I tell people at my strategy luncheons that living in the San Francisco Bay area is like living in the future. There is an explosion of high tech innovation going on here, and we locals often find ourselves the guinea pigs for the latest hot products. However, sometimes the future is not such a great place to be.

I learned this the other day when I received a parking ticket in the mail. I didn?t recall finding a notice of violation tucked under my windshield wiper in the recent past, so I looked into it. To my chagrin, I learned that the city is now outfitting its busses with video cameras pointing forward and sideways. The digital recordings are then transmitted to parking control officers sitting behind computers for review.? They issue tickets which are mailed to the registered owner of the vehicles.

San Francisco suffers from one of the worst parking nightmares in the country. The streets were never planned, they just sort of happened on their own during the frenzy of the 1849 gold rush. They were built to handle the traffic of horses and carriages, and later cable cars, not the crush of traffic we get today.

Sky-high real estate prices have driven millions into the suburbs across the bridges over which they must commute. So parking has always been in short supply and it is very expensive. When I drive into the city for a Saturday night dinner, sometimes the parking tab is more expensive than the meal.

Newly minted millionaires from tech IPO?s are now buying vintage Victorian homes, and then retrofitting garages underneath them. Every time this is done, it eliminates another parking spot on the street to make room for the driveway. So while the traffic is increasing, the number of parking spots is actually declining.

The city originally installed the cameras to catch offenders driving in bus lanes during rush hour. When they discovered that the cameras also captured the license plates of illegally parked cars they expanded the program. Last year 3,000 such tickets were issued.

The program has been so successful that the cash strapped city will greatly expand it this year. And with a great San Francisco track record to point to, the firm selling the system is planning on going nationwide. Soon it will come to a city near you. Like I said, sometimes the future is not such a great place to be.

Parking in San Francisco Can be Tight

Global Market Comments

January 30, 2013

Fiat Lux

SPECIAL HIGH YIELD FOREIGN STOCK ISSUE

Featured Trade:

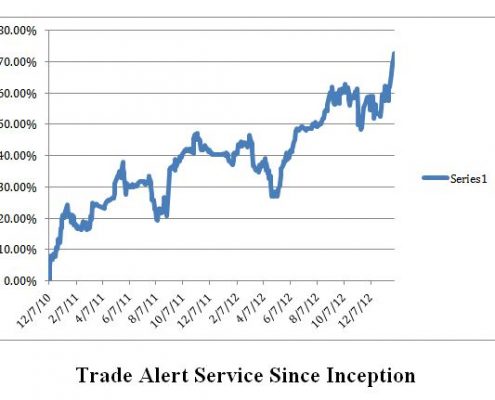

(TRADE ALERT SERVICE POSTS FIVE CONSECUTIVE ALL TIME HIGHS).

(SPY), (IWM), (FCX), (AIG), (TLT), (FXY), (YCS),

(REACH FOR YIELD WITH HIGH DIVIDEND FOREIGN STOCKS),

(FTE), (SAN), (BCE), (ECH), (VE), (AWC)

The Trade Alert Service of the Mad Hedge Fund Trader posted a new all time high today, pushing its two-year return up to 72.67%. The Dow average booked a miniscule 13% gain during the same time period. The industry beating record was achieved on the back of a spectacular January, which so far had earned readers a mind blowing 17.62% profit.

Right after the January 2 opening, I shot out Trade Alerts urging readers to take maximum long positions in the S&P 500 (SPY) and the Russell 2000 small cap index (IWM). Later, I piled on longs in copper producer Freeport McMoRan (FCX) and American Insurance Group (AIG). I balanced these out with aggressive short positions in the Treasury bond market (TLT), and the Japanese yen (FXY), (YCS).

After grinding around just short of the previous top for four tedious and painful months, the breakout was certainly welcome news for many. Once I racked up an unprecedented 25 consecutive profitable trades over the summer, things went wobbly. The Fed unleashed an early, surprise, pre election QE3. Then inventors stopped drinking the Apple (AAPL) Kool Aide en masse. The extent of the tax loss selling after the Obama win was also a bit of a shocker. Maybe I should take longer vacations.

Then the ?aha? moment came. I concluded at the end of November that the multiple political crises facing us were nothing more than hot air. This meant the risk markets were poised to launch multi month bull runs to new all time highs, and I positioned myself, and my followers, accordingly. In the end, that is exactly what we got.

