Featured Trades: (TBT), (YCS), (SSO)

2) Instant Gratification Alert. If you are one of the 1,000 recent new subscribers to The Diary of a Mad Hedge Fund Trader, religeously executed every trade I recommended, and ignore the naysayers and the party poopers, well done!

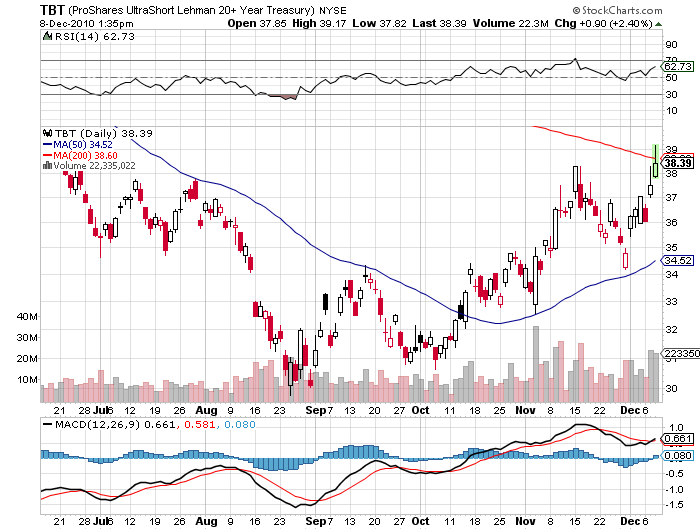

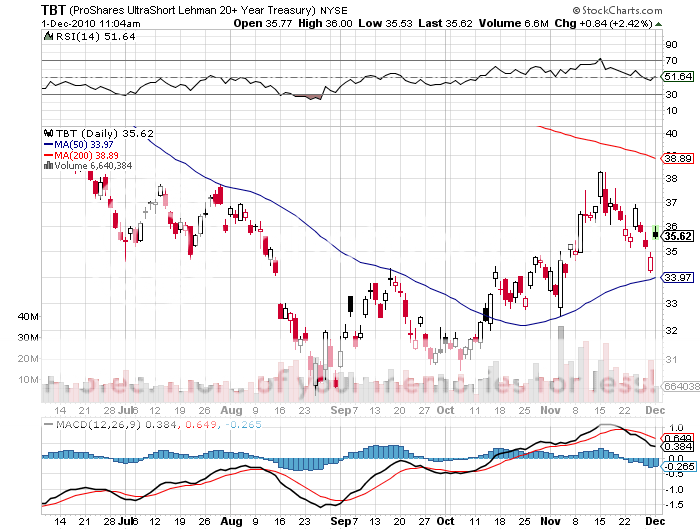

As I write this, the leveraged short Treasury bond ETF, the (TBT), has exploded to the upside, breaking the 200 day moving average. It has tacked on an impressive 10% from my cost last week, popping from $35.60 to $39.10. The options markets are now seeing massive buying of the December $40 calls. Of course, boosting our positions was the good old US Treasury, which slammed the market with $60 billion in new paper today. But we knew this was coming weeks ago.

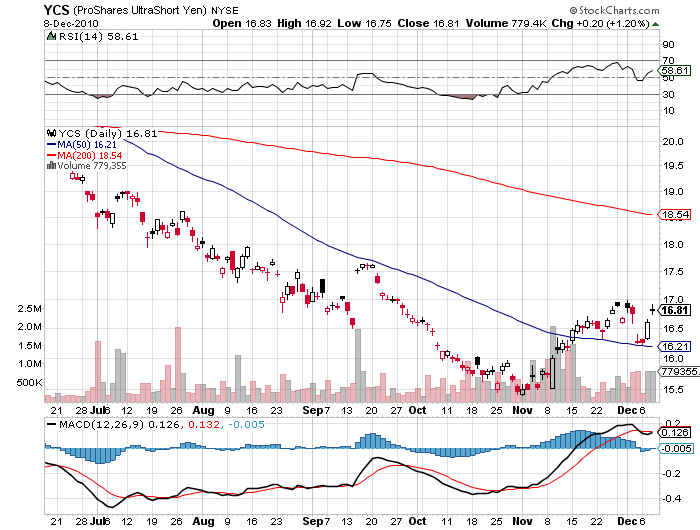

The yen saw a major breakdown, sending the short play ETF (YCS) off to the races. Good job to those who acted on my trade alert yesterday and doubled up.

