Google Gives Us Some Good News

I am not saying that Google’s (GOOGL) earnings report will save the market; the market isn’t just GOOGL.

However, the company demonstrated there is still some positive performance out there in the tech sector when many out there are having a hard time.

It is clear that we are about to embark on a journey where big tech actively pulls the levers of shareholder returns to get over the low bar of expectations.

It is true that Google has not innovated for years and is still relying on its cash cow called the Google search engine, to drive ad revenue.

At some point, there will be competition as proprietary technology becomes beatable.

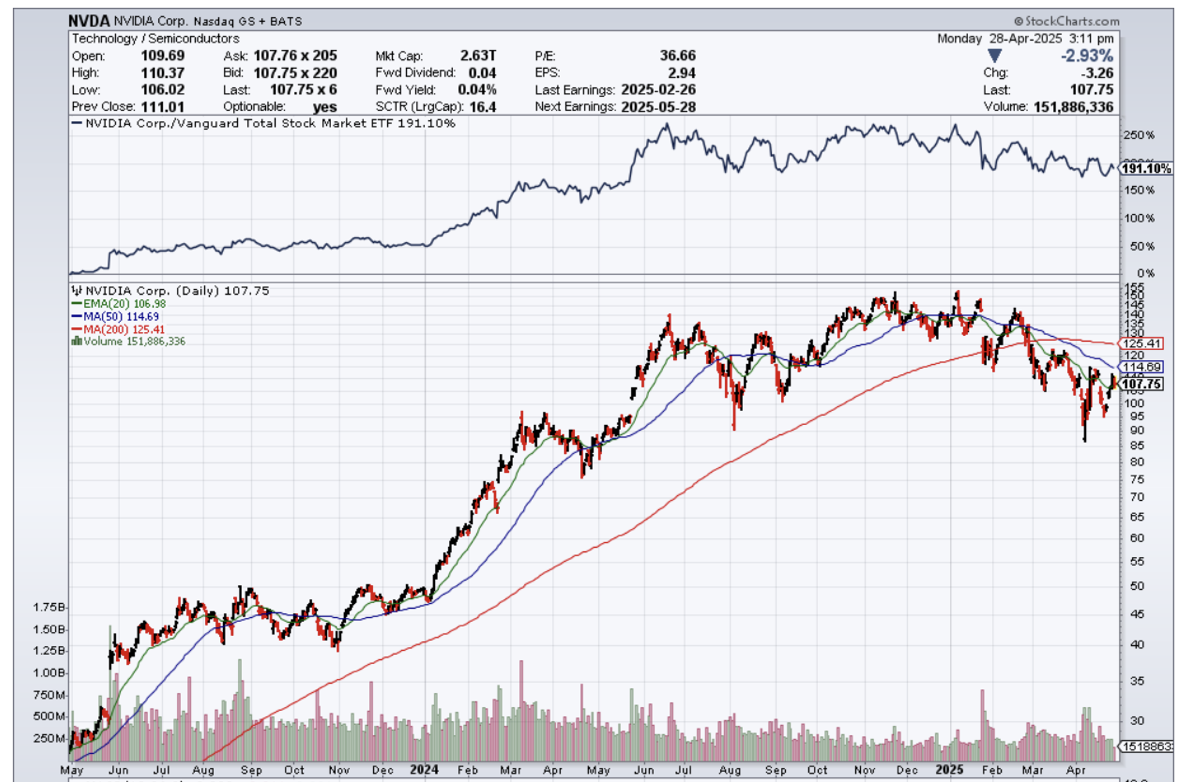

Competition is prompting the company and its rivals to spend heavily on infrastructure, research, and talent. While Google benefits from AI startups spending on its cloud and business tools, it’s also racing to present an answer to popular conversational AI chatbots, which consumers are beginning to think of as an alternative to using Google Search.

Google’s beginning of the answer to that threat — its “AI Overviews” and “AI Mode” in search, in which summarized responses are drafted by generative AI and highlighted ahead of Google’s web links — have seen mixed success. Meanwhile, Google’s AI changes to search have decimated traffic to independent websites across the open web.

Google Cloud brought in an operating profit of $2.18 billion, indicating that Google may be nudging out more profits from Cloud even as sales slow.

