Global Market Comments

February 26, 2010

Featured Trades: (TOYOTA), (TM), (PALLADIUM), (PALL),

(RESIDENTIAL HOUSING), (XHB)

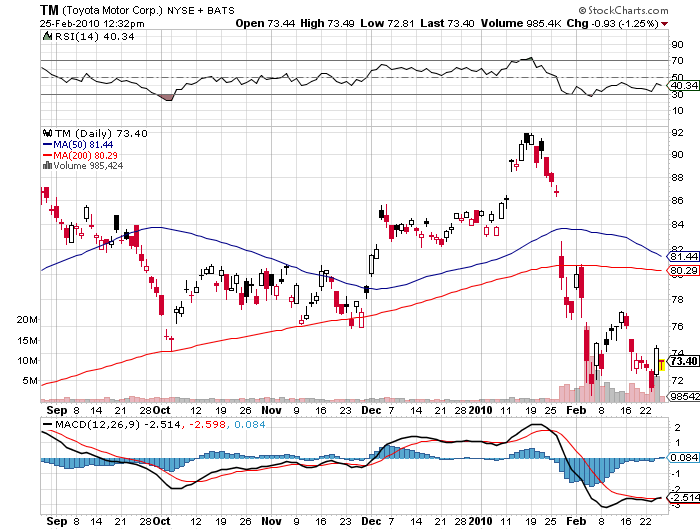

1) Since I am probably the only person in the country who once worked for Toyota, speaks Japanese, and worked in the White House Press Corps, and am therefore fluent in the ways of Washington, I feel obliged to comment on yesterday's Congressional hearings on Toyota. There, Akio Toyoda, president of the Toyota parent and grandson of the founder and English speaking Yoshimi Inaba, president of Toyota Motor North America, Inc. faced the firing squad. It was the usual Congressional theater, with the member from Kentucky, where non union Toyota plants are located, listing off the firm's charitable donations to the community, while the one from Michigan launching a vicious, no-holds-barred attack. The language spoken by the two Japanese couldn't have been more different. Toyoda spoke the words of inherited wealth, of a ruling shogun, of privilege, and of condescension. Inaba talked like the hardscrabble warrior that he was, who spent 40 years clawing his way up the Toyota organization ladder. I think the entire crisis happened because Toyota management believed in their products to such incredible extremes that any criticism was viewed merely as the unhappy grumblings of competitors. Similarly, the quality of Japanese products became so ingrained in the minds of American regulators that they too fell asleep at the switch, giving the company a free pass on the rising tide of consumer complaints. On top of this, you can pile the Japanese cultural preference against sending bad news up the command chain. This is one reason why Japan lost WWII, and is why the suicide rate in the country is so appallingly high. When the bill finally came due, the price tag was 37 dead in acceleration accidents, and a witch hunt on national TV. Toyota's management will make sure, literally on pain of death, that every product rolling off the assembly line from here will be models of engineering perfection. The stock has held up amazingly well so far, probably because it is mostly owned by strong hands, with few traders involved. Not only should you buy the stock when global markets return to risk accumulation mode, you should buy a Toyota car as well. It will be the only time in your life that you can find them at a discount.

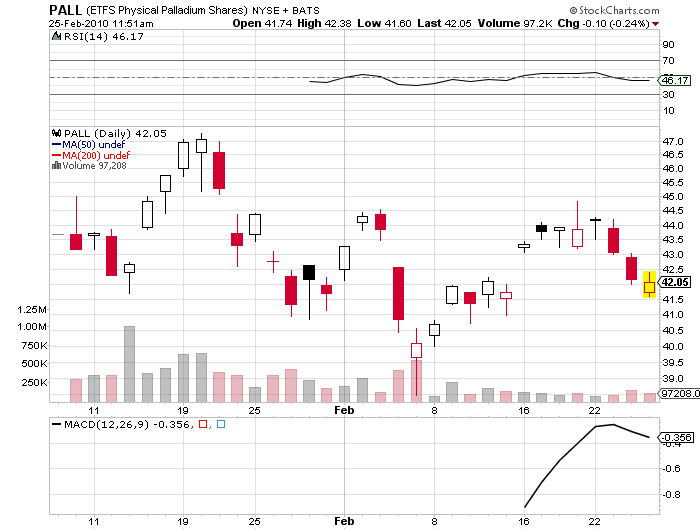

2) Since the run up to the Toyota hearings began, the palladium ETF (PALL) has dropped about 10%, giving up all of the gains that occurred after my January 27 story on the white metal (click here for the piece). The sell off happened because traders assumed the dent to Toyota's reputation would mean fewer car sales, less demand for catalytic converters, and less need for palladium or platinum. The crazy thing about this logic is that those dumping Toyotas will buy a vehicle from another car maker instead, maintaining demand for catalytic metals at their current level. Maybe it was the wholesale flight from all hard assets that took the poor man's platinum down. Watch your screens.

3)I just thought I'd repost my interview with Toyota USA president Jim Lentz in the wake of his testimony in front of congress this week. He looks like he aged about ten years since I saw him in November. In journalism they tell you to always be nice to people on the way up, because you meet them again on the way down. Now there are rumors of a criminal prosecution of Jim.

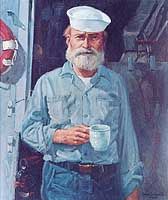

'I spent an evening chewing the fat with James Lentz, the president of Toyota Motor Sales, USA, (TM) who let loose some incredibly insightful views on the long term future of the global economy. I have been following Toyota for 35 years, hobnobbing with senior management, touring their factories in Japan, and driving their marvelously engineered products. It is far and away one of the best run multinationals, with awesome research resources, spending $9 billion a year on R&D, but are also one of the most secretive organizations on the planet. If the CIA only kept its secrets so well! Peak oil is going to hit in 2017-2020, making gasoline prohibitively expensive. Toyota is racing to get as many hybrids out there as possible by then, converting a Mississippi factory from Highlanders to the hugely popular Prius. In Japan there is a backlog of 200,000 orders for these cars, and Toyota makes a profit on every one. The plug in version of this car will be fleet tested in the US next year, and sold to the public from 2012. But hybrids, which reduce emissions by 70%, compared to conventional cars, are just a transitional solution until the technology for hydrocarbon free alternatives, like electric only and fuel cells, mature in the 2020's. The US car market will come in at 10 million units this year, but will rebound to 15-16 million units by 2015. At 9.3 years, the average age of the American car fleet is the oldest on record, and replacement demand will be huge. New car based consumer societies are also emerging in Argentina, Mexico, Thailand, and Indonesia. The American car industry, accounting for 4% of GDP and 10% of total employment, isn't going away, as many fear. However, it will evolve beyond current recognition. Toyota is certainly putting its money where its mouth is, with an $18.2 billion investment in 14 American factories, directly employing 34,000, and indirectly another 380,000. Long term, I love this stock. James has worked for Japan's largest car maker for 26 years, but still can only order one beer in that impossible pictographic language. By the time the evening was out, I made sure he could order a second, and a third, in Japanese.'

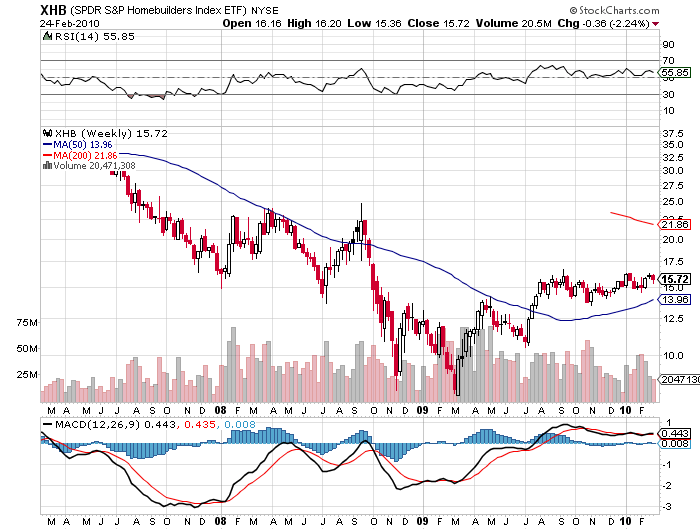

4) The US Department of Housing and Urban Affairs certainly peed on the parade of those blowing horns and banging drums because they believed the real estate market was recovering. Seasonally adjusted new home sales for January came in at a paltry 309,000, the lowest figure on record, and a gut wrenching decline of 11.2% from the previous month, versus the expected gain of 3.8%. It just doesn't get any worse than this. Sure, the horrendous weather in the Northeast was a factor. But the harsh reality is that, with enormous federal and state tax incentives soon to expire, the life support that kept this industry alive is about to see the plug kicked out. Once the Fed ends the TALF, mortgage rates are going up, even is overnight rates remain rock bottom, putting another stake through the heart of this market. Unemployment is going to stay pitilessly high, sending consumer confidence into another death spiral. For what it's worth, I never bought the whole green shoots thing, viewing the enormous gains seen in stocks over the last year as nothing more than one giant dead cat bounce. The XHB, the homebuilders ETF, held up remarkably well. But let's face it, the life has already been sque

ezed out of this sector. There is nothing left to short. There are going to be so many great trading opportunities this year that you shouldn't even think about tying your capital up in a house. Rent, don't buy.

'It's very difficult to navigate a business through a paradigm shift. You must hard wire your system to second guess all the time, questioning what is next, and then what is next. You've got to retain optionality for both investment portfolios and the business your run to navigate this well,' said Mohamed El-Erian, co-chairman of the bond house PIMCO.

