Every time the price of oil spikes, we learn vast amounts of information about the global reach of this indispensable commodity. It's like taking a non-core elective in geology at college. So I was fascinated when I found the chart of relative sector winners and losers below.

No surprise that energy does best from sky high crude prices. It is followed by telecommunications and health care. You would also expect consumer discretionary stocks to take it on the nose, as high energy prices almost always lead to a cyclical downturn in the economy. Who is the worst performer of all? Europe, which makes the recent weakness even more understandable.

Europe Will be the Biggest Loser from High Oil Prices

Global Market Comments

February 15, 2013

Fiat Lux

Featured Trade:

(FEBRUARY 20 GLOBAL STRATEGY WEBINAR),

(THE BOND CRASH HAS ONLY JUST STARTED),

(TLT), (TBT),

(WATCH SAVINGS RATES FOR INTERNATIONAL MARKET CUES)

iShares Barclays 20+ Year Treas Bond (TLT)

ProShares UltraShort 20+ Year Treasury (TBT)

Often while searching for a piece of data through Google, I stumble across something else, which is far more interesting. That is how I found the table below of international savings rates.

Why should you care? Because countries with high savings rates tend to have strong economies and great stock markets, since there is plenty of excess cash available to pour into investments. Those with low savings rates suffer from weak economies and poor stock markets, because of a shortage of available capital. When the American savings rate dropped below zero in the latter part of the last decade, it set off emergency alarms for me that a collapse of the financial markets was on the horizon.

During the last four decades, I have watched Japan's savings rates plunge from 16% to 2.8%, and you know the result for markets there. When it approaches zero, that will be the time to short the JGB's, the yen, and the Nikkei stock index. The only country that doesn't fit this analysis is Australia, with a mere 2.5% savings rate, but boasts a positively virile stock market and currency. The resource boom there is skewing things towards under saving and over consumption.

By the way, the outlook for the US, with its still miserable 3.9% savings rate, does not look great when considering this benchmark. Don't expect a runaway bull market anywhere savings rates are low and falling. What are savings rates telling us are the best countries in which to invest? China, 38%, India, 34.7%, and Turkey, 19.5%.

Australia? 2.5%

Japan? 2.8%

USA? 3.9%

Brazil? 6.8%

Britain? 7.0%

Germany? 11.7%

Ireland? 12.3%

Switzerland? 14.3%

Turkey? 19.5%

India? 34.7%

China ?38%

Global Market Comments

February 14, 2013

Fiat Lux

SPECIAL ASIAN HIGH YIELD STOCK ISSUE

Featured Trade:

(REACHING FOR DIVIDENDS IN ASIA),

(SSW), (CHT), (MLYBY), (EWSS)

(AN EVENING WITH GENERAL DOUGLAS FRASER)

(EWZ), (ECH), (GXG), (CU), (CORN), (SOYB), (WEAT)

Seaspan Corporation (SSW)

Chunghwa Telecom Co., Ltd. (CHT)

Malayan Banking Bhd (MLYBY)

iShares MSCI Singapore Small Cap Fund (EWSS)

iShares MSCI Brazil Capped Index (EWZ)

iShares MSCI Chile Capped Investable Mkt (ECH)

Global X FTSE Colombia 20 ETF (GXG)

First Trust ISE Global Copper Index (CU)

Teucrium Corn (CORN)

Teucrium Soybean (SOYB)

Teucrium Wheat (WEAT)

I never cease to be amazed by the intelligence provided me by the US Defense Department, which after the CIA, has the world?s most impressive and insightful economic research team. There are few places a global strategist like me can go to get intelligent, thoughtful forty-year views, and this is one. Wall Street, eat your heart out.

Of course, they are planning how to commit ever declining resources in future military conflicts. I am just looking for great trading ideas for my readers, which my assorted three-star and four-star friends have in abundance. I usually have to provide some extra analysis and tweak the data a bit to obtain the precise ticker symbols and entry points, but then that?s what you pay me to do.

