There is only us, there is no them, said director Ken Burns when speaking about the American people.

There is only us, there is no them, said director Ken Burns when speaking about the American people.

Occasionally, I get a call from Concierge members asking what to do when their short positions in options were assigned or called away. The answer was very simple: fall down on your knees and thank your lucky stars. You have just made the maximum possible profit for your position instantly.

We have the good fortune to have Seven spreads left that are deep in-the-money going into the June option expiration in 7 trading days. They are the:

Risk On

(MSTR) 6/$330-$340 call spread 10.00%

(TSLA) 6/$190-$200 call spread 10.00%

Risk Off

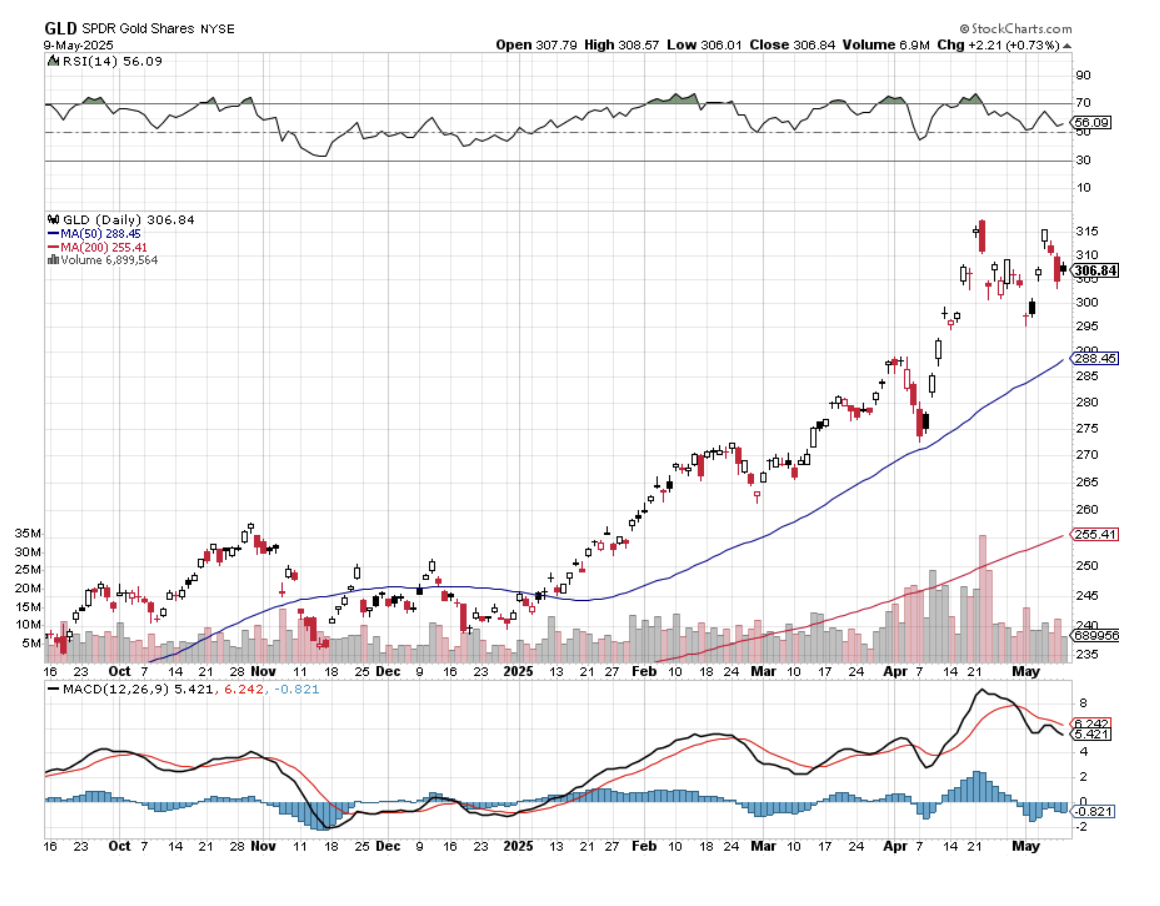

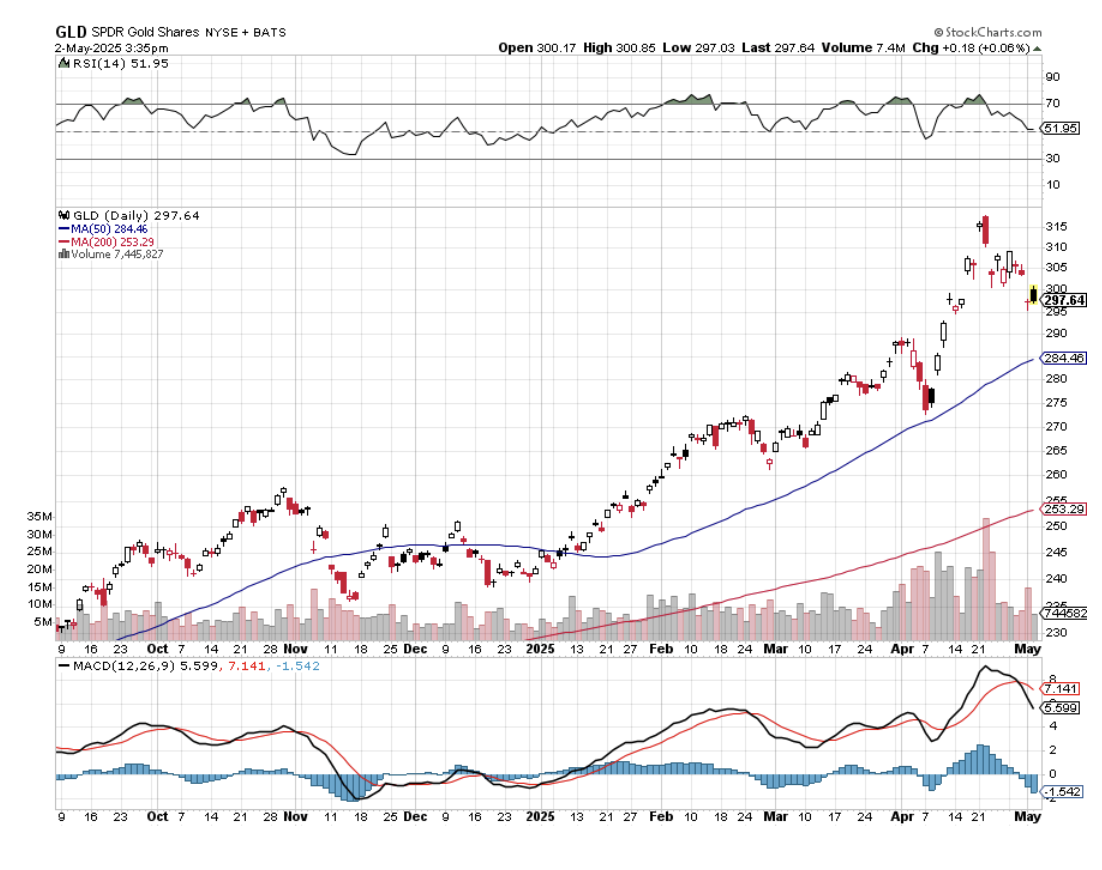

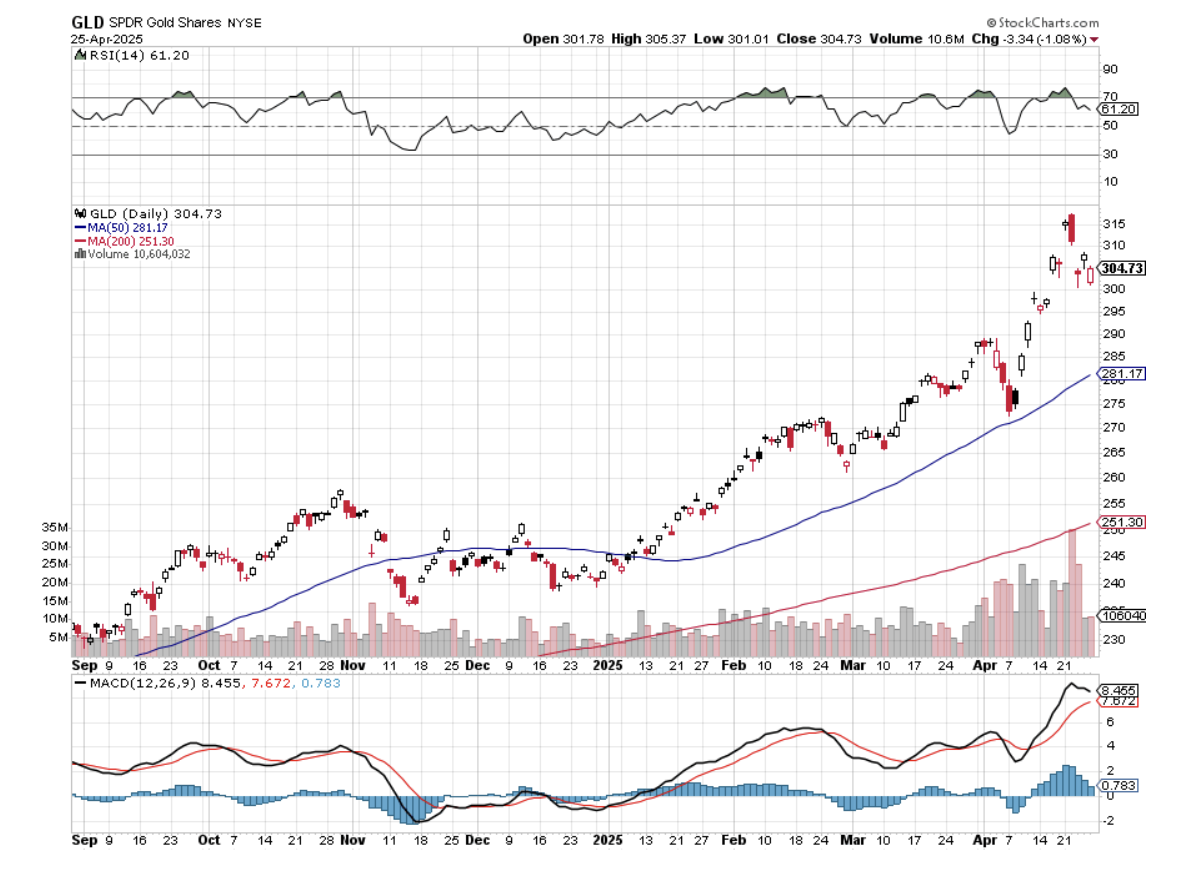

(GLD) 6/$275-$285 call spread -10.00%

(AAPL) 6/$220-$230 put spread -10.00%

(QQQ) 6/$540-$550 put spread -10.00%

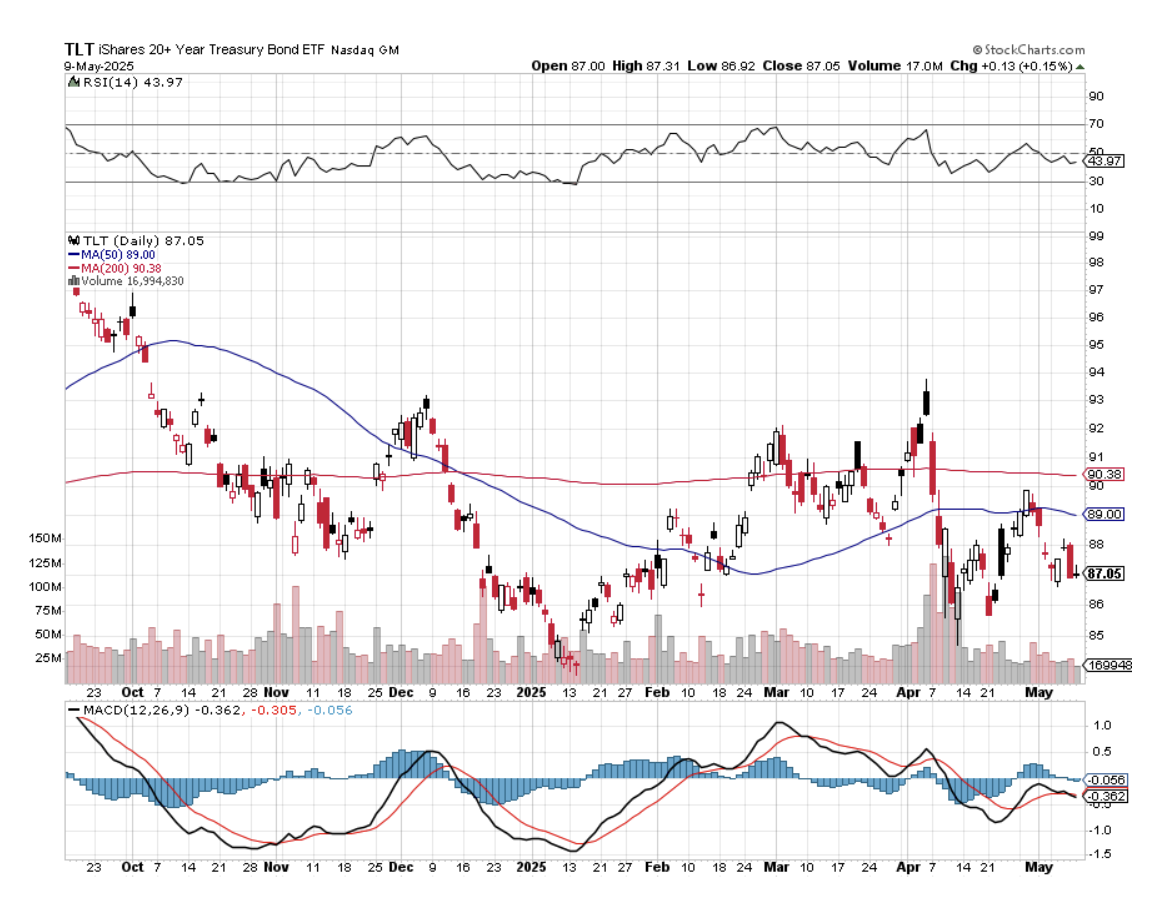

(TLT) 6/$88-$91 put spread -10.00%

(WPM) 6/$75-$80 call spread -10.00%

In the run-up to every options expiration, which is the third Friday of every month, there is a possibility that any short options positions you have may get assigned or called away.

