Global Market Comments

May 6, 2013

Fiat Lux

Featured Trade:

(MAY 8 LAS VEGAS STRATEGY LUNCHEON),

(BEN?S NEW LEG FOR THE BULL MARKET),

(SPY), (IWM), (AAPL), (GLD), (SLV), (CU), (TLT), (YCS), (FXY)

(PLEASE USE MY FREE DATA BASE SEARCH)

SPDR S&P 500 (SPY)

iShares Russell 2000 Index (IWM)

Apple Inc. (AAPL)

SPDR Gold Shares (GLD)

iShares Silver Trust (SLV)

First Trust ISE Global Copper Index (CU)

iShares Barclays 20+ Year Treas Bond (TLT)

ProShares UltraShort Yen (YCS)

CurrencyShares Japanese Yen Trust (FXY)

Come join me for lunch at the Mad Hedge Fund Trader?s Global Strategy Update, which I will be conducting in Las Vegas, Nevada on Wednesday, May 8, 2013. An excellent meal will be followed by a wide-ranging discussion and an extended question and answer period.

I?ll be giving you my up to date view on stocks, bonds, currencies, commodities, precious metals, and real estate. I will also explain how I have been able to deliver a blowout 40% return since the November, 2012 market bottom. And to keep you in suspense, I?ll be throwing a few surprises out there too. Tickets are available for $179.

I?ll be arriving at 11:00 and leaving late in case anyone wants to have a one on one discussion, or just sit around and chew the fat about the financial markets. The PowerPoint presentation will be emailed to you three days before the event.

The lunch will be held at a major Las Vegas hotel on the Strip, the details will be emailed with your purchase confirmation. Please make your own hotel reservations, as business there is booming.

I look forward to meeting you, and thank you for supporting my research. To purchase tickets for the luncheons, please go to my online store.

The original purpose of this letter was to build a database of ideas to draw on in the management of my hedge fund. When a certain trade comes into play, I merely type in the symbol, name, currency, or commodity into the search box, and the entire fundamental argument in favor of that position pops up with a link chain to older stories.

You can do the same. Just type anything into the search box with the little magnifying glass in the upper right side of my Homepage and a cornucopia of data, charts, and opinion wills appear. Even the price of camels in India (to find out why they?re going up, click here). As of today, the database goes back to February 2008, and comprises some 2 million words, or triple the length of Tolstoy?s epic novel, War and Peace.

Watching the traffic over time, I can tell you how the database is being used, and the implications are fascinating:

1) Small hedge funds want to see what the large hedge funds are doing.

2) Large hedge funds look to see what they have missed, which is usually nothing.

3) Midwestern advisors to find out what is happening in New York and Chicago.

4) American investors to find out if there are any opportunities overseas (there are lots).

5) Foreign investors wish to find out what the hell is happening in the US (about 1,000 inquiries a day come in through Google?s translation software in a multitude of languages).

6) Specialist traders in stocks, bonds, currencies, commodities, and precious metals are looking for cross market insights which will give them a trading advantage with their own book.

7) High net worth individuals managing their own portfolios so they don?t get screwed on management fees.

8) Low net worth individuals, students, and the military looking to expand their knowledge of financial markets (lots of free online time in the Navy).

9) People at the Treasury and the Fed trying to find out what the private sector is doing.

10) Staff at the SEC and the CFTC to see if there is anything new they should be regulating.

11) More staff at the Congress and the Senate looking for new hot button issues to distort and obfuscate.

12) Yet, even more staff in Obama?s office gauging his popularity and the reception of his policies.

13) As far as I know, no justices at the Supreme Court read my letter. They?re all closet indexers.

14) Potential investors/subscribers attempting to ascertain if I have the slightest idea of what I am talking about.

15) Me trying to remember trades which I recommended, but have forgotten.

16) Me looking for trades that worked so I can say, ?I told you so.?

It?s there, it?s free, so please use it.

Global Market Comments

May 3, 2013

Fiat Lux

Featured Trade:

(SO I LIED),

(TURKEY IS ON THE MENU), (TUR), (TKC)

(THE NEW CALIFORNIA GOLD RUSH), (GLD)

iShares MSCI Turkey Invest Mkt Index (TUR)

Turkcell Iletisim Hizmetleri AS (TKC)

SPDR Gold Shares (GLD)

I sit here with my fingertips battered, bruised, and bleeding. My lower back aches, and my shoulders are as tight as a drum. After promising to take it easy for a while because the risk/reward in the market so badly sucks, I knocked out six Trade Alerts in one day. That is on top of conducting a one-hour strategy webinar and writing a 1,600 word daily newsletter. So I lied.

