ANOTHER SPECIAL CHINA ISSUE

Featured Trades: (USO), (VALE), (BTU), (FCX), (CAT),

(FXI), (EWA), (EWC), (FXA), (FXC), (CORN), (SOYB), (WEAT)

Currency Shares Canadian Dollar Trust ETF

Currency Shares Australia Dollar Trust ETF

Australia iShares ETF

Canada iShares ETF

iShares FTSE/Xinhua China 25 ETF

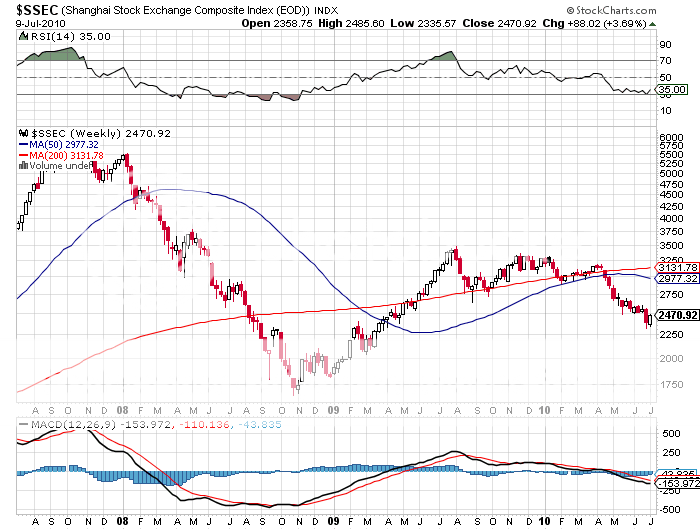

1) How China's Economy is Already Bigger Than the US. China has already surpassed the US in the global competition sweepstakes and is on track to extend its lead. No, I'm not talking about some pie in the sky 2030 or 2050 forecast from some hole in the wall research boutique. I'm referring to right now, today, this minute. At the end of 2009, America could boast a GDP of $14.2 trillion, while China's stood at $4.9 trillion. The Middle Kingdom will grow by at least 10% this year, generating $490 billion in new GDP, while the US, growing at only an average 3% rate, will add $425 billion in this key measure of economic muscle. That easily makes China the world's largest country in terms of new business activity, and therefore, the most important when gauging the future direction of financial markets. This is why I have been feverishly pounding the table this year screaming that it's all about China, China, China. It's also why I announced to readers why I'd rather get a poke in the eye with a sharp stick than buy equities (click here for the call). Since then, the Chinese stock markets have been falling, not in a great cataclysmic crash, but in a slow death by a thousand cuts. Chinese equity PE multiples have fallen from 50, three years ago, to 10 today, and there are still no buyers. Money managers and financial advisors of all stripes only need to make one call this year: when will the Chinese economy turn? This is harder than it sounds because it means that your entire investment strategy is now dependent on unreliable, contradictory, and untimely data, from a third world nation that only recently moved on from the abacus to measure business activity. When good data does become available, you can then count on the locals to front run and inside trade the first 10%-20% of the move. That will leave you with the difficult choice of getting in late, or not at all. I never said this was going to be easy. So I'll give you a head start and tell you when this will happen: the day before the People's Bank of China stops tightening. This is why hedge funds have kept a laser like focus on Chinese bank reserve requirements, which now stand at 17.5%.? When the slowdown does end, every stock, bond, currency, and commodity market will do so as well. Focus first on the things that the Chinese have no choice but to buy. Just go down their list of largest imports, and you'll find oil (USO), iron ore (VALE), coal (BTU), food (CORN), (SOYB), (WEAT), copper (FCX), and machinery (CAT). You can also buy the suppliers of these commodities, including Australia (EWA), Canada (EWC), and their currencies (FXA, FXC). There is a huge buy setting up here, but the overwhelming verdict of the markets is 'Not Yet'! While I'm waiting for the big trade, you can find me having lunch at a restaurant on Grant Street in San Francisco's Chinatown, eating chop suey and egg foo yung, pestering the waiters for the names of the next hot IPO's.

