Much of the fury in yesterday?s nearly 500 point ?melt up? in the Dow was generated by hedge funds panicking to cover shorts. Convinced of the imminent collapse of Europe, the impotence of governments, and the death spiral in sovereign bonds, many managers were running a maximum short position at the Monday opening, and for the umpteenth time, were forced to cover at a loss. Meet the new dumb money: hedge funds.

When I first started on Wall Street in the seventies, you heard a lot about the ?dumb money.? This was a referral to the low end retail investors who bought the research, hook-line-and-sinker, loyally subscribed to every IPO, religiously bought every top, and sold every bottom.

Needless to say, such clients didn?t survive very long, and retail stock brokerage evolved into a volume business, endlessly seeking to replace outgoing suckers with new ones. When one asked ?Where are the customers? yachts?, everyone in the industry new the grim answer.

Since the popping of the dot-com boom in 2000, the individual investor has finally started to smarten up. They bailed en masse from equities, seeking to plow their fortunes into real estate, which everyone knew never went down. Since 2008, the exit from equities has accelerated. There have been over $400 billion in redemptions of equity mutual funds, compared to $800 billion in purchases of bond funds.

Although I don?t have the hard data to back it, I bet the average individual investor is outperforming the average hedge fund in 2011. With such heavy weightings of bonds and cash, how could it be otherwise. While the current yields are miniscule, the capital gains have to be humongous this year, with yields plunging from 4% to 2%.

This takes me back to the Golden Age of hedge funds during the 1980?s. For a start, you could count the number of active funds on your fingers and toes, and we all knew each other. The usual suspects included the owl like Soros, the bombastic Robertson, steely cool Tudor-Jones, the nefarious Bacon, the complicated Steinhart, of course, myself, and a handful of others.

The traditional Wall Street establishment viewed us as outlaws, and believed that if the trades we were doing weren?t illegal, they should be, like short selling. Investigations and audits were a daily fact of life. It wasn?t easy being green.

It was worth it, because in those days, if you did copious research and engaged in enough out of the box thinking, you could bring in enormous profits with almost no risk. I used to call these ?free money? trades. To be taken seriously as a manager by the small community of hedge fund investors you had to earn 40% a year, or you weren?t worth the perceived risk. Annual gains of 100% were not unheard of.

Let me give you an example. In 1989, you could buy a warrant on a Japanese stock near parity, for $100 that gave you the right to own $500 worth of stock. You bought the warrant and sold short the underlying stock. Overnight yen yields then were at 6%, so 500% X 6% = 30% a year, your risk free return. If the stock then fell, you also made money on your short stock position. This was not a bad portfolio to have in 1990, when the Nikkei stock index plunged from ?39,000 to ?20,000 in three months, and some individual shares dropped by 80%.

Trades like this were possible because only a smaller number of mathematicians and computer geeks, like me, were on the hunt, and collectively, we amounted to no more than a flea on an elephant?s back. Today, there are over 10,000 hedge funds managing $2.2 trillion, accounting for anywhere from 50% to 70% of the daily volume.

Many of the strategies now can only be executed by multimillion dollar mainframe computers collocated next to the stock exchange floor. Winning or losing trades are often determined by the speed of light. And as the numbers have expanded exponentially from dozens to hundreds of thousands, the quality of the players has gone down dramatically, with copycats and ?wanabees? crowding the field.

The problem is that hedge funds are no longer peripheral to the market. They are the market, and therein lies the headache. How are you supposed to outperform the market when it means beating yourself? As a result, hedge fund managers have replaced the individual as the new ?dumb money, buying tops and selling bottoms, only to cover at a loss, as we witnessed on Monday.

The big, momentum breakout never happens anymore. This is seen in hedge fund returns that have been declining for a decade. The average hedge fund return this year is a scant 1%. Make 10% now and you are a hero, especially if you are a big fund. That hardly justifies the 2%/20% fee structure that is still common in the industry.

When markets disintegrate into a few big hedge funds slugging it out against each other, no one makes any money. I saw this happen in Tokyo in the 1990?s, when hedge funds took over the bulk of trading. Volumes shrank to a shadow of their former selves, and today, Japan has fallen so far off the radar that no one cares what goes on there. Japanese equity warrants ceased trading by 1995.

