Germany Brings Down Bitcoin

The German government unloading hundreds of Bitcoin (BTC) shows how a random event can reverse positive sentiment.

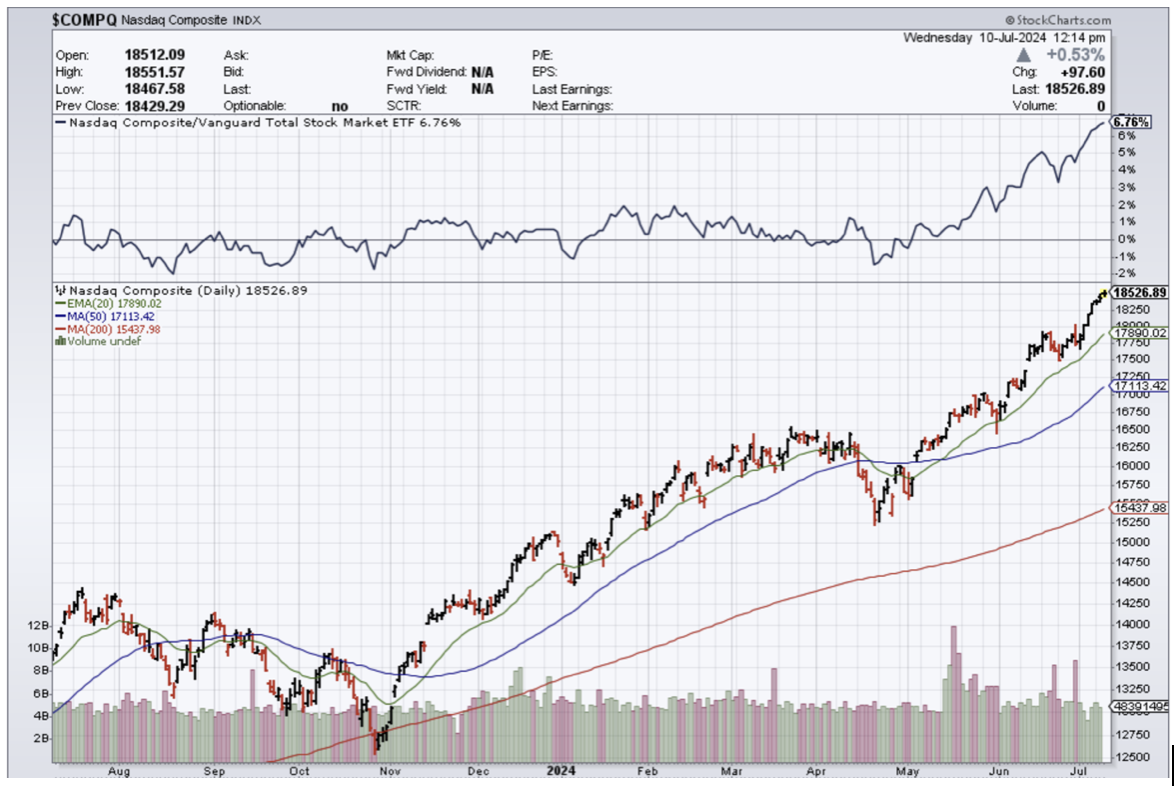

Technology stocks ($COMPQ) aren’t immune to this type of price action and as we inch closer to the election in November, get prepared for the likelihood of wonkiness to increase.

Luckily enough, the onslaught of regulatory attacks from all sorts of governments has more or less been priced into tech stocks.

A billion fine here or there for many of these tech titans is just a drop in the ocean.

Even political events now do little to sway tech stocks, because many events are just ephemeral in nature and don’t change the trajectory of tech.

Bitcoin isn’t necessarily directly important to tech stocks but operates in parallel.

It is true that there is a lot of crossover between talent pools in the labor forces. Everyone working in Google and Apple knows people working in Bitcoin and vice versa.

More often than not big tech has acted as a feeder source to fill position at Bitcoin and crypto companies.

For weeks now, Germany’s government has been selling hundreds of millions of dollars worth of Bitcoin — and it’s been a key factor behind the cryptocurrency’s intense sell-off.

Last month, the German government began selling Bitcoin from a wallet operated by the country’s Federal Criminal Police Office.

They also sold 900 bitcoins in June.

Last week, the government sold an additional 3,000 bitcoins worth roughly $172 million. Then on Monday, German police sold a further 2,739 bitcoins or $155 million worth of the cryptocurrency.

Bitcoin prices have also been under stress from the payout of billions of dollars worth of digital currency from the collapsed bitcoin exchange Mt. Gox — which went bankrupt in 2014 — to creditors.

A trustee for the Mt. Gox bankruptcy estate has started making repayments in bitcoin and bitcoin cash to some of the creditors through a number of designated crypto exchanges.

Bitcoin’s price is still up a good 89% in the last 12 months.

In January 2024, police in the eastern German state of Saxony announced the seizure of close to 50,000 bitcoins, worth around $2.2 billion at the time.

Today, Germany’s BKA holds roughly 32,488 bitcoins. At current prices, the government’s holdings are worth roughly $1.9 billion.

Although it might feel like a one-off, I do believe governments around the world will be in a position to confiscate more crypto in the future.

This could end up government owning more and more of the finite Bitcoin supply in circulation and could lead to regulation taking a backseat.

The golden goose won’t be killed if the government has skin in the game.

Even though this could become an unusual way for governments to onboard themselves into the crypto ecosystem, killing crypto would have a contagion whiplash that can’t be fully quantified as of now.

Uncertainty always tanks the market.

In fact, I believe the drop in Bitcoin from $73,000 to $53,000 is a positive event for investors because they can load up again at cheaper prices.

I believe we are in a goldilocks phase in technology where Bitcoin and tech stocks grind higher.

Temporary events that drop tech stocks or bitcoin by 20% are few and far between.

Many tech investors would love a better entry point, and it will truly take a real black swan to knock tech stocks or Bitcoin off their high and mighty perch.

As it stands, expect higher prices in both asset classes.