So far in 2013, I have issued an exhausting 114 opening, closing, and updated Trade Alerts. That includes one amazing run of 19 consecutive profitable trades. You have to strike while the iron is hot, make hay while the sun shines, yada, yada, yada. Making money in the market this year has been a turkey shoot.

Since writing about my performance a few days ago, which now stands at an eye popping 35.88% for 2013 and 90.93% over the past 30 months, I have been deluged with inquiries about how I pulled off this trading miracle from the incredulous. Is he using insane amounts of leverage? Or is he just telling porky pies, a not unheard of practice in this sullied industry.

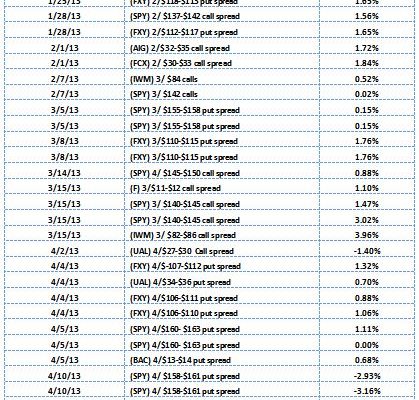

So in the interest of full disclosure, I am posting below every trade I have alerted readers to since January 1, along with the profit and loss. Of the 43 trades executed in 2013, 37 have been profitable, some quite impressively so. Each trade is shown in terms of its contribution to the portfolio?s total annual return. That is a success rate of 86%, which rightly earns me an honored place in the Hedge Fund Trader?s Hall of Fame.

Global Trading Dispatch, my highly innovative and successful trade-mentoring program, earned a net return for readers of 40.17% in 2011 and 14.87% in 2012. The service includes my Trade Alert Service, daily newsletter, real-time trading portfolio, an enormous trading idea database, and live biweekly strategy webinars. To subscribe, please go to my website at www.madhedgefundtrader.com, find the ?Global Trading Dispatch? box on the right, and click on the lime green ?SUBSCRIBE NOW? button.

Feast your eyes.

I am building lists of emerging market ETF?s to snap up during any summer sell off, and Turkey popped up on the menu. The country is only one of two Islamic countries that I consider investment grade, (Indonesia is the other one). The 82 million people of Turkey rank 15th in the world population, and 16th with a GDP of $960 billion GDP. Some 25% of the population is under the age of 15, giving it one of the planet?s most attractive demographic profiles.

The real driver for Turkey is a rapidly rising middle class, generating consumer spending that is growing by leaps and bounds. Its low wage labor force is also a major exporter to the European Community next door.

I first trod the magnificent hand woven carpets of Istanbul?s Agia Sophia in the late 1960?s while on my way to visit the rubble of Troy and what remained of the trenches at Gallipoli, a bloody WWI battlefield. Remember the cult film, Midnight Express? If it weren?t for the nonstop traffic jam of vintage fifties Chevy?s on the one main road along the Bosporus, I might as well have stepped into the Arabian Nights. They were still using the sewer system built by the Romans.

Four decades later, and I find Turkey among a handful of emerging nations on the cusp of joining the economic big league. Exports are on a tear, and the cost of credit default swaps for its debt is plunging. Prime Minister Erdogan, whose AKP party took control in 2002, implemented a series of painful economic reform measures and banking controls, which have proven hugely successful.

Foreign multinationals like General Electric, Ford, and Vodafone, have poured into the country, attracted by low costs and a rapidly rising middle class. The Turkish Lira has long been a hedge fund favorite, attracted by high interest rates.

Still, Turkey is not without its problems. It does battle with Kurdish separatists in the east, and has suffered its share of horrific terrorist attacks. Inflation is a worry. The play here long has been to buy ahead of membership in the European Community, which it has been denied for four decades. Suddenly, that outsider status has morphed from a problem to an advantage.

The way to get involved here is with an ETF heavily weighted in banks and telecommunications companies, classic emerging market growth industries like (TUR). You also always want to own the local cell phone company in countries like this, which in Turkey is Turkcell (TKC). June elections could provide us with the trigger to move into this enchanting country. Turkey is not a riskless trade, but is well worth keeping on your radar.

I See A Trade Here

I See A Trade Here

Global Market Comments

May 2, 2013

Fiat Lux

Featured Trade:

(SELLING GOLD AGAIN), (GLD),

(IS USA, INC. A ?SELL?),

(COLUMBIA IS POPPING UP ON MY RADAR), (GXG), (EEM)

SPDR Gold Shares (GLD)

Global X FTSE Colombia 20 ETF (GXG)

iShares MSCI Emerging Markets Index (EEM)

What would happen if I recommended a stock that had no profits, was cash flow negative, and had a net worth of negative $44 trillion? Chances are, you would cancel your subscription, demand a refund, de-friend me from you Facebook account, and delete my email address from your address book.