Global Trading Dispatch, my highly innovative and successful trade-mentoring program, earned a net return for readers of 40.17% in 2011 and 14.87% in 2012. The service includes my Trade Alert Service, daily newsletter, real-time trading portfolio, an enormous trading idea database, and live biweekly strategy webinars. To subscribe, please go to my website at www.madhedgefundtrader.com, find the ?Global Trading Dispatch? box on the right, and click on the lime green ?SUBSCRIBE NOW? button.

Global Market Comments

January 29, 2013

Fiat Lux

Featured Trade:

(BONDS ARE BREAK DOWN ALL OVER),

(TLT), (TBT), (MUB), (LQD), (HCN), (JNK), (AMJ),

(REPORT FROM THE INAUGURATION)

It looks like the Great Bond Reallocation of 2013 is real. The Treasury bond market is getting absolutely hammered this morning, the ten-year yield breaching 2.00%. That smashes the 1.40%-1.90% band, which has imprisoned the bond market for the past year.

The immediate trigger was the release of absolute blowout December durable goods figures this morning. They came in at a red hot 4.6%, versus an expected 2.0%. It is clear that companies are ramping up capital investment and hiring, now that the shackles of the presidential election, the fiscal cliff, and the debt ceiling crisis, have been thrown off. We?ll see the other shoe fall on Friday, when the January nonfarm payroll is released, which collapsing weekly jobless claims are predicting will be surging as well.

Cash flows into equity mutual funds and ETF?s for January have already exceeded $55 billion, and will easily close out the month as the largest in history. Yet, the move has been so fast, going up virtually every day this year, that many investors have been left on the sidelines.

Much of this money is coming from cash accounts that were topped up during the tax loss selling at the end of 2012. But there is no doubt that a major chunk is now coming out of bonds. That is what the market is screaming at us loud and clear today.

I don?t expect an immediate bond market crash here. We?ll more likely see a move up to a new trading band of $1.90%-$2.50%. So there is plenty of time to trim back positions. But the long build up here is so gargantuan, it could take 20-30 years to unwind, as it did last time, from 1948. The message here is that you should be slamming every bond market rally for the rest of 2013.

I am posting yesterday?s yields from a range of high yield instruments so I can look back on my own website in five years and see how insanely low they once were.

(TLT) ? 2.66% iShares Barclays 20+ Year Treasury Bond ETF

(MUB) ? 2.89% iShares S&P National AMT-Free Muni Bond ETF

(LQD)? - 3.83% iShares iBoxx $ Investment Grade Corporate Bond ETF

(HCN) ? 4.70% Health Care REIT, Inc.

(AMJ) ? 5.35% JP Morgan Alerian MLP Index ETN

(JNK) ? 6.78% SPDR Barclays High Yield Bond ETF

I am writing this report from the steps of the Capital Building in Washington DC, scratching my notes on the back of a commemorative program with a golf pencil, absolutely freezing my buns off.

I am wearing all the warm clothes I own, including my Marine Corps olive winter weight double knit wool officer?s trousers. These were the pants that successfully executed the retreat from the Chosun Reservoir in Korea in 1950 in -40 degree temperatures, and I?m still cold. Maybe it?s my thin California blood. Perhaps they?re trying to keep us on ice until 2016.

House minority leader, Nancy Pelosi, kindly made available an Air Force jet to transport the many San Francisco Bay Area guests to the inauguration. We paid for it, so why not? To navigate the iron clad security, we were ordered to claim our seats three hours in advance. Hence, the frozen vigil. You would think a $6 billion election would at least get us more comfortable seats.

The upside is that I am trapped here with the top 300 people who run the country, including cabinet officials, White House staff, the Joint Chiefs, the entire Supreme Court, and senior members of congress. You can bet that everyone here has the highest-level FBI clearance and background checks. No Homeland replay here. It is all fertile ground for finding new trading ideas for my readers, especially now that politics has become such an important part of the investment landscape.

