When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline. Read more

Global Market Comments

March 21, 2018

Fiat Lux

Featured Trade:

(THE VALUE CASE FOR FACEBOOK), (FB), (AAPL),

(WHAT ALMONDS SAY ABOUT THE GLOBAL ECONOMY)

When it rains, it pours.

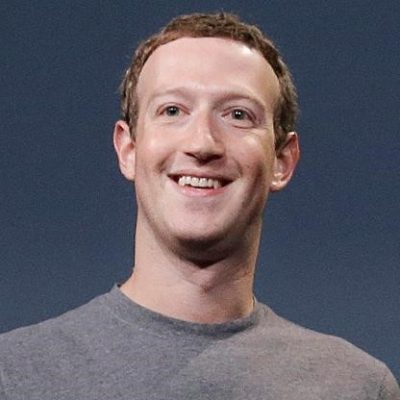

That is how Facebook founder Mark Zuckerberg must feel after suffering two black swans in two days.

First came the disclosures that a client, Cambridge Analytica, used the information from 50 million Facebook users to help the Russians influence the 2016 presidential election.

Today, we learned that the company is being investigated by the Federal Trade Commission for failure to keep customer information private.

As a result, the company has lost all of its 2018 year-to-date stock performance, and is now taking a big bite out of 2017.

The question now arises, what should you do about all of this as the educated investor?

Facebook is one of the most widely owned companies in the world, right after Apple (AAPL). It often is the largest single position of many major institutional investors. And there isn't one that isn't salivating at adding to its position at fire-sale prices.

For the first time in ages, Facebook is now selling at a screaming discount to the main market, with a PE multiple of only 16.5X at today's low, compared to 19X, and 14.5X if you strip out cash on the balance sheet. Facebook has in effect become another Apple (AAPL) in valuation terms.

Fundamentals have not changed. Some 66% of advertisers say they will increase their spend over the next year.

Regulatory fear is overdone, and it is difficult to imagine in what form that such regulation would take. What, an (FB) friend tax on your account? I would go broke.

If anything, more regulation could be a net positive for (FB), as it creates a deeper moat with which it can protect and grow its business. For more depth on this topic please read today's issue of the Mad Hedge Technology Letter.

The barriers to entry for new competitors, already huge, are about to become insurmountable.

The worst case is that founder Mark Zuckerberg may have to undergo an unpleasant appearance in front of the technophobes in congress.

The company is growing at a compound 30% annual rate and is far and away the dominant player in a deeply moated space. In other words, it is still a company whose shares you should die for.

We'll know for sure when the company gives its Q1, 2018 earnings report after the market close on May 2.

In Q4, 2017 it announced an earnings per share of $2.21, a beat of 26% over analyst expectations. Revenues rose by an eye-popping 47.2% to $12.97 billion for the quarter YOY, a beat of $420 million.

Full year 2017 free cash flow came to $17 billion. Q4 operating income came to $7.4 billion representing a 53% profit margin.

Some 89% of the company's ad revenues came through mobile phones.

There are now 2.1 billion people using Facebook, and 1.1 billion on a daily basis. Some 700 million come to the site daily to buy and sell things through Facebook market.

Its WhatsApp subsidiary has 1.5 billion users who transmit 60 billion messages a day.

Its Oculus Rift entry in the virtual reality gaming space, to which my own kids are hopelessly addicted, is the front-runner in the field.

You might want to wait for the smoke to clear and the dust to settle. However, right here right now at $162 a share it would be perfect for your long-term "buy and forget" portfolio, not only for you and your kids, but for your grandkids as well.

I'm Willing to Bet on the Zuk

Yes, that's right, you read it correctly, almonds.

By now, many of you have figured out that I like calling my paid subscribers to find out how they find the service. I always ask for suggestions for improvements. Then I ask what they do besides trade the markets.

I get an amazing array of answers. One reader flew helicopters in Alaska to inspect oil pipelines, executing trades on his cell phone in between flights. Another ran a Russian hedge fund in Moscow.

The sheep farmer in Australia relied on me as his connection with the rest of the world. The family office in Spain valued my American view of the world.

Then I called a subscriber in Modesto, Calif., who said he was in the almond business.

My interest piqued, so I proceeded to grill him. And with that, I obtained a fascinating insight into an obscure corner of the global economy.

