Global Market Comments for December 11, 2008

Featured trades: (BA), ($WTIC), ($GOLD), ($XEU)

1) Weekly jobless claims soared by 58,000 to 573,000, a 26 year high. A lot of workers came back from their Thanksgiving turkey only to get fired. According to UCLA's Anderson report, unemployment in California will peak at 8.7% next year. This may be conservative.

2) The euro ($XEU) broke out to the upside, moving to $1.3280, a two month high. Gold ($GOLD) also moved up $20 to $827. If the dollar continues to weaken, it could jeopardize Treasury efforts to sell bonds to finance reflation, half of which are bought by foreigners. The weak dollar could also be the trigger for a long overdue trading rally in commodities. Crude ($WTIC) has already rocketed from $40.50 to $48.50 this week. I think commodities will be the big play next year, and some hedge funds are already starting to do some early toe dipping in the waters at these incredibly oversold levels.

3) Real Estate investor Sam Zell says that it took a 'tsunami' of?? unforecastable developments to drive the Chicago Tribune into a preemptive bankruptcy. The Chicago Cubs won't be affected by the proceedings. Zell bought the company a year ago when revenues were falling at an annualized 3%, at a price assuming a 6% annualized drop. Instead he got a 20% plunge in revenues, death for any leveraged deal. Complicating matters is an FBI interrogation of Zell related to the governor Blagojevich case.

4) The International Energy Agency predicts that total crude demand will fall this year for the first time in 25 years. This has created an unexpected?? window of opportunity to move to alternatives before the next up spike, which will probably start in 2010.

6) Boeing (BA) announced that it was delaying delivery of its fuel efficient 787 Dreamliner by another six months to Q1, 2010. Some airlines have decided that with fuel prices down 75% in five months, and with a deep recession staring them in the face, their rusty, worn out, gas guzzler aircraft don't look so bad after all. Some 2,444 planes, or 11.5% of the global fleet is now parked in mothballs, with the bulk coming from Europe.

7) Jamie Diamond, CEO of JP Morgan (JPM), believes that US home prices could drop another 20%. Oops.

8) Goldman Sachs (GS) put out an important report on China, predicting that its growth rate will drop from?? 9% in 2008, to 6% next year. It will then bounce back?? to a 9% rate in 2010. While I believe this is still optimistic, it is more evidence pointing towards the 'V' type recession scenario I have been expecting, rather than the 'U' type scenario anticipated by most.?? Last month, exports fell 2.2%, the sharpest drop in nine years. A big problem here is that modern China has never had a recession, just a growth rate that varied from hot, to red hot, so the country's companies have no experience in managing real downturns.

QUOTE OF THE DAY

' This recession will be so deep and so prolonged, that 0% interest rates will be reached even by the most anal retentive, gradualist central bank before the middle of 2009.' Willem Buiter, a former member of the Bank of England's monetary policy committee. Imagine, global zero interest rates.

Global Market Comments for December 11, 2008

Featured trades: (BA), ($WTIC), ($GOLD), ($XEU)

1) Weekly jobless claims soared by 58,000 to 573,000, a 26 year high. A lot of workers came back from their Thanksgiving turkey only to get fired. According to UCLA's Anderson report, unemployment in California will peak at 8.7% next year. This may be conservative.

2) The euro ($XEU) broke out to the upside, moving to $1.3280, a two month high. Gold ($GOLD) also moved up $20 to $827. If the dollar continues to weaken, it could jeopardize Treasury efforts to sell bonds to finance reflation, half of which are bought by foreigners. The weak dollar could also be the trigger for a long overdue trading rally in commodities. Crude ($WTIC) has already rocketed from $40.50 to $48.50 this week. I think commodities will be the big play next year, and some hedge funds are already starting to do some early toe dipping in the waters at these incredibly oversold levels.

3) Real Estate investor Sam Zell says that it took a 'tsunami' of?? unforecastable developments to drive the Chicago Tribune into a preemptive bankruptcy. The Chicago Cubs won't be affected by the proceedings. Zell bought the company a year ago when revenues were falling at an annualized 3%, at a price assuming a 6% annualized drop. Instead he got a 20% plunge in revenues, death for any leveraged deal. Complicating matters is an FBI interrogation of Zell related to the governor Blagojevich case.

