Global Market Comments

December 9, 2015

Fiat Lux

(SPECIAL OIL ISSUE)

Featured Trade:

(HERE COMES THE FINAL BOTTOM IN OIL),

(USO), (XOM), (COP), (OXY), (LINE),

(TESTIMONIAL)

United States Oil (USO)

Exxon Mobil Corporation (XOM)

ConocoPhillips (COP)

Occidental Petroleum Corporation (OXY)

Linn Energy, LLC (LINE)

I had a fascinating dinner last week at Morton?s, San Francisco?s best steak restaurant, with one of John Hamm?s original investors.

You remember John, the legendary Texas oilman who saw fracking coming a mile off and made billions?

Since some of what my friend had to say came true in a matter of days, I thought I?d pass on the essence of our conversation.

The oil storage facility at Cushing, Oklahoma is full, at 480 million barrels. The US Strategic Petroleum Reserve has been full for a long time, with 713 million barrels (36 days of US consumption).

Contangos are exploding. It might as well be the end of the world for the oil industry.

The oil Armageddon is here, and the final flush is upon us.

There is a 50% chance we will bottom at $32/barrel, and another 50% chance that we go all the way down to $20. If we go down to $20, the last three ticks of the move will be $22?.$20?.$22. Then a saw tooth bottom will unfold between $24 and $32 which will last for several months.

There will be many chances to buy this bottom. There isn?t going to be a ?V? shaped bottom in oil this time, like we saw in past energy crashes.

The margin clerks and risk control managers are in control now, so we may see the final low sooner than you think. But it could be some time before we break $40 again to the upside and hold it.

The industry was really drinking the Kool-Aid with both hands to get it this wrong. Ultra low interest rates drove in billions in capital from first time oil investors looking to beat zero interest rates. They also saw China continuing an endless economic boom forever, and the energy demand that went with it.

In the end, they got both the supply and demand sides of the equation completely wrong on a global scale, always a recipe for disaster.

Many of the fields drilled in places like North Dakota would never have been touched during normal times. Then Saudi Arabia came out of left field with a grab for global market share that has yet to play out.

The seeds of this recovery are already evident. Chinese auto sales are up 19% YOY. China is buying all the cheap oil it can to fill up its own strategic oil reserve. Miles driven in the US are already up 4.6% YOY, which is a huge gain.

All of this will contribute to a higher US GDP in 2016.

Once we put in a final bottom in oil, don?t expect $100 a barrel any time soon. The ma and pa investor in the oil patch will not be back in this generation.

Marginal sources, like high cost Canadian tar sands, deep offshore, and some in North Dakota aren?t coming back either. These supplies needed $100/barrel just to break even.

Personally, my friend does not see oil topping $80/barrel this decade. He see?s a $62-$80 trading range persisting for a long time.

As the US has become more energy independent, the geopolitical factors have mattered less and less. That is why oil moved only $1 on an ISIS victory, the Paris attacks, or some other disaster.

To call the bottom in oil, watch the shares of ExxonMobil (XOM), Conoco Phillips (COP), and Occidental Petroleum (OXY). When they revisit their August lows, down 5%-10% down from here, that will be a great time to jump back into the oil space.

None of these companies are going under, and the dividend payouts are now enormous, (XOM) at (3.7%), (COP) at (5.8%), and (OXY) at (4.2%).

Distressed debt is where the smart money is focusing now, where double-digit returns have become common. If the issuer goes bankrupt the equity owners get wiped out while the bondholders get the company for pennies on the dollar.

Energy companies and master limited partnerships (MLP?s) have far and away been the biggest borrowers in the high yield market in recent years.

There is a junk maturity cliff looming, with $145 billion in bonds due for refinancing from 2017-2021. Expect the default ratio to rocket from this year?s 2.8% to 25%. A 12% default rate is a normal peak in a recession.

Individual company research now has a bigger payoff than in any time in history, even the 2008-09 crash.

