Featured Trades: (THE MARKETS ARE ON A KNIFE EDGE)

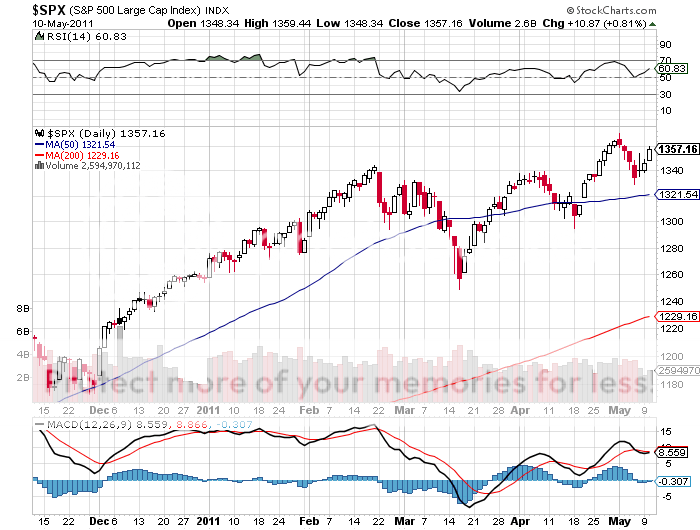

1) The Markets Are On a Knife Edge. All global asset classes are within a hair's breadth of completely breaking down.

