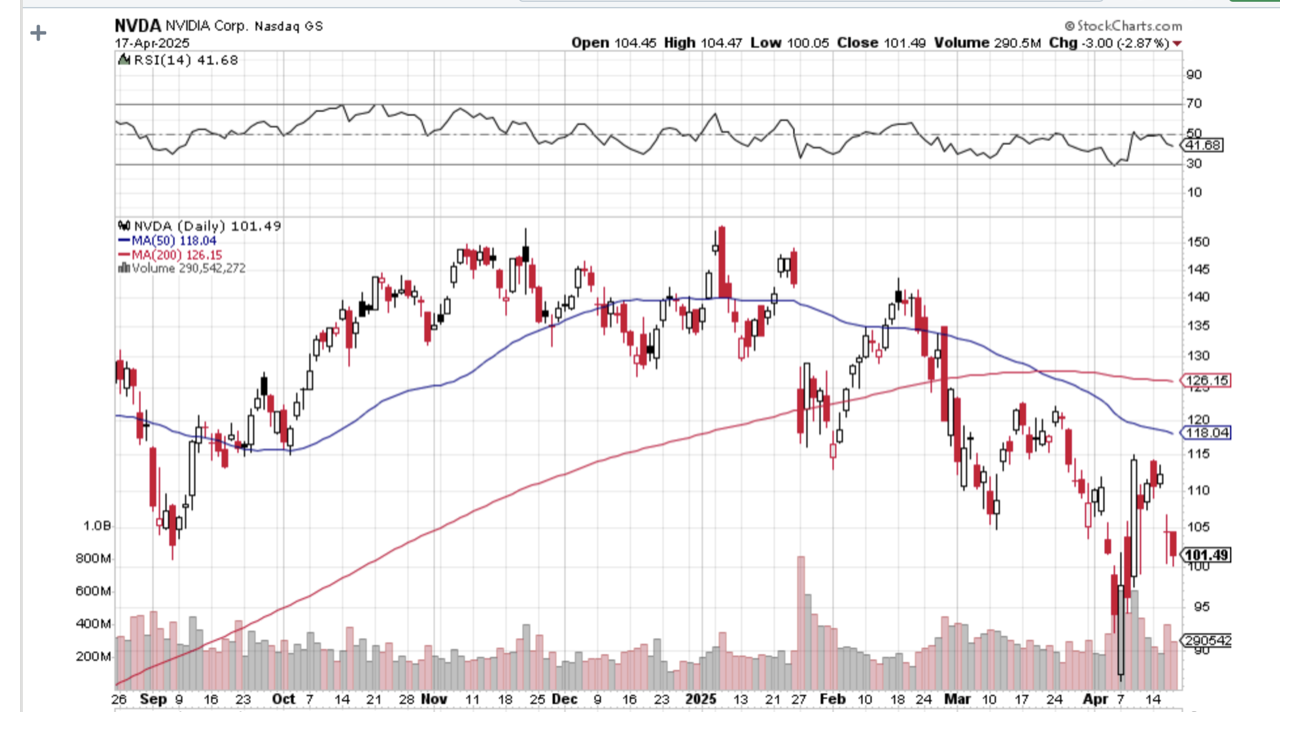

Nvidia Suffers a Perfect Storm, with a ban on selling its no.2 chip in China, the H20, and a national security investigation by Congress. The shares suffered an 11% selloff. Semiconductors are definitely the chief whipping boy in this trade war. These H20 chips are dumbed down solely for export to China so they can be sold anywhere else.

China Imposes Rare Earth Ban for US, essential elements for all electronic manufacturing. The US has plenty of rare earths, but 90% of the processing is done in China. You can’t make semiconductors without rare earths.

Foreign Central Banks Selling US Treasury Bonds, and buying Treasury bills. Fewer dollars are needed to recycle smaller trade surpluses. It’s also a good time to de-risk. Taken together, that signals foreign governments could be pessimistic on the long-term prospects of the U.S. while trying to increase their access to cash in the near term. In February, foreign central banks unloaded a net $19.6 billion in longer-term U.S. bonds and notes. They sold $24.1 billion in January, 2025, and $42.3 billion in December, 2025. A little over a billion was sold in November 2025.

