Goodbye the Quarter from Hell

Good riddance! I?m never eating at THAT restaurant again!

That?s all I can say about the completion of the first quarter of 2016. Talk about an e.coli of a quarter!

It was the worst quarter in hedge fund history. Bodies will be washing up on the beach for months.

Back-to-back we saw both the worst start to a year in stock market history, followed by the sharpest rally. Up to 70% of the net buying from the February 11 ?Jamie Diamond? bottom is thought to be corporate buybacks.

What?s more, it has done three of these nausea inducing round trips in the past 18 months, with barely any net over all change.

That is the most difficult market in the world to trade.

Activist funds especially took it in the shorts. Without exception, the best performing stocks of 2016 had the largest short positions.

Telecommunications stocks closed with the best performance at +15.3%, followed by utilities +13.9%, and consumer staples +5.2%, all defensive high dividend yielders. The reach for yield is alive and well.

Banks took the worst beating, down -5.4%, thanks the Fed?s abandonment of any near term interest rate hikes. Health care also got roughed up, down -5.7%, thanks to the double-barreled assault from both political parties.

I can see right now that there will be a great long bank, long health care trade setting up for the second half of the year, once the election gets out of the way.

I managed to keep my head above water. I closed the quarter up 3.31%, with March peeling off 2.42%. I played the entire month from the short side, which saw 15 of 22 trading days produce gains. Only a highly disciplined stop loss approach kept me from losing my shirt.

It really was the quarter of the STOP LOSS, with me taking hits on the (GDX), (FXE), (XIV), (FXY), and (SPY). The sad truth is that all of these losses expired at their maximum profit point except for the (SPY). If I had only held on, these would have been winners, at the expense of many sleepless nights for both you and me.

If you haven?t done this before, I DON?T recommend you try it some time.

Praise be to gold (GLD), which has saved my bacon three times in three months.

The good news is that I am still only 4% short of an all time performance high. Thus, I live to fight another day.

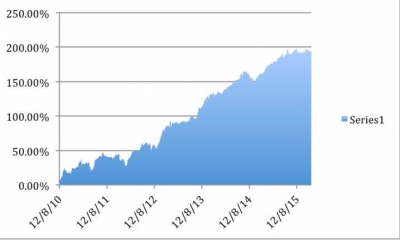

During the aforementioned 18 months from hades, the (SPY) gained a miserly 5.6%, while the Mad Hedge Fund Trader?s Trade Alert service rocketed by 47.58%.

It?s a classic case of the harder I work, the luckier I get. Being nimble, and having a half-century of trading experience under my belt helps a lot too.

When I ran my big hedge fund during the 1990?s, I learned that if you are flat when you?re wrong and up huge when you are right, the customers will take that all day long.

Mad Hedge Fund Trader 5 ? Year Audited Performance