4) The International Energy Agency predicts that total crude demand will fall this year for the first time in 25 years. This has created an unexpected?? window of opportunity to move to alternatives before the next up spike, which will probably start in 2010.

6) Boeing (BA) announced that it was delaying delivery of its fuel efficient 787 Dreamliner by another six months to Q1, 2010. Some airlines have decided that with fuel prices down 75% in five months, and with a deep recession staring them in the face, their rusty, worn out, gas guzzler aircraft don't look so bad after all. Some 2,444 planes, or 11.5% of the global fleet is now parked in mothballs, with the bulk coming from Europe.

7) Jamie Diamond, CEO of JP Morgan (JPM), believes that US home prices could drop another 20%. Oops.

8) Goldman Sachs (GS) put out an important report on China, predicting that its growth rate will drop from?? 9% in 2008, to 6% next year. It will then bounce back?? to a 9% rate in 2010. While I believe this is still optimistic, it is more evidence pointing towards the 'V' type recession scenario I have been expecting, rather than the 'U' type scenario anticipated by most.?? Last month, exports fell 2.2%, the sharpest drop in nine years. A big problem here is that modern China has never had a recession, just a growth rate that varied from hot, to red hot, so the country's companies have no experience in managing real downturns.

QUOTE OF THE DAY

' This recession will be so deep and so prolonged, that 0% interest rates will be reached even by the most anal retentive, gradualist central bank before the middle of 2009.' Willem Buiter, a former member of the Bank of England's monetary policy committee. Imagine, global zero interest rates.

Global Market Comments for December 10, 2008

Featured trades: (GM), (F), (NYT)

1) The global financial crisis is evolving into a global consumer spending crisis, which is much more difficult to fix. In 2007, 85% of home mortgages were securitized in markets that ar closed. Now just five banks are extending two thirds of new mortgages, and their originations are down 50% YOY. Oppenheimer & Company's banking firebrand Meredith Whitney predicts that housing has another 20% to fall. Banks will cut credit lines to consumers by $2 trillion to protect their capital. One in five US homes are now underwater on their mortgages, and in Michigan it is one out of two.

2) It looks like the Big Three is going to get their $15 billion. This will enable them to last about four more months. My read on this is that the Democrats are throwing the industry a bone to placate constituents like the United Auto Workers, and that when Detroit comes back for more money in the Spring, they will let them go into bankruptcy. That way they can say, 'We tried to save them.' General Motors (GM) and Ford (F) were unchanged.

3) My friends from Illinois are mortified by the revelations about indicted Illinois governor Mark Blagojevich. Apparently, the word 'bleep' is in common usage in Chicago. What does 'bleep' mean?

4) Cantor Fitzgerald has filed an application with the Commodity Futures Trading Commission to launch markets for six month futures contracts on individual Hollywood movies. The contract would enable producers to hedge their risks, and allow investors to bet on the success or failure of upcoming releases. I don't think this will work, because the temptations for insider trading would be rife. Could this be a new way to go long Bonds?

5) The euro finally noticed that US interest rates are at zero and broke $1.30, a one month low.

6) The New York Times (NYT) hocked its Times Square building the same day that the Chicago Tribune and Los Angeles Times parent filed for bankruptcy. Print newspapers will become extinct within ten years. Bad for professional, fact oriented journalists and accuracy, good for trees.

QUOTE OF THE DAY

'I am all in favor of a bail out of the big three, because over the years, I have made a fortune repairing their cars.' Ray Magliozzi, one of the Tappet Brothers, of Car Talk fame.

Global Market Comments for December 10, 2008

Featured trades: (GM), (F), (NYT)

1) The global financial crisis is evolving into a global consumer spending crisis, which is much more difficult to fix. In 2007, 85% of home mortgages were securitized in markets that ar closed. Now just five banks are extending two thirds of new mortgages, and their originations are down 50% YOY. Oppenheimer & Company's banking firebrand Meredith Whitney predicts that housing has another 20% to fall. Banks will cut credit lines to consumers by $2 trillion to protect their capital. One in five US homes are now underwater on their mortgages, and in Michigan it is one out of two.

