Global Market Comments

December 15, 2015

Fiat Lux

Featured Trade:

(DECEMBER 16 GLOBAL STRATEGY WEBINAR),

(THREE CHEERS FOR GERMANY),

(EWG), (HEDJ), (EUO), (FXE),

(TESTIMONIAL)

iShares MSCI Germany (EWG)

WisdomTree Europe Hedged Equity ETF (HEDJ)

ProShares UltraShort Euro (EUO)

CurrencyShares Euro ETF (FXE)

I noticed last week that Angela Merkel, the Chancellor of Germany, was picked by the editors of Time Magazine as their ?Person of the Year.?

This is creating an outstanding investment opportunity, a real game changer. As a result, Germany?s economy could grow by an extra 1% a year. But more on that later.

She received the accolade for convincing her country to accept 1 million refugees from the Middle East. They will be plopped down in the middle of a population of 80.6 million, so it is a very big deal.

That is like the US taking in 4 million refugees with no notice. The most we took in after the collapse of Vietnam was 125,000.

In addition, she talked her electorate into bailing out Greece, not once, but twice.

I SAY ?THREE CHEERS? FOR GERMANY.

History has really come full circle. After bearing the cross for the holocaust for seven decades, the country carries out one of the greatest humanitarian acts of all time.

I know the Germans well.

I lived in West Berlin during the 1960?s with a former Nazi family. Needless to say, the dinner conversations were interesting. But they loved Americans, for it was we who rescued them from the Russians and Bolshevism in 1945.

I spent my weekends smuggling western newspapers and US dollars into East Berlin to the underground across Checkpoint Charlie. I was too young and dumb to know any better.

When I got caught, I spent a night in a communist jail cell. To this day, the words ?Das ist Verboten? still send a chill down my back. The East German Volkspolizei were not very nice guys.

If you want to see a close approximation of that prison, go watch the just released Stephen Spielberg movie ?Bridge of Spies,? about the Gary Powers exchange. They really nailed the Cold War atmosphere of Berlin during the sixties.

Yes, when I was 16, I used to listen to machine guns mow down fleeing refugees at night. Every time a guard hit someone, they were awarded a gold watch. I lived in Tiergarten, within easy earshot of the Berlin Wall at Brandenburg Gate. And you wonder why I?m such a tough guy.

Angela Merkel has always been an enigma to me. Those of us who know the old East Germany well, find it difficult to imagine anyone intelligent or useful coming from there. To see her leading an essentially conservative country is positively mind blowing.

She is clearly brilliant, with a PhD in physics. She is fluent in Russian, and is in close communication with Vladimir Putin on a regular basis in his own language. She entered politics as soon as the wall came down in 1989, signing up with the conservative Christian Democratic Union.

Today, she is widely considered the de facto leader of Europe. She is also regarded as the most powerful woman in history (at least for another year).

Full Disclosure: During my annual European sojourns, I always spend a day briefing Merkel?s staff in Berlin about the current state of the world. I also attempt to decode the American political scene, which Europeans find an indecipherable mystery, but which has enormous implications for them.

?The Person of the Year? can be a dubious honor, and is defined as the person who most influenced history that year. Aviation pioneer Charles Lindbergh, who first soloed the Atlantic Ocean, was originally picked by Time in 1927.

Adolph Hitler was named in 1938 for peacefully redrawing the map of Europe. The only other Germans so named were Konrad Adenauer in 1953, the country?s postwar leader, and Willy Brandt in 1970, noted for normalizing relations with the Soviet Union and Eastern Europe.

To say that Germany is overwhelmed by the immigrant crisis would be a severe understatement.

Almost every high school gym in the country has been converted to emergency housing. There are shortages of everything, from blankets to clothing and translators.

Medieval Afghan men are showing up with 13-year old brides. The backlash is that the Nazi party is experiencing a resurgence of popularity, not only in Germany, also in the Netherlands, France, and Sweden.