Small leveraged companies with exposure to the price of oil are toast.

The play is for the toll takers, master limited partnerships that profit from the volume of oil pumped, and not the price of oil. Over time, volumes will increase, and so will the profits at these MLP?s.

In the meantime, everything is getting thrown out with the bathwater, regardless of fundamentals. People just don?t want to be near the space, especially going into yearend book closing.

Nobody wants to be seen as the idiot who owned oil in 2015.

Linn Energy (LINE) is a perfect example of this. It suspended its dividend so it could buy more assets on the cheap. It has plenty of cash, and will be backstopped by Blackrock with additional credit lines, if necessary.

While this raises volatility for the short term, it increases returns over the long term. It?s definitely your ?E? ticket ride.

I pointed out that President Obama did the oil industry the biggest favor in history by dragging his feet on the Keystone Pipeline, and then ultimately killing it. It prevented US consumers from loading the boat with $100/barrel tar sands crude at the top of the market.

My friend conceded that it is unlikely the pipeline would ever be built. The market has moved away.

I have accumulated a variety of odd tastes in my half-century of traveling around the world.

So when I heard we were eating at Morton?s, I brought my own jar of Coleman?s hot English mustard. It makes a medium rare cooked filet mignon taste perfect, but my action always puzzles the waiters. They never have it.

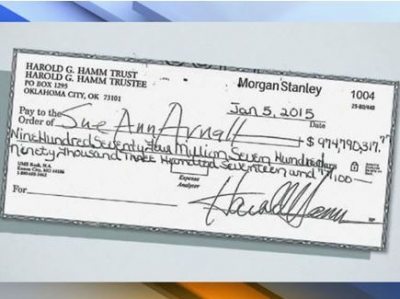

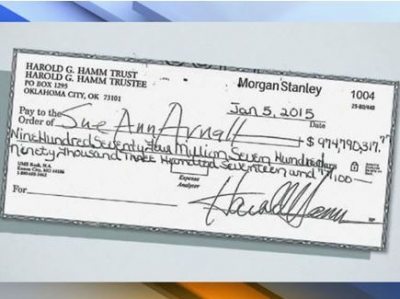

John Hamm gained public notoriety last year when he wrote a $974 million divorce settlement check to is ex wife and she refused to cash the check. I asked if the check ever got cashed?

?She cashed the check,? he said.

Needless to say, my friend picked up the check for the dinner as well. I let him drive my Tesla Model S-1 back to his hotel.

?The bears have the run of the table here in oil,? said John Kilduff from Again Capital Partners.

Global Market Comments

December 8, 2015

Fiat Lux

Featured Trade:

(THE PASSIVE/AGGRESSIVE PORTFOLIO),

(ROM), (UYG), (UCC), (DIG), (BIB), (UGL), (UCD), (TBT),

(THE DIFFERENCE BETWEEN MAD HEDGE FUND TRADER AND MAD DAY FUND TRADER)

ProShares Ultra Technology (ROM)

ProShares Ultra Financials (UYG)

ProShares Ultra Consumer Services (UCC)

ProShares Ultra Oil & Gas (DIG)

ProShares Ultra Nasdaq Biotechnology (BIB)

ProShares Ultra Gold (UGL)

ProShares Ultra Bloomberg Commodity (UCD)

ProShares UltraShort 20+ Year Treasury (TBT)

Thanks to our ballistic, market beating performance, up 47% year to date, we have recently enjoyed a large influx of new subscribers, especially from Australia and New Zealand. So I want to take to take this opportunity to clarify exactly what you bought.

While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to six-month time frame, Mad Day Trader will exploit money-making opportunities over a brief ten minute to one month window.

It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points.

The Diary of a Mad Hedge Fund Trader is written by me, John Thomas, who you may have met during my many Global Strategy Luncheons around the world.

I use a combination of deep, long term fundamental research, technical analysis, and a global network of long time contacts to generate great investment ideas for you, the reader.