I?m in the cheap seats, about 20 rows back from the podium. I can see many of the individuals who I have interviewed for The Diary of a Mad Hedge Fund Trader over the past five years. Has it been that long? Chairman of the Joint Chief?s, general John Dempsey, in on my left. The family values champion, Newt Gingrich, is chatting animatedly with his third wife, Callista. Treasury Secretary, Tim Geithner, claims a prime seat in the third row. My own Senator, Barbara Boxer, sits far to the left of the president. Holy moly! There sits The Man from Uncle, David McCallum. What?s he doing here?

Spread out below us is a vast crowd of fans, estimated at 800,000. It is a festive, party like mood, with many moving foot to foot to stay warm. A half dozen massive jumbotrons line the Great Mall. It is really quite impressive to see masses of people as far as the eye can see. The last time I saw a crowd this big was in the early 1970?s at Beijing?s Tianamen Square, where a million identically dressed screaming Chinese waved little red books and listened, enthralled, to chairman Mao Zedong speak.

Last night, I attended the Red, White, and Blue Ball for the military, the first of 13 such events the president must attend, as it was the easiest for me to get tickets. Barack and Michelle performed the opening dance. Then they switched partners, the president dancing with a young Navy ensign, while Michelle embarrassingly towered over a decorated Army sergeant.

The great revelation here is that the Commander-in-Chief can?t dance worth beans. That?s the consequence of spending too much time poring over law books, and not enough at the Arthur Murray Dance Studio. (slow-slow-quick-quick!).

The administration took advantage of every opportunity for symbolism. Supreme Court Chief Justice, John Roberts, performed the official swearing in within the amply warmed White House on Sunday. His vote decided in favor of Obamacare, the president?s signature achievement during his first term.

The message of Obama?s second inaugural address couldn?t be clearer: No more Mr. Nice guy. He won the election, was never going to run for office again, and it is going to be all hardball from now on. The politician in the next seat told me that he was going to take several more runs at the wealthy, this time on deductions. The carried interest provision, which lets the rich pay only a maximum 15% rate on their earned income, was toast. It looks like I will have plenty to write about during the coming four years. The few Republicans in attendance wore universally sour expressions.

When the ceremony broke up I shouldered myself to the front of the crowd to find Obama?s sole Supreme Court nominee, Sonia Sotomayor. I managed to get her to agree to meet me for lunch in San Francisco next week. I will write that interview up, if I can tear myself away from furiously writing Trade Alerts for this unrelenting market.

I then nudged my way over to say hello to my old friend, former CIA director, Leon Panetta. I complimented him on his portrayal in the Oscar nominated film, Zero Dark Thirty, when he ran the agency during the Osama bin Laden assassination. Does this presage a future career in Hollywood?

He said no, he was retiring for real to his California walnut farm, where he would deal with a different sort of pest. I sympathized, as I owned 20 acres of chardonnay grapes in the next valley over from his spread, near the tiny agricultural hamlet of Gonzalez. Watch out for those glassy winged sharpshooters! I thanked him for the time he permitted me over the years. He responded that the nation was grateful for my year of assistance and insights. Wow! That accolade alone was worth the trip.

On the way out, I was handed a bag of tchotchke to end all. It brimmed with yet another commemorative program, a framed invitation to the inauguration, a pair of gold-rimmed Champaign flutes, cuff links, a lapel pin, souvenir pens and pencils, and a ?2013 Inauguration? baseball cap.

The flight home was not as glamorous as the one on the way out. The C-130 Hercules out of Andrews Air Force Base was not exactly designed for comfort, with everyone strapped in by five point harnesses. So I meandered up to the cockpit and asked the captain, who was old enough to be a grandchild of mine, if he could give a little flight time to a retired Desert Storm pilot. Without hesitating, he said, ?Yes Sir?, and motioned to the copilot, who handed me his headphones and jumped out of his seat.

I flicked off the autopilot, and put the old bird through some gentle, lazy turns. The avionics were amazing, like something out of Star Trek. If we only had this stuff 20 years ago, I might not be missing a disk out of my back. I then proceeded to fly 100 of my neighbors across the Rockies, to Travis Air Force Base and home.

Global Market Comments

January 28, 2013

Fiat Lux

Featured Trade:

(THE RACE TO THE BOTTOM FOR CURRENCIES MEANS A RACE TO THE TOP FOR STOCKS),

(SPX), (SPY), (EWG), (DWJ), (FXY), (YCS), (FXE),

(RUBBING SHOULDERS WITH ?THE 1%? AT INCLINE VILLAGE)

Even the Old Hands, like myself, are somewhat amazed by the strength of the global equity markets this month. The S&P 500 has risen 11 out of the last 12 trading days, and is up almost every day this month. It has been the best January in 18 years.

