I am always watching for market topping indicators and I have found a whopper. The number of new IPOs from technology mega unicorns is about to explode. And not by a little bit but a large multiple, possibly tenfold.

Six San Francisco Bay Area private tech companies valued by investors at more than $10 billion each are likely to thunder into the public market next year, raising buckets of cash for themselves and minting new wealth for their investors, executives, and employees on a once-unimaginable scale.

Will it kill the goose that laid the golden egg?

Newly minted hoody-wearing millionaires are about to stampede through my neighborhood once again, buying up everything in sight.

That will make 2019 the biggest year for tech debuts since Facebook’s gargantuan $104 billion initial public offering in 2012. The difference this time: It’s not just one company, and five of them are based in San Francisco, which could see a concentrated injection of wealth as the nouveaux riches buy homes, cars and other big-ticket items.

If this is not ringing a bell with you, remember back to 2000. This is exactly the sort of new issuance tidal wave that popped the notorious Dotcom Bubble.

And here is the big problem for you. If too much money gets sucked up into the new issue market, there is nothing left for the secondary market, and the major indexes can fall, buy a lot.

The onslaught of IPOs includes ride-sharing firm Uber at $120 billion, home-sharing company Airbnb at $31 billion, data analytics firm Palantir at $20 billion, FinTech company Stripe at $20 billion, another ride-sharing firm Lyft at $15 billion, and social networking firm Pinterest at $12 billion.

Just these six names alone look to absorb an eye-popping $218 billion, and that does not include hundreds of other smaller firms waiting on the sidelines looking to tap the public market soon.

The fear of an imminent recession starting sometime in 2019 or 2020 is the principal factor causing the unicorn stampede. Once the economy slows and the markets fall, the new issue market slams shut, sometimes for years as they did after 2000. That starves rapidly growing companies of capital and can drive them under.

For many of these companies, it is now or never. The initial venture capital firms that have had their money tied up here for a decade or more want to cash out now and roll the proceeds into the “next big thing,” such as blockchain, health care, or artificial in intelligence. The founders may also want to raise some pocket money to buy that mansion or mega yacht.

Or, perhaps they just want to start another company after a well-earned rest. Serial entrepreneurs like Tesla’s Elon Musk (TSLA) and Netflix’s Reed Hastings (NFLX) are already on their second, third, or fourth startups.

And while a sudden increase in new issues is often terrible for the market, getting multiple IPOs from within the same industry, as is the case with ride-sharing Uber and Lyft, is even worse. Remember the five pet companies that went public in 1999? None survived.