If it weren?t for the commitments of this newsletter, I would be back in Berlin in a heartbeat volunteering my services.

Needless to say, the bill for all of this will be enormous. Germany is really the only country that could afford dispensing so much aid.

One of the reasons it can do so is that it happens to have a spare country at hand. Much of the old East Germany is still empty, its cities depopulated. This is where the new immigrants will eventually be settled.

It is perhaps because Angela is a mathematician that she understands there is an enormous long-term dividend that the country will reap.

Look at the economic growth rates of the US and Europe for the past 50 years, and the continent has always lagged the US by 1% per annum. By opening up the gates to a flood of immigration, Germany can make up this difference. So can the rest of Europe.

The great thing for Germany is that these are not your ordinary political or economic refugees. Much of the Syrian middle class has decamped, bringing their educational and professional skills with them. For the Germans, it is a win-win.

This is not a long-term thing. German GDP growth recently and unexpectedly surged, from a 0.3% to a +1.5% annual rate. Some of this is no doubt due to the European Central Bank?s newly aggressive policy of monetary easing. Massive spending on social services has to also be a factor.

European stocks are already poised to outperform American ones by two to one in 2016, thanks to quantitative easing, the postponement of the Greek crisis, and a generation low in asset prices there. Immigrants could pour the economic gasoline to the fire.

Clearly German stocks are a prime target here, which you can buy through the iShares Germany Fund (EWG), as is Europe in general, with the Wisdom Tree European Hedged Equity Fund (HEDJ). But make sure you hedge out your European currency risk for the short term, as the (HEDJ) does.

A revival of the continental economy will also eventually engineer a recovery in the Euro (FXE), (EUO) against the dollar. Don?t press those shorts too aggressively down here.

The great irony here is that this is all unfolding in Germany while mosque burning and bombing are taking place across the US, and there is talk of closing its border on religious grounds.

It is the sort of thing that happened in Germany in 1938, as my former Berlin hosts would have reminded me.

History is coming full circle a second time.

Good for You Angela

Good for You Angela

I have been in the money management business working for a long time-only manager for 18 years, and in this business for 35.? I know you are the real deal.?

I also know many hedge fund managers. Besides Ken Griffin in Chicago at Citadel, who is up 16% year to date, very few are even up for the year.?

I believe in what you do.

Don

Cleveland, OH

Global Market Comments

December 14, 2015

Fiat Lux

SPECIAL RISK ALERT

Featured Trade:

(SPECIAL RISK ALERT)

(SPY), (VIX), (USO), (HEDJ), (DXJ)

SPDR S&P 500 ETF (SPY)

VOLATILITY S&P 500 (^VIX)

United States Oil (USO)

WisdomTree Europe Hedged Equity ETF (HEDJ)

WisdomTree Japan Hedged Equity ETF (DXJ)

Special Note: I?m sending out the Monday letter early today because this content won?t wait.

Sorry to throw up at your Christmas party, but there have been a number of developments that have occurred over the last two days that I think you should know about.

It won?t wait until the Monday newsletter.

The Third Avenue Fund closed its leveraged junk fund to redemptions this morning, highlighting the disappearance of liquidity in the fixed income market.

Then the International Energy Agency (IEA) announced that they see the oil (USO) glut continuing for all of 2016. Crude dove another dollar to a new seven year low.

But they already said exactly the same thing a few weeks ago. Which means the financial markets are really worrying about far bigger things that we just can?t see yet.

Other than that, how was the play Mrs. Lincoln?

Sure, these are one off?s. I?ll tell you what really bothered me.

I watch the Volatility Index (VIX), (XIV) like a hawk.

On Thursday, The S&P 500 (SPY) closed up on the day, but the (VIX) kept gaining as well, closing at its highs. This is never a sign of good things to come.

On Thursday, the Federal Reserve should hike interest rates for the first time in a decade. My concern is that a 25 basis point move has become so widely expected and discounted that the only possible market reaction is a bad one.

