Grown Up For Success

Well, folks, it looks like we've stumbled upon a diamond in the rough in the healthcare sector. Universal Health Services (UHS) has caught my eye, and let me tell you, it's not just because I've spent more time in hospitals lately than I care to admit. (Note to self: skydiving and arthritis don't mix.)

Now, I've been around a while, and I've learned to spot a good deal when I see one. UHS is trading at a valuation that's making my wallet itch. We're talking about a forward P/E of just 13x based on analysts' 2025 EPS estimates of $17.85.

To put that in perspective, it's like finding a Rolex at a yard sale - the Medical Care Facilities industry is strutting around with a 17x forward P/E.

And here's where it gets really interesting. UHS is sporting a PEG ratio of 0.62. For those of you who dozed off during Finance 101, that's like getting a growth stock at a value price. The industry average is sitting pretty at 1.56, making UHS look like an absolute steal.

Now, let's talk about what UHS actually does. They're in the business of owning and operating acute care hospitals, outpatient facilities, and behavioral healthcare centers.

As of Q2 2024, they've got 359 inpatient facilities and 48 outpatient joints spread across 39 states, D.C., Puerto Rico, and even jolly old England.

The company operates under two main segments: Acute Care Hospital Services, which brings in about 87% of the bacon, and Behavioral Health Services, accounting for the remaining 13%.

Inpatient revenue from both segments makes up roughly 64% of total revenue, with outpatient services filling in the rest.

Now, here's where things get even more interesting. The global hospital services market is expected to expand quickly – we're talking about a 6.4% annual growth rate, potentially hitting $21 billion by 2032.

But UHS isn't just sitting pretty waiting for the market to grow. Oh no, they're expanding faster than a tech startup with too much venture capital.

They've got plans for 12 new freestanding emergency departments, a 150-bed acute care hospital under construction in Vegas (because what happens in Vegas... might need medical attention), a 136-bed hospital in D.C. set to open in spring 2025, and a 150-bed facility in Palm Beach Gardens, Florida, ready to roll in spring 2026.

And let's not forget about their Behavioral Health segment. They recently opened a 128-bed behavioral hospital in California and are cooking up a 96-bed joint venture in West Michigan.

Now, I've seen my fair share of companies promise the moon and deliver a mere pebble, but UHS seems to be putting their money where their mouth is.

Just in Q2 2024, they saw their gross margin jump from 39% to 42.6% year-over-year. Operating income margin? Up from 7.9% to 11.2%. Net income margin? A healthy increase from 4.8% to 7.4%.

And they're not just calling it a lucky quarter - they're expecting to keep this party going for the next few periods.

With all this good news, UHS has bumped up their 2024 EPS guidance by a whopping 17% to $15.80 per diluted share.

On top of all these, they've also increased their stock repurchase program by $1 billion, bringing the total authorization to $1.228 billion.

For those of you who slept through that part of business school too, that's like making your slice of the pie bigger without having to bake a new one.

Now, I'm not saying UHS is without risks. They've got a high concentration of revenue in California, Nevada, and Texas. It's like they're betting big on blackjack, roulette, and Texas Hold'em all at once. Any major changes in these states' regulations, economy, or even weather patterns could hit UHS hard.

They're also heavily reliant on Medicare and Medicaid reimbursements. So if Uncle Sam decides to tighten the purse strings, UHS could feel the pinch.

Plus, they're required to treat emergency patients regardless of their ability to pay. A sudden influx of non-paying customers could put a dent in their profits faster than you can say "insurance claim denied."