ANOTHER SPECIAL CHINA ISSUE

2) Who's Been Buying All Those Japanese Bonds? International bond and foreign currency markets were stunned last week when figures were released showing that the Chinese had bought record amounts of Japanese government bonds in May. The move was no doubt the impetus behind the big rally that took Japanese ten year debt to a pitiful 1.15% yield, and triggered the break out by the yen from a six month, ?90- ?95 range that caught many hedge funds flat footed. The Middle Kingdom's purchases of short term yen paper soared to $8.3 billion, more than the entire first quarter. China has the enviable problem in that it has a plethora of riches. In fact, it has so much money, that there are really only three places it can go: US Treasuries, Euro denominated bonds, and JGB's. Any move out of one, necessitates purchases of the other two, and a good dose of Euroscare, no doubt, stampeded the Chinese away from that beleaguered currency into the yen. Sure they can dabble in other attractive, fundamentally strong currencies, like the Australian and Canadian dollars and Swiss francs (click here for more depth). But the floats in these lesser currencies are so small that any serious move would quickly send them through the roof. Where else can you go with $2.4 trillion? Antique postage stamps? Vintage baseball cards? Collectable Beanie Babies? (Ebay would love it!). I think not. This also explains why, no matter how dire its prospects are, some two thirds of China reserves are still parked in the dollar.

ANOTHER SPECIAL CHINA ISSUE

Featured Trades: (SOYBEANS), (SOYBEAN MEAL),

(CORN), (WEAT), (SOYB)

Teucrium Agricultural Trust Corn Fund

Teucrium Agricultural Trust Soybean Fund

Teucrium Agricultural Trust Wheat Fund

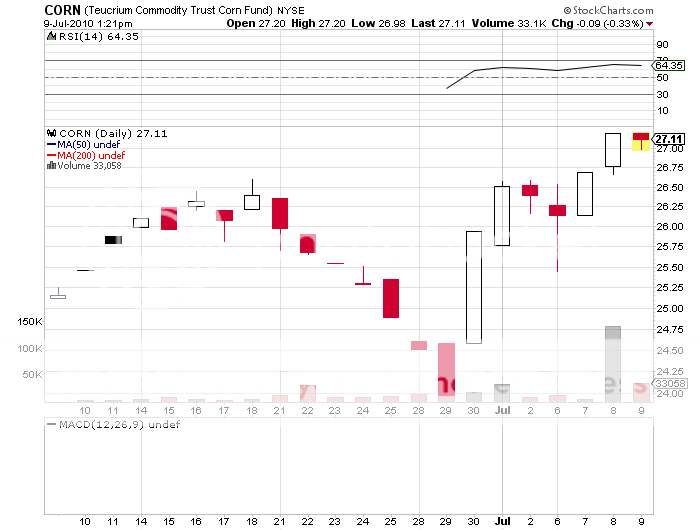

3) The Grains Take Off. It turns out that perfection doesn't continue forever, after all. That was the bet I was more than happy to make three weeks ago when I started to buy the ags (click here for 'Going Back Into the Ags' ). Since then, torrential rains in the US and Canada have worsened growing conditions, causing the US Department of Agriculture and virtually every independent research house to stat rapidly paring forecasts of both acreage and yields. Oats have had a gigantic move, corn futures clocked a limit move up day, wheat has taken off like a scalded chimp, and soybeans have decisively broken out to the upside. It's not just a North American problem. Reports of shortages have started pouring in from the major producers of Brazil, Russia, China, the Ukraine, and Australia. The hidden hand of massive Chinese buying is now turning up everywhere, as they scramble to lock in supplies to feed their hungry masses. The backwardation in the soybean meal market, where front month futures contracts trade at big premiums to the far months, speaks volumes about the demand out there. Just look at the wheat action on Friday. The USDA announced a slight improvement in the crop, which should have tanked the market, but the futures tacked on 4% anyway. Throw bad news on a market, and if it goes up, you want to own it. No one was more surprised than the full time grain traders, who saw nothing but record supplies stretching out as far as the eye could see. Only the (CORN) ETF has made it to market so far, bringing in a 13% gain from its low.? The paperwork for wheat (WEAT) and soybean ETF's (SOYB) is still in the works. So the only way to play this was through the futures markets. I look for more gains in the grains, and it is safe to say that, at this stage, you have missed the bottom. And as I always like to say with the ags, if the trade doesn't work out, you can take delivery and eat your longs.

