Featured Trades: (THE HARDEST JOB IN THE WORLD), (FXI), (TLT)

3) The Hardest Job in the World. US Vice President, Joe Biden, currently has the toughest job in the world. He has gone to China, hat in hand, to convince the country's leaders to buy even more US Treasury bonds than they already have. This he must do with ten year yields approaching 2.0%, delivering some of the largest negative yields in history. He is in effect saying, 'give me a dollar, and I promise to give you 90 cents in ten years.' Such a deal!

I'm sure that Joe's lifetime spent hobnobbing with local politicos in union halls, PTA's, and Boy Scout troops in rural Delaware has left him ill prepared for the task at hand. They used to say you could walk through Joe's deepest thoughts and not get your ankles wet. How he became the second most powerful man in the world, I will never know. Like string theory and Einstein's theory of relativity, politics can be difficult to fathom. Yet, he is going up against some of the most brilliant technocrats the world's oldest civilization has to offer.

China is already the planet's largest buyer of Treasury bonds, taking down up to 50% of the monthly auctions, its total holdings approaching $1.3 trillion. It will continue on the bid. You can forget about all of those Armageddon scenarios where China dumps its holdings, sending interest rates soaring. There is simply nowhere else to go with adequate size and liquidity. China is going to have to recycle its $250 billion a year bilateral trade surplus into dollar instruments of every description. Its total reserve now exceed $3 trillion, the largest in history

However, new buying of alternative assets has already begun. The recent run up in gold has Chinese fingerprints all over it. The Middle Kingdom was also a major player of the European refi's, no doubt attracted by sky high double digit yields. Much of the strength of hard assets last year, such as with copper, came from Chinese buying, not for consumption, but to use as a financial asset. It is also attempting to spread the wealth in a more subtle fashion through buying of minority stakes in many of the world's multinational blue chips.

I wish Joe the best of luck in his venture. Just watch out for the Peking Duck state dinner. This is when the greatest number of elderly American visitors die of heart attacks, according to an embassy official I know there.

-

-

Maybe I'll Have the Fish

Featured Trades: (LESSON OF THE CRASH OF 2011),

(SPX), (OIL), (COPPER), (GLD), (PALL)