The target holding period can be anywhere from three days to six months, although if something fortuitously doubles in a day, I don?t need to be told twice to take a profit (yes, this happens sometimes).

Last year, I issued some 200 Trade Alerts, of which 84% were profitable.

The Mad Day Trader is a separate, but complimentary service run by my Philadelphia based friend, Bill Davis. He uses a dozen proprietary short-term technical and momentum indicators he developed himself to generate buy and sell signals.

These will be sent to you by email for immediate execution. During normal trading conditions, you should receive up to ten alerts a month. The target holding period can be anywhere from a few minutes to a month.

Bill issues far tighter stop loss limits, given the short-term nature of his strategy. The goal is to keep losses miniscule so you can always live to fight another day.

You will receive the same instructions for order execution, like ticker symbols, entry and exit points, targets, stop losses, and regular real time updates, as you do from the Mad Hedge Fund Trader.

Bill also sends out an outstanding daily commentary, which gives followers the true color of the market.

He supplies key support and resistance levels for several indexes, which the markets will revolve around. Traders love it.

At the end of each day, a separate short-term model portfolio will be posted on the website for both strategies.

Bill Davis is a 40-year market veteran who has spent a career in financial education. Suffice it to say, Bill knows which end of a stock to hold up.

I have followed his work for yonks, and can?t imagine a better partner in the serious business of making money for you, the reader.

Together, the Mad Hedge Fund Trader and the May Day Trader comprise Mad Hedge Fund Trader PRO, which is for sale on my website for $4,500 a year.

I hope this makes everything crystal clear for the new subscribers. If you have anymore questions, please call my loyal assistant, Nancy, in Florida at 888-716-1115 or 813-388-2904, or email her directly at support@madhedgefundtrader.com.

When Nancy is tied up, calls are automatically routed through to our web developer, Doug.?Please remember that Sydney, Melbourne, and Brisbane Australia are 16 hours ahead of Florida, while Perth is 13 hours ahead.

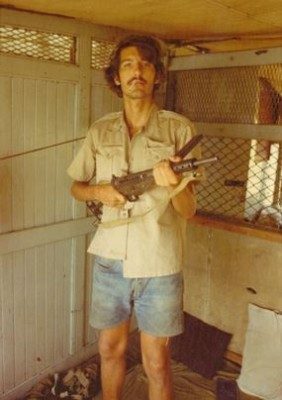

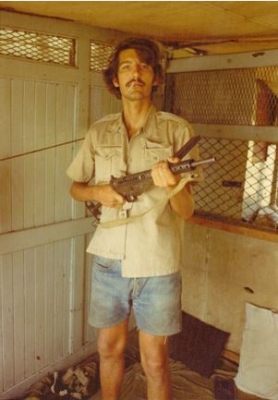

Sometimes it?s Good to Have Gunslingers on Your Side

Sometimes it?s Good to Have Gunslingers on Your Side

Global Market Comments

December 7, 2015

Fiat Lux

Featured Trade:

(MAD HEDGE FUND TRADER HITS NEW ALL TIME HIGH),

(FXE), (EUO), (XIV), (JPM), (DIS), (MSFT),

(TESTIMONIAL)

(THE NEW CALIFORNIA GOLD RUSH), (GLD

CurrencyShares Euro ETF (FXE)

ProShares UltraShort Euro (EUO)

VelocityShares Daily Inverse VIX ST ETN (XIV)

JPMorgan Chase & Co. (JPM)

The Walt Disney Company (DIS)

Microsoft Corporation (MSFT)

SPDR Gold Shares (GLD)

It has been a long hard slog, but I finally managed to get the performance of my Trade Alert Service up once again to a new all time high.

I have not pushed forward my service?s performance numbers to loftier heights since September 29.

It had to happen sooner or later.

What finally did it was my absolute nailing of the blockbuster November nonfarm payroll at 211,000. Headline unemployment dropped to a new decade low at 5.0%.

