The punitive 25% tariff against Columbia for refusing to take back their own immigrants clearly signals how international relations will be conducted going forward. Never mind that it was rolled back 25 hours later. The intentions are clear. Notice that it is America’s biggest exporters, the Magnificent Seven, that are getting absolutely slaughtered this morning.

Who’s next? There are no allies anymore.

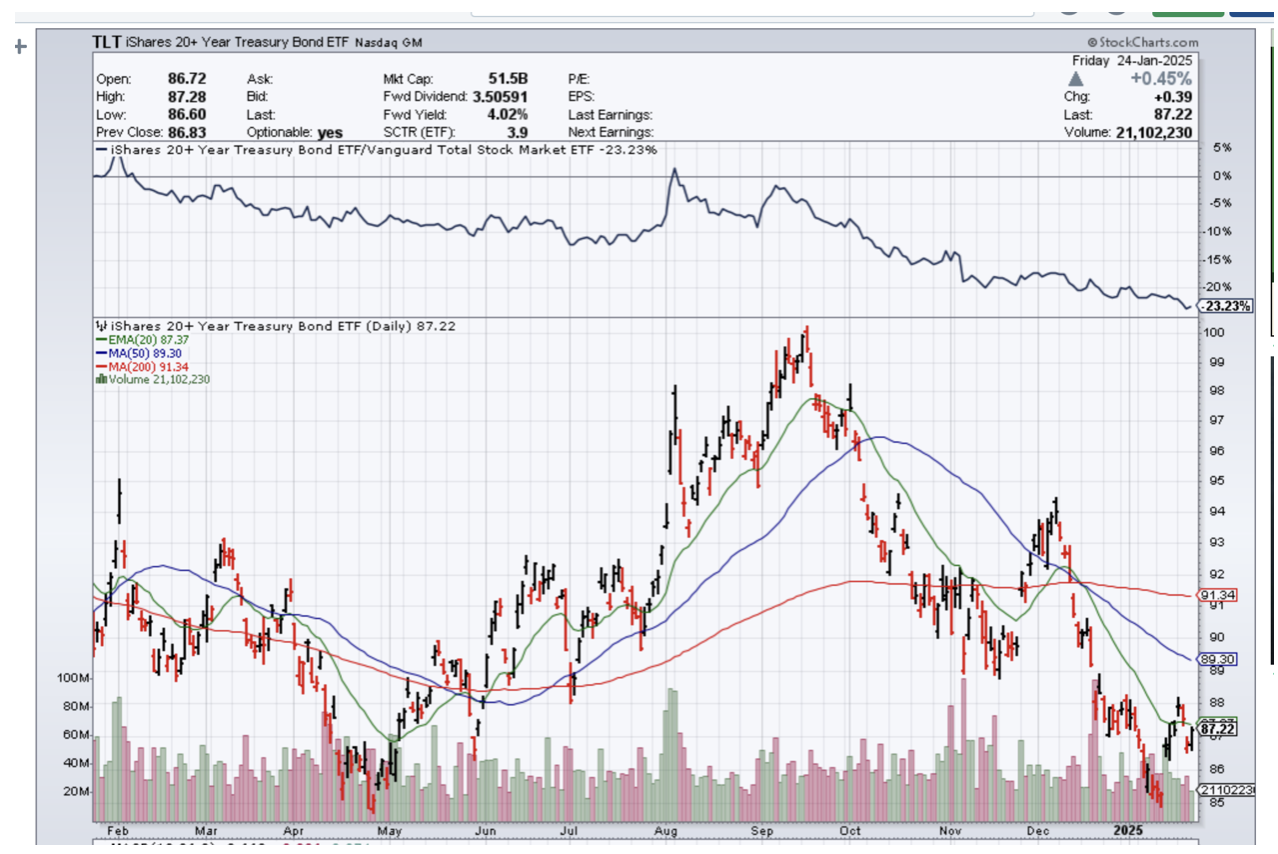

I am normally not a shy, retiring, or timid person, as those who know me will testify heartily. However, given that I have only executed three trades this month, one might be forgiven for thinking so. Those would be successful longs and shorts in Tesla (TSLA) and a stop loss in bonds (TLT). Still, up 2.29% so far in such an indecisive month is better than a poke in the eye with a sharp stick.

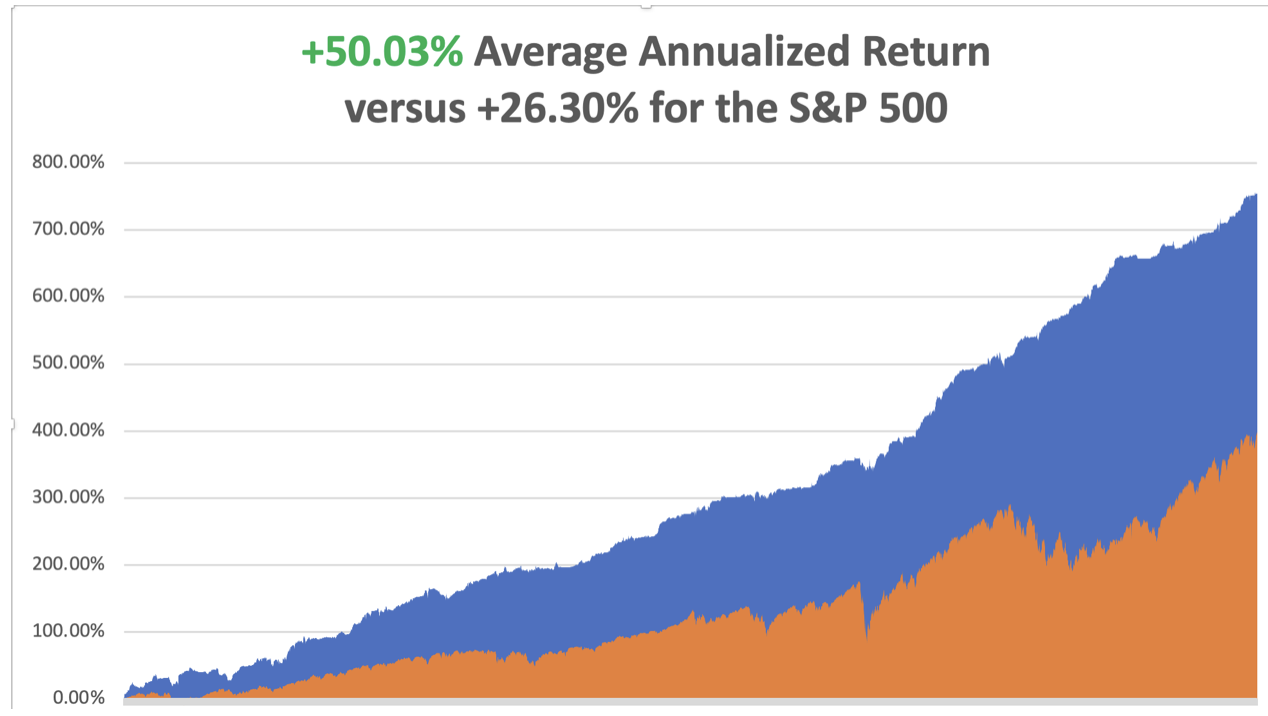

Partly I have acquired a newfound shyness because I don’t want to spoil a near-perfect record for the last five months of 2025. During this period, I executed 47 trades and lost on only 4 of them for a win rate of 91.49%. This is the highest success rate in the nearly 17-year history of the Mad Hedge Fund Trader. What’s more, we took in a staggering 57.9% during this time when the stock market was earning almost nothing.

But the market is certainly indecisive, can’t decide where to go, and is awaiting its marching orders. This is not a time to bet the ranch as we did in Q4 with financials, but only to stick a nervous toe in the water until the market tells you what to do. For now, better to bet just a single cow.