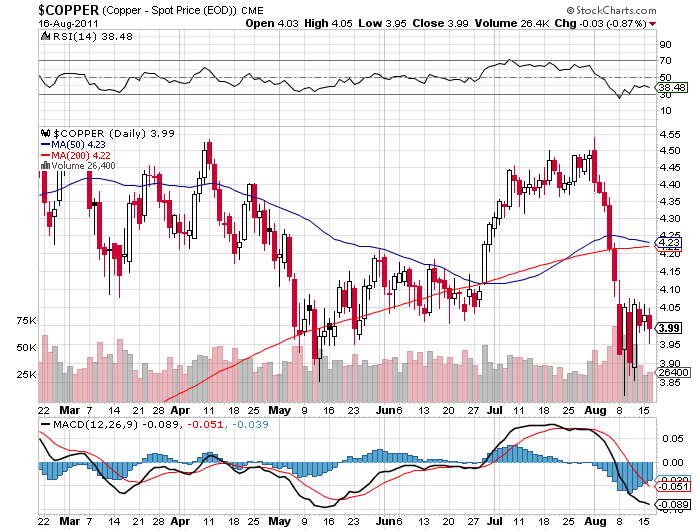

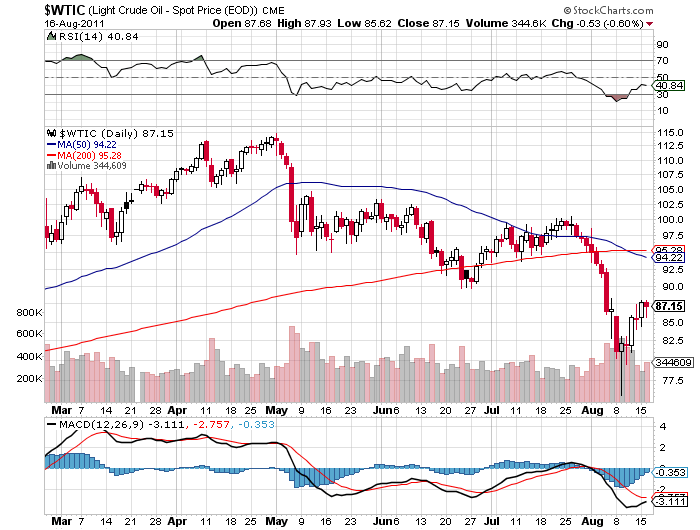

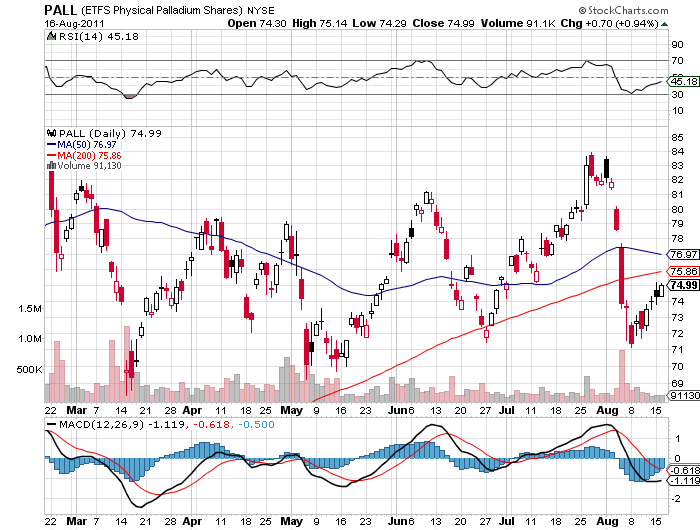

2) Lessons From the Crash of 2011. The Dow only moved double digits today, down 78 points, finally delivering the sort of quiet, somnolescent, low volume day one would normally expect during the dog days of August. Last week was one of the most violent in market history and traders are bracing themselves for more. So let us take pause to analyze what we got right in the melt down, and what went horribly wrong.

Running small, limited risk positions, such as through short dated options, certainly saved the day. The source of endless abuse when the bull was running, my caution is now the reason we are still in business. While losses are painful, they were anything but life threatening.

Followers of my trade mentoring program, Macro Millionaire, are up 24% since inception. This is well down from the 42% gain we saw in the spring, but it still places us in the top 1% of all hedge fund managers. What is most important is that we live to fight another day. I know many top hedge fund managers who would kill for these returns right now (sorry, John).

My view that the current market multiples were a myth was truly vindicated. I was getting tired of the endless procession of permabulls who kept insisting that at a 15 times multiple, the S&P 500 was cheap. The last time I heard this was in 2000, when NASDAQ multiples went from 100 to 50, on their way to 10. Before that, it was in Japan in 1990, when multiples went from, guess what, 100 to 50 on their way to 10. Some 20 years later, Japanese multiples remain at 15. Here we are at an 11 times multiple in the US, and sell side brokers are still insisting that equities are cheap.

When I first entered the stock business in the seventies, typical equity earnings multiples were in the seven to eight neighborhood. If you performed exhaustive stock screens, which then involved paging through endless reams of 10-k's, newsletters, and tip sheets printed in impossibly small type, you could occasionally find something at a two multiple, the kind Graham and Dodd wrote about as 'cigar butts with one puff left.' Anything over ten was considered outrageously overpriced, fit only to be sold on to retail investors. This is when the prime rate was at 6%.

The sell off we saw this month is consistent with my long term view that we are permanently downshifting from a 3.9% to a 2%-2.5% growth rate, and the lower multiples this deserves. If you had any doubts, take a look at the $16 billion in equity mutual fund outflows last week, versus the tens of billions sucked in by bond mutual funds. I'm convinced that if the circuit breakers had not been installed, we would have been visited by another four digit instantaneous flash crash.