February 25, 2010

Featured Trades: (?EUREKA?), (SPX),

(VIX), (USO), (FCX), (GLD), (TBT),(TBF), (CHK),

(UNG), (COAL), (BTU), (LUMBER), (WY),

(HEDGE FUND RADIO)

2)After my year in the White House Press Corps, I vowed never to return, and took a really long shower, hoping to scrub every last spec of prejudice, self interest, and institutionalized dishonesty off of my battered carcass. But sometimes I see some maneuvering that is so unprincipled, crooked, and against the national interest that I am unable to restrain my fingers from the keyboard. I?m talking about the absolutely merciless hatchet job the coal producers are inflicting on the natural gas industry. Coal today accounts for 50% of America?s 3.7 trillion kilowatts in annual power production. Chesapeake Energy?s (CHK) Aubrey McClendon says correctly that if we just shut down aging conventional power plants over 35 years old, and replace them with modern gas fired plants, the US would achieve one third of its ambitious 2020 carbon reduction goals. The share of relatively clean burning natural gas of the national power load would pop up from the current 23% to 50%. Even the Sierra Club says this is the fastest and cheapest way to make a serious dent in greenhouse gas emissions. So what do we get? The press has recently been flooded with reports of widespread well poisonings and forest destruction caused by the fracting processes that recently discovered a new 100 year supply of ultra cheap CH4. While the coal industry has had 200 years to build a formidable lobby in Washington, the gas industry is a neophyte, their only public champions being McClendon and T. Boone Pickens. But memories in Washington are long, and Obama & Co. recall all too clearly that this was the pair that financed the Swift Boat Veterans for Truth that torpedoed Democrat John Kerry?s 2004 presidential campaign. What goes around comes around. This will be unhappy news for the 23,000 the American Lung Association expects coal emissions to kill this year. Can?t the coal industry be happy selling everything they rip out of the ground to China? There! I?ve had my say. Now I?m going to go have another long shower.

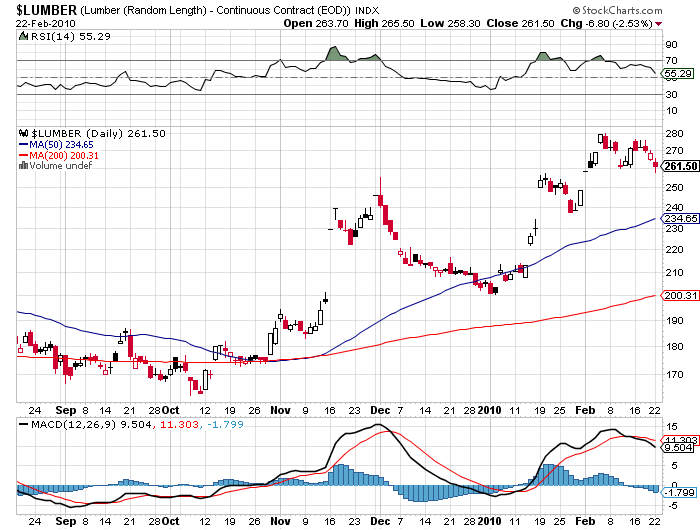

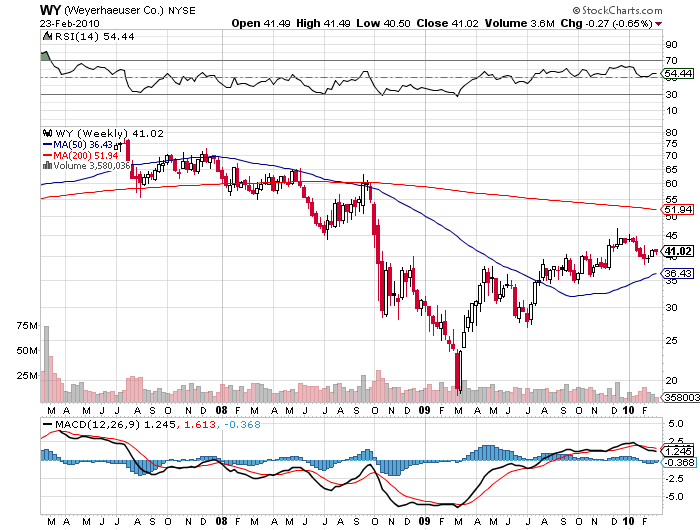

3)Long term readers of this letter know that I, alone in the forest,? have been a huge bull on lumber futures for the past year. The draw was a double play on low interest rates, and a subsidy fueled recovery of new home construction, and a rising tide of imports by China. A soggy greenback was another incentive, as was decades of mill closures, both by environmentalists and economists that left the supply/demand balance so finely tuned that prices could rise on the purchase of a single rail car of two by fours. And up they went, from $1.35 to a high of $2.80 by last week. I also recommended Weyerhaeuser (WY), which managed a double. I have to tell you that the bloom is now coming off the rose. The dollar is strong, eating into exports, and Chinese demand is starting to flag as the Mandarins in Beijing slam on the monetary brakes. And the long awaited homebuilding recovery? With a tsunami of foreclosures about to hit an already distressed market, that is looking more like a 2020 than a 2010 affair. Best case? We grind sideways with other commodities for the reasons that I have listed above. Worst case? We burn to the ground once more. Bottom line? Time to get out of Dodge and leave it for Bambi.

4) My guest on Hedge Fund Radio this week is Jon Najarian, the co-founder of the online trading platforms, OptionMonster and TradeMonster. Jon started his career as a linebacker for the Chicago Bears, and I can personally attest that he still has a handshake that?s like a steel vice grip. Maybe it was his brute strength that enabled him to work as pit trader on the Chicago Board of Options Exchange for 22 years, where he was known by his floor call letters of ?DRJ.? He formed Mercury Trading in 1989 and then sold it to the mega hedge fund Citadel in 2004. OptionMonster uses a patented algorithm developed by Jon called ?Heat Seeker??, which spots unusual tr

ading patterns by monitoring the 180,000 transactions per second that occur in the financial markets. Jon is going to talk to us about the state of the financial markets, online research, and the tricks involved in becoming a winning trader. You can log into Hedge Fund Radio anytime from anywhere in the world for free by clicking here

QUOTE OF THE DAY

?The total breakdown of the system is ahead of us. It may come in four, five, or ten years, and it will devastate the world economy. By bailing out the issuers of derivatives, the Fed actions have only postponed the day of reckoning,? said Marc Faber, publisher of the Gloom, Doom & Boom Report.

Global Market Comments

February 24, 2010

(SPECIAL JOSEPH STIGLITZ ISSUE)

1) The great thing about interviewing Joseph Stiglitz over dinner is that you don?t have to ask any questions.? You just turn him on and he spits out one zinger after another. And he does this in a kibitzing, wizened, grandfatherly manner like one would expect from a character that just walked off the set of Fiddler on the Roof. The unfortunate thing is that you also don?t get to eat. The Columbia University professor and former World Bank Chief Economist animatedly talked the entire time, and I was too busy feverishly taking notes to ingest a single crouton.

Stiglitz argued that for 30 years after the end of the Great Depression there was no financial crisis because a newly empowered SEC was on the beat, and everything worked. A deregulation trend that started under Reagan began stripping away those protections, with the eventual disastrous repeal of Glass-Steagle in 1999. The philosophical justification adopted by many economists, including Fed chairman Alan Greenspan, was that unfettered markets always lead to efficient outcomes.

This belief was based on simplistic models assuming that markets were always perfect, always open, and that everyone had perfect information. Stiglitz?s own work on ?information asymmetry,? which earned him a Nobel Prize in economics in 2001, pulled the rug out from under this theory, because it showed that one party to a transaction always has more information than the other, often the seller.

The banks used this window to introduce super leveraged derivatives that had never been regulated, studied, or even understood. They then clawed open accounting loopholes that were so imaginative that not only were shareholders and regulators deceived about how much risk was involved, senior management was clueless as well. Instead of managing risk, they created risk.

A 2006 GDP that was 80% derived from real estate transactions and a savings rate that fell to zero meant that a severe crash was a sure thing. President Bush?s response was to unleash an extreme form of ?trickle down economics,? with the banks given $700 billion with no conditions attached. Intended to recapitalize the banks so they could resume lending to the mainstream economy, much of the money ended up being paid out in bonuses and dividends. Of the $180 billion used to rescue AIG, $13 billion went to Goldman Sachs, and much of the rest went to German and French banks. No wonder Main Street feels cheated.

The financial system is now more distorted than ever, with major institutions wards of the state, and smaller banks that actually lend to consumers and small businesses going under in record numbers, because the playing field is so uneven. There are too many structural conflicts of interest. The ?once in a 100 year tsunami? argument is merely a justification for changing nothing. Banks would rather maintain the fiction that the loans on their books are good, than make adjustments, meaning there will be more foreclosures in 2010 than in 2009 or 2008. No financial system has ever wasted assets on this scale, and the end result will be a national debt many trillions of dollars larger.

The $787 billion stimulus package was too small, and should have been at least $1.2 trillion, but there was no way Obama was going to get more out of this Senate. The 40% of the stimulus that was tax cuts will get saved and create no immediate beneficial effects on the economy. More money should have gone to the states, which unable to deficit spend, are now a huge drag on the economy. But even this meager package was able to prevent the unemployment rate from rising from 10% to 12%, as it was set to do. The inadequacy of the first package means a second is almost a certainty. Any major spending cuts will produce ?Hoover? outcomes.

The outlook for the economy is bleak, at best.

Well, I don?t get to chat at length with a Nobel Prize winner every day, so I thought I?d give you the full blast, even though I had to leave a lot out. I?ll talk more about markets tomorrow.