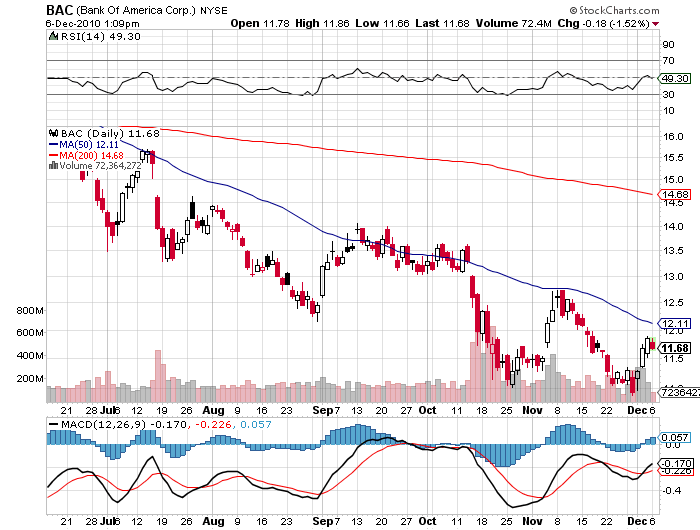

Stocks are holding up remarkably well against profit taking pressure off of Obama's tax compromise speech yesterday, a classic 'buy the rumor, sell the move' development. The really exciting thing is that Bank of America (BAC) is hugely outperforming to the upside, with the calls I recommended yesterday taking off like a scalded chimp. The March, 2011 $12-$14 call spread soared by 21%, while the aggressive version of this trade, paired with a short $10 BAC put, jumped by 100%. Not bad for a day's work. I knew I was good, but not that good!

New subscribers to my letter have clocked profits of up to 10% in a week, and all positions are now in the money. Some, who took on more leverage than I recommended, have seen their networth skyrocket by 20% in days. The portfolio has some nice cross hedges working, with any pullbacks in stocks more than offset by gains in short Treasuries and short yen. The strategy is firing on all 16 cylinders.

For those of you who have a need for instant gratification, you might consider cashing in here, calling it a year, and taking off for some skiing at Aspen, St. Barts for some sun bathing, or Wisconsin to visit the in-laws. In a zero return world, you don't get to coin 10-20% in a week very often, and sometimes it is prudent to take the money and run.

For those who thought this was the tenth big ticket Internet marketing scam they purchased in the past year and just sat back and watched with skepticism, don't worry. There will be other opportunities, and plenty of good entry points. There are so many rip offs out there, I will be the last one in the world to blame you for your jaundiced eye. I come from an unforegiving, uncompromising world where only results backed by cold, hard numbers have value, not empty words and hollow promises.

As for me, I'll be hanging on to my positions, and even looking to increase them. I'll be the guy who stays in the bar until they pile the chairs on the tables, mop up the spilled champaigne, flicker the lights a few times, and all of a sudden, every girl still hanging around suddenly looks beautiful. I think that I have sunk my teeth into some solid, sustainable trends here that will be good for months, if not years. I'll leave the day trading to the kids.

Watch your trade alerts. Fiat Lux.

-

-

-

Will It Be Trading for Christmas?

-

Or Sunbathing?

'A market system without significant bankruptcies cannot work,' said Dr, Alan Greenspan, former chairman of the Federal Reserve.

