Global Market Comments

July 25, 2014

Fiat Lux

Featured Trade:

(JULY 30 GLOBAL STRATEGY WEBINAR FROM ZERMATT, SWITZERLAND),

(A SPECIAL NOTE ON EXERCISED OPTIONS),

(AN AFTERNOON WITH DR. PAUL EHRLICH),

(POT), (MOS), (AGU), (CORN), (WEAT), (SOYB)

Potash Corp. of Saskatchewan, Inc. (POT)

The Mosaic Company (MOS)

Agrium Inc. (AGU)

Teucrium Corn ETF (CORN)

Teucrium Wheat ETF (WEAT)

Teucrium Soybean ETF (SOYB)

Global Market Comments

July 24, 2014

Fiat Lux

Featured Trade:

(JAPAN TO LAUNCH IRA?S),

(DXJ), (FXY), (YCS),

(KISS THAT UNION JOB GOODBYE)

WisdomTree Japan Hedged Equity (DXJ)

CurrencyShares Japanese Yen ETF (FXY)

ProShares UltraShort Yen (YCS)

Global Market Comments

July 23, 2014

Fiat Lux

Featured Trade:

(THE SECOND AMERICAN INDUSTRIAL REVOLUTION),

(INDU), (SPY), (QQQ), (USO), (UNG), (GLD), (DBA),

(TESTIMONIAL)

?

Dow Jones Industrial Average (^DJI)

SPDR S&P 500 (SPY)

PowerShares QQQ (QQQ)

United States Oil (USO)

United States Natural Gas (UNG)

SPDR Gold Shares (GLD)

PowerShares DB Agriculture ETF (DBA)

Global Market Comments

July 22, 2014

Fiat Lux

SPECIAL ISSUE ON TURKEY

Featured Trade:

(LAST CHANCE TO ATTEND THE JULY 24 ZERMATT, SWITZERLAND GLOBAL STRATEGY SEMINAR),

(HAS TURKEY SUFFERED ENOUGH?),

?(TUR), (EEM)

iShares MSCI Turkey (TUR)

iShares MSCI Emerging Markets (EEM)

I am writing this to you from the veranda of the presidential suite at the Ciragan Palace Hotel in Istanbul. The former palace of an Ottoman prince, the commerce of the Straights of Bosphorus plays out before me.

Empty supertankers lumber up the narrow waterway to pick up another load of Russian crude at Baku, followed by full containerships loaded with consumer goods to pay for it. Peripatetic ferries rapidly crisscross its course laden with passengers fleeing Istanbul?s traffic nightmare. Amid the mix are dozens of racing yachts, the chief status symbol of Turkey?s new elite.

It?s amazing that you don?t read about more Turkish maritime disasters!

The first thing you learn about Turkey these days is that it is no longer an emerging economy. It has emerged! It now ranks 17th in GDP, and could be tenth in another decade. Per capita income has soared to $11,000, compared to $48,000 in the US and $6,000 in China. Once overly dependent on Europe for trade, Turkey has ramped up its shipment of goods to much of the emerging world.

A runaway property boom has placed it fourth in the world in the number of billionaires, with 28. It is the fourth largest shipbuilder, a major auto manufacturer and boasts an important defense industry. If you are eating cherries, hazelnuts, olives, or figs in Europe, chances are that they came from a farm in Turkey.

Turkey joined the European customs union in 1996. It is now negotiating for full European Community membership, becoming the first Asian member, an event expected to occur in the next 5-10 years.

I have taken great pleasure in recent years returning to old haunts I first saw 46 years ago. That was when I lived on $1 a day, carried my worldly possessions in a Kelty backpack and slept under bridges, in bombed out farmhouses, or the local Youth Hostel. I remember that Istanbul?s had a thriving population of bedbugs and a permanently blocked sewer line.

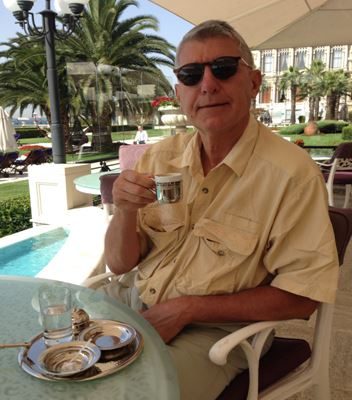

However, this time around I?m staying at five star hotels, like the Kempinski, and the first decision of the day is whether or not to have French Champagne with my fresh squeezed orange juice.

