Hi Beta Is Suddenly Hot

The Federal Reserve swung its big stick again.

They are and will continue to be the largest influencer in tech share price action in the short-term and the last 2 days has proved it.

Whatever you think or say about the equity market, we can’t hide from the truth that liquidity will either wreak havoc on short-term price action or shoot it to the moon like we saw post-Fed announcement about the latest rate hike.

Tech shares lifted off like an Elon Musk spaceship to Mars and the Mad Hedge Technology Letter was tactical enough to take profits on a DocuSign (DOCU) put spread and stomp out in Meta (META) before the earnings report.

I was able to add some additional long tech as Friday is proving to benefit from the spillover effect.

No matter how we view it, volatility isn’t going anywhere any time soon.

Why?

Since January 2020, the US has printed nearly 80% of all US dollars in existence.

Lots of fiat paper sloshing around in the system has many unintended consequences.

When pushed into certain asset classes, the hot money polarizes price action. That’s how we got all the meme stock craziness.

This phenomenon won’t be going away anytime soon and the Fed slowly reducing their asset sheet pales in comparison to the liquidity hanging around on the sidelines.

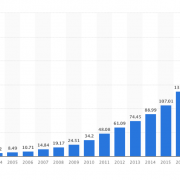

The Fed hike means short-term rates now stand at between 4.5%-4.75%, the highest since October 2007.

The move marked the eighth increase in a process that began in March 2022. By itself, the fund's rate sets what banks charge each other for overnight borrowing, but it also spills through to many consumer debt products.

Tech shares took off because Chairman Powell acknowledged that “the disinflationary process” had started.

In a blink of an eye, the Nasdaq was up 2% and growth stocks were up 5%.

Powell intentionally didn’t pour cold water on the rally when he had a chance to smash it down with more hawkish rhetoric or a 50 basis point hike.

It appears highly likely that Powell isn’t interested in tech stocks or any equities for that matter experiencing another bloodbath like 2022.

There might be pitchforks out for him if there is a 30% loss in major indexes this year and perhaps he is scared that Washington would bring the heat. He likes his cushy job and the benefits that come with it.

I do believe this is only the first of a series of Powell Houdini acts where he is willing to disappear behind any sort of opportunity to smash down the markets and let them run wild.

Tech stocks will be a natural buy-the-dip opportunity during this deflation narrative.

We have a clear runway from 6.5% inflation to around 4% and during this 2.5% deflation drop, I can easily see the Nasdaq lurching higher.

I used Friday to add a bullish position in Lyft (LYFT) and Amazon (AMZN) after their terrible earnings while I took almost maximum profit in our Netflix (NFLX) call spread.

It was almost as if Powell announced a new round of QE or, well, sort of.