China Cancels Boeing Order, as part of the tit-for-tat trade war that’s seen Trump levy tariffs of as high as 145% on Chinese goods. Beijing has also requested that Chinese carriers halt any purchases of aircraft-related equipment and parts from US companies, the people said, asking not to be identified discussing matters that are private.

Morgan Stanley Marks Down (SPX) Earnings, from $270 to $257 per share. Citigroup said the Goldilocks sentiment in place entering this year has given way to abject uncertainty. Expect an avalanche of coming downgrades of US stocks.

MicroStrategy Loads the Boat with Bitcoin. The company, which does business as Strategy, revealed in a Form 8-K that it had acquired 3,459 Bitcoins for roughly $285.8 million, or around $82,618 per Bitcoin, between April 7 and Monday, April 14. The latest purchase brought MicroStrategy’s total holdings to 531,664 units of the digital currency, with an aggregate purchase price of $35.92 billion. Sell (MSTR) rallies. This is not a RISK OFF” asset, which trades like a leveraged long tech stock.

Unemployment Fears Hit Five-Year High. Consumer worries grew over inflation, unemployment, and the stock market as the global trade war heated up in March, according to a New York Fed survey. The probability that the unemployment rate would be higher a year from now surged to 44%, up 4.6 percentage points, and the highest level going back to the early Covid pandemic days of April 2020. The expectation that the market will be higher a year from now slid to 33.8%, a decline of 3.2 percentage points to the lowest reading going back to June 2022.

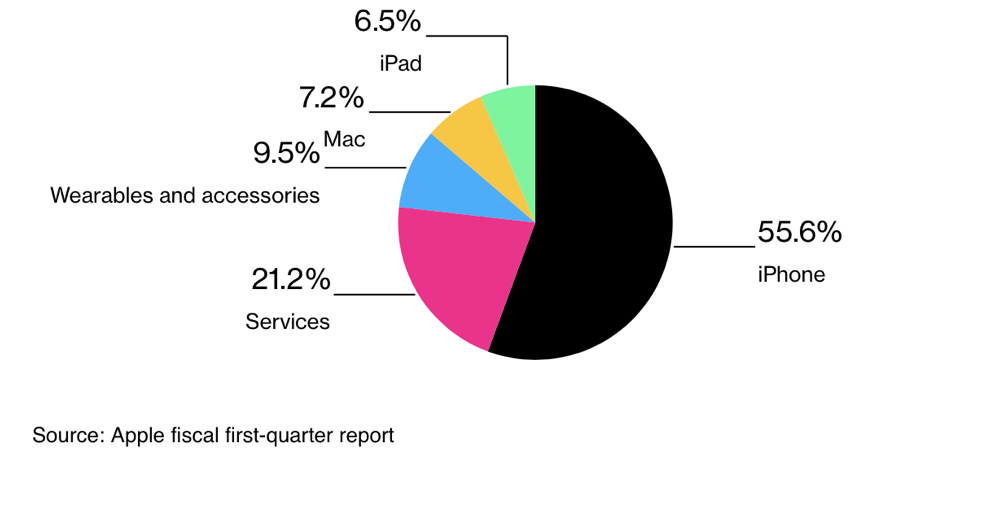

Apple Flew $2 Billion Worth of iPhones from India to beat the trump tariffs. (AAPL) It is probably the worst-affected company by the trade wars. Front-running tariffs have been going on throughout the economy.

US Temporarily Exempts Import Duties on Smart Phones and Chips, lifting a huge burden off Apple’s shoulders. The administration finally realized that moving iPhone production from China to the US is impossible. Like coffee beans, they can’t be grown here, except in Hawaii. Looks like Tim Cook’s million-dollar donation to Trump paid off. Buy Apple on dips.

My Ten-Year View – A Reassessment

We have to substantially downsize our expectations of equity returns in view of the election outcome. My new American Golden Age, or the next Roaring Twenties, is now looking at multiple gale-force headwinds. The economy will completely stop decarbonizing. Technology innovation will slow. Trade wars will exact a high price. Inflation will return. The Dow Average will rise by 600% to 240,000 or more in the coming decade. The new America will be far more efficient and profitable than the old. My Dow 240,000 target has been pushed back to 2035.

On Monday, April 21, at 8:30 AM EST, the Conference Board Leading Economic Indicators are announced.

On Tuesday, April 22, at 3:30 AM, the Crude Oil Stocks are released.