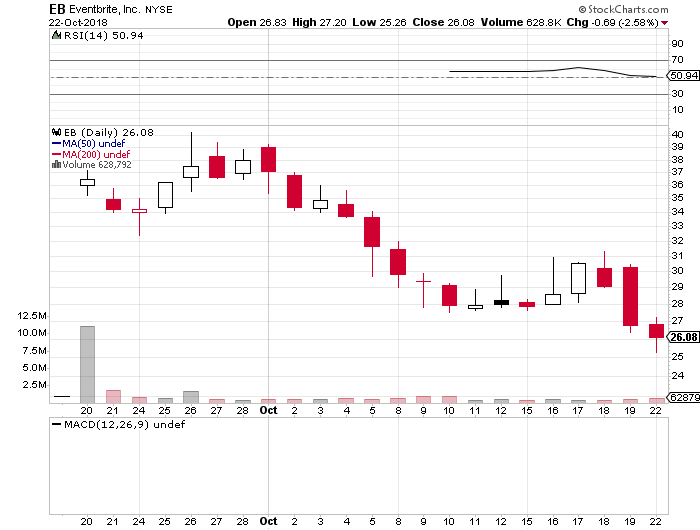

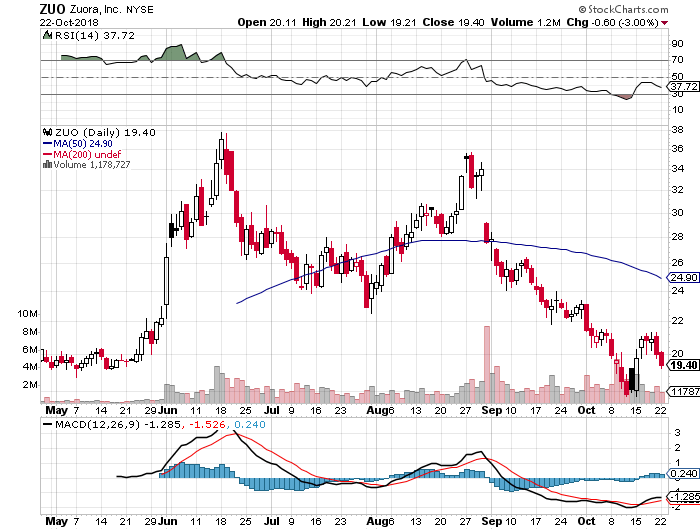

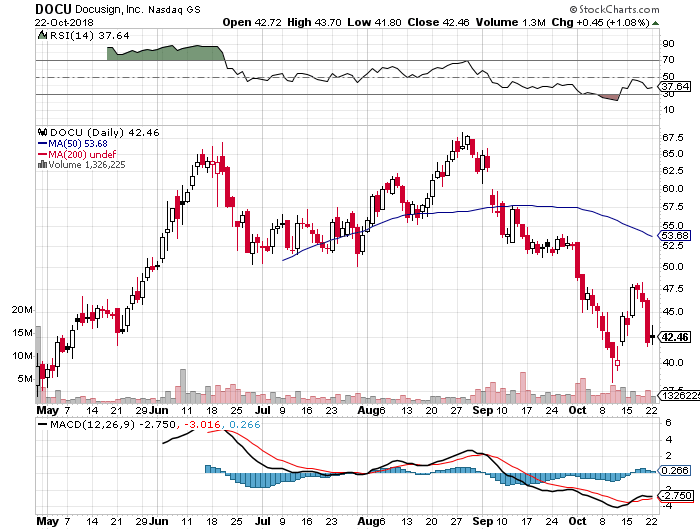

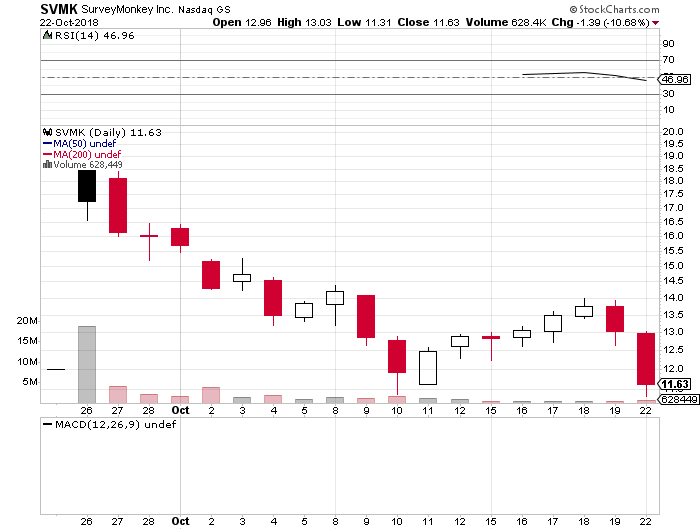

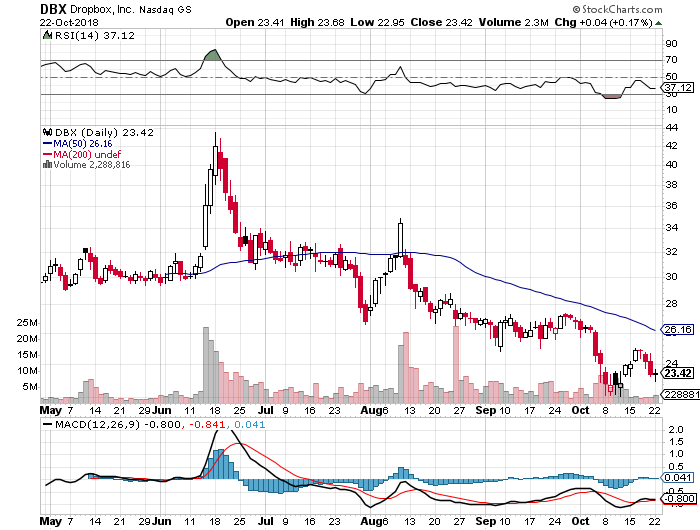

The move comes on the heels of an IPO market in 2018 that was a huge disappointment. While blockbuster issues like Dropbox (DB) and DocuSign (DOCU) initially did well, Eventbrite (EB), SurveyMonkey (SVMK), and Zuora (ZUO) have all been disasters.

Some 80% of all IPOs lost money this year. This was definitely NOT the year to be a golfing partner or fraternity brother with a broker.