February 19, 2010

Featured Trades: (GOLD), (GLD),

(STIMULUS PACKAGE),

(SQM), (ENS), (XIDE), (ZBB),

2) Since the one year anniversary of Obama?s stimulus plan has generated much debate over whether it has been a success or a failure, I?d thought I?d pass on this wonderful pie chart from Clusterstock. Of the $792 billion package, 23% has been spent, 12% issued in tax cuts, and 19% is in the pipeline. That leaves 31% more to be spent, and another 15% in tax cuts to be implemented in this and future years. At first glance, the stimulus seems clevery back-end loaded to achieve maximum advantage for the Democrats on Election Day in November. A deeper analysis shows that it is a lot harder to spend $792 billion than you think. Believe me, I?ve tried. You can?t exactly go down to Home Depot, buy some materials, and put a bunch of guys you found on Craig?s List to work. The immense size of Washington?s projects mean the planning and approvals can stretch out for years. You don?t snap your fingers and get a new bullet train from Los Angeles to San Francisco built. Remember also, that for every $10 the feds pump into the economy, the states take back $4 in budget cutbacks, leaving a modest, at best, net impact on the economy. Which state is the biggest beneficiary of government largesse? With a Republican in the White House for eight out of the last nine years, solidly Democratic California was absolutely starved of government spending, and therefore, had the most large, shovel ready projects when the package passed. In fact, the weary residents of the Golden State only get 77 cents back from each $1 they pay the Treasury in taxes.? The local freeways have broken out with a rash of orange cones so severe it would put a junior prom night to shame. It?s just in time too. The potholes were about to shake my poor ?96 Toyota Corolla to death.

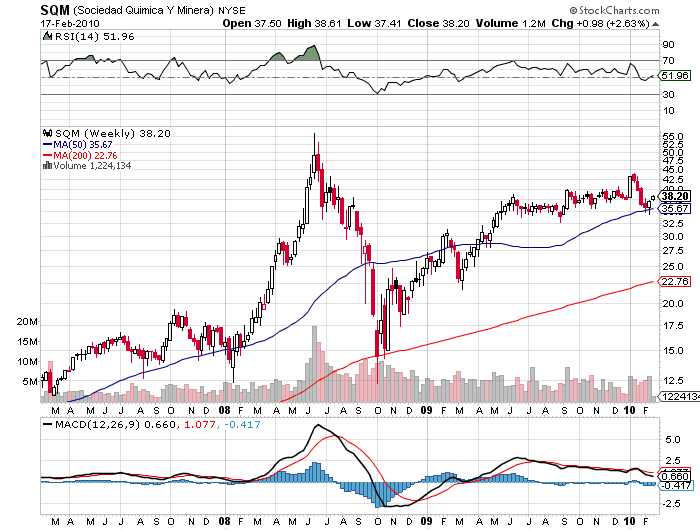

3) Long time readers of this letter know that I have been a huge bull on lithium plays, my pick in the sector, Sociedad Quimica Y Minera (SQM), bringing in a handy 250% pop off the lows in 2009. Since I?m in a report reading mood, I thought I would sit back in my Aeron office chair, put me feet up on my polished beech desk, and plow through the numerous submissions forwarded to me by readers who attended the first ?Lithium Supply and Markets Conference? in Santiago, Chile in January. The bad news is that a truly economic, price competitive lithium battery is still some ways off. Prices for lithium-ion batteries for hybrid electric vehicles (HEV) need to drop by 50% and those for plug-in hybrid electric vehicles (PHEV) by 67%-80% in order to compete on a level playing field. Gasoline has 64 times more energy per unit of weight than lithium batteries, but this advantage is partially offset by electric motors that are four times more efficient than conventional piston engines. Lighter weight cars and other design improvements, like recapturing power when braking, shrink the lead further. Dr. Steven Chu?s Department of Energy is pouring money into research on an amazingly wide front, and strides are being made with different electrodes (silver, sulfur, manganese), leading to rapid advances in inorganic chemistry. The challenges are formidable, with overcharged large lithium ion batteries prone to explode or catch on fire, or internally or externally short circuit. The conservative big car companies, Toyota and Honda, have stuck with proven nickel metal hydride batteries offering half the power per weight, and are understandably reluctant to make the needed multibillion dollar investments until more is known about the long term life of lithium batteries. Another wrinkle is that Bolivia, the Saudi Arabia of lithium salt reserves, has effectively nationalized the industry before it got off the ground, limiting its investment in development to $350 million. As the production of EV?s, HEV?s, and PHEV?s is expected to ramp up to 5 million vehicles a year by 2020, this could be a problem. Many in the industry expect that lithium prices will not be driven by demand from car makers, but by the price of oil. Take crude up to $150 again, and all of a sudden, everything works. Unlike past battery car movements, this one is not going away. The intelligent way to approach the industry now is to invest in low cost producers of proven battery technology, like Enersys (ENS), Exide Technologies (XIDE), C&D Technologies (CHP), and ZBB Energy (ZBB). Leave the pie in the sky stuff for later. Unlike past battery car movements, this one is not going to end up crushed in a junkyard. I?ll let you know how my lithium battery powered all electric (EV) Nissan Leaf, on sale in December, works out.

s, publisher of Forbes magazine.

Global Market Comments

February 18, 2010

Featured Trades: (USO), (CRUDE), (SILVER),

(FOREIGN TREASURY HOLDINGS),

(TBT), (TBF), (HEDGE FUND RADIO)

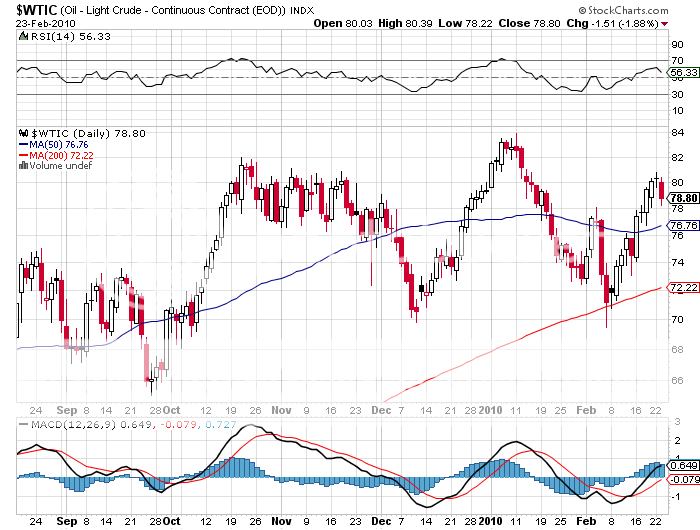

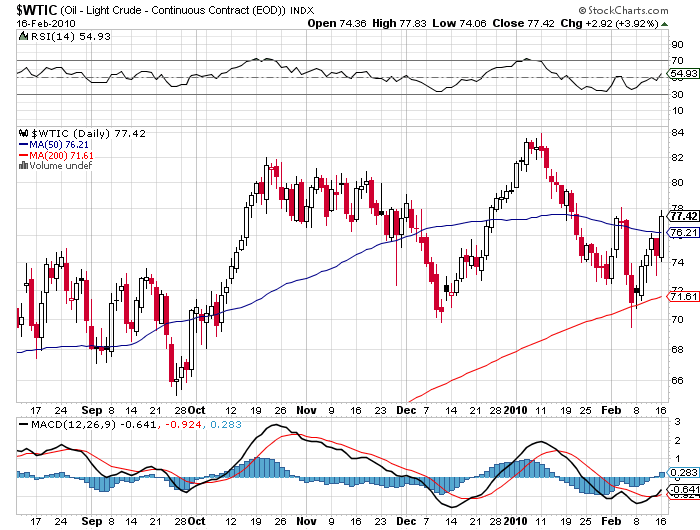

1) I?m not buying the $8 rally in crude (USO) this week because the contango which has been supporting prices in the face of lukewarm demand for the past year has been rapidly disappearing. Contango involves buying crude on the spot market, taking delivery, storing it in leased supertankers, and reselling it in the forward market for returns that at times have exceeded a non leveraged 100%. This enabled the US hedge fund community to effectively operate the world?s second largest navy, keeping so many ships bulging with Texas tea you could almost walk across the Caribbean without getting your ankles wet. At the peak, there were thought to be over 100 ships slow steaming in circles to conserve fuel, creating enough demand to support charter rates globally. By my calculation, the annualized contango return has recently shrunk to a mere 7.12%, not much more than you can get with investment grade corporate bonds. That means when the current crop of forward contracts expire, they won?t be rolled over, dumping vast amounts of crude on the open market. Another factor cutting the knees out from under crude has been the recently strong dollar. Many managers last year found a barrel of oil a much more desirable hard currency than our flaccid greenback. That monetary demand now seems to be on hold. Don?t buy any more oil at these prices than you can use in your salad dressing. If the economy does slow in the second half, as many are predicting, it will be nice to buy your own tankers full of crude at lower prices.

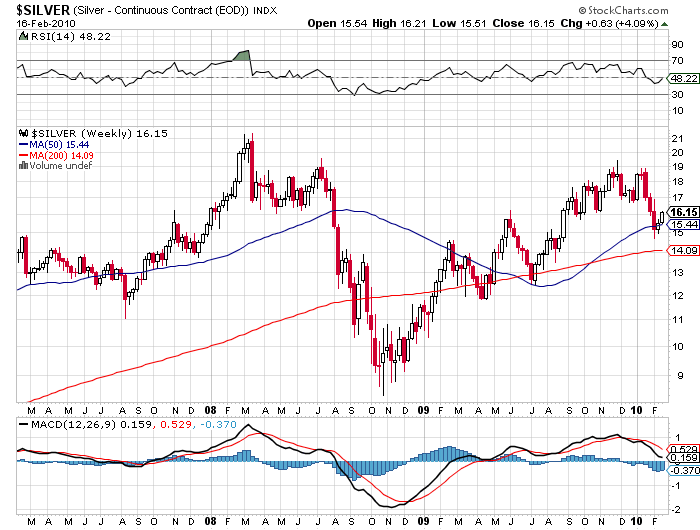

2) If you missed the great run up in silver last year that saw prices run up 95%, you are being offered a second bite at the apple. The latest round of risk reduction by global hedge fund has bashed the white metal, knocking $5 off of the $19.50 high seen in the heady days of November. Today we are at $16.15, and it looks like the 200 day moving average at $14.09 will hold. The metal is at the bottom end of its historic valuation relative to gold, which has ranged between 12:1 (Remember the Hunt Brothers?) and 70:1. Geologically, silver is 17 times more common than the yellow metal. All of the gold ever mined is still around, from King Solomon?s mine, to Nazi gold bars in Swiss bank vaults, and would fill two Olympic sized swimming pools. But most of the silver mined has been consumed in various industrial processes, and is sitting at the bottom of toxic waste dumps. Silver did take a multiyear hit when the world shifted from silver based films to digital photography during the nineties. Now rising standards of living in emerging countries are increasing the demand for silver, especially in areas where there is a strong cultural preference for the jewelry, as in Latin America. That means we are setting up for a classic supply demand squeeze. I think we could run to the old high of $50/ounce in the next economic cycle, if another monetary crisis doesn?t get us there first. Since silver can trade with double the volatility of gold, this forecast could prove conservative.? You can buy the futures, where a 5,000 ounce contract worth $80,700 on the COMEX carries a margin requirement of only $6,750. You can also buy one ounce American silver eagle .9993% pure coins, but make sure you have a big safe to accumulate a serious position.

