We have one options position that is in-the-money and about to expire at the close of business today, and I just want to explain to the newbies how to best maximize their profits.

This comprises the Currency Shares Japanese Yen Trust (FXY) August $97-$100 in-the-money vertical bear put spread with a cost of $2.70.

As long as the FXY closes at or below $97.00 today, the position will expire worth $3.00 and you will achieve the maximum possible profit of 11.11%.

That is not a bad return in only 11 trading days in this zero interest rate world.

Better that a poke in the eye with a sharp stick, as they say.

In this case, the expiration process is very simple. You take your left hand, grab your right wrist, pull it behind your neck and pat yourself on the back for a job well done.

Your broker (are they still called that?) will automatically use the long put to cover the short put, cancelling out the positions. The profit will be credited to your account on Monday and the margin freed up.

Of course, I am watching these positions like a hawk, as always.

If an unforeseen geopolitical event causes the FXY to take off to the upside once again, such as if Janet Yellen announces that there will never be another interest rate hike again, you should get the Trade Alert in seconds.

If the FXY expires slightly out-of-the-money, like at $97.01, then the situation may be more complicated, and can become a headache.

On the close, your short put position expires worthless, but your long put position is converted into a large, leveraged outright naked short position in the yen with a net cost of? $97.30.

You do not want this position on pain of death, as the potential risk is huge and unlimited, and your broker probably would not allow it unless you put up a ton of new margin.

This is not what moneymaking is all about.

Professionals caught in this circumstance then buy an amount of yen equal to the short position they inherit with the expiring FXY $100 put to hedge out their risk.

Then the long yen position is cancelled out by the short yen position resulting from the exercised put, and on Monday both disappear from your statement.

However, this can be dicey to execute going into the close.

So, for individuals, I would highly recommend just selling the August FXY $97-$100 put spread outright in the market if it looks like this situation may develop and the FXY is going to close very near the $97 strike, even if it as a loss.

The risk control is just too hard for individual traders to handle.

There is another reason to come out early. Some brokers exercise the options in the spread into shares on expiration, and then hit you with an extra commission on the sale of the yen.

So check with you broker to see how they handle options expirations.

To be forewarned is to be forearmed.

Keep in mind also, that the liquidity in the options market disappears and the spreads widen, when a security has only hours or minutes until expiration.

This is known in the trade as the ?expiration risk.?

One way or the other, I?m sure you?ll do OK, as long as I am looking over your shoulder, as I will be.

Now your only problem is to figure out how to spend the money.

Well done, and on to the next trade.

Well Done and On to the Next Trade

?There?s a great quote from Warren Buffet where he says ?You don?t know who?s swimming without a swimsuit until the tide goes out.? "The tide is starting to go out for the unicorns. I don?t know if it is 20% out or 80% out, but you are starting to see which unicorns don?t have great business models, lack solid unit economics, or are over promotional on what they are able to achieve.? said Bill Gurley, general partner of venture capital firm Benchmark Capital.

?

Global Market Comments

August 18, 2016

Fiat Lux

Featured Trade:

(UPGRADE NOW TO MAD OPTIONS TRADER),

(SEPTEMBER 16th PORTLAND, OR GLOBAL STRATEGY LUNCHEON),

(PETER F. DRUCKER ON MANAGEMENT)

I had planned on formally launching our new Mad Options Trader service at the end of August.

But why wait?

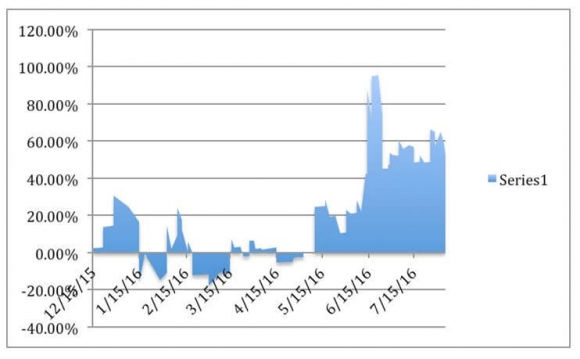

Matt has delivered such blowout results so far this month, up a stunning 20%, that to delay might unfairly deprive subscribers from future profits.

So, as of today, Nancy, in customer support, is taking Mad Options Trader orders. Just put "MOT Upgrade" in the subject line, and she will get back to you shortly.

