It?s another sign of the times when the weekend fruit picker population is doubled by people hard hit by the economy, looking to save money on food costs.

After driving through miles of undulating brown hills studded with oak trees, passing mile upon mile of horse ranches, rusted out cars, and abandoned mobile homes, you come to Brentwood, the fruit capital of Northern California. There, thousands of families, half from Asia, harvest ripe bing cherries and peaches at the wholesale price of $1 a pound, fruit that normally costs $6 a pound at the supermarket. It all is a great opportunity to teach young kids the value of hard work, and where their food comes from. Anything you eat in the orchard is free, an old California tradition. No doubt none of these people are counted in the government?s employment statistics.

It is all a great deal if you don?t mind having purple fingertips at the end of the day. Just watch out for the cars pulled over on the side of the road on the way home, their occupants puking out all their excess cherries. In a nod to the 21st century, growers in this Grapes of Wrath industry compile lists of email addresses, and notify their itinerant fruit pickers which crops are ready for harvest via the Internet. Also on the calendar this season are grapes, apples, apricots, plums, loquats, nectarines, mandarin oranges, and wheel chair accessible walnuts (?)

At the end of each harvest, professional crews sweep through and pick up what?s left, if the prices will bear it. If you wonder why we put up with the earthquakes, high taxes, gridlocked politics, and a non-functioning state government, this is the reason.

By the way, does anyone know what to do with 50 pounds of cherries? Send me your recipes.

Global Market Comments

April 25, 2013

Fiat Lux

Featured Trade:

(MAY 8 LAS VEGAS STRATEGY LUNCHEON),

(SELL IN MAY HAS ALREADY STARTED),

(SPY), (IWM), (TLT), (TBT), (GLD), (SLV), (USO), (UNG),

(CHINA?S VIEW OF CHINA), (FXI), (EEM)

SPDR S&P 500 (SPY)

iShares Russell 2000 Index (IWM)

iShares Barclays 20+ Year Treas Bond (TLT)

ProShares UltraShort 20+ Year Treasury (TBT)

SPDR Gold Shares (GLD)

iShares Silver Trust (SLV)

United States Oil (USO)

United States Natural Gas (UNG)

iShares FTSE China 25 Index Fund (FXI)

iShares MSCI Emerging Markets Index (EEM)

Come join me for lunch at the Mad Hedge Fund Trader?s Global Strategy Update, which I will be conducting in Las Vegas, Nevada on Wednesday, May 8, 2013. An excellent meal will be followed by a wide-ranging discussion and an extended question and answer period.

I?ll be giving you my up to date view on stocks, bonds, currencies, commodities, precious metals, and real estate. I will also explain how I have been able to deliver a blowout 40% return since the November, 2012 market bottom. And to keep you in suspense, I?ll be throwing a few surprises out there too. Tickets are available for $179.

I?ll be arriving at 11:00 and leaving late in case anyone wants to have a one on one discussion, or just sit around and chew the fat about the financial markets. The PowerPoint presentation will be emailed to you three days before the event.

The lunch will be held at a major Las Vegas hotel on the Strip, the details will be emailed with your purchase confirmation. Please make your own hotel reservations, as business there is booming.

I look forward to meeting you, and thank you for supporting my research. To purchase tickets for the luncheons, please go to my online store.

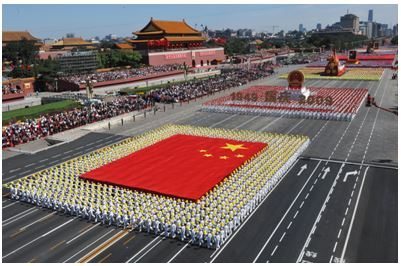

I ran into Minxin Pei, a scholar at the Carnegie Endowment for International Peace who imparted to me some iconoclastic, out of consensus views on China?s position in the world today.

He thinks that power is not shifting from West to East; Asia is just lifting itself off the mat, with per capita GDP at $5,800, compared to $48,000 in the US. We are simply moving from a unipolar to a multipolar world. China is not going to dominate the world, or even Asia, where there is a long history of regional rivalries and wars.