If you thought marijuana, estimated by the Drug Enforcement Administration to be at $6 billion a year, was California's largest cash crop, you'd be wrong.

Grapes used to be our largest legal crop, at $5 billion a year. But almonds will beat all this year, possibly reaching as high at $8 billion.

You can blame the six-year California drought, which was then followed by a year of flooding of biblical proportions.

This has driven the price of almonds from $1/pound a few years ago to as much as $4/pound today.

The price spike has ignited fierce water wars across the state, with increasingly desperate farmers battling over an ever-diminishing commodity.

Those located in the eastern half of the Central Valley (which you will remember from your freshman English class in The Grapes of Wrath) are sitting pretty.

They have long-term contracts to buy water from federal public works projects at subsidized prices that date back to the Great Depression.

These rights can make or break the value of a farm, and are passed down from one generation to the next.

The eastern half of the valley is another story. When construction of Interstate 5 was completed in 1979, most of it was still barren desert, a rain shadow effect of the state's coastal mountain range.

Only the oil industry was there in force, especially around the Elk Hills oil find (watch the Daniel Day Lewis movie, There Will Be Blood). I know because my grandfather worked there for Standard Oil during the 1920s.

So when large-scale farming developed there during the 80s, they had to buy water on the spot market.

The problem is that during a drought, there is very little water for sale. So parched farmers have turned to drilling to irrigate their fields.

This has led to an even bigger headache. In the 19th century, you could drill 100 feet and find all the water you wanted.

Today, they have to go as deep as 1,200 feet, and even these ancient deep aquifers are drying up. And that's assuming you have the $1 million it costs to drill such a well.

Indeed, the elevation of the Central Valley has fallen by 10 feet over the past century because of the underground water that has been withdrawn so far.

Destruction of rural buildings through catastrophic subsidence is becoming widespread.

The only alternative is to let your crops die. You see this in abundance while making the drive from San Francisco to Los Angeles, withered trees frozen in tortured and grotesque death throes.

Also plentiful are irate billboards attacking the government for depriving local farmers of their cheap water.

Even if you have plenty of water, it is still not smooth sailing in the almond business these days.

China is the world's largest buyer of almonds. The demand there has been so great that the Chinese have become major buyers of almond farms throughout the state, at premium prices.

However, the Middle Kingdom's recent anticorruption campaign is starting to take a big bite out of sales.

In years past, individuals would buy dozens of boxes of almond cookies to pass out to friends, customers, employers, government officials and regulators during the Lunar New Year celebrations.

Not so today. The difference has led to the cancellation of a few shiploads of the prized nuts.

My friend kindly invited me to tour his roasting and packaging facilities the next time I was in the neighborhood.

I was left thinking, this really is a global economy that is so integrated that, when a butterfly flaps its wings in Brazil, it causes a typhoon in Japan.

It also is a great example of how information about one asset class can provide insights about all the others.

With that, I opened a fresh bag of healthy unprocessed Nut Up almonds that I picked up at Save Mart and grabbed a fresh handful. I hear they're going to sponsor a NASCAR driver soon to bring healthy food to the hinterlands.

Another Batch for China

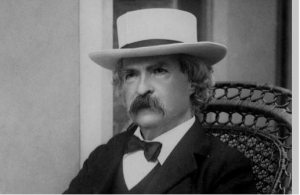

"Let us endeavor so to live that when we die, even the undertaker will be sorry," said the 19th century American humorist Mark Twain.

Global Market Comments

March 20, 2018

Fiat Lux

Featured Trade:

(AMERICA'S NATIVE INDIAN ECONOMY)

When I was remodeling my 160-year-old London house years ago, the chimney was in desperate need of attention. After the chimney sweep crawled up the fireplace (yes, they still have them), he found a yellowed and somewhat singed envelope addressed to Santa Claus.

Thinking it was placed there by my kids, he handed it over to me. In it was a letter penned in a childlike scrawl, written with a quill and ink, dated Christmas, 1910, asking for a Red Indian suit.

Europeans have long had a fascination with our Native Americans. So, in preparation for my upcoming European strategy luncheon tour, I thought I would get myself up to date about our earliest North American residents.

Business is booming these days on Indian reservations, or it isn't, depending on where they live.