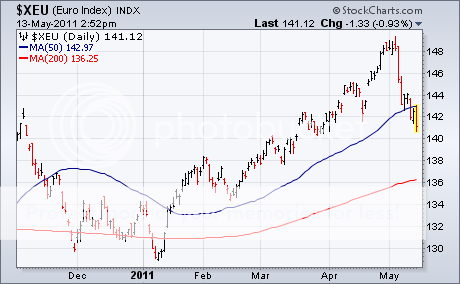

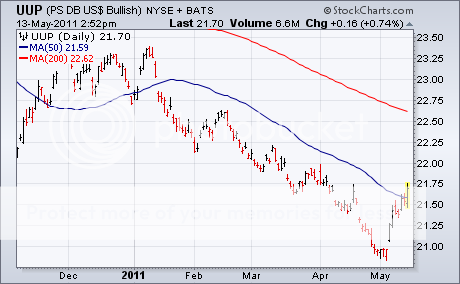

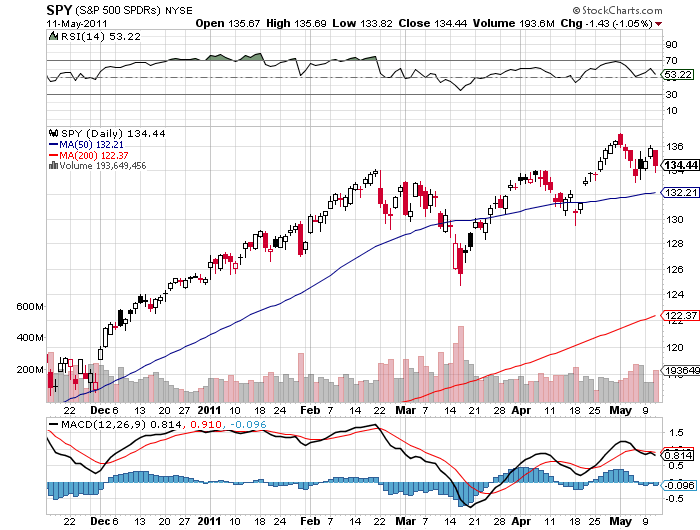

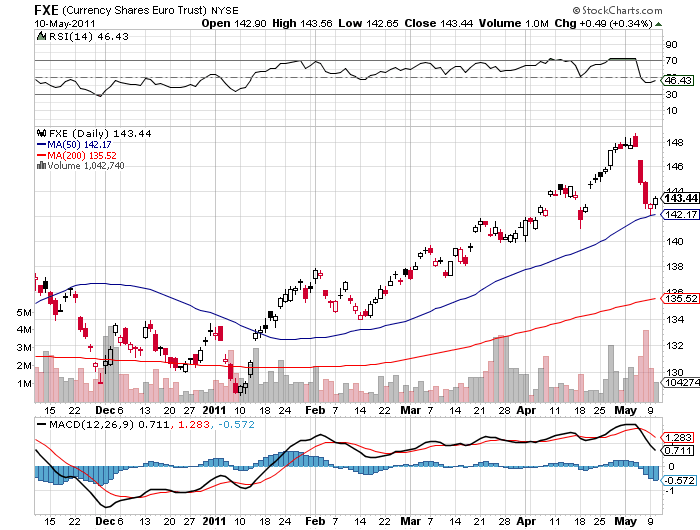

The S&P 500 sits perilously on its neckline. Just below here there are a ton of sell stops that could pare 5% off the index very rapidly. The more volatile and leading emerging market ETF (EEM) has already broken this key level. Look also at the euro, which has been marching in almost complete lockstep with stocks. It has crashed through the 50 day moving average, and has so far struggled unsuccessfully to recover it. The flip side of all of this is the (UUP), a dollar long against a basket of currencies, which appears to have entered new bull market territory.

What positive surprise is out there that could possibly hold things out there for a few more weeks or months? I can't think of one. What surprise negative is out there that could cause the whole house of cards to collapse. I can think of a dozen. Only Ben Bernanke has the power to stick his finger in the dyke, and right now he is keeping his hands in his pocket.

-

-

-

-

Ben, Where are You?

Featured Trades: (THE CORN CONUNDRUM), (JJG), (DBA), (CORN)

2) The Corn Conundrum. In the days of olde, the prices of agricultural commodities were determined by the birds, the bees, and Mother Nature. No more.

The Mississippi River basin is suffering once in a century floods, thousands of acres of farmland have been destroyed, and those still in operation are far behind schedule in their spring plantings. Private analysts are predicting a substantial fall in yields this year. Drought in Texas means they may lose half their wheat crop. China has flipped from a net exporter of food to a large net importer for the first time in many years. So prices for corn, wheat, and soybeans should be absolutely going through the roof right now. Right?