Another of my theories was also tested and found to ring true, that when the 'RISK OFF' light starts flashing red, there is no place to hide. While the S&P 500 (SPX) collapsed by 22%, oil (USO) was down 25%, and copper (CU) gave back 18%. Palladium (PALL) was pared by 20% in a single day. Gold (GLD) performed like a star, but don't kid yourself that it is a store of value offering a safe haven. All of the fundamentals true today were valid during the 2008 crash, when the barbarous relic gave back 32%. Gold has behaved well so far because the current crisis wasn't bad enough. The next one will be.

The flight to safety assets, bonds, the dollar, Swiss franc, and yen, did well, as I expected. The outlier here was the Treasury bond market, which saw yields plummet to new 40 year lows of 2.03%. These returns blow the mind of virtually every investment professional in the industry. How the purchasers can accept a real yield of negative 1% for a decade is beyond me and everyone else. But as the legendary economist, John Maynard Keynes, used to say, 'markets can remain irrational longer than you can remain liquid.' He should know, as he went bust twice in his career.

-

-

-

Ignore the 'RISK OFF' Signal and You Will Get Hurt

Featured Trades: (THE US IS TURNING INTO JAPAN)

1) Brace Yourself. The US is Turning into Japan. (SPX) As a silver tsunami of 80 million baby boomers retires, they will be followed by only 65 million from generation 'X'. The intractable problems that unhappy Japan is facing will soon arrive at our shores. Boomers, therefore, better not count on the next generation to buy them out of their homes at nice premiums, especially if they are still living in the basement and not paying any rent. They are looking at best at an 'L' shaped recovery, which is a polite way of saying no recovery at all.

What are the investment implications of all of this? Get your money out of America, Europe, and Japan, and pour it into China, India, Brazil, Mongolia, Indonesia, Mexico, Malaysia and other emerging markets with healthy population pyramids. You want the wind behind your investment sails, not in your face with hurricane category five violence. Use any serious dip to load the boat with the emerging market ETF (EEM) and individual emerging market ETF's.

-

The 'Graying' of America Bodes Ill for Investors

-

-

-

-

Featured Trades: (A VISIT TO THE INSANE ASYLUM)

2) A Visit to the Insane Asylum. Watching the ten year Treasury bond tickle a 2.00% yield yesterday, I thought it would be propitious to revisit the insanity that is going on in this market.

Historically, ten year bond yields matched the nominal GDP growth rate. So an average 3.5% GDP growth for the past decade added to a 2.5% inflation rate gave you a bond yield trading around 6%. Today the math is from a different universe. A 2.0% GDP rate added to 0% inflation is giving you the 2.0% yield you see glaring at you from your screen today. The market is essentially betting that inflation will remain at zero for another decade.

There is one honking great problem with this scenario. Rampant inflation has already broken out in great swaths of the global economy. Anyone who purchases precious metals, commodities, energy, food, health care, user fees of any kind, or a college education can tell you, not only that inflation is alive and well, it is flourishing. Residents of China (FXI), India (PIN), and Turkey (TUR) and other emerging markets, and the commodity producing countries of Australia and Canada, can also tell you a lot about inflation.

The last place you can expect this stealth inflation to appear is in government statistics, a deep lagging indicator. And don't ever expect inflation to show its ugly face where you want it the most, in your wages, pension benefits, or 401k returns.

Given the strongly positive yield curve, where 30 year yields are trading at a 3.5% premium to overnight rates, this is probably the best time in four decades to sell Treasury bonds. With rates this low, the market is not telling the government that it is issuing too much debt, but that it is not issuing enough. Personally, I don't understand why the Treasury isn't floating more paper at the long end. Maybe it has something to do with politics. At this point I have to replay John Maynard Keynes most famous quote, which I keep glued to my computer monitor, 'markets can remain irrational longer than you can remain liquid.'

So, I wouldn't be betting the ranch on Treasury bond shorts just yet. Better to limit yourself to cleaning out any last remnants of Treasury longs from your portfolio. When the turn does come, you'll be wanting to jump with both feet into the 2X leverage short Treasury ETF (TBT), and day trade its younger, more athletic cousin, the 3X (TMV).