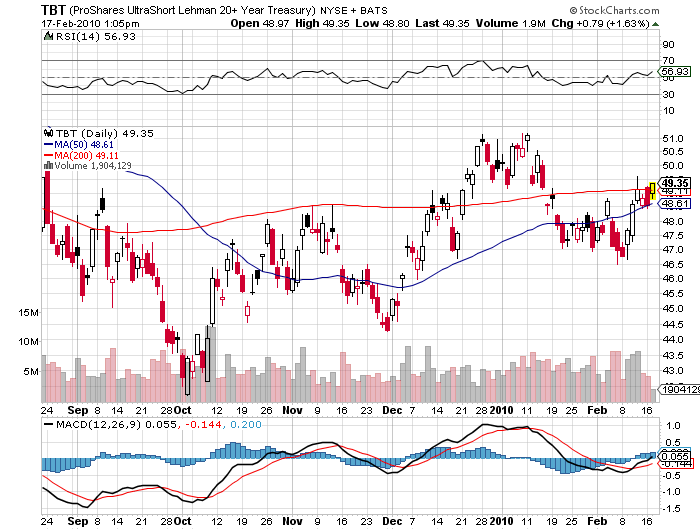

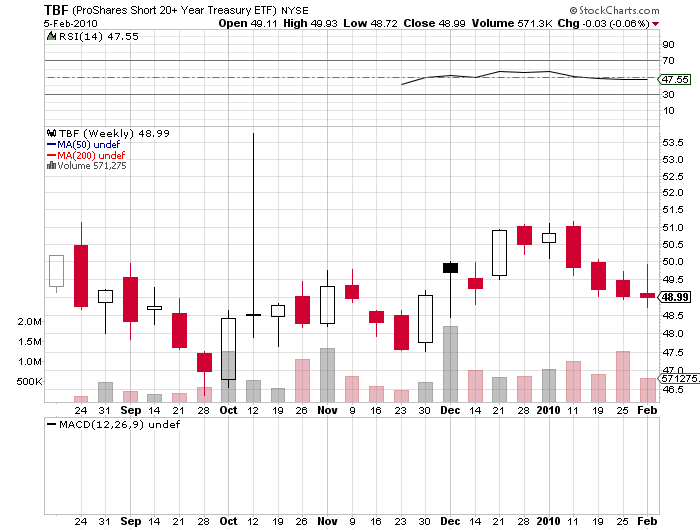

3) Make my sushi order a double. The latest figures from the Treasury Department for December show that Japan is now the largest holder of US government debt. China slipped to the number two position after unloading $34.2 billion in paper in December, paring its holdings to a mere $755.4 billion. This is an ominous development for several reasons. Japan has the world?s worst demographic outlook, with the number or retirees skyrocketing relative to the number of wage earners. Soon the country will have to start drawing down its substantial savings to offset falling contributions from a shrinking workforce. Today?s firm hands will become tomorrow?s loose ones, as Japan inevitably flips from a buyer to a seller of American debt. Chinese liquidation of its holdings also does not bode well for future sales, and could become the lead up to our first failed Treasury auction. I have been warning about such a possibility for months now, and see it as the triggering event for a cataclysmic collapse of the bond market, and the spike up in yields. If this comes to pass, you can kiss that recovery goodbye. Keep trading the (TBF) and the (TBT) from the long side, and explore some outright shorts in the 30 bond futures contract.

4) My guest on Hedge Fund Radio this week is Peter Schiff, president of Euro Pacific Capital, one of the country?s leading international fund managers. Peter obtained his degree in finance from the University of California at Berkeley in 1987. In 1996 he set up Euro-Pacific Capital, a firm that has successfully focused on investing in foreign stocks, bonds, gold, and commodities. Peter was the economic advisor to libertarian Ron Paul?s 2008 presidential campaign. Today Peter is running for the US senate seat in Connecticut that will soon be vacated by the retiring senator Chris Dodd. Peter is a man of strong beliefs and opinions, which he will be more than happy to share with us. We will be talking about investment strategies to survive the coming debacle, and of course, politics. Hedge Fund Radio is broadcast every Saturday morning at 12:00 pm Eastern time, 11:00 am Central time, 9:00 am Pacific Coast Time, and 5:00 pm Greenwich Mean Time. For the online link to the live show, please go to www.bizradio.com , click on ?Listen Live!?, and click on ?Houston 1180 AM KGOL.?? For archives of past Hedge Fund Radio shows, please go to my website by clicking here

QUOTE OF THE DAY

?We are no longer the locomotive in the world economy. We?re the passenger, and occasionally the caboose,? said Clark Winter, CIO at SK Investment Partners, about the Chinese flag hanging outside the New York Stock Exchange last week.

Global Market Comments

February 16, 2010

Featured Trades: (CHINESE YUAN),

(CYB), (PLATINUM), (PPLT), (EWT)

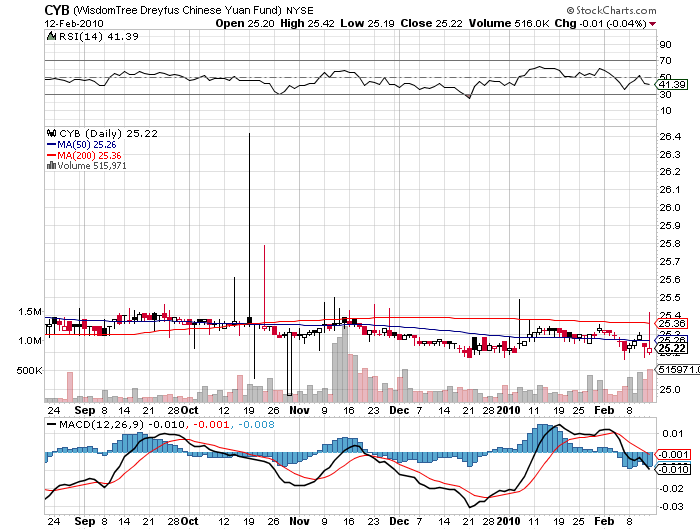

1) The Chinese Yuan is just begging for a home run. Any doubts that it is a huge screaming buy should have been dispelled last week when news came out that China had displaced Germany as the world's largest exporter. The Middle Kingdom shipped $1.2 trillion in goods in 2009, compared to only $1.1 trillion for Deutschland. The US has not held the top spot since 2003. China's surging exports of electrical machinery, power generation equipment, clothes, and steel were a major contributor. German exports were mired down by lackluster economic recovery in the EC, which has also been a major factor behind the weak euro. Sales of luxury Mercedes and BMW cars, machinery, and chemicals have cratered.

Two back to back interest rate rises for the Yuan, and a snugging of bank reserve requirements to 16% by the People's Bank of China, have stiffened the backbone of the Yuan even further. That is the price of allowing the Federal Reserve to set China's monetary policy via a fixed Yuan exchange rate. Is it possible that Obama's stimulus program is reviving China's economy more than our own?

The last really big currency realignment was a series of devaluations that took the Yuan down from a high of 1.50 to the dollar in 1980. By the mid nineties it had depreciated by 84%. The goal was to make exports more competitive. The Chinese succeeded beyond their wildest dreams. There is absolutely no way that the fixed rate regime can continue. There are only two possible outcomes. An artificially low Yuan has to eventually cause the country's inflation rate to explode. Or a global economic recovery causes Chinese exports to balloon to politically intolerable levels. Either case forces a major revaluation. Of course timing is everything. It's tough to know how many sticks it takes to break a camel's back. Talk to senior officials at the People's Bank of China, and they'll tell you they still need a weak currency to develop their impoverished economy. Per capita income is still at only $5,000, a tenth of that of the US. But that is up a lot from $100 in 1978. Talk to senior US Treasury officials, and they'll tell you they are amazed that the Chinese peg has lasted this long. How many exports will it take to break it? $1.5 trillion, $2 trillion, $2.5 trillion? It's anyone's guess. One thing is certain. A free floating Yuan would be at least 50% higher than it is today, and possibly 100%. In fact, the desire to prevent foreign hedge funds from making a killing in the market is a not a small element in Beijing's thinking. The Chinese Central bank governor, Zhou Xiaochuan, says he won't entertain a revaluation for the foreseeable future. The Americans say they need it tomorrow. To me, that means about six months. Buy the Yuan ETF, the (CYB). Just think of it as an ETF with an attached lottery ticket. If the Chinese continue to stonewall, you will get the token 2.2% annual revaluation the swaps have been discounting. Since the chance of the Chinese devaluing is nil, that beats the hell out of the zero interest rates you now get with T-bills. If they cave, then you could be in for a home run.