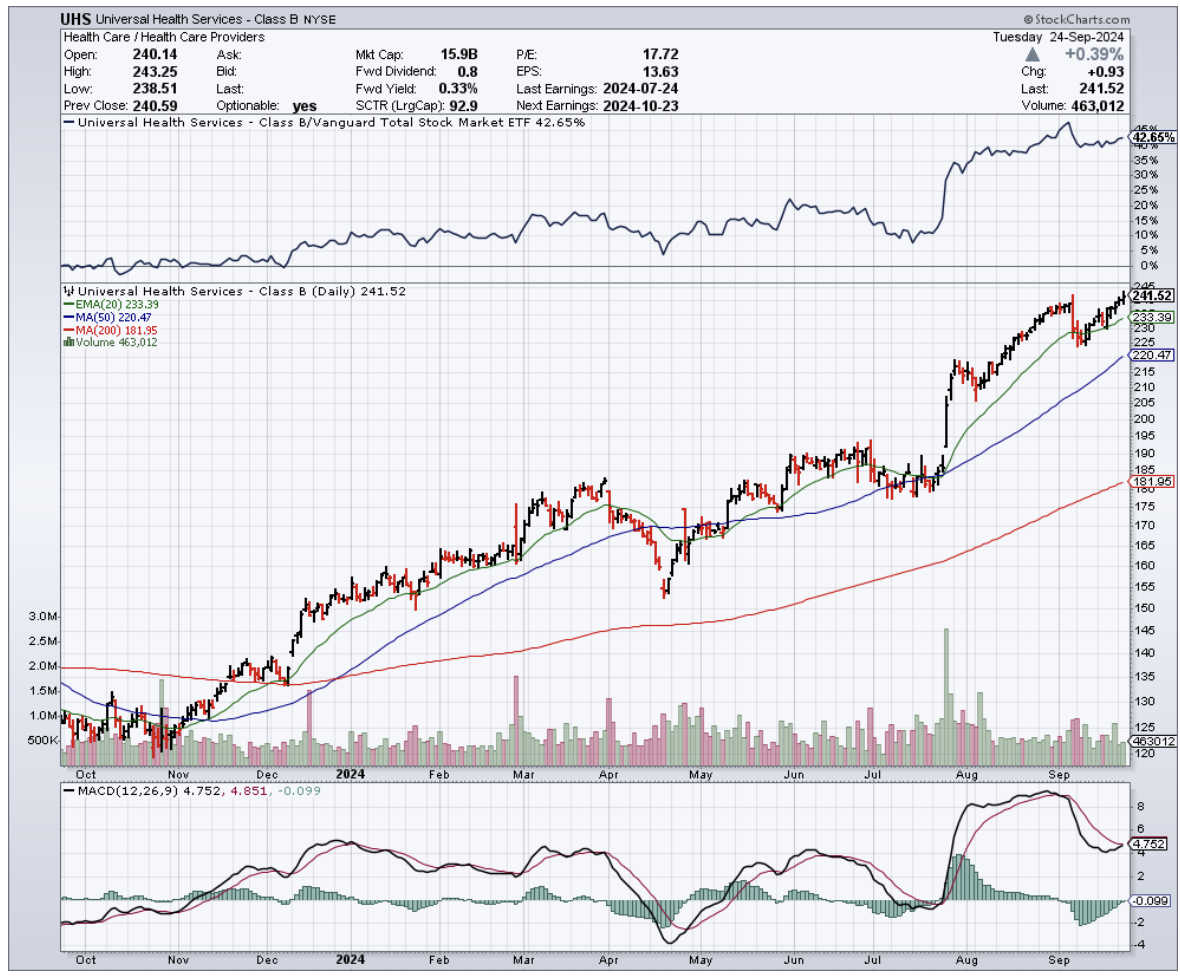

But overall, the prognosis for UHS looks good. With their margin increases, strong earnings growth, positive stock momentum, and that juicy low valuation, they're poised to be the frontrunners of the global hospital services market.

In my decades of watching the markets, I've learned that sometimes the best opportunities come wrapped in hospital gowns rather than pinstripe suits. UHS might just be one of those opportunities.

I suggest you add it to your watchlist. And if the market hiccups and gives us a dip? Well, that might just be the perfect time to scoop some up for your portfolio.