Of the country's 565 reservations, some 239 have moved into the casino business and the cash flow has followed.

In 2010, Indian gaming reaped some $26.7 billion in revenues, or some $9,275 per indigenous native. That is a stunning 44% of America's total casino revenues.

Some, like the Pequot tribe's massive Foxwoods operation just two hours from New York City, now the world's largest casino, once had money raining down upon it.

But the casino grew so large that it entirely occupied the diminutive Connecticut reservation allocated to it by an obscure 17th century treaty.

During the salad days, the profits were so enormous that an annual $250,000 stipend was paid to each officially registered tribal member.

A poker boom helped. No surprise that the tribe grew from 167 to 665 members during the past 30 years.

Today, the operation is burdened with $2.5 billion in debt, thanks to some bad investments and an ill-timed expansion.

Casinos in more rural locations in the far west, distant from population centers, have fared less well.

Those that contracted out for professional management from Las Vegas and Atlantic City firms, such as Harrah's, MGM and Caesars, earn a modest living.

But the reservations attempting local management on their own fall victim to inefficiencies, incompetence, corruption, nepotism, over hiring of locals and outright theft.

Believe it or not, it is possible to lose money in the casino business, and some have had to shut down.

Overbuilding is another problem. In northern New Mexico you can find several casinos within five miles of each other competing for the same customers. Most of their clients (read losers) are in fact local tribal members, the same individuals these houses are intended to help.

The 326 tribes that avoided the casino industry do so at the cost of a big hit to their standard of living.

That explains why Native American median household income reaches only $35,062, compared to $50,046 for the US as a whole. Many, such as the numerous Hopi, shun it because of their religion.

Without gambling there are few economic opportunities on the reservations, which is why they were given the land in the first place.

The parched conditions of the west limit farming. Unemployment runs as high as 80% on some reservations, such as the White Mountain Apaches.

As a result, a high proportion of the country's 2.9 million Native Americans are wards of the federal government, living on food stamps and other government handouts.

That's not how it was supposed to be. The first modern reservation was set up for the Navajo tribe in 1851 at a baking hellhole on the Pecos River, with the intention of enforcing a primitive form of apartheid to ensure their survival.

The legendary scout Kit Carson was hired to herd the hapless Indians to their new home.

He did it by burning all the crops in their homelands and cutting down every tree.

Because they surrendered early rather than fight, today they are the most populous tribe, with 160,000, owning the largest reservation, at 24,000 square miles, mostly in Arizona.

Those who signed treaties early survived, which gave them status as an independent nation but ceded all matters regarding defense to the federal government.

In fact the Iroquois, Sioux, and the Chippewa separately declared war on Germany during WWII. Some even issued their own passports to attend the last Olympics. Those who didn't had to settle for much smaller reservations, or got wiped out.

In 1975, congress passed the Indian Self-Determination and Education Assistance Act, which devolved power from the government to the tribes.

Florida's Seminole tribe won the right in court to open a casino in 1981, which was confirmed by the Supreme Court in 1987. After that, it was off to the races, with Indian bingo parlors sprouting across the country.

During the 19th century Indian wars when hundreds of thousands died, the practice was to attack a wagon train, kill all the men, marry the women and adopt the children.

As a result, I am descended from three different tribes, the Delaware, Sioux, and the Cherokee, as are about a quarter of native Californians my age. So I tried to cash in on government largess by applying for tribal scholarships to go to college.

It was to no avail. Only those who can trace their lineage to a 1941 Bureau of Indian Affairs census and are one-eighth Native American can qualify.

When whites married Indians 150 years ago, the common practice was to baptize them and give them western names, obliterating their true heritage.

They were also pretty casual with marriage records in the Wild West. Jumping over a broom doesn't exactly make it into the county records. But we still have many of the wedding photos, and it's clear who they are.

I never did find out if that little boy got his Red Indian suit for Christmas, but I hope he did.

So, Should I Double Down?

So, Should I Double Down?

When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline. Read more

When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline. Read more

Global Market Comments

March 19, 2018

Fiat Lux

Featured Trade:

(MARKET OUTLOOK FOR THE WEEK AHEAD, or DEALING WITH CHAOS OVERLOAD),

(TLT), (FB), (AAPL), (FXE), (AVGO), (QCOM),

(THE BEST TESTIMONIAL EVER)