The cloud unit is so far the clearest indicator of how the AI boom is contributing to the company’s sales, as startups that require more computing power for their work become customers. Though Google Cloud still lags in third place behind Amazon and Microsoft offerings, it’s one of Alphabet’s most important growth areas.

Alphabet’s board authorized a $70 billion share buyback and boosted its dividend by 5%, to 21 cents a share.

With Google’s search business still holding up at a tough time in global business, I must conclude that Google is doing better than expected.

I believe that we will see a consolidated trend in 2025 of big tech dipping into their huge cash reserves to give back returns to shareholders. Google increasing its dividend by 5% is just the beginning, and we expect bigger returns as we move to the latter part of the year.

There is nowhere to invest in innovation right now in technology, which is why management is quick to buy back stock.

If there is some great project out there, management is keeping it close to its vest.

The long-term problem is that when you fire all the Americans with high wages who secured the company’s success to this point, replacing Americans with cost-cutting employees from India won’t deliver the same amount of innovation as the past in a mature environment.

American tech is supposed to set the bar in innovation, and now they are no,t which is why China is rapidly catching up to Americans on all cutting-edge technology, whether it be EVs or chip manufacturing.

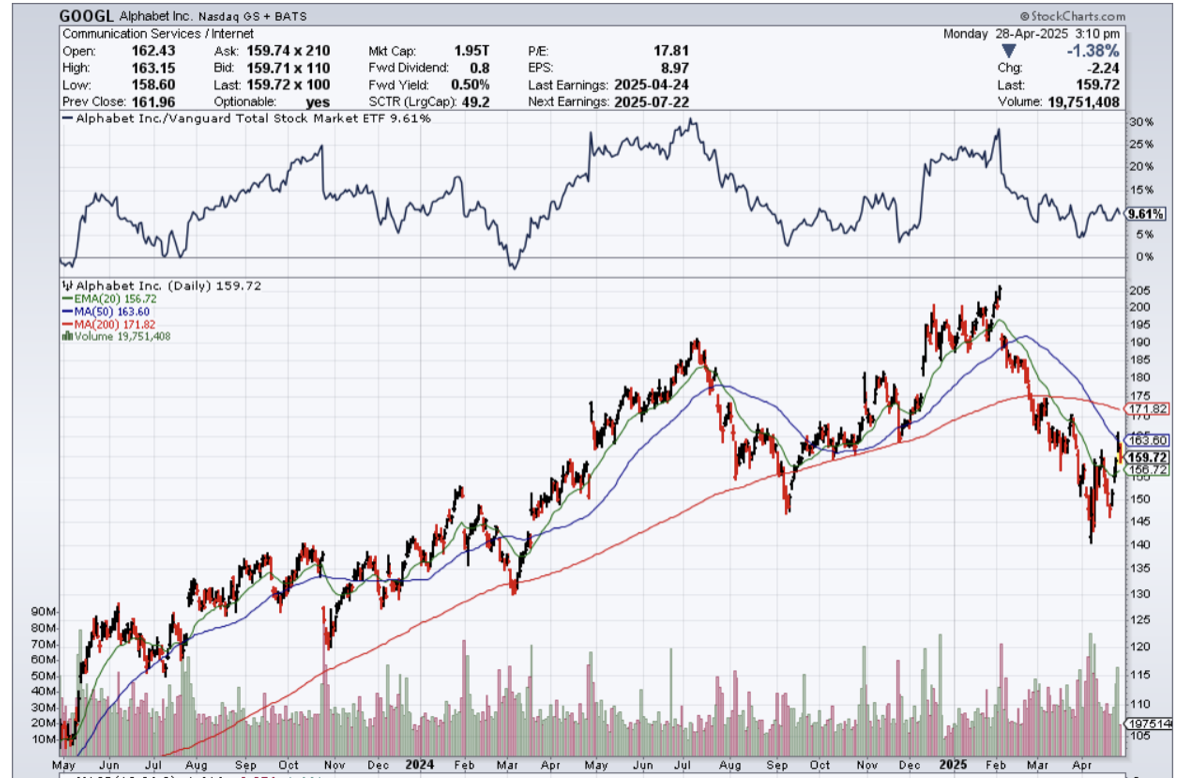

Google is no longer a growth company, and that hurts the stock price.

We could experience a bear market rally that could propel Google along, but that depends on the whims of global politics, which Google has no control over.

If you look at the risk/reward scenario, Google is worth a bullish trade after the wild pullback.