2) It looks like the Big Three is going to get their $15 billion. This will enable them to last about four more months. My read on this is that the Democrats are throwing the industry a bone to placate constituents like the United Auto Workers, and that when Detroit comes back for more money in the Spring, they will let them go into bankruptcy. That way they can say, 'We tried to save them.' General Motors (GM) and Ford (F) were unchanged.

3) My friends from Illinois are mortified by the revelations about indicted Illinois governor Mark Blagojevich. Apparently, the word 'bleep' is in common usage in Chicago. What does 'bleep' mean?

4) Cantor Fitzgerald has filed an application with the Commodity Futures Trading Commission to launch markets for six month futures contracts on individual Hollywood movies. The contract would enable producers to hedge their risks, and allow investors to bet on the success or failure of upcoming releases. I don't think this will work, because the temptations for insider trading would be rife. Could this be a new way to go long Bonds?

5) The euro finally noticed that US interest rates are at zero and broke $1.30, a one month low.

6) The New York Times (NYT) hocked its Times Square building the same day that the Chicago Tribune and Los Angeles Times parent filed for bankruptcy. Print newspapers will become extinct within ten years. Bad for professional, fact oriented journalists and accuracy, good for trees.

QUOTE OF THE DAY

'I am all in favor of a bail out of the big three, because over the years, I have made a fortune repairing their cars.' Ray Magliozzi, one of the Tappet Brothers, of Car Talk fame.

Global Market Comments for December 9, 2008

Featured trades: (VLCCF), (NYX), (NDAQ), (CME), (ICE), (SYMC), (CHKP), (LFP)

1) The stock market is up nine out of the last 12 trading days, and the Dow is up 1,000 from the post jobs report Friday low. The worst financial crisis in 70 years is being met head on by the biggest reflationary effort in history, and reflation is winning.

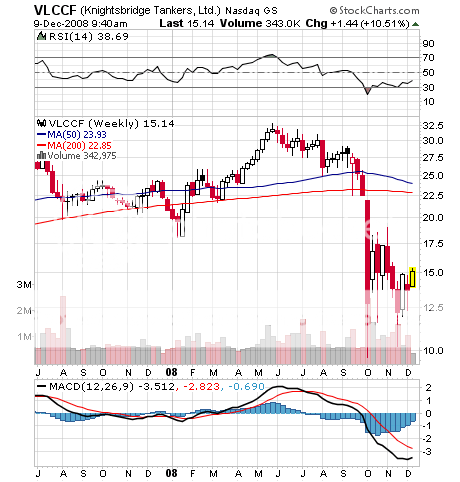

2) Tales of the global storage crisis are running rampant through the crude market, with the majors said to be chartering one to two tankers a day for storage 'on the water.' One potential play here is to buy Bermuda based Knightsbridge Tankers, Ltd. (VLCCF), which owns and operates very large crude carriers. The stock has soared 50% in a week.