Buy when there is blood in the streets!

That is the time-honored tradition of traders and investors everywhere when it comes to emerging markets (EEM). I had a friend who reliably bought every coup d?etat in Thailand during the seventies and eighties, and he made a fortune, retiring to one of the country?s idyllic islands off the coast of Phuket.

Blood is certainly flowing in Turkey these days. You have the real kind flowing in Istanbul?s Taksim Gezi Park, the country?s own Democracy Square, where students and labor leaders have been protesting the conservative, mildly Islamic policies of Prime Minister Recep Tayyip Erdogan. The violence led to 3,000 arrests and 11 dead.

The fat then fell into the fire with the latest round of instability in the Middle East.? A new terrorist group called ISIS (Islamic State of Iraq and the Levant), even more violent and extreme than its Al Qaida parent, took over the northern portion of that country.

Iraq is Turkey?s second largest trading partner, supplying services, infrastructure, food and consumer goods in exchange for oil. That business completely ceased, and more than 50 Turkish hostages were taken, mostly truck drivers. The oil price spike that followed delivered yet another blow to an already fragile Turkish economy, which depends heavily on imported energy.

This brought a plunge by two thirds in Turkey?s economic growth, from 4.7% annualized rate in the first quarter of 2014, to only 1.6% in May. That was well off from the heady days of 9% growth seen in 2010-2011, when Turkey was one of the fastest countries to bounce back from the 2008-2009 financial crisis. This does not auger well for the future.

The new civil war in Iraq and the endless fighting in Syria have prompted 1 million refugees to flee to Turkey. You see them everywhere in Istanbul, living in abandoned buildings or trolling the streets for handouts. I gave ten Turkish lira to the children below to take their picture. The resulting burden on the country?s nascent social services is immense.

If this were the only problem the country was facing, you might conclude that the timing was ripe to ramp up your investments here.

Better to lie down and take a long nap first.

Turkey is sitting atop a massive property bubble. While GDP has risen by 400% over the past decade, property prices are up by an incredible 900%, and stocks 1,000%. Much is financed by undercapitalized local Turkish banks or by foreign debt.

That is a huge problem when the Turkish lira is weak, as it leads to rising principal amounts and interest rate payments in dollars, Euros and Swiss francs. You see abandoned construction projects all over the country, the casualties of just such a squeeze.

These conditions are about to worsen. We learned from the general collapse of emerging markets (EEM) last year that they are the most sensitive to US Federal Reserve tightening. That tightening has only just begun.

Fed governor, Janet Yellen, has indicated that the central bank?s monthly Treasury bond buying will get tapered down from a high of $80 billion a month down to zero by October. Actual interest rate increases are likely to follow next year.

This is all likely to suck more money out of Turkish financial markets into US ones, to the detriment of Turkish prices everywhere. This is one of the reasons that the Turkish stock market plunged a gob smacking 50% from its highs last year.

European weakness, far and away Turkey?s largest trading partner, caused the country to run a massive $56.8 billion current account deficit in 2013. A borrowing binge to finance speculative real estate projects was another contributing factor.

Consumer prices are also raging away at 9.2% a year. This is often a problem with what I call the ?advanced? emerging markets. Economic growth brings uncontrolled inflation, which raises its cost of labor in the international marketplace and erodes its competitiveness. You see this in Turkey, China and India.

The only way a country can fight back is to devalue its currency. But that frightens away foreign investors, a large factor in the country?s economic miracle.

This is the conundrum in which the Turkish Central Bank finds itself today: High interest rates, a strong currency, and no growth? Or low interest rates, a weak currency, and no foreign investors. It?s a choice that would vex Solomon.

For the short term, Turkey has clearly chosen the latter, ratcheting up short-term interest rates by a gob smacking 4.75% during one night last winter. That caused the Turkish Lira to rally smartly, some 10%. But ten-year government bond rates now hover just above 9.0%, hardly a business friendly rate, removing yet another leg supporting precarious Turkish real estate prices.

Still, conditions today are a vast improvement over the bad old Turkey of decades ago. For 40 years, the military controlled weak elected governments, and one cruel fact that I have learned over the years is that generals are lousy at running economies.