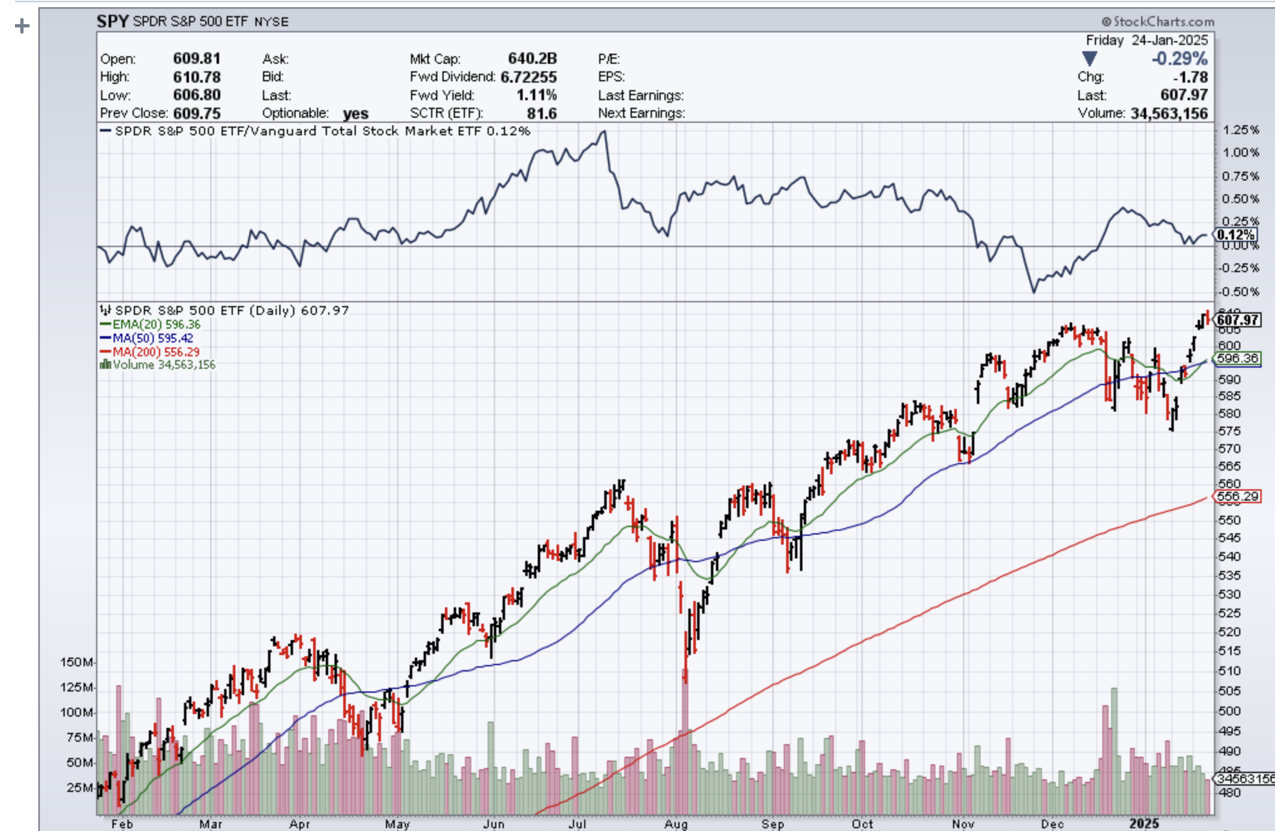

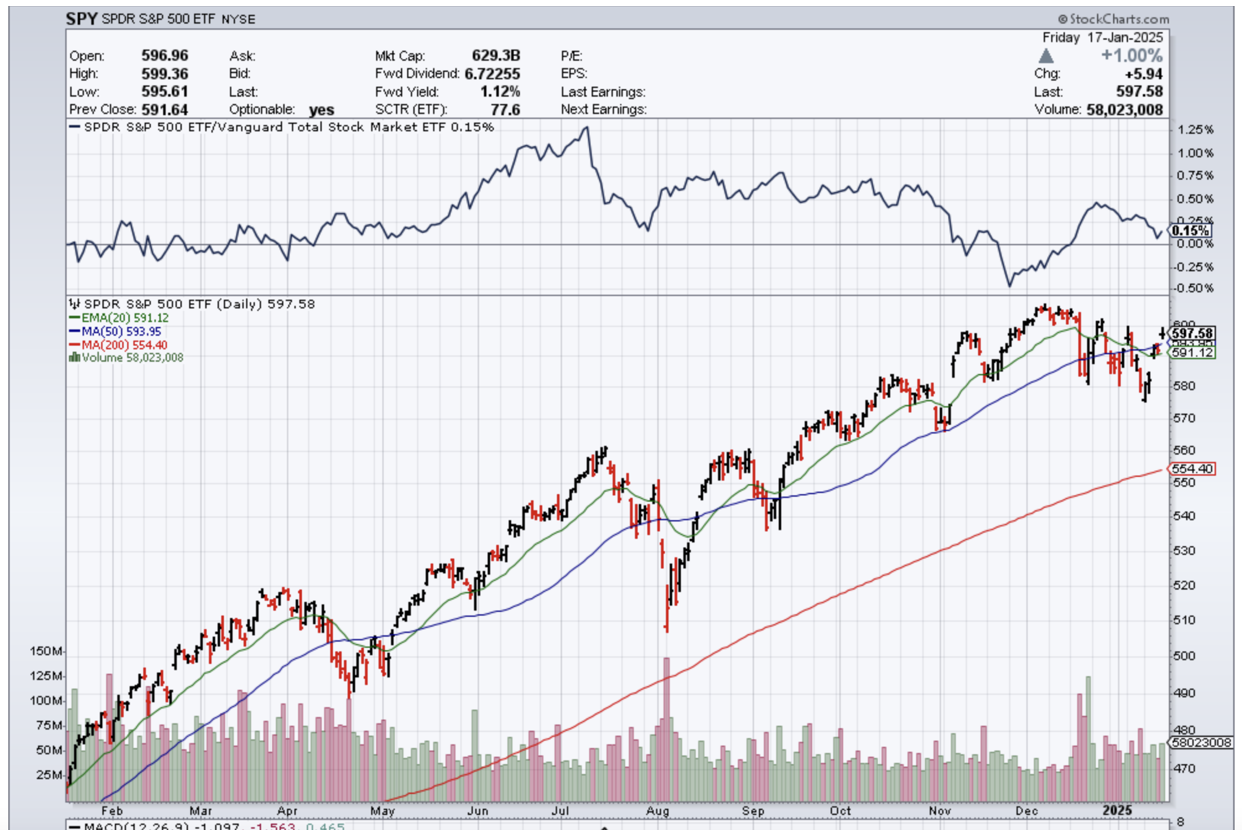

By far the most interesting chart last week is that for the S&P 500 (SPY). Two weeks ago, we saw a lower low at $575 followed by a higher high up to $610 the following week. This is known as an “outside trade” in the trade and always presages an increase in volatility. And volatility we shall get.

All of the traditional market valuation indicators followed by Wall Street are now at their 98% to 100% levels of extreme. This is a clear warning signal of hard times ahead. Apple is giving us the best “tell” having its worst start to the year since 2008, down $40, or 15.38%, some $600 billion in market cap.

It could be a long wait.

The new administration is attempting to pass a Grand policy bill that will approve all of its policy initiatives in a single bill. That might take until May at the earliest and November at the latest, if it passes at all. That is a very long time for the market to wait for a result.

I explained last week that the bull case is that the new administration does nothing. We got a step in that direction last week when Trump said he would “study” tariffs rather than implement them. If Trump ends up not implementing tariffs, or only token ones, it would be good news for the growth of the US economy.

Let me summarize how the China-US trade works in a single sentence. China makes a widget for $1.00 which it then sells to an American buyer for $2.00, reaping a 100% profit. The American buyer then sells its Chinese widget for $20. Some 5% of the profit stream stays in China and 95% with the American seller. Stop this trade and that $18 US profit is lost, wiping out two million US small businesses. I argue that 95% of something is better than 100% of nothing.

By the way, the same argument applies to TikTok, which probably supports another two million single individual revenue streams.

Netflix Earnings Rocketed on the back of 19 million new subscribers. The streaming giant reported better-than-expected fourth-quarter results and raised its 2025 revenue forecast. For the fourth quarter, earnings of $4.27 per share topped Street estimates of $4.18. Revenue of $10.25 billion also topped the Bloomberg consensus estimate of $10.11 billion. Netflix added 18.91 million subscribers in the quarter versus an expected 9.18 million. Mad Hedge already took profits on a long going into the announcement.

The streaming wars are well and truly over.

Apple is in Free Fall, after multiple downgrades, taking the stock down $40, or 15% in a month. Apple has lost some market share in China and has had limited traction with its AI offerings. Even a strong dollar is hurting. Apple sells a lot of things overseas. That’s the fundamental backdrop. The technical picture shows investors what can happen if investors continue to see a deterioration in the company’s business. Avoid (AAPL) for now.