What is so unusual in this cycle is that so many firms have left going public to the last possible minute. The desire has been to milk the firms for all they are worth during their high growth phase and then unload them just as they go ex-growth.

The ramp has been obvious for all to see. In the first nine months of 2018, 44 tech IPOs brought in $17 billion, according to Dealogic. That’s more than tech IPOs reaped for all of 2016 and 2017 combined.

Also holding back some firms from launching IPOs is the fear that public markets will assign a lower valuation than the last private valuation. That’s an unwelcome circumstance that can trigger protective clauses that reward early investors and punish employees and founders. That happened to Square (SQ) in its 2015 IPO.

That’s happening less and less frequently: In 2017, one-third of IPOs cut companies’ valuations as they went from private to public. In 2018, that ratio has dropped to one in six.

Also unusual this time around is an effort to bring in more of the “little people” in the IPO. Gig economy companies like Uber and Lyft are lobbying the SEC for changes in new issue rules that will enable their drivers to participate even though they may be financially unqualified.

As a result, when the end comes, this could come as the cruelest bubble top of all.

Don’t Get Run Over

With stock market volatility greatly elevated and trading volumes through the roof, there is a heightened probability that your short options position gets called away.

If it does, there is only one thing to do: fall down on your knees and thank your lucky stars. You have just made the maximum possible profit for your position.

Most of you have short option positions, although you may not realize it. For when you buy an in-the-money call option spread, it contains two elements: a long call and a short call. The short called can get assigned, or called away at any time.

You have to be careful here because the inexperienced can blow their newfound windfall if they take the wrong action, so here’s how to handle it.

The 5:30 AM phone call was as shrill as it was urgent.

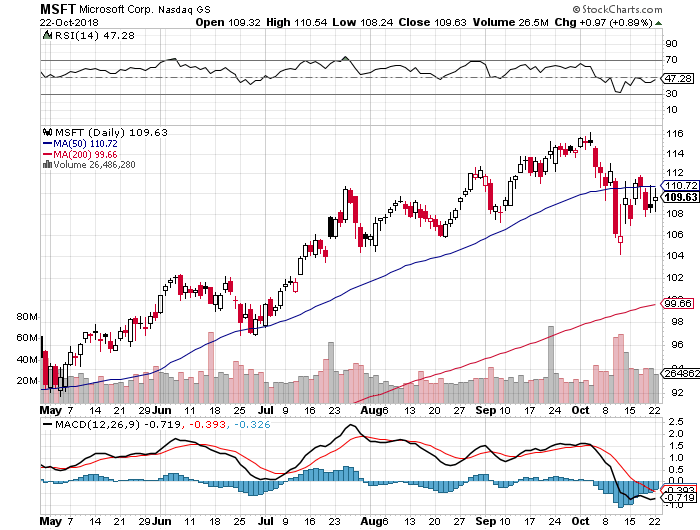

A reader had employed one of my favorite strategies, buying the Microsoft (MSFT) November 2018 $90-$95 in-the-money vertical call spread at $4.50.

He had just received an email from his broker informing him that his short position in the (MSFT) November $95 calls was assigned and exercised against him.

He asked me what to do.

I said, “Nothing.”

For what the broker had done in effect is allow him to get out of his call spread position at the maximum profit point 20 days before the November 16 expiration date.

All he had to do was call his broker and instruct him to exercise his long position in his November $90 calls to close out his short position in the $95 calls.

Calls are a right to buy shares at a fixed price before a fixed date, and one option contract is exercisable into 100 shares.

In other words, he bought (MSFT) at $90 and sold it at $95, paid $4.50 cents for the right to do so, his profit is 50 cents, or ($0.50 X 100 shares X 22 contracts) = $1,100. Not bad for a nine-day limited risk play.

Sounds like a good trade to me.

Weird stuff like this happens in the run-up to options expirations.

A call owner may need to sell a long stock position right at the close, and exercising his long November $95 calls is the only way to execute it.

Ordinary shares may not be available in the market, or maybe a limit order didn’t get done by the stock market close.

There are thousands of algorithms out there which may arrive at some twisted logic that the puts need to be exercised.

Many require a rebalancing of hedges at the close every day which can be achieved through option exercises.

And yes, calls even get exercised by accident. There are still a few humans left in this market to blow it.

And here’s another possible outcome in this process.

Your broker will call you to notify you of an option called away, and then give you the wrong advice on what to do about it.