The first week saw the biggest inflows to equity mutual funds in 10 years. Yet, the market went up so fast, most of the largest investors were left at the starting gate, with the bulk of their new money yet to go into the market. If you weren?t as fast on the trigger as I was, you were left to read about it in the Wall Street Journal, and on your way to the Tombstone career cemetery. Hint to market strategists: that money is still out there trying to get in.

It appears that the race to the bottom for currencies is the race to the top for equities. The reality is that in such a competition, everyone wins. Since the mid November low, the (SPX) has risen by 12%. But Germany (EWG), which has had to carry the dead weight of an appreciating Euro, is up 29%. Japan, where the yen has plunged 16%, has seen the currency hedged equity ETF (DWJ) soar by 31%. My own Trade Alert Service tacked on 21%. For investors, this is a ?heads I win, tails you lose? market.

Certainly, the data flow has been there in abundance to justify such ebullience. Everywhere I look, I see improving PMI?s, increasing orders, rising real estate prices. Some 70% of American companies have, so far, beat earnings expectations.

In the US, business is running on all 12 cylinders (or all 80 kw of lithium ion battery power in my world), with the housing, energy, and auto industries all kicking in at once. Yesterday, weekly jobless claims hit a five year low at 335,000, and this morning the HKSB private Chinese PMI rose to a healthy 51.9.

The new Japanese stimulus efforts are so Godzilla like in proportions that the country?s GDP growth could flip from -3.5% to +3% in a mere two quarters. Do I hear the words ?global synchronized expansion?, anyone? Yikes. It makes the (SPX) at 1,500, and the (IWM) at $89 look positively cheap. Even the Federal Reserve?s own dividend discount valuation model says that the (SPX) should be worth 1,750 here.

Hedge funds are getting creamed, as usual, because their shorts are rising much faster than their longs. Look no further than Netflix (NFLX), which had a jaw dropping open short interest of 45%, but soared by a staggering 71% in two days after their earnings announcement. The pain trade is on. That?s why I have been going commando, without any shorts at all, save in the Japanese yen. Thank goodness I?m not in that business anymore. It is sooo last year?s game.

It is, in fact, a one stock market. But this time, there is only a single stock going down, Apple (AAPL), while everything else rises. A close friend whose market timing I respect told me on Tuesday, when the stock traded at $514, that it would hit a final bottom at $438 in three months. Three days later, and here we are at $437.

When the company announced an increase in cash on the balance sheet of $23 billion, the market took $100 billion off its market capitalization, depriving it of its vaunted ?largest company in the world? status. Go figure. This is truly a classic falling knife scenario, which is better observed from afar.

If you had asked me in September, when Apple was trading at $700, where would the (SPX) be if it fell to $437, I would have answered 1,000. Yet, here we are at 1,500. Here?s an intriguing thought, what if my friend is at least partly right, and Apple goes up from here? My own target of the (SPX) at 1,600 becomes a chip shot, possibly by March. Hey, if Ben Bernanke wants me to pile into risk assets, who am I to argue? I?ve always been a team player.

I think I?ll buy more stocks (SPY), (IWM), sell more yen (FXY), (YCS), and drive the Tesla around the mountain one more time. Maybe I can get the clock up to 500 miles.

If you really want to get a read on how ?the 1%? are faring these days, take a ski vacation to the tony hamlet of Incline Village on the pristine shores of Nevada?s Lake Tahoe.

Each morning, I trekked to Starbucks, one of the few local sources for the Wall Street Journal and the New York Times. There, trophy wives line up to buy their chai tea lattes, all tall, thin, and blonde, wearing designer sunglasses and snow boots, as if produced from a Gucci cookie cutter. The parking lot is jammed with Range Rovers and Cadillac Escalades.

Keeping up with the Jones?s here on fabled Lakeshore Drive can be quite a task, especially when they are populated by such names as Oracle?s Larry Ellison, casino mogul, Steve Wynn, and Saudi arms dealer, Adnan Kashoggi. Ellison alone is thought to have poured $200 million into his mountain retreat. Some of these compounds offer private beach lodgings for bodyguards and dog groomers. Junk bond king, Michael Milken, springs for the cost of the town?s annual Fourth of July fireworks display as it coincides with his birthday.