What if Janet doesn?t raise? What if she raises by 50 basis points? What if she raises by 25 basis points, but then makes excessively hawkish or dovish comments afterwards? In either case, you can expect the market to drop 5% very quickly.

In other words, we are setting up for an asymmetric move. The possible upside gains are incremental, but the downside risks are huge. That is not a scenario you want to walk into with a big ?RISK ON? portfolio.

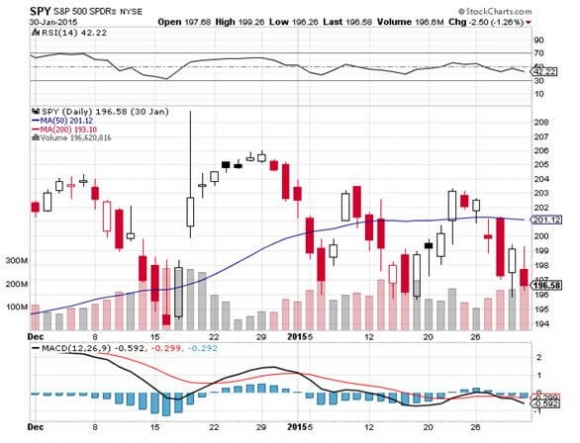

Cast all this against a backdrop of the (SPY) decisively breaking both the 50 and the 200-day moving averages this morning, and all of a sudden the sidelines are looking very alluring.

You can tell by the way that the market has been flip flopping every day for a month now that both traders and investors have the daylights scared out of them.

There have been 27 days in a row when we have not seen two consecutive UP days in the (SPY), the longest since 1970.

Everyone is on a hair trigger.

IT GETS WORSE!

On Friday next week, we will see the biggest S&P 500 options expirations in history, some $1.1 trillion worth. More than $670 billion of these are puts, and $215 billion are close to the money.

To see this kind of mega volume unwind two days after the Fed announcement is somewhat unnerving.

This is the time when a lot of annual hedges get rolled over by big hedge and mutual funds. This is going to take place in waning December liquidity. The net effect will be to put a turbocharger on any move that unfolds next week, WHATEVER IT IS!

All of this put my slow grind up into yearend scenario at risk. This is why I just booted out 60% of my model trading portfolio, much at close to cost.

Oil can reverse at anytime and launch one of those screaming, rip-your-face-off $5 short covering rallies. Then everything will be Hunky-Dory and stocks will rally again. There is just no way of knowing. There are too many random variables. It is, in fact, unknowable.

But I am not willing to bet a quarter of my 2015 performance to find out. Your money either.

Sorry, but eight years into the newsletter business, I still think like an actual hedge fund manager. Part of my motivation is to protect my 40% profit this year, which with the indexes all down, is a performance for the ages.

If you are a medium to long-term investor, you can ignore all of this.

We are not entering a recession. We are not launching into a new bear market. Stocks are on track to produce single digit returns in the US next year, and double digit ones in Europe (HEDJ) and Japan (DXJ).

This is just a trading call. I just want to have more cash to take advantage of any extreme price movements headed our way in the near future. High on the list will be buying technology and financials on any big dip, and selling short the (VIX).

After all, I am the Mad Hedge Fund Trader, not the Mad Long Term Investor.

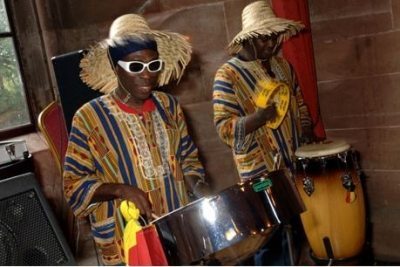

So it might be a good year to take a long Christmas cruise. The balmy climes of the Caribbean are pleasant this time of year, especially if you have kids. You can let them have the run of this ship and not be concerned. There?s nothing like listening to Christmas carols on steel drums. I hear Norwegian Cruise Lines is still offering some great packages (click here for their site).