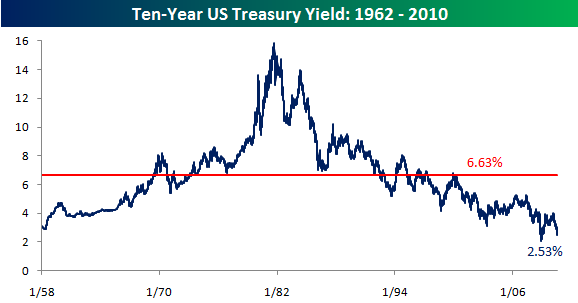

'There is an extraordinary amount of crowding out that is occurring as a consequence of the United States Treasury preempting the flow of savings in the economy. Approximately one third of the decline in capital investment as a share of cash flow is directly attributable to the crowding out of all other borrowers by the US Treasury,' said Dr, Alan Greenspan, former chairman of the Federal Reserve.

Featured Trades: (LOS ANGELES STRATEGY LUNCHEON REVIEW)

1) Los Angeles Strategy Luncheon Review.? Even though I grew up in Los Angeles during the fifties and sixties, visiting today feels like a trip to an exotic foreign country. It's as if the city was destroyed in some terrible war and rebuilt in a hodgepodge way, as Tokyo and Berlin were after WWII.? Most of what I remember fell victim to the developer's bulldozers decades ago. The land inhabited by the orange groves and horse ranches of my youth are now overrun with high rises, strip malls, and fast food joints. Only Philippe's, home of the French double dip sandwich, lasts forever, the same sawdust still on the floor as when my dad first took me there for lunch in 1956. The manager there recognized me and kindly pulled me out of the one hour wait for a repast in the kitchen. It is true that you can't go home again.

I knew the luncheon at the Los Angeles Athletic Club was going well when those at the gathering next door, held by a down market competitor, complained that we were laughing too loudly. Now that the markets are solidly in '?RISK ON' mode, there was much discussion and debate on the triggers and timing of the next bout of '?RISK OFF.' I am aiming for the end of Q1, 2011, when Ben Bernanke announces that quantitative easing has been such a success that he is ending the program early. The bond trading desks will see this coming first. Maybe that is what the surge last week in the TBT, from $34 to $37, is telling us?

I performed my ritual dump on the residential real estate market, as always. It is such a soft target. It is really like sneaking up behind a disabled person in a wheel chair, tying his shoe laces together, and getting a laugh when he tries to stand up and falls on his face.

Kevin from Anchorage, Alaska won the prize for the greatest distance traveled to the event, some 3,701 miles, according to Mapquest. He also scored highest on the pop quiz, getting eight out of ten right. As one of my 'early adopters' and longest running readers, no doubt the huskies on his dog sled team are wearing Gucci muckluks by now. Spend your Zimbabwean dollars wisely.

That night I went to the spectacular, futuristic, Frank Gehry design Disney Concert Hall to catch Beethoven's 5th Symphony, one of my favorites. The next morning I was awoken at my beachfront Hermosa Beach suite by a volley ball class, instructed by six foot tall Viking hotties, so I went surfing with the dolphins.

On the way home, Interstate 5 was punctuated by signs every few miles by libertarian farmers demanding 'Nancy Pelosi, Hands Off Our Water,' threatening armed action if enormous federal subsidies are not extended. There is so much that is deeply wrong with this country.? However, the split pea soup at Andersen's in Santa Nella was perfect as always, and I bought two cases to take home.

My next strategy luncheon will be held in Chicago, Illinois on Tuesday, December 28.

-

-

Featured Trades: (A SCALP IN THE FINANCIALS)

2) There is @$*% Scalp Here in Financials. Regular readers of this letter are well aware that I despise financial stocks for the worthless pieces of paper that they are. Therefore, I think you should rush out and buy financials stocks right now.

There is a method to my 'Madness.' Financials are the preeminent lagging sector in the world's top lagging market. That alone will prompt some hedge fund managers to pull money out of super performing emerging markets for investment into the unloved and ignored sector. The 'Dogs of the Dow' crowd will most likely get sucked into the logic too.