Most of you have short option positions, although you may not realize it. For when you buy an in-the-money vertical option debit spread, it contains two elements: a long option and a short option.

The short options can get “assigned,” or “called away” at any time, as it is owned by a third party, the one you initially sold the put option to when you initiated the position.

You have to be careful here because the inexperienced can blow their newfound windfall if they take the wrong action, so here’s how to handle it correctly.

Let’s say you get an email from your broker telling you that your call options have been assigned away. I’ll use the example of the in-the-money SPDR Gold Shares SPDR (GLD) May $275-$285 vertical BULL CALL debit spread, which you bought at $9.00 or best on May 6.

For what the broker had done, in effect is allowed you to get out of your call spread position at the maximum profit point 7 trading days before the May 17 expiration date. In other words, what you bought for $9.00 on May 6 is now worth $10.00, a gain of 11.11%!

All you have to do is call your broker and instruct them to exercise your long position in your (GLD) June 275 calls to close out your short position in the (GLD) June $285 calls.

This is a perfectly hedged position, with both options having the same expiration date, the same number of contracts in the same stock, so there is no risk. The name, number of shares, and number of contracts are all identical, so you have no net exposure at all.

Calls are the right to buy shares at a fixed price before a fixed date, and one option contract is exercisable into 100 shares.

To say it another way, you bought the (GLD) at $275 and sold it at $285, paid $9.00 for the right to do so for 33 trading days, so your profit is $1.00, or ($1.00 X 100 shares X 12 contracts) = $1,200. Not bad for a 33-day defined, limited risk play.

Sounds like a good trade to me.

Callaways most often happen in the run-up to a dividend payout. If you can collect a full monthly or quarterly dividend the day before the stock registration dates by calling away someone’s short option position, why not? In fact, a whole industry of these kinds of strategies has arisen in recent years in response to the enormous growth of the options market.

(GLD) and most tech stocks don’t pay dividends, so callaways are rare.

Weird stuff like this happens in the run-up to options expirations like we have coming.

A call owner may need to buy a long (GLD) position after the close, and exercising his long May 205 call is the only way to execute it.

Adequate shares may not be available in the market, or maybe a limit order didn’t get done by the market close.

There are thousands of algorithms out there that may arrive at some twisted logic that the calls need to be exercised.

Many require a rebalancing of hedges at the close every day, which can be achieved through option exercises.

And yes, options even get exercised by accident. There are still a few humans left in this market to make mistakes.

And here’s another possible outcome in this process.

Your broker will call you to notify you of an option called away, and then give you the wrong advice on what to do about it. They’ll tell you to take delivery of your long stock and then post additional margin to cover the risk.

Or they will tell you to sell your remaining long option position at whatever price you can get, wiping out most, if not all, of your great profit. This generates the maximum commission for your broker.

Either that, or you can just sell your shares on the following Monday and take on a ton of risk over the weekend. This generates oodles of commission for the brokers but impoverishes you.

There may not even be an evil motive behind the bad advice. Brokers are not investing a lot in training staff these days. It doesn’t pay. In fact, I think I’m the last one they really did train 50 years ago.