This is how the upgrade works.

For example, let?s say you have nine months remaining on your existing $3,000 Global Trading Dispatch subscription. You will get a credit for $2,250. Nancy will then bill you $4,500 against this.

That brings the upfront cost for the upgrade to $2,250, but your subscriptions for the GTD + MOT combo now have a full year to run together.

This means that Nancy is going to have to manually calculate the price for each new upgrade to MOT for each of you individually, and then give you a precise amount you can send to us by PayPal or check.

Early action will be rewarded.

Regardless, your free MOT "test flight" will continue until the end of August, as promised, and the new paid MOT subscription will start on September 1st.

The month end coincides with the Labor Day weekend, so the time we can deal with the incoming crush of orders is thus further shortened.

Nancy warned me that I better start processing orders now, or her ?head would explode.?

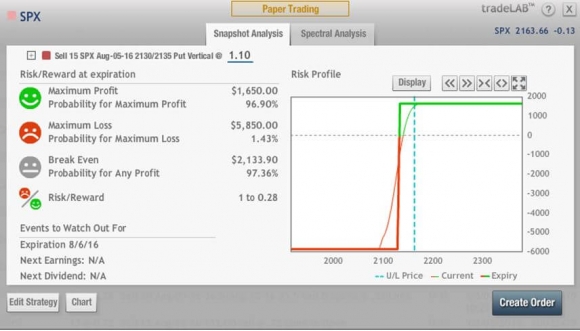

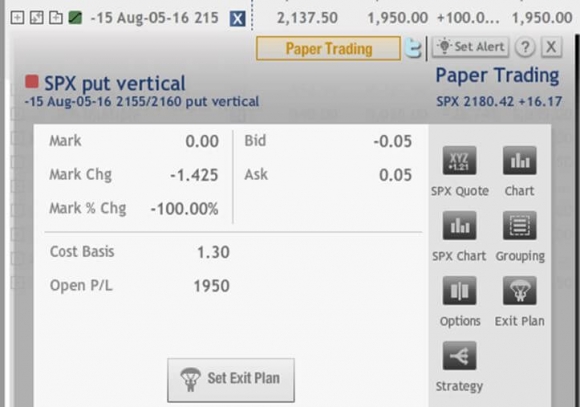

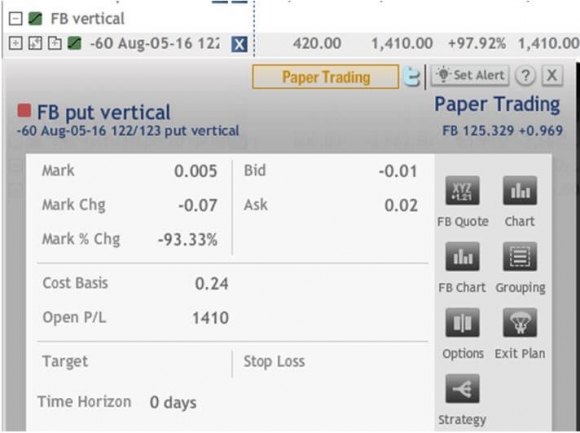

Matt?s unique service focuses primarily on the weekly US equity options expirations, with the goal of making profits at all times.

The trading will take place in the S&P 500 (SPX), major industry ETF?s like the Financials Select Sector (XLF), and large capitalized single names, such as Facebook (FB), JP Morgan Chase & Co. (JPM), and Apple (AAPL).

Matt is my old friend and fellow comrade in arms of Top Gun Options, one of the best performing trade mentoring outfits in the industry.

Matt knows what he is talking about. An independent audit shows that he has racked up an incredible 53.03% performance, net of commissions and fees, so far in 2016, one of the most difficult years in trading history.

That works out to an average 7.92% a month, or an incredible 95.09% a year.

Matt, a native of New Jersey, joined the Navy straight out of college, and rose to become an F-18/A fighter pilot. He attended the famed Top Gun school in Coronado, California. During the second Iraq War, Matt flew 44 combat missions.

Matt left the service in 2006, and immediately entered the hedge fund industry. A rapid series of promotions eventually took him to Peak6 Investments, L.P., a prominent Chicago hedge fund.

There, he soaked up the most crucial elements of technical market timing, fundamental name selection, risk control, and options trade execution.

These are the multiple skills that have enabled Matt to post such a blockbuster performance.