Lets face it, the banks are making money hand over fist here. A steepening yield curve gives them the best free lunch of all time, borrowing from the Fed at zero interest rates and investing in government paper further down the curve . They can also lend it to prime corporate borrowers at 4%, 5%, or even 6%. The environment is so friendly that even bankers can make money. Rumors abound that they are ready to restore dividends early, Fed permission be damned, putting them on the menu for pension funds once more. ??Maybe this is why the Vampire Squid, Goldman Sachs, upgraded the sector last week to an overweight?

Mind you, I'm only recommending a one night stand with the banks here, not a long term relationship. If you do get married, make sure it is in Reno, Nevada, where you can get one of those quickie divorces. If banks were forced to use the same accounting rules that the SEC foists on me, like marking positions to market on a daily basis, they'd be showing huge negative net worths, and would be out of business overnight. All of those subprime loans they took on at the peak of the real estate bubble are still carried at full value. Banks will only lend to the best quality firms because they know huge hits are coming their way, and have to conserve capital. This is also why the foreclosure rate is so slow. Any faster and they'd really go broke.

Of course, the banks all know this, Ben Bernanke knows this, and I know this, hence the free lunch. There is another side to this coin. If banks join the party, it could give the S&P 500 the juice to make it up to my 1348 target, or even 1,400 in 2011. That is a best case scenario.

-

-

Look for a One Night Stand Only

Featured Trades: (BUY THE &%$#! DIP)

3) Buy the &%$#! Dip. For proof that I will leave no stone unturned in my eternal search for market insight, look no further than the video link below of two imaginary fund managers debating how to deal with the current market. I think the message is 'buy the dip.' It is irrefutable proof that the end of year silly season is upon us. For a good laugh, click the link, but be forewarned that fowl language is involved. Here it is: http://www.youtube.com/watch?v=jllJ-HeErjU&feature=player_embedded

Lunch with the Central Intelligence Agency is always interesting, although five gorillas built like brick shithouses staring at me intently didn't help my digestion.

Obama's pick of Leon Panetta as the agency's new director was controversial because he didn't come from an intelligence background- upsetting the career spooks at Langley to no end. But the President thought a resume that included 16 years as the Democratic congressman from Monterey, California, and stints as Clinton's Chief of Staff and OMB Director, was good enough. So when Panetta passed through town on his way home to heavenly Carmel Valley for the holidays, I thought I'd pull a few strings in Washington to catch a private briefing.

The long term outlook for supplies of food, natural resources, and energy is becoming so severe that the CIA is now viewing it as a national security threat. Some one third of emerging market urban populations are poor, or about 1.5 billion souls, and when they get hungry, angry, and politically or religiously inspired, Americans have to worry. This will be music to the ears of the hedge funds that have been stampeding into food, commodities, and energy since March. It is also welcome news to George Soros, who has quietly bought up enough agricultural land in Argentina to create his own medium sized country.

Panetta then went on to say that the current monstrous levels of borrowing by the Federal government abroad is also a security issue, especially if foreigners decide to turn the spigot off and put us on a crash diet. I was flabbergasted, not because this is true, but that it is finally understood at the top levels of the administration and is of interest to the intelligence agencies. Toss another hunk of red meat to my legions of carnivorous traders in the TBT, the leveraged ETF that profits from falling Treasury bond prices!

Job one is to defeat Al Qaida, and the agency has had success in taking out several terrorist leaders in the tribal areas of Pakistan with satellite directed predator drones. The CIA could well win the war in Afghanistan covertly, as they did the last war there in the eighties, with their stinger missiles supplied to the Taliban for use against the Russians. The next goal is to prevent Al Qaida from retreating to other failed states like Yemen and Somalia. The Agency is also basking in the glow of its discovery of a second uranium processing plant in Iran, sparking international outrage, and finally bringing Europeans to our side with sanctions against Iran.