Morgan Stanley (MS) Warns Customers to Cut Stock Exposure. With the S&P 500 index touching a new all-time high Wednesday, U.S. stocks remaining pricey and valuations appearing stretched, investors should make sure to keep a diversified portfolio. The S&P 500 index’s valuation is too high, expectations for earnings growth are too ambitious, and that it’s unclear what President Donald Trump’s policies will mean for Wall Street.

Credit Card Delinquencies Soar, as have minimum monthly payments. The share of active credit card holders just making minimum payments rose to 10.75% in the third quarter of 2024, the highest ever in data going back to 2012. The share of cardholders more than 30 days past due rose to 3.52%, an increase from 3.21%, for a gain of more than 10%. Even with the rising delinquency rate, it is still well below the 6.8% peak during the 2008-09 financial crisis and not yet indicative of serious strains.

Home Insurance Costs are Soaring, for homeowners in the most-affected regions, California and Florida. For consumers living in the 20% of zip codes with the highest expected annual losses, premiums averaged $2,321, or 82% more than those living in the 20% of lowest-risk zip codes from 2018-22. This is going to get worse before it gets better.

Ban Lifted on New Natural Gas Export Facilities in 4 Years, reversing a Biden-era climate initiative. Cheniere Energy (LNG), an old Mad Hedge favorite has risen 75% since the summer and sold off on the news. The big winner here? China, which can now buy more low-priced natural gas.

Housing Starts were up 3.0% in December, with single-family homes up only 3%, while multifamily saw a 59% rise. It should be the shift away from home sales crushed by 7.2% mortgage rates. You can write off real estate in 2025.

EV and Hybrid Sales Reach a Record 20% of US Vehicle Sales in 2024 and now account for 10% of the total US fleet. And you wonder why oil prices are so low. That includes 1.9 million hybrid vehicles, including plug-in models, and 1.3 million all-electric models. Tesla continued to dominate sales of pure EVs but Cox Automotive estimated its annual sales fell and its market share dropped to about 49%.

SpaceX Starship Blows Up on test launch number seven. The Federal Aviation Administration issued a warning to pilots of a “dangerous area for falling debris of rocket Starship,” according to a pilots’ notice. Looks like that Mars trip will be delayed.

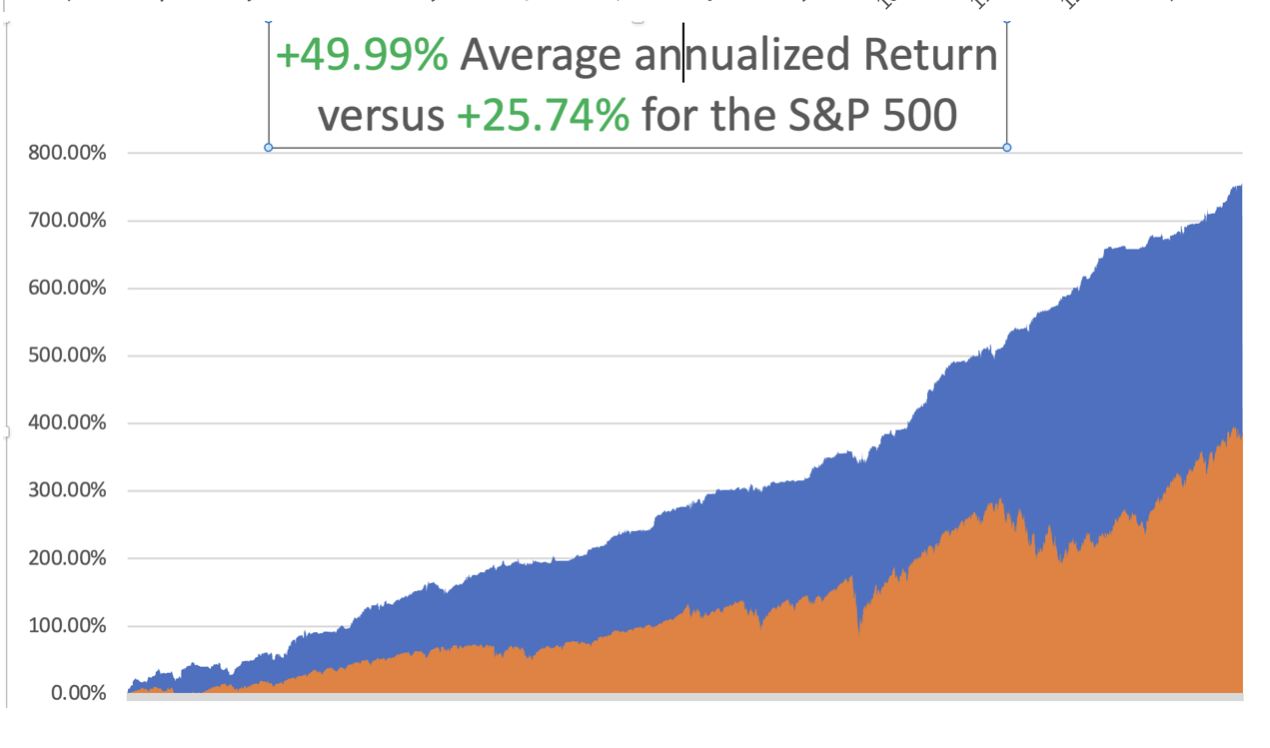

We managed to grind out a +2.29% return so far in January. That takes us to a year-to-date profit of +2.29% so far in 2025. My trailing one-year return stands at +88.88% as a bad trade a year ago fell off the one-year record. That takes my average annualized return to +50.03% and my performance since inception to +754.13%.

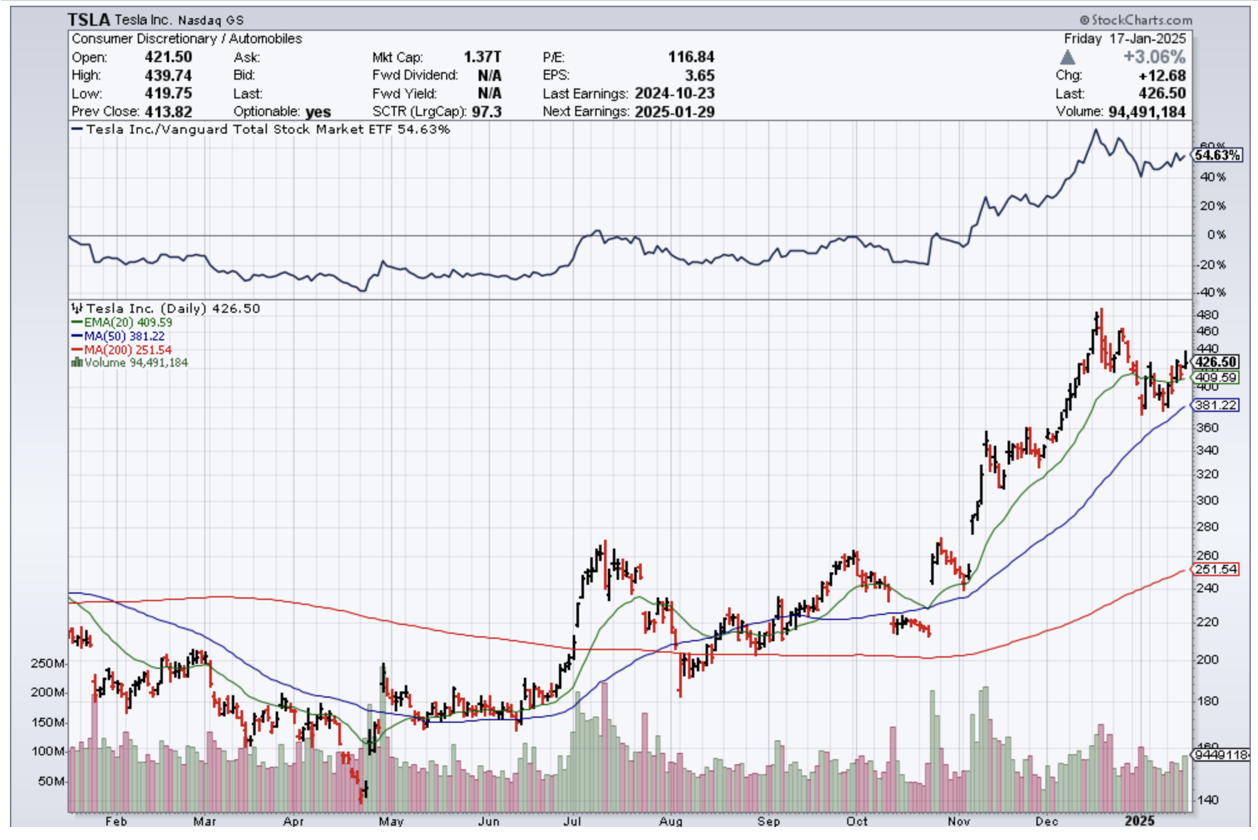

I used a 19% spike in Tesla shares to add a new short position there. The combination of my long and short hedging each other is known as a “short strangle.” It is a combined bet that Tesla will not fall below $310 or rise above $540 by the February options expiration in 19 trading days. Sounds pretty good to me.