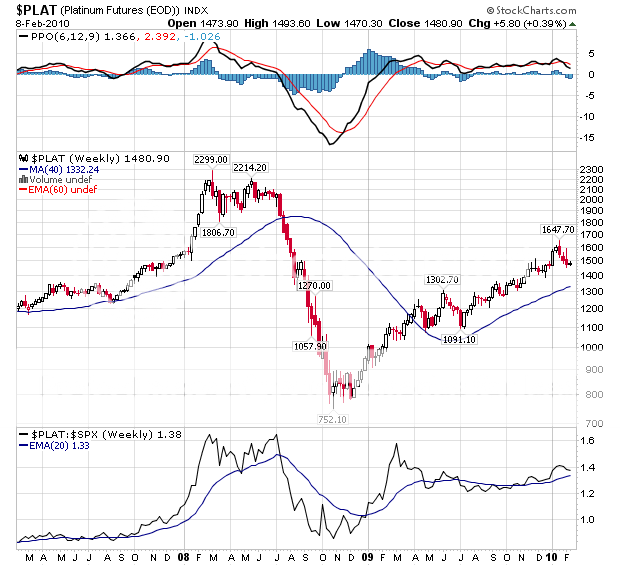

2) Since you've been romancing gold, you should check out platinum, her younger, racier, and better looking sister who wears the low riders. The white metal had a 67% pop last year, compared to the more sedentary 44% appreciation seen in gold. While gold made a hard fought all time high, Pt has to rise a further 50% from here just to match its 2008 high of $2,200, suggesting that some catch up play is in order. I have always been puzzled by the fact that platinum is 30 times more rare than gold, but at $1,480 an ounce, it trades at a mere 30% premium to the barbaric metal. You have to refine a staggering 10 tons of ore to come up with a single ounce of platinum. The bulk of the world's 210 tons in annual production comes from only four large mines, 80% of it in South Africa, and another 10% in the old Soviet Union. All of these mines peaked in the seventies and eighties, and have been on a downward slide since then. That overdependence could lead to sudden and dramatic price spikes if any of these are taken out by unexpected floods, strikes, or political unrest. While no gold is consumed, 50% of platinum production is soaked up by industrial demand, mostly by the auto industry for catalytic converters. No lesser authority than Jim Lentz, the CEO of Toyota Motors Sales, USA, told me he expects the American car market to recover from the current 11 million units to 15-16 million units by 2015. That's a lot of catalytic converters. Jewelry demand for platinum, 95% of which comes from Japan, is also strong, as the global pandemic of gold fever spreads to other precious metals. You can trade Platinum futures on the New York Mercantile Exchange, where a margin requirement of only $6,075 for one contract gets you exposure to 50 ounces of platinum worth $75,000, giving you 12:1 leverage. Email me at madhedgefundtrader@yahoo.com if you want to learn how to do this. For those who like to get physical, the US mint issues Platinum eagles from 1997-2008 in nominal denominations of $100 (one ounce), $50 (?? ounce), $25 (1/4 ounce) and $10 (1/10th ounce) denominations. Stock traders should look at the ETF (PPLT).

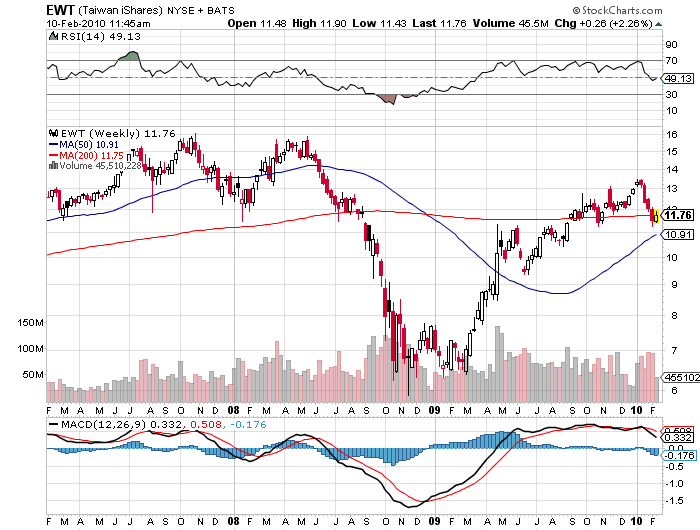

3) The handful of Chinese army officers I huddled with in the underground bunker all stared intently at their watches. Three, two, one, and then KABOOM! At exactly 12:00 noon, the blast of distant artillery sent a five inch shell screaming over our heads and exploded into the hill above us. The ground shook under our feet, causing dust to drift down from the concrete ceiling above us.?? It was 1976, and The People's Republic of China just let lose its daily symbolic protest against its errant rebellious province, known locally as the Republic of China, and to you and me, as Taiwan. Fast forward 34 years later and the Middle Kingdom is sending salvos of money raining down on that prosperous island. Last year, China Mobile (CHL), the world's largest cell phone company, bought 12% of Far Eastone Telecommunications (4904.Taiwan). Although a small deal, it represented the first ever direct investment from China into Taiwan. The move could trigger a takeover binge by big Chinese companies of their offshore cousins. It was only a few years ago Taiwanese businessmen suffered long prison terms for just visiting, let alone investing in China, which they have done in a major, but surreptitious way, for 30 years. Readers of this letter are well aware of my aggressive recommendations to buy emerging markets China and Taiwan since the beginning of 2009. Now you have another reason to buy both. Closer ties between China and Taiwan auger well for the stock markets of the two high growth countries. The iShares MSCI Taiwan fund ETF (EWT) at one point were up an impressive 125% from the March lows, so if you see a substantial dip it might be a good idea to double up. I guess Beijing figured out that if you can't beat them, buy them. The proxy takeover bid is mightier th

an the sword.

'A statistical model built around a normal distribution when applied to markets can be a very dangerous thing,' said David Kelly of JP Morgan.

February 11, 2010

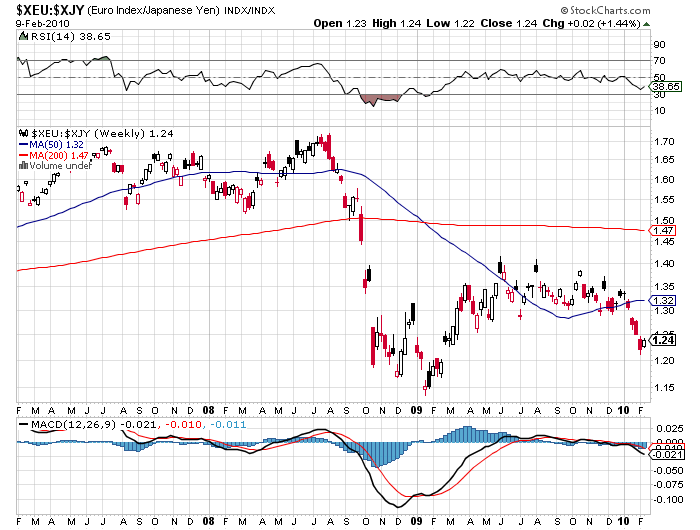

Featured Trades: (EUROYEN CROSS), (GOLD), (GLD),

(CBS), (SISI), (HTZ), (RAD), (M), (LVS), (AMD),

(AMR), (CAL), (S), (HEDGE FUND RADIO)

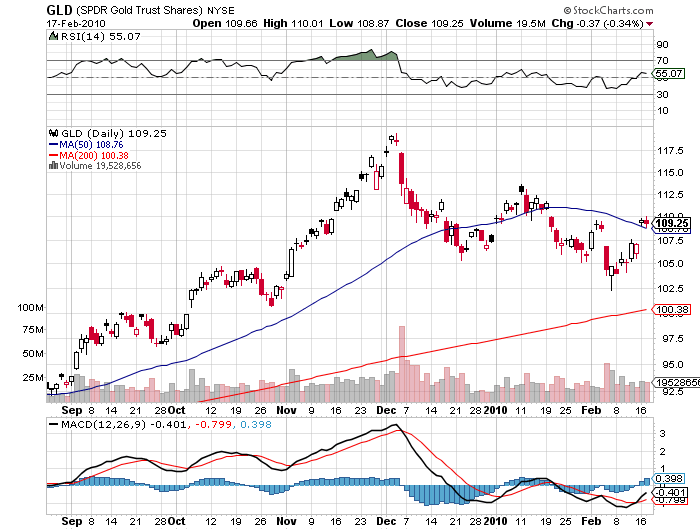

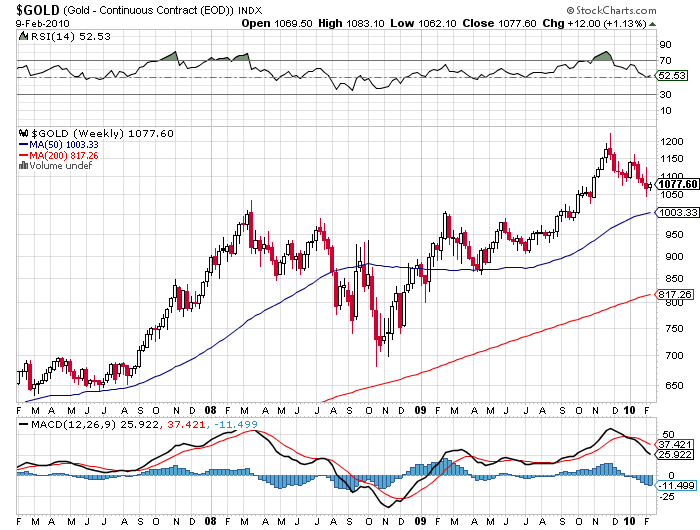

2) Brace yourself for the impending gold shortage. Gold shortage? Yup. With the launch of a flurry of dedicated gold ETF?s last year, total ETF holdings of the barbaric relic, now exceed total world production. South Africa suffered its steepest decline in gold production since 1901, falling 14%, to a mere 232 tons. It now ranks only third in global production of the yellow metal, after China and the US. Severe electricity rationing, a shortage of skilled workers, and more stringent mine safety regulations have been blamed. Choked off credit has frozen the development of new capital intensive deep mines, and existing mines are easily flooding. Rising production costs have driven the global break even cost of new gold production up to $500 an ounce. It takes a lot of labor, fuel, and heavy machinery to rip gold out of the ground, and none of these are getting any cheaper. Political risks are heating up. In the meantime, the financial crisis has driven flight to safety demand for gold bars and coins to all time highs. Last year, the US Treasury ran out of blanks for one ounce $50 American Gold Eagle coins, now worth about $1,160. Competitive devaluations by almost every central bank, except Japan, mean that currencies are not performing as the hedge that many had hoped. It all has the makings of a serious gold shortage for the future. The current downturn has to be just a blip in the long term bull market. Now that we are solidly over $1,000, and recently kissed $1,225, the match could hit the fuel dump at any time. Just let this current risk reversal burn out before you load the boat.