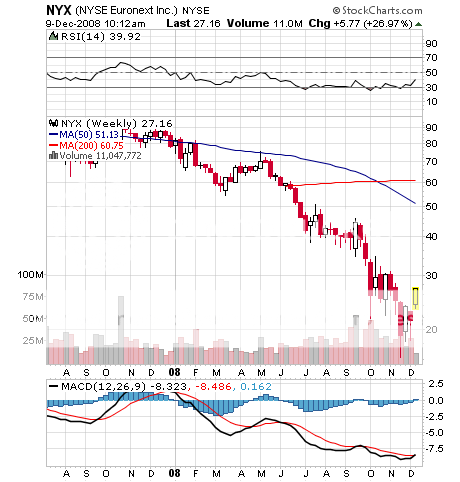

3) The four main listed stock and commodity exchanges, which have been decimated this year, all had big bounces yesterday. These include NYSE Euronext (NYX), Nasdaq OMX Group (NDAQ), CME Group (CME), and the Intercontinental Exchange (ICE). These companies earn their money from fees for execution, clearing and settlement, and the provision of data services. The stocks are discounting a worst case scenario, despite seeing trading volume leap 54% this year. Investors are betting that the current stock market selloff will be followed by a nuclear winter of low volume range trading for years. NYX alone has seen its stock dive from $90 to $10, and its P/E multiple shrink from 59 times in 2006 to 6.4 times today. I think these stocks are all strong buys here. They have stable, low cost expenses, geographical diversification, well known brands, own no securities, and carry almost no debt. A certain outcome of the financial crisis will be to drive once opaque and murky derivatives trading, like credit default swaps, on to these listed exchanges, a boon for volumes. They also benefit hugely from the long term trends of globalization and the shift from analogue to electronic trading.

5) The mantle of capital markets bad boy will shift from hedge funds to private equity firms in 2009. These companies, which are unhedged super long leverage funds, employ the most delusional mark to model assumptions and the most generous deferred accounting practices. The sushi will hit the fan next year, when major public pension funds and endowments, who drank from this well too many times, announce horrific multibillion dollar losses. First will come bankruptcies of their many junk grade investments, then implosion of the private equity funds themselves, followed by widespread private equity layoffs. Young MBA's are about to become a dime a dozen.

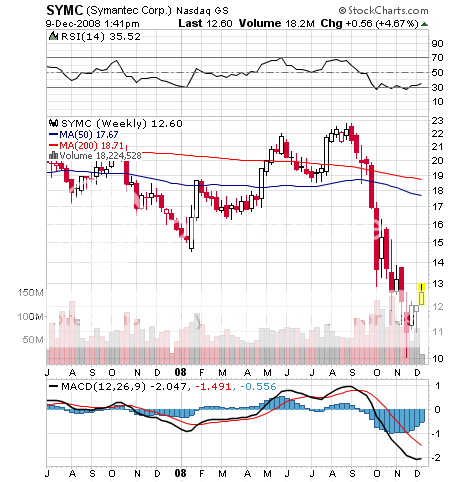

6) One group that doesn't get laid off in a recession is hackers and identity thieves, making security software companies good early recovery plays. They have low average selling prices, rapid returns on investment, large installed bases that have to be upgraded every year, no costs associated with large manufacturing operations, and IT departments that must buy them. Symantec (SYMC) offers end point security for desktops and laptops, and Check Point Technologies Software (CHKP) sells corporate firewall protection. Longtop Financial (LFT) offers the equivalent play in China.

QUOTE OF THE DAY

'Black Man Given Nation's Worst Job' was the headline given Obama's win by The Onion, a satirical publication. After winning 365 electoral votes for the Democrats, the most since the Lyndon Johnson win in 1964, maybe all of our future Presidential candidates will be black.

Global Market Comments for December 9, 2008

Featured trades: (VLCCF), (NYX), (NDAQ), (CME), (ICE), (SYMC), (CHKP), (LFP)

1) The stock market is up nine out of the last 12 trading days, and the Dow is up 1,000 from the post jobs report Friday low. The worst financial crisis in 70 years is being met head on by the biggest reflationary effort in history, and reflation is winning.

2) Tales of the global storage crisis are running rampant through the crude market, with the majors said to be chartering one to two tankers a day for storage 'on the water.' One potential play here is to buy Bermuda based Knightsbridge Tankers, Ltd. (VLCCF), which owns and operates very large crude carriers. The stock has soared 50% in a week.

3) The four main listed stock and commodity exchanges, which have been decimated this year, all had big bounces yesterday. These include NYSE Euronext (NYX), Nasdaq OMX Group (NDAQ), CME Group (CME), and the Intercontinental Exchange (ICE). These companies earn their money from fees for execution, clearing and settlement, and the provision of data services. The stocks are discounting a worst case scenario, despite seeing trading volume leap 54% this year. Investors are betting that the current stock market selloff will be followed by a nuclear winter of low volume range trading for years. NYX alone has seen its stock dive from $90 to $10, and its P/E multiple shrink from 59 times in 2006 to 6.4 times today. I think these stocks are all strong buys here. They have stable, low cost expenses, geographical diversification, well known brands, own no securities, and carry almost no debt. A certain outcome of the financial crisis will be to drive once opaque and murky derivatives trading, like credit default swaps, on to these listed exchanges, a boon for volumes. They also benefit hugely from the long term trends of globalization and the shift from analogue to electronic trading.

