Featured Trades: (ALIBABA)

2) Double Click on Alibaba. Given my bullish take on China in my September 28th letter, I'm going to be putting a few more single names out there. Jim Trippon's China Stock Market Digest published a recommendation that caught my eye (click here for my Hedge Fund Radio interview with Jim).

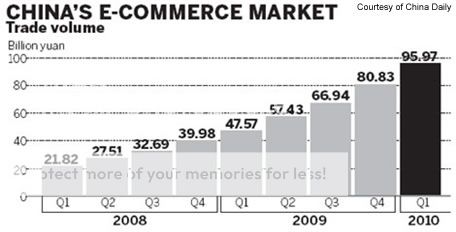

Alibaba (ALBCF) (HKG 1688) is the Middle Kingdom's preeminent e-commerce company, and far and away dominates this fastest growing sector of the economy. In the first half of this year, e-commerce sales in China doubled to $31 billion, and the full year figure is expected to grow to $64.5 billion. So far this year, 36 million have joined the Internet there, bringing the total to 420 million.

Electronics accounted for 44.2% of sales, followed by clothing (17.4%), and jewelry (5.8%). Despite this blistering growth, Internet market penetration stands at only 31.8%, among the lowest in Asia. Deutsche Bank predicts the total market will grow to $220 billion by 2014, while the number of users soars to a mind numbing 812 million, nearly triple the US population! That implies an explosive? 700% growth of the market over a four year period.

Alibaba's profits jumped by 46% in Q2. The stock is not cheap with a PE multiple of 55, but it is almost the only game in town. Despite the amazing outlook for the online industry in China, the stock has fallen for most of 2010, presenting investors with a reasonable entry point. Here is not a bad place to start scaling in. As the ADR's traded on the pink sheets are illiquid, better to buy the Hong Kong traded stock.

More Than All the Clicks in China

Featured Trades: (GOLD), (GLD)

SPDR Gold Shares Trust

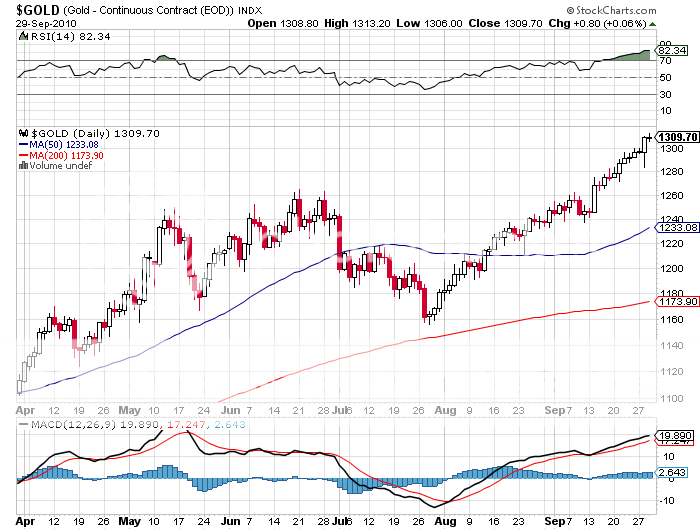

3) Gold is Now At the Deep End of the Pool. For me, the best case scenario which I have been predicting for nearly two years has arrived. But as much as I love gold for the long term, I have to take note when a number of short term technical and momentum models start flashing red lights that it is entering extremely overbought levels. The yellow metal has now risen for 12 out of the past 14 days.

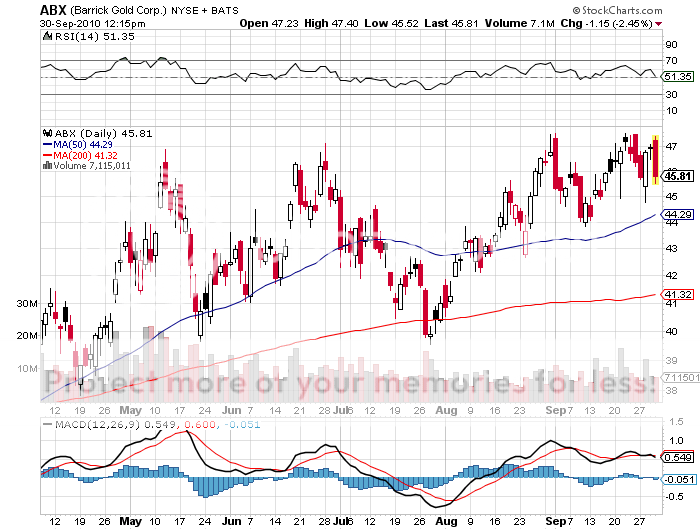

Aaron Regent, Barrack Gold's (ABX) CEO, the world's largest gold producer, says he can't imagine ever needing to hedge the company's output again. Not a day goes by without an emerging market central banks making new purchases, with announcements this week coming from India and Sri Lanka. Gluskin Sheff's permabear David Rosenberg, trotted out his own target for the barbarous relic of $3,000/ounce.