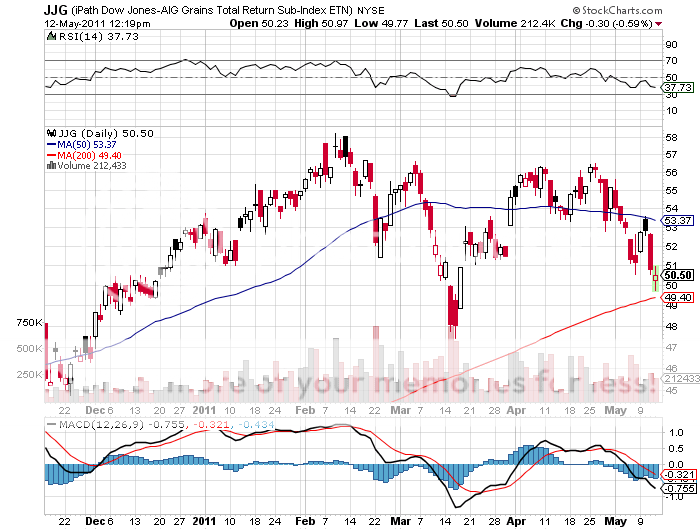

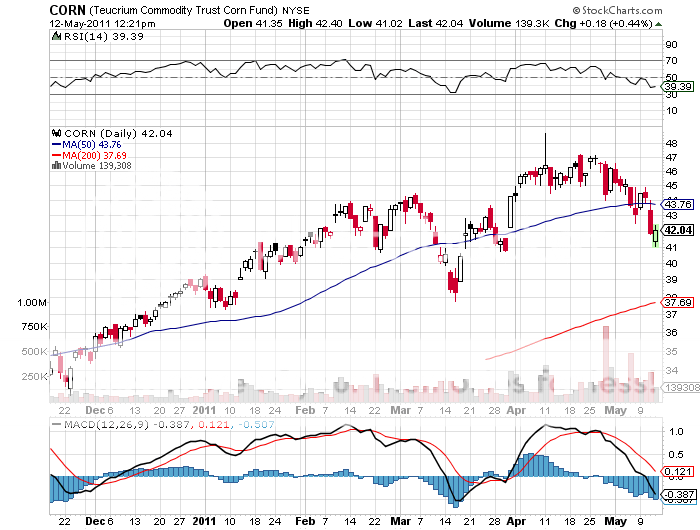

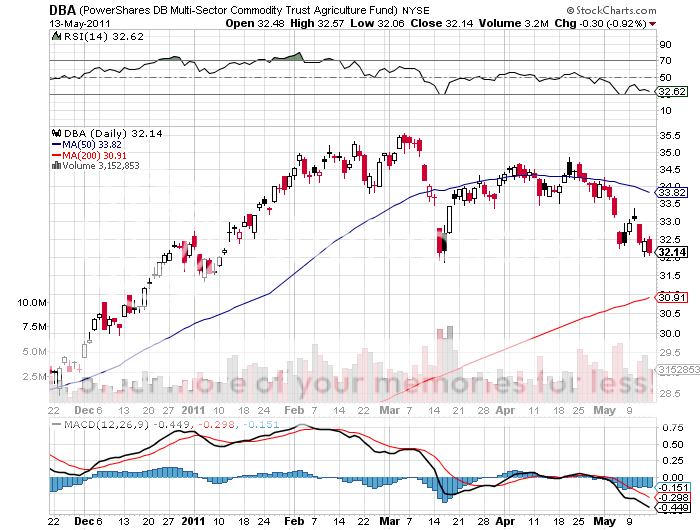

Wrong. Take a look at the charts below for the grain ETF (JJG), the agricultural ETF (DBA), and the fund for corn (CORN), and it is clear that they all peaked at the end of April, right when oil, the euro, gold, silver, stocks, and other commodities began to sell off in earnest. The harsh reality is that food has become just another asset class to be flailed mercilessly by high frequency traders and momentum driven hedge funds. And with the world now in 'RISK OFF' mode that means the ags go down with everything else, big time.

This is only a temporary state of affairs. The basic fact is that the world is still making people faster than the food to feed them. The long term fundamentals for food are in fact getting worse at an ever accelerating rate. Has anyone mentioned? that the world is running out of fresh water with which to irrigate?

So once the hot money has had its way on the downside, they will reverse and pile back in on the long side. Bring an end to the 'RISK OFF' trade, and the ags will be one of the first sectors that you will want to buy.

-

-

-

Still Looking for the 'BUY' Signals for the Ags

'The speculative fever seems to have broken. The old adage that the best cure for high commodity prices is high commodity prices is working,' said Ed Yardeni, president of Yardeni Research.

Featured Trades: (THIS CHART KEEPS ME AWAKE AT NIGHT)

2) This Chart Keeps Me Awake at Night. The forest and the trees are the constant dilemma facing traders on hedge fund desks, the exchange floor, the commodities pits, or behind PC's at home. While spending all day focusing intently on the tree in front of them with a magnifying glass, they miss the fact that a forest fire is raging all around them.

So let me step back and let me give you the 90,000 foot view of what is going on here. Check out the chart below showing the S&P 500 index for the past 14 years. This is what a lost decade looks like up close and ugly; a very broad sideways trading range. Notice that the range in the second peak is wider than the first. This is a sign of increasing volatility in global financial markets. Will the third peak be wider still? My bet is yes.

Trace the smoking gun to its source and you find the fingerprints of hedge funds and high frequency traders all over it. But there are more players in this crime scene than just them. Like a chapter from Agatha Christie's Murder on the Orient Express, everyone is guilty. You can blame two wars that are bleeding us white, the doubling of the national debt during the 2000's, the rising leverage in our society as a whole, our country's declining role in the world economy, and the falling American standard of living.

Until I see proof otherwise, the US is well into its second lost decade. If that is really the case, then stocks at this level are about to come crashing down to earth once again. Can Ben Bernanke work some hocus pocus and keep things levitating a little longer? I am waiting with baited breath, and keeping my finger on my mouse, ready to hit the SELL button.

From Up Here'?.

-

This is What I see

Featured Trades: (A REVIEW OF THE GOLD FUNDAMENTALS), (WORLD GOLD COUNCIL), (GLD), (ABX)