Some 63 of my 70 round trips, or 90%, were profitable in 2023. Some 74 of 94 trades have been profitable in 2024, and several of those losses were really break-even. That is a success rate of +78.72%.

Try beating that anywhere.

My Ten-Year View – A Reassessment

We have to substantially downsize our expectations of equity returns in view of the election outcome. My new American Golden Age, or the next Roaring Twenties is now looking at a headwind. The economy will completely stop decarbonizing. Technology innovation will slow. Trade wars will exact a high price. Inflation will return. The Dow Average will rise by 600% to 240,000 or more in the coming decade. The new America will be far more efficient and profitable than the old.

My Dow 240,000 target has been pushed back to 2035.

On Monday, January 27, at 8:30 AM EST, Leading Economic Indicators are out.

On Tuesday, January 28 a 8:30 AM, the Durable Goods are released.

On Wednesday, January 29 at 8:30 AM, the Federal Reserve Interest Rate Decision is announced. A press conference follows at 2:30.

On Thursday, January 30 at 8:30 AM, the Weekly Jobless Claims are disclosed. We also get an update on GDP growth.

On Friday, January 31 at 8:30 AM, Core PCE is printed. At 2:00 PM the Baker Hughes Rig Count is printed.

As for me, occasionally I tell my close friends that I hitchhiked across the Sahara Desert alone when I was 16 and met with looks that are amazed, befuddled, and disbelieving, but I actually did it in the summer of 1968.

I had spent two months hitchhiking from a hospital in Sweden all the way to my ancestral roots in Monreale, Sicily, the home of my Italian grandfather. My next goal was to visit my Uncle Charles, who was stationed at the Torreon Air Force base outside of Madrid, Spain.

I looked at my Michelin map of the Mediterranean and quickly realized that it would be much quicker to cut across North Africa than hitching all the way back up the length of Italy, cutting across the Cote d’Azur, where no one ever picked up hitchhikers, then all the way down to Madrid, where the people were too poor to own cars.

So one fine morning, I found myself taking a deck passage on a ferry from Palermo to Tunis. From here on, my memory is hazy and I remember only a few flashbacks.

Ever the historian, even at age 16, I made straight for the Carthaginian ruins where the Romans allegedly salted the earth to prevent any recovery of a country they had just wasted. Some 2,000 years later, it worked as there was nothing left but an endless sea of scattered rocks.

At night, I laid out my sleeping bag to catch some shut-eye. But at 2:00 AM, someone tried to bash my head in with a rock. I scared them off but haven’t had a decent night of sleep since.

The next day, I made for the spectacular Roman ruins at Leptus Magna on the Libyan coast. But Muamar Khadafi pulled off a coup d’état earlier and closed the border to all Americans. My visa obtained in Rome from King Idris was useless.

I used the opportunity to hitchhike over Kasserine Pass into Algeria, where my uncle served under General Patton in WWII. US forces suffered an ignominious defeat until General Patton took over the army in 1943. Some 25 years later, the scenery was still littered with blown-up tanks, destroyed trucks, and crashed Messerschmitts.

Approaching the coastal road, I started jumping trains headed west. While officially the Algerian Civil War ended in 1962, in fact, it was still going on in 1968. We passed derailed trains and smashed bridges. The cattle were starving. There was no food anywhere.

At night, Arab families invited me to stay over in their mud brick homes as I always traveled with a big American Flag on my pack. Their hospitality was endless, and they shared what little food they had.

As the train pulled into Algiers, a conductor caught me without a ticket. So, the railway police arrested me and on arrival, they took me to the central Algiers prison, not a very nice place. After the police left, the head of the prison took me to a back door, opened it, smiled, and said “Si vou plais”. That was all the French I ever needed to know. I quickly disappeared into the Algiers souk.

As we approached the Moroccan border, I saw trains of camels 1,000 animals long, rhythmically swaying back and forth with their cargoes of spices from central Africa. These don’t exist anymore, replaced by modern trucks.

Out in the middle of nowhere, bullets started flying through the passenger cars splintering wood. I poked my Kodak Instamatic out the window in between volleys of shots and snapped a few pictures.

The train juddered to a halt and robbers boarded. They shook down the passengers, seizing whatever silver jewelry and bolts of cloth they could find.

When they came to me, they just laughed and moved on. As a ragged backpacker, I had nothing of interest for them.

The train ended up in Marrakesh on the edge of the Sahara and the final destination of the camel trains. It was like visiting the Arabian Nights. The main Jemaa el-Fna square was amazing, with masses of crafts for sale, magicians, snake charmers, and men breathing fire.

Next stop was Tangiers, the site of the oldest foreign American Embassy, which is now open to tourists. For 50 cents a night, you could sleep on a rooftop under the stars and pass the pipe with fellow travelers which contained something called hashish.

One more ferry ride and I was at the British naval base at the Rock of Gibraltar and then on a train for Madrid. I made it to the Torreon base main gate where a very surprised master sergeant picked up my half-starved, rail-thin, filthy nephew and took me home. Later, Uncle Charles said I slept for three days straight. Since I had lice, Charles shaved my head when I was asleep. I fit right in with the other airmen.

I woke up with a fever, so Charles took me to the base clinic. They never figured out what I had. Maybe it was exhaustion, maybe it was prolonged starvation. Perhaps it was something African. Possibly, it was all one long dream.

Afterward, my uncle took me to the base commissary where I enjoyed my first cheeseburger, French fries, and chocolate shake in many months. It was the best meal of my life and the only cure I really needed.

I have pictures of all this which are sitting in a box somewhere in my basement. The Michelin map sits in a giant case of old, used maps that I have been collecting for 60 years.

Stay Healthy,

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader

North Africa in 1968

Welcome to Florida

“To pursue the mosquito theory as a cause of yellow fever would be a complete waste of government money,” said an army doctor in 1898.

Global Market Comments

January 24, 2025

Fiat Lux

Featured Trade:

(SOME SAGE ADVICE ON ASSET ALLOCATION)

Global Market Comments

January 23, 2025

Fiat Lux

Featured Trades:

(WHY WATER WILL SOON BE WORTH MORE THAN OIL),

(CGW), (PHO), (FIW), (VE), (TTEK), (PNR),

(WHY WARREN BUFFETT HATES GOLD),

(GLD), (GDX), (ABX)