On Wednesday, April 23, at 1:00 PM, New Home Sales are published.

On Thursday, April 24, at 8:30 AM, the Weekly Jobless Claims are disclosed. We also get Existing Home Sales.

On Friday, April 25, at 8:30 AM, we get the University of Michigan Consumer Sentiment.

As for me, not a lot of people get a chance to board a WWII battleship these days. So when I got the chance, I jumped at it.

As part of my grand tour of the South Pacific for Continental Airlines in 1981, I stopped at the US missile test site at Kwajalein Atoll in the Marshall Islands, a mere 2,000 miles west southwest of Hawaii and just north of the equator.

Of course, TOP SECRET clearance was required, which I’ve had since I was 20, and no civilians were allowed.

No problem there, as clearance from my days at the Nuclear Test Site in Nevada was still valid. Still, the FBI visited my parents in California just to be sure that I hadn’t adopted any inconvenient ideologies in the intervening years.

I met with the admiral in charge to get an update on the current strategic state of the Pacific. China was nowhere back then, so there wasn’t much to talk about in the wake of the Vietnam War.

As our meeting wound down, the admiral asked me if I had been on a German battleship. “It’s a bit before my time,” I replied. “How would you like to board the Prinz Eugen he responded.

The Prinz Eugen was a heavy cruiser, otherwise known as a pocket battleship built by Nazi Germany. It launched in 1938 at 16,000 tons and with eight 8-inch guns. Its sister ship was the Admiral Graf Spee, which was scuttled in the famous Battle of the River Plate in South America in 1939.

Early in the war, it helped sink the British battleship HMS Hood and damaged the HMS Prince of Wales. The Prinz Eugen spent much of the war holed up in a Norwegian fjord and later provided artillery support for the retreating German Army on the eastern front. At the end of the war, the ship was handed over to the US Navy as a war prize.

The US postwar atomic testing was just beginning, so the Prinz Eugen was towed through the Panama Canal to be used as a target. Some 200 ships were assembled, including those from Germany, Japan, Britain, and even some American ships deemed no longer seaworthy, like the USS Saratoga. One of the first hydrogen bombs was dropped in the middle of the fleet.

The Prinz Eugen was the only ship to remain afloat. In the Navy film of the explosion, you can see the Prinz Eugen jump 200 feet into the air and come down upright. The ship was then towed back to Kwajalein Atoll and put at anchor. A typhoon came later in 1946, capsizing and sinking it.

It was a bright and sunny day when I pulled up to the Prinz Eugen in a small boat with some Navy divers. There was no way the Navy was going to let me visit the ship alone.

The ship was upside-down, with the stern beached, the bow in 300 feet of pristine turquoise water. The propellers had recently been sent off to a war memorial in Germany. The ship’s eight cannons lay scattered on the bottom, falling out of their turrets when the ship tipped over.

The small part of the Prinz Eugen above water had already started to rust through. But once underwater, it was like entering a live aquarium.

A lot of coral, seaweed, starfish, and sea urchins can accumulate in 36 years, and every inch of the ship was covered. Brightly tropical fish swam in schools. A six-foot mako shark with a hungry look warily swam by.

My diver friends knew the ship well and showed me the highlights to a depth of 50 feet. The controls in the engine room were labeled in German Fraktur, the preferred prewar script. Broken dishes displayed the Nazi swastika. Anti-aircraft guns frozen in time pointed towards the bottom. No one had been allowed to remove anything from the ship since the war, and in the Navy, most men follow orders.

It was amazing what was still intact on a ship that had been blown up by a hydrogen bomb. You can’t beat “Made in Germany.” Our time on the ship was limited as the hull was still radioactive, and in any case, I was running low on oxygen.

A few years later, the Navy banned all diving on the Prinz Eugen. Three divers had gotten lost in the dark, tangled in cables, and drowned. I was one of the last to visit the historic ship.

I checked with my friends in the Navy, and the Prinz Eugen is still there, but in deteriorating condition. When the ship started leaking oil in 2018 and staining the immaculate beaches nearby, the Navy launched a major effort to drain what was left from the 80-year-old tanks. No doubt a future typhoon will claim what is left.

So if someone asks if you know anybody who’s been on a German battleship, you can say, “Yes,” you know me. And yes, my German is still pretty good these days.

Vielen dank!