How does this end? We have already seen the outcome; that investors flee markets run by hedge funds and migrate to those where they have less of an impact. That explains the meteoric rise of trading volumes of other assets classes, like bonds, foreign exchange, gold, silver, and other hard assets.

Hedge funds are left on their own to play in the mud of the equity markets as they may. This will continue until hedge fund investors start departing in large numbers and taking their capital with them. The December redemption notices show this is already underway. Just ask John Paulson.

Oops! That Wasn?t in the Game Plan

-

How About 2% and 20%?

?Don?t get greedy. Don?t expect much. This is a single and double type of market. You?ve got to play it this way,? said Jeffrey Kleintop, a market strategist at LPL Financial.

The world?s major central banks launched a coordinated attempt to restore liquidity to the financial markets today, sending risk assets everywhere flying. The group moved to substantially lower interbank dollar swap rates, from 100 to 50 basis points. These swaps involve Federal Reserve dollar deposits with the European Central Bank and offsetting ECB Euro deposits with the Fed.

This eases liquidity concerns inside the European money markets. The action included the Federal Reserve, the ECB, the Swiss National Bank, the Bank of Japan, and the Bank of Canada. Clearly, the Europeans do not have a 2008 style systemic collapse on the menu.

The initiative made sure the bear trap that sprung on Monday bit even deeper into short sellers, as it was intended to do. The Dow (INDU) opened up 300, the (FXE) 1.54%, oil $1.50, silver 1.53%,? Australian dollar (FXA) a stunning 2.5 cents, and copper (CU) 12 cents. Bellwether Caterpillar (CAT) popped 5.3%, while my favorite, Freeport McMoRan leapt by 6.3%. The action assures that my call for a Christmas rally in global risk assets plays out, although earlier than I expected.

You really have to wonder what disaster was imminent to force the central bankers? hands. Many suspect that a major European bank was on the verge of going under, possibly a French one. So far, the major casualties have been American institutions, notably MF Global (MF) and Jeffries (JEF). It will take a few months for the truth to leak out.

The coordinated action puts my short term 1,266 target for the S&P 500 within easy reach. The big moves we were seeing in oil and the Australian dollar gave us plenty of warning that Santa Claus might show up early this year, but it is nice to get confirmation.

As for the Euro, the positive benefits are likely to be ephemeral, as the European bazooka is just a short term patch and does nothing to address the continent?s horrific systemic problems. I am therefore happy to keep running my outstanding euro short position.

Looks Live He Arrived Early This Year

For the first time in three years, China (FXI) has cut its prime lending rate by 50 basis points. The timing caught many analysts by surprise, as such move was not expected until the lunar new year in early February. Perhaps recent data showing collapsing exports prompted the Mandarins in Beijing to hurriedly move up the timetable.

The Middle Kingdom?s action is one of the most important developments in financial markets this year, since it represents a major sea change, and is hugely positive for the global economy. It could signal a coming year of additional incremental interest rate cuts and bank reserve reductions designed to keep the country above the ?red line? GDP growth rate of 8%. Observers were also stunned by the magnitude of the cut, 50 basis points, compared to the usual 25 basis point move seen by the People?s Bank of China.

I have been comfortably out of Chinese equities for more than a year, vowing not to return to the mainland until interest rates fell. Now the worm has turned. It may be time to take another look at companies like Build Your Dreams (BYDDF), which has risen by 50% since my undercover visit there last month. Other names like China Telecom, China Mobile, and Baidu (BIDU), are also starting to look interesting.

We Want Lower Interest Rates!

Mark Fisher of MBF Asset Management and Dennis Gartman of the eponymous Gartman Letter joined forces today to launch a new exchange traded note, or ETN, that promises to capture the ?RISK ON? trade. The instrument is designed as an improvement over the old Volatility Index ETF where traders attempted to capture short term market swings.

The note has the following makeup:

longs

48% energy

46% equities

30% foreign currencies

18% agricultural commodities

10% metals

shorts

36% sovereign bonds

14% foreign currencies

While the first day trading volume was large and the timing propitious, with the Dow up 300 points at the opening, the note presents several risks. The exact definition of ?RISK OFF? evolves by the day, and the quarterly resets and rebalancing?s may not be frequent enough to catch the changes. This is why the fund sponsors kept gold out of the mix, which morphed from a ?RISK OFF? asset in the first half into a solidly ?RISK ON? one in the second half, and could well change gender once more.

