Getting on Board the Gene-Editing Revolution

I love buying straw hats during snowstorms, Christmas ornaments in January, and the latest outdoor equipment in October when the best quality gear is for sale at incredible discounts.

Such a bargain is to be had right now with CRISPR Therapeutics (CRSP), which has been at the forefront of the gene-editing revolution from day one. And I actually know how this works.

After decades of false starts and controversial experiments, genetic treatments are now starting to paint a credible and promising picture of their benefits. With the first-ever gene therapy treatment receiving approval in 2017 and the first RNA interference (RNAi)-based drug getting the greenlight in 2018, the biotech world appears to be ready for the next big thing: CRISPR gene editing.

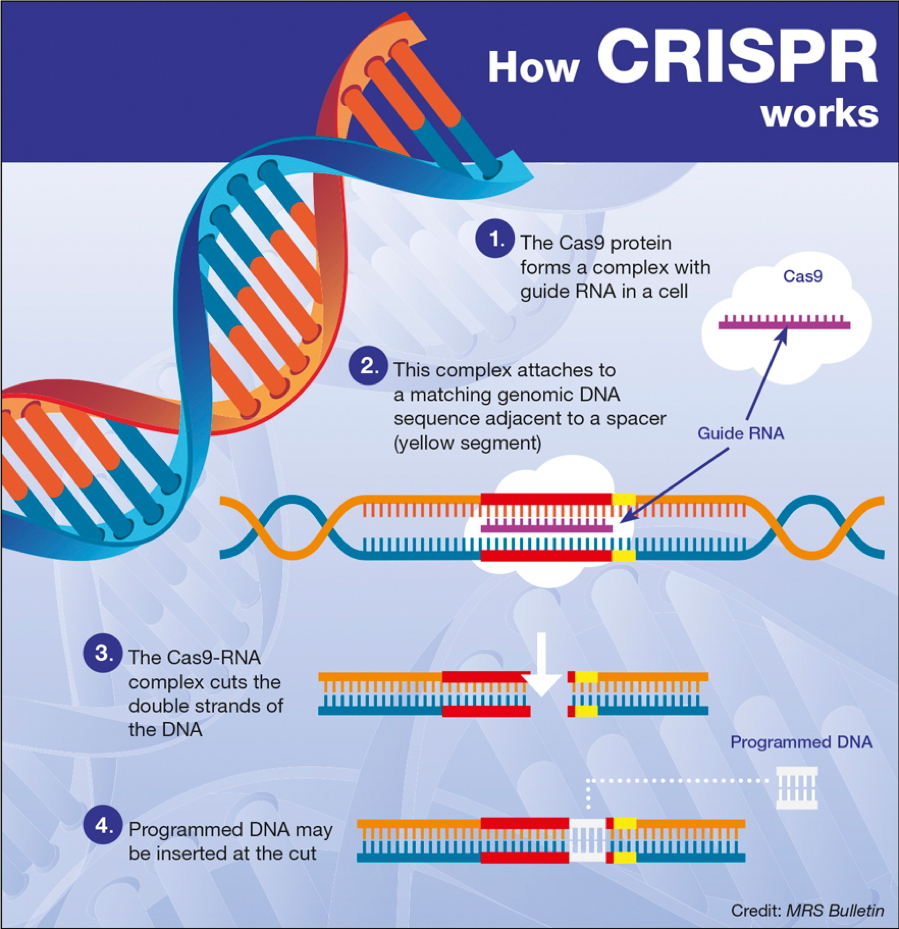

Crispr technology has the potential to offer a cure for diseases such as multiple sclerosis and even cancer. Apart from its healthcare benefits, this technology can also be utilized in the agriculture industry. A possible application of it is to synthesize chemicals including fuels and plastics. Crispr can be used to store data as well.

Well, that’s what the investors in this revolutionary technology are hoping to accomplish anyway -- so much so that the market cap of pioneering company CRISPR Therapeutics (CRSP) has soared to an incredible $2.7 billion.

Although CRISPR Therapeutics has been experiencing an upward trajectory in 2019, shareholders of this stock since its inception in 2013 have been through quite a rollercoaster ride as the company’s first drug candidate only managed to enter clinical trials this year.

While cash burn is obviously a legitimate fear, CRISPR Therapeutics actually has a massive mound of cash pile. Hence, the future (or the next five years, at least) of this red-hot growth stock won’t be a problem for the company as long-term prospects look promising.

One of the most aggressive supporters of CRISPR Therapeutics is Vertex Pharmaceuticals (VRTX), which recently splurged $175 million in an upfront cash payment to fund the development of the biotech company’s study on a gene-editing therapy called CTX001.

This method is designed to help patients suffering from rare genetic blood disorders beta-thalassemia and sickle cell disease. Aside from these blood diseases, Vertex expanded the collaboration to also cover muscle disorders commonly known as Duchenne muscular dystrophy and myotonic dystrophy type 1. Earlier in 2019, the FDA granted a Fast Track designation for CTX001.

Despite minimal information on CRISPR’s pipeline, a lot can be deduced from the behavior of its investors alone. Looking at the roster of the company’s largest shareholders, it’s quite noticeable that a whopping 42% belongs to institutional investors.

Since institutions tend to prefer more established companies compared to smaller ones, the presence of these investors in CRISPR signifies a positive outlook for the stock. A quick caveat though -- the downside of this is for the stock to turn into a “crowded trade” due to the number of institutions that own it. That makes its share price sensitive to the biotech market and to the on-again, off-again IPO market.

Meanwhile, insider ownership for CRISPR Therapeutics amounts to $51 million -- a fact that could signify the earning potential of this stock and the promising future it holds. Some shareholders would consider this as a real positive sign as the heavy presence of the board members in the share registry ensures that their interests align with that of the shareholders.

So, what’s the bottom line here? While CRISPR’s shares at one point jumped by an astounding 72% this year, there’s no indication that the stock is slowing down anytime soon. That is if no clinical setback hinders the company’s forward march. Given the potential of the technology and its healthy cash pile ready to fund its future endeavors, this development biotech is anticipated to be worth tens of billions in terms of future revenues.

The global clamor to embrace revolutionary medical treatments is something we can’t ignore, particularly due to the northward rise of the biotech sector. With CRISPR Therapeutics promising that the initial clinical trials are only there to whet investors’ appetites, it’s exciting to be part of a technology that could actually change the landscape of the medical profession.

Buy CRISPR Therapeutics on the dip. Now is a great place to start scaling in with a one-third position.