Good Luck and Good Trading,

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader

The Prinz Eugen in 1940

On Pelelui Island

“When goods don’t cross borders, armies do,” said Frederic Bastiat.

Global Market Comments

April 17, 2025

Fiat Lux

Featured Trade:

(THE MAD HEDGE TRADERS & INVESTORS SUMMIT REPLAYS ARE UP)

(APRIL 16 BIWEEKLY STRATEGY WEBINAR Q&A),

(SPY), (SH), (SDS), (TLT), (MSTR), (GLD),

(GOLD), (SLV), (AGQ), (NEM)

Learn from 24 of the best professionals in the market with decades of experience and the track records to prove it. They are offering a smorgasbord of successful trading strategies.

Every strategy and asset class will be covered, including stocks, bonds, foreign exchange, precious metals, commodities, energy, and real estate.

Get the tools to build an outstanding performance for your own portfolio. To view, click here.

Below, please find subscribers’ Q&A for the April 16 Mad Hedge Fund Trader Global Strategy Webinar, broadcast from Incline Village, NV.

Q: Is it time to get out of the (SH), which is the short S&P 500 LEAPS?

A: I would say no. We're still very deep in the money for the LEAPS I put out two months ago. I doubt we're going to new highs by August when that LEAPS expires, so I would hang on to it, especially if you have other longs on the stock market. But if you're nervous, you probably have at least a 50% profit in that anyway, so take the money and run.

Q: Could the S&P 500 trade down to 4,500?

A: Absolutely, yes. China is kind of in a good position. They can wait. They can wait a very long time until they get what they want. We can't. Trump needs China to fold immediately, or the trade with China will cause a never-ending recession in the US. Remember, we have elections here—in China, they don't. That puts them in a very strong negotiating position. That's why you're seeing basically all economic data roll over and point to a recession. Even if some settlement is negotiated, there still will be some tariffs left. They just won't be at 145%. You know, it’s not a great investment environment to bet your retirement savings on, and certainly not an environment to engage in very rapid short-term trading unless you have 50 years of experience like I do. That's why I'm up this month, and the rest of the world is getting absolutely crushed.

Q: Are you going to send more LEAPS?

A: LEAPS are something we do at market bottoms, not tops, because we have such enormous leverage in the LEAPS trade—they’re usually 10 - 1 to 100 - 1 leverage. At some point, there'll be a lot of fantastic LEAPS in technology stocks, but I don't think we've hit bottom yet. In fact, at best, they've mounted weak bounces over the last few days. So, the charts still look terrible—not a good time for LEAPS.

Q: When do you see the bottom?

A: I have no idea, nobody has any idea. It's like economic policy is changing hour by the hour. Best thing to do is nothing in that situation—and that's what most of the economy is doing. That's why the economy is shutting down. Nobody knows what the final picture will look like—the uncertainty is the greatest since the uncertainty of the pandemic, or 9/11 before that.

Q: Should I hide in a money market fund?

A: No, with the money market fund, you run credit risk with the issuer of that fund. With 90-day US Treasury bills, there's no risk, so you have a government guarantee to get all your money back on the maturity date. If your custodian goes bankrupt, you can always get the T-bills back. It may take you three years in custodian bankruptcy proceedings to get your money market fund back. That’s what we saw with MF Global in 2011.

Q: What is the end game of the China-US trade dispute? How does it affect the stock market?

A: Well, we can't see an end game. Basically, you have two counterparties who are stubborn as heck, and we could be stuck in no man's land for a very long time. You'd have to think eventually a settlement of some type comes. Is that worth a recession for the U.S? For most people, I doubt it. And what if China just wants to wait out Trump and wait for the tariffs to go away in four years? That is a possible outcome. Stock markets always discount the worst-case scenario first before they discount anything else. I think that's what we saw last week, when we broke 5,000 in the S&P 500.

Q: Are you optimistic about bank stocks now?

A: No. They will lead the downturn along with technology stocks. But when this all ends, they will also lead the upturn, and that's why you're seeing bank stocks have such hard bounces off their bottom. It's another one of two sectors that people will be first to rush into—banks and technology stocks. And while tech is expensive, banks are cheap.

Q: How can interest rates fall when government policies, interest rate policies, are causing them to spike?

