Google is Still On Sale

Google (GOOGL) shares were up 65% last year and I would still call the name cheap in 2022.

It’s interesting for me to see ARK (ARKK) Funds CEO Cathy Woods claim that growth is on sale now.

I take the other side of the argument and would pontificate that quality is for sale, like Google, who has carved out an unrivaled position in the digital ad space.

Their cash cow business is so effective that they are set to achieve $100 billion in free cash flow by 2023.

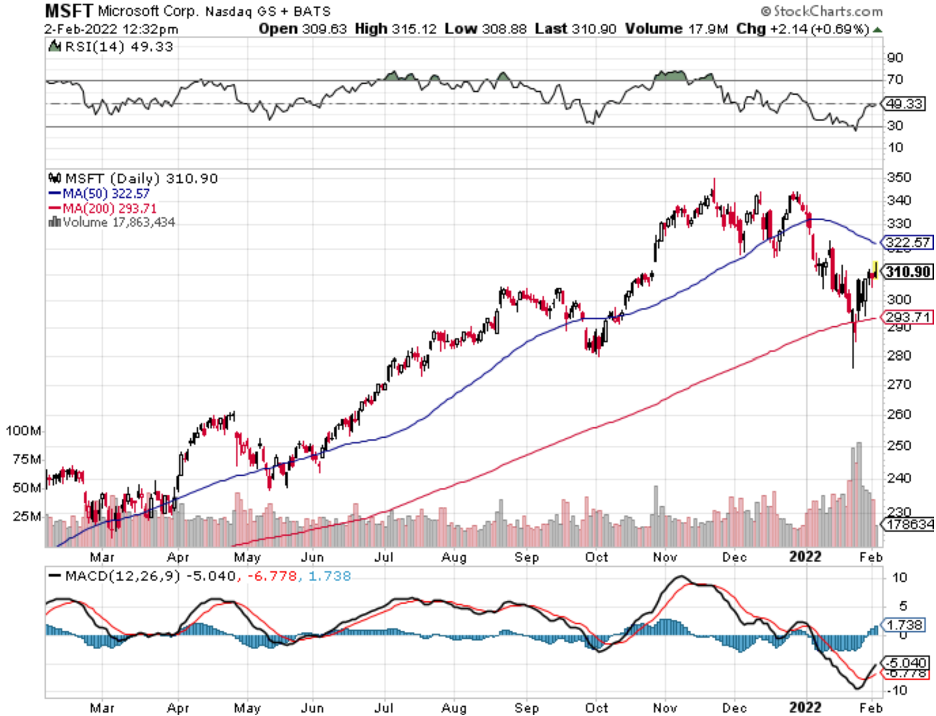

It’s mind-boggling that a company of this magnitude still trades at a discount even though generating more free cash flow than Apple (AAPL) and Microsoft (MSFT).

Google’s ad revenue was up to $61 billion which was up from $46 billion last year.

These numbers are staggering because of the sheer math it takes to jump to 33% when we are talking about over $50 billion.

Google is so big that the law of large numbers works against them, but they still shrug that off and register these outlandish numbers.

This company is one of the sure-fire bets in tech along with Microsoft and it’s no surprise that the best companies are taking the rest of the market on their back to diffuse this recent volatility.

The plaudits don’t stop there with their critical cloud division growing 45% year over year to $5.5 billion.

The cloud and ad revenue serve as the structural stabilizers to a healthy business and all signs point to Google having tremendous value as a stock.

Google also announced a 20:1 stock split which should allow investors with smaller bank accounts access to the stock.

Apple and Tesla saw huge inflows after they announced stock splits and I see no reason why this should be different for Google.

Fortunately, it appears that supply chain bottlenecks aren’t materially damaging Google’s ad demand.

Now Google is on the verge of cruising by $2 trillion in market cap.

Since we are in a market where outperformers are rewarded, Google is in great shape for 2022 when supply chain problems are set to improve.

I have repeatedly said to stay away from those companies that cannot meet expectations and aren’t cash flow-positive.

There is no more free money to subsidize poor management or a poor product or both.

When we analyze Google’s ad business from a microeconomic level, then it’s easy to understand that businesses cannot get rid of their services because of its deep application for consumers.

People also want deals.

They're looking for value.

For shoppers, Google made it possible to browse and discover the hottest deals for major moments like Black Friday and Cyber Monday on Google Search.

For merchants, Google made it even easier to list promotions via automated imports from third-party integrations like Shopify and WooCommerce.

Google is easily selling ad inventory, attracting new customers, and building brand loyalty.

In the holiday season, the number of merchants using promo features jumped 280% year over year.

Retailers are also turning to Google to help them transform and accelerate growth such as Warby Parker, who drove a 32% year-over-year increase.

They accomplished this by not only opening stores and expanding their contact lens business but also by tapping into Google across services.

Omnichannel bidding, smart shopping campaigns and an expanded presence in Google Maps to promote in-store eye exams contributed to Warby Parkers’ success.

Google is making it easier for viewers to buy what they see and simpler for advertisers to drive action with innovative solutions like product feeds and video action campaigns and emerging formats like live commerce.

Backcountry.com generated a 12-1 return on ad spend with product feeds in 2021 and plans to double its investment in 2022, while Samsung, Walmart, and Verizon partnered with creators to host shoppable holiday live stream events in the U.S.

In short, Google has pricing power, and its strategic position is such that it’s hard not to see rampant growth ahead in the short and long term.

Its cash position is enviable to any tech or non-tech company and at some point a dividend is inevitable.

Even with its success, Google is still investing aggressively for the future and is part of every cutting-edge technology from artificial intelligence to self-driving and even the metaverse.