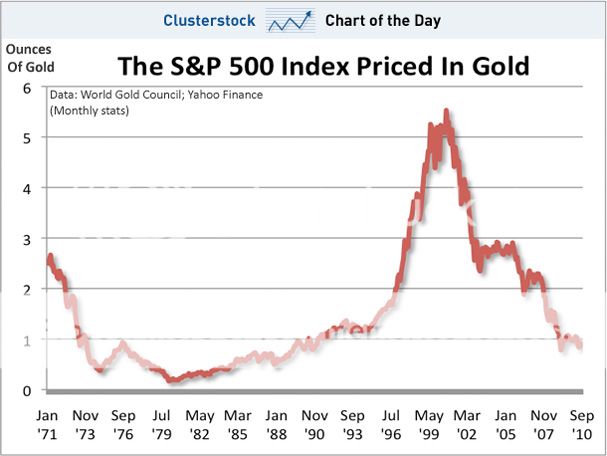

Look at the chart below of the S&P 500 priced in gold, and you can only conclude that gold has to reach $10,000/ounce for the ratio to reach the last trough we saw in 1979. Higher predictions are more common than National Rifle Association bumper stickers at a Sarah Palin rally.

I remember all too well when gold last traded like this in that earth-shaking year. Just as I boarded a flight in Hong Kong, my long futures position ticked $750. By the time I landed in Johannesburg 20 hours later, it was trading at $900. I bailed. The fat lady then sang, and gold then bled for 20 years. Investors married to their positions got wiped out.

Traders who stay involved here should do so only against buying cheap out of the money puts for insurance. Remember, this is the commodity that takes the elevator up and the elevator down, and year end book closings are not far off.

Featured Trades: (EMERGING MARKETS), (EEM),

(EWZ), (RSX), (PIN), (FXI)

Brazil iShares ETF

Market Vectors Russia ETF

PowerShares India Portfolio ETF

iShares FTSE/Xinhua China 25 Index ETF

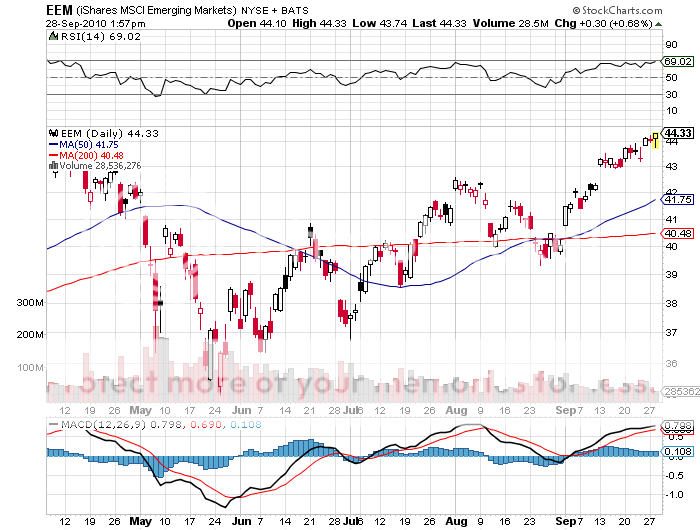

1) The Long View on Emerging Markets. I managed to catch a few comments on TV yesterday in the distinct northern accent of Jim O'Neil, the fabled analyst who invented the 'BRIC' term, and who has been kicked upstairs to the chairman's seat at Goldman Sachs International (GS) in London.

Jim thinks that it is still the early days for the space, and that these countries have another ten years of high growth ahead of them. As I have been pushing emerging markets since the inception of this letter, this is music to my ears. By 2018 the combined GDP of the BRIC's, Brazil (EWZ), Russia (RSX), India (PIN), and China (FXI), will match that of the US. China alone will reach two thirds of the American figure for gross domestic product. All that requires is for China to maintain a virile 8% annual growth rate for eight more years, while the US plods along at an arthritic 2% rate.