'We in the business of trying to judge risk significantly underestimated the extreme tail risk, the so called risk involved in very low probability events and what the consequences would be should they happen,' said former Federal Reserve Chairman Alan Greenspan.

Featured Trades: (JAPAN), (EWJ), (NIKKEI)

Japan iShares ETF

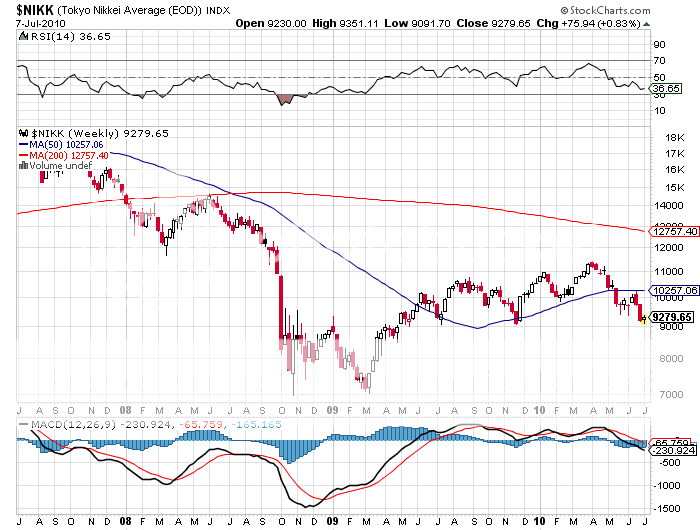

1) Why I Still Hate Japan. Like watching an old friend who fell from the high life as a special bracket investment banker to a stumbling drunk, I can't help but pity Japan's beleaguered stock investors. Since peaking in 1989 at 39,800, they have been mired in a 20 year bear market, the longest in history, and there is no sign of the index climbing substantially off the current 10,000 level anytime soon. I have watched with dismay as GDP growth shriveled from a white hot 10% in the sixties, to 7%, 5%, 3%, and now 1%, and share prices reflect this.

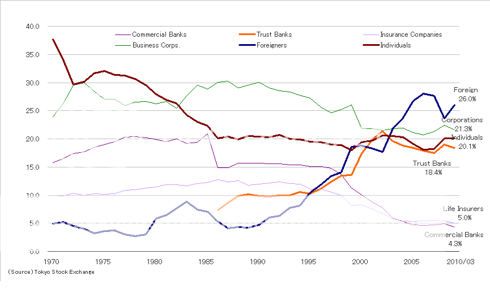

Not even the Japanese want to buy their own stocks, with foreign institutions accounting for up to 60% of trading volume on a good day, while domestic ones generate a paltry 10%. Local investors would much rather buy emerging market funds, currency funds, bond funds, anything but their own equities. This explains the miserable 1.15% yield investors get on ten year JGB's. Nikkei stock index volatility is driven by a handful of foreign hedge funds that rush in, and then right back out.

Although the government launched one Keynesian reflationary package after another during the nineties, the end result was a massive accumulation of debt and a thousand 'bridges to nowhere.' Obama take note.? In four decades I have watched the country degenerate from a paragon of fiscal rectitude to one of the most debt burdened nations on the planet. The country's total debt, net of cross holdings, is 111.6%, and is rocketing towards the 140% now seen in Greece.