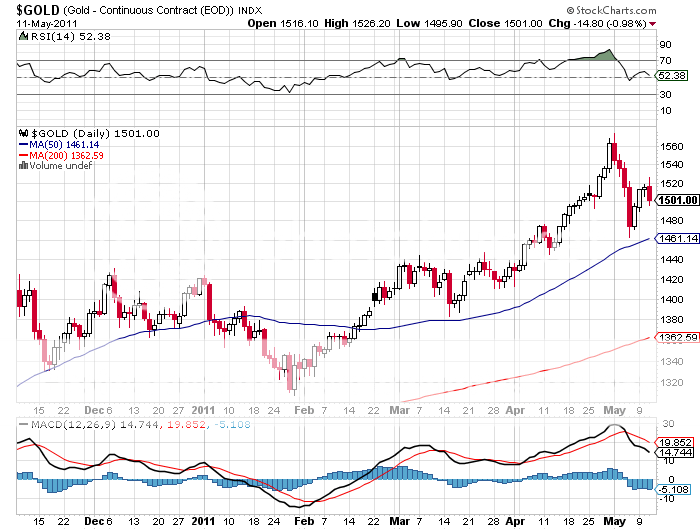

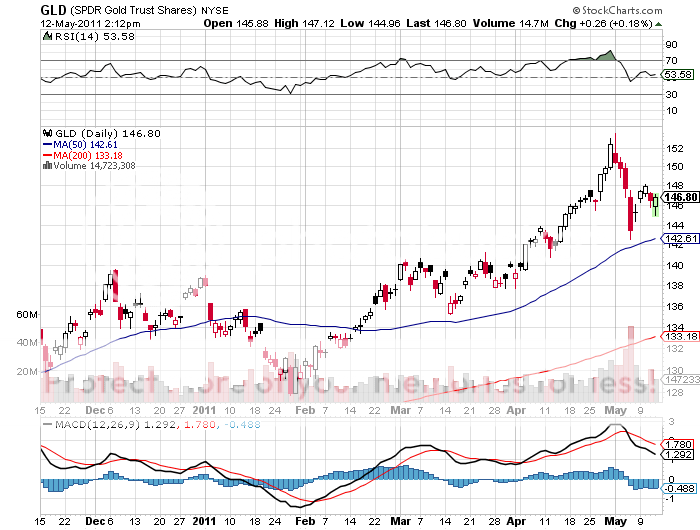

3) A Review of the Gold Fundamentals. With gold crashing through to $1,500 this morning, I thought that I would once against re-examine the fundamentals for the barbarous relic. That is most easily done by reading the Q1 report from the World Gold Council, the final authority on all matters regarding the yellow metal (click here for their link).

Among the many nuggets that I was able to glean was the fact that per capita gold ownership in the US is $1,197 per person. In China, it is $36. Chinese per capita incomes are rising dramatically. What do you think they are going to buy, with a fixed currency encouraging raging domestic inflation? In fact, a rising share of the global trade is moving to the Shanghai Gold Exchange, where imports of the yellow metal are sold to retail buyers.

The US is still on top with gold reserves of $372 billion, followed by Germany ($155 billion), the IMF ($128 billion), Italy ($112 billion), and France ($114 billion). In 2010, central banks turned net buyers of gold for the first time in 21 years, thanks to the end of a decade long liquidation of the European Community's collective holdings, and that trend has continued this year.

Interestingly, the Gold Spider ETF (GLD) is now the sixth largest holder of gold, followed by China, Switzerland, and Russia. Despite rising prices, (GLD) actually saw a 69.5 metric tonne outflow in holdings in Q1. Perhaps this is smart money, like George Soros' Quantum Fund, getting out at an intermediate term top? I believe that one of our many future financial crises will derive from redemptions hitting (GLD) faster than the market can handle them.

A weak US dollar and exploding American debt levels this year have been big factors in the rising demand for gold. But a little known fact is that gold is actually falling in price when valued in the currencies of several emerging markets, like India, China, and Turkey.

I think that a global 'RISK OFF' trade will hit gold just as hard as the other precious metals and commodities, possibly taking it down as much as 20%-30%. But then the long term fundamentals will reassert themselves, ultimately taking it up to the old inflation adjusted all time high of $2,300. The great thing about gold is that they're not making it anymore.

If you would like to get you gold analysis in musical form with a guitar picking folksong with entertaining graphics, then please click here for a good laugh.

-

-

Featured Trades: (TRADE SCHOOL) , (SPY),

1) Trade School. I fielded a lot of questions at yesterday's Macro Millionaire webinar on how I was able to make so much money with small positions. As of today, the year to date theoretical returns for the model portfolio is 34%, putting it in the top 1% of all hedge fund performance, and most of the time I have been 80%-90% in cash.

Let me tell you how it's done. You are about to learn about the wonderful world of leverage. I currently am 95% in cash and 5% in the (SPY) August, 2011 $130 puts, a bet that stocks on the S&P 500 are going to fall. I usually don't allocate more than 5% of my capital to a single position. If I am completely wrong because I have been smoking the wrong stuff, or am finally succumbing to my advanced age, the most I can lose is 5%, or $5,000 in a notional $100,000 portfolio.