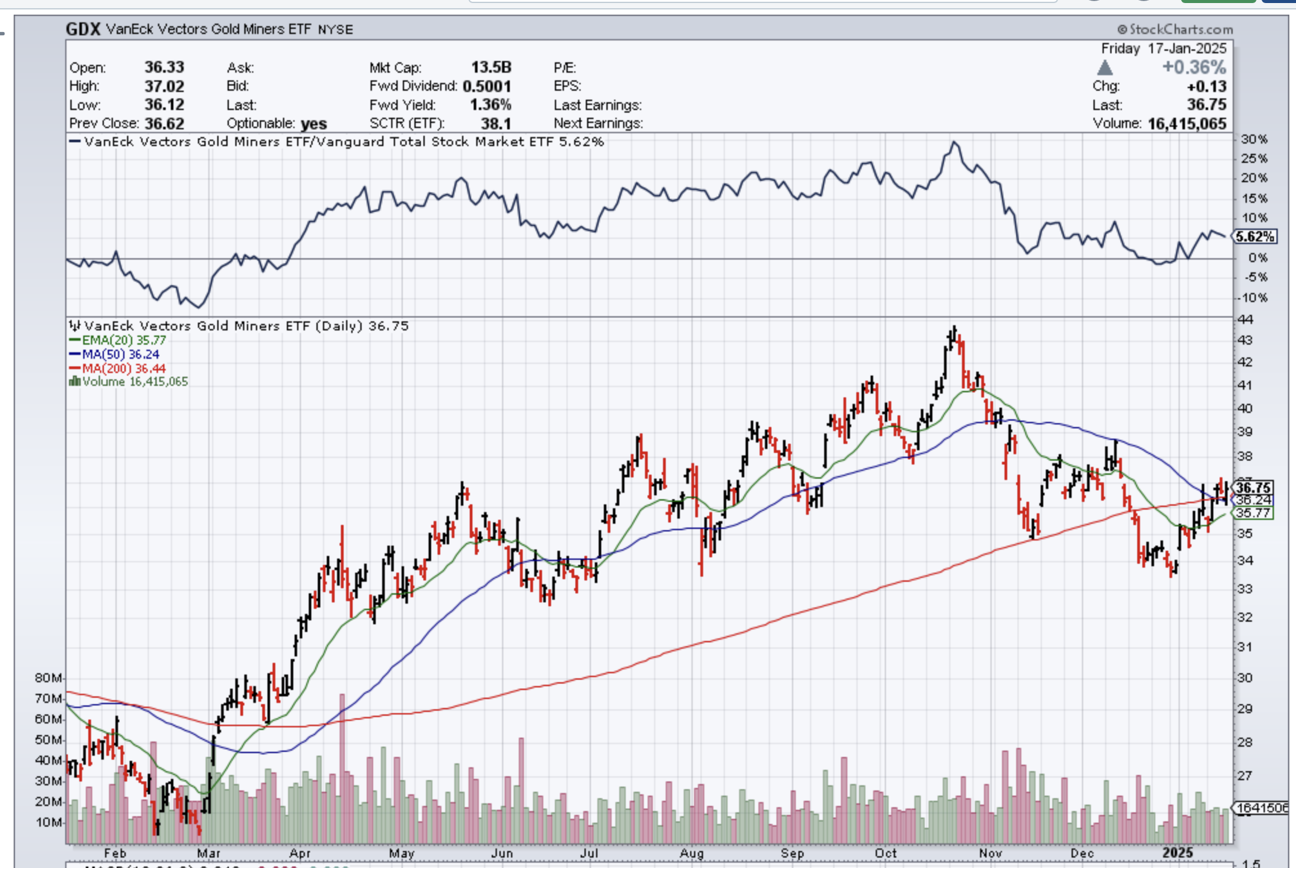

After seven years in the penalty box, gold is finally starting to come alive, and the Armageddon crowd is absolutely loving it. Maybe after ten years of rising, stocks are finally expensive on a relative basis?

These are the guys who are perennially predicting the collapse of the dollar, the default of the US government, hyperinflation, and the end of the world.

Better to keep all your assets in gold and silver, store at least a year’s worth of canned food, and keep your untraceable guns well-oiled and supplied with ammo, preferably in high-capacity magazines.

If you followed their advice, you lost your shirt.

I have broken many of these wayward acolytes of their money-losing habits. But not all of them. There seems to be an endless supply emanating from the hinterlands.

The “Oracle of Omaha” Warren Buffet often goes to great lengths to explain why he despises the yellow metal.

The sage doesn't really care about the gold, whatever the price. He sees it primarily as a bet on fear. I imagine he feels the same about Bitcoin, the modern tulips of our age.

If investors are more afraid in a year than they are today, then you make money on gold. If they aren't, then you lose money.

The only problem now is that fear ain’t working.

If you took all the gold in the world, it would form a cube 67 feet on a side, worth $5 trillion. For that same amount of money, you could own other assets with far greater productive earning power, including:

*All the farmland in the US, about 1 billion acres, which is worth $2.5 trillion.

*Seven Apple’s (AAPL), the second largest capitalized company in the world at $731 billion.

Instead of producing any income or dividends, gold just sits there and shines, making you feel like King Midas.

I don't know. With the stock market at an all-time high and oil trading at $75/barrel, a bet on fear looks pretty good to me right now.

I'm still sticking with my long-term forecast of the old inflation-adjusted high of $2,300/ounce.

It is just a matter of time before emerging market central bank buying pushes it up there. And who knows? Fear might make a comeback too.

Global Market Comments

January 22, 2025

Fiat Lux

Featured Trades:

(TRADING FOR THE NON-TRADER),

(ROM), (UXI), (UCC), (UYG)

Global Market Comments

January 21, 2025

Fiat Lux

Featured Trades:

(MARKET OUTLOOK FOR THE WEEK AHEAD or NOW WE ENTER THE GREAT UNKNOWN),

(GS), (MS), (JPM), (C), (BAC) (TLT), (TSLA)

I am writing this to you from Indian Rock Beach, Florida, an extended sand bar outside of Tampa on the west coast. Cabin cruisers pass by every five minutes. There is not much fishing though with rain and temperatures in the low 40s, the coldest of the year. leaving a lot of free time for indoor work. Every building is missing a chunk of wall or roof if not totally destroyed from the October hurricane Helena, including my own Airbnb. The last hurricane here took place in 1921.

Everywhere I look, hedge fund managers are derisking, cutting exposure, and laying on hedges. The reason is that no one has a handle on what is going to happen in financial markets in the short term. Do we go up, down, or nowhere? The rapid unwind of the post-election rally has put the fear of markets back in them once again.

There is also a rare shortage of news in the financial media. It’s as if someone is sucking all the oxygen out of the room.