Japan used to have a great story up until the eighties, when they were the world's low cost provider of quality manufactured goods. The Nikkei was the place to be when Japan's share of the US car market soared from 3% to 40%, and the yen went hyperbolic from ?360 to ?78. But then a beefy new kid showed up in the neighborhood called China, which has taken over that role. Sure, the quality isn't there yet, but you can't beat those prices! This is why global investors see Asia as a China only bet, and avoid the Land of the Rising Sun like the plague.

Equity price earnings multiples have fallen from 100 down to 15. But even that seems high if the country is only able to eke out 1% GDP growth rate for the foreseeable future. An appreciating yen serves only to tighten the screws on the country's prolific exporters even further. Now it seems they want to raise VAT taxes too. That will simply hobble consumption further. Some 12.7% of Japan's equity is still held in corporate crossholdings, a relic from the old zaibatsu days, that will continue to weigh on share prices. Great thing to have in a rising market, but not so good on the downside.

Japan has the world's worst demographic outlook (click here for my analysis). They're just not making Japanese anymore. Changing governments as often as I change my socks doesn't exactly inspire confidence among foreign investors. What does the center left Democratic Party of Japan (DPJ) stand for, anyway? Politics has degenerated into a scrum of conflicting interests to see who gets a share of an ever shrinking pie.

Independent research analyst Darrel Whitten of Japaninvestor.com (click here for the site ) believes that Japan has to engineer a substantially weaker yen to stimulate exports, aggressively use the Bank of Japan's balance sheet to create inflation, and draw up a new pro growth economic plan, much like the Ministry of International Trade and Industry (MITI) successfully engineered in the fifties. I won't be holding my breath. The strong leadership and ironclad consensus that created the Japanese economic miracle isn't to be found these days. Until then, Japan will, at best, be a single stock story, with money pouring into companies that can still prosper against these incredible force nine gales.

I have made such a massive personal investment in Japan, living there ten years, learning their impossible language, and publishing several books on the topic. I wish I had better news to report. But I don't.

Ownership of Japanese Equities

Featured Trades: (SPX), (YCS), (TBT)

