Featured Trades: (SPX)

S&P 500 Large Cap Index ETF

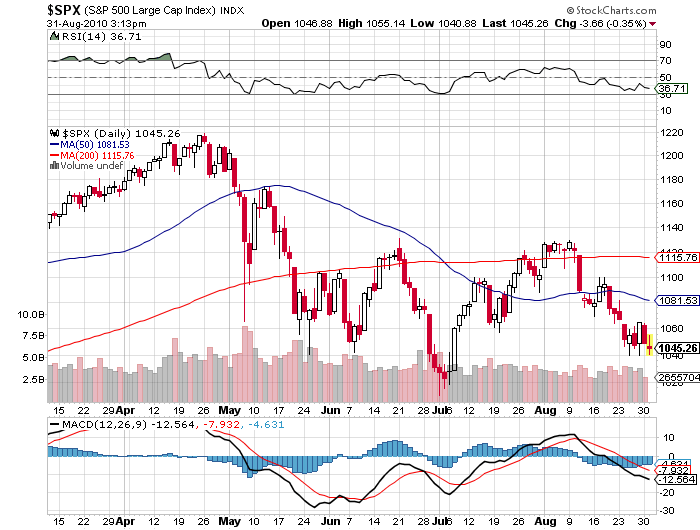

3) My Equity Scenario for the Rest of 2010. Not a day goes by when I don't fall down on my knees and thank the heavens that I avoided equities for much of this year (click here for 'I'd Rather Get a Poke in the Eye With a Sharp Stick Than Buy Equities' in January). Trading in American stocks this week is a sloppy, low volume, conviction free affair as everyone waits for an August non-farm payroll figure they know will be terrible. Good thing I focused on the grains, the Canadian and Australian dollars, emerging market equities and debt, junk bonds, precious metals, rare earths, and a few special situations like BIDU, POT, AGU, and MOS.

That report could be the stick that breaks the 1038 support which has held for 3 ? months and takes us down to my long standing 950 target for the S&P 500 (click here for 'Why There is No Place to Hide in This Sell Off'). Gold's positively virile action today, where it touched $1,250, just shy of an all time high, tells you that September is not going to be a pretty picture.

Historically, stock markets are weak for the six months going into midterm elections. The April 25 top on the SPX neatly fits that time table. In every election since 1950, markets then rallied for six months after the midterms, setting up for a nice year end rally.

The catalyst for the move will be the removal of the elections themselves as an unknown. With the two political parties at contemptible, diametrical, even hateful? extremes, elections these days have a much larger impact on financial markets than they have in the past.

End September will also bring the next round of earnings reports, which should be pretty good. After all, firing people to boost productivity and profitability is the winning business model of 2010. A 950 SPX gives you a PE multiple of 10, the lowest it has been for years. For you technicians out there, 950 also happens to be a key Fibonacci level.

I have often said that markets will do whatever they have to do to screw the most people. Getting as many as possible maximum short in September, then running the markets for the rest of the year, fits the bill nicely.

Thanks Goodness I Avoided Equities This Year

4) Another Admiring E-Mail. I get about 500 emails a day, but occasionally, I get one so choice that I have to pass it on to you. To the thousands of students, job seekers, and soon to be cashiered veterans who read this letter every day online, take heart!

'Dear Mad Hedge Fund Trader,'

'I'd like to purchase a subscription.? I have learnt a lot from your website, and used some of the insights I got in getting a job (first job actually), 4 weeks ago. The job is at XXXX in Sydney, Australia. I'd like to pay you back by getting a 2 year subscription, but $849 is about a quarter of my monthly salary at this point (I'm way down the corporate ladder). If you could send me the details to put in for a subscription, that would be awesome. I will check this mailbox in the morning before I leave for work. Thank you very much, XXXX'

You can't make this stuff up.

