Featured Trades: (MY TAKE ON THE 2012 PRESIDENTIAL ELECTION)

1) My Take on the 2012 Presidential Election. As I write this, I am sitting at the San Francisco consulate of the People's Republic of China, awaiting the issuance of my business visa. Since I will soon be in the neighborhood, I plan to interview some companies that I want to buy on the next upswing in the global financial markets. The Defense Department has asked me to call on my senior contacts in the People's Liberation Army to try and get a read on the Middle Kingdom's next likely president, Xi Jinping. Also, it has been ages since I had a decent Peking Duck.

It seems that whenever you do anything with China, there are always scads of people around. I had to wait in line on cold and foggy Geary Street an hour just to get into the building, pestered by assorted anti-government demonstrators. I'm now inside with my laptop, but my number is A288, and so far they have only gotten up to A24. It looks like I have a long haul.

Therefore, I am going to take advantage of the very rare luxury of some extra free time and speculate at length on the prospects of another president, that of Barrack Hussein Obama. Having spent time in the White House Press Corp under Carter and Reagan, I have some inside knowledge about how whole election process works.

The most important factor to affect global financial markets next year and years beyond will be the outcome of the 2012 presidential election. As card carrying paid up members of the Mad Hedge Fund Trader network, I therefore have not only the responsibility, but the obligation to give you my forecast about how this is going to play out.

To believe that President Obama is anti-business and bad for the economy is lunacy of the highest order. Barack knows more American history than either you or I will ever forget. He is well aware that a poor economic performance has been the primary creator of one term presidents since WWII.

Kennedy was assassinated, Johnson retired early, Carter was demolished by the stagflation caused by the Iranian revolution and the second oil shock, and George H.W. Bush was turfed out by a minor recession, despite winning the first Gulf War. Therefore, the economy had to be Obama's top priority from the first day in office. To do otherwise was for Obama to risk becoming one of the countless jobless himself.

I believe that the economy that Obama inherited was so broken that it will take decades to fix, if ever. It is easy to forget that virtually the entire financial system was bankrupt, the credit markets had seized up, and the ATM's were two weeks away from failing to dispense cash. The government newly found itself a major investor in the country's 20 largest banks, General Motors, and AIG.

But the reflationary measures he was able to get through a reluctant congress were too small to engineer the recovery he needed. The boldness of the moves seen during the Great Depression was sadly absent. Remember, Franklin Roosevelt directly hired 3 million men during his first two years through the Civilian Conservation Corps, immediately preventing 5 million from immediate starvation. This was when the population was less than half of what it is today.

To a large extent, Obama has become the fall guy for the excesses of earlier administrations. The big problems facing the country are long term and structural. The $15 trillion national debt is the product of 30 years of tax cuts and spending increases, primarily for defense.

Our runaway health care costs can be traced by our failure to nationalize health care when the rest of the developed did so in the late 1940's, enabling them to keep their medical expenses to two thirds of ours, with better results. Social security and Medicare were financially flawed from the day they were launched, and modern day politicians were loath to touch them once they became sacred cows. None of these intractable problems are amenable to a quick fix.

All of this leaves Obama's popularity in the polls falling, going into one of the most acrimonious and hard fought elections in American history. Obama has become the Jackie Robinson of American politics, the first African-American to play in major league baseball. The better the job he does, the more people hate him. Robinson died at 53, largely due to stress.

Is Obama the Jackie Robinson of American politics?

-

If he can't pull out of his tailspin, I believe the president will withdraw his candidacy, and throw it open to other contenders. That is what Lyndon Johnson did in 1968 due to declining health and an unpopular war. When you try to push history forward too quickly, sometimes it bites you back. The election of Obama was such a generational leap in so many ways that some retracement was inevitable. Blame it all on the excesses of the previous administration, which were many. After all, the Democrats don't want to commit suicide.

There are two potential candidates. I believe that Hillary Clinton was given the safe position as Secretary of State precisely to hold her in reserve as a backup candidate in 2012 in case something happened to Obama. People of both political parties agree that she has done a spectacular job managing America's role in the Arab spring, providing military support to drive Khadafy out of power, and keeping the Chinese buying out gargantuan debt issues. But as a presidential candidate, she is not without baggage.

Who wins This Contest?