This generates tons of commissions for the broker but is a terrible thing for the trader to do from a risk point of view, such as generating a loss by the time everything is closed and netted out.

Avarice could have been an explanation here but I think stupidity and poor training and low wages are much more likely.

Brokers have so many ways to steal money legally that they don’t need to resort to the illegal kind.

This exercise process is now fully automated at most brokers but it never hurts to follow up with a phone call if you get an exercise notice. Mistakes do happen.

Some may also send you a link to a video of what to do about all this.

If any of you are the slightest bit worried or confused by all of this, come out of your position RIGHT NOW at a small profit! You should never be worried or confused about any position tying up YOUR money.

Professionals do these things all day long and exercises become second nature, just another cost of doing business.

If you do this long enough, eventually you get hit. I bet you don’t.

Global Market Comments

October 22, 2018

Fiat Lux

Featured Trade:

(THE MARKET OUTLOOK FOR THE WEEK AHEAD, or HEADING FOR LAKE TAHOE),

(SPY), (TLT), (VIX), (MSFT), (AMZN), (CRM), (ROKU),

(BRING BACK THE UPTICK RULE!)

There’s nothing like a quickie five-day tour of the Southeast to give one an instant snapshot of the US economy. The economy is definitely overheating and could blow up sometime in 2019 or 2020.

Traffic everywhere is horrendous as drivers struggle to cope with a road system built to handle half the current US population. Service has gotten terrible as workers vacate the lower paid sectors of the economy. Everyone you talk to tells you business is great, from the CEOs down to the Uber drivers.

I managed to miss Hurricane Michael by two days. Hartsfield Jackson Atlanta International Airport was busy with exhausted transiting Red Cross workers. The Interstate from Savanna to Atlanta, Georgia was lined with thousands of downed trees. In Houston mountains of debris were evident everywhere, the rotting, soggy remnants of last year’s Hurricane Harvey.

I managed to score all day parking in downtown Atlanta for only $8. I kept the receipt to show my disbelieving friends at home.

Bull markets climb a wall of worry and this one has been no exception. However, the higher we get the greater the demands on the faithful.