Featured Trades: (SOUTH AFRICA), (EZA)

South Africa iShares ETF

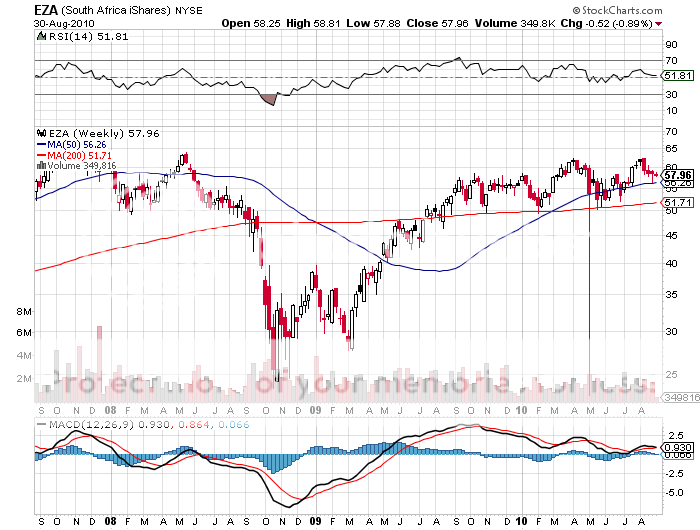

2) On Safari in South Africa. When I first visited South Africa (EZA) as a journalist in 1979, I was stuffed into the trunk of a car and smuggled into Soweto, a fenced off? 'township' , so I could write about the appalling living conditions there. Six ANC bodyguards accompanied my every move, as to venture out alone amidst 100,000 oppressed blacks would have been suicidal. Bringing along my Japanese wife to the land of apartheid didn't exactly go down well with the white locals either, as there was only one hotel in the country that would accommodate us.

The bottom line: everyone hated us. We were lucky to get out alive. Is those days, when long lines of Afrikaners snaked out of coin dealers selling their krugerrands for $900/ounce, everyone was convinced the country would soon blow up in a gigantic, bloody racial war.

It never happened. The Afrikaners made peace with the ANC, an incredible reconciliation process ensued, and by 2010 the country had healed enough to host the World Cup. It's all proof that if you live long enough, you see everything.

Now, South Africa is popping up on the radars of several big hedge funds as one of a handful of frontier emerging markets ready to make the move to prime time. Of course we already know about world class companies like De Beers, Standard Bank, and Sasol, which give it enough muscle in services and industry to stand out from the rest of the Dark Continent.

But did you know about alternative energy and venture capital? Local entrepreneurs report that South Africa is among the best countries to start a new company these days, with top rate universities, a plentiful, well educated professional class, a trained work force, generous government subsidies for key industries, and a healthy local market. Despite its well earned reputation as the premier source for the world's gold and diamonds, 50% of the country's exports were manufactured goods.

This dynamic mix enabled South Africa's GDP to hold up well during the financial crisis. Analysts are expecting a 3.3% growth rate this year and acceleration to 5% or more next year.

But this all misses the really big play in EWZ, whose ticket to prosperity will get punched by selling into fast growing markets? and a rapidly rising standards of living in the rest of Africa. The entire region has enjoyed accelerating GDP growth rates since 2002. This has been partly fueled by soaring commodity prices where Africa has a lock on the market, such as for cobalt and iridium, crucial elements for advanced electronics and cell phones.

There have been a number of new oil discoveries in Nigeria and Sudan. The Chinese are pouring tens of billions of dollars there into gigantic farms in Africa to feed its own hungry masses. Mass distribution of free anti retrovirals and malaria drugs by the likes of billionaire Bill Gates and the US government has also stopped the AIDS epidemic in its tracks.

Mind you, this is not a country without challenges. The unemployment rate is stuck at a daunting 24.5%, crime is rampant, income disparities are vast, and inter racial strife still percolates under the surface. However, when the world's investors flip back to risk accumulation mode, this is a new country you should consider.

Are You a Bull or a Bear?