'BRIC' almost became the 'RIC' when O'Neil was formulating his strategy a decade ago. Conservative Brazilian businessmen were convinced that the new elected Luiz In??cio Lula da Silva would wreck the country with his socialist ways. He ignored them and Brazil became the top performing market of the G-20 since 2000. An independent central bank that adopted a strategy of inflation targeting was transformative.

If you believe that the global financial markets are back into risk accumulation mode, as I do, then you probably should top up your Brazil position, as it has lagged in the smaller emerging markets so far this year. Jim Chanos, you may be right about a China crash, but you're early by a decade!

It Turns Out He Didn't Wreck the Country After All

Featured Trades: (RESIDENTIAL REAL ESTATE)

2) Pushing on a String Up Close and Ugly. With many economists arguing that Quantitative Easing II amounts to nothing more than pushing on a string, I'll show you what it looks like up close and ugly. The online real estate firm, Zillow.com, has analyzed the results of tens of thousands of recent mortgage applications, with sobering results (click here for their site).

Ben Bernanke can cut interest rates all he likes, but can't raise personal credit scores, and that is a big problem. Some one third of Americans now have credit scores under 620 and are unable to obtain loans under any circumstances. Of the 47% who have good scores over 720, less than half are getting loans at the lowest interest rates. This is important because a mere 20 point improvement in scores leads to a $6,400 drop in the cost of an average conventional loan over its 30 year life.

This won't change until banks return to risk accumulation mode, which is at least five years off. I never miss an opportunity to pile abuse on the residential real estate market, as I believe that for demographic and other reasons it will be dead money for another decade (click here for 'The Hard Truth About Residential Real Estate'). This is just another nail in the coffin.

Not Looking Like a Great Short Term Investment

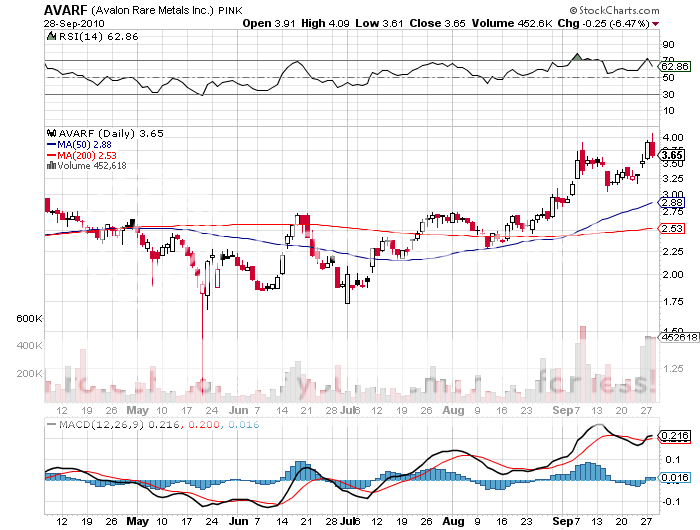

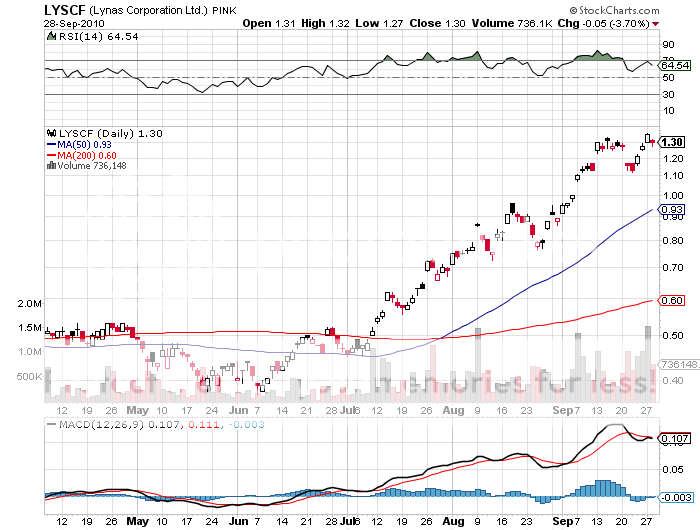

Featured Trades: (RARE EARTHS), (MCP), (AVARF), (LYSCF)

