Global Market Comments

May 19, 2016

Fiat Lux

Featured Trade:

(10 REASONS WHY STOCKS ARE ABOUT TO ROLL OVER),

(SPY), (QQQ), (IWM), (VIX),

(TESTIMONIAL),

(WELCOME TO THE DEFLATIONARY CENTURY),

(TLT), (TBT)

SPDR S&P 500 ETF (SPY)

PowerShares QQQ ETF (QQQ)

iShares Russell 2000 (IWM)

VOLATILITY S&P 500 (^VIX)

iShares 20+ Year Treasury Bond (TLT)

ProShares UltraShort 20+ Year Treasury (TBT)

I hate to be a Debbie Downer here, but the writing on the wall couldn?t be more clear.

The Fed minutes, released at 2:00 PM this afternoon, greatly increased the probability of a Fed rate rise in June. That set the cat among the pigeons.

Higher interest rates are terrible news for stocks, except the long-suffering financials.

It focused a great, bright spotlight on the many reasons shares should go down, including:

1) Talk of an interest rate hike from my former Berkeley economics professor, Federal Reserve Chairman Janet Yellen, is ramping up. If they pull the trigger, you can chop 10% off of the stock market in a week. Yes, central banks DO make mistakes.

2) Corporate earnings are falling. Look no further than the disaster that are retail stocks (M), (TGT), (JCP).

3) At 19 times 2016 earnings, stocks are at decade highs in terms of valuations. Fear of heights anyone. Don the oxygen masks!

4) The calendar is hugely negative. No one ever makes fast money investing in May. Buy stocks today, and you may not break even until next year. Try explaining that one to your boss, your investors, and your next executive outplacement professional.

5) A monster rally in the bond market is predicting an imminent ?RISK OFF? move in global risk assets. Try whistling past the graveyard.

6) So is the near straight line rally in gold stocks (ABX), (GDX), (GLD).

7) Only a rare coincidence of global supply disruptions, like in Canada, Iraq, Libya, Nigeria, and Venezuela, has gotten oil up this high. When production comes back on stream, watch Texas tea roll over to test new lows, taking stocks with it.

8) If England leaves the European Community after its June 23 ?Brexit? referendum, you can kiss the global economy goodbye, including ours. Last time I checked, the polls were 43% to 42% in favor of staying, far too close for comfort. Book that European vacation now before the continent implodes.

9) Turn on the TV or open your Twitter account and you get a hand grenade thrown at you from a presidential candidate. Stocks would rather hide out in a bomb proof bunker.

10) According to my vintage Rolex wristwatch, this bull market is seven years, two months, nine days, four hours, three minutes and 47 seconds old. Sounds pretty geriatric to me.

Watch Out! They Bite!

My husband wanted me to tell you that, as a retired Marine, he understands completely. ?The more you sweat in training, the less you bleed in war. ?Gratefully, for us, you have done a lot of sweating over the years! ?

Cheryl

Oregon

Ignore the lessons of history, and the cost to your portfolio will be great. Especially if you are a bond trader!

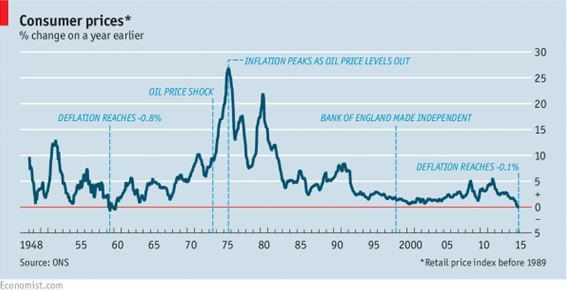

In Britain they celebrated something unusual last year. The government reported the first year on year decline in consumer prices in 54 years (see chart below).

In fact, prices for the things they buy day to day were 0.1% lower than they were 12 months before.

Meet deflation, up front and ugly.

If you looked at a chart for data from the United States, they would not be much different, where consumer prices are showing a feeble 0.4% YOY price gain. This is miles away from the Federal Reserve?s own 2% annual inflation target.

We are not just having a deflationary year or decade. We may be having a deflationary century.

If so, it will not be the first one.

The 19th century saw continuously falling prices as well. Read the financial history of the United States, and it is beset with continuous stock market crashes, economic crisis, and liquidity shortages.

The union movement sprung largely from the need to put a break on falling wages created by perennial labor oversupply and sub living wages.