-

-

Meet Your New Bond Fund Manager

Featured Trades: (THE EURO IS READY TO TURN)

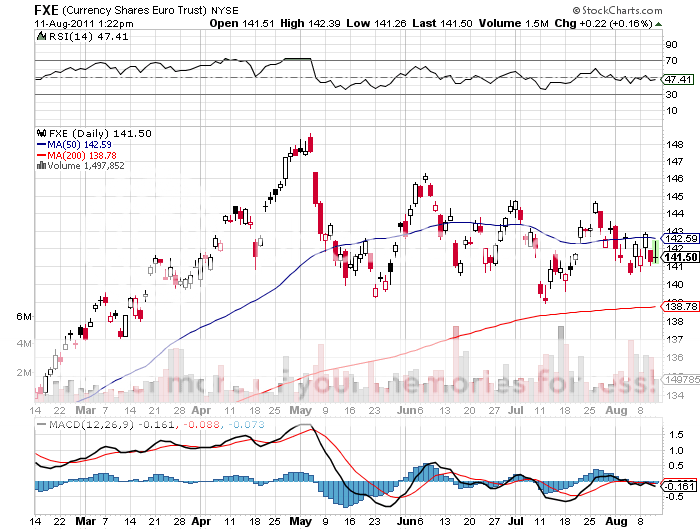

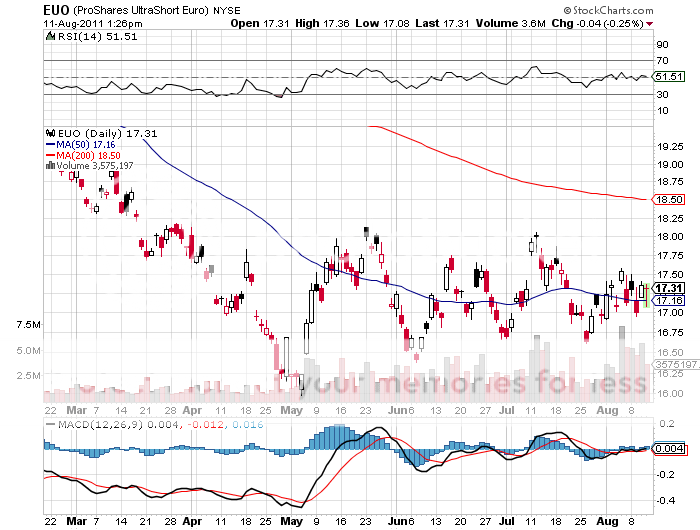

1) The Euro is Ready to Turn. I believe that we may be about to witness a sea change in the value of the Euro versus the US dollar.

Since January, the Euro has been beating the daylights out of Uncle Buck, as European interest rates have been rising, while those for Uncle Buck have been falling. Trading 101 dictates that widening spreads produce strong currencies.

Never mind that the European Central Bank has been raising rates for all the wrong reasons. President Jean Claude Trichet kept an incredibly narrow focus on the rising price of oil, commodities, gold, and food, while ignoring the other gale force deflationary headwinds facing the global economy. This astigmatism delivered two 25 basis point interest rate hikes, while the economy was clearly heading into the dump.

You can blame the conflicting mandates of the two central banks. The Federal Reserve is required to simultaneously fight inflation and maintain full employment. The ECB need only worry about inflation. This is partially rooted in the German influence over the ECB, where memories off Weimar style hyperinflation during the 1920's is still strong. This can lead to sharply diverging policies between the two central banks that can create great opportunities for traders.

Now commodities prices are in free fall, and these decisions to tighten are not looking like such a great idea. In the meantime, interest rates for the greenback have been pegged at zero for two years as a result of the Federal Reserve's latest emergency moves. They can go no lower. Therefore, the spread is about to move in favor of the dollar, possibly dramatically so. This is dollar bullish and Euro bearish.

Take a look at the charts for Euro/dollar and it's clear that they have been hinting as much. There are four undeniable declining peaks from $1.49 trending downward, suggesting that worse is to come. We are already through the 50 day moving average. The no brainer target here is the 200 day moving average at $1.38.