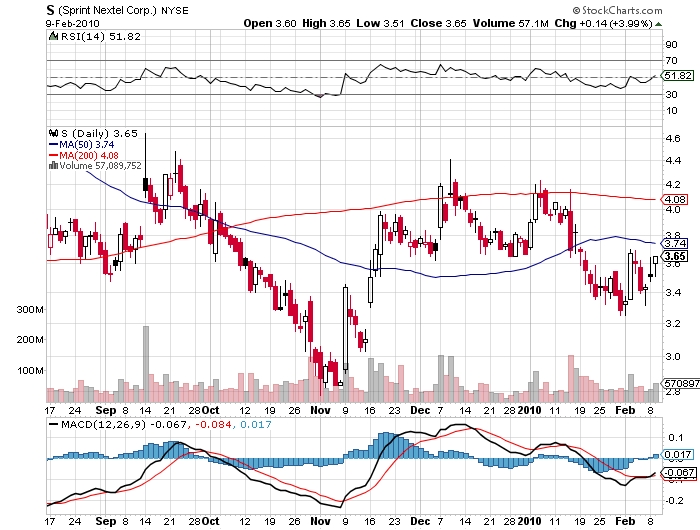

3) Fear of law suits prevents most analysts from publishing lists of short selling targets. But the Audit Integrity Co., a forensic accounting firm,?? regularly posts lists of public companies they believe may go bankrupt (see http://www.auditintegrity.com). Many of their picks reflect the accelerating shift from the old economy to the new economy. With offices in New York and Los Angeles, they look at leverage, market position, debt, and their own proprietary indicators. Another red flag are the legal shenanigans that companies resort to when coming out of a recession, like writing off large amounts of good will. In the media space, CBS (CBS), Sirius XM Radio (SIRI), and Hertz Global (HTZ) are at risk. In the consumer field, Rite Aid (RAD), Macy?s (M), and Las Vegas Sands (LVS) made the list. Advanced Micro Devices (AMD) is the largest tech company to warrant scrutiny. Airlines, always a favorite of bankruptcy mavens, include American Airlines (AMR), and Continental (CAL). Sprint Nextel (S) tops the list of telecom companies. Better take that portfolio out and give it a good scrubbing.

4) My guest on Hedge Fund Radio this week is the legendary commodities trader Dennis Gartman. Dennis has been in the market since they traded rocks for pre-Cambrian settlement. Dennis has published his daily ?Gartman Letter? since 1987, which is a must read for hedge fund managers, major corporations, banks, prop desks, and hedge funds. Dennis started his career as an economist for ?Cotton, Inc,? where he analyzed cotton supply and demand for the US textile industry. He went on to trade foreign exchange for NCNB National Bank in Charlotte, North Carolina, and to trade bond futures as an independent member of the Chicago Board of Trade. He then managed the futures brokerage operation of Sovran Bank. Dennis recently served as an outside director of the Kansas City Board of Trade, and taught classes on derivatives at the Federal Reserve school for bank derivatives. Dennis is going to share his thoughts with us on stocks, bonds, currencies , commodities, and the economy. Hedge Fund Radio is broadcast every Saturday morning at 12:00 pm Eastern time, 11:00 am Central time, 9:00 am Pacific Coast Time, and 5:00 pm Greenwich Mean Time. For the online link to the live show, please go to www.bizradio.com , click on ?Listen Live!?, and click on ?Houston 1180 AM KGOL.?? For archives of past Hedge Fund Radio shows, please go to my website by clicking here

QUOT

E OF THE DAY

?Making money on a trade is like getting applause, but you are the only one who hears it,? said Jon Najarian, an ex Chicago bears linebacker who now runs optionmonster.com.

Global Market Comments

February 10, 2010

Featured Trades: (SPX), (SDS), (BERNIE MADOFF), (CIA), (DBA), (MOO), (MON), (MOS), AGU), (POT)

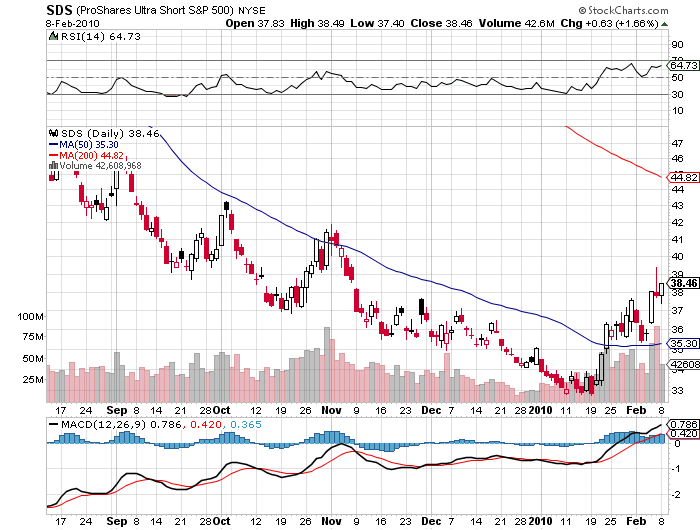

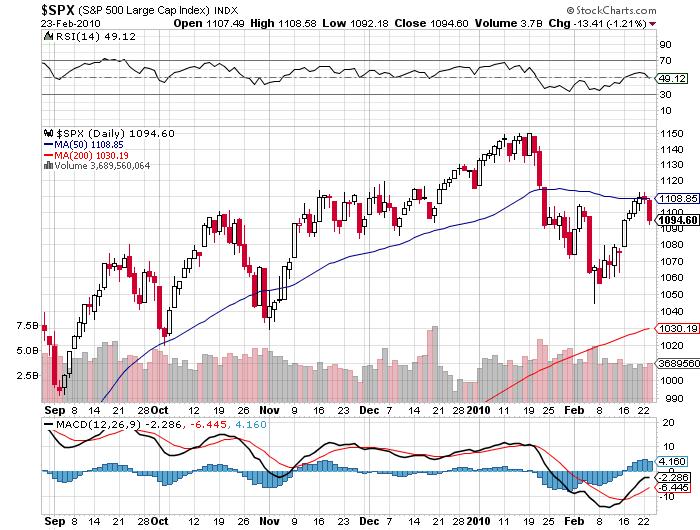

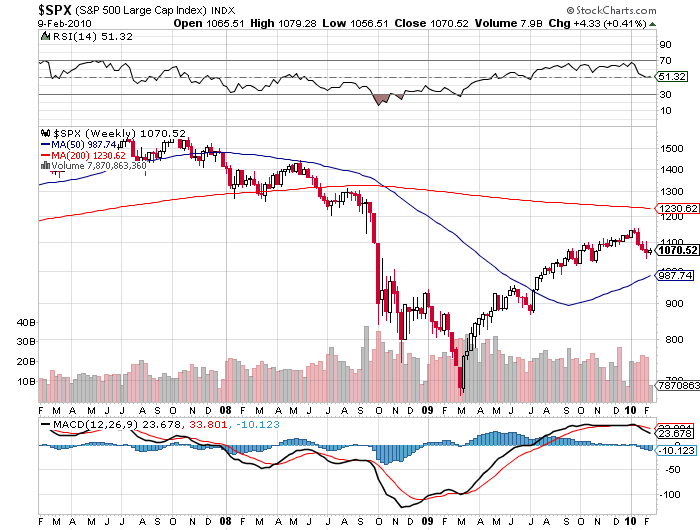

1) Note to self. Don't do your midnight pee next to the bear box. They're called that for a reason. And I'm sorry that my shouting at the hungry, six foot tall black bear standing in front of me, no doubt attracted by my Cheetos, hot dogs, and marshmallows, woke up the campers at the 57 surrounding sites. Of course it was too dark to find my bear spray. My ursine challenger eventually saw the merit of my logic that the neighbor's bacon stuffed ice chest was more appealing than me, and lumbered off into the darkness. I have successfully avoided a bear of a different sort this year, those of the stock market kind (see my January 4 Annual Asset Allocation Review piece entitled 'I'd Rather Get a Poke in the Eye with a Sharp Stick Than Buy Equities'). Never have I seen such a disconnect between the markets and the real economy. All of a sudden the world has gotten expensive. Stock prices have been levitated by vapor in a faith based rally. Cost cutting, not sales growth, has artificially boosted earnings above subterranean forecasts. Commodity prices have soared because of stockpiling and speculation, not consumption. Puzzled CEO's of many stripes are seeing no recovery in their businesses whatsoever. I have used the big up days to sell short dated out-of- the-money calls which, mercifully, expired worthless. That's because I keep my favorite quote from John Maynard Keynes pasted to my monitor, 'Markets can remain irrational longer than you can remain liquid.' Sure we're going down more, but zero interest rates won't let us crash. Date that SDS position, a 200% leveraged bet that the S&P 500 is going to fall, but don't marry it.