-

The dark horse in the race is Michael Bloomberg, the highly popular mayor of New York. If there was ever a politician who can change his spots, it is Michael. A lifetime Democrat, he switched parties to win as a Republican in a Democratic town. He could flip flop again, or bolt to form a third party. I have known Michael since he went door to door on Wall Street seeking funding to start his data business to replace the aging Quotrons. A more quixotic mission there never was.

Yet he succeeded wildly, making himself a billionaire many times over, proving his credentials as an entrepreneur and a businessman, and creating an urban legend. An early adopter, I have personally paid him over $1 million in fees for the past 20 years for his versatile machine, as have most other hedge fund managers.

Where do the Republicans stand in all of this? They have to spend a year appealing to the conservative base, attempting to outmaneuver each other in a marathon to the right. Then they only have two months to swerve back to the middle to win the election. They have a somewhat hopeless task, and is why we have so many two term presidents.

What Rick Perry harangues about is popular in libertarian, oil based Texas, but will they wear it in Ohio, Washington, or Florida? I think not. Mitt Romney's Mormon origins leave his party's Christian base cold, and he is unelectable without them. Both these men are presenting themselves as modern day incarnations of Ronald Reagan. But I knew Ronnie for decades, first as an aspiring governor of California, and a Reagan they are not. I can't imagine Perry telling me an off color joke.

The rest of the field are just 'also rans'. On top of this, the power of the presidency as a campaign tool is not to be underestimated. Air Force One versus a chartered bus? Give me a break.

Or This One?

-

There are a few imponderables to consider in 2012. Some 4 million immigrants became naturalized US citizens in four years, who have a very high turnout ratio. Given anti-immigrant rants in states like Arizona and Alabama, you can count on almost all of these going Democratic. Another 4 million millennials will have reached voting age. Obama managed to get this group to turn out in unprecedented numbers in 2008. He didn't run in 2010, and they failed to show. Will they return in 2012? Another demographic trend that has been ongoing for 50 years is the migration to the sunbelt, which favors the Republicans. I don't know how all of this nets out, but I bet Carl Rove does. Ask him.

Or This One?

-

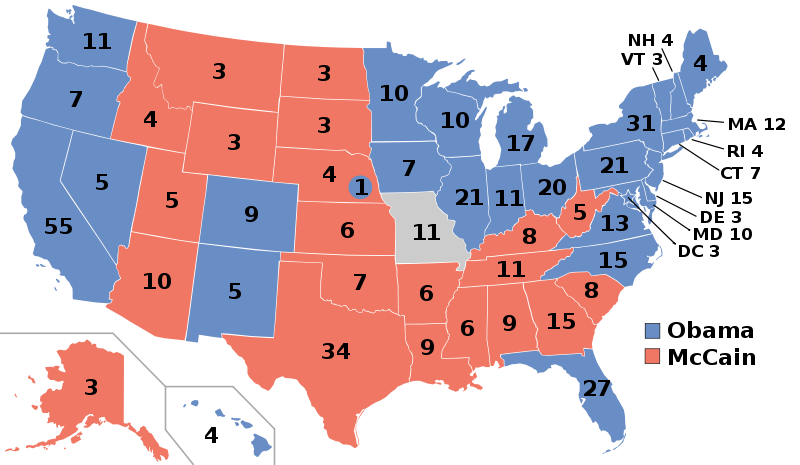

In the end it will come down to Ohio and Florida again, as it has in the last three elections. Few remember that Obama won by a landslide in 2008, taking some 365 electoral votes compared to the 270 needed to win. The Democrats could lose a staggering 94 votes and still take the presidency.

That means losing the entire Midwest and some of the East, including North Carolina (15), Virginia (13), Indiana (11), Missouri (11), Maryland (10), Colorado (9), Iowa (7), Connecticut (7), West Virginia (5), and New Mexico (5), and still seeing blue ties (or pant suits) in the White House. In the end it will come down to Ohio and Florida again, as it has in the last three elections.

This is a race that is wide open and could go in any direction. That is why you are seeing such a plethora of Republican candidates. In politics, 14 months is 14 centuries, and anything could happen by November 6, 2012. New candidates will enter the fray, while old ones fade away. Rick Perry may have already peaked. The economy might even recover, or at least fail to melt down. After all, who heard of Barrack Hussein Obama 14 months before the last election? For those of us who trade for a living, this will be one giant unknown to pile on top of all the others, right up to election day.