If I am right, then things get real interesting real fast. When the (SPY) drops below $130, I am suddenly short a whole load of stock. To be more precise, the 5% weighting in the put translates into 16 contracts with an underlying value of $208,000 (16 X $100 X $130). If the market reaches $127, then I reach my breakeven point, covering the $3 premium I initially paid for my put.? When the (SPY) drops to $124, I have doubled my initial capital, gaining a profit of 100%. If the stock market then drops 10% from my breakeven point to $114, then I make a mind numbing $20,800, or a 416% return on capital. That would add 20.8% to my $100,000 portfolio. That is not an outlandish target. That would simply take us back to where the index started the year.

The bottom line here is that the risk reward is overwhelmingly in my favor, that I am risking a little to make a lot. Mix this in with some old fashioned fundamental analysis, top rate technical analysis, and some of my own secret sauce, and you have a winning strategy. You could make your asset class selection with a coin toss, and still make money with this approach. This is why 22 out of the last 24 trades for Macro Millionaire have been profitable, and why big double digit, or even triple digit returns are within reach.

This is how the best performing hedge funds do it. This is how you can do it. You just have to sit up and pay attention. Just thought you'd like to know.

-

Featured Trades: (COPPER), (CU), (CAT), (FCX)

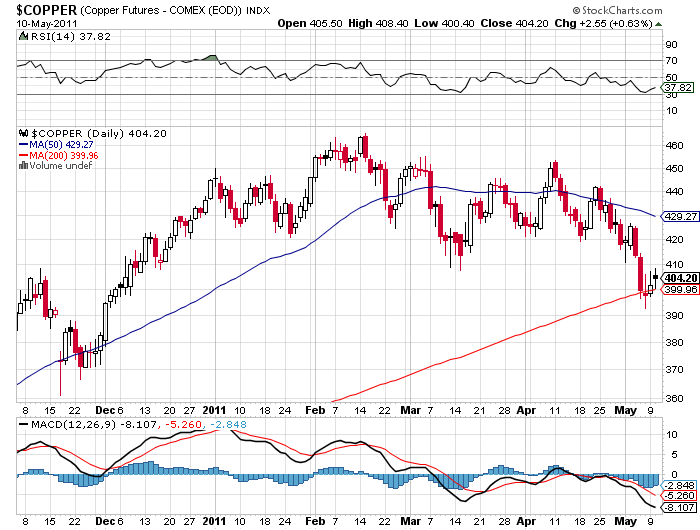

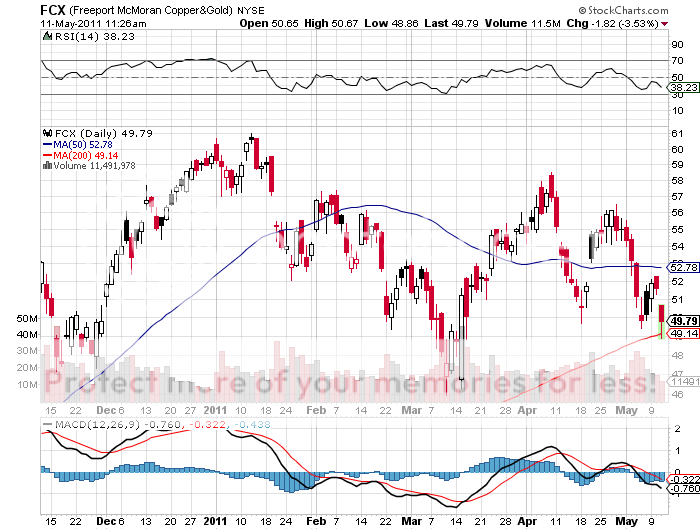

2) Give Dr. Copper an A+ for Accuracy. No one has been singing louder the praises of the predictive power of copper prices (CU) louder than me this year. They call the red metal 'Dr. Copper' because of its uncanny ability to forecast the future direction of the global economy. Look at the charts below and it is clear that the eminent professor has been crying 'watch out below' since February. Ditto for top copper producer, Freeport McMoRan.

So it is with the greatest interest that I picked up some comments this coming from my old friend, FCX CEO, Dan Adkerson. He believes that the recent weakness in copper is not the beginning of a new bear market, but merely short term profit taking driven by speculators. Chinese tightening has been a drag, which accounts for 35%-40% of global demand. It's clear that the sudden sell off in crude has also created some spill over selling in other hard assets.

However, Adkerson argues that the long term case for copper is still compelling. The Chinese drive for a higher standard of living is irresistible, and that requires enormous amounts of copper for roads, construction, and shipbuilding. A burgeoning global hybrid and electric car industry is also increasing demand for copper.