Cyber warfare is a huge new battlefront. Some 100 countries now have this capability, and they have stolen over $50 billion worth of intellectual property from the US in the past year. As much as I tried to pin Panetta down on who the culprits were, he wouldn't name names, but indirectly hinted that the main hacker-in-chief was China. This comes on the heels of General Wesley Clark's admission that the Chinese cleaned out the web connected mainframes at both the Pentagon and the State Department in 2007. The Bush administration kept the greatest security breach in US history secret to duck a hit in the opinion polls.

I thought Panetta was incredibly frank, telling me as much as he could without those gorillas having to kill me afterwards. I have long been envious of the massive budget that the CIA deploys to research the same global markets that I have for most of my life, believed to amount to $70 billion, but even those figures are top secret. If I could only manage their pension fund with their information with a 2%/20% deal! I might even skip the management fee and go for just the bonus. The possibilities boggle the mind!

Panetta's final piece of advice: don't even think about making a cell phone call in Pakistan. I immediately deleted the high risk numbers from my cell phone address book.

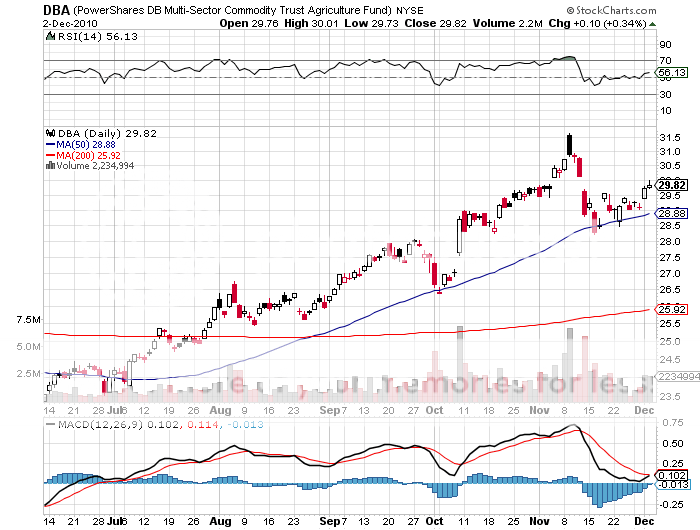

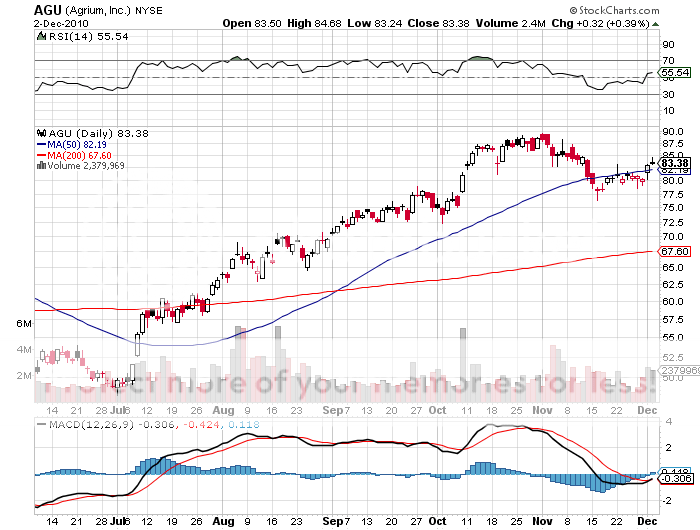

I have been pounding the table with these guys for four decades to focus more on the resource issue, but they only seemed interested in missiles, planes, tanks, subs, and satellites. What a long strange trip it's been. Better take another look at the Market Vectors agricultural ETF (DBA), their agribusiness ETF (MOO), as well as my favorite ag stocks, Monsanto (MON), Mosaic (MOS), and Agrium (AGU). Accidents are about to happen in their favor.

