Global Trading Dispatch Hits 64%, 11 Day Home Run On Yen Short

When I covered my short position on the Japanese yen on Friday, it was not because I suddenly fell in love with the Land of the Rising Sun, began each day with a Zen meditation, started eating sushi three times a day, or initiated writing this letter from a hot tub. It is because followers of my Trade Alert Service suddenly had an 11 day, 64% gain on their hands. We now live in a world where a bird in the hand is worth ten in the bush, so I took the money and ran.

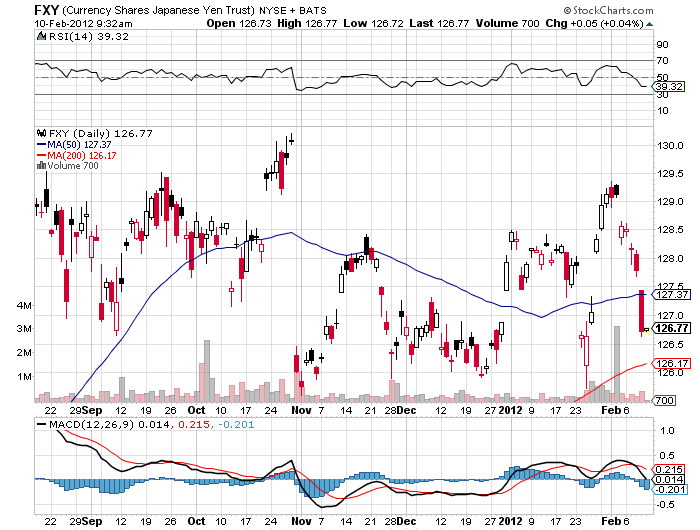

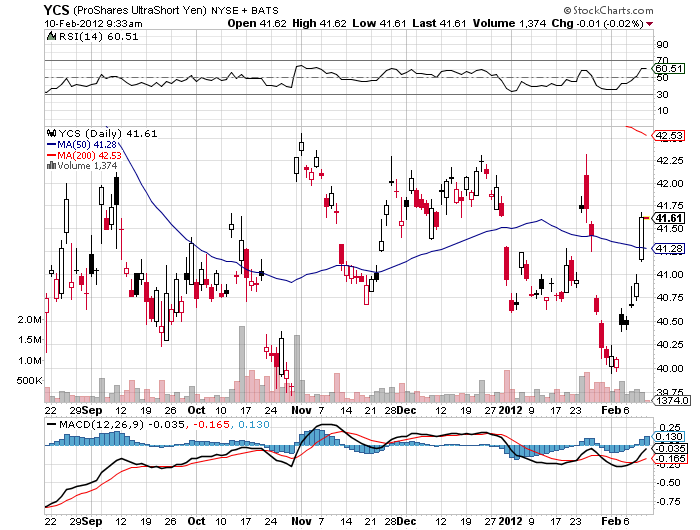

There were a few other reasons for my lightning fast, cat like move. A sudden and unexpected extension of the global ?RISK ON? trade spilled into the foreign exchange markets, causing the Japanese currency to depreciate from ?76 to ?78.8. That took my March, 2012 puts from $1.65 to $3.00, before they settled at $2.70.

Taking profits before a three day weekend allowed me to duck the accelerated time decay in these short dated options. An instant return to the ?RISK OFF? trade, which was squarely placed on the table by the stock market?s gap down opening on Friday, could send the yen right back to poking at all-time highs. And while the recent move in the yen has been dramatic, all we have really done is move back to the bottom of a nine month trading range. And there is nothing like adding 3.18% to the value of your portfolio in a month that has otherwise been difficult for hedge funds.

I think that we are getting close to the tipping point for the complete collapse of the Japanese economy. This will lead to eye popping declines in the value of the Japanese stock and bond markets and the yen. For US based investors, the easiest way to play this is with short positions in the ETF (FXY), and through the leveraged short yen ETF (YCS). So I will be revisiting this trade soon, and frequently, I hope.

Global Trading Dispatch, my highly innovative and successful trade mentoring program, earned a net return for readers of 40.17% in 2011. Those who wish to participate should email John Thomas directly at madhedgefundtrader@yahoo.com. Please put ?Global Trading Dispatch? in the subject line, as we are getting buried in emails.

To see the data, charts, and graphs that support this research piece, as well as more iconoclastic and out-of-consensus analysis, please visit me at www.madhedgefundtrader.com . There, you will find the conventional wisdom mercilessly flailed and tortured daily, and my last four years of research reports available for free. You might have a good laugh too.