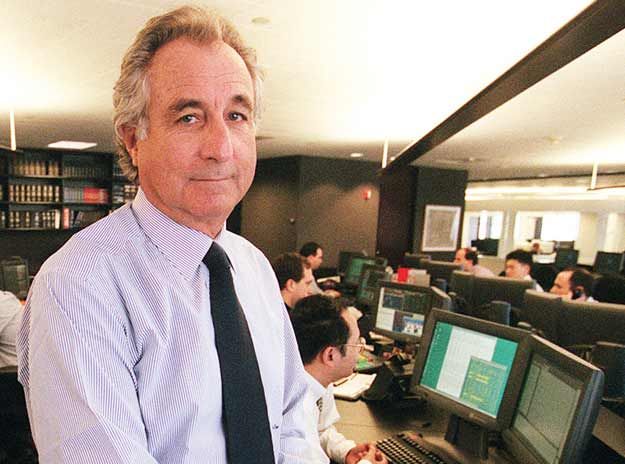

2) I spent a sad and depressing, but highly instructional evening with Dr. Stephen Greenspan, who had just lost most of his personal fortune with Bernie Madoff. The University of Connecticut psychology professor had poured the bulk of his savings into Sandra Mansky's Tremont feeder fund; receiving convincing trade confirms and rock solid custody statements from the Bank of New York. This is a particularly bitter pill for Dr. Greenspan to take, because he is an internationally known authority on Ponzi schemes, and just published a book entitled Annals of Gullibility-Why We Get Duped and How to Avoid It. It is a veritable history of scams, starting with Eve's subterfuge to get Adam to eat the apple, to the Trojan Horse and the Pied Piper, up to more modern day cons in religion, politics, science, medicine, and yes, personal investments. Madoff's genius was that the returns he fabricated were small, averaging only 11% a year, making them more believable. In the 1920's, the original Ponzi promised his Boston area Italian immigrant customers a 50% return every 45 days. Madoff also feigned exclusivity, often turning potential investors down, leading them to become even more desirous of joining his club. For a deeper look into Greenspan's fascinating, but expensively learned observations and analysis, go to his website at www.stephen-greenspan.com.

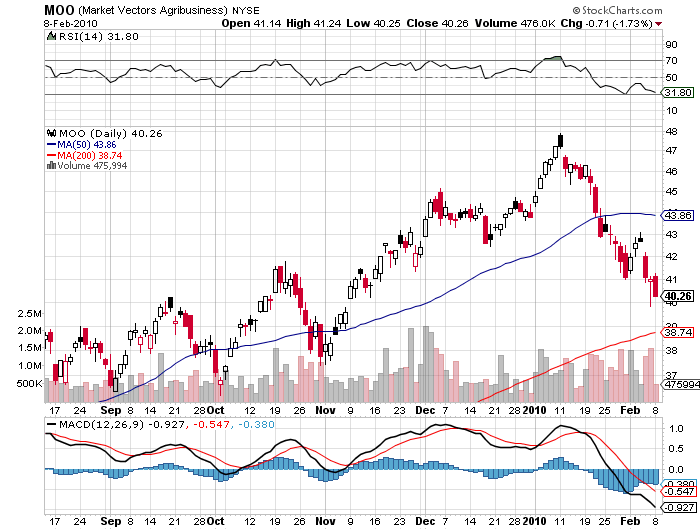

4) Lunch with the Central Intelligence Agency is always interesting, although five gorillas built like brick shithouses staring at me intently didn't help my digestion. When Panetta passed through town on his way home to heavenly Carmel Valley for the holidays, I thought I'd pull a few strings in Washington to catch a private briefing. The long term outlook for supplies of food, natural resources, and energy is becoming so severe that the CIA is now viewing it as a national security threat. About one third of emerging market urban populations are poor, or about 1.5 billion souls, and when they get hungry, angry, and politically or religiously inspired, Americans have to worry. This will be music to the ears of the hedge funds that have been stampeding into food, commodities, and energy, since March. Panetta then went on to say that the current monstrous levels of borrowing by the Federal government abroad is also a security issue; especially if foreigners decide to turn the spigot off and put us on a crash diet. I was flabbergasted, not because this is true, but that it is finally understood at the top levels of the administration and is of interest to the intelligence agencies. Job one is to defeat Al Qaeda, and the agency has had success in taking out several terrorist leaders in the tribal areas of Pakistan with satellite directed predator drones. The CIA could well win the war in Afghanistan covertly, as they did the last war there in the eighties, with their stinger missiles supplied to the Taliban for use against the Russians. The next goal is to prevent Al Qaeda from retreating to other failed states, like Yemen and Somalia. Cyber warfare is a huge new battlefront. Some 100 countries now have this capability, and they have stolen over $50 billion worth of intellectual property from the US in the past year. As much as I tried to pin Panetta down on who the culprits were, he wouldn't name names, but indirectly hinted that the main hacker-in-chief was China. I thought Panetta was incredibly frank, telling me as much as he could without those gorillas having to kill me afterwards. I have long been envious of the massive budget that the CIA deploys to research the same global markets that I have for most of my life, believed to amount to $70 billion, but even those figures are top secret. Panetta's final piece of advice: don't even think about making a cell phone call in Pakistan. I immediately deleted the high risk numbers from my cell phone address book. Better take another look at the Market Vectors agricultural ETF (DBA), their agribusiness ETF (MOO), as well as my favorite ag stocks, Monsanto (MON), Mosaic (MOS), Potash (POT), and Agrium (AGU). Accidents are about to happen in their favor.

'The next Pearl Harbor will be a cyber attack,' Said Leon Panetta, Director of the CIA.

Featured Trades:

(THE MAD HEDGE FUND TRADER?S STRATEGY LUNCHEONS), (DEMOGRAPHIC TRENDS),

(CYB), (EEM), (USO), (GLD), (SHREVE?S), (?SNOWMAGEDDON?)

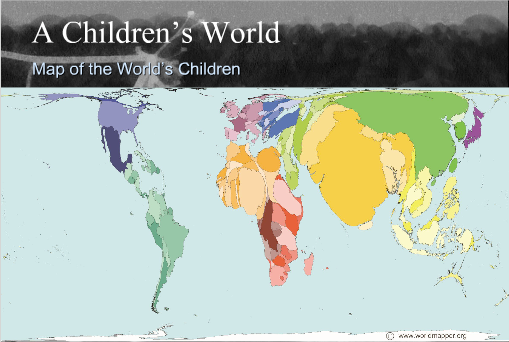

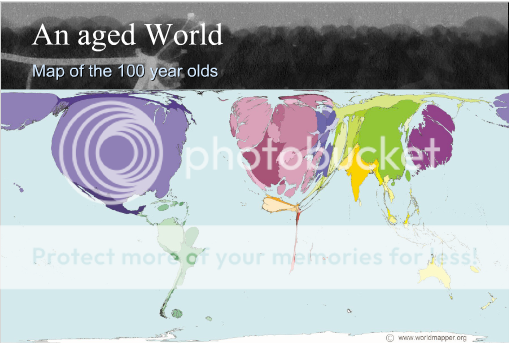

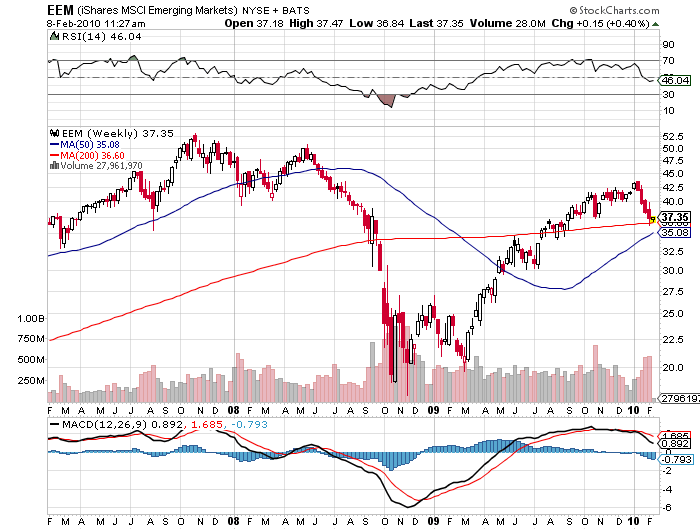

2) You can never underestimate the importance of demographics in shaping long term investment trends, so I thought I?d pass on these two maps, which I pulled off of Paul Kedrosky?s Infectious Greed website. The first shows a map of the world drawn in terms of the population of children, while the second illustrates the globe in terms of its 100 year olds. Notice that China and India dominate the children?s map. Kids turn into consumers in 20 years, stay healthy for a long time, and power economic growth. The US, Japan, and Europe shrink to a fraction of their actual size on the children?s map, so economic growth is in a long term secular downtrend there. There is more bad news for the developed world on the centenarian?s map, which show these countries ballooning in size to unnatural proportions. This means higher social security and medical costs, plunging productivity, and falling GDP growth. The bottom line is that you want to own equities and local currencies of emerging market countries, and avoid developed countries like the plague. This is why we saw a doubling, tripling, and quadrupling of emerging stock markets (EEM) last year, and why there is an irresistible force pushing their currencies upward (CYB). (see my Yuan revaluation piece by clicking here

3) A few years ago, I went to a charity fund raiser at San Francisco?s priciest jewelry store, Shreve & Co., where the well heeled men bid for dinner with the local high society beauties, dripping in diamonds and Channel No. 5. Well fueled with champagne, I jumped into a spirited bidding war over one of the Bay Area?s premier hotties, who shall remain nameless. Suffice to say, she has a sports stadium named after her. The bids soared to $6,000, $7,000, $8,000. After all, it was for a good cause. But when it hit $10,000, I suddenly developed lockjaw. Later, the sheepish winner with a severe case of buyer?s remorse came to me and offered his date back to me for $9,000.?? I said ?no thanks.? $8,000, $7,000, $6,000? I passed. The current altitude of the stock market reminds me of that evening. If you rode gold (GLD) from $800 to $1,200, oil (USO), from $35 to $80, and the (FXI) from $20 to $40, why sweat trying to eke out a few more basis points, especially when the risk/reward ratio sucks so badly, as it does now? I realize that many of you are not hedge fund managers, and that running a prop desk, mutual fund, 401k, pension fund, or day trading account has its own demands. But let me quote what my favorite Chinese general, Deng Xiaoping, once told me: ?There is a time to fish, and a time to hang your nets out to dry.? At least then I?ll have plenty of dry powder for when the window of opportunity reopens for business. So while I?m mending my nets, I?ll be building new lists of trades for you to strap on when the sun, moon, and stars align once again. And no, I never did find out what happened to that date.