Matt, known to his friends by his old pilot handle of ?Whiz?, is an incredibly valuable addition to the Mad Hedge Fund Trader team. I have appointed him Head of Options Trading.

I have known for some time that fortunes were being made in the weekly options expirations, where stories of tenfold returns are not unheard of. It is a strategy that is perfectly suited to these highly volatile, uncertain times, with most options positions expiring within four days.

Matt allows us to fill that gap in our product offerings.

The Mad Options Trader provides essential support for the active trader and will include:

1) Instant Trade Alerts texted out at key technical levels. Alerts will be sent out on the opening and closing of every position.

2) Weekly Market Strategy Webinars held every Monday at 1:00 PM EST to give you a head?s up on the week ahead.

3) A weekly Live Trading Room held every Tuesday from 9:00 to 11:00 AM EST to give members active real time trading experience.

4) Specialized Training Webinars on how to best execute Matt?s trades.

What I love about Matt is that he eats his own cooking. Many of the Trade Alerts he recommends are executed in his own personal retirement account with real dollars.

To see how he has performed so far in 2016, please check out the daily chart below.

Good Luck and Good Trading,

John Thomas

Publisher and CEO of The Mad Hedge Fund Trader

Mad Options Trader 2016 YTD Independently Audited Performance

Global Market Comments

August 17, 2016

Fiat Lux

SPECIAL CYBER SECURITY ISSUE

Featured Trade:

(MORE CASHING IN ON CYBER SECURITY),

(PANW), (FEYE), (HACK), (SNE)

Palo Alto Networks, Inc. (PANW)

FireEye, Inc. (FEYE)

PureFunds ISE Cyber Security ETF (HACK)

Sony Corporation (SNE)

I have covered this exciting sector at length in previous newsletters.

Now we have a fantastic entry point!

Who?s really reading your email? I bet you?d like to know!

Another day, another hack attack.

Today we learned that 5.6 million fingerprint records kept by the Office of Personal Management were recently stolen.

This is the agency that functions as the US government?s human resources department, maintaining records on 21.5 million current and former employees.

The timing couldn?t be more inauspicious, as the announcement was made during a visit by Chinese president Xi Jinping, whose military was almost certainly the origin of the attack.

Great! Now the enemy has the fingerprints of every FBI and CIA agent!

There must be a way to make money out of this.

Wait! There is!

Palo Alto Networks (PANW) is a San Francisco Bay area cyber security company that offers businesses and governments an innovative firewall platform solution for big, network wide security problems.

In the P&L sweet spot they are.

I know the company well, and have been recommending to my followers that they buy the shares for the past year, during which time it tripled.

What? You want me to buy a stock that has just tripled?

No, I have not just started smoking California largest agricultural product (no, it?s not almonds or grapes).

By chance, I happened across a senior officer of the Palo Alto Networks at a dinner party last week. Prospects for the firm are booming, with sales growth running at a torrid 30% YOY rate.

Yet, (PANW) has only 10% market share of an industry that is currently exploding. This is an aggressive, extremely well managed $15 billion company that is about to become a $150 billion company.

Keeping in contact with the Joint Chiefs of Staff on a weekly basis, I am constantly concerned at how serious the cyber security threat has become, yet how little understood it is by the public.

You don?t have to go any further than the management of Sony (SNE), one of the world?s largest multinationals, which was almost wiped out in November 2014 by hackers from one of the poorest and most backward countries in the world.

Upset by the portrayal? of their leader, Kim Jong-un, in a low budget comedy, The Interview, North Korean hackers were able to bring the firm to its knees.

They downloaded the entire contents of Sony?s hard drives, leaking the juicy parts to online journalists (Angelina Jolie?s pay, etc.), and then wiped them clean, destroying some 3,000 computers and 8000 servers. It was the hacking equivalent of a full-scale nuclear attack.

Sony had to revert to snail mail, couriers, and landline telephone calls to survive. They couldn?t even pay their employees. Some $6 billion in market capitalization was wiped out.

Now here is the scary part.

The FBI has confided in me that if the S&P 500 were subjected to a Sony level attack, 90% are unlikely to survive. And the Sony attack was actually a primitive, simplistic, low-level attack.

A lot of countries don?t like the United States for any number of reasons. Now they can do something about it. That is a problem. And a market.