Avarice could have been an explanation here, but I think stupidity and poor training, and low wages are much more likely.

Brokers have so many legal ways to steal money that they don’t need to resort to the illegal kind.

This exercise process is now fully automated at most brokers, but it never hurts to follow up with a phone call if you get an exercise notice. Mistakes do happen.

Some may also send you a link to a video on what to do about all this.

If any of you are the slightest bit worried or confused by all of this, come out of your position RIGHT NOW at a small profit! You should never be worried or confused about any position tying up YOUR money.

Professionals do these things all day long, and exercises become second nature, just another cost of doing business.

If you do this long enough, eventually you get hit. I bet you don’t.

Calling All Options!

When I was in Ukraine, the air raid sirens used to go off every night exactly at 2:00 AM.

The Russian goal was to deprive the civilian population of sleep and to make their lives miserable. It was also when the country was least able to defend itself.

You knew the missiles were on the way, it was just a question of whether your number was up. You could only hope to make it to the basement before they hit. It was not safe to go back to sleep until you heard the explosions nearby.

It is not a pleasant feeling.

Here we are in the United States in 2025, and there are missiles on the way, but they are economic ones. Ford Motors (F) has already started raising prices so they can spread them out over a longer period of time. Food and produce prices from Mexico will deliver the first price shocks, as they can go bad in a day. The first hint of this might be visible with the release of the Consumer Price Index at 8:30 AM EST on Tuesday, May 13. That’s when we learn if the inflationary surge is hitting now, or if we have to wait until June. But we know for sure it’s coming.

In fact, there is an onslaught of horrific economic data headed our way. Economic growth is slowing dramatically, prices are rising, international trade is grinding to a halt, and consumer confidence is already at all-time lows. We just don’t know yet if it is going to hit us or blow up the neighbors down the street.