Enjoy riding the New York subway? Workers paid 10 cents an hour built it 120 years ago. It couldn?t be constructed today, as other more modern cities have discovered. The cost would be wildly prohibitive.

The causes of 19th century price collapse were easy to discern. A technology boom sparked an industrial revolution that reduced the labor content of end products by ten to hundredfold.

Instead of employing a 100 women for a day to make 100 spools of thread, a single man operating a machine could do the job in an hour.

The dramatic productivity gains swept through then developing economies like a hurricane. The jump from steam to electric power during the last quarter of the century took manufacturing gains a quantum leap forward.

If any of this sounds familiar, it is because we are now seeing a repeat of the exact same impact of accelerating technology. Machines and software are replacing human workers faster than their ability to retrain for new professions.

This is why there has been no net gain in middle class wages for the past 30 years. It is the cause of the structural high U-6 ?discouraged workers? employment rate, as well as the millions of millennials still living in parents? basements.

Instead of steam and electric power, it is now the internet, cheap computing power, global broadband, and software that is swelling the ranks of the jobless.

What?s more, technology gains are now going hyperbolic to a degree never seen before in civilization.

To the above add the huge advances now being made in healthcare, biotechnology, genetic engineering, DNA based computing, and big data solutions to problems.

If all the diseases in the world were wiped out, a probability within 30 years, how many jobs would that destroy?

Probably tens of millions.

So the deflation that we have been suffering in recent years isn?t likely to end any time soon. In fact, it is just getting started.

Why am I interested in this issue? Of course, I always enjoy analyzing and predicting the far future, using the unfolding of the last half century as my guide. Then I have to live long enough to see if I?m right.

I did nail the rise of eight track tapes over six track ones, the victory of VHS over Betamax, the ascendance of Microsoft operating systems over OS2, and then the conquest of Apple over Microsoft. So I have a pretty good track record on this front.

For bond traders especially, there are far reaching consequences of a deflationary century. It means that there will be no bond market crash, as many are predicting, just a slow grind up in long term interest rates instead.

Amazingly the top in rates in the coming cycle may only reach the bottom of past cycles, around 3% for ten-year Treasury bonds (TLT), (TBT).

The soonest that we could possibly see real wage rises will be when a generational demographic labor shortage kicks in during the 2020?s. That could be a decade off.

I say this not as a casual observer, but as a trader who is constantly active in an entire range of debt instruments.

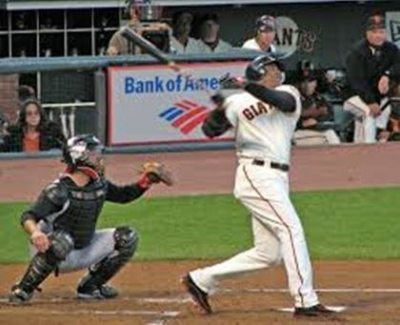

So the bottom line here is that there is additional room for bond prices to fall and yields to rise. But not by that much, given historical comparisons. Think of singles, not home runs.

It really will be just a trade. Thought you?d like to know.

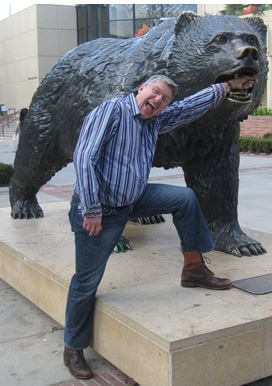

Try This at Your Peril

Try This at Your Peril

Global Market Comments

May 18, 2016

Fiat Lux

Featured Trade:

(WATCH OUT FOR THE HEAD AND SHOULDERS TOP),

(SPY), (QQQ), (IWM),

(THE SERVICE JOB IN YOUR FUTURE),

(MCD),

(TESTIMONIAL)

SPDR S&P 500 ETF (SPY)

PowerShares QQQ ETF (QQQ)

iShares Russell 2000 (IWM)

McDonald's Corp. (MCD)

The market has been chattering quite a lot about the massive downside bets on the S&P 500 being placed by some of the industry?s best known players.

That is something I would expect from my long time client and mentor George Soros.

But Warren Buffett as well? He is one of the greatest long term, pro America bulls out there.

It is the sort of news that gives investors that queasy, seasick feeling in the pit of their stomachs. You know, like when a new Tesla owner shows off his warp speed ?ludicrous mode??

