Hewlett Packard - Remember Them?

Artificial intelligence is not always the golden ticket, but some legacy companies, they are using this trend to springboard themselves back to relevancy.

Look at companies like Dell (DELL) or Oracle (ORCL) – they epitomize what I am talking about.

For years, these certain legacy tech firms were crowbarred into this narrow definition of some aging enterprise software company that was from yesteryear.

It was true back then but some have changed.

Hewlett Packard (HPE) is another Silicon Valley brand name that has reinvented itself for artificial intelligence and its stock price has reaped the dividends.

The stock has exploded to the $20 per share range after languishing in the teens for years.

HPE latest report was topped up with its better-than-expected revenue fueled by sales of servers built for artificial intelligence work.

The strong performance was due to the company’s server business, which generated revenue of $3.87 billion.

Sales of AI-oriented systems doubled from the first quarter to more than $900 million.

Increased demand and better availability of high-powered semiconductors from Nvidia (NVDA) led to an increase in AI systems sales.

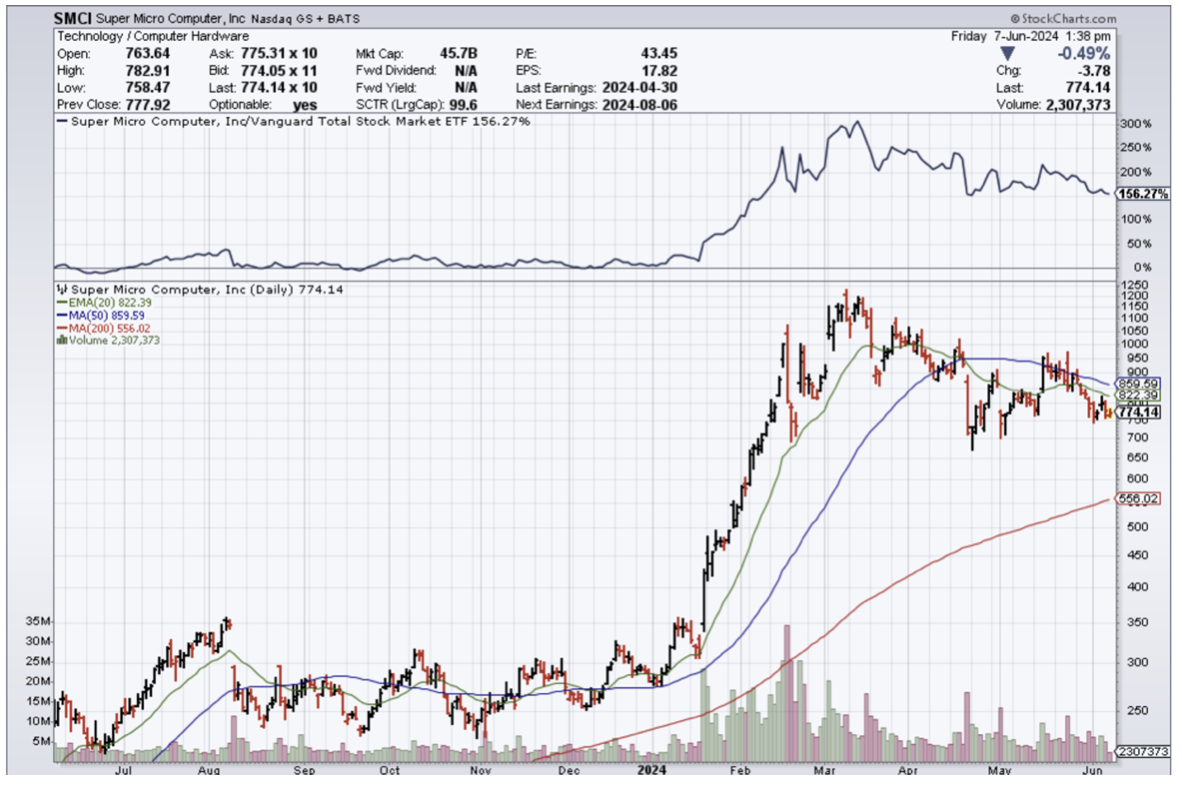

HPE would be a good way to play the catch-up trade in AI servers compared with its peers in the server space, including Dell Technologies (DELL) and Super Micro Computer (SMCI).

HPE’s current backlog for AI systems is now $3.1 billion.

This is the first quarter HPE has broken out AI server revenue and investors likely welcome the increased disclosure.

The AI-server ramp-up is finally materializing.

The full-year forecast is underwhelming given the increased AI business, suggesting other business lines, such as networking, are dragging down the results.

I am not saying that HPE is the finished article right now and is a pure AI play. I am not. They have a lot to work on and that might be a generous statement to even say that.

There is still plenty to dislike about HPE who are saddled with legacy businesses that barely move the needle.

However, if HPE smartly harnesses resources right, I do believe they could eventually turn into an above-average AI play.

At this point, many tech companies view the participation of AI or not as an existential matter.

Many companies will get left behind and swept into the dustbin of history.

When the biggest tech companies in the world talk about AI constantly on their earnings call, it is not a head fake. This is the real deal so get with the program.

There are many different types of semiconductors with different levels of sophistication, from simple chips in kitchen appliances to cutting-edge graphics processing units (GPUs) used in artificial intelligence (AI) applications, as well as cryptocurrency mining.

In many of these use cases, semiconductor chips will need an AI server to act as storage for the data or some other similar function.

The data produced is substantially greater than analog chips and of higher quality.

We are still in the early innings of the AI revolution, so it is important to know which stocks possess an upward trajectory in terms of business models and sub-sectors.

In 2024, semiconductor chips and AI server stocks have made their stamp in the tech world and aren’t going away.

Remember that the trend is your friend and I wouldn’t fight this one. It’s a massive trend to fight and be on the wrong end.

Moving forward, I believe HPE will make meaningful optimization decisions to amplify its AI server business while minimizing its legacy divisions to the benefit of the future share price.

If they can somewhat achieve these results, the stock should easily rise by 3X.