-

-

Featured Trades: (THE REAL ESTATE MARKET IN 2030)

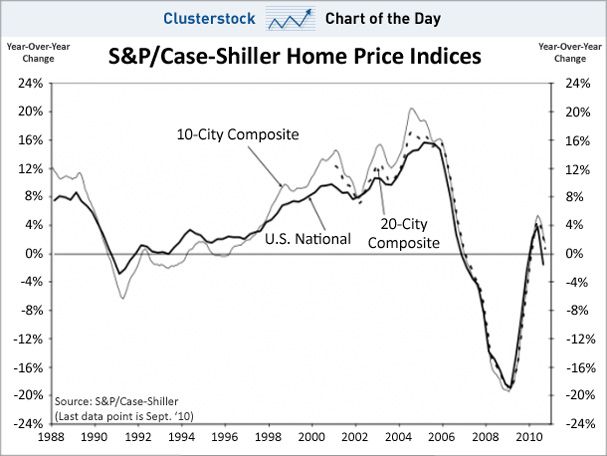

3) The Real Estate Market in 2030. A number of analysts, and even some of those in the real estate industry, are finally coming around to the depressing conclusion that there will never be a recovery in residential real estate. Long time readers of this letter know too well that I have been hugely negative on the sector since late 2005, when I unloaded all of my holdings (click here for 'The Hard Truth About Residential Real Estate'). However, I believe that 'forever' may be on the extreme side. Personally, I believe there will be great opportunities in real estate starting in 2030.

Let's back up for a second and review where the great bull market of 1950-2007 came from. That's when a mere 50 million members of the 'greatest generation', those born from 1920 to 1945, were chased by 80 million baby boomers born from 1946-1962. There was a chronic shortage of housing, with the extra 30 million never hesitating to borrow more to pay higher prices. When my parents got married in 1949, they were only able to land a dingy apartment in a crummy Los Angeles neighborhood because he was an ex-Marine. This is where our suburbs came from.

Since 2005, the tables have turned. There are now 80 million baby boomers attempting to unload dwellings on 65 million generation Xer's who earn less than their parents, marking down prices as fast as they can. As a result, the Federal Reserve thinks that 50% of American homeowners either have negative equity, or less than 10% equity, which amounts to nearly zero after you take out sales commissions and closing costs. That comes to 70 million homes. Don't count on selling your house to your kids, especially if they are still living rent free in the basement.

The good news is that the next bull market in housing starts in 20 years. That's when 85 million millennials, those born from 1988 to yesterday, start competing to buy homes from only 65 million gen Xer's. By then, house prices will be a lot cheaper than they are today in real terms. The next interest rate spike that QEII guarantees will probably knock another 25% off real estate prices. Think 1982 again. Fannie Mae and Freddie Mac will be long gone, meaning that the 30 year conventional mortgage will cease to exist.

All future home purchases will be financed with adjustable rate mortgages, forcing homebuyers to assume interest rate risk, as they already do in most of the developed world. With the US budget deficit problems persisting beyond the horizon, the home mortgage interest deduction is an endangered species, and its demise will chop another 10% off home values.

To make matters worse, Ben Bernanke's current massive monetary expansion assures that there will be one at least one, and possible two interest rate spikes by 2030. If you think the real estate market is bad now, wait until mortgage rates hit 18%.

For you millennials just graduating from college now, this is a best case scenario. It gives you 15 years to save up the substantial down payment banks will require by then. You can then swoop in to cherry pick the best neighborhoods at the bottom of a 25 year bear market. People will no doubt tell you that you are crazy, that renting is the only safe thing to do, and that home ownership is for suckers. That's what people told me when I bought my first New York coop in 1982 at one tenth its current market price.

Just remember to sell by 2060, because that's when the next intergenerational residential real estate collapse is expected to ensue. That will leave the next, yet to be named generation, holding the bag, as your grandparents are now.

-

Featured Trades: (TBT TRADE ALERT)

2) Trade Alert for the (TBT). It's time to get in on the greatest short play of the coming decade. I have been pounding the table that investors should pile into the (TBT), the 200% leveraged bet that Treasury bond prices would go down, since August. It rose 28% after that, rocketing from $30 to $38.40. Well, the market gods have deigned to give us a decent entry point. It neatly bounced off the 50 day moving average at $34 yesterday, and appears to have resumed its upward path.