Adkerson's big challenge is how to meet all this demand. The enormous capital requirements and long lead times essential for the opening of new mines means that his company must think not in terms of weeks, months or even years, but in decades. He has no problem making those commitments. FCX already produces 4 million pounds of copper per year. With a current production cost of $1 per pound, it can easily handle the recent decline from $4.70 to $3.92.

There is no doubt that copper has been leading the charge to the downside in this global 'RISK OFF', environment. But when it runs its course, copper and FCX are going to be some of the first positions that I step back into.

-

-

Which Way Now, Chief?

'Long term, the pressure on commodity prices is only one way, and that is up, said Doug Oberhelman, CEO of Caterpillar (CAT).

Featured Trades: (HOW TO BUILD A TOP), (QQQ), (XLF), (SPX)

2) How to Build a Top. Yes, we are all in the instant gratification business. We all want to ride an uptrend for nine months, sell at the top tick, and stay short for the entire four month selloff that ensues. In real life, it really only happens in the movies. If someone tells you they actually did this, you want to run a mile. I carry around in my wallet a tattered and dog eared SELL ticket for Nikkei futures that I wrote in 1989 at ?38,800, right next to my spare condom. It has been 21 years since I came that close.

The reality is that putting in a market top is a choppy, bloody, stop and start affair, a lot like giving birth. A short term breakdown is followed by a medium term breakdown and then a long term breakdown, with a lot of confusion and contradictory indicators in between. They never do an on the dime, 180 degree turn.

Currently, the S&P 500 remains in a long term, or more than six month uptrend, a medium term uptrend of two to six months, and a short term uptrend of one to eight weeks. Last week's gut wrenching selloff is now threatening the short term uptrend. If it breaks, then the medium and long term trends will be at risk. To see this most clearly, look at the chart below for the PowerShares QQQ Trust (QQQ) for technology shares, which often leads the (SPX). Broken resistance now turns into support at 58.

Now examine the chart for another sector that leads the market, the financials (XLF), which is clearly in a downtrend that shows no sign of stopping. There is now way the (SPX) can make substantial headway from here carrying the deadweight of the financials, which carry a heavy weight in the index.

The bottom line here is that the next step in the formation of this top could be either a double top at in the (SPX) at 1,376, or a marginal new high at 1,400. In either case I expect one or the other to fail. So I have my stops for my current short positions in the (SPX) that I slapped on last week above 1400.

Since I am short through a risk limiting put option accounting for only a small part of my portfolio, I don't mind taking a little pain on the way up. You can never top tick these things, only scale in through increments. At the first sign of weakness, I want to double up my short position to take advantage of a definitive break of the short and medium term trends.

If I am right in my assumption that a slowing economy will lead to a broader and more prolonged 'RISK OFF' trade, then further weakness in stock markets is a sure thing.

-

-

-

Yep, Sold the Top Tick and Bought the Bottom Tic

Featured Trades: (FROM BAD TO WORSE FOR THE EURO), (FXE), (EUO), (UUP)

3) From Bad to Worse for the Euro. I am going to take a profit here in my short position in the euro by selling my (FXE) September, 2011 $145 puts. I don't double my capital in two days very often. When I do, I am inclined to grab it by the lapels and shake it until its gold teeth come clattering down on the ground. I don't care about the fundamentals. I don't care about the technicals. A double is the easiest thing in the world to understand. I don't even need a calculator to figure it out.

I managed to pick up these puppies in the greatest of all possible rushes at $3.50. By selling my full 5% weighting at the $7.10 I see on my screen now, I will reap a profit of 103%. For my notional $100,000 portfolio, that brings in a net profit of $5,142, or a 5.14% return, not a bad piece of change for 48 hours' worth of work. For some hedge funds, this is considered a modest year.

Normally I like to keep a position like this for a couple of months, so I don't wear out my fingertips mouse clicking my way through too many short term trades. But the truth is that we have had three months of volatility crammed into two eye popping days. That is normally how long it takes the euro to move eight cents against the dollar. The precipitous decline we saw from $1.49 to $1.42 has in fact been the sharpest fall in the European currency in many years.

By coming out of my short position here, I am also gaining a tactical advantage. If we get a snap back rally, or if Ben Bernanke can somehow keep the party going a little longer, you can sell into another rally in the euro. Initial support at the 50 day moving average can be expected. To mix up a few metaphors (editor please ignore), dry powder here is worth its weight in gold. It also makes sense to roll down the strike as a risk control measure.

If You Miss the Train, Another One Always Comes Along

-