A: Well, it's very simple: when foreign investors lose faith in the U.S. Government, they have, they pull their money out. They don't need to be here. It's a situation of, “Well, if you don't need us, we don't need you.” And foreigners own about 25% of all of the $36 trillion in national debt out there, or about $9 trillion. And in stocks they own here and the number goes up to $12 trillion. It doesn't take much selling to cause a panic in the bond market. That is what we have been seeing. Whether that continues, I have no idea—it depends on the next tweet coming out of Washington.

Q: What about Bank of America (BAC)?

A: Yeah, it will also bounce the hardest off the bottom—great buy, and these things are all cheap relative to technology stocks. You know, banks still have PE multiples in the low teens. Tech stocks are all the way down to the low 20s from the 30s and 40s, so they're roughly trading at double the multiples of bank stocks. That's one reason people are rushing back into these.

Q: What's the basis of your prediction on a falling US dollar?

A: Again, it's foreign selling. I don't think I've ever seen a falling dollar and rising interest rates in 60 years of watching. It goes against all economic fundamentals in the currency markets. But when there's a panic, there's a panic. People want out of everything at any price, and that's what's happening now. As long as foreigners are dumping our assets, the dollar will keep going down—dumping our assets means dollar selling after 80 years of dollar buying.

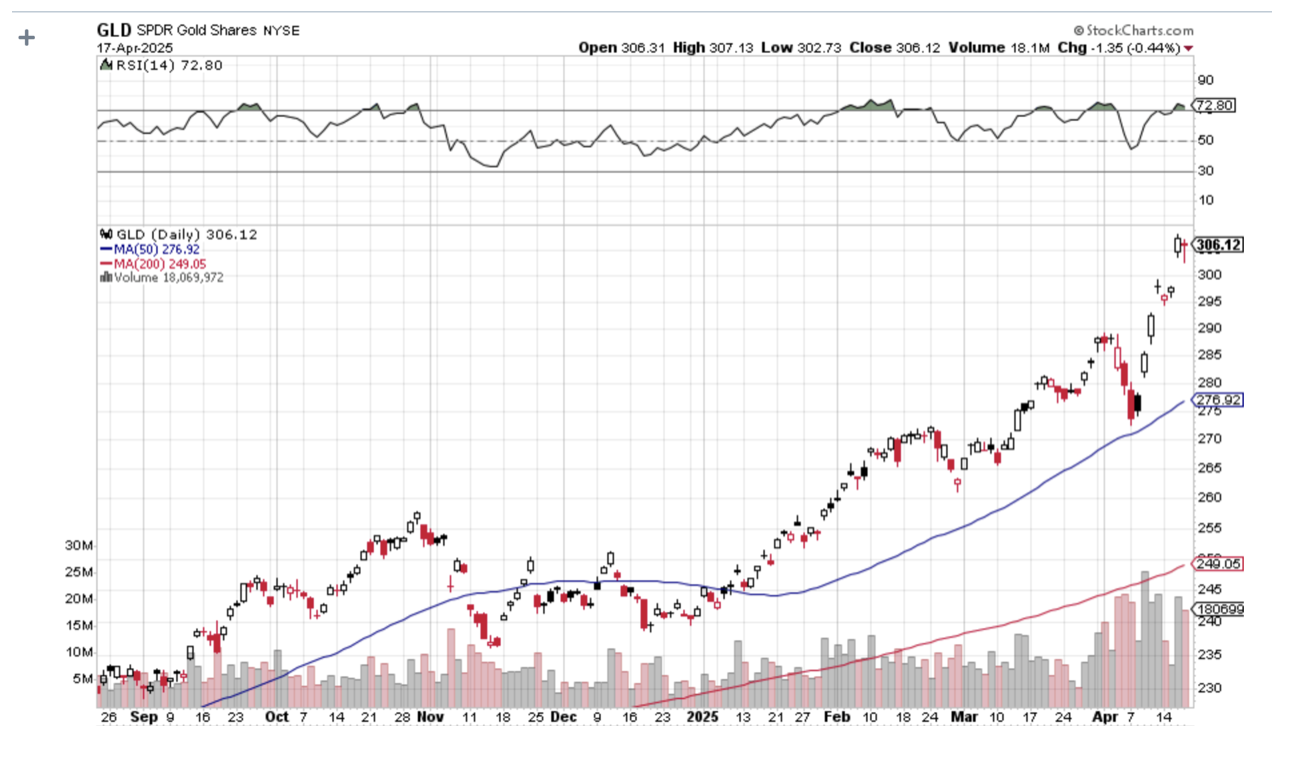

Q: Is gold the only safe haven?