China can?t even control China, where recessions lead to revolutions, and 30% of the country, Tibet and the Uighurs, want to secede. China?s military is entirely devoted to controlling its own people, which make US concerns about their recent build up laughable.

All of Asia?s progress, to date, has been built on selling to the US market. Take us out, and they?re nowhere. With enormous resource, environmental, and demographic challenges constraining growth, Asia is not replacing the US anytime soon.

There is no miracle form of Asian capitalism; impoverished, younger populations are simply forced to save more, because there is no social safety net. Try filing a Chinese individual tax return, where a maximum rate of 40% kicks in at an income of $35,000 a year, with no deductions, and there is no social security or Medicare in return. Ever heard of a Chinese unemployment office or jobs program?

Nor are benevolent dictatorships the answer, with the despots in Burma, Cambodia, North Korea, and Laos thoroughly trashing their countries. The press often touts the 600,000 engineers that China graduates, joined by 350,000 in India. In fact, 90% of these are only educated to a trade school standard. Asia has just one world-class school, the University of Tokyo.

As much as we Americans despise ourselves and wallow in our failures, Asians see us as a bright, shining example for the world. After all, it was our open trade policies and innovation that lifted them out of poverty and destitution. Walk the streets of China, as I have done for nearly four decades, and you feel this vibrating from everything around you. I?ll consider what Minxin Pei said next time I contemplate going back into the (FXI) and (EEM).

China: Not All it?s Cracked Up to Be

China: Not All it?s Cracked Up to Be

Global Market Comments

April 24, 2013

Fiat Lux

Featured Trade:

(JULY 2 NEW YORK STRATEGY LUNCHEON),

(THINGS ARE HEATING UP IN MEXICO),

(EWW), (UMX), (BSMX), (EEM),

(BUDGET CUTS HOT THE WILD ANIMAL MARKET)

iShares MSCI Mexico Capped Invstbl Mkt (EWW)

ProShares Ultra MSCI Mexico Cppd IMI (UMX)

Grupo Financiero Santander S.A.B. de C.V. (BSMX)

iShares MSCI Emerging Markets Index (EEM)

Come join me for lunch for the Mad Hedge Fund Trader?s Global Strategy Seminar, which I will be conducting in New York, NY on Tuesday, July 2, 2013. An excellent three-course lunch will be provided. A PowerPoint presentation will be followed by an extended question and answer period.

I?ll be giving you my up to date view on stocks, bonds, foreign currencies, commodities, precious metals, and real estate. And to keep you in suspense, I?ll be throwing a few surprises out there too. Enough charts, tables, graphs, and statistics will be thrown at you to keep your ears ringing for a week. Tickets are available for $209.

The formal luncheon will run from 12:00 to 2:00 PM. I?ll be arriving an hour early and leaving late in case anyone wants to have a one on one discussion, or just sit around and chew the fat about the financial markets.

The event will be held at a prestigious private club on Central Park South, the details of which will be emailed to you with your purchase confirmation.

I look forward to meeting you, and thank you for supporting my research. To purchase tickets for the luncheons, please go to my online store.

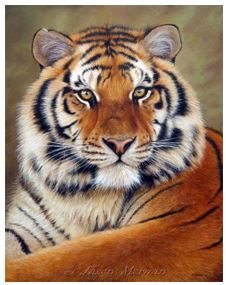

In case you missed it, the second hand animal market has crashed. Forced to slash budgets by cash starved municipalities, the nation?s public zoos have been paring back their collections of living exhibits.

The Washington Zoo is trying to offload a 7,000 pound hippopotamus; while the San Francisco Zoo is short some tigers after one ate a visitor and had to be shot. The Portland Zoo was able to liquidate a portfolio of lemurs only because of the popularity of the recent DreamWorks? ?Madagascar 3? animated film.

When zoos are forced to economize, they downsize the big eaters first to save on feed costs; hence, the absence of elephants in San Francisco (Could this be a political gesture?). In fact, zoo staff was recently busted for illegally harvesting acacia on private property, a favorite food of giraffes, which grows wild here after its introduction a century ago.