I went into the report short the Euro (FXE), (EUO), short volatility (XIV), and long US stocks up the wazoo, especially financials (JPM), technology (MSFT), and consumer discretionaries (DIS).

When I saw the report at 5:30 AM Pacific Standard Time, I went back to bed. I knew everything would be running my way, big time, and I didn?t want to be awake to take profits too soon.

When we tallied the numbers at the end of the day, I was blinking at the largest one-day gain for Mad Hedge Fund Readers in years, up a ballistic +5.73%.

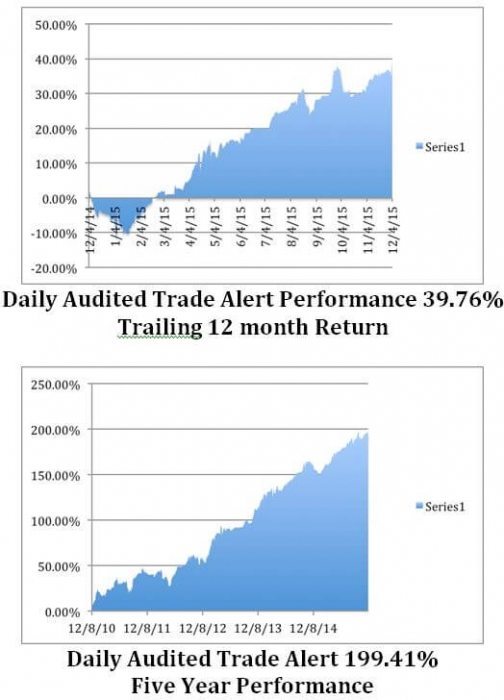

Furthermore, my five-year record catapulted to a new all time high of 199.41%. That works out to an average annualized return of an eye popping 39.88%. I have no doubt we will top the magical 200% level on Monday.

The fruit of these labors was to take the Mad Hedge Fund Trader?s profit for 2015 up to a new all time high at 46.60%.

December so far has been as hot at the Sahara Desert that I recently escaped, up a blistering 2.79%. It is a return that most hedge fund managers would kill for.

In fact hedge funds would take any return now, even a single basis point, as most are showing red ink for 2015.

It seems like only a Madman can prosper in these hopeless trading conditions.

The last ten consecutive Trade Alerts I have issued have been profitable, most instantly.

It has been a near perfect year. I said nearly.

Followers have found themselves in the green during every month of 2015, except during October, when the monster melt up short caught me short US stocks.

I started out 2015 with the goal of earning 25% for my readers during the first half, and another 25% in the second half. This latest batch of trades puts me right on track for reaching my yearend target.

Under promise and over deliver; it has always been a winning business strategy for me.

This is against a backdrop of major market indexes that are all down so far this year, despite sudden bursts of volatility and long, Sahara like stretches of boredom.

The key to winning this year has been to put the pedal to the mettle during those brief, but hair raising selloffs, and then take quick profits.

They don?t call me ?Mad? for nothing.

When the market is dead, you sit on your hands.

After all, you are trying to pay for your own yacht, not your broker?s.

When the market pays you to stay away, you stay away in droves.

Those who have made the effort to wake up early every morning and read my witty and incisive prose have an impressive row of notches on their bedpost to show for their effort.

My groundbreaking trade mentoring service was first launched in 2010. Thousands of followers now earn a full time living solely from my Trade Alerts, a development of which I am immensely proud.

Some 50% of my clients are over 50 and managing their own retirement funds fleeing the shoddy but expensive services provided by Wall Street. The balance is institutional investors, hedge funds, and professional financial advisors.

The Mad Hedge Fund Trader seeks to level the playing field for the average Joe. Looking at the testimonials that come in every day, I?d say we?ve accomplished that goal.

Quite a few followers were able to move fast enough to cash in on my trading recommendations. To read the plaudits yourself, please go to my testimonials page by clicking here. Our business is booming, so I am plowing profits back in to enhance our added value for you.