4) While Obama?s White House staff is digging out from ?snowmageddon,? a potential nightmare is giving him sleepless nights. Let?s say we spend our $2 trillion in stimulus and get a couple of quarters of decent growth. The ?V? is in. Then once the effects of record government spending wear off, we slip back into a deep recession, setting up a classic ?W.? Unemployment never does stop climbing, reaching 15% by year end, and 25% when you throw in discouraged job seekers, jobless college graduates, and those with expired unemployment benefits. This afflicted Franklin D. Roosevelt in the thirties. So Congress passes another $2 trillion reflationary budget. Everybody gets wonderful new mass transit upgrades, alternative energy infrastructure, smart grids, and bridges to nowhere. But with $4 trillion in extra spending packed into two years, inflation really takes off. The bond market collapses, as China and Japan boycott the Treasury auctions. The dollar tanks big time, gold breaks $2,300, and silver explodes to $50. Ben Bernanke has no choice but to engineer an interest rate spike to dampen inflationary fires and rescue the dollar, taking the Fed funds rate up to a Volkeresque 18%. %. The stock market crashes, taking the S&P well below the 666 low we saw in March. Housing, having never recovered, drops by half again, wiping out more bank equity, and forcing the Treasury to launch TARP II. The bad news accelerates into the 2012 election year. Obama is burned in effigy; Sarah Palin is elected president, and immediately sets to undoing all of his work. Republicans, reinvigorated by new leadership, and energized by a failing economy, retake both houses of congress. National health care is shut down as a wasteful socialist mistake, boondoggle subsidies for alternative energy are eliminated, and the savings are used to justify huge tax cuts for high income earners. We invade Iran, and crude hits $500. If you?re over 50, and all of this sounds vaguely familiar, it?s because we?ve been through it all before. Remember Jimmy Carter? Remember the ?misery index,??? the unemployment rate plu

s the inflation rate, which hit 30, and catapulted Ronald Reagan into an eight year presidency? A replay is not exactly a low probability scenario. This is why credit default swaps live at lofty levels. It?s also why the investing public is gun shy, favoring bonds over stocks by a 15:1 margin. Are the equity markets pricing in these possibilities? Not a chance. The risk of economic Armageddon is still out there. Personally, I give it a 50:50 chance. Batten the hatches, and please pass the Xanax.

February 8, 2010Featured Trades: (JANUARY NONFARM PAYROLL),

(TBF), (TBT), (ASML), (CSCO), (JDSU), (MU), (JNPR), (SNDK)

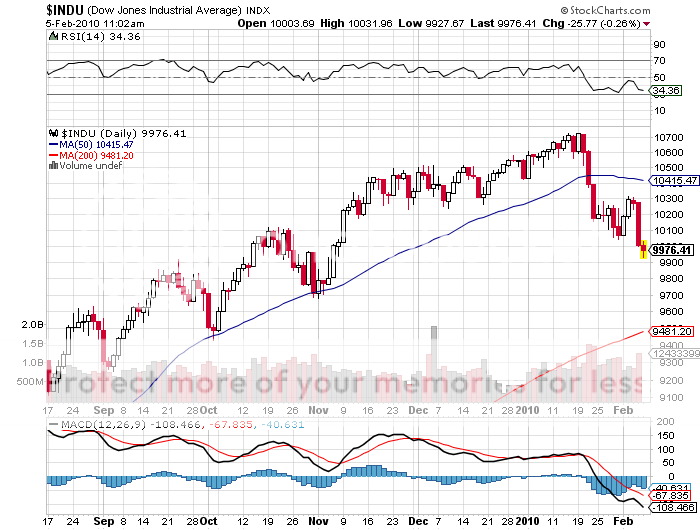

2) I hate to sound like Chicken Little predicting that the sky is falling, but there is a disaster of monumental proportions setting up in the Treasury bond market. Last year investors fleeing the terror of the financial markets poured some $375 billion into bond mutual funds and virtually nothing into equity funds. It makes you wonder who bought all those stocks that drove the S&P 500 up 60% last year. My guess? Hedge funds, day traders, and hot money punters who will puke at the drop of a hat. The flight to quality since mid January has only accelerated the flow into fixed income funds. Treasury bonds, already the world?s more overvalued asset class, are getting more expensive. This will only end in tears, with the retail end investor, once again, left holding the bag. Use this strength to build a core short in the 30 year T-bond, either through the futures market, ETF?s ( TBF for the 100% short and TBT for the 200% short), our outright borrows. I still think this will be the trade of the decade.

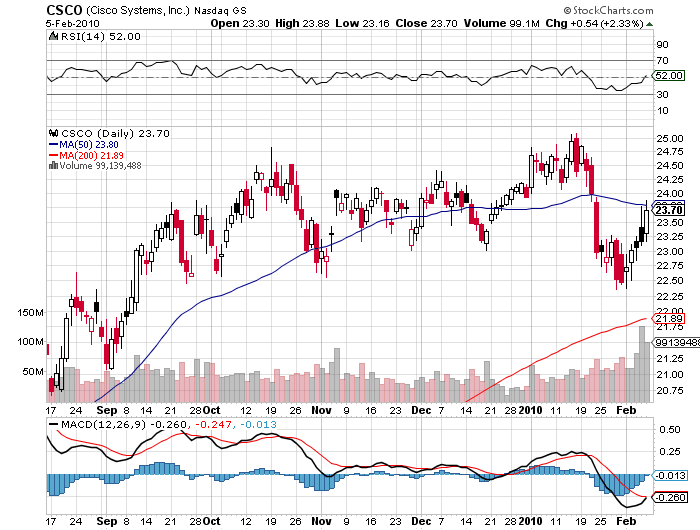

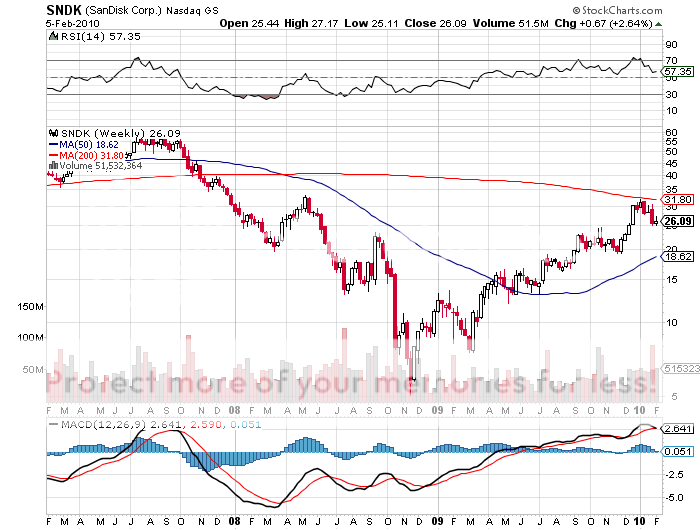

3)When the current risk reversal ends, there is one sector that I am going to jump into with both of my size 14 boots. After the dotcom bust of 2000, technology stocks spent nearly a decade in the penalty box, shunned by the investing world as the poster boys for wild excess. During this time, cash balances doubled, free cash flows soared, outstanding shares shrank, and multiples fell to a tenth of their bubblicious peaks. I started recommending this group at the absolute bottom of the market last March (click here for the call ), and it was no surprise to me when they outperformed almost every sector on the upside. With 60%-80% of their earnings coming from abroad, primarily Asia, I saw them really as foreign stocks wearing cowboy hats, pearl snap buttoned shirts, and Ray Ban aviator sunglasses. They were great weak dollar plays. They did not need banks, as they are almost entirely self financed, didn?t have derivatives books, and had minimal real estate exposure. While their customers here were getting poorer, many more overseas were getting richer. The industry represents the last, best hope that America has for competing globally, as it is our only means of staying on top of the international value added chain. It seems that in addition to bulk commodities like corn, wheat, soybeans, coal and timber, aircraft, weapons, and movies, tech companies are among the few that make things foreigners want to buy. The lessons of the bubble made them ultra conservative in their capital spending which will lead to product shortages and much higher prices in any recovery. Memory, for example, has seen no capex at all for three years. They are surfing the wave of innovation, and will cash in big time from the mobile computing revolution, cloud computing, and the virtualization of data centers. During the last tech bubble the industry did not have the global market that it does today. Now, demand from the rising emerging market middle class is kicking in, as it is for commodities. The nine month tech rally we saw in 2009 could? just be the down payment of a decade long bull market in these stocks which will end with another bubble. When John Chambers, a first class manager, discussed Cisco?s (CSCO) outlook after announcing blowout Q4 earnings, he was so effusive he sounded like he was on ecstasy. Take a look at Juniper Networks (JNPR), JDS Uniphase, (JDSU), Sandisk (SNDK), Micron Technology (MU), and lithography toolmaker (ASML). Long dated call spreads in all of these make sense on a decent dip.

?People that have complete disdain for government intervention in the economy and markets of the West have complete faith in nine guys in a room being able to figure out the very complex and rapidly growing Chinese economy,? said hedge fund manager Jim Chanos of Kynikos Associates, about foreign investors? unlimited faith in the Middle Kingdom?s politburo.