In the ultimate feat of hubris one upsmanship, one billionaire is converting the profits from his check cashing business to build a $150 million, 36,000 square foot residence that looks like a convention center. He has ruffled the feathers of locals by chopping down every ancient pine and cedar tree on the property to max out the square footage, violating multiple town ordinances. Who knew that cashing checks was so profitable?

In fact, lakefront Incline boasts one of the few neighborhoods in the US that has held up reasonably well during the real estate crash, with six properties changing hands at $1,000 a square foot in the last year. I guess they?re just not making beachfront property any more. Current listings include a 3 bedroom, 2 bath bungalow for $49.9 million and a 8,694 square foot palace for $43 million. If you are looking for a real bargain, check out the five bedroom French castle at www.inclinecastle.com for $22.85 million. As with the large diamond shortage I have written about previously, this is further evidence that the rich are getting richer at an accelerating rate.

The land here was originally owned by one of the Comstock silver barons of the 1860?s. You may recall it as the location of the TV series ?Bonanza? and I?m sure that every female reader will remember ?Little Joe?. A development company subdivided the land during the 1950?s with the intention of creating a Palm Springs in the mountains, spurred on by the completion of Interstate 80 as part of the infrastructure demanded by the 1960 winter Olympics at nearby Squaw Valley.

Devoid by edict of the down market fast food chains that afflict most of America, Incline boasts two municipal golf courses, where at 6,300 feet, the air is so thin that your drive travels an extra 50 yards. If you want a Big Mac, you have to travel down the road to California-- if the road isn't blocked by snow.

Incline is also a Mecca for libertarian millionaires drawn by the absence of a state income tax. Unfortunately, they also possessed the financial sophistication to buy gorgeous mountainside homes, extract cash-out refi's all the way up, invest the proceeds in the stock market, and lose it all in the subsequent crash.

The result has been a meltdown of Biblical proportions in the housing market. Of the 8,000 homes in the village, 400 are for sale at distressed prices and another 400 or more discouraged sellers hang over the market. Brokers report a brisk business in bank owned short sales, foreclosures, and sales on the Washoe County Court House steps for homes worth less than $800,000 at prices down 60%-70% from the 2006 peak.

Jumbo financing is now an extinct species, unless you're happy to pay a 200 basis point premium over conventional loans. So the middle market, where homes are priced from $1 million to $4 million, has ceased to exist. Only cold, hard cash talks here. But high net worth individuals hate tying up capital in an illiquid asset when more attractive options abound. Precious metal coins are especially popular in the Silver State.

I am sad to report that antidepressant addiction among realtors in Incline Village is at epidemic proportions, since they don?t have anything to sell to the 1%. Some of their properties have been on the market so long that snow drifts have collapsed balconies, the local wildlife have moved in, and prospective buyers are scared away by offensive odors. Break-ins by black bears have become a serious problem, leaving basketball sized poops on the living room floor.

Abandoned homes see their pipes freeze and burst, causing irreparable damage. In Las Vegas, foreclosed homes can be easily spotted from the air by their dead lawns and green swimming pools. In Incline the 'tells' are the ten foot high mountains of frozen snow dumped there by snow plows, blocking entry. I guess all real estate markets really are local.

Owners used to be able to cover half their annual carrying costs by renting out their properties during Christmas and New Year's, and for a few weeks in the summer. Unfortunately, that market has collapsed also. There are not a lot of high rollers willing to fork out $10,000 a week for a vacation rental in a recession.

If you are one of the 99%, I?d think again before buying a vacation home any time soon. The only consolation is that conditions are much worse in Las Vegas. The optimists concede that prices could stay down for another decade. The pessimists can already be found at the bottom of the lake with the Godfather's Fredo Corleone, another former resident of Incline Village.

Global Market Comments

January 24, 2013

Fiat Lux

Featured Trade:

(SPX 1,600, HERE WE COME!),

(SPX), (SPY), ($INDU), (TLT), (VIX), (USO)

(WHY THE YEN WILL NEVER RECOVER), (FXY), (YCS)