There is also the problem of rolls, backwardations, and contangos, which have long bedeviled ETF?s in the commodities area, such as with the one for oil (USO) and natural gas (UNG). Tracking error can be problematic for these kinds of funds, which offer carry hefty management and administration fees. This could attract opportunistic hedge funds which are already coining it shooting against existing commodity and leveraged ETF?s.

I wish Dennis and Mark the best of luck with their new endeavor. But another thing that scares me is that new ETF?s often come out at market tops to cash in on market fads. Look no further than the disastrous rare earth (REMX), wind (FAN), and solar (TAN) ETF?s, which plunged not long after launch. Could this mark the end of the ?RISK ON?/?RISK OFF? parameter that has served me so well in recent years? Better to execute your own ?RISK ON?/?RISK OFF? trades simply by reading this letter and taking the trade alerts.

Don?t Follow the Lemmings

My worst fears about the deteriorating state of the US residential housing market were confirmed today with the release of the closely watched Case-Shiller Home Price Index. Nationwide, Q3 delivered a 3.9% decline in home prices, hot on the heels of a whopping 5.8% plunge in Q2. Most markets are at 8-10 year lows with the exception of Detroit, which is plumbing a new 20 year low.

Negative equity cities, and indeed, entire states, are proliferating like wildfire. The data give even more strength to the bleaks forecasts I delivered in my recent November 16 piece on the subject, ?Why Residential Real Estate Will Not Recover.?

The market took no prisoners. Year on year falls were greatest in Atlanta (-9.8%), Minneapolis (-7.4%), Las Vegas (-7.3%), and Tampa (-6.7%). The closest Q3 haircuts were seen in Atlanta (-5.9%), San Francisco (-1.5%), Tampa (-1.5%), and Las Vegas (-1.4%). What is going on in Atlanta? Haven?t they heard that the Civil War is over and they can stop burning the city? The only green figure was seen in Washington DC, which saw a 1% YOY gain, buoyed by an every rising tide of spending by the government and the lobbyists there to grease the works.

There seems to be a generational migration towards rental housing underway. New families are not being formed at past rates, as unemployed adult children living rent free in parents? basements do not exactly make hot marriage candidates. Almost all new construction has been shifted to multifamily dwellings. In San Francisco I have seen condo projects converted midstream into rentals before buildings are even finished to satisfy the new demand.

If you followed my advice years ago and unloaded your dwelling, why should you care about any of this? There is not a chance that the banks have taken a further 25% decline in home prices into their plans. Collapsing house prices brings collapsing banks, but this time congressional gridlock assures there will be no TARP and no bail outs. Goodbye financial system. This is what bank share prices are screaming at us, which look like grim death warmed over.

I would spend more time looking for great deals in the real estate market. But quite honestly, it is kind of a downer spending your Sunday afternoon visiting an open house, only to find the listing agent hanging from the shower head. Rent, don?t buy.

Not Exactly a ?BUY? Signal for Housing

?We?re spending billions in Iraq and Afghanistan. Let?s rebuild America first. If you build us a bridge or a school in West Virginia we won?t blow it up and we won?t burn it down,? said Senator Joe Manchin.

The coming bear trap that I warned about last week sprung this morning on the non-subscribing unwary, triggering panic buying by short sellers in all ?RISK ON? assets. Oil (USO), gold (GLD), silver (SLV), copper (CU), and foreign currencies all moved in lockstep to the upside. The trigger was news that leaked out over the weekend that the International Monetary Fund would make available several hundred billion dollars to bail out the beleaguered European ?PIIGS?.

Never mind that the IMF immediately denied any such moves from multiple offices around the world. The tipoff that something big was coming was the strong performance during Friday?s stock market opening, ostensibly off the back of healthy ?Black Friday? figures, which rapidly faded at the close. I suppose the big money was too busy fighting turkey indigestion to maintain the ephemeral gains. Once the buying started during the Sunday Asian market hours, it was all over but the crying.

With many managers poo-pooing today's move, one has to ask if this is a one day wonder, a much needed 24 hour holiday from the deluge of bad news from the Continent?