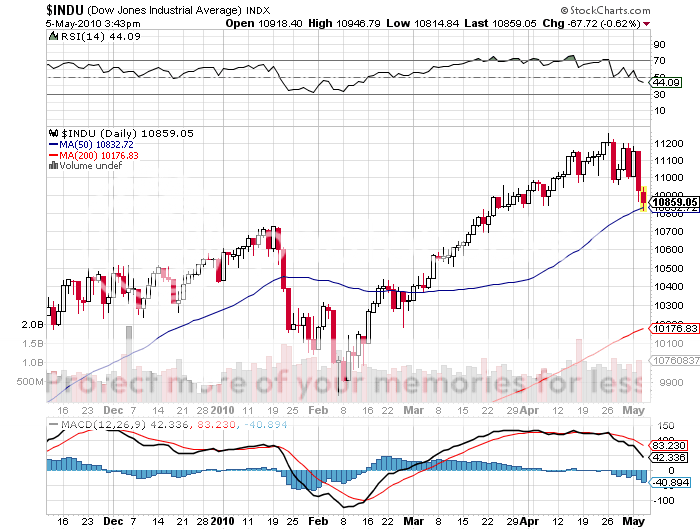

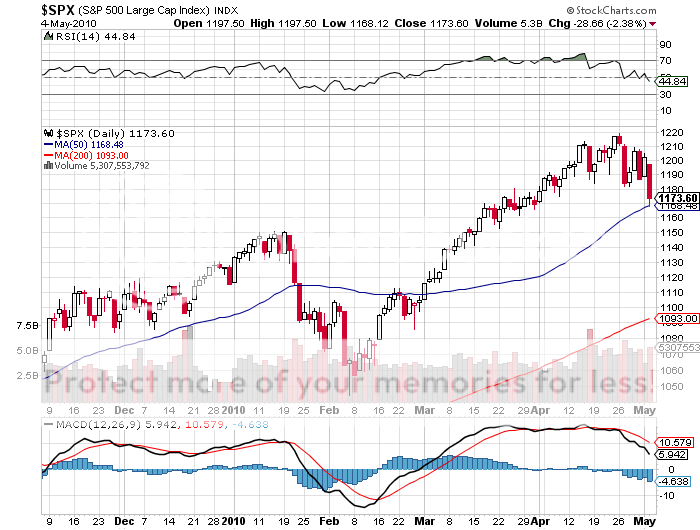

When I boarded my plane in San Francisco on Thursday morning, May 6, the Dow was down an uncomfortable, but tolerable 150 points. When I arrived in New York that night I was greeted with headlines screaming 'CRASH: DOW PLUNGES 1,000.' I was not surprised. In a letter sent to my premium subscribers the day before I predicted a fall in the S&P 500 to 1,050 (click here for the call), although I thought it might take two months to get there. Instead, we got it in two hours!

Featured Trades: (GLOBAL RISK REVERSAL)

1) There's a Massive Global Risk Reversal Going on. The Gulfstream is fueled up, the flight plan filed, and my pilot is carping about missing our IFR clearance slot, so I'll just quickly dash off a few words here before I take off for the Big Apple. They are rioting in the streets in Athens, and bankers are being burned at the stake. I love it. It's clear that there is a massive global risk reversal going on. The euro has collapsed to the $1.28 handle, crude is under $80, and the Dow has shed 400 points in two days. S&P 500 at 1050, here we come! The yen has just gapped up ?2 as hedge funds rush to unwind their carry trades. There is a rising crescendo of stops going off in all markets that is so loud that I can hear it with my head buried under my pillow. Precious metals proved nowhere to hide, either. Did someone say something about 'Sell in May and Go Away?''

Maybe something about cash fleeing all assets in unison? It is great entertainment watching from the sidelines. As long as flocks of black swans are alighting on the markets, as in Alfred Hitchcock's Birds, it is better to wait for the dust to settle. The big trade here is to wait for the big trade, several of which are setting up. Anyone who believes in 'decoupling' at this stage also believes in the Easter Bunny, Santa Claus, and the Loch Ness Monster, and also that the Chicago Cubs will win the World Series this year. That's the limo driver at the door. Gotta run.

Not a Busy Signal

Featured Trades: (SPX), (BP)

1) Yesterday, the lemmings discovered the Law of Gravity,and the plaintive squeals of the dying mammals could be heard throughout the financial markets. European finance ministers must be depressed that their $140 billion bailout of Greece only bought them 24hours of grace in the eyes of investors. The European finance ministers might as well drown themselves in the seas of red on my screen. Only the Vix and British Petroleum (BP) are green. How perverse. Oil down$3.50! Boiiing! Silver off a buck! Kaboom! The ten year Treasury at 5.59%! Pow!It also looks like the oil spill in the Gulf of Mexico could make a sizeable dent in US Q2 GDP. You all know that I have been negative on equities for a while now (click here for my piece on buying cheap downside protection). The global nature of the sell off across all asset classes also came as no surprise (click here for that prediction). The flight to quality has given another shot of adrenaline to the dollar against my core shorts, the yen and the euro,both of which broke down to new lows for the year today. Most fascinating is that my April surprise came through too (click here for the report). The withdrawal of the Fed at the beginning of the quarter as the sole purchaser of real estate debt in the market, led not to a crash in bond prices, but a huge six point rally, sending yields into the dump. With the coming collapse of the Treasury market the new mantra among traders, it turns out everyone was short! Once again, Shanghai's status as a canary in the coal mine for all global markets is reaffirmed (click here for the explanation). Where am I going to buy the dip first? Shanghai.The hedge fund managers who saw all of these complex pieces fitting together and positioned for it made multiple killings. Those who didn't, have joined their furry cousins at the bottom of the cliff.