Perennial financial crises scared off foreign investors and the International Monetary Fund had to come in and bail out the country as often as I change my socks. The US turned a blind eye to these abuses, as Turkey was the only NATO member bordering the old Soviet Union and an unstable Middle East.

The potential was always there. Turkey has a highly positive population pyramid, with a large, dynamic and young population only needing to support a miniscule aging population. All that was needed was leadership and confidence.

Prime Minister Erdogan, riding a wave of popularity with his AKP, or Justice and Development Party, delivered that in spades after his election as prime minister in 2003. Pursuing a no nonsense, technocratic, pro business approach, a Turkish economic revival ensued, delivering meteoric results for the country. Yet, he was just Islamic enough to keep the religious hard liners, the Army and terrorist groups at bay.

I had a chance to hear the prime minster speak, attending what turned into a political rally on the first day of Ramadan, in front of the storied Blue Mosque in Istanbul. The only words I understood were ?God is great.? But his support among his conservative base, who were ebullient over his surprise appearance, is undeniable.

Yet, another problem is that this man behind the curtain who has delivered so much is about to leave the stage. Term limits prevent Erdogan from running for Prime Minister again, so he is seeking the presidency instead, a largely ceremonial post under Turkey?s constitution.

That will likely make the current president the next Prime Minister, Abdullah Gul, a close political ally of Erdogan?s. But he is not the same guy.

Even with his impending diminished status, Erdogan is charging ahead with public works projects, the scale of which would impress Franklin Delano Roosevelt. He wants to build a third bridge connecting Europe with Asia. He is planning a tunnel under the Bosphorus. He wants Istanbul?s airport to become the largest in the world. The price tag for all of this is enormous.

So has Turkey suffered enough?

I have to admit that I came to revisit the exotic playground of my impetuous youth to issue the mother of all Trade Alerts and jump back into the ETF (TUR). What I heard in the bazaars, outside mosques and speaking to local businessmen suggests that the pain has only just begun.

As discretion seems to be the better part of valor this year, I think I?ll pass on that Trade Alert.

The US Dollar?s Ten Year Rise Against the Turkish Lira

The US Dollar?s Ten Year Rise Against the Turkish Lira

Global Market Comments

July 21, 2014

Fiat Lux

Featured Trade:

(CHECKING IN WITH SKYBRIDGE?S ANTHONY SCARAMUCCI)

?We are in a broad based liquidity driven bull market.? Furthermore, the major indexes are poised to tack on ?another 10% by the end of this year.?

That was the informed view of SkyBridge Capital managing partner Anthony Scaramucci, known as the ?Mooch? to his friends. I touched based with Anthony while passing through New York a few weeks ago.

Scaramucci?s Views are not to be taken lightly. SkyBridge Capital is a research driven alternative investment firm with over $10 billion in?total assets under advisement or management. The firm offers?hedge fund investing solutions?that address?a wide range of market participants from individual retail investors to large institutions.

SkyBridge tracks the strategies, outlooks, and the performance of many of the 10,000 hedge funds managing $2.7 trillion in assets. As a result, there are few better reads out there on where the global financial markets are heading than the view at SkyBridge.

Anthony says there are three major drivers for the markets today. A race to the bottom by central banks globally is forcing unprecedented liquidity into the markets.

Zero interest rates and a $4.6 trillion balance sheet have effectively made the Federal Reserve the world?s largest hedge fund. There are no longer any bond vigilantes to bring discipline.

Less appreciated by traders is the fine print in the Dodd/Frank financial regulation bill that has unleashed a new generation of corporate raiders. Corporations are using the $2 trillion in cash on their balance sheets to fight back, repurchasing their own shares. Thus, company buy backs are at all time highs, and there is much more to come.

All of this means that financial assets of every description can only go one direction, and that is northward.

One result of this is that index funds are beating the pants off of hedge funds. Long/short equity managers, which comprise 43% of the funds out there, are underperforming for the sixth consecutive year.

Macro funds are getting destroyed because many historical cross asset relationships have broken down. Suddenly, the world no longer makes sense to them and has apparently gone mad, at the investors? expense.

To me, this is all a classic sign of too much hedge fund money chasing too few trades. The hedge fund industry has gotten too big for its britches.