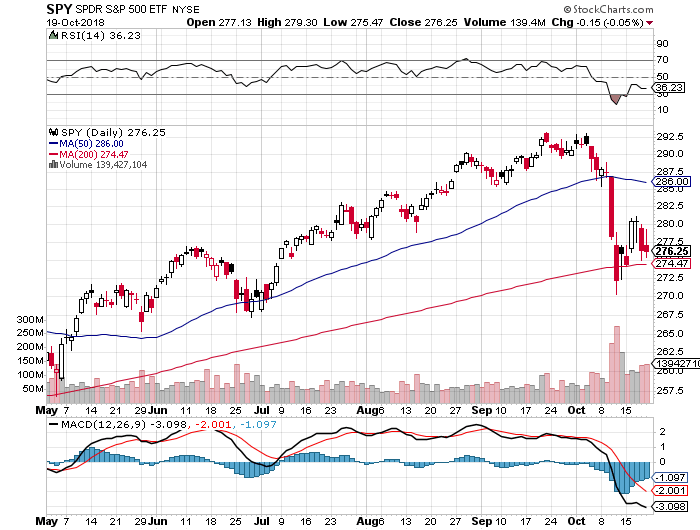

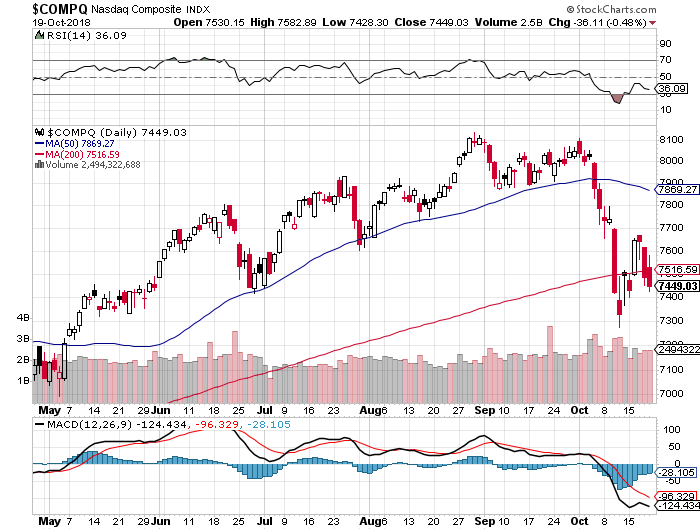

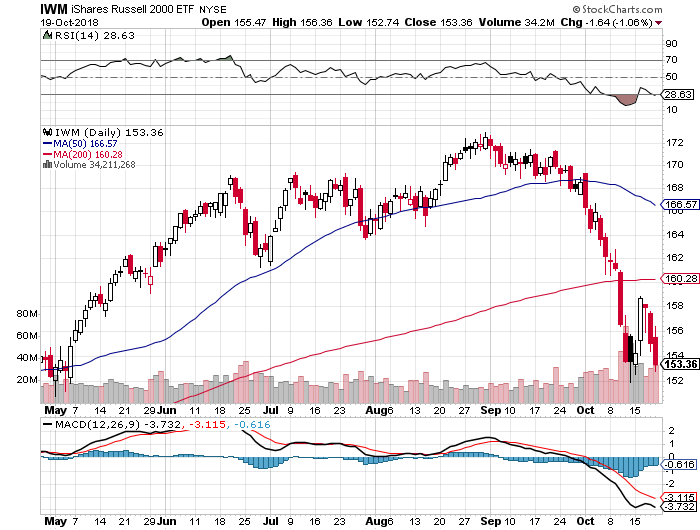

Last week saw my Mad Hedge Market Timing Index plunge to an all-time low reading of 4. I back-tested the data and was stunned to discover that October saw the steepest selloff since the 1987 crash, which saw the average crater 21% in one day.

And while evidence of a coming bear market is everywhere, the reality is that stocks can keep rising for another year. Market bottoms are easy to quantify based on traditional valuation measure, but tops are notoriously difficult to call. Look for one more high volume melt up like we saw in January and that should be it.

Real interest rates are still zero (3.2% bond yields – 3.2% inflation), so there is no way this is any more than a short-term correction in a bull market.

The world is still awash in liquidity

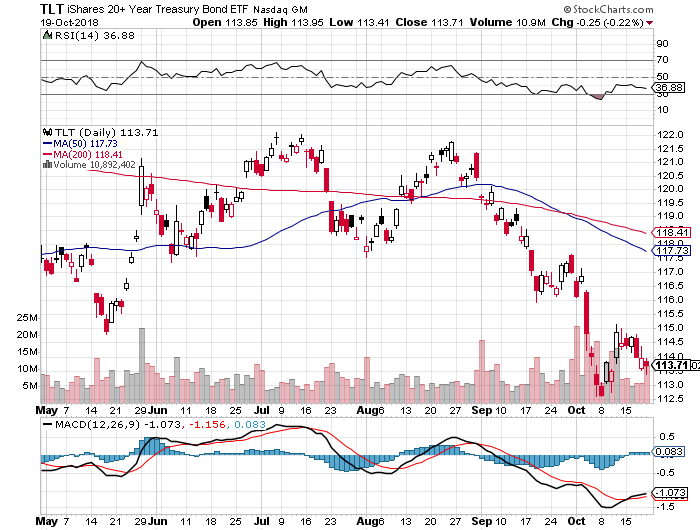

The Fed says they’re still raising rates four times in a year no matter what the president says. Look for a 3.25% overnight rate in a year, and 4% for three months funds. If inflation rises to 4% at the same time, real rates will still be at zero.

There certainly has not been a shortage of things to worry about on the geopolitical front. After Saudi Arabia was caught red-handed with video and audio proof of torturing and killing a Washington Post reporter, it threatened to cut off our oil supply and dump their substantial holding of technology stocks.

Tesla made another move towards the mass market by accelerating its release of the $35,000 Tesla 3. Production is now well over 6,000 units a month.

If you had any doubts that housing was now in recession, look no further than the September Existing Home Sales which were down a disastrous 3.5%. In the meantime, the auto industry continues to plumb new depths. In some industries, the recession has already started.