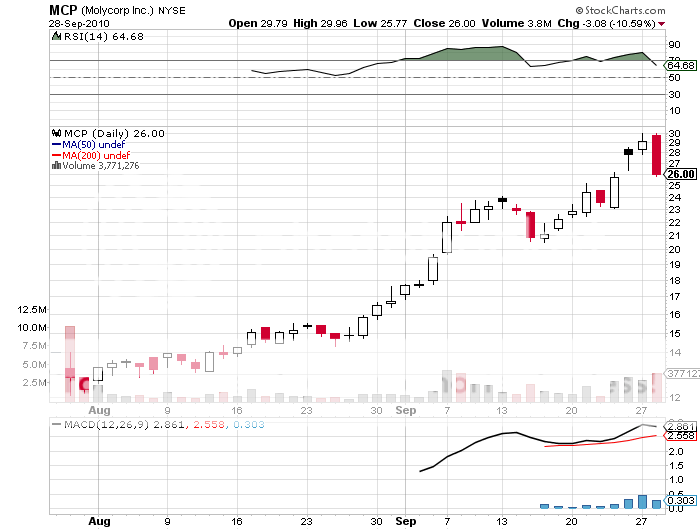

3) Have You Seen Molycorp Lately? I have only recommended one stock IPO this year, and that is for the resurrecting rare earths producer, Molycorp (MCP).? Since the July launch, it has rocketed 114% from $14 to $30, and then pulled back 15% today (click here for 'It's Off to the Races at Molycorp').

What set the cat among the pigeons this week was Japan's seizure of a Chinese fishing vessel in disputed waters between the two countries. Japan arrested the captain, and China threatened to cut off Japan from supplies of rare earths for its huge electronics industry. Japan later released the captain, and China denied it made the threat, all rare earths stocks, including my picks of MCP, Avalon Rare Metals (AVARF), and Lynas (LYSCF) went ballistic anyway.

It is enough to say that the markets are incredibly nervous about rare earths supplies, volatility is increasing, and it is still in the early days in this industry.? For more on this obscure backwater of the commodities markets, please click here for 'Peak Rare Earths is Upon Us'. When will the next spike in rare earths occur? On October 5, the House Armed Services Committee holds hearings on the American military dependence on Chinese rare earths supplies, which need these metals for virtually all advanced weapons systems. Watch this space.

I Was Looking for Salmon, Not Samarium

(SPECIAL MONGOLIAN ISSUE)

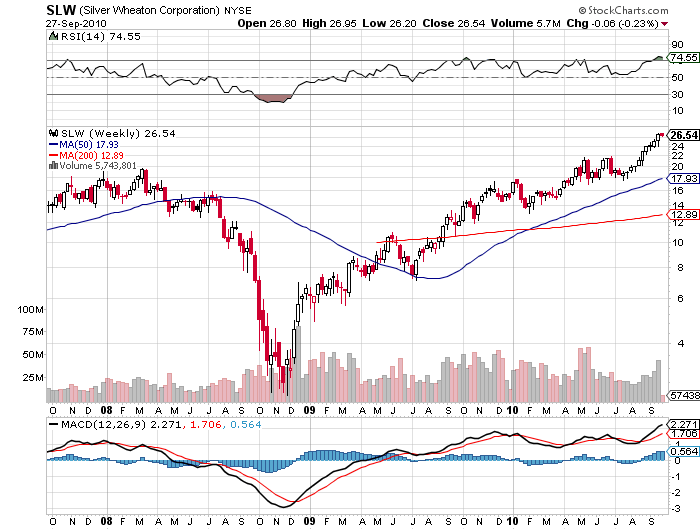

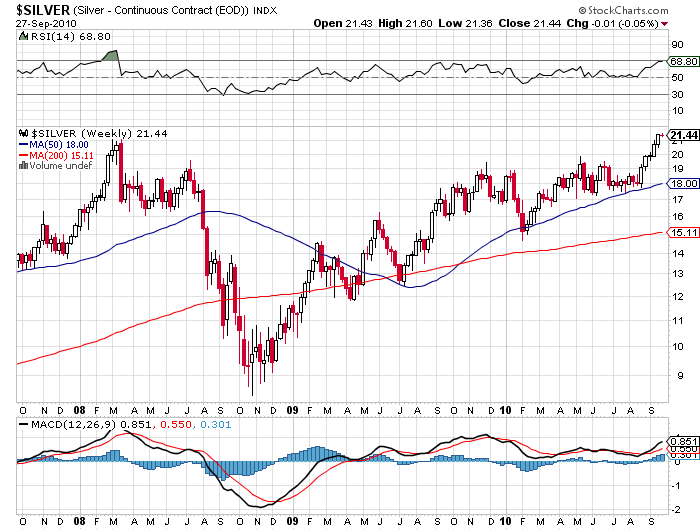

Featured Trades: (SILVER), (SLW), (SLV)

iShares Silver Trust

2) The Leveraged Upside Play in Silver. Silver really seems to have the bit between its teeth, not pausing at all after blasting through $21/ounce to a new 30 year high. If you think the move will continue, you better take a look at Silver Wheaton (SLW), a stock I have been recommending for a year, and has clocked a gain of 104% (click here for the call).