Well, they're up to number A285 now, so it's time to fold up the laptop and get in another line. I'm sure at least half of you are disappointed that I can't go on, the other half, not so much. See you in Shensen.

Or Will Obama Pull a Johnson?

-

'An employer now has access to, not only cheap software, cheap automation, cheap robots, cheap labor, but cheap genius as well,' said Tom Friedman, a columnist for the New York Times.

'For the last 20 years we used to trade inside a trend. There's no trend anymore. The day to day trade right now is what is the soup du jour, what is the trade of the day,' said Scott Bauer, a floor trader on the Chicago Mercantile Exchange.

Featured Trades: (WHY I COVERED MY GOLD SHORT), (GLD)

1) Why I Covered My Gold Short. I have to tell you that I was just not feeling the love from my gold short when I came into the office Wednesday morning. You would have thought that, with a double top on the charts in place, there would be a move of the same ferocity we saw two weeks ago, when the barbarous relic cratered $220 in days. But this time, when gold down $132 in 24 hours, the momentum suddenly vaporized.

There are now three possible scenarios for the yellow metal. The double top at $1,920 holds, and we collapse to $1,500-$1,600. We continue to bounce around like a ping pong ball between $1,700-$1,900. We break out to a new high to $2,000. Notice that my October puts, which I strapped on when gold was trading at $1,835, losses money in two out of three of these possibilities. Hence, time to heave-ho the gold short.

Hard earned experience has taught me that you never want to be short the precious metals whenever European Central Bank President Jean Claude Trichet speaks. He never fails to disappoint, befuddle, or outrage traders, giving new life to whatever flight to safety trades are out there.

There also is a risk that traders will reach for their barf bags once they hear Obama's jobs speech, triggering another globalized 'RISK OFF' leg. In any case, he will never get anything through the Tea Party dominated House of Representatives, so what we're likely to get is a round of campaign posturing. Many Republican congressmen have already indicated that they won't even attend. It is all moot.

I have done three gold trades this year, all from the short side, and all profitable. This is despite the fact that my long term belief is that it will eventually hit the old inflation adjusted high of $2,300. The spikes in this market are clearly more visible that the bottoms, which tend to be slow, grinding affairs. The next big call in this market will be what to do if we hit $1,920 again; to sell once more, or go long. When I figure this one out, I'll let you know.

The market gave me a gift on my exit, with gold plunging to $1,790 off the back of some momentary strengthening in the stock market. I whipped out a trade alert that enabled my Macro Millionaire followers to book a quick 28% profit on their puts, boosting their year to date return by 72 basis points. Better not to swing for a home run this time, and settle for a single.

For those who wish to participate in Macro Millionaire, my highly innovative and successful trade mentoring program, please email John Thomas directly at madhedgefundtrader@yahoo.com . Please put 'Macro Millionaire' in the subject line, as we are getting buried in emails.

-

-

Featured Trades: (HEDGE FUNDS RAMP UP MARKET SHORTS), (SPX), (SPY)

