Great Potential For A Tech Sub-Sector

I know many people don’t talk about this, but they should.

Much of the insurance industry has been lapping up the profits, because of cataclysmic hurricanes, floods, earthquakes, tsunamis, and mudslides.

Why not do the same with tech?

Now there is a new insurance sub-sector that could become equally as expensive for companies protecting against cybersecurity risks.

The demand for cyber insurance is set to grow amid a series of high-profile cyber-attacks and this trend is unrelenting.

From my channel checks, the cyber insurance industry is set to expand at an 18% compound annual growth for the next 5 years.

Instead of physically robbing a bank and exposing oneself to the violent harm, cyber criminals are sitting behind computers in remote parts of the world digitally looting from their laptops.

Even if they do get caught, they are often in countries that have no extradition agreements with victims from the nation state.

The low risk nature of the heist and asymmetrical gains are almost like options trading.

Let’s see some of the instance of recent cyber fraud.

United Healthcare’s Change Healthcare medical billing processor, which links one third of Americans to health-insurance payments, suffered a cyber-attack in February, crippling the payments systems of a significant number of hospitals.

The May attack on Ticketmaster compromising 560 million customer records was another win for the cyber bullies.

An estimated $8 trillion was lost globally to cybercrime in 2023, a significant increase vs. the $600 billion estimated in 2018.

This industry pays and a time will come when Fortune 500 companies will become the main target.

Some of these far flung places that have major cyber hacking operations are little known places in South East Asia where they took in over $200 billion last year.

Malware, generative AI, and deepfakes have been integrated into their operations while opening up new underground markets and cryptocurrency solutions for their money laundering needs.

As a result cyber frauds have continued to intensify from East and Southeast Asia.

This is just the tip of the iceberg, but the message is clear.

If funds are illegal taken, it is almost impossible to recover them when they are funneled into China then laundered into a 3rd party jurisdiction.

Much of this type of cybercrime is now professionalized.

Ultimately, cybersecurity insurance is a variable that is set to mushroom in the coming years.

Cybercriminals are not only in the widely active East Asia, but many more from Eastern Europe and Africa, and each region is imitating each other as they see strategies succeed.

Ironically, according to the data, the only companies that feel it is worth paying up for cybercrime insurance and companies in North America and Europe.

If this starts to become a drag on the earnings, it could really drag down some smaller companies.

As what is usual for bigger companies, these types of costs are usually passed down to the end consumer and their pricing power allows big tech to do it.

Many have not heard of insurance in tech, and it might be the new tail risk to monitor moving forward in tech, because the monetary rewards for starting a hacking ring in a foreign country is too great to ignore.

I predict that in the next few years, one big tech name will fall due to a run on its security integrity creating a new massive windfall into cybersecurity firms.

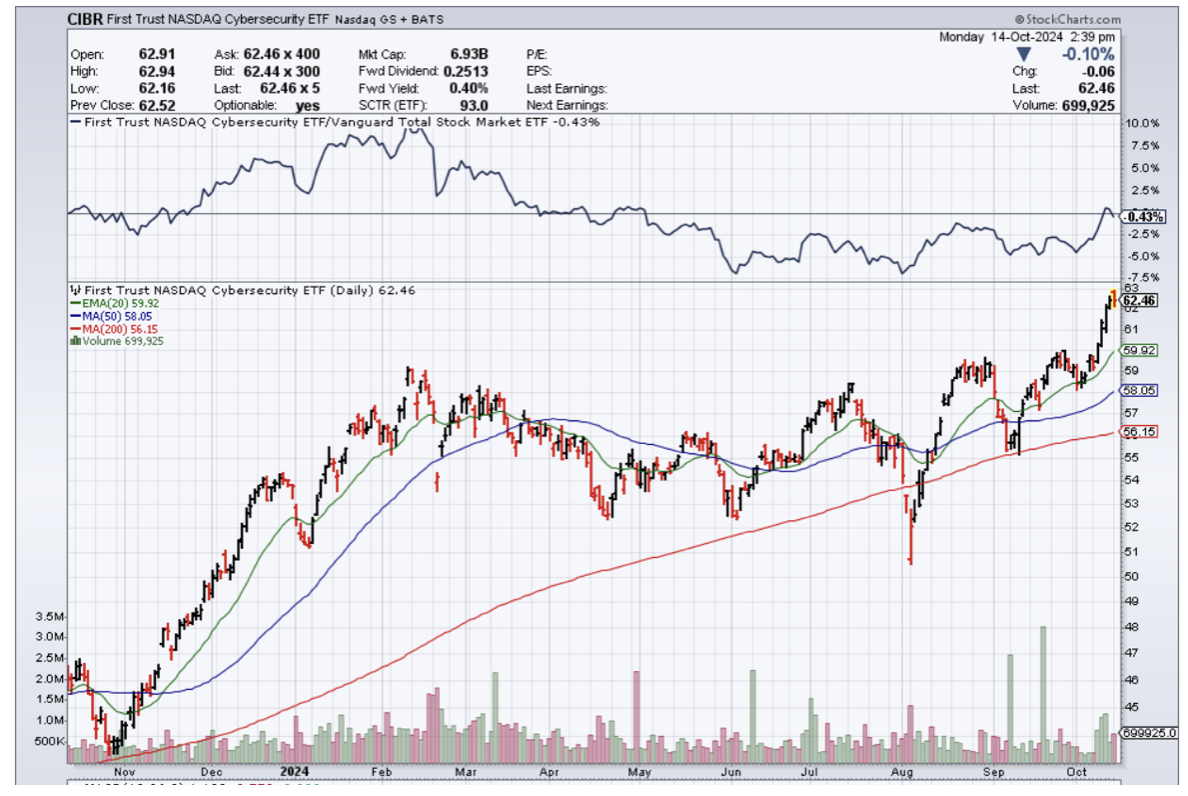

Readers should not fall asleep at the wheel and invest in First Trust Nasdaq Cybersecurity ETF (CIBR).