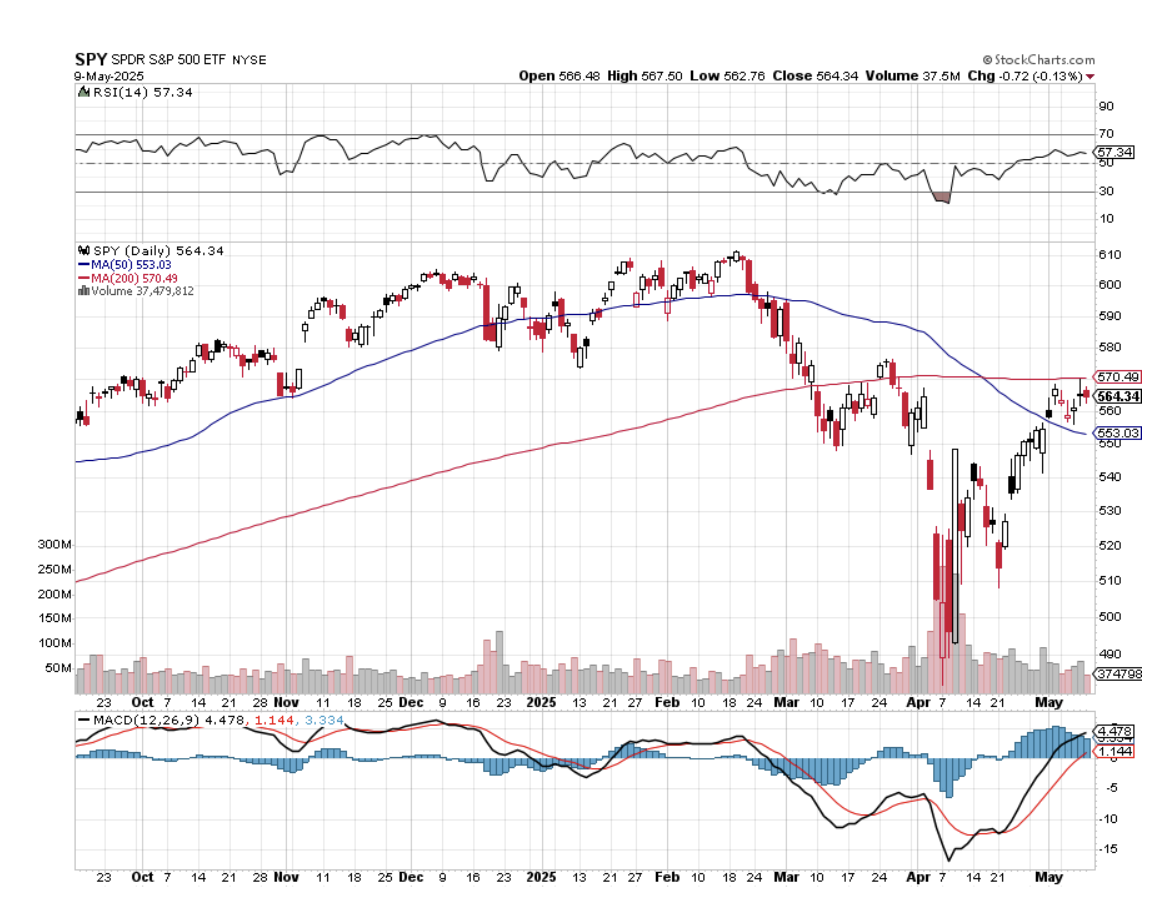

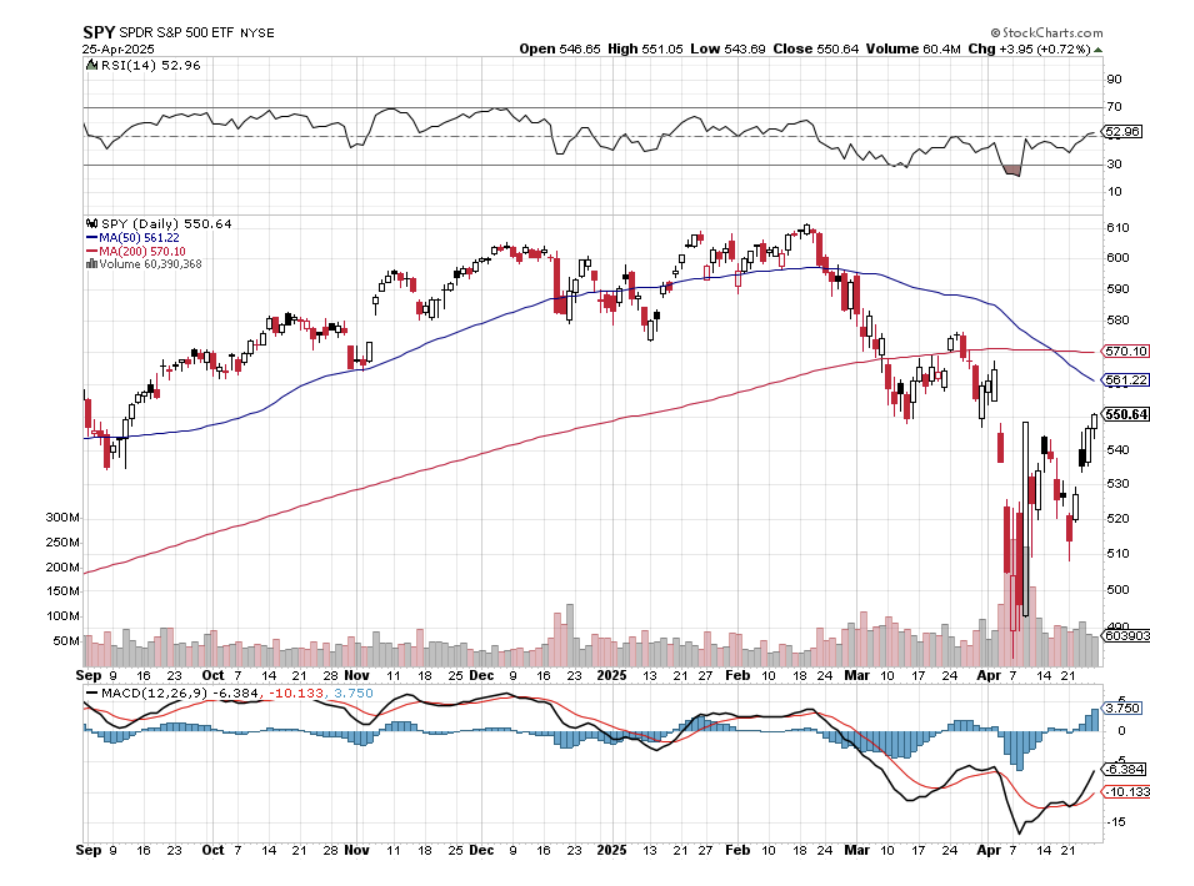

The truly alarming thing about these developments is that the data from hell is going to hit just as the stock market is completing one of its most rapid rises in history, up 19.75% in a month. Stocks are now even more expensive than they were in February, with a price earnings multiple of 22X and earnings falling.

