Here Comes the Rolling Top

The S&P 500 is now at 1,370, and most strategist forecasts for 2012 hover around 1,400, plus or minus some spare change. So the next nine months are going to be incredibly boring. Or they won?t.

Even in a bull market, one expects to see pullbacks of at least one third of the recent gain. Apply that logic towards the 317 points the (SPX) has tacked on since the October low, and that adds up to a 106 point, 7.7% correction down to 1,270.

Given the massive liquidity in the system, the underweight positions of many institutions, and the incredibly low level of interest rates, we are likely to see a rolling type market top that unfolds over the next several weeks or months. That is in contrast to a spike top which you can spot on a chart without your glasses from 20 feet away. These tops can be devilishly difficult to trade, with the limits defined more by time than price.

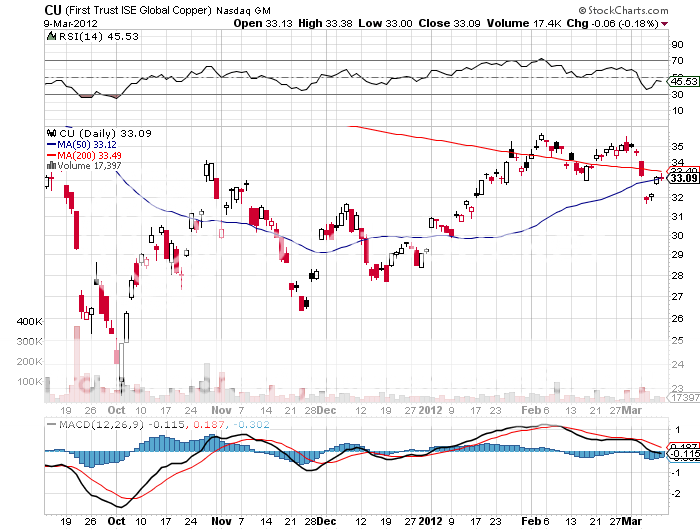

If you want to see what such a rolling top looks like, take a peek at the chart for my old friend, Dr. Copper, that great prognosticator of future economic activity. He shows that we have already been putting in a rolling top for the last two months. This no doubt reflects the slowing economy and the building copper inventories in China, where the red metal is widely used as a monetary instrument. China, in effect, is on a copper standard. In 2011, the peak in copper preceded the one for the (SPX) by exactly 12 weeks.

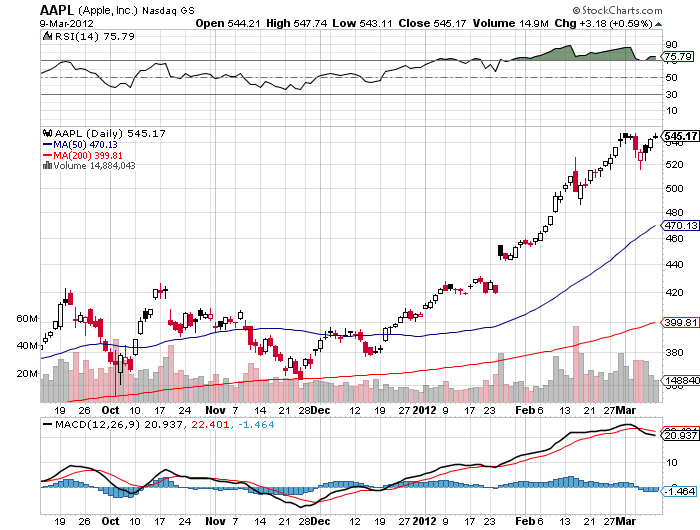

While the broader indexes are likely to deliver a rolling top, that is not the case with individual sectors and stocks. That means you can use these individual spikes to assist in your timing of the overall market. Let me give you three of my favorites with their charts below. Apple (AAPL) is the lead right now. Not only does it dominate NASDAQ (QQQ), it often leads the daily value traded of all stocks worldwide. It is tough to see global rally in risk assets surviving any substantial selloff in Apple.