I learned in Japan?s never end bear market that when you only have hedge funds trading with hedge funds, nobody makes any money.

Another issue is our antiquated tax code, which has remained frozen in the 1980?s. Any attempt to change it is thwarted by well-funded special interests, at the economy?s, and your expense.

To broaden its horizons and enhance insights for its clients, SkyBridge recently purchased the rights to the old ?Wall Street Week? from Maryland Public Broadcasting, the once venerable TV investment program hosted by the respected Louis Rukeyser.

Scaramucci believes that the financial media have been hijacked by the 24-hour news cycle that distills crucial information down to 30-second bullet points. Complex economic and investment issues deserve a more thoughtful and extended analysis. Anthony plans to restart the long format program sometime next year.

Scaramucci is the author of two books, The Little Book of Hedge Funds: What You Need to Know About Hedge Funds but the Managers Won?t Tell You, and Goodbye Gordon Gekko: How to Find Your Fortune Without Losing Your Soul.

On my way out of Anthony?s office I noticed a K-bar, a vintage WWII combat utility knife, mounted in a plaque on the wall with a message of thanks from Wounded Warriors Project (click here for their site http://www.woundedwarriorproject.org ).

I laughed, as I have the exact same plaque on my wall at home. The blade is still razor sharp. In recent years, Anthony has raised an impressive $5 million for the worthy veterans organization.

I thanked the ?Mooch? for his contribution and headed out the door for the Lexington line, hoping to beat the rush hour traffic.

Checking in with the ?Mooch?

Checking in with the ?Mooch?

Global Market Comments

July 18, 2014

Fiat Lux

Featured Trade:

(MAD HEDGE FUND TRADER SETS NEW ALL TIME HIGH WITH 22.9% GAIN IN 2014),

(AAPL), (CAT), (MSFT), (TLT), (GM), (SPY)

(PLAY CHINA?S YUAN FROM THE LONG SIDE),

(CYB), ($SSEC), (EEM)

Apple Inc. (AAPL)

Caterpillar Inc. (CAT)

Microsoft Corporation (MSFT)

iShares 20+ Year Treasury Bond (TLT)

General Motors Company (GM)

SPDR S&P 500 (SPY)

WisdomTree Chinese Yuan Strategy ETF (CYB)

Shanghai Stock Exchange Compostite Index ($SSEC)

iShares MSCI Emerging Markets (EEM)

I am writing this to you from the island of Sardinia, part of Italy, a clump of arid mountains dropped right in the middle of the western Mediterranean.

I am bobbing offshore from Porto Cuervo on the famed Costa Smeralda, or Emerald Coast, in a friend?s 100-foot sailboat, awaiting permission to enter.

The water here is so clear that the boats appear to float on air. This afternoon I swam at La Spiaggia Rosa on Budelli Island, famed as the most perfect beach in Italy.

After making a fortune for his hedge fund clients following my Trade Alerts over the past year, a week?s free use of my friend?s favorite toy was the least he could do. Renting this baby costs $50,000 a week, not including tips for the crew, which I covered.

The harbor is so clogged with the traffic of mega yachts belonging to Russian oligarchs, Arab sheiks and other hedge fund managers, that there is no room for us to dock. The ship belonging to the Crown Prince of Saudi Arabia floats just ahead of us in the queue, a nice little 150 footer. So that?s where all my gas money goes! (Or went, now that I am a Tesla driver).

Despite these distractions, I am happy to report that the industry beating performance of the Mad Hedge Fund Trader?s Trade Alert Service has punched through to a new all time high.

The total return for my followers so far in 2014 has reached 22.9%, compared to a far more arthritic 3% for the Dow Average during the same period. So far in July, followers have earned a welcome 3.14%.

I managed to pull this off during some of the most difficult trading conditions in market history. Turnover across all asset classes is hitting decade lows (see chart below), and volatility has crashed through the floor.

Even on the big down days, the Volatility Index reached no higher than the 12% handle. Most of the rest of the hedge fund industry is getting walloped.

The three and a half year return is now at an amazing 145.3%, compared to a far more modest increase for the Dow Average during the same period of only 37%.

That brings my averaged annualized return up to 40.6%. Not bad in this zero interest rate world. It appears better to reach for capital gains than the paltry yields out there.