Featured Trades: (SILVER), (SLV)

iShares Silver Trust ETF

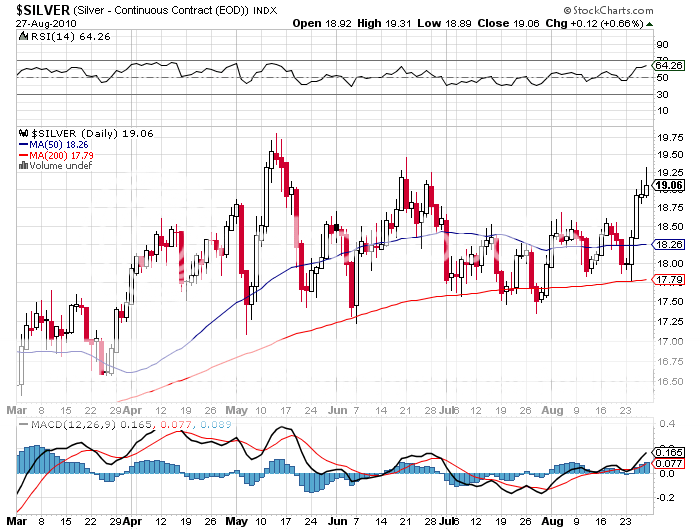

2) Silver is Hot, Hot, Hot. Those who followed my advice to watch silver should by now have the precious coins raining down upon them (click here for 'Why the Really Big Play is in Silver' ).

Since then, the precious white metal has jumped 8% to $19.30, just pennies short of a multiyear high, compared to a more pedestrian 4% move by gold (GLD). It is thus fulfilling my prediction that it would outperform the barbaric relic by 2:1 on the upside.

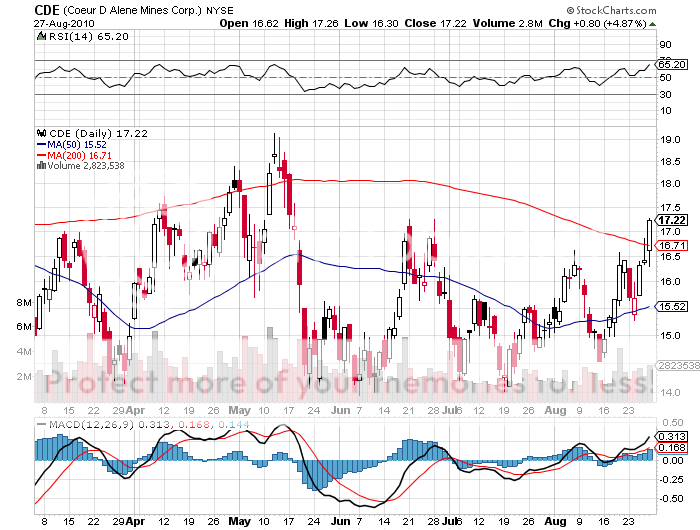

The action has spilled over into the miners, with Coeur D Alene Mines (CDE) rocketing by 19% in two weeks, while Silver Wheaton (SLW) is up 14% and Hecla Mining (HL) has tacked on an impressive 16%.

Precious metals traders have been stumped by the move, expecting that industrial demand for silver would slump in the face of a double dip recession. What they aren't seeing is the surging monetary demand for silver, which continues to grow beyond all expectations. Not only do you see Americans and Europeans fleeing into silver, rather than lock themselves into 30 year returns in the Treasury bond market at 2.5%, the Chinese are leveraging up a rising standard of living into increased silver coin purchases.

Silver also has a much bigger catch up game to play. While gold is a mere 2% off its all time high, silver must appreciate by 153% to reach a new peak.

Your choices here are the silver ETF, the miners listed above, or futures contracts listed on Comex. You can also get physical by adding to your holdings of .999 fine silver buffalos at a small margin over spot by clicking here. If these guys sell out, shop around, because there are plenty of other merchants with competitive prices. You can always use them to bribe the border guards when you are fleeing the country.