Take a 50% position here at $35.60. If you are working with a portfolio of five positions, that is half of 20%, or 10% of your total funds. Buy the second half on a dip or an upside breakout. Put in a protective stop loss order to pull the ripcord at $32.90 in case congress fails to extend the Bush tax cuts, we go back into a double dip recession, or a giant comet destroys the earth.

The no brainer short term target here is last week's high of $38.40. The next stop is the 200 day moving average at $38.90, up 9% from here. Beyond that, you can contemplate this year's high of $52, up 45%. If you have read my research in any depth, then you already know that I believe the (TBT) will eventually trade to $200. I go into the fundamental arguments for this trade once more next week.

-

-

Featured Trades: (SSO TRADE ALERT), (NSANY), (TM), (TTM)

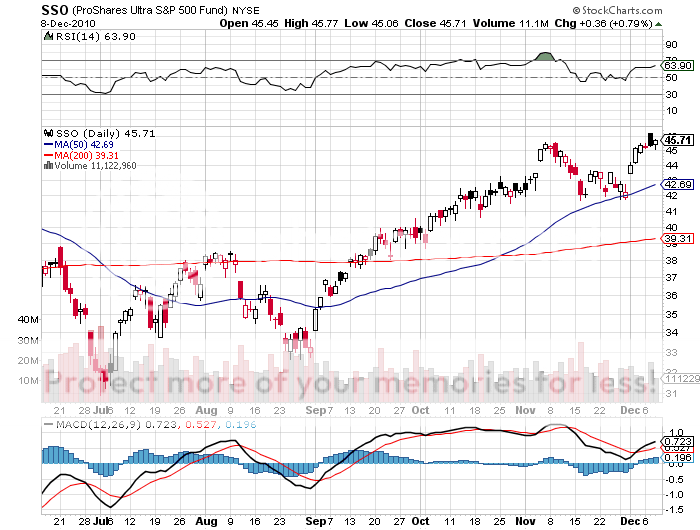

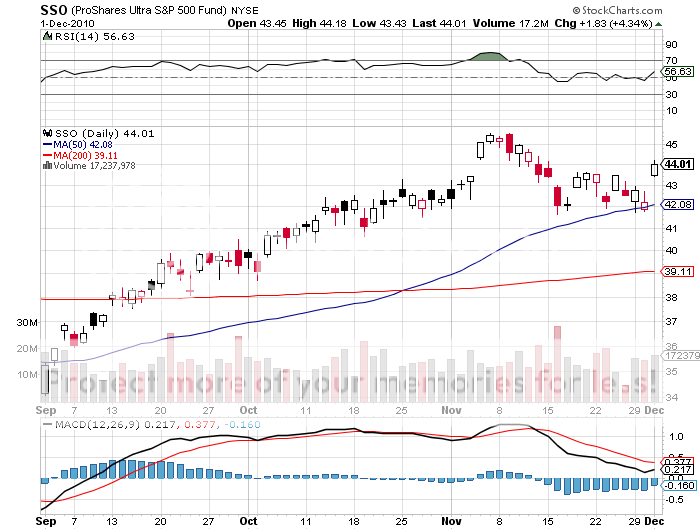

3) Trade Alert for the (SSO). After the Dow's impressive 250 point blast off to the upside yesterday, my phone started ringing off the hook. Fundamental and technical analysts around the world were screaming at me that a major breakout was at hand, it was off to the races, and the 'RISK ON' trade was back from the dead in all its glory. The train was leaving the station, and if I didn't jump on now, I would be the one getting post cards from the successful aggressive traders visiting their Swiss bank accounts.

There was more confirming price action than Sarah Palin Bumper stickers at a National Rifle Association rally. The Treasury bond market took a nosedive, my TRADE ALERT yesterday to buy the (TBT) smelling like roses. The Australian dollar (FXA), a hedge fund darling because of its high yield, bounced hard off the AUS$0.9550 level. Crude oil rocketed from $83.90 to $87. Copper popped from $3.79 a pound to $3.94. The equity price action was impressive globally, from Indonesia to China (FXI), Poland (EPOL), Australia (EWA), Chile (ECH), and more. Suddenly, the path to take couldn't be more clear if it was outlined by high intensity landing lights.