5) The mantle of capital markets bad boy will shift from hedge funds to private equity firms in 2009. These companies, which are unhedged super long leverage funds, employ the most delusional mark to model assumptions and the most generous deferred accounting practices. The sushi will hit the fan next year, when major public pension funds and endowments, who drank from this well too many times, announce horrific multibillion dollar losses. First will come bankruptcies of their many junk grade investments, then implosion of the private equity funds themselves, followed by widespread private equity layoffs. Young MBA's are about to become a dime a dozen.

6) One group that doesn't get laid off in a recession is hackers and identity thieves, making security software companies good early recovery plays. They have low average selling prices, rapid returns on investment, large installed bases that have to be upgraded every year, no costs associated with large manufacturing operations, and IT departments that must buy them. Symantec (SYMC) offers end point security for desktops and laptops, and Check Point Technologies Software (CHKP) sells corporate firewall protection. Longtop Financial (LFT) offers the equivalent play in China.

QUOTE OF THE DAY

'Black Man Given Nation's Worst Job' was the headline given Obama's win by The Onion, a satirical publication. After winning 365 electoral votes for the Democrats, the most since the Lyndon Johnson win in 1964, maybe all of our future Presidential candidates will be black.

Global Market Comments for December 8, 2008

Featured trades: (HYG), ($WTIC)

1) The November nonfarm payroll came in at a breathtaking 533,000, almost double the worst case forecast, goosing the unemployment rate up to 6.7%, a 15 year high. The September figure was revised down from minus -283,000 to a gut wrenching minus -403,000, meaning that the economy has lost -936,000 jobs since the Lehman bankruptcy. There are 4.09 million people now collecting federal unemployment checks, a 26 year high. Services took the biggest hit. It is clear that a lot of seasonal Christmas hiring never happened. This figure is consistent with the minus -8.5% GDP rate this quarter alone! It is now looking more like a 1974 type recession than a 1982 type recession. Brace yourself. December will be worse.

2) There is a huge 'crowding out' problem developing in the bond market for next year. A record $650 billion in investment grade paper has to be rolled over, followed by another $50 billion in non investment grade bonds. The problem is that the credit crisis has closed the market for new issues, and the earliest it can reopen is sometime next year. At the very least, interest rates are going to be a lot higher. The market has already severely punished next year's biggest private borrowers, especially highly leveraged REIT's, which are expecting an avalanche of retail tenant bankruptcies next year. In the meantime the Federal government, which is expected to tap the markets for up to $2 trillion next year, is having no problem borrowing whatsoever. The 10 year Treasury hit yet another 50 year low yield yesterday of 2.54%, and the 30 year hit a staggeringly low yield of 3.04%.

3) All 11,000 plus mutual funds tracked by Morningstar are down on the year, a first.

4) After losing 200,000 jobs after the dot com bust, Silicon Valley could get hurt even worse this time. Hewlett Packard (HPQ) has already announced 24,000 layoffs, Sun Microsystems (JAVA) 6,000, and Ebay (EBAY) and Yahoo (YHOO) 1,000 each. Google (GOOG) is rumored to be readying the axe for 3,000.?? In the past, new start ups absorbed a lot of these. That won't happen this time because of the complete vaporization of the venture capital market.

5) After their unprecedented collapse this year, corporate bonds, with their senior claims, now offer investors a far more attractive risk/reward ratio than the underlying equities. A great way to play for the possibility that these bonds may outperform equities in the first leg of any recovery is the ETF iShares iBoxx High Yield Corporate Bond Fund (HYG). It has fallen from $103 to $62 in the past year.