For a preview of how stock markets behave ahead of single digit years, look at the chart below for the (SPY) for December and January exactly a year ago.

It amounts to a whole lot of nothing, tedious trading in a very narrow range. That?s why I was buying very deep-in-the-money vertical bull debit spreads until three days ago.

Enjoy the cruise!

And Merry Christmas to You Too!

And Merry Christmas to You Too!

Global Market Comments

December 11, 2015

Fiat Lux

Featured Trade:

(DECEMBER 16 GLOBAL STRATEGY WEBINAR),

(THE TECHNICAL/FUNDAMENTAL TUG OF WAR: WHO WILL WIN?)

(MAKE YOUR NEXT KILLING IN AFRICA),

(AFK), (GAF)

(TESTIMONIAL)

Market Vectors Africa ETF (AFK)

SPDR S&P Emerging Middle East&Afr ETF (GAF)

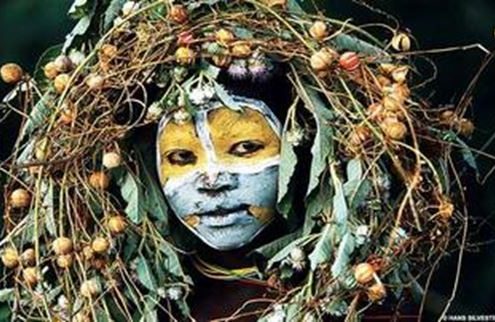

Feel like investing in a state sponsor of terrorism? How about a country whose leaders have stolen $400 billion in the last decade and has seen 300 foreign workers kidnapped? Another country lost four wars in the last 40 years.

Still interested? How about a country that suffers the world?s highest AIDS rate, regularly endures insurrections where all of the Westerners are rounded up and massacred, and racked up 5 million dead in a continuous civil war?

Then, Africa is the place for you, the world?s largest source of gold, diamonds, chocolate, and cobalt!

The countries above are Libya, Nigeria, Egypt, and the Congo. Below the radar of the investment community since the colonial days, the Dark Continent has recently been attracting the attention of large hedge funds and private equity firms.

Goldman Sachs has set up Emerging Capital Partners, which has already invested $2 billion there. China sees the writing on the wall, and has launched a latter day colonization effort, taking a 20% equity stake in South Africa?s Standard Bank, the largest on the continent.

In fact, foreign direct investment last year jumped from $53 billion to $61 billion, while cross border M & A leapt from $10.2 billion to $26.3 billion.

The angle here is that all of the headlines above are in the price, that price is very low, and the perceived risk is much greater than actual risk. Price earnings multiples are low single digits, cash flows are huge, and returns of capital within two years are not unheard of.

The reality is that Africa?s 900 million have unlimited demand for almost everything, and there is scant supply, with many firms enjoying local monopolies.

African GDP growth took off like a rocket in 2003, nearly tripling, thanks to the global commodity and precious metals boom and the taming of AIDS with free generic antiretroviral drugs. Equity markets don?t reflect this yet.

The big plays are your classic early emerging market targets, like a rising middle class, banking, telecommunications, electric power, and other infrastructure.

For example, in the last decade, the number of telephones has soared from 350,000 to 10 million. It reminds me of the early days of investing in China in the seventies, when the adventurous only played when they could double their money in two years, because the risks were so high.

This is long term back book stuff and is definitely not for day traders. If you are willing to give up a lot of short-term liquidity for a high return, then look at the Market Vectors Africa Index ETF (AFK), and the SPDR S&P Emerging Middle East & Africa ETF (GAF).

Global Market Comments

December 10, 2015

Fiat Lux

Featured Trade:

(PRINT YOUR OWN CAR),

(EUROPEAN STYLE HOMELAND SECURITY),

(TESTIMONIAL)