Featured Trades: (GOLD), (GLD), (GDX)

SPDR Gold Shares ETF

Market Vectors Gold Miners ETF

1) The San Francisco Money Show. I attended the Woodstock of investment conferences last week, the San Francisco Money Show, which offered an entertaining three ring circus of traders, foreign exchange models, options platforms, newsletters, cruises, video broadcasts, and more.

The cavernous Marriott Marquis hotel and convention center South of Market on 4th Street was absolutely bubbling with new ideas. You couldn't walk five feet without tripping over a great investment theme, and information overload was the problem of the day. There was a plethora of celebrity speakers, including Elaine Garzarelli, John Mauldin, and Think or Swim founder, Tom Sosnoff.

There really is no corner of the financial markets that was not well represented by market makers, analysts, technology providers, and investors-- thousands of them. With the soaring level of US government debt scaring the daylights out of everyone, the precious metals dealers were there in force.

Of course, the hard asset crowd was everywhere, and you could not swing a dead cat without hitting a miner looking for new funding. Never mind that the barbaric relic went up for all the wrong reasons. The dollars they're making are still just as good at the bar. The only thing missing from the show was the long predicted hyper inflation. Want to prospect in the Ivory Coast? No problem.

I was pleasantly surprised by the diversity of major corporate sponsors there to promote their own shares, like Darden Restaurants, Proctor and Gamble, Roche, Sanofi Aventis, Vale, and Nidec, several of which are great investments. A variety of oil service companies were also well represented. A 'green' section offered a look at wind, solar, and geothermal energy providers.

I took the opportunity to talk with companies about everything from the latest drilling costs, long term food prices, and the true cost of geothermal, to the clever play in gold coins (go for those struck at the San Francisco Mint). I was constantly amused every few minutes by attendees who, seeing my nametag, asked to have a photo taken with the one and only Mad Hedge Fund Trader, and to sign their program.

After I make my fortune, there was even a booth extolling the virtues of retiring on the beach in Costa Rica or Belize. It was a great opportunity to chat with the end investors who ultimately drive all these markets. All in all, it was a weekend well invested. For a calendar of future events, go to www.MoneyShow.com.

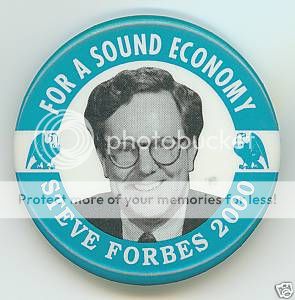

Featured Trades: (STEVE FORBES)

2) A Chat With Steve Forbes. I sat down with Forbes magazine publisher and perennial Republican presidential candidate, Steve Forbes, whose father, Malcolm, I knew from my journalism days in the seventies. He was there formally to promote his new book, Power Ambition Glory, but I couldn't help but sense his loftier goals.

He says that the crash was a failure of government. It was caused by the Fed, which pursued a weak dollar policy, kept interest rates too low for too long, and printed too much money. Our central bank should pursue a strong dollar policy which will bring a revival of the credit markets. We have the most hard left president and congress in history, and they are on the cusp of getting what they want. Lifting the rules on upticks and naked shorting threw gasoline on the fire.

The rating agencies are a cartel we should get rid of. Let the free markets work. The stock market recovery last year came with the modification of mark-to-market rules, which never should have been in force. George Bush betrayed the Republican party by abandoning its principles.

Steve has always championed the libertarian wing of his party, and has been the leading proponent of the flat income tax. Did I just hear the first campaign speech of the 2012 presidential election?