Is anyone ready for a February market crash repeat? You may be about to get it.

I have been through many bear markets since I started trading in 1965, a move down in the indexes of 20% or more. They can last 31 months (2002) and decline as much as 56% (2009). In 1987, we had a bear market in a day!

This one is number nine for me. And while no two bear markets are alike, they all share common characteristics. I have seen them caused by oil shocks, hyperinflation, financial engineering, the Dotcom Crash, the Great Financial Crisis, and the Pandemic. This is the first one caused by a trade war.

Spoiler alert! The monster is about to jump out of a closet at you at the end of the movie.

If you’re praying that the new trade deal with the UK is going to rescue your retirement funds, don’t hold your breath. It’s not a treaty; it is simply an agreement to agree sometime in the distant future. It’s not even a letter of intent. It’s nothing but a bunch of hot air.

In 2024, the U.S. actually ran a trade surplus, not a deficit, with the UK. The surplus was $11.9 billion. The U.S. exported $79.9 billion worth of goods to the U.K. and imported $68.1 billion, resulting in a surplus.

Some $10.5 billion of US aircraft were sold to the UK in 2024, followed by $7 billion in machinery and nuclear reactors and $5.6 billion in pharmaceuticals. The deals announced last week were nothing new, just a reaffirmation of existing trade that has been going on for years.

In the meantime, the punitive 10% tariff against UK imports stands. That is nowhere near enough to move the needle for the $27.7 trillion US GDP. And this was the easy one. Why the US needs to negotiate a trade agreement with a country where it is already running a surplus is beyond me.