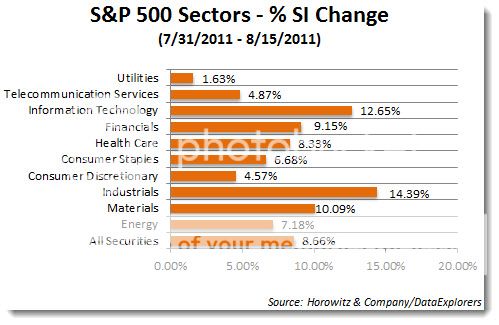

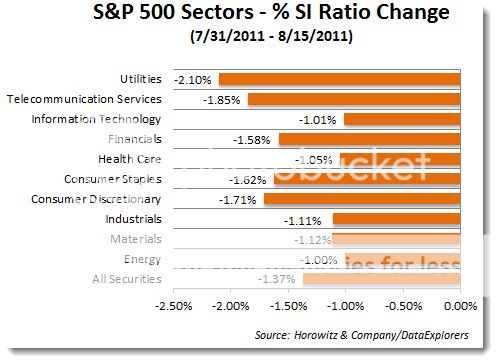

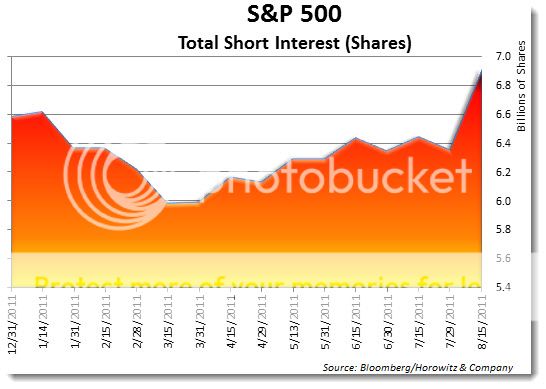

2) Hedge Funds Ramp Up Market Shorts. Hedge funds have gotten much more aggressive on the short side, as recent data show, with enviable results. According to Data Explorers, and independent research boutique, emboldened market timers and macro players increased their shorts in industrial stocks by 14.39% from July 31 to August 15, information technology by 12.65%, and materials by 10.09%. Industrials' share of total stock market capitalization fell by 1.11% during the same time frame, information technology dropped by 1.01%, and materials pared 1.11%.

This large scale selling, driven by an economic outlook that is fading fast, no doubt was a major contributor to the hellacious volatility we saw in August. Freshly sated, traders will no doubt come back to this well again, keeping volatility high. This is creating the enormous swings we are seeing in the market on an almost daily basis. The bad news for the rest of us is that hedge fund short positions are still only a tiny fraction of what we saw in 2008. There is plenty of dry powder to ramp them up much more from here.

I continue to believe that we will see some sort of 'RISK ON' rally in the Autumn, which might take us up 10%-20% from the August 8 low. There is at least a 50% chance that the bottom is in for this move, and that we rally from here, but in a highly choppy stop and start fashion. If I'm wrong, it will be by only a few dozen points into the 1,000 handle for the S&P 500 (SPX), (SPY). For the big crash, you are going to have to wait until next year.

What will be the driver for the next leg up? Corporations will once again deliver outstanding quarterly earnings for the season that begins at the end of September. The Fed will pour another gallon of gasoline on risk assets in some form, such as a 'twist' policy towards the debt markets. The esteemed government agency always seems to have some new tricks up its sleeve these days, so we may see some of those too. Finally, the bulked up shorts themselves will provide some ample tinder to get this fire going to the upside.

The longer term view, whether this rally lasts for weeks or months, is that this will be the last chance you have to unload equities before a much larger sell off in 2012. No matter how you cut it, the presidential election is not shaping up to be an equity friendly event, and it promises to drag out for another tortuous 14 months.

-

-

-

Hedge Fund Traders Are Getting More Aggressive With Their Shorts

Featured Trades: (IS THE SECOND SHOE ABOUT TO DROP ON THE EURO?),

(FXE), (FXF)

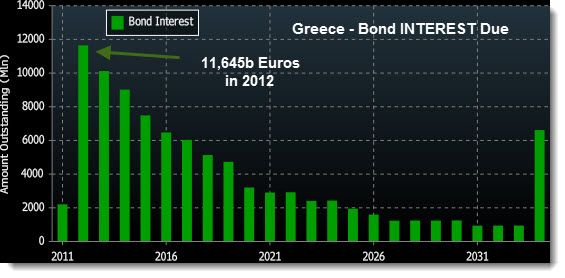

1) Is the Second Shoe About to Drop on the Euro? There were two pieces of news today that enabled the Euro (FXE) to benefit from a much needed relief rally. First, the German Supreme Court ruled in favor of the legality of the Greek bailout package. Then the Italian Senate approved a $70 billion austerity package that is a prerequisite for the rolling over of the country's existing debt.

With news this dramatic, you would expect the Euro to launch a major rally of three, four, or even five cents. But the best the damaged and suspect currency managed was a feeble one cent rally.

It is an old trader's nostrum that if you throw good news on a stock and it fails to go up, then you sell it. The European currency is starting to meet that qualification.

It's not like there is a shortage of reasons to dump the Euro. The sovereign debt crisis and the conjoined banking crisis have sent Europe's economy into a tailspin. GDP forecasts for the continent are rapidly crash landing down to zero.

It is only a matter of time before European Central Bank President Jean Claude Trichet admits that he committed a major policy error by raising interest rates for the Euro twice in the first half of the year. The inflationary fears that prompted him to stumble badly have proven to be a phantom. Oil alone has fallen by $25 since the last rate hike, and many other key commodities are now showing losses for the year.