Palo Alto Networks maintains the world?s largest database of viruses and malware. That enabled it to trace the Sony attack to the Hermit Kingdom within hours.

It contained several lines of code that were identical to the ?Dark Soul? attack against South Korean banks in 2013, which incinerated 40,000 bank computers and caused $700 million worth of damages.

What the Sony attack revealed was a long history of massive under investment in cyber security by corporations and governments in the US, Europe, and Asia.

The potential future market for cyber security products and services is being wildly underestimated.

The great irony here is that the attack is not against systems, which are usually pretty secure. It is their human users that have become the problem.

Unfortunately, we are have become familiar with ?spoofing? emails where an innocuous email asks the user to ?click here? for an Adobe upgrade, a notice from Yahoo, or a request from PayPal to update your password.

Do so, and you invite lines of code that will eventually make it to your system administrator. Once they have this password, they can access or do anything.

Don?t think only dummies fall for this.

My friend, retired FBI chief Robert Mueller, had his personal account at the Bank of America cleaned out in a similar fashion. What was unusual in his case is they caught the transgressor, after a huge expenditure of bureau resources.

(Hint: if an incoming email appears the slightest bit suspicious, hover your mouse over the sender?s name, and the sending email address will appear. If it looks anything but belt and braces safe, don?t open it and mark it as SPAM. Especially watch for the last three letter of the address, which are always a tip off).

The FBI estimates that there are up to 10,000 hackers in the world with the capability of a Sony level attack, many operating from China, Russia, Eastern Europe, or other locations beyond the reach of US extradition treaties.

The global cyber war has been going on for about 15 years now, and the public hears very little about it.

In recent years, Iran attacked Saudi Arabia?s Aramco, destroying 30,000 computers, and briefly shutting down a portion of the country?s oil production.

A major attack was launched against the Venetian Hotel in Las Vegas, which is owned by prominent Israel supporter and major Republican Party contributor, Sheldon Adleson.

There is a happy ending to this piece. You don?t need to place your entire wealth into gold bricks and bury them in the backyard to keep it safe.

If North Korea is a bicycle in the hacking arms race, the US is the F-35 Lightening next generation stealth fighter.

We are winning the cyber way hands down, but you?d never know it. This is a war fought silently, online, and in dark shadows.

President Obama in fact authorized a measured counter attack on North Korea?s information infrastructure, which proved devastating. But it was only a pinprick relative to what we could have done.

Our real cyber weapons are reserved for an actual shooting war sometime in the future. That?s to prevent the enemy from learning our true capabilities and preparing for them.

Imagine a country trying to defend itself with snail mail, couriers, and landline telephone calls from an American assault. Think the Sony attack times 10,000. Nothing would work.

It couldn?t be done.

Congress has so far refused to fund a substantial increase in America?s cyber warfare arsenal, referring instead to spend money on old heavy metal weapons systems, like aircraft carriers, tanks, and the above mentioned F-35.

It?s all about sucking money out of Washington to create local jobs in red states to win elections. A stepped up cyber program would focus money almost entirely in Silicon Valley.

Don?t want to do that!

This is how General George Armstrong Custer was sent to the Battle of Little Big Horn with antiquated 16 year old Civil War trapdoor Springfield carbines, while the Sioux had state of the art Winchester ?yellow boy? repeaters.

And we know how that one turned out!

But don?t get mad. Get even. Take another look at Palo Alto Networks (PANW), Fireye (FEYE), and the Pure Funds ISE Cyber Secu

rity ETF (HACK).

Guess Who May Be Looking at Your Records?

Global Market Comments

August 16, 2016

Fiat Lux

Featured Trade:

(AUGUST 17th GLOBAL STRATEGY WEBINAR),

(INTRODUCING ?STOCKS TO BUY FOR THE COMING ROARING TWENTIES?),

(A DIFFERENT VIEW OF THE US)

If you think the Dow Average has delivered a ballistic performance in recent months, you haven't seen anything yet!

Are you ready for Dow 338,550 by 2038?

A decade of independent research proves that such an incredible outcome is not only possible; it is probable.

If I am wrong, I am understating the potential appreciation of stocks.

Catch the next investment wave correctly, and you can look forward to retiring in style and comfort.

In fact, you may never need to work another day in your life!

I have distilled the cream of my objective and unbiased research into a single eBook entitled "Stocks to Buy for the Coming Roaring Twenties".