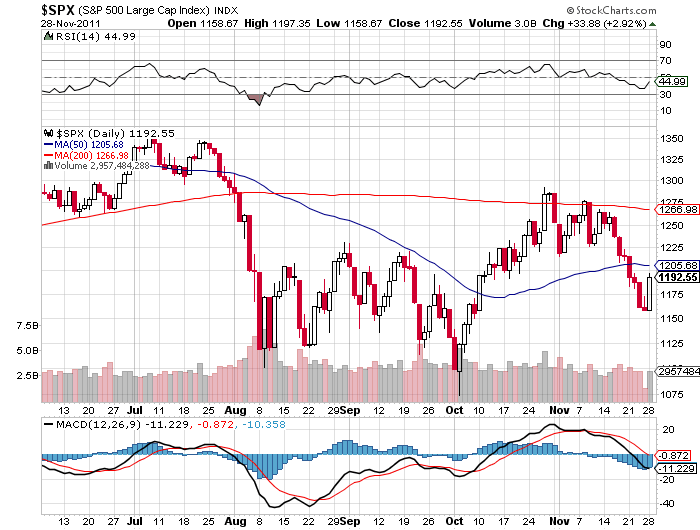

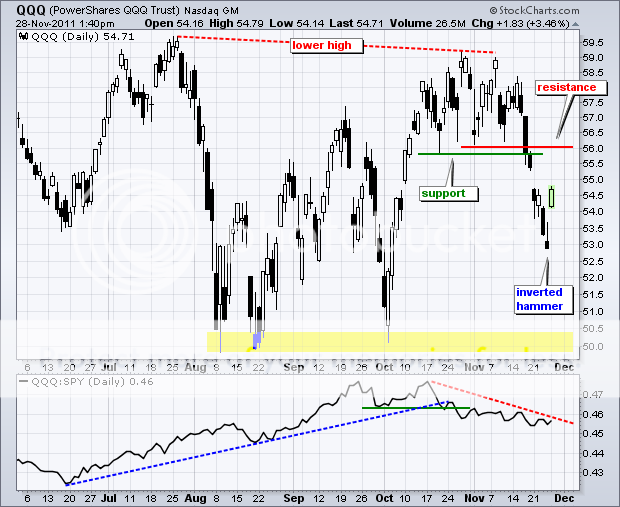

The charts below suggest that this is more than a one day wonder and that there is more juice to go. Certainly breaking the 50 day moving average at 1,205 would be a positive development. At the very least, we should take a run to the old S&P 500 support level at 1,230, which should now pose substantial resistance. Break that, and the 200 day moving average at 1,266 comes into play, close to the three month highs we saw two weeks ago.

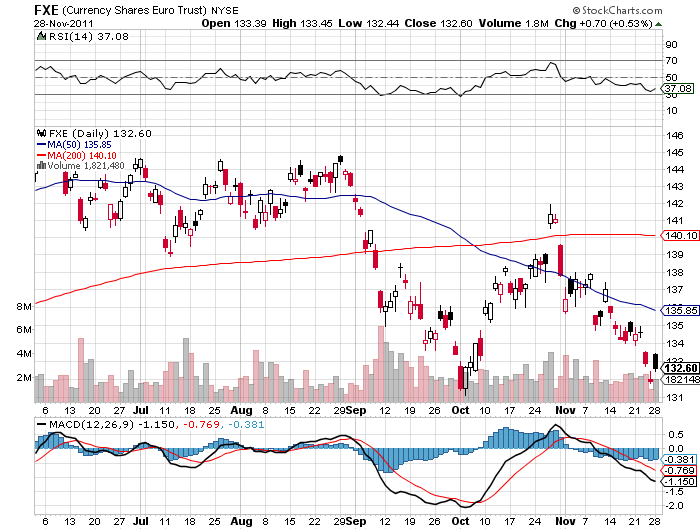

The interesting mover today was the Euro, which hardly moved at all, the ETF (FXE) gained a scant 0.53%. You would think that the troubled European currency would be the primary beneficiary of any rescue attempts. It wasn?t. This feeble response tells me that the Euro is fundamentally flawed, is still the currency that everyone loves to hate, and is looking at more downside than upside. That is why I didn?t join the lemmings this morning scrambling to cover shorts.