If you get another pop up to the $1.44 handle on a wave of 'RISK ON' buying, it might be worth strapping on short Euro bets like the (EUO), a 2X leveraged ETF that profits from a falling Euro. Buying puts on the (FXE) would also work. You might be in for quite a rise.

-

-

Is Uncle Buck Ready for a Comeback?

Featured Trades: (USE THE MELT DOWN TO LOAD UP ON INDIA),

(EEM), (PIN), (INDY), (EPI)

2) Use the Melt Down to Load Up on India. Take a look at the chart for the emerging market ETF (EEM) below and you will be surprised to see how well it has held up in the recent collapse. This is in sharp contrast to its performance during the 2008 crash, when emerging markets outperformed developed markets to the downside by a factor of two or three.

So I thought it would be useful to spend some time with Sunil Asnani, portfolio manager at Matthews International Capital Management in San Francisco. He argues that you want to buy these markets during periods of market instability. Historically, they take the biggest hits, but then bounce back the hardest. For example, the India market (PIN) roared back 250% after the 2008 melt down, versus only a 104% move for the S&P 500. This is what you would expect for an economy that has grown 6%-7% a year for the past two decades, nearly double the American rate.

Asnani addresses the opportunities in India from a unique perspective in that before obtaining his advanced degrees, he was the Superintendent of the Kerala Police Department. He believes that India's growth can accelerate from this level. India is first and foremost an infrastructure play. The massive capital investment program that China is now completing is only just getting started in India. Spend six hours a day between meetings in Mumbai traffic jams, and you can understand the need. Another round of reforms and deregulation is poised to unleash India's incredible entrepreneurial culture. It also is carving out an important niche at the bottom end of the global car market.

India is on the verge of becoming the next China. Runaway wage increases of 20% a year for trained staff are rapidly pricing the middle Kingdom out of labor intensive industries. The bill will also start to come due for China's 30 year old 'one child' policy in about five years, which will create massive demographic headwinds for further growth. India, on the other hand, has one of the world's most enticing demographic pyramids, and will remain a young country for decades to come. That brings an ever rising tide of customers. At $3,500 per annum, India's per capita GDP is only half of China's.

The Mumbai stock exchange has 5,000 listed stocks, but liquidity is poor and short selling is rare. While countless hours spent on the phone with tech support in Bangalore might convince you this is first and foremost a software country, it only accounts for 5% of GDP and 1% of the workforce.

The world's largest democracy does have its weaknesses. Some 70% of its oil is imported, so any sharp rise in the price of crude has a huge negative impact on the economy. Asnani reckons that each $10 increase in the price of oil chops 30 basis points a year off of GDP growth. Only 2% of the population pays taxes, creating perennial budget deficits. While the country's higher education is world class, elementary education is backward. Perhaps 50% of the rural population is unable to read or write. Inflation, now officially at 8%, but realistically probably over 12%, is a constant risk.

Many of these price increases are tied to the rising price of food. India has one of the world's most primitive agricultural sectors. Its productivity here is 1/3 of China's and 1/5 that of the US, thanks to ancient land holding practices, primitive technology, and a backward distribution system. One third of India's food production perishes to rot and rats before it reaches the end consumer.

Talking to strategists at the major hedge funds, India is where they are happiest making their 20 year bets. So you might want to take a look at the leading India ETF's, (PIN), (INDY), and (EPI).

-

-

-

-

You Would Rather Invest Here

-

Than Here

-

See Any Potential Markets Here?

