Holder Retirement Could Send Bank of America Flying

Watching the market melt down today, I have been hurriedly compiling a shopping list of stocks to buy, and writing the Trade Alerts in advance for readers to execute.

If I am right about interest rates remaining flat or rising for the rest of the year, then financials have to be at the absolute top of such a list.

Bank of America (BAC) certainly was the chief whipping boy of the financial crisis. Since 2008, it has paid out more than $50 billion in fines and lawsuit settlements for every transgression under the sun.

After getting a bail out from the US Treasury, it was forced to cut its dividend payment to a token one cent. Do any Google search on the company and you are inundated with a flood of bad news.

All that is now ancient history. The entire banking industry is now moving into the sweet spot in the economic cycle. This is because rising interest rates mean that they will be able to charge more for loans, while their cost of funds (deposits and equity) remains low. These rising spreads fall straight to the bottom line.

Now with the bank?s Torturer-in-Chief, US Attorney General Eric Holder, announcing his retirement, the way is clear for better days ahead.

With the 30-year bull market in bonds now at an end, substantially higher rates in the near future are now included in virtually every economic forecast out there. Since the beginning of 2014 the ten-year Treasury yield has collapsed from 3.05% to as low as 2.32% at he end of August, pummeling bank shares.

What happens next? They go from 2.32% back up to 3.05%, possibly by yearend, then a lot more. Bank shares will ride on the back of this bull.

The jungle telegraph is now ringing with the prospect of a dividend hike by the company, currently at a lowly four cents. We may get the good news as soon as the next reporting period on October 14. The implications of such a move are broad.

If it pulls this off, it is only because of renewed confidence by the markets in the improved financial condition of the company. After several capital raises and the liquidation of the wreckage of the 2008 crash, US banks are now the healthiest in history, with balance sheets of bedrock stability.

Ahem, they are also too big to fail, again.

To get the dividend yield on the shares up to industry standard of 2.5%, the company really needs to raise its dividend to 42 cents. It certainly has the cash flow to do this. In 2013, (BAC) reported net income of $11.4 billion, more than four times to amount needed to cover such a payout.

Needless to say, this is all great news for the share price. The prospective return of increasing amounts of capital to shareholders should suck in new and wider classes of shareholders. It won?t be just about hedge fund punters anymore. Respectable, large and long term holding institutions will be in there as well.

Take a look at the charts below, and it is clear that such a move is underway. (BAC) broke out from the end of a classic triangle formation, which traditionally resolves itself to the upside. New post crash highs beckon.

You can find more dry powder in the chart for the Financials Select Sector SPDR ETF (XLF), which clearly rejected a complete breakdown at long-term trend support in early February.

Finally, take a gander at the chart for the S&P 500. New life from the financials will be the adrenaline shot this market needs to break it out of its current low volume sideways consolidation, taking it to new highs as well.

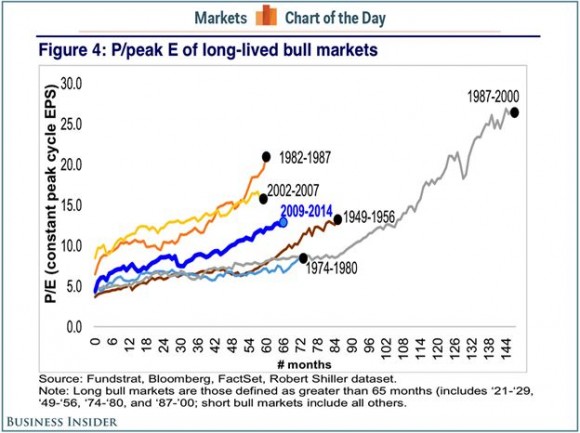

Finally, for those who are concerned that the bull market was killed off by last week?s massive Alibaba IPO (BABA), take a look at he chart below provided by my friends at Business Insider. Certainly, the collapse of the iShares iBoxx High Yield Corporate Bond ETF (HYG) has put the fear of God into traders.

The chart tracks long-lived bull markets in terms of their price earnings multiples. It shows that we have only reached half the length of the great 1987-2000 bull market. The implication is that this bull could live another five or more years.

This bull is not dead, it is just resting.

So far, the S&P 500 has declined by a feeble 2.8% off the $202 top. If we break the 50-day moving average here, we could make it down to the 200-day moving average at $1,880, a more substantial 7% pullback. Take that as a gift, and load the boat for the year-end rally.

I?ll send out the Trade Alert to buy (BAC) when I think the timing is ripe.

(XLF) Weekly

(XLF) Daily

Time to Visit the ATM Again

Time to Visit the ATM Again