The 130-page, 25,000-word book focuses on the sectors and individual stocks that will lead investors forward for the next two decades. It is packed with hard data, charts, and pictures.

Long-term readers of the Diary of a Mad Hedge Fund Trader will be familiar with its themes.

I outline the major trends that will drive the economy forward for the next twenty years including demographics, globalization, onshoring, and the return of inflation.

This is clearly going to be another American Century.

I then focus on technology, biotechnology, health care, solar, battery technology, cybersecurity, and many other industries that will lead the United States into a new Golden Age.

I provide an explanation of how a dozen hyper-accelerating technologies intertwine to deliver exponential economic growth. The trickle-down effect for the rest of the economy, and the world, will be enormous.

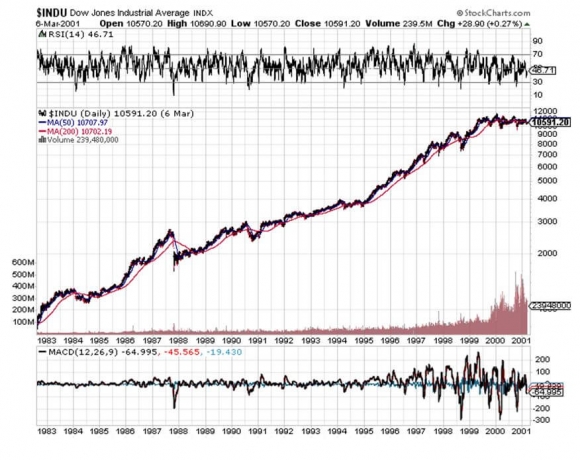

Potentially, the major stock indexes could rise by 18.3 times over the following 18 years, starting in 2020. That would take the Dow Average from the present 18,500 to 338,550 by 2038.

If you think this sounds fanciful, I have seen it all before.

From August 1982 until April 2000, the arrival of cheap microprocessors, Windows, and the Internet had a cross leveraged effect on each other which drove the Dow Average up exactly 18.3 times, from 600 to 11,000.

Remember all those Dow 10,000 by 2000 hats?

All I'm calling for is a repeat. That's if you can fit 338,550 on to a hat!

Except this time, we have not just three, but two dozen major trends and far more powerful demographic influences driving us forward.

The book can be purchased for $49 by clicking here. You can download it in a PDF file, print it out, or distribute it freely to your friends by email.

Read and enjoy.

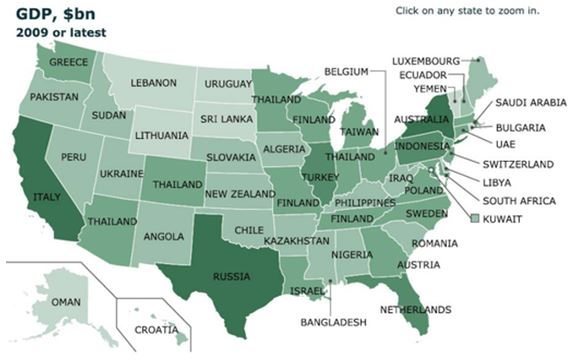

My mother lives in Pakistan, my daughter in Greece, and I have a ski chalet in Peru.

What's more, I have had strategy luncheons in Australia, Thailand, and Turkey.

At least these would be my conclusions after looking at a map prepared by my esteemed former employer, The Economist magazine, of the United States, renaming each state with it's international equivalent in GDP.

There are other tongue-in-cheek comparisons to be made.

Texas is portrayed as Russia, which makes sense, as both are oil exporters. Ditto for Alaska, which is represented by Oman.

As for Hawaii? It is renamed Croatia. Now that would really give President Obama birth certificate problems!

I worked for this august publication for a decade during the seventies, and have been reading the best business magazine in the world for over four decades. They never cease to inform, entertain, and titillate.

An April 1 issue once did a full page survey on a fictitious country off the coast of India called San Serif.

It noted that if the West coast kept eroding, and the East coast continued silting up, the country would eventually run into the subcontinent, creating serious geopolitical problems.

It wasn't until someone figured out that the country, the prime minister, and every town on the map was named after a type font that the hoax was uncovered.

This was way back, in the pre-Microsoft Word era, when no one outside the London typesetter's union knew what ?Times Roman? meant.