Featured Trades: (TREASURY 30 YEAR AUCTION BOMBS)

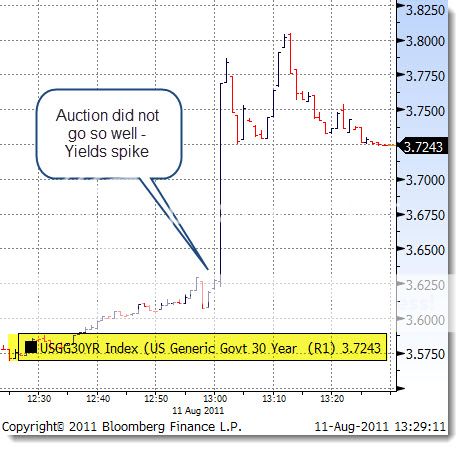

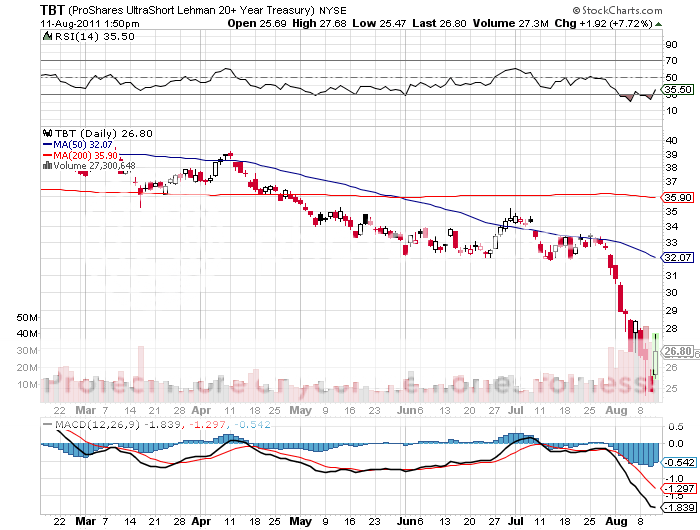

3) Treasury 30 Year Auction Bombs. If you want to see what a failed Treasury bond auction looks like, take a look at the intraday chart for Thursday's sale of 30 year paper, which was a miserable failure. Prices dove and yields soared, from a near 40 low at 3.57% all the way back up to 3.81%.

It looks like investors are unwilling to accept an inflation adjusted real yield of near zero for 30 years. Big surprise. They are already taking a negative real yield of -1.5% for 10 year bonds. In fact, real yields have disappeared around the world, from here to Germany to Japan. Fixed income investment is now globally a mug's game.

This will give hope to beleaguered investors in the (TBT), the leveraged ETF that profits from falling long bond prices and rising yields. My idea here did not exactly turn out to be the rose garden that I expected. After nibbling at $31 a few weeks ago, the (TBT) swan dived all the way down to $24 and change, a loss of 22%. Thank goodness I never doubled up on the way down. Yes, hedge funds can lose money.

I am afraid that the medium term outlook for the (TBT) is not great. By taking the unprecedented action of pegging interest rates at zero for two years, the Federal Reserve has created an indirect bid all the way down the yield curve which will be supportive of bond prices. Also, if the economy remains feeble, the next round of emergency, last resort Fed measures could include buying longer dated paper, like 10 year and 30 year Treasury bonds. At this point, I am just looking to get out at cost.

-

Featured Trades: (JOBLESS CLAIMS SEND BEARS FLEEING)