The great thing about this company is that it is a silver royalty stock. I'll spare you the legal details. Suffice it to say that it has a locked in cost of silver at $4/ounce, and current earnings forecasts are based on $17. With the white metal last trading at $21.40, any gains drop straight to the bottom line. Furthermore, the opening of new mines will see production soar from 23 million ounces a year to 40 million by 2013, giving you a double leveraged effect to the upside.

The only caveat I would ad is that this is not exactly a new trade, and that there is certainly more risk at $26.30/share than there was at $14. If silver turns, this will definitely be your E-ticket ride to the downside.

(SPECIAL MONGOLIAN ISSUE)

Featured Trades: (OIL), (HNR)

3) Are the Rumors About Harvest Natural Resources True? I have staff around the world constantly monitoring Internet chat rooms in a search of early movers. If they find something interesting, I make a few calls to see how real it is. After all, the Internet is 99% garbage, and 1% inspiration. That's how I found Houston based independent exploration company Harvest Natural Resources (HNR) (click here for their site).

HNR has a nice little business developing fields in Venezuela, Gabon, Oman, Indonesia, and China, for which it receives payments from local governments. It recently bought into the Antelope Field in the Duchesne Basin in Northwest Utah, which almost immediately hit a gusher. This one well is thought to be worth more than the rest of the company's entire operations, implying there is a latent double in the stock. Although the grizzled veterans with oil stains permanently under their fingernails I talk to have known about this field's potential for years, it is little known outside the industry or in the stock market.

Sure, I know you've heard this one before. But the company stands up on its own, even if the Utah angle turns out to be a fairy tale. The company has no debt, and fits in nicely with my own long-term view that oil assets of every description, from the majors to the indies, pipeline companies, and service companies, will do well over the long term. The only way I could be wrong is if Ben Bernanke figures out how to create a new barrel of oil with a printing press.

This one might be worth a punt. At the current share price you can buy the company for its existing business and get the Antelope field for free.

Featured Trades: (QUANTITATIVE EASING)

1) Bring on the Bernanke Put! It is now clear that the Fed's unprecedented message last week implying that public enemy number was deflation, not inflation, has given a green light to global risk accumulation of every description. Any further slowdown in the economy will now be met with aggressive quantitative easing. Although I don't spend vast amounts of time dissecting Fed statements, the words are unequivocal:

"The Committee will continue to monitor the economic outlook and financial developments and is prepared to provide additional accommodation if needed to support the economic recovery and to return inflation, over time, to levels consistent with its mandate."

Never was so much said by so few words.

It is rare that everything goes up at once, but that is exactly what we got, with stocks, bonds, foreign currencies, commodities all rallying hard. Coming into the Fall, I did have some concerns that asset classes that performed well over the summer, like emerging stock markets, precious metals, and the grains, might sell off on any American stock market strength, as managers rotate money from outperforming groups to laggards.

It was not to be. On Friday, the 23 point leap in the S&P 500 was matched by gold punching through $1,300, silver hitting another 30 year high above $21, the grains tacking on 5%, and most emerging markets reaching either six month highs or all time highs.

Who was not invited to this love fest? Financial stocks, where a weak housing market continues to wreak havoc with balance sheets, whether they publicly admit it or not. The US dollar was also missing in action, since any quantitative easing is certain to fan the inflationary fires down the road. The euro has blasted through to a multi month high, and the British pound is threatening the same.

I warned readers that the markets were primed for a move like this (click here for 'My Equity Scenario for the Rest of 2010'). All of the seasonal and historical indicators were predicting that in an election year like this one, six months of famine in the equity markets would then be followed by six months of feast. It looks like the S&P 500 now has a free pass to make a run to the 200 week moving average at 1,200, and possibly the high for the year at 1220. After that we'll see how real this is, for stocks anyway.

Party away like there's no tomorrow, but keep an eye on the door as usual, and keep snugging up those stops on US equities. Use the strength in long dated Treasuries to unload what you still own.