An evening with General Douglas Fraser did not disappoint. He is an Air Force four-star who is the commander of US Southern Command (SOUTHCOM), one of nine unified Combatant Commands in the Department of Defense. Its area of responsibility encompasses Central America, South America, and the Caribbean. SOUTHCOM is a joint command comprised of more than 1,200 military and civilian personnel representing the Army, Navy, Air Force, Marine Corps, Coast Guard, and other federal agencies.

The United States is now the second largest Hispanic country in the world, and it will soon become the largest. These industrious people now account for 15% of US GDP, and that figure will grow to 35% by 2050. The Hispanic birthrate in many parts of the US is triple that of any other ethnic group. Because of this, any politicians that pursue anti-immigrant policies are doomed to failure. This may, in part, explain the November election result.

Latin America?s GDP is growing at 4% a year, more than double the current US rate. American trade with the region grew by 72% last year, with imports surging an eye popping 112%. It is the source of one third of our foreign energy supplies. It has tremendous wealth in copper, iron ore, and food production that have yet to be exploited. In the last decade, 40 million have risen out of poverty. Yet 13% of the inhabitants earn less than $1 a day.

This poverty has made Latin America fertile ground for the international drug trade, which poses one of the greatest threats to America?s security today.? Profits from the cocaine trade reached $88 billion in 2011, which is more than the GDP of any single Central American country. Some $33 billion worth of this narcotic made it into the US last year. Brazil is the world?s second biggest consumer of cocaine, after the US, with the UK the largest per capita consumer. The farther you move this product from the source, the more expensive it gets. Cocaine costs $2,000 a kilo in Brazil, $40,000 in the US, $80,000 in Europe, and $150,000 in the Middle East.

Technology has made communications, organization and logistics tools once only found in the military available to anyone. This creates a level playing field for international crime organizations of all sorts. The drug business is so profitable that the cartels are now building submarines in the jungles of Columbia at a cost of $4 million each, and sending them under water to the US to make a $100 million profit per voyage.

This illicit wealth is financing the growth of other illegal activities, like money laundering, arms dealing, human trafficking, and even the transportation of exotic animals. This is corrupting the smaller and weaker governments. Key transit point, Honduras, bas become so violent, with the highest murder rates in the world that the US recently had to withdraw 150 Peace Corps volunteers.

As a result, Fraser has had to modify the mission of SOUTHCOM from a primarily military one to non-traditional crime fighting. His planes are intercepting smugglers at the favored Venezuela-Honduras-US air corridor, as well as craft making it up the Central American west coast.? He is providing military assistance, training, and joint operations where he can, but must balance this with the human rights record in each country.

In addition to his other responsibilities, General Fraser is also keeping close track of China?s rapidly expanding trade relations in the area. They have begun selling inexpensive, low end weapons and military equipment to some of these countries.

The investment opportunities I picked up from General Fraser were legion. It certainly made the ETF?s for Brazil (EWZ), Chile (ECH), and Columbia (GXG) no brainers for a long term portfolio. The Brazilian Real and the Chilean peso are screamers. Copper (CU) and the grains, (CORN), (SOYB), and (WEAT), are probably also good bets.

General Fraser graduated from the Air Force Academy in 1974 and is fluent in Spanish. He has commanded Air Force combat units in Japan, Korea, and Germany. He was later a senior officer in the Space Operations Command. General Fraser joined SOUTHCOM in 2009 after serving as deputy commander of the Pacific Command.

After his briefing, the readers of the Diary of a Mad Hedge Fund Trader who came at my invitation that evening were given the opportunity to ask questions of one of America?s most senior military officers on a one on one basis. In a lighthearted moment, I mentioned to the General that his career total of 2,800 flight hours exceeding my own by only 600 hours. But his rides were vastly more exciting than mine, with most of his time spent in F-16?s and F-15-s, some of the most lethal weapons ever developed.? My log contains an assortment of aircraft that include a lot of more sedentary Cessna?s, a few C-130 Hercules, a P51 Mustang, a De Havilland Tiger Moth, and a few precious hours in a Russian Mig-25 and Mig-29.