Global Trading Dispatch, my highly innovative and successful trade-mentoring program, earned a net return for readers of 40.17% in 2011, 14.87% in 2012, 67.45% in 2013, and 30.3% in 2014.

Our flagship product, Mad Hedge Fund Trader Pro, costs $4,500 a year. It includes?Global Trading Dispatch?(my trade alert service and daily newsletter).

You get a real-time trading portfolio, an enormous research database, and live biweekly strategy webinars. You also get Bil Davis' Mad Day Trader service.

To subscribe, please go to my website at?www.madhedgefundtrader.com, click on the ?Memberships? located on the second row of tabs.

And now for the rest of the year.

I can?t wait!

Off to Find the Next Great Trade

Off to Find the Next Great Trade

SUPER trade with the (XIV). Thank you John!

I happened to be in front of my screens, when the alert came in. I saw it on the 5-minute divergence between price and RSI and went long at 27.60.

I?m at dinner just now and I got your ?take profit? Trade Alert.

I checked the chart and found we were at the 61.8% retracement of yesterday's move and took profits perfectly at $29.83. I took in an 8.08% profit in one day. That?s $818.41 less $4 bucks in commissions.

Nice, nice trade.

Thank you again John. Thank you for your call the other day.

Have a nice weekend coming up.

Semper Fi from Germany

Yours,

Jay

California is called the ?Golden State? for a good reason.

Countless fortunes have been made in mining, farming, real estate, tourism, movie making, aircraft manufacturing, aerospace, and more recently, in technology and pot growing.

The Google (GOOG) and Facebook (FB) IPO?s each minted 1,000 millionaires, and Twitter?s (TWTR) deal is said to have produced 1,600 more.

Recently, a lucky couple found the real thing while hiking ?somewhere in Northern California.?

Spotting an old, rusted out tin can, they started digging. To their utter amazement they uncovered five cans containing 1,427 gold coins worth more than $10 million.

Speculation ran rampant as to the original source of the cache. During the Mexican period prior to 1848, the notorious bandit, Joaquin Murrieta, killed more than 40 people in robberies up and down the state. The booty was never found.

Black Bart waylaid 28 Wells Fargo (WFC) stagecoaches in Northern California in the 1880?s, and said he buried the loot near an old oak tree.

Some even postulated that the coins belonged to the sole surviving member of the Jesse James gang, who retrieved the gold on his release from prison in Missouri and then moved to California.

Things got really interesting when my old friend, Don Kagin of Kagin?s, Inc., got involved (click here for his site).

Don has been the feature of several of my past pieces about rare and exotic coins (click here for ?The Mystery of the Brasher Doubloon?).

After close inspection, Don concluded that the coins were in mint, unissued condition dating from 1847 to 1894. One coin alone, an 1866 Liberty $20 gold piece, is worth more than $1 million.

Don?s take is that the coins were stolen during an inside job at the San Francisco Mint in 1900, one of the few buildings to survive the 1906 earthquake. The surrounding fires burned so hot, that the gold coins inside melted.

The building still stands today. However, it is structurally unsound to continue as a Treasury building, so it is rented out for parties. If that is the case, the coins are still the property of the US government.

But the US Treasury never filed a claim, lacking the documentary evidence dating back to the period.

The government has done this many times in the past, fighting a ten year legal battle to recovers some stolen, unissued 1933 gold double eagle?s, the last minted prior to Franklin Delano Roosevelt?s ban on private gold ownership.

One of these sold for $7,590,000 in 2002, making it the world?s most valuable coin. The government won in that case.

The find sparked a stampede of similar gold seekers, turning hills into suspected neighborhoods into Swiss cheese.

Too bad the lucky hikers didn?t find their cache five years earlier. Since then the price of the barbarous relic has fallen by 45%.

So Hiking Pays Off After All

So Hiking Pays Off After All

?It?s a funny thing about life. If you refuse to accept anything but the best, you very often get it,? said British Novelist, Somerset Maugham.