Helicopter Ben Says It's Party Time

Featured Trades: (GOLD), (GG), (GLD)

SPDR Gold Trust Shares

2) What's Next for Gold? Now that gold has hit my target for the year of $1,300, it is time to pause and reassess. A nice reversal may take place after the November election, especially if the Republicans take the house. While their promises to reduce the deficit are gold negative, the fact is that their tax cutting proposals are more likely to lead to bigger deficits, not smaller ones. With only 18% of the Federal budget discretionary, and the rest tied up in defense spending and entitlements, the amount of spending cuts they are proposing are impossible. Even if we eliminated all discretionary spending, the government would still be hugely in the red.

Another factor that could lean on gold prices would be a rise in capital gains taxes from 15% to 20% passed by Congress during the lame duck session. That would trigger a stampede to take profits in all asset classes before the year end. With gold up 35% this year and at the top of the list of performers, it could get hit with a serious bout of profit taking.

None of this changes the long term fundamental case for gold. The current environment of negative real interest rates is the dream scenario for the yellow metal. The last time this happened was during the seventies, when gold moved from $34/ounce to $900. As long as interest rates and stay low, you can expect gold to continue its rise. Goldcorp (GG) CEO, Charles Jeannes, says he believes we will see a $1,500 print sometime '?in the next one or two years.' Goldcorp is one of the largest gold producers in the world.

Although not many have noticed, the re-emergence of inflation has already started. Anyone who looks at the blistering prices rises of wheat, corn, soybeans, sugar, iron ore, coal, and other key raw materials can't look me straight in the eye and say there's no inflation. Of course the last place you will find it is in government statistics, a deep lagging indicator.

The Fall is always the peak demand time of year for the yellow metal, and the Fed's recent move towards QEII is likely to give the barbarous relic a shot of steroids. The only question here is whether a $100 pull-back starts here, at $1,350, $1,400, or even $1,500. When it does, you can expect a ton of buying waiting for it below from central banks, institutional investors, ETF's, and individuals alike.

Featured Trades: (EWZ), (PBR), (OIL)

Brazil iShares ETF

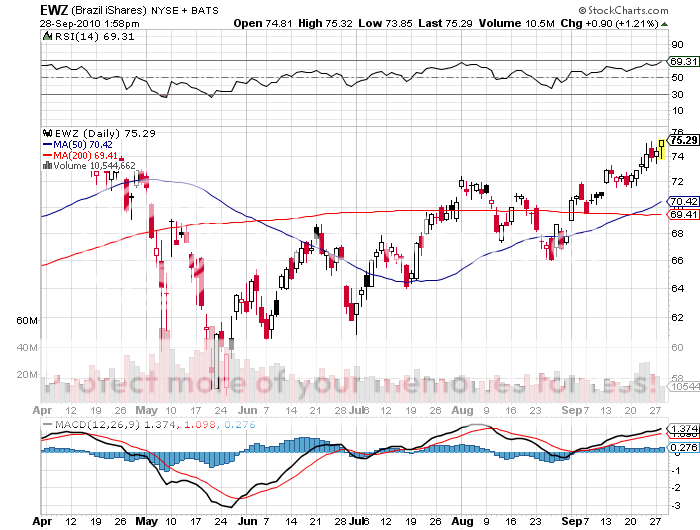

3) Why You Should Buy Brazil's Petrobras. I often get asked why I haven't been more positive about Brazil (EWZ). The answer is twofold; an upcoming election was about to bring a regime change in the high growth country, and there was a huge supply overhang from the upcoming secondary equity offering from Petrobras (PBR), the largest in history.

That turned out to be a good call, with the main market dropping 6% so far in 2010, when most emerging markets were going to the moon.? PBR has been a great short, dropping 31% from its peak.

Now Petrobras issue is done, and it is time to review the space. The company raised a staggering $70 billion, with the Chinese government coming in a major participant. The issue was priced so low that success was assured, despite its gargantuan size. Hedge funds and institutional investors whittled down their PBR weightings, hoping to cover their underweight on the deal. As the issue was generously oversubscribed, they are now scrambling to cover these shorts.

Petrobras will use the funds raised to develop their enormous Tupi offshore field, which is estimated to have 50 billion barrels of recoverable reserves. That will double the company's production to 3.9 million barrels a day by 2014, which is equivalent to 20% of American consumption. The company is well on its way to becoming the next oil major.

I think oil is a great place for the long term, and now is not a bad time to get in, as it has been one of the few underperforming commodities this year. I usually say buy the dips, but the dip in PBR has been going on for the past six months, so just buy now.