Let me lay out the fundamental case for US stocks here. The American economy is currently enjoying a growth spurt, possible at a 3.5% annualized rate, while Japan and Europe drag. This is what the collapse of the Euro is telling us. One need look no further than US auto sales for November, which grew at a white hot 17% YOY rate, and is a huge driver for the broader economy. This is why I have three auto names in my model portfolio, Nissan (NSANY), Toyota (TM), and Tata Motors (TTM). This is what the collapse of the Euro is telling us. Quantitative easing is benefiting equities more than any other asset class, as its simulative effects are clearly working. The 30% of active managers that are underperforming the index are playing catch up by pouring money into the best performing names. Yesterday's blistering move is giving traders the trigger they were waiting for.

The best way to participate here is through the ProShares Ultra Index ETF (SSO), a 200% leveraged bet that the broader stock market goes up. Buy a half position at the opening today at $44, or 10% of your total portfolio, and the other half at the opening tomorrow after the release of the November nonfarm payroll figures. If we get a bad number, you'll buy the second lot lower and cut your average price. A good number will send the market off to the races again and raise your cost, but you will be in the money on you total position. Keep in mind that with a 20% position in a double leveraged instrument, you are 40% long the US market, a decent sized position.

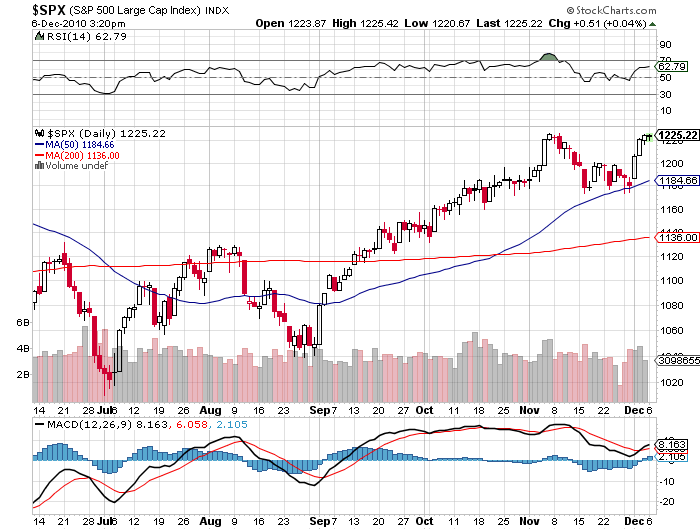

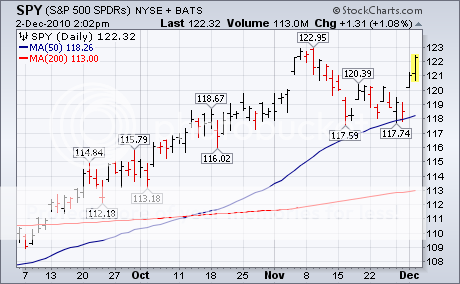

The technical set up is looking great. Look at the chart below and see how hard we bounced off the 50 day moving average. I think a New Year allocation liquidity burst could give this trade a six week life, and could take us as high as 1,348 in the S&P 500, or 12.1% higher than yesterday's closing price. That should take the (SSO) up 24%. Put a stop below at $41.70, well below the 50 day moving average. That means you are risking 5.2% to make 24%, a ratio of 4.6 to one, which is respectable.

What could go wrong with this trade? Congress fails to compromise on the extension of the Bush tax cuts, putting a double dip recession back on the table. My guess is that the opposite will happen. After much blustering, saber rattling, and threats of gridlock, which will cause brief scares for the market, some type of compromise will be reached. Congress will correctly conclude that the public is sick to death of their antics and do to right thing. The stock market should do hand flips and summersaults when this happens. See you in Zurich.

-

-

See You in Zurich