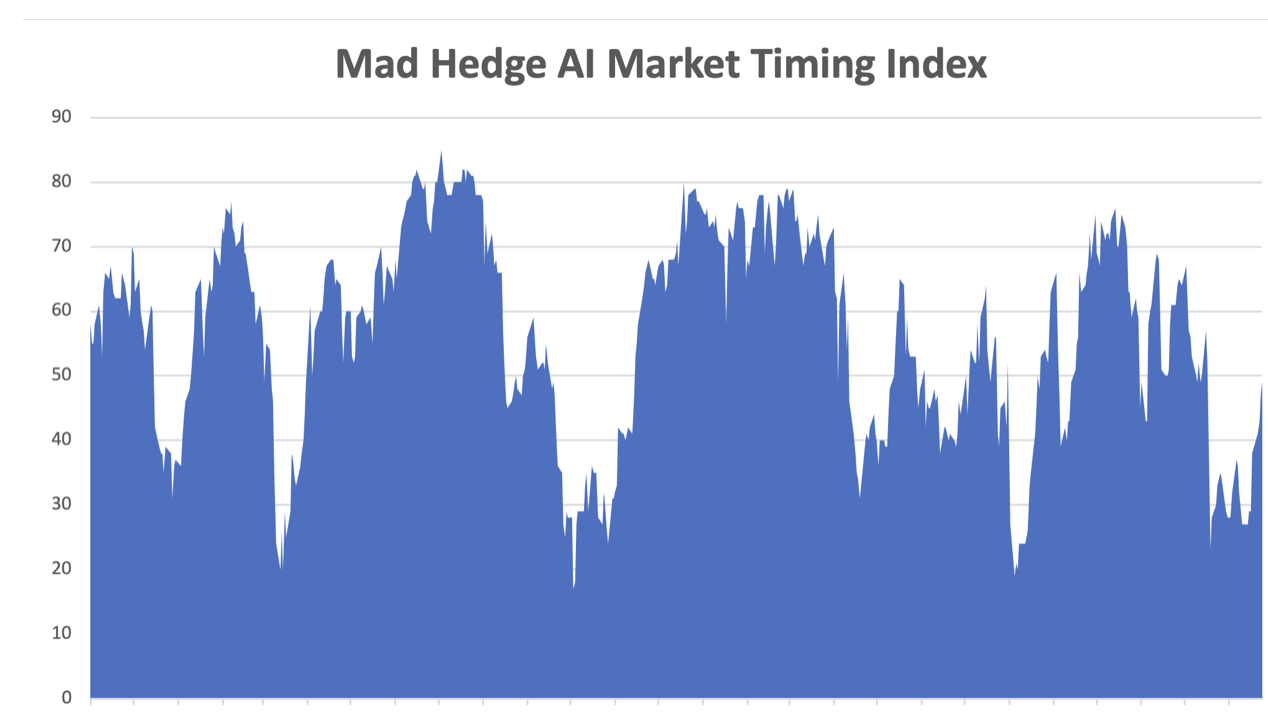

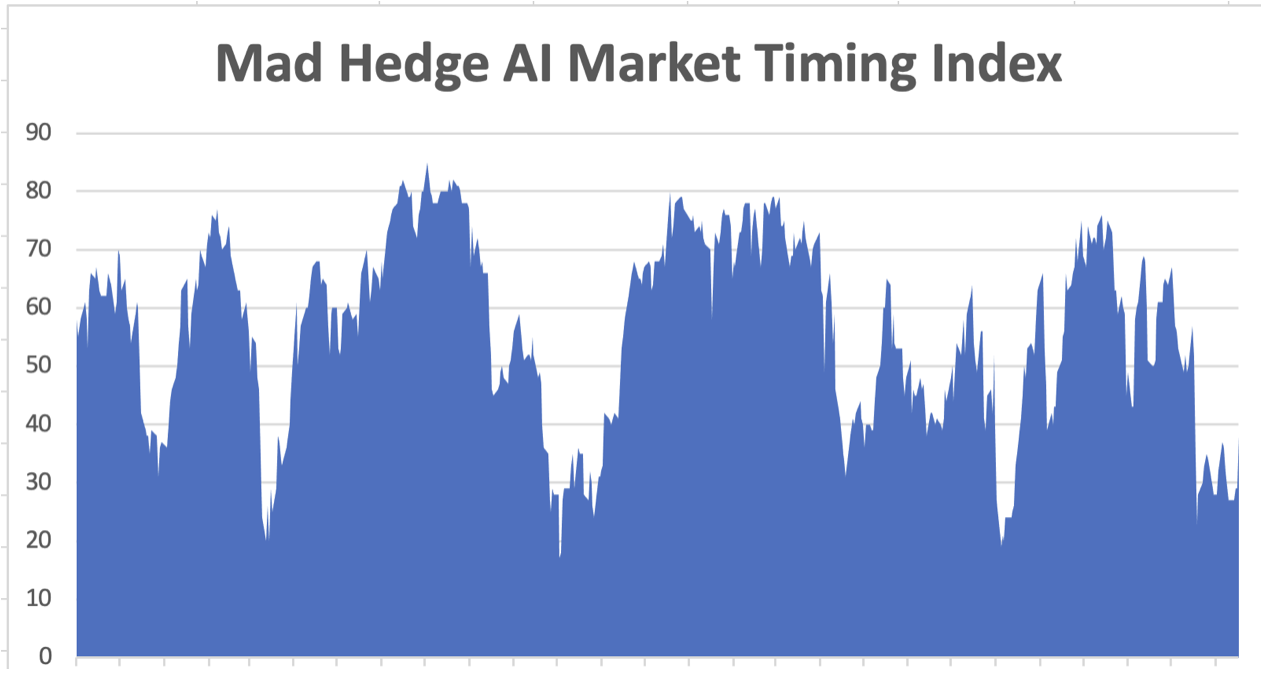

We had about a week where the Mad Hedge Market Timing Index in the mid-twenties was enticing us back into the market. I was expecting a hot December Consumer Price Index to give us a nice selloff and the perfect entry point I had been waiting a month for, in line with all the economic warm data of the last three months.

But it was not to be. The CPI printed at a cool 2.9% YOY and the Dow Average opened up 700 points the next morning, the first step in a 1,700-point three-day rally. Half the December losses came back in a heartbeat.

So much for the great entry point.