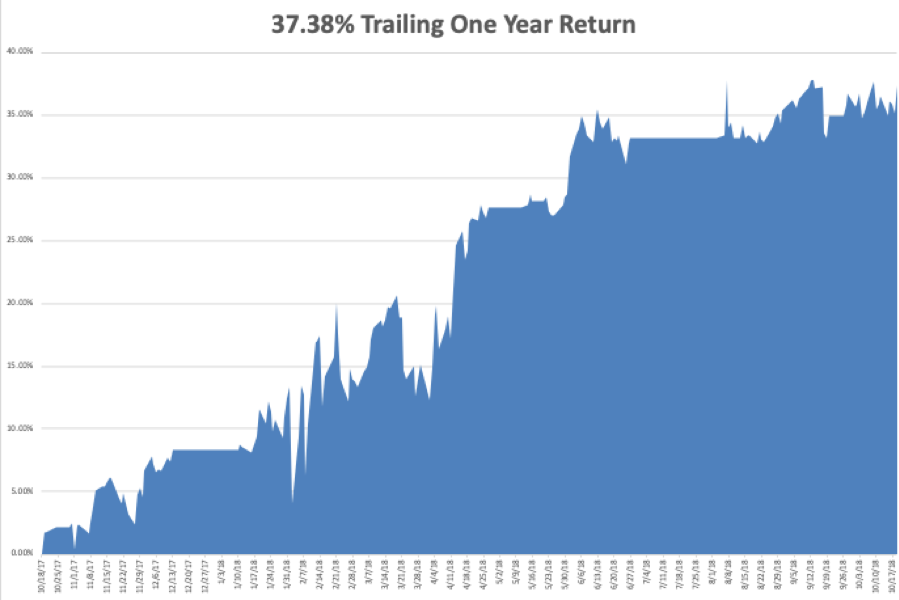

We have been killing it on the trading front. My 2018 year-to-date performance has bounced back to a robust 29.07%, and my trailing one-year return stands at 35.37%. October is up +0.68%, despite a gut-punching, nearly instant NASDAQ swoon of 10.50%. Most people will take that in these horrific conditions.

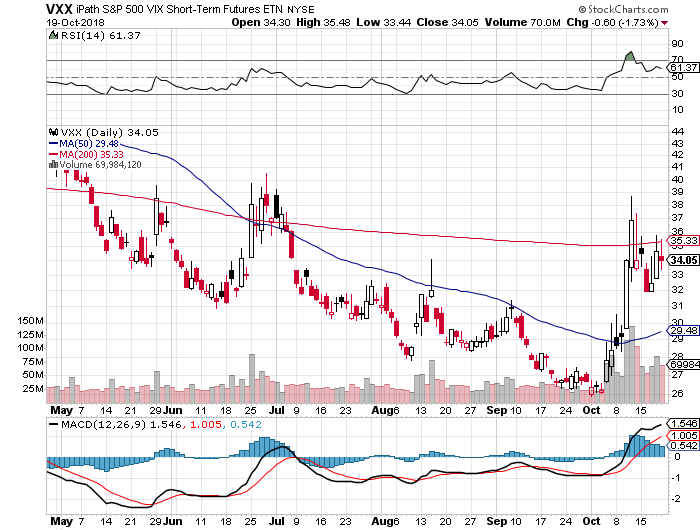

My single stock positions have been money makers, but my short volatility position (VXX), which I put on early, refuses to go down, eating up much of my profits.

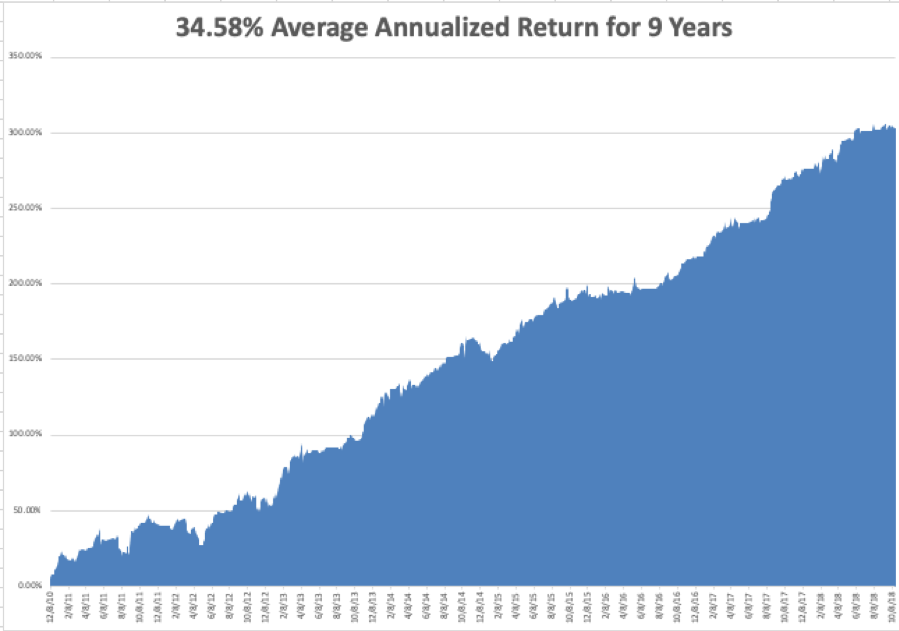

My nine-year return appreciated to 305.54%. The average annualized return stands at 34.58%. Global Trading Dispatch is now only 44 basis points from an all-time high.