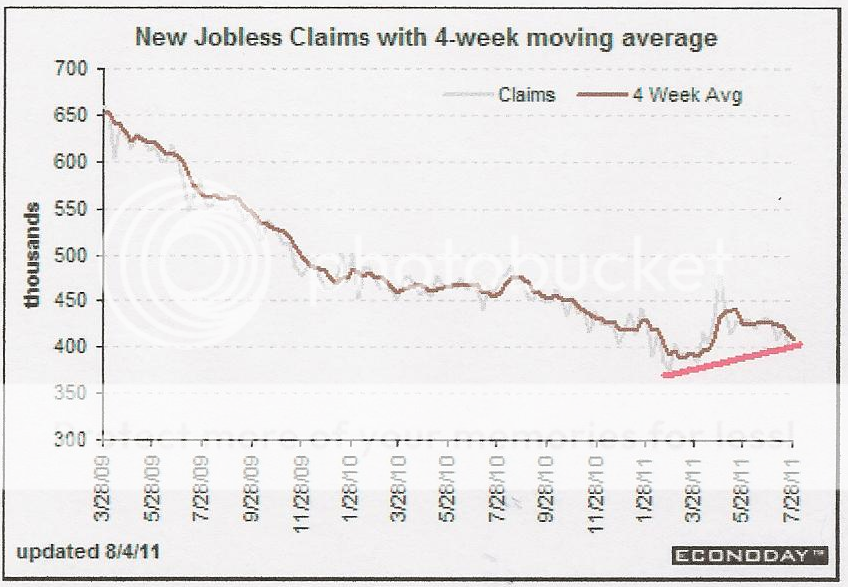

1) Jobless Claims Send Bears Fleeing. The single most important coincident indicator you can follow, the weekly jobless claims, showed a modest improvement, sending bears fleeing.

The figures released at 8:30 am EST every Thursday had claims fall by 7,000 to 395,000. This is the third consecutive week that claims have been at or below the crucial 400,000 level. The four week moving average moved down by 3,250.

The data reflects new hiring by the auto industry, which now seems on tracks to reach a healthy 13.5 million units this calendar year. The rapid recovery in Japan is also having a positive pull on the numbers. It is further evidence that the world economy is better than the stock market is indicating. The daily 600 point swings are starting to look more like a market 'accident' than an indicator of the future earning power of US corporations.

The improving trend is likely to spur some portfolio managers to move off the bench where they have been frozen in dropped jaw amazement and into 'BUY' mode. Interest rates are now pegged at zero for two more years, the year Treasury bond yield is hovering above 2.0%, and PE Multiples have just crashed from 15 to 11, the bottom of a multiyear range. At the worst of the 2008-2009 crash, earnings multiples spent only a few nanoseconds at the 9 level. Not to do so requires them to take all of their time-tested investment models and toss them out the window.

-

There Goes My Model

Featured Trades: (THE TRUE COST OF OIL)

2) The True Cost of Oil. I received some questions last week on my recent solar pieces as to whether I minded paying more money for 'green' power. My answer is 'hell no,' and I'll tell you why. My annual electric bill comes to $1,500 a year. Since the California power authorities have set a goal of 33% alternative energy sources by 2020, PG&E (PGE) has the most aggressive green energy program in the country (click here for 'The Solar Boom in California'). More expensive solar, wind, geothermal, and biodiesel power sources mean that my electric bill may rise by $150-$300 a year.

Now let's combine my electricity and gasoline bills. Driving 15,000 miles a year, my current gasoline engine powered car uses 750 gallons a year, which at $3/gallon for gas costs me $2,250/year. So my annual power/gasoline bill is $3,750. My new Nissan Leaf (NSANY) will cost me $180/year to cover the same distance (click here for 'Getting Something for Nothing'). Even if my power bill goes up 20%, as it eventually will, thanks to the Leaf, my power/gasoline bill plunges to $1,980, down 47%.

There is an additional sweetener which I'm not even counting. I also spend $1,000/year on maintenance on my old car, including tune ups and oil changes. The Nissan Leaf will cost me next to nothing, as there are no oil changes or tune ups, and my engine drops from using 250 parts to just five. We're basically talking brake pads and tires for the first 100,000 miles.

There is a further enormous pay off down the road. We are currently spending $100 billion a year in cash up front fighting our wars in the Middle East, or $273 million a day! Add to that another $200 billion in back end costs, including wear and tear on capital equipment, and lifetime medical care for 3 million veterans, some of whom are severely messed up.

We import 9.1 million barrels of oil each day, or 3.3 billion barrels a year, worth $270 billion at $82/barrel. Some 2 million b/d, or 730 million barrels/year worth $60 billion comes from the Middle East. That means we are paying a de facto tax which amounts to $136/barrel, taking the true price for Saudi crude up to a staggering $219/barrel!

We are literally spending $100 billion extra to buy $60 billion worth of oil, and that's not counting the lives lost. Even worse, all of the new growth in Middle Eastern oil exports is to China, so we are now spending this money to assure their supplies more than ours. Only a government could come up with such an idiotic plan.

There is another factor to count in. Anyone in the oil industry will tell you that, of the current $82 price for crude, $30 is a risk premium driven by fears of instability in the Middle East. The Strategic Petroleum Reserve, every available tanker, and thousands of rail cars are all chocked full with unwanted oil. This is why prices remain high.