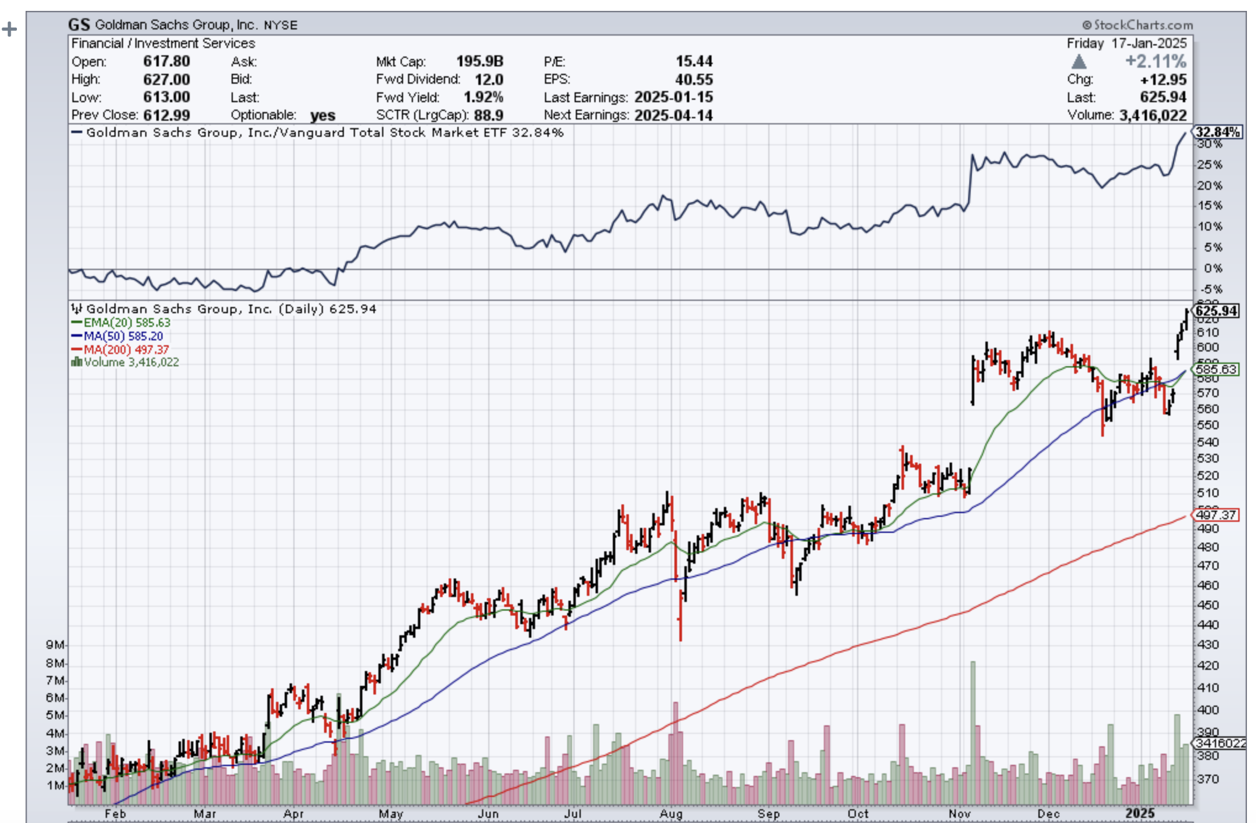

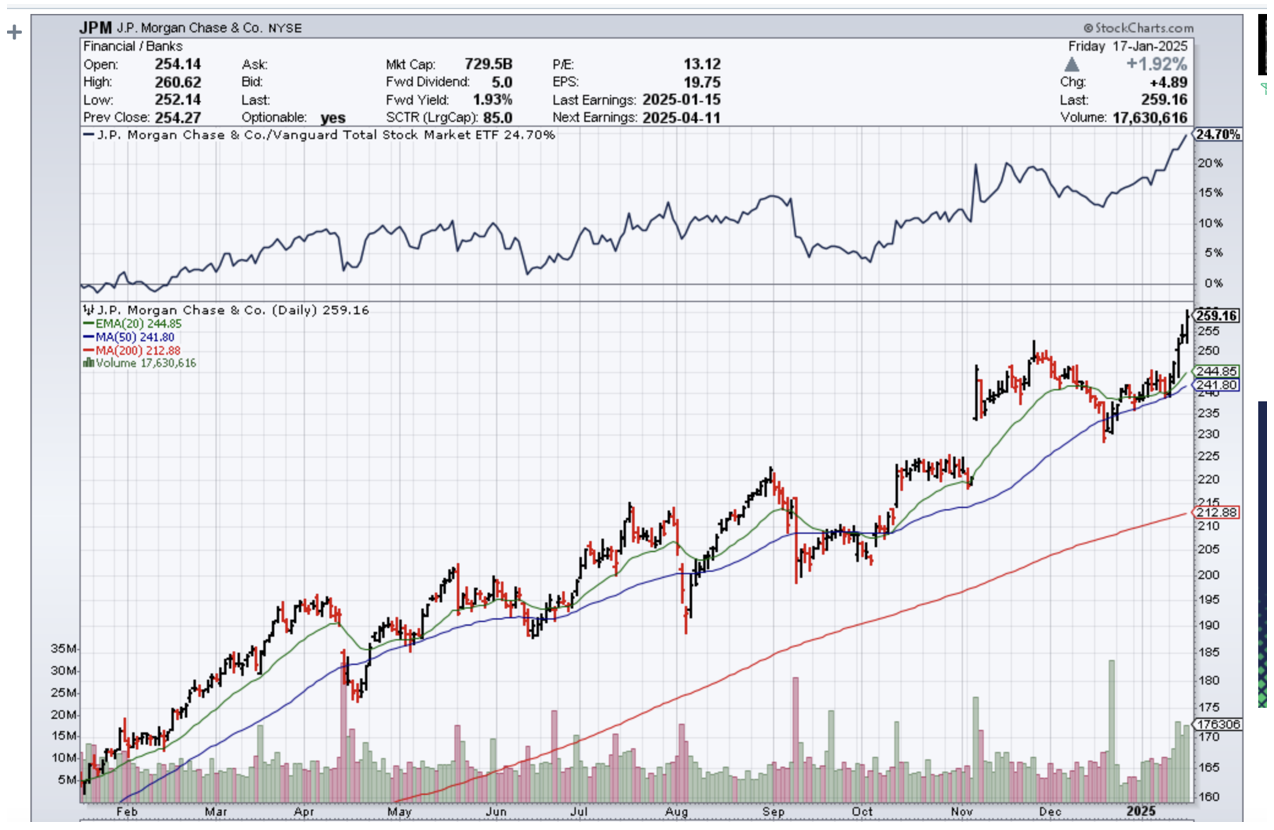

All of my target stocks like (GS), (MS), (JPM), (C), and (BAC) went ballistic. I only managed to get into a long in Tesla (TSLA) because the implied volatility was a sky-high 70%. That way, the stock could take a surprise hit and I still would have a safety cushion large enough to eke out the maximum profit by the February 20 option expiration. What’s next? How about a $100 in-the-money bearish Tesla put spread, once the rally burns out?

I can’t remember a time when there was such a narrow field of attractive trading targets. Rising interest rates have killed off bonds, foreign currencies, precious metals, and real estate. A weak China has destroyed commodities and energy, with US overproduction contributing to the latter. Only financials look interesting for the short term and big tech for the long term.

At that point, financials are not exactly undiscovered investments, but they should have another three months of life in them. That’s when big tech should reclaim the leadership, when we get another surprise AI-driven earnings burst.

What does this get us in the major indexes? With so much of the stock market on life support, not much, maybe 10% at best. After that, who knows?

There is no point in looking for any more financial news today (Sunday), as there isn’t any with a holiday tomorrow. So I am headed out for a one-hour walk of the beach.

We managed to grind out a +2.07% return so far in January. That takes us to a year-to-date profit of +2.07% so far in 2025. My trailing one-year return stands at +75.92%. That takes my average annualized return to +49.99% and my performance since inception to +753.93%.

I stopped out of my long position in (TLT) near cost. My January 2025 (TSLA) expired on Friday at its maximum profit point, soaring a torrid $50 in the two days going into expiration.

Some 63 of my 70 round trips, or 90%, were profitable in 2023. Some 74 of 94 trades were profitable in 2024, and several of those losses were really break-evens. That is a success rate of +78.72%.

Try beating that anywhere.

My Ten-Year View – A Reassessment

When have to substantially downsize our expectations of equity returns in view of the election outcome. My new American Golden Age, or the next Roaring Twenties is now looking at a headwind. The economy will completely stop decarbonizing. Technology innovation will slow. Trade wars will exact a high price. Inflation will return. The Dow Average will rise by 600% to 240,000 or more in the coming decade. The new America will be far more efficient and profitable than the old.

My Dow 240,000 target has been pushed back to 2035.

Consumer Price Index Cools at 0.2%, or 3.2% YOY, the first drop in six months. Economists see the core gauge as a better indicator of the underlying inflation trend than the overall CPI which includes often-volatile food and energy costs. The headline measure rose 0.4% from the prior month, with over 40% of the advance due to energy.

Los Angeles Fires to Cost $270 Billion, with only $30 billion covered by insurance. Inflation will rise as the cost of construction labor and materials soar. Tradesmen around the country are packing their trucks and heading west to snare work at double the normal rate. There is no trade here as the new home builders are not involved, who are set up to only build mass-produced tract homes. Yet another black swan for 2025.

$4 Trillion in Asset Management Disrupted by the Los Angeles Fires, with some relocating office space and supporting staff members who have lost their homes. The LA area is home to large industry players like Capital Group, TCW Group, hedge funds Oaktree Capital and Ares Management.

Bonds Hit 14-Month Lows at a 4.80% Yield, as fixed income dumping continues across the board. “Higher Rates for longer” don’t fit in here anywhere. But there may be a BUY setting up for (TLT) at 5.0%.

The Trump Bump is Gone, stock markets giving up all their post-election gains. Technology was especially hard hit, with lead stock NVIDIA down 15%. It seems that people finally examined the implications of what Trump was proposing for the stock market. Tax-deferred selling of the enormous profits run up under the Biden administration is a big factor.

Amazon is Getting Ready for Another Run. Strong earnings and continuing excitement about artificial intelligence will help Amazon stock move back into the green. The e-commerce and cloud company to beat estimates when it reports its fourth-quarter results—analysts are expecting a profit of $1.48 a share on sales of $187.3 billion, according to data from FactSet. Buy (AMZN) on dips.

JP Morgan Announces Record Profits, boosted by volatility tied to the US elections in November. Trading revenue at the firm rose 21% from a year earlier, jumping to $7.05 billion. Fixed income was the star, with revenue beating analysts’ estimates, while equities-trading revenue fell short. Buy (JPM) on dips.