Yet that is precisely what my former colleague at Morgan Stanley did, technology guru Mary Meeker. Now a partner at venture capital giant Kleiner Perkins, Mary has brought her formidable analytical talents to bear on analyzing the United States of America as a stand alone corporation. The bottom line: the challenges are so great they would daunt the best turnaround expert. But our problems are not hopeless or unsolvable.

The US government was a miniscule affair until the Great Depression and WWII, when it exploded in size. Since 1965 when Lyndon Johnson?s ?Great Society? began, GDP rose by 2.7 times, while entitlement spending leapt by 11.1 times. If current trends continue, the Congressional Budget Office says that entitlements and interest payments will exceed all federal revenues by 2025.

Of course, the biggest problem is with health care spending, which will see no solution until health care costs are somehow capped. Despite spending more than any other nation, we get one of the worst results, with lagging quality of life, life spans, and infant mortality. Some 28% of Medicare spending is devoted to a recipient?s final year of life. Somewhere, there are emergency room cardiologists making a fortune off of this.

Social Security is an easier fix. Since it started in 1935, life expectancy has risen by 26% to 78, while the retirement age is up only 3% to 68. Any reforms have to involve raising the retirement age to at least 70, and means testing recipients.

The solutions to our other problems are simple, but require political suicide for those making the case. For example, you could eliminate all tax deductions, including those for home mortgage deductions, charitable contributions, IRA contributions, dependents, and medical expenses, and raise $1 trillion a year. That would wipe out the current budget deficit in one fell swoop.

Mary reminds us that government spending on technology laid the foundations of our modern economy. If the old ARPNET had not been funded during the sixties, Google, Yahoo, EBay, Facebook, Cisco, and Oracle would be missing today. Global Positioning Systems (GPS) was also invented by and is still run by the government and has been another great wellspring of profits.

There are a few gaping holes in Mary?s ?thought experiment?. I doubt she knows that the Treasury Department carries the value of America?s gold reserves, the world?s largest at 8,965 tons worth $414 billion, at only $32 an ounce, versus an actual market price of $1,445.

Nor is she aware that our ten aircraft carriers are valued at $1 each, against an actual cost of $5 billion in today?s dollars. And what is Yosemite worth on the open market, or Yellowstone, or the Grand Canyon? These all render her net worth calculations meaningless.

Mary expounds at length on her analysis, in her book entitled USA Inc. which you can buy at Amazon by clicking on the title or the book cover below.

Worth More Than a Dollar?

Worth More Than a Dollar?

How About $32 an Ounce?

How About $32 an Ounce?

My current scenario for global equities has them selling off over the summer, then a rebounding led by emerging markets starting sometime in the fall. In that case, you want to start building short lists of high growth countries to pile into, once the turn comes.

I would be including Columbia on any such list. It enjoys that sweet spot of being an oil exporting emerging country whose shipments hit an all-time high of 884,000 barrels a day, about half the quantity that Libya once shipped. The quality of the government has improved dramatically over the last decade. It is a narco state no more, although public and investors? perceptions lag deeply. The country has seen upgrades by leading credit agencies. Billionaire Carlos Slim, the world?s richest man, has recently been seen as a major investor.

The country also enjoys one of the world?s most favorable demographic pyramids. A young, upwardly mobile workforce is producing a rising tide of consumers and a burgeoning middle class, while expensive seniors requiring social services and medical care are few and far between.

Columbia was the world?s best performing equity market in 2010, bringing in gains of over 100%. That was how the country ETF (GXG) performed. Is history about to repeat itself?

Like most emerging stock markets this year (EEM), Columbia has been beaten like a red headed step child. That makes it a prime target for a rotation, should another leg to the ?RISK ON? market develop later in the year, as I expect. They also make great coffee. Just ask Juan Valdez.

Juan Valdez is Setting Up for a Buy

Juan Valdez is Setting Up for a Buy

Global Market Comments

May 1, 2013

Fiat Lux

Featured Trade:

(MAY 1 GLOBAL STRATEGY WEBINAR),

(OLD TECH?S BIG COMEBACK),

(AAPL), (MSFT), (INTC), (HPQ), (XLK), (AMAT),

(GET READY FOR YOUR NEXT BIG TAX HIT)

Apple Inc. (AAPL)

Microsoft Corporation (MSFT)

Intel Corporation (INTC)

Hewlett-Packard Company (HPQ)

Technology Select Sector SPDR (XLK)

Applied Materials, Inc. (AMAT)