That is unless you are running heavy short positions in stocks, as I am.

Every technical analyst in the world is pouring over their charts and coming to the same conclusion. A ?Head and Shoulders? pattern is setting up for the major indexes, especially for the S&P 500 (SPY).

And if you think the (SPY) chart is bad, those for the NASDAQ (QQQ), and the Russell 2000 (IWM), look much worse.

This is terrible news for stock investors, as well as owners of other risk assets like commodities, oil and real estate. It is wonderful news for those long of Treasury bonds (TLT), the Euro (FXE), gold (GLD), and silver (SLV).

A head and shoulders pattern is one of the most negative textbook indicators out there for financial markets. It means that there is only enough cash coming in to take prices up to the left shoulder, but no higher.

There is not even enough to challenge the old high, taking a double top decidedly off the table.

The bottom line: the market has run out of buyers. Be very careful of markets where everyone is bullish long term, but no one is doing any buying.

When the hot, fast money players see momentum rapidly fading, they pick up their marbles and go home. Some of the most aggressive, like me, even flip to the short side and make money in the falling market.

If we make it down to the ?neckline? and it doesn?t hold, then the sushi really hits the fan. Right now, that neckline is at $204.60 in the S&P 500 (SPY). Break that, and it?s hasta la vista baby. See you later.

Stop losses get triggered, the machines takeover, and shares move to the downside with a turbocharger. Distress margin calls on the most levered players (usually the youngest ones) add further fuel to the fire. We might even get a flash crash

This is when the really big money is made on the short side.

There is a new wrinkle this year that could make this sell off particularly vicious. To see a formation like this setting up during May is particularly ominous. It means that ?Sell in May? is going to work one more time

?It?s not like we have any shortage of bearish headlines to prompt a stampede by the bears.

The turmoil in Europe, one of the largest buyers of American exports, could cause the US to catch a cold. This is what the latest round of earnings disappointments has been hinting at.

Margin debt to own stocks has recently exploded to an all time high.

It could well be that the market action is just the dress rehearsal for a deeper correction in the summer, when markets are supposed to go down.

If markets do breakdown, it won?t be bombs away. The (SPY) might make it down to $181, $177, or in an extreme case $174. But to get sustainably below that, we really need to see an actual recession, not just a growth scare.

Remember that earnings are still growing year on year, once you take out the oil industry. That is not a formula for any kind of recession.

It is a formula for a 10% sell off in an aged bull market. That?s where you load the boat with the best quality stocks (MSFT), (FB), (GOOG), (CELG), etc., which should be down 25-35%, and then clock your +25% year in your equity trading portfolio.

If you are NOT a trader, but a long-term investor monitoring you retirement funds, just go take a round-the-world cruise and wake me up on December 31. You should be up 5% or more, with dividends, and skip the volatility.

Ignore It at Your Peril

Ignore It at Your Peril

Volatility? What Volatility?

Volatility? What Volatility?

Volatility? What Volatility?

Volatility? What Volatility?I've subscribed to John's trading service for several years.

As a writer myself, I look forward to John's daily newsletters. They are loaded with great investment ideas and information affecting world markets. They are delivered in clear, entertaining?prose and are a joy to read. I learn something new from them every day.

John's advice has saved me from losing a lot of money by keeping me in the market when others were bailing out. Following his option trades allowed me to make sure my son graduated from Stanford with zero student debt. That's a lot of green, folks. Stanford is 50+ K a year.

Alan

Florida

Global Market Comments

May 17, 2016

Fiat Lux

Featured Trade:

(TEST DRIVING TESLA?S SELF DRIVING TECHNOLOGY),

(TSLA),

(WILL GOLD COINS SUFFER THE FATE OF THE $10,000 BILL?)

(GLD), (GDX)

(TESTIMONIAL)

Tesla Motors, Inc. (TSLA)

SPDR Gold Shares (GLD)

VanEck Vectors Gold Miners ETF (GDX)

I knew I was on the right track when the salesman told me that the customer who just preceded me for a Tesla Model X 90D SUV was the Golden Bay Warriors star basketball player, Steph Currie.

Well, if it's good enough for Steph, then it's good enough for me.

Last week, I received a call from Elon Musk's office to test the company's self-driving technology embedded in their new vehicles for readers of the Diary of a Mad Hedge Fund Trader.

I did, and prepare to have your mind blown!