SPECIAL BOND BUBBLE ISSUE

Featured Trades: (TREASURY BONDS), (TIPS), (TBT)

ProShares Ultra Short 20 year +Treasury ETF

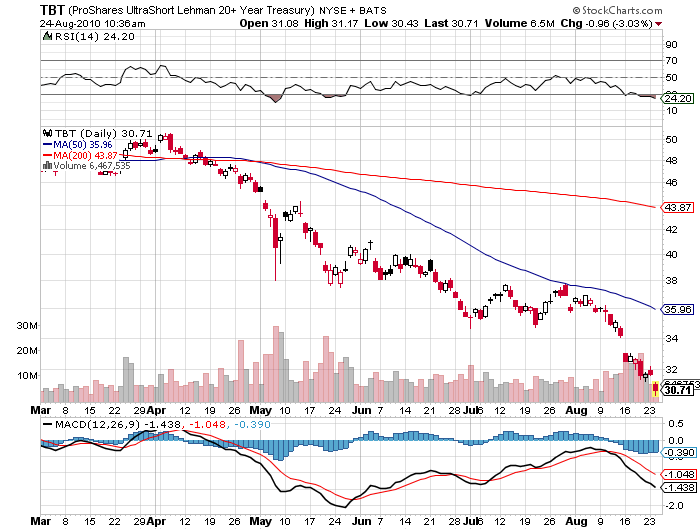

1) Don't Buy That Treasury Bond. Another week later, and Treasury bond prices have raced up to even dizzier heights, breaking more records for over valuation. According to the Investment Company Institute, outflows from equity mutual funds over the last two years totaled $232 billion, while inflows into bond funds soared to a staggering $559 billion. Today, 'bond funds' ranked with 'Miss Universe' and 'Lindsey Lohan' among Yahoo's top ten search terms. Companies, like FedEx, are looking to issue corporate bonds maturing in 100 years. No doubt the prospect of 80 million baby boomers bailing on equities so they can become coupon clippers for life is providing some extra juice for this market.

In a Wall Street Journal article last week, the Wharton School's Jeremy Siegel pointed out that ten year inflation protected securities (TIPS) with yields under 1% are selling at a PE multiple equivalent of 100 times, the same valuation that dotcom stocks saw a decade ago (click here). Bonds with four year maturities have negative real yields.

The last time this happened, in 1955, ten year bonds brought in an annual return of only 1.9% for the following decade. The potential capital losses for these securities now loom large. In the meantime, the short Treasury ETF (TBT) trades at $30.60.

Let me run some numbers here. If the yield on the 30 year Treasury bond runs up to last year's low of 3%, the TBT will fall to a new all time low of $27. If I'm right, and we move back up to the 2010 high of 5.05%, the TBT pops back to $51.50. Running a downside risk of 11% to capture a potential gain of 68% sounds like a pretty good risk/reward ratio to me. But it might get better. Don't forget that my long term, multi year target for this ETF is $200.

If the futures players get this right, a move in the December long bond (ZBZ0) on the CBOT from today's high of 134.5 to this year's low of 111.50 multiplies your minimum margin requirement from $3,375 to $23,000, a 6.8 fold return.

But wait, there's more! If you don't feel like making big bets until you figure out what the new normal looks like, try a limited risk position through the TBT options. The March $30 strike calls are trading at $4. A run up by the ETF to this year's high puts these babies at $21 at expiration, a net profit of $17, a gain of 425%.

I'll tell you some key targets to watch for to determine the timing on this: when the yen approaches ?80, the S&P 500 touches 950, the 30 year yield tickles 3%, and the ten year yield slams into 2%, it will all be over but the crying. I'm still keeping my powder dry for taking another shot at this trade, but my trigger finger is getting mighty itchy.

Getting an Itchy Trigger Finger for the TBT

Not as Popular as a Bond Fund?