Cover Those Shorts!

If you want to delve into the case against the long term future of US Treasury bonds in all their darkness, take a look at Foreign Affairs, the establishment bimonthly journal read by academics, intelligence agencies, and politicians alike, which I am sure you all have sitting on your nightstands. In a well-researched and thought out article penned by Roger C. Altman and Richard N. Haas, the road to ruin ahead of us is clearly laid out.

The US has no history of excessive debt, except during WWII, when it briefly exceeded 100% of GDP. That abruptly changed in 2001, when George W. Bush took office. In short order, the new president implemented massive tax cuts, provided expanded Medicare benefits for seniors, and launched two wars, causing budgets deficits to explode at the fastest rate in history. To accomplish this, strict 'pay as you go' rules enforced by the previous Clinton administration were scrapped. The net net was to double the national debt to $10.5 trillion in a mere eight years.

Another $4 trillion in Keynesian reflationary deficit spending by president Obama since then has taken matters from bad to worse. The Congressional Budget Office is now forecasting that, with the current spending trajectory and last year?s tax compromise, total debt will reach $23 trillion by 2020, or some 160% of today's GDP, 1.6 times the WWII peak.

By then, the Treasury will have to pay a staggering $5 trillion a year just to roll over maturing debt. What's more, these figures greatly understate the severity of the problem. They do not include another $9 trillion in debts guaranteed by the federal government, such as bonds issued by home mortgage providers, Fannie Mae and Freddie Mac. State and local governments owe another $3 trillion. Double interest rates, a certainty if commodity price inflation continues unabated, and our debt service burden doubles as well.

It is unlikely that the warring parties in Congress will kiss and make up anytime soon. It is therefore likely that the capital markets will emerge as the sole source of any fiscal discipline, with the return of the 'bond vigilantes.' They have already made their predatory presence known in the profligate nations of Europe, and they are expected to arrive here eventually. Such forces have not been at play in Washington since the early 1980's, when bond yields reached 13%, and homeowners paid 18% for mortgages. Since foreign investors hold 50% of our debt, policy responses will not be dictated by the US, but by the Mandarins in Beijing and Tokyo. They could enforce a cut back in defense spending from the current annual $700 billion. They might even demand a retreat from our $150 billion a year commitments in Iraq and Afghanistan.

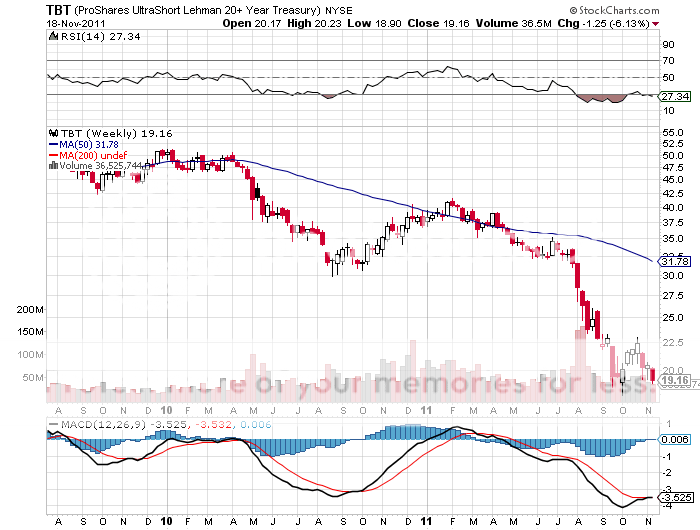

Personally, I think the US will never recover from the debt explosions engineered by Bush and by 'deficits don't count' vice president Chaney. The outcome has permanently lowered standards of living for middle class Americans and reduced influence on the global stage. But I'm not going to get mad, I'm going to get even. I am going to make a killing profiting from the coming collapse of the US Treasury market through buying the leveraged short Treasury bond ETF, the (TBT). I am sticking to my short term forecast for this fund to rise from the current $19.16 to $26, then $32, then $40. And that is despite a hefty and rising cost of carry of nearly 0.5% a month.

Looks Like I Can?t Afford the Next War

?Better to have stop and go, than no go at all,? said hedge fund legend, George Soros, about the choppy prospects for the US economy.