I was driving at 80 MPH on CA-24, a windy eight-lane freeway that snakes its way through the San Francisco East Bay mountains. Suddenly the salesman reached over and flicked a lever on the left side of the driving column.

The car took over!

There it was, winding and turning along every curve, perfectly centered in the lane. As much as I hated to admit it, the car drove better than I ever could.

All that was required was for me to touch the steering wheel every five minutes to prove that I was not sleeping.

The cars do especially well in rush hour driving, as it is adept at stop and go traffic. You can just sit there and work on your laptop, read a book, or watch a movie on the built in 4G WIFI HD TV.

When we returned to the garage the car really showed off. When we passed a parking space, another button was pushed, and we perfectly backed 90 degrees into a parking space, measuring and calculating all the way.

The range is 255 miles, which I can recharge at home at night from a standard 220-volt socket in seven hours. The chassis can rise as high as eight inches off the ground so it can function as a true SUV.

The ludicrous mode, a $10,000 option, take you from 0 to 60 mph in three seconds. However, even a standard Tesla can accelerate so fast that it will make the average passenger carsick.

Here's the buzz kill.

Tesla absolutely charges through the nose for extras.

The 22-inch wheels are $5,500, the third row of seats to get you to seven passengers is $4,000, the premium sound is $2,500, leather seats are $2,500, and the self-driving software is $2,500.

A $750 tow hitch will accommodate a ski rack on the back. There is a $1,000 delivery charge, even if you pick it up at the Fremont factory.

It's easy to see how you can jump from an $88,000 base price to a total cost of $130,000, including taxes.

The middle row of seats DOESN'T fold down flat, limiting your cargo space to 6 feet long and 3 1/2 feet wide. So if you are a frequent hauler of surfboards and skis, as I am, you will have to order the six-seat configuration and squeeze them between the two middle row seats.

My company will be purchasing the car under Section 179 of the International Revenue Code. The car qualifies because it weighs over 6,000 pounds and is therefore a truck under tax law.

This allows me to deduct the entire $130,000 cost of the vehicle up front, plus the maintenance and insurance costs for the entire life of the car. However, I will have to maintain a mileage log as a hedge against any future IRS audits.

Ironically, Section 179 was enacted as a subsidy for consumer purchases of the eight mile per gallon Hummer, which was originally built by AM General and owned by General Motors (GM).

After several attempts to sell the division failed, production was permanently shut down. However, the tax subsidies live on for any like designed vehicle.

What was really amazing was to learn how far the technology has moved forward fr0m my four year old Tesla Model S-1.

The range is now 302 miles. Only four-wheel drive versions are now made. And it too has the self-driving software.

It looks like I'll have to buy two Tesla's this year.

As for 'drop dead' curb appeal, nothing beats the Model X. Concerning the stock, not so much.

Thanks for Your Subscription!

The conspiracy theorists will love this one.

Buried deep in the bowels of the 2,000 page health care bill was a new requirement for gold dealers to file Form 1099's for all retail sales by individuals over $600.

Specifically, the measure can be found in section 9006 of the Patient Protection and Affordability Act of 2010.

For foreign readers unencumbered by such concerns, Internal Revenue Service Form 1099's are required to report miscellaneous income associated with services rendered by independent contractors and self-employed individuals.

The IRS has long despised the barbaric relic (GLD) as an ideal medium to make invisible large transactions. Did you ever wonder what happened to $500, $1,000, $5,000, and $10,000 bills?

The $100,000 bill was only used for reserve transfers between banks, and was never seen by the public. The other high denomination bills were last printed in 1945, and withdrawn from circulation in 1969.

Although the Federal Reserve claims on their website that they were withdrawn because of lack of use, the word at the time was that they disappeared to clamp down on money laundering operations by the mafia.

IN FACT, THE GOAL WAS TO FLUSH OUT MONEY FROM THE REST OF US.

?

Dan Lundgren, a republican from California's 3rd congressional district, a rural gerrymander east of Sacramento that includes the gold bearing Sierras, has introduced legislation to repeal the requirement, claiming that it places an unaffordable burden on small business.

Even the IRS is doubtful that it can initially deal with the tidal wave of paper that the measure would create.

Currency trivia question of the day: whose picture was engraved on the $10,000 bill? You guessed it, Salmon P. Chase, Abraham Lincoln's Secretary of the Treasury.