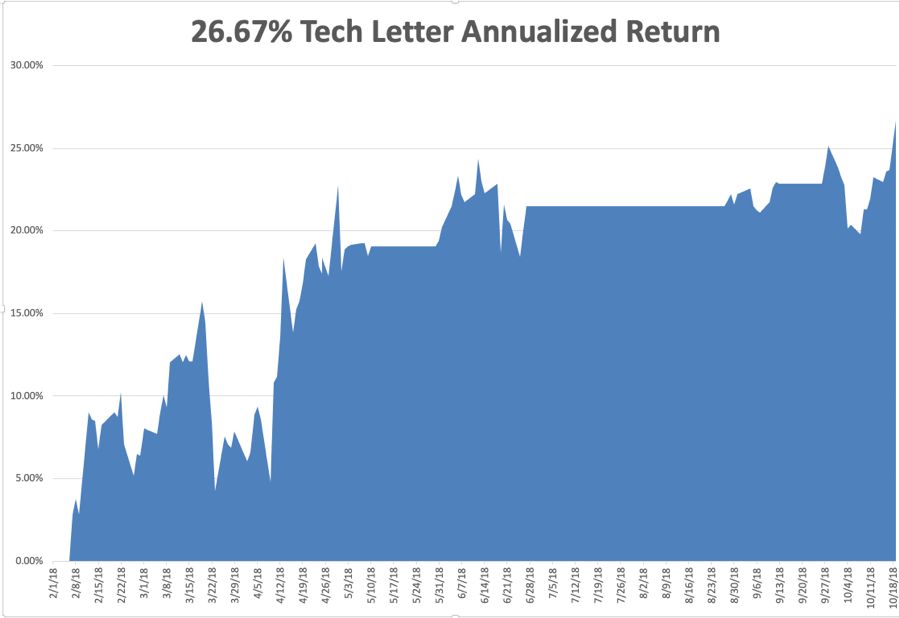

The Mad Hedge Technology Letter has done even better, blasting through to a new all-time high at an annualized 26.67%. It almost completely missed the tech meltdown and then went aggressively long our favorite names right at the market bottom.

I’d like to think my 50 years of trading experience is finally paying off, or maybe I’m just lucky. Who knows?

This coming week will be pretty sedentary on the data front, with the Friday Q3 GDP print the big kahuna. Individual company earnings reports will be the main market driver.

Monday, October 22 at 8:30 AM, the Chicago Fed National Activity Index is out. 3M (MMM), and Logitech (LOGI) report.

On Tuesday, October 23 at 10:00 AM, the Richmond Fed Manufacturing Index is published. Juniper Networks (JNPR), Lockheed Martin (LMT), and United Technologies report.

On Wednesday, October 24 at 10:00 AM, September New Home Sales will give another read on entry-level housing. At 10:30 AM the Energy Information Administration announces oil inventory figures with its Petroleum Status Report. Advanced Micro Devices (AMD), Ford Motor (F), and Microsoft (MSFT) report.

Thursday, October 25 at 8:30, we get Weekly Jobless Claims. Alphabet (GOOGL) and Intel (INTC) report.

On Friday, October 26, at 8:30 AM, a new read on Q3 GDP is announced.

The Baker-Hughes Rig Count follows at 1:00 PM.

As for me, I am headed up to Lake Tahoe this week to host the Mad Hedge Lake Tahoe Conference. The weather will be perfect, the evening temperatures in the mid-twenties, and there is already a dusting of snow on the high peaks. The Mount Rose Ski Resort is honoring the event by opening this weekend.

Good luck and good trading.

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader

“The next time we have a global economic crisis it will be much worse than in 2008. There will be money printing and war. The whole system will collapse. You don’t want to own government bonds and cash. Equities don’t do well, but at least you still have the ownership of companies. Precious metals do well in that environment, and so does oil,” said Mark Faber, publisher of the Gloom, Boom, and Doom Report.