A: Yes. We'll get into this in the gold section, but even gold went down for three days, and then wiser heads prevailed and it actually triggered a panic melt-up in gold assets. The miners were up 25% in days. That is another great weak-dollar play.

Q: How do you protect the US from a dollar fall?

A: Change our economic policies; end the trade war.

Q: Is it a good time to buy a house?

A: No, it is not, unless you can wait out the current downturn. High interest rate mortgage rates shot up from 6.5% to 7.1% in a week, and that basically kills off the housing market for the foreseeable future. And of course, when people are worried about their futures, their savings, and their assets, the last thing they do is go out and buy a house.

Q: Is there enough negative sentiment around now for us to go back into the bond market?

A: No. There is no precedent for the type of market action that's going on now. Will the U.S. government suddenly become reasonable? I doubt it. You can expect tweet bombs to happen at any time. So, people are just hoarding cash and avoiding risk at all costs. It used to be that bonds were the safe place to go. No longer. Not with 10% moves down in a week like we saw last week. Sorry—T-Bills are the only actual safe play out there, and their yield is the same as Treasury bonds without the risk.

Q: Will crypto keep going down?

A: If we continue with a risk-off market, I think you can expect crypto to keep falling. Crypto fell 30% from its top—at least Bitcoin did. It's basically matching the downside with tech stocks one for one, so no protection in crypto, no diversification. The protection aspect that was promised by crypto promoters lever shows. No flight to safety is happening there whatsoever. And that's why I'm looking to add to my short in MicroStrategy Inc. (MSTR)—they're a leveraged long Bitcoin play.

Q: Is the U.S. economy set for a hard landing?

A: I think absolutely, yes, the hard landing is in progress. That's what all of the economic data says. It's hard to find any positive news coming out of the economy—people are running for their lives, essentially.

Q: Do you expect inflation to return and take stocks lower?

A: Absolutely, yes. The highest tariffs in history start hitting retail prices in the next month or two, and the price increases should be dramatic, especially on anything from China. So yeah, we should see that come out in the data in the next few months.

Q: Do you expect silver to follow gold?

A: Yes, I do, but it hasn't been performing as well because there is a recession drag on silver, which you don't have for gold. Silver (SLV), (AGQ) are used in a lot of electronics and solar panels.

Q: When do you get back into gold (GLD)?

A: Whenever we get a dip. So far, any dips have been very brief and short-term. It's kind of reminiscent of the 1970s when gold moved from $32 an ounce to $900. That’s when you found me in a line in Johannesburg, South Africa, waiting to sell all my Krugerrands.

Q: Which countries will benefit from manufacturing moving out of China?

A: The answer is really no countries. As soon as manufacturing moves from China to another one like Vietnam, the US then puts punitive tariffs on that second country. So, there's no place to hide. It's really a war against the world. That's the message that the administration is putting out: if you don't want to build a factory here, we don't want to do business with you. We don't want your products. And most companies will do nothing. They'll wait this out, wait for a future president to eliminate all tariffs. Until then, international trade grinds to a halt. No trade makes sense at 145% tariff. Just to give you some idea on how much that is, if you buy a top end MacBook Pro for $8,000, and you pay the full 145% tariff, that is an $11,600 tariff if you have to pay it, which brings the total cost of a MacBook Pro to nearly $19,600. How many are you going to buy at that price?

Q: Do you think the Fed will cut interest rates?

A: No, we haven't seen the inflation data yet. They are backward-looking, and only after we see a sharp rise in prices will they raise rates. Chances of them cutting now are zero with all the risks in inflation to the upside right now and unemployment still under control. So, no interest rate cuts this year.

To watch a replay of this webinar with all the charts, bells, whistles, and classic rock music, just log in to www.madhedgefundtrader.com, go to MY ACCOUNT, click on GLOBAL TRADING DISPATCH, then WEBINARS, and all the webinars from the last 12 years are there in all their glory.

Good Luck and Good Trading

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader

Global Market Comments

April 16, 2025

Fiat Lux

Featured Trade:

(THE IRS LETTER YOU SHOULD DREAD),

(TESTIMONIAL)