The International Energy Agency says the world is now using 87 million b/d, or 32 billion barrels a year worth $2.6 trillion. This means that the risk premium is costing global consumers $950 billion/year. If we abandon that oil source, the risk premium should fall substantially, or disappear completely. What instability there is becomes China's headache, not ours.

If enough of the country converts to alternatives and adopts major conservation measures, then we can quit importing oil from that violent part of the world. No more sending our president to bow and shake hands with King Abdullah. Oil prices would fall, our military budget would drop, the federal budget deficit would shrink, and our taxes would likely get cut.

One Leaf shrinks demand for 750 gallons of gasoline, or 1,500 gallons of oil per year. That means that we need 20.4 million Leafs on the road to eliminate the need for the 2 million barrels/day we are importing from the Middle East. The Department of Energy has provided a $1.6 billion loan to build a Nissan plant in Smyrna, Tennessee that will pump out 150,000 Leafs a year by end 2012. Add that to the million Volts, Tesla S-1's, is Mitsubishi iMiEV's hitting the market in the next few years. Also taking a bite out of our oil consumption are the 1 million hybrids now on the road to be joined by a second million in the next two years. That goal is not so far off.

Yes, these are simplistic, back of the envelop calculations that don't take into account other national security considerations, or our presence on the global stage. But these numbers show that even a modest conversion to alternatives can have an outsized impact on the bigger picture.

By the way, please don't tell ExxonMobile (XOM) or BP (BP) I told you this. They get 80% of their earnings from importing oil to the US. I don't want to get a knock on the door in the middle of the night.

-

-

-

-

Is $219 Oil Worth This?

-

Or This?

-

Will it Be a Nissan Leaf?

-

A Volt?

-

A Tesla S-2?

-

Or a Mitsubishi iMiEV?

-

Featured Trades: (BERNANKE SAYS BUY STOCKS, OR ELSE!)

2) Bernanke Says Buy Stocks, Or Else! I believe that the risk markets are discounting a recession that isn't going to happen. Not yet, anyway. So I am going to start adding some small, limited risk call options here.

After analyzing the statement from the Federal Reserve yesterday, it is clear that Ben Bernanke is holding a gun to your head, threatening to pull the trigger if you don't buy stocks.

By taking the ten year Treasury bond yield down to 2.0%, some 80% of equities now have dividend yields greater than bonds. A substantial number of companies are paying dividends double or more the ten year yield. This is unprecedented in economic history. Take a look at the yields of some of the most conservatively run companies:

AT&T (T) 6.2%

ExxonMobile (XOM) 2.70%

Procter & Gamble (PG) 3.50%

Wal-Mart (WMT) 3.00%

Johnson & Johnson (JNJ) 3.70%

3 M Co. (MMM) 2.80%

Dupont (DD) 3.70%

McDonald's (MCD) 3.00%

There is something else important that no one is focusing on. The 25% crash in the price of oil from $100 a barrel equates to one of the largest tax cuts in history for consumers. Each dollar decline in the price of gasoline adds $10 billion a month to the purchasing power of American consumers, and $40 billion a month to consumers globally. You can make the same argument for other commodities as well, which have all suffered enormous declines.

In fact, today's surprise draw of 5 million barrels in inventories reported by the Department of Energy suggests that the economy is stronger than perceived, not weaker. Someone is going to notice this soon.

Since the July peak to the Asian bottom, the (SPX) has plunged 23%. This is with an economy that is growing at a 2% rate. During the 2008-2009 crash, the (SPX) fell 52%, when GDP was shrinking at a 6% rate, we had just lost several major financial institutions, the credit markets had seized up, and the ATM's were two weeks away from shutting down.

Am I the only one that sees a mismatch here? Have the markets just imagined a phantom disaster?

I think the no brainer here is for the (SPX) to rally back up to the 200 day moving average at 1289. That is up 170 points from this morning's opening. Get even a piece of that and it will boost your performance nicely.

-