Global Market Comments

October 19, 2018

Fiat Lux

Featured Trade:

(LAST CHANCE TO BUY TICKETS NOW FOR THE MAD HEDGE LAKE TAHOE CONFERENCE FOR OCTOBER 26-27)

(FIVE STOCKS TO BUY AT THE BOTTOM),

(AAPL), (AMZN), (SQ), (ROKU), (MSFT)

Tickets for the Mad Hedge Lake Tahoe Conference are selling briskly. If you want to obtain a ticket that includes a dinner with John Thomas and Arthur Henry you better get your order in soon.

The conference date has been set for Friday and Saturday, October 26-27.

Come learn from the greatest trading minds in the markets for a day of discussion about making money in the current challenging conditions.

How soon will the next bear market start and the recession that inevitably follows?

How will you guarantee your retirement in these tumultuous times?

What will destroy the economy first, rising interest rates or a trade war?

Who will tell you what to buy at the next market bottom?

John Thomas is a 50-year market veteran and is the CEO and publisher of the Diary of a Mad Hedge Fund Trader. John will give you a laser-like focus on the best-performing asset classes, sectors, and individual companies of the coming months, years, and decades. John covers stocks, options, and ETFs. He delivers your one-stop global view.

Arthur Henry is the author of the Mad Hedge Technology Letter. He is a seasoned technology analyst and speaks four Asian languages fluently. He will provide insights into the most important investment sector of our generation.

The event will be held at a five-star resort and casino on the pristine shores of Lake Tahoe in Incline Village, NV, the precise location of which will be emailed to you with your ticket purchase combination.

It will include a full breakfast on arrival, a sit-down lunch, coffee break. The wine served will be from the best Napa Valley vineyards.

Come rub shoulders with some of the savviest individual investors in the business, trade investment ideas, and learn the secrets of the trading masters.

Ticket Prices

Copper Ticket - $599: Saturday conference all day on October 27, with buffet breakfast, lunch, and coffee break, with no accommodations provided

Silver Ticket - $1,299: Two nights of double occupancy accommodation for October 26 & 27, Saturday conference all day with buffet breakfast, lunch and coffee break

Gold Ticket - $1,499: Two nights of double occupancy accommodation for October 26 & 27, Saturday conference all day with buffet breakfast, lunch, and coffee break, and an October 26, 7:00 PM Friday night VIP Dinner with John Thomas

Platinum Ticket - $1,499: Two nights of double occupancy accommodation for October 26 & 27, Saturday conference all day with buffet breakfast, lunch, and coffee break, and an October 27, 7:00 PM Saturday night VIP Dinner with John Thomas

Diamond Ticket - $1,799: Two nights of double occupancy accommodation for October 26 & 27, Saturday conference all day with buffet breakfast, lunch, and coffee break, an October 26, 7:00 PM Friday night VIP Dinner with John Thomas, AND an October 27, 7:00 PM Saturday night VIP Dinner with John Thomas

Schedule of Events

Friday, October 26, 7:00 PM

7:00 PM - Exclusive dinner with John Thomas and Arthur Henry for 12 in a private room at a five-star hotel for gold and diamond ticket holders only

Saturday, October 27, 8:00 AM

8:00 AM - Breakfast for all guests

9:00 AM - Speaker 1: Arthur Henry - Mad Hedge Technology Letter editor Arthur Henry gives the 30,000-foot view on investing in technology stocks

10:00 AM - Speaker 2: Brad Barnes of Entruity Wealth on "An Introduction to Dynamic Risk Management for Individuals"

11:00 AM - Speaker 3: John Thomas - An all-asset class global view for the year ahead

12:00 PM - Lunch

1:30 PM - Speaker 4: Arthur Henry - Mad Hedge Technology Letter editor on the five best technology stocks to buy today

2:30 PM - Speaker 5: John Triantafelow of Renaissance Wealth Management

3:30 PM - Speaker 6: John Thomas

4:30-6:00 PM - Closing: Cocktail reception and open group discussions

7:00 PM - Exclusive dinner with John Thomas for 12 in a private room at a five-star hotel for Platinum or Diamond ticket holders only

To purchase tickets, click: CONFERENCE.

“When we launch a product, we're already working on the next one. And possibly even the next, next one.” – Said CEO of Apple Tim Cook

Global Market Comments

October 18, 2018

Fiat Lux

SPECIAL TRAVEL PLANNING ISSUE

Featured Trade:

(IS AIRBNB YOUR NEXT TEN BAGGER?)

“The red light on a television camera going on has the same effect on members of Congress as a full moon does on werewolves,” said former Secretary of Defense, Robert Gates.