6) Now that crude ($WTIC) has bounced off?? $40, and rumors are flying about a glut of products, analysts are wondering how much further Texas Tea can fall. The contango situation is the most severe in the 30 year history of the futures contract. This means that you can buy a barrel for $44 today and sell it for one year delivery at $61, storing it in the interim. Normally arbitrageurs step in here to do exactly that, but now they can't obtain financing, and can't find any empty storage if they did. Merrill Lynch put out a report saying that crude could hit $25. Will it hit the 2002 low of $17.85, the 1998 low of $10.35, or the Great Depression low of ten cents? In every case crude fell to the value of the barrel holding it. Has anyone noticed that the value of the government's Strategic Petroleum Reserve (SPR) has plunged by $75 billion since June? That is almost one bail out's worth.?? I am lowering my forecast low for retail gasoline in 2009 from $1.29 to 99 cents! Buy that Hummer while it is still cheap:).

QUOTE OF THE DAY

'Beware a 12 division strategy for a 10 division army.' Former Army Chief of Staff Eric Shinseki, fired by President Bush for opposition to his Iraq strategy, and just appointed by Obama as head of the Dept. of Veteran's Affairs.

Global Market Comments for December 8, 2008

Featured trades: (HYG), ($WTIC)

1) The November nonfarm payroll came in at a breathtaking 533,000, almost double the worst case forecast, goosing the unemployment rate up to 6.7%, a 15 year high. The September figure was revised down from minus -283,000 to a gut wrenching minus -403,000, meaning that the economy has lost -936,000 jobs since the Lehman bankruptcy. There are 4.09 million people now collecting federal unemployment checks, a 26 year high. Services took the biggest hit. It is clear that a lot of seasonal Christmas hiring never happened. This figure is consistent with the minus -8.5% GDP rate this quarter alone! It is now looking more like a 1974 type recession than a 1982 type recession. Brace yourself. December will be worse.

2) There is a huge 'crowding out' problem developing in the bond market for next year. A record $650 billion in investment grade paper has to be rolled over, followed by another $50 billion in non investment grade bonds. The problem is that the credit crisis has closed the market for new issues, and the earliest it can reopen is sometime next year. At the very least, interest rates are going to be a lot higher. The market has already severely punished next year's biggest private borrowers, especially highly leveraged REIT's, which are expecting an avalanche of retail tenant bankruptcies next year. In the meantime the Federal government, which is expected to tap the markets for up to $2 trillion next year, is having no problem borrowing whatsoever. The 10 year Treasury hit yet another 50 year low yield yesterday of 2.54%, and the 30 year hit a staggeringly low yield of 3.04%.

3) All 11,000 plus mutual funds tracked by Morningstar are down on the year, a first.

4) After losing 200,000 jobs after the dot com bust, Silicon Valley could get hurt even worse this time. Hewlett Packard (HPQ) has already announced 24,000 layoffs, Sun Microsystems (JAVA) 6,000, and Ebay (EBAY) and Yahoo (YHOO) 1,000 each. Google (GOOG) is rumored to be readying the axe for 3,000.?? In the past, new start ups absorbed a lot of these. That won't happen this time because of the complete vaporization of the venture capital market.

5) After their unprecedented collapse this year, corporate bonds, with their senior claims, now offer investors a far more attractive risk/reward ratio than the underlying equities. A great way to play for the possibility that these bonds may outperform equities in the first leg of any recovery is the ETF iShares iBoxx High Yield Corporate Bond Fund (HYG). It has fallen from $103 to $62 in the past year.

6) Now that crude ($WTIC) has bounced off?? $40, and rumors are flying about a glut of products, analysts are wondering how much further Texas Tea can fall. The contango situation is the most severe in the 30 year history of the futures contract. This means that you can buy a barrel for $44 today and sell it for one year delivery at $61, storing it in the interim. Normally arbitrageurs step in here to do exactly that, but now they can't obtain financing, and can't find any empty storage if they did. Merrill Lynch put out a report saying that crude could hit $25. Will it hit the 2002 low of $17.85, the 1998 low of $10.35, or the Great Depression low of ten cents? In every case crude fell to the value of the barrel holding it. Has anyone noticed that the value of the government's Strategic Petroleum Reserve (SPR) has plunged by $75 billion since June? That is almost one bail out's worth.?? I am lowering my forecast low for retail gasoline in 2009 from $1.29 to 99 cents! Buy that Hummer while it is still cheap:).