A Dead Lemming, RIP

Featured Trades: (UBR), (UPV), (UMX), (UXJ), (TMV)

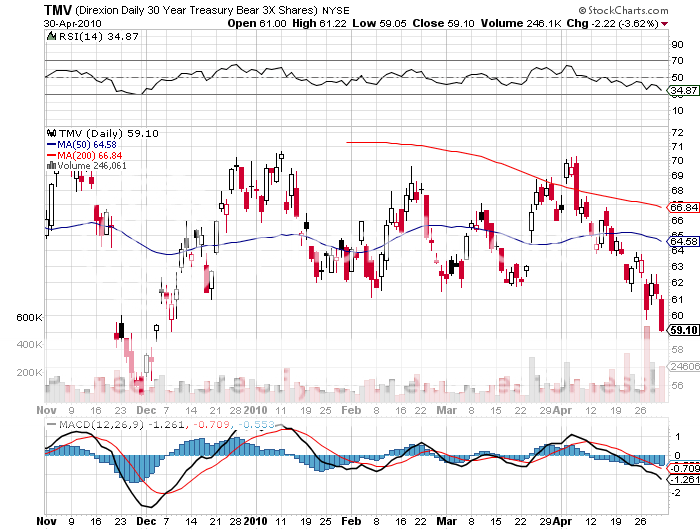

1) The Leverage Window Just Opened Wider. Just as the public debate on risk control gets underway on Capitol Hill, a number of instruments have been launched that will allow unsophisticated retail investors to ramp up their leverage, big time. It's like handing out free fireworks right after your hometown burns down.? Last week, Proshares launched a gaggle of new leveraged ETF's on key benchmark international stock indexes that give individual investors opportunities to bet the ranch in ways they previously never thought possible. They include 200% leveraged long ETF's on Brazil (UBR), Europe (UPV), Mexico (UMX), and the Pacific ex-Japan (UXJ). These funds carry 0.95% expense ratios, rather hefty for index funds. Short versions of these ETF's already trade. While it's great to have a broader range of instruments to trade in the international arena, remember that these are truly double-edged swords. When you're right, the cash pours in; when you're wrong, you hemorrhage dollars like a hemophiliac spills blood. You also have the additional risks of tracking error, poor management, and liquidity. While on this topic, I'll mention another ETF which should carry a surgeon general's warning on every trade ticket, as with a pack of cigarettes. The Direxion Daily 30 Year Treasury Bear 3X ETF (TMV) gives investors a 300% short bet on the long dated Treasury bond. Triple the 4.6% current yield you are shorting and throw in the expense ratio, and long term investors are facing a 15% per annum headwind. Unless the US embarks on a Grecian style default on its debt in the very near future, it will be tough to make money holding this instrument. That is, unless you are a day trader, in which case, the cost of carry is zero. That is surely the purpose for which this potentially toxic instrument was intended.

Featured Trades: (Q1 GDP)

1) My Square Root Scenario is Happening. The 'square root' scenario that I have been forecasting for the US economy is coming to pass. On Friday, the Commerce Department's Bureau of Economic Analysis confirmed that the US grew at a 3.2% annualized rate in Q1, compared to a 2009 Q3 figure of 2.2%,? and 2009 Q4 growth of 5.6%. What's more, the recovery remains very lopsided, with only export oriented businesses booming and large swaths of the domestic economy, like construction and real estate, still struggling. Keep in mind that the S & P 500 over 1,200 is discounting growth continuing its torrid 3% or more growth rate for the rest of the year. It's all going to make this coming Friday's nonfarm payroll more interesting than usual. The whisper number is now calling for job growth of 200,000. A beat will deliver another leg up in the stock market, possibly to 1,250. A shortfall could trigger our annual summer correction. Whatever the outcome, Obama's political future may depend on it.