The next move on interest rates has to be down, possibly as far as to zero. American interest rates are already at zero and can't go any lower. This is all hugely Euro negative and dollar positive.

Now that the Swiss franc (FXF) is out of the picture as a viable short, hedge fund traders are trolling for fresh meat to kill. Newly invigorated by the overnight fortune they made on the Swiss franc, the focus now has to be shifting to the Euro.

The break of the 50 moving average on the charts is signaling to technicians that we may be about to break out of the $1.40-$1.46 range that has prevailed all year to a new, lower $1.36-$1.40 range. Demolish that, and we could be eventually headed towards $1.17, and even parity against the buck.

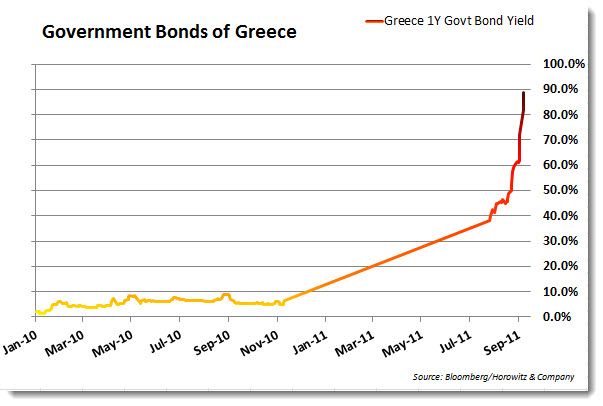

What will be the headline that finally blows down the European house of cards? The inevitable default of Greece, which after looking at the charts below, could happen at any time, with or without a bailout.

-

-

Brussels, We Have a Problem

'Go where the growth is, and where the debt isn't, and that is emerging markets,' said David Donabedian, the chief investment officer of Atlantic Trust Co., the private wealth management arm of Invesco.

'The Unites States government is in the business of securities manipulation,' said Jim Grant of the research boutique Interest Rate Observer.

Featured Trades: (AUGUST NONFARM PAYROLL TORPEDOES MARKET RALLY)

2) August Nonfarm Payroll Torpedoes Market Rally. Economist and market strategists alike were stunned by the August nonfarm payroll report showing zero job growth. The headline unemployment rate stayed unchanged at 9.1%.

The reports for June and July were revised down a gut punching 58,000. Employers obviously reacted to the damage the Tea Party was threatening to inflict on the global economy with a Treasury bond default by instituting an immediate hiring freeze.

The figures were further muddled by conflicting cross currents. The Verizon strike cut 45,000 from the reported total. At the same time, a return of state employees to work in Minnesota, which had been shut down over a budget impasse, boosted the figures by 22,000.

Health care lost 30,000 workers, government 17,000, and construction 5000. Professional and business services gained 28,000 jobs. What is really frightening here is that only 4,700 temps were hired, which normally lead the recovery stage in the economic cycle.

Risk assets everywhere fled in terror, while a monster rally launched in the bond markets. Yields for the ten year Treasury bond reached a new intraday low in the mid 1.90%'s, while the 30 year was seen well below $3.50%.

For me, the real stunner in the report was the revision to July government job losses up to an amazing 71,000. Clearly what is happening here is that as short term government stimulus programs run out, public workers are being let go in record numbers.

Congress deadlocked and the House is ideologically handcuffed, so there is no chance that any of these job creating programs will be renewed. This is going to get a lot worse before it gets better.

Will this cause me to lower my 2% GDP forecast for 2011? I don't think so. But it will force some permabulls, paid cheerleaders, and Kool-Aide drinkers to revise down their own overoptimistic targets from 4% and 3% down to my own more realistic and greatly subdued figure. Hint: This is not good for stock prices.

What organizations are currently advertising the greatest number of job openings? The US Air Force, at 134,000, followed by Taco Bell, the National Guard, and Staples. Looks like you better sharpen up your target practice or your Spanish if you want that paycheck bad enough.

Oops. There Goes the Economy

-

I Think I Have a Job in My Sights

'Patience is not a word that is fixated on two year election cycles. China has a five year plan. We have a five minute plan,' said Steven Roach, former non-executive chairman of Morgan Stanley Asia.