The hardest to move? Baltimore has been trying to sell its snake collection for two years now. Talk about an illiquid market. Maybe they should try AIG. Snake derivatives anyone?

Pink Slips for Tony?

Pink Slips for Tony?

When the Dow crashed 514 points in a single day a few years ago, the market lost a staggering $850 billion in market capitalization. High frequency traders were possibly responsible for half of this move, but generated a mere $65 million in profits, some 7/1,000?s of a percent of the total loss. Are market authorities and regulators being penny wise, but pound foolish?

The carnage the HF traders are causing is triggering a rising cry from market participants to ban the despised strategy. Many are calling for the return of the ?short sale test tick rule?, or SEC Rule 17 CFR 240.10a-1, otherwise known as the ?uptick rule?, which permits traders to execute short sales only if the previous trade caused an uptick in prices.

The rule was created eons ago to prevent the sort of cascading, snowball selling that we are seeing today. It was repealed on July 6, 2007. Check out a chart of the volatility that ensued and it will make the hair on the back of your neck raise.

Those unfamiliar with how algorithmic trading works see it as something akin to illegal front running. ?Co-location? of mainframes with exchange computers, or having them in adjacent rooms, gives them another head start over the rest of us. Much of the trading sees HF traders battling each other, and involves what used to be called ?spoofing?, the placing of large, out of the market orders with no intention of execution. Needless to say, if you or I tried any of these shenanigans, the SEC would lock us up in the can so fast it would make your head spin.

Many accuse exchange authorities of a conflict of interest, allowing members to reap sizeable custody fees from HF traders, while the rest of us get taken to the cleaners. Co-location fees run in the hundreds of thousands of dollars per customer per month. This is happening while traditional revenue sources, like proprietary trading, are disappearing, thanks to Dodd-Frank. There is no doubt that the volatility is driving the retail investor from the market.

In fact, HF trading has been around since the nineties, back when the uptick rule was still in place and colocation was a term out of Star Trek. But it was small potatoes then, confined to a few niche players like Renaissance, and certainly lacked the firepower to engineer 500 point market swings.

The big problem with this solution is that HF trading now accounts for up to 70% of the daily trading volume. Ban them, and the market volatility will shrink back to double digit trading ranges that will put us all asleep. The diminished liquidity might make it difficult for the 800 pound gorillas of the market, like Fidelity and Caplers, to execute trades, further frightening end investors from equities. It is possible that we have become so addicted to the crack cocaine that HF traders provide us that we can?t live without it?

HF Traders Are Driving Individual Investors Out of the Market

HF Traders Are Driving Individual Investors Out of the Market

Global Market Comments

April 23, 2013

Fiat Lux

Featured Trade:

(MAY 8 LAS VEGAS STRATEGY LUNCHEON),

(PROBING FOR A BOTTOM IN GOLD), (GLD),

(IS THIS THE FINAL BOTTOM FOR APPLE?),

(AAPL), (GOOG), (JCP)

SPDR Gold Shares (GLD)

Apple Inc. (AAPL)

Google Inc. (GOOG)

J. C. Penney Company, Inc. (JCP)

Come join me for lunch at the Mad Hedge Fund Trader?s Global Strategy Update, which I will be conducting in Las Vegas, Nevada on Wednesday, May 8, 2013. An excellent meal will be followed by a wide-ranging discussion and an extended question and answer period.

I?ll be giving you my up to date view on stocks, bonds, currencies, commodities, precious metals, and real estate. I will also explain how I have been able to deliver a blowout 40% return since the November, 2012 market bottom. And to keep you in suspense, I?ll be throwing a few surprises out there too. Tickets are available for $179.

I?ll be arriving at 11:00 and leaving late in case anyone wants to have a one on one discussion, or just sit around and chew the fat about the financial markets. The PowerPoint presentation will be emailed to you three days before the event.

The lunch will be held at a major Las Vegas hotel on the Strip, the details will be emailed with your purchase confirmation. Please make your own hotel reservations, as business there is booming.

I look forward to meeting you, and thank you for supporting my research. To purchase tickets for the luncheons, please go to my online store.