Global Market Comments

February 13, 2013

Fiat Lux

Featured Trade:

(THE MUNI BOND MYTH),

(MUB), (TLT), (JNK), (ACTHX),

(BEWARE THE COMING EQUITY CAPITAL FAMINE)

iShares S&P National AMT-Free Muni Bd (MUB)

iShares Barclays 20+ Year Treas Bond (TLT)

SPDR Barclays High Yield Bond (JNK)

Invesco High Yield Muni A (ACTHX)

The world is about to suffer an acute shortage of equity capital over the next eight years, which could total $12.3 trillion. That is the conclusion of the McKinsey Global Institute, an affiliate of McKinsey &Co., a great well of long-term economic thinking which I have been drawing from for the last 40 years.

The cause of the coming debacle is quite simple. Investable assets in the emerging world with minimal experience in equity investment are growing four times faster than those in the developed world. While developed countries own 80% of the world?s $196 trillion in assets today, that share is expected to decline to 64% by 2020. This means that, by far, the greatest growth in assets will be in countries where managers have the least experience in equity investment.

The reasons for the waning interest in equities in the West are well known. For a start, the performance of developed stock markets has been terrible, with one ?lost decade? behind us, and another ahead. Aging populations wind down equity investment as they get older, shifting an ever-larger share of their assets into bonds and cash. The rise of defined contribution plans shifts a greater focus on fixed income investments. More money is going into hedge funds and private equities. The regulatory burden of Dodd-Frank is scaring many banks out of stock brokerage into safer managed alternatives. When stocks aren?t being ?sold?, no one buys them.

Anyone who has ever tried to sell equities to emerging market investors, like myself, can tell you the challenges they run up against. Much of the region?s assets are controlled by quasi-government institutions with a much greater debt orientation. Equity issuance is very expensive and tightly regulated. Corporate transparency and government oversight is a joke. No one believes the figures that are coming out of China.

Minority shareholders have no say and few rights, with annual meetings often over in an hour. There also is a long cultural tradition of keeping your wealth tied up in gold and silver instead of paper assets. No surprise then, that most emerging market investors view equities as riskier and more speculative than they are in the West and would rather keep their money elsewhere.

A shortage of equity capital is likely to make stock markets even less attractive than they recently have been. It will force companies to use more leverage, which will create greater volatility in earnings and share prices. A smaller equity cushion will lead to a higher frequency of bankruptcies during hard times. High growth companies, such as in technology, will have a particularly tough time raising capital, and IPO markets could dry up from the lack of money.

The net result of these anti-equity trends is that yields will have to rise substantially to become more competitive with bonds. Companies can achieve this by either raising dividends or watching share prices fall. This may be the reason behind soaring dividend yields globally over the last three years. The price of admission for equity capital hungry corporations is going up, big time. The $100 billion plus equity requirements of troubled European banks only exacerbate this situation.

The only way around this crisis is for investment banks to greatly step up their marketing efforts in the emerging markets, especially in China. The Middle Kingdom?s investable assets are expected to soar 328% from $19.8 trillion to $65 trillion by 2020. That will make it one of the world?s largest markets for investment products in a very short time. Major firms, like Morgan Stanley, Goldman Sachs, JP Morgan, Sogen, and UBS have already made massive investments in the region to boost business there.

To read the McKinsey piece in full, please click here. Better start learning Mandarin if you want to stay in the brokerage business.

What! No Equity Takers in Asia?

Global Market Comments

February 12, 2013

Fiat Lux

Featured Trade:

(TRADE ALERT SERVICE POSTS NEW ALL TIME HIGH),

(SPY), (IWM), (FCX), (AIG), (FXY), (YCS),

(DON?T GET CAUGHT IN THE NEXT REAL ESTATE BUBBLE),

(PHM), (LEN), (KBH)

(WHY WATER WILL SOON BECOME MORE VALUABLE THAN OIL), (CGW), (PHO), (FIW), (VE), (TTEK), (PNR),

(TESTIMONIAL)

SPDR S&P 500 (SPY)

iShares Russell 2000 Index (IWM)

Freeport-McMoRan Copper & Gold Inc. (FCX)

American International Group, Inc. (AIG)

CurrencyShares Japanese Yen Trust (FXY)

ProShares UltraShort Yen (YCS)