This has been the profit since my groundbreaking trade mentoring service was first launched in 2010. Thousands of followers now earn a full time living solely from my Trade Alerts, a development of which I am immensely proud of.

Another particularly vexing challenge is that the principal market driver has shifted from economics to geopolitics. The global economic recovery continues, but at a snail?s pace, so it hardly moves the needle on the volatility front.

The carnage in Syria, Iraq, and the Ukraine continues unabated, but nobody seems to care, except for a handful of humanitarian organizations. Not even the potential bankruptcy of a Portuguese bank, the Banco Espiritu Santo, could get the markets to correct for more than an hour. But get a new rumor about Apple?s impending launch of its iPhone 6, and it?s off to the races.

I learned a long time ago to trade the market you have, not the one you wish you had. The world seems to be drowning in complacency.

However, I am using every dip to add risk and every rally to take it back off, keeping positions small all along the way. I am also trading front month options only to minimize my own volatility and pare the hit when a correction finally does come.

It has become yeoman?s work.

So, in the relentless grind up, I took profits on my Caterpillar (CAT) position. My long in Microsoft options (MSFT) is set to expire at its maximum value today. My short position in the S&P 500, the July (SPY) $199 puts, will imminently expire worthless. That?s the way you want to play it; your longs tack on 20% and your shorts go to zero.

I also added a hedging short in the Euro (FXE) and an additional long in Apple (AAPL), of course!

In the meantime, the world is waiting to see whether the US can deliver a second half GDP growth rate of 4% per annum?or not.

Quite a few followers were able to move fast enough to cash in on the move. To read the plaudits yourself, please go to my testimonials page by clicking here. They are all real and new ones come in almost every day.

My esteemed colleague, Mad Day Trader Jim Parker, was no slouch either, dodging in an out of the raindrops to make money on an intra day basis.

What would you expect with a combined 85 years of market experience between the two of us? Followers are laughing all the way to the bank.

Don?t forget that Jim clocked an amazing 2013 with a staggering 374% trading profit. That was just for an eight-month year!

The Opening Bell With Jim Parker, a quickie but insightful webinar giving followers an instant snapshot of the market opening every day, has been an overwhelming success. Many customers have already reported dramatic improvements in their trading results.

Watch this space, because the crack team at Mad Hedge Fund Trader has more new products and services cooking in the oven. You?ll hear about them as soon as they are out of beta testing.

Our business is booming, so I am plowing profits back in to enhance our added value for you. Now available is the Mad Hedge Fund Trader Channel on YouTube that will enable me to post videos from my frequent travels around the world.

The coming year promises to deliver a harvest of new trading opportunities. The big driver will be a global synchronized recovery that promises to drive markets into the stratosphere by the end of 2014.

Global Trading Dispatch, my highly innovative and successful trade-mentoring program, earned a net return for readers of 40.17% in 2011, 14.87% in 2012, and 67.45% in 2013.

Our flagship product,?Mad Hedge Fund Trader PRO, costs $4,500 a year. It includes my Global Trading Dispatch?(my trade alert service and daily newsletter). You get a real-time trading portfolio, an enormous research database, and live biweekly strategy webinars. You also get Jim Parker?s?Mad Day Trader?service and?The Opening Bell with Jim Parker.

To subscribe, please go to my website at?www.madhedgefundtrader.com, find the ?Global Trading Dispatch??or ?Mad Hedge Fund Trader PRO??box on the right, and click on the blue??SUBSCRIBE NOW??button.

The Most Perfect Beach in Italy

The Most Perfect Beach in Italy

Hello from Sardinia

Hello from Sardinia

Global Market Comments

July 17, 2014

Fiat Lux

Featured Trade:

(JULY 24 ZERMATT, SWITZERLAND GLOBAL STRATEGY SEMINAR)

(ANNOUNCING THE MAD HEDGE FUND TRADER VIDEO CHANNEL ON YOUTUBE),

(THE ULTRA BULL ARGUMENT FOR GOLD),

(GLD), (GDX), (ABX), (SLV)

SPDR Gold Shares (GLD)

Market Vectors Gold Miners ETF (GDX)

Barrick Gold Corporation (ABX)

iShares Silver Trust (SLV)