Looking for Leveraged Long Plays

This is a time where everyone is wondering: what is the future of coronavirus and, in turn, the economy?

It is highly likely that the stock market will bottom out over the next few weeks and then begin a period of sideways chop in a wide range.

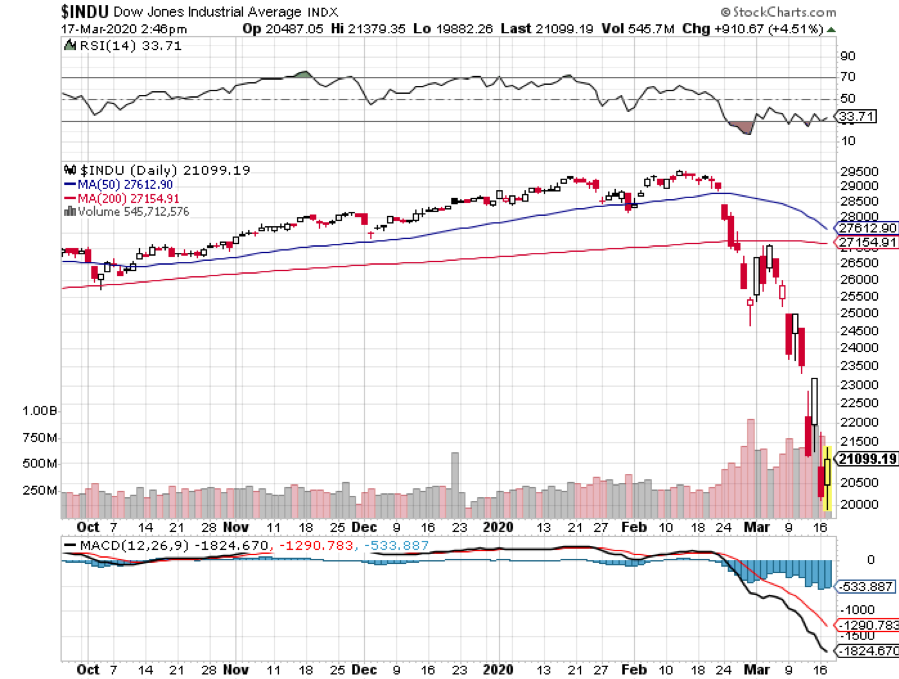

That range could be half the recent loss, a staggering 5,000 points in the Dow Average (INDU), or 500 S&P 500 points (SPX).

The math is quite simple.

With much of the country now on lockdown, Corona cases will keep climbing sharply in the US from the present 5,000 cases. They will keep doubling every three days for the next two weeks, the incubation time for the disease possibly reaching as high as 40,000 cases.

Just in the time it took me to write this piece, the number of cases worldwide jumped from 184,000 to 194,873 (click here for the link).

At that point, everyone who has the disease will become visible and can be isolated. The following week will bring a sharp falloff in the number of new cases, which many traders and investors will read as the end of the epidemic.

Shares will rocket.

The lockdowns and the “shelters in place” will come off. The economy will start to return to normal. Stock investors will pile in.

Then another spike in new cases will take place, prompting a secondary round of shutdowns and another run at the lows.

On top of this, the market will have to digest a coming set of economic numbers that will be the worst in history. All eyes will be on the Thursday Weekly Jobless Claims out at 8:30 AM, that will be our first look at the terrifying layoffs to come.

Our first look at economic growth comes at the end of April when the Q1 GDP is released. Since we had two months of growth before the crash and lockdown, it comes in as high as zero.

Not so with Q2, which could bring in a 5% or more shrinkage in the economy at an annualized rate. No doubt more 1,000 point down days are setting up when these figures are printed.

This is precisely what healthcare officials want to happen. That way, Corona cases can be spaced out over a year, keeping the national civilian and military hospital system from getting overwhelmed.

This is what the future of coronavirus will look like for the economy. Suffice it to say that there are some spectacular long side plays setting up. I’ll cover some of the best ways to play it.

One is the ProShares Ultra S&P 500 (SSO), a 2x long the underlying stock index. Since the all-time high four weeks ago, the (SSO) has cratered by 54.50%.

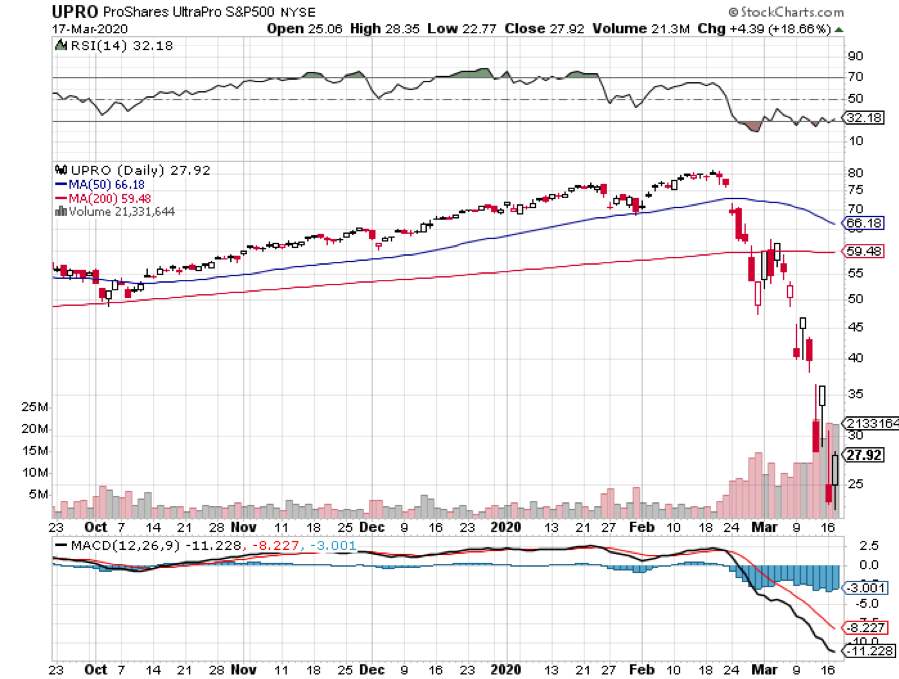

Another is the ProShares Ultra Pro S&P 500 (UPRO), a 3x long the underlying stock index. Since the all-time high four weeks ago, the (SSO) has cratered by an eye-popping 74.40%.

Needless to say, the velocity of these instruments is enormous, and the bid offered spreads wide. If you want your “E-ticket” ride for the stock market, this is it. Trade these with extreme caution.

Get a piece of either one of these and the gains can be huge. The (SSO) has to jump by 120% to the old high, while the (UPRO) needs to soar by 290%.

Good Luck!

This Morning’s Traffic Report

The San Francisco Rush Hour