PulteGroup, Inc. (PHM)

Lennar Corp. (LEN)

KB Home (KBH)

Guggenheim S&P Global Water Index (CGW)

PowerShares Water Resources (PHO)

First Trust ISE Water Idx (FIW)

Veolia Environnement S.A. (VE)

Tetra Tech Inc. (TTEK)

Pentair Ltd. (PNR)

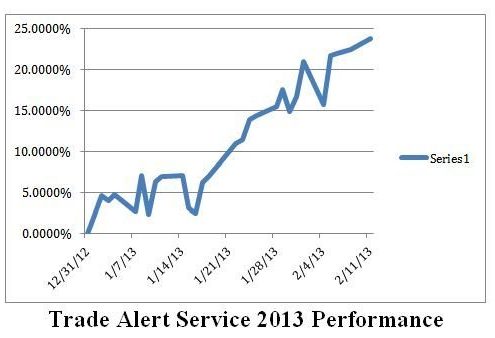

The Trade Alert Service of the Mad Hedge Fund Trader has posted a 23.76% profit year to date, taking it to another new all time high. The 26-month total return has punched through to an awesome 78.81%, compared to a miserable 14% return for the Dow average during the same period. That raises the average annualized return for the service to 36.4%, elevating it to the pinnacle of hedge fund ranks.

My bet that the stock markets would move sideways to up small has paid off big time, as I continued to run sizeable long positions in the S&P 500 and the Russell 2000 (IWM). My substantial short volatility positions are contributing to profits daily. I booked nice profits from holdings in American International Group (AIG) and copper producer, Freeport McMoRan (FCX). I also prudently doubled up my short positions in the Japanese yen.

Is has truly been a month where everything is working. Even my short positions in deep out of the money calls on the (SPY) are breaking. While the (SPY) has been going up, it has not been appreciating fast enough to hurt the position. All told, the last 18 consecutive recommendations of the Trade Alert Service have been profitable. I have eight trades to go to beat this record.

Global Trading Dispatch, my highly innovative and successful trade-mentoring program, earned a net return for readers of 40.17% in 2011 and 14.87% in 2012. The service includes my Trade Alert Service, daily newsletter, real-time trading portfolio, an enormous trading idea database, and live biweekly strategy webinars. To subscribe, please go to my website at www.madhedgefundtrader.com, find the ?Global Trading Dispatch? box on the right, and click on the lime green ?SUBSCRIBE NOW? button.

If you think that the upcoming energy shortage is going to be bad, it will pale in comparison to the next water crisis. So investment in fresh water infrastructure is going to be a great recurring long-term investment theme. One theory about the endless wars in the Middle East since 1918 is that they have really been over water rights.

Although Earth is often referred to as the water planet, only 2.5% is fresh, and three quarters of that is locked up in ice at the North and South poles. In places like China, with a quarter of the world's population, up to 90% of the fresh water is already polluted, some irretrievably so. Some 18% of the world population lacks access to potable water, and demand is expected to rise by 40% in the next 20 years.

Aquifers in the US, which took nature millennia to create, are approaching exhaustion. While membrane osmosis technologies exist to convert sea water into fresh, they use ten times more energy than current treatment processes, a real problem if you don't have any, and will easily double the end cost of water to consumers. While it may take 16 pounds of grain to produce a pound of beef, it takes a staggering 2,416 gallons of water to do the same. Beef exports are really a way of shipping water abroad in concentrated form.

The UN says that $11 billion a year is needed for water infrastructure investment and $15 billion of the 2008 US stimulus package was similarly spent. It says a lot that when I went to the University of California at Berkeley School of Engineering to research this piece, most of the experts in the field had already been retained by major hedge funds!

At the top of the shopping list to participate here should be the Claymore S&P Global Water Index ETF (CGW), which has appreciated by 14% since the October low. You can also visit the PowerShares Water Resource Portfolio (PHO), the First Trust ISE Water Index Fund (FIW), or the individual stocks Veolia Environment (VE), Tetra-Tech (TTEK), and Pentair (PNR). Who has the world's greatest per capita water resources? Siberia, which could become a major exporter of H2O to China in the decades to come.