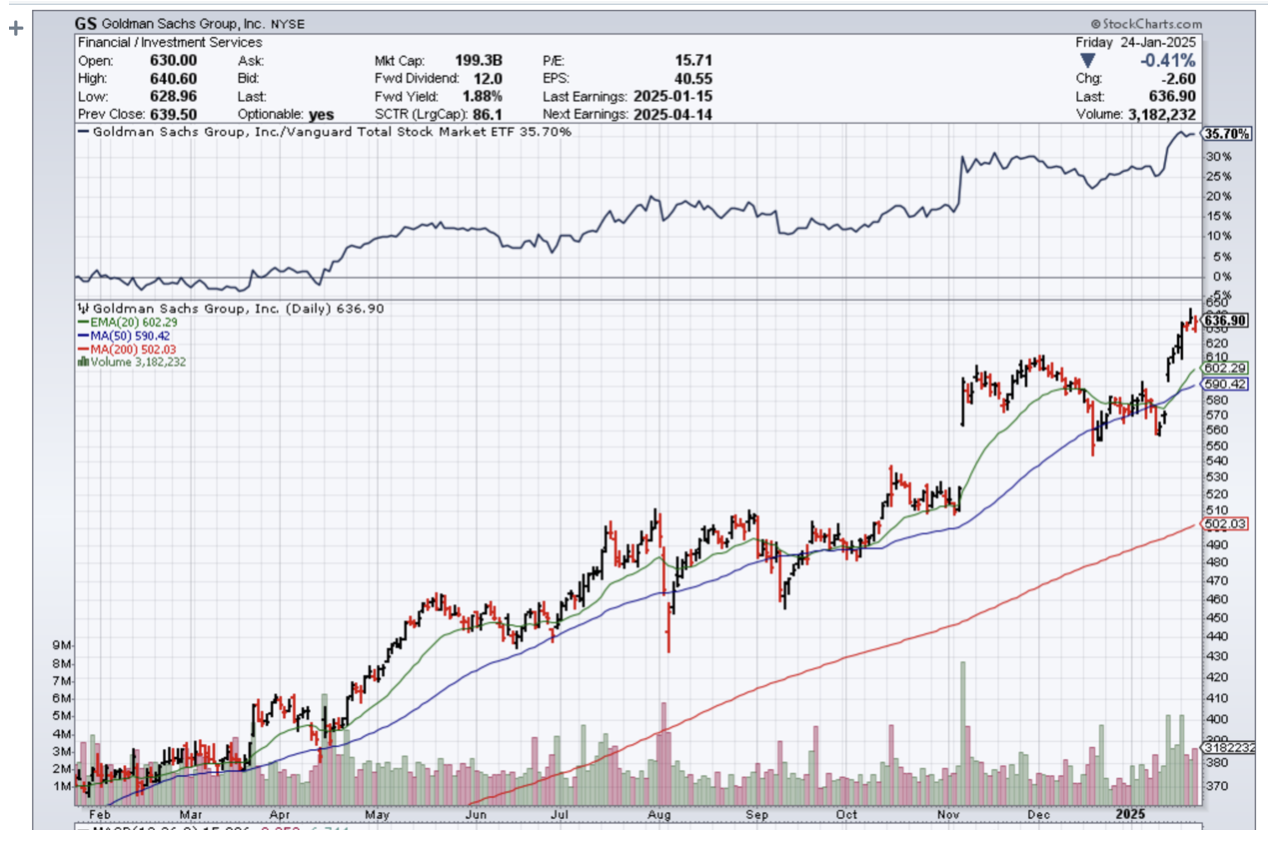

Goldman Sachs Beats. The firm’s fourth-quarter profits more than doubled to $4.1 billion, buoyed by strength in its investment bank, expansion of its asset management business, and a surprise $472 million gain from a balance sheet bet. Goldman ended 2024 as the best-performing stock among major US banks with a 48% advance. The bank is positioning itself for a long-awaited resurgence in deals after ditching major parts of a consumer foray.

Morgan Stanley Doubles Profits. Equities were the big winner, with revenue jumping 51% in the quarter and reaching an all-time high for the full year. In the wealth business, net new assets fell just shy of estimates even as revenue topped expectations.

SEC Sues Elon Musk, alleging the billionaire violated securities law by acquiring Twitter shares at “artificially low prices.” In his purchases, Musk underpaid for Twitter shares by at least $150 million, the SEC says. Musk bought Twitter in 2022 for about $44 billion, later changing the name to X. Expect this case to get lost behind the radiator next week.

Fed Minutes are Turning Hawkish, making an interest rate cut at the March 19 meeting unlikely. Inflation is stubbornly above target, the economy is growing at about 3% pace and the labor market is holding strong. Put it all together and it sounds like a perfect recipe for the Federal Reserve to raise interest rates or at least to stay put.

EIA Expects Weak Oil Prices for All of 2025. Many analysts expect an oversupplied oil market this year after demand growth slowed sharply in 2024 in the top consuming nations: the U.S. and China. The EIA said it expects Brent crude oil prices to fall 8% to average $74 a barrel in 2025, then fall further to $66 a barrel in 2026.

Housing Starts were up 3.0% in December, with single-family homes up only 3%, while multifamily saw a 59% rise. It should shift away from home sales crushed by 7.2% mortgage rates. You can write off real estate in 2025.

EV and Hybrid Sales Reach a Record 20% of US Vehicle Sales in 2024 and now account for 10% of the total US fleet. And you wonder why oil prices are so low. That includes 1.9 million hybrid vehicles, including plug-in models, and 1.3 million all-electric models. Tesla continued to dominate sales of pure EVs but Cox Automotive estimated its annual sales fell and its market share dropped to about 49%.

SpaceX Starship Blows Up on test launch number seven. The Federal Aviation Administration issued a warning to pilots of a “dangerous area for falling debris of rocket Starship,” according to a pilots’ notice. Looks like that Mars trip will be delayed.

On Monday, January 20, the markets are closed for Martin Luther King Day.

On Tuesday, January 21 at 8:30 AM EST, nothing of note takes place.

On Wednesday, January 22 at 8:30 AM, the API Crude Oil Stocks are printed.

On Thursday, January 23 at 8:30 AM, the Weekly Jobless Claims are announced.

On Friday, January 24 at 8:30 AM, Existing Home Sales are published. At 2:00 PM the Baker Hughes Rig Count is printed.

As for me, back in the early 1980s, when I was starting up Morgan Stanley’s international equity trading desk, my wife Kyoko was still a driven Japanese career woman.

Taking advantage of her near-perfect English, she landed a prestige job as the head of sales at New York’s Waldorf Astoria Hotel.

Every morning, we set off on our different ways, me to Morgan Stanley’s HQ in the old General Motors Building on Avenue of the Americas and 47th street and she to the Waldorf at Park and 34th.

One day, she came home and told me there was this little old lady living in the Waldorf Towers who needed an escort to walk her dog in the evenings once a week. Back in those days, the crime rate in New York was sky-high and only the brave or the reckless ventured outside after dark.

I said, “Sure, what was her name?”

Jean MacArthur.

I said, "THE Jean MacArthur?"

She answered, “Yes.”

Jean MacArthur was the widow of General Douglas MacArthur, the WWII legend. He fought off the Japanese in the Philippines in 1941 and retreated to Australia in a dramatic night PT Boat escape.

He then led a brilliant island-hopping campaign, turning the Japanese at Guadalcanal and New Guinea. My dad was part of that operation, as were the fathers of many of my Australian clients. That led all the way to Tokyo Bay where MacArthur accepted the Japanese in 1945 on the deck of the battleship USS Missouri.

The MacArthurs then moved into the Tokyo embassy where the general ran Japan as a personal fiefdom for seven years, a residence I know well. That’s when Jean, who was 18 years the general’s junior, developed a fondness for the Japanese people.

When the Korean War began in 1950, MacArthur took charge. His landing at Inchon Harbor broke the back of the invasion and was one of the most brilliant tactical moves in military history. When MacArthur was recalled by President Truman in 1952, he had not been home for 13 years.

So it was with some trepidation that I was introduced by my wife to Mrs. MacArthur in the lobby of the Waldorf Astoria. On the way out, we passed a large portrait of the general who seemed to disapprovingly stare down at me taking out his wife, so I was on my best behavior.

To some extent, I had spent my entire life preparing for this job.

I had stayed at the MacArthur Suite at the Manila Hotel where they had lived before the war. I knew Australia well. And I had just spent a decade living in Japan. By chance, I had also read the brilliant biography of MacArthur by William Manchester, American Caesar, which had only just come out.

I also competed in karate at the national level in Japan for ten years, which qualified me as a bodyguard. In other words, I was the perfect after-dark escort for Midtown Manhattan in the early eighties.

She insisted I call her “Jean”; she was one of the most gregarious women I have ever run into. She was grey-haired, petite, and made you feel like you were the most important person she had ever run into.

She talked a lot about “Doug” and I learned several personal anecdotes that never made it to the history books.

“Doug” was a staunch conservative who was nominated for president by the Republican party in 1944. But he pushed policies in Japan that would have qualified him as a raging liberal.

It was the Japanese who begged MacArthur to ban the army and the navy in the new constitution for they feared a return of the military after MacArthur left. Women gained the right to vote on the insistence of the English tutor for Emperor Hirohito’s children, an American Quaker woman. He was very pro-union in Japan. He also pushed through land reform that broke up the big estates and handed out land to the small farmers.

It was a vast understatement to say that I got more out of these walks than she did. While making our rounds, we ran into other celebrities who lived in the neighborhood who all knew Jean, such as Henry Kissinger, Ginger Rogers, and the UN Secretary-General.

Morgan Stanley eventually promoted me and transferred me to London to run the trading operations there, so my prolonged free history lesson came to an end.

Jean MacArthur stayed in the public eye and was a frequent commencement speaker at West Point where “Doug” had been a student and later the superintendent. Jean died in 2000 at the age of 101.

I sent a bouquet of lilies to the funeral.

Kyoko passed away in 2002.

In 2014, China’s Anbang Insurance Group bought the Waldorf Astoria for $1.95 billion, making it the most expensive hotel ever sold. Most of the rooms were converted to condominiums and sold to Chinese looking to hide assets abroad.

The portrait of Douglas MacArthur is gone too. During the Korean War, he threatened to drop atomic bombs on China’s major coastal cities.

Good Luck and Good Trading,

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader

"In both the 1982 and 1990 gains, the market accelerated at the end. Lightening may not strike twice but we would advise against flying a kite in a thunderstorm," said Laszlo Birinyi of Birinyi Associates.

Global Market Comments

January 17, 2025

Fiat Lux

Featured Trades:

(JANUARY 15 BIWEEKLY STRATEGY WEBINAR Q&A),

(GS), (MS), (JPM), (C), (BAC), (TSLA), (HOOD), (COIN), (NVDA), (MUB), (TLT), (JPM), (HD), (LOW), FXI)