QUOTE OF THE DAY

'Beware a 12 division strategy for a 10 division army.' Former Army Chief of Staff Eric Shinseki, fired by President Bush for opposition to his Iraq strategy, and just appointed by Obama as head of the Dept. of Veteran's Affairs.

Global Market Comments for December 4, 2008

Featured trades: (VIX), ($GOLD), ($SPX), (BAC), (DD), (T)

1) The relentless drumbeat of layoffs continues. United at SFO 500, DuPont (DD) 2,500, AT & T (T) 1,200, and Bank of America 30,000! Many of the BAC cuts will be at its newly acquired Merrill Lynch subsidiary. If the Big Three auto makers go under, add another two million to these figures. Overnight the ECB cut interest rates by 0.75% to 2.50%.

2) Historically, recessions end right after the government announces them. The most powerful leading indicator, the stock market, understands this and enters a bull market soon after. Employers, the most pitiful lagging indicator, start hiring about two years later.

3) It looks like the Volatility Index (VIX) is heading into a new, permanently higher range. When the VIX was at 15%, it created a daily Dow range of 1%, or 140 points. At 60% it creates a 4% daily range, or 350 points. Fasten your seat belts!

4) Hawaii has adopted the Better Place exchangeable battery program for cars you were so interested in. The state is an ideal location for such a program because the island limits most car trips to less than 40 low speed miles. Gas is expensive there, because it all must be imported from the West Coast. It will cost $1 billion to build the initial recharging network, and fleets are expected to be the initial users.

5) Famed short seller Bill Fleckenstein, author of Greenspan's Bubbles: The Age of Ignorance at the Federal Reserve, has made a killing in this year's melt down. Bill is such a serious short seller that he keeps a seven foot tall stuffed bear in his office wearing a 'Dow 10,000' hat. Bill has just covered his stock shorts because the government has created just too much liquidity to justify the risk. And maybe he looked at the chart of the S&P 500 below. He is, however, keeping a core long in gold because the current massive reflationary campaign will eventually come back to bite in the form of much higher inflation.

Global Market Comments for December 4, 2008

Featured trades: (VIX), ($GOLD), ($SPX), (BAC), (DD), (T)

1) The relentless drumbeat of layoffs continues. United at SFO 500, DuPont (DD) 2,500, AT & T (T) 1,200, and Bank of America 30,000! Many of the BAC cuts will be at its newly acquired Merrill Lynch subsidiary. If the Big Three auto makers go under, add another two million to these figures. Overnight the ECB cut interest rates by 0.75% to 2.50%.

2) Historically, recessions end right after the government announces them. The most powerful leading indicator, the stock market, understands this and enters a bull market soon after. Employers, the most pitiful lagging indicator, start hiring about two years later.

3) It looks like the Volatility Index (VIX) is heading into a new, permanently higher range. When the VIX was at 15%, it created a daily Dow range of 1%, or 140 points. At 60% it creates a 4% daily range, or 350 points. Fasten your seat belts!

4) Hawaii has adopted the Better Place exchangeable battery program for cars you were so interested in. The state is an ideal location for such a program because the island limits most car trips to less than 40 low speed miles. Gas is expensive there, because it all must be imported from the West Coast. It will cost $1 billion to build the initial recharging network, and fleets are expected to be the initial users.

5) Famed short seller Bill Fleckenstein, author of Greenspan's Bubbles: The Age of Ignorance at the Federal Reserve, has made a killing in this year's melt down. Bill is such a serious short seller that he keeps a seven foot tall stuffed bear in his office wearing a 'Dow 10,000' hat. Bill has just covered his stock shorts because the government has created just too much liquidity to justify the risk. And maybe he looked at the chart of the S&P 500 below. He is, however, keeping a core long in gold because the current massive reflationary campaign will eventually come back to bite in the form of much higher inflation.