SPECIAL BOND BUBBLE ISSUE

Featured Trades: (RESIDENTIAL REAL ESTATE), (BAC)

2) Another Nail in the Coffin for Residential Real Estate. Those few, like myself, who believe that the residential real estate market has another down leg ahead of it, got their smoking gun yesterday. July existing home sales cratered 27.2% to a seasonally adjusted rate of 3.83 million units, the sharpest month to month drop in history, and the lowest sales pace since 1995. YOY sales are off 25.5%, and the June figures were also revised down. Inventories are now at a 12.5 month supply, the highest on record.

Low end buyers totally bailed on the market. It looks like the baby boomer effect is hitting the market big time, as I have been detailing in my endless posts on the subject (click here for 'The Hard Truth About Residential Real Estate'). It is also now screamingly obvious that the net effect of the $8,000 first time home buyers tax credit and similar, complimentary efforts by the states has been to pull forward purchases of homes, not create new demand. Like this was ever in doubt?

I can tell you one thing for sure. Bank share prices have not yet discounted weaker home prices, and the bleeding collateral this implies. The 36% decline that Bank of America's (BAC) shares have suffered since April may not be enough. Again, rent, don't buy, unless you plan on living there for ten years, and don't mind giving up your first born child for collateral.

SPECIAL BOND BUBBLE ISSUE

Featured Trades: (GOLD), (GLD), (GDX)

SPDR Gold Shares ETF

Market Vectors Gold Miners ETF

3) Why Gold Seems Unbreakable. While the rest of the world has been going to hell in a hand basket, gold (GLD), (GDX) refuses to take a serious dip, and is threatening the old $1,260 high. Today, the World Gold Council, the ultimate go-to source for figures on global supply and demand for the barbaric relic, published its 2010 Q2 assessment yesterday. The report paints a positively bullish outlook for the yellow metal (click here for the link at http://www.gold.org/).

Investment demand has been skyrocketing, causing total buying to jump 36% to 1,050 metric tonnes YOY. Purchases from the new exchange traded funds have soared 414% to 291 tonnes. Hoarding of gold bars, primarily in emerging markets, is up 29% to 96 tonnes. India and China will continue to be the new demand driver for the foreseeable future.

A flight to safety bid from Europeans desperate for a hard alternative to the Euro has been strong. A recovering economy has caused industrial electronics gold consumption, especially from Japan, to jump 14% to 107 tonnes, near all time highs. Substantially higher prices caused jewelry demand to fall 5% to 408 tonnes, driven by a pull back in buying from India.

I'm starting to wonder if my long term target of $2,300/ounce is too conservative (click here for 'What to do About Gold'). Overall, it is one of the most positive reports I can recall. Gold bugs should print it out so they can sleep with it under their pillows at night.

Sleeping Better With Gold Coins Under Your Pillow

SPECIAL BOND BUBBLE ISSUE

Featured Trades: (TREASURY BONDS)

4) Its Official: China is Unloading its Treasury Bonds. It looks like the smart money these days is found in China. While American investors have been scrambling over each other to buy more Treasury bonds at historically low yields, China has begun quietly unloading some of its own enormous holdings. In June, the Middle Kingdom sold $21.2 billion of?? paper, reducing its net long to $839.7 billion. This is little more than 10% of the total $8.18 trillion in federal debt that Uncle Sam has outstanding.

Total foreign ownership of US Treasury bonds amounts to $4 trillion, up from $2.4 trillion in three years.?? Instead, the Chinese have been buying Japanese government bonds, which today carry a paltry 0.9% yield, but have the merit that they are denominated in a rapidly appreciating currency. The Mandarins in Beijing have also been picking up a variety of bonds in Europe which have seen yields pushed to near records, thanks to the debt crisis there.

Officials at the People's Bank of China say that it is all part of a broader diversification effort away from the greenback. PIMCO's Bill Gross has apparently been taking Mandarin lessons on the sly because he has also been paring back his own massive holdings in longer dated Treasuries. To understand why, take a look at the chart below of the spread between the Dow dividend yield and the ten year Treasury yield which has turned positive for the first time since 1955.

China Can't Unload Those Treasury Bonds Fast Enough