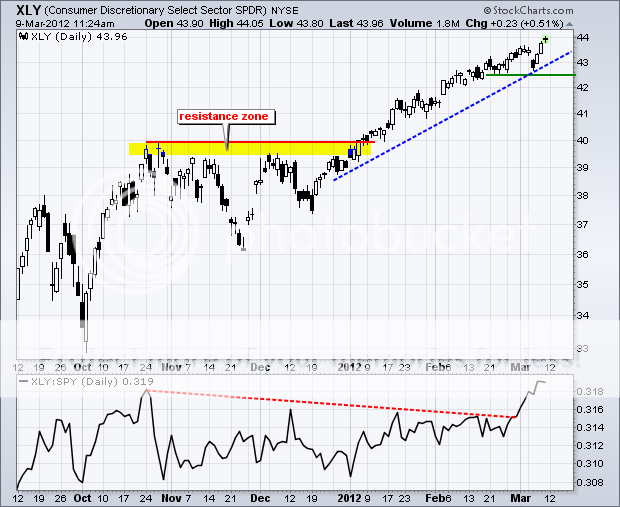

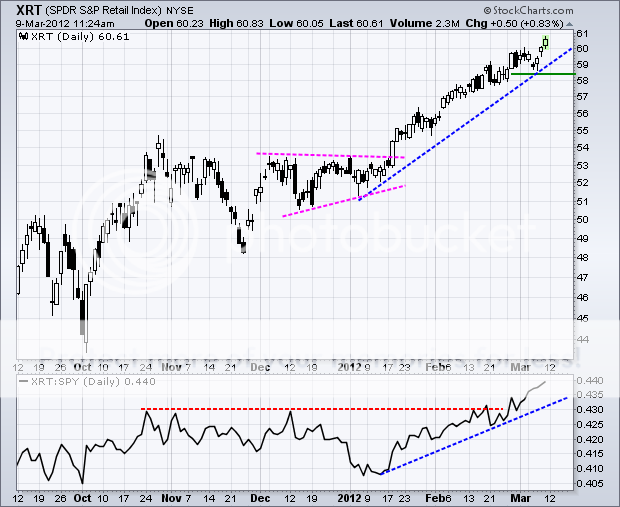

The consumer discretionary and retail sectors are two additional pathfinder sectors, the most economically sensitive in the market. As long as consumers are packing McDonalds (MCD), Home Depot (HD), and Target (TGT), or burning up their Comcast (CMCSA) broadband connections buying stuff from Amazon (AMZN), you won?t see appreciable market weakness.

Financials are another important sector to watch. They were far and away the best performers during January, with lead stocks like Bank of America (BAC) rising as much as 55%. (BAC) is a dog of the Dow on steroids. But they have stalled since then, providing a major drag on the index. If investors see the glass half full instead of half empty, any upside breakout by banks will take the broader market to new highs for the year. If they don?t, it could roll over like a dead duck.

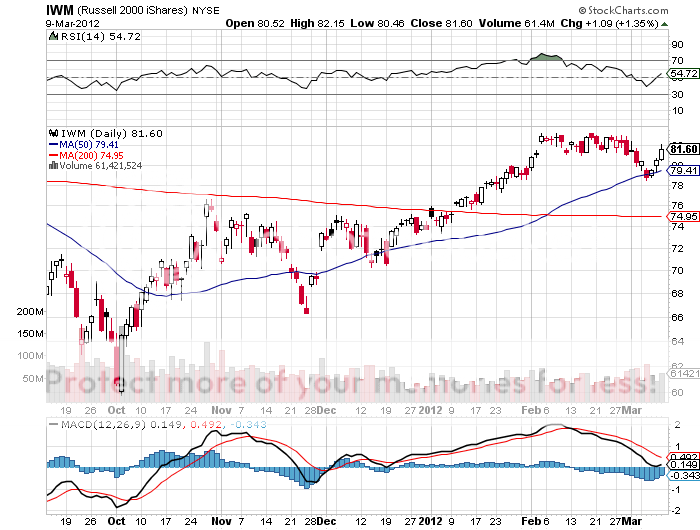

Finally, there is another class of stocks that may lead the charge on the downside, and that is small caps. Look at the chart below for the ETF for the Russell 2000 (IWM). Small companies are always hardest hit in any slowdown because they are more highly leveraged and have less access to external financing, like bank loans and equity floatation?s. I made a bundle last year shorting the (IWM), and plan to do so again this year.

What could drive the final stake through the heart of this bull move? Greece has finally defaulted, and the credit default swaps have been triggered, so the garlic eaters are out of the picture for the time being. Slowing emerging market economies, which account for 75% of global GDP growth, is the 800 pound gorilla sitting in the room that no one wants to acknowledge.

Rising oil prices and the threat of $5/gallon gasoline are his twin brother. War with Iran, or an Israeli air strike there, is the second cousin in the waiting room out front. And quantitative easing, which has been powering risk assets mightily for five years, is about to become an extinct species.

I?ll tell you what worries me the most. The principal driver of the three year bull market has been rapidly rising corporate earnings. They are now starting to slow dramatically. All of the increase in share prices this year has been based on rising multiples, from 13X to 14X, not expanding profits. That is not a healthy bull market to inhabit. Shall you bet the ranch on 15X? I think not.

So how is the genius, aggressive hedge fund trader going to deal with these opaque markets? Bet that the market is going to stay in a broad range for a few more months. We aren?t going to the moon, nor are we going to crash. We are more likely to die of ice than fire.

There are several ways to play this kind of market. If you have a plain vanilla stock portfolio, you should be executing buy writes against your existing holdings to take in extra premium income. With the bull move five months old, call options are trading at historically rich levels. This low risk, high return strategy involves selling short call options against existing stock positions. If your stock gets called away, you just say ?thank you very much? and buy it back on the way down.

For the more aggressive, you can add naked short sales of deep out of the money calls one month out. Last week, I sold April expiration Apple calls 20% out of the money, and they have already dropped in value by 65%. When the April?s expire, I?ll role out to the May?s. You don?t get rich with a strategy like this, but you earn a living. Don?t leverage up too much on this one. It is the surest way to go out of business that I know of.

What To Do With Four 800 Pound Gorillas in the Room?