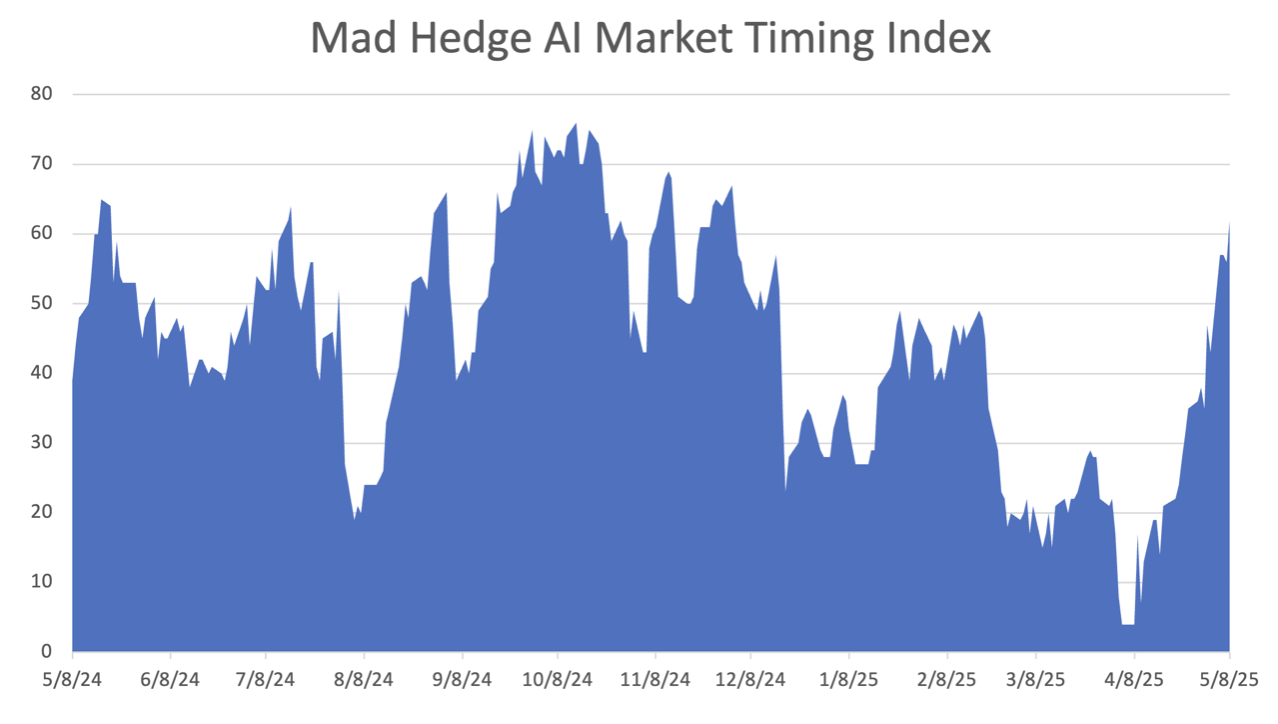

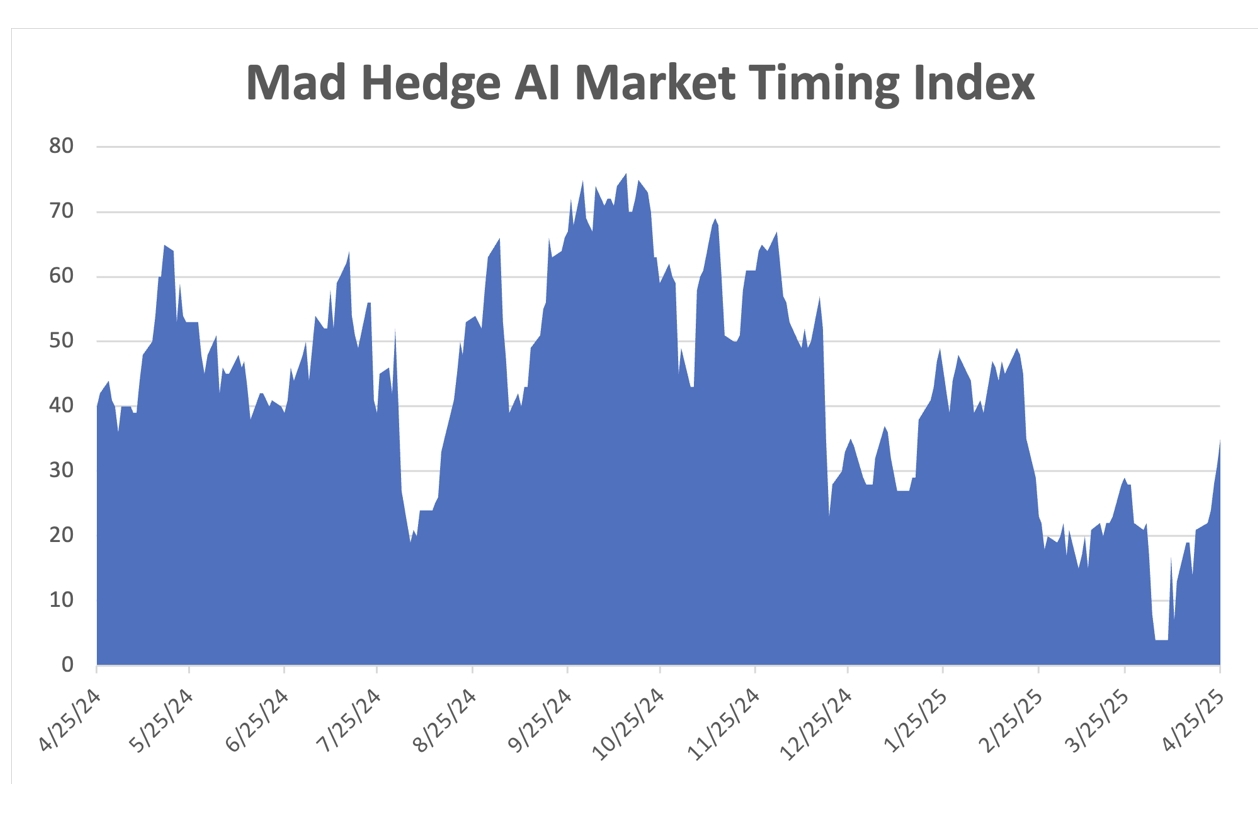

All of this has prompted me to run the first 100% short model portfolio in the 17-year history of the Mad Hedge Fund Trader. If the market moves sideways or up small, we will make our maximum profit by the June 20 option expiration in 28 trading days (Memorial Day is a Holiday). If the market crashes, which it can do at any time, we make the maximum profit immediately. That should take us to a 2025 year-to-date profit of over 43%.

Heads I win, tails you lose, I like it.

Current Capital at Risk

Risk On

NO POSITIONS 0.00%

Risk Off

(GLD) 5/$275-$285 call spread -10.00%

(GLD) 6/$275-$285 call spread -10.00%

(SPY) 6/$610-$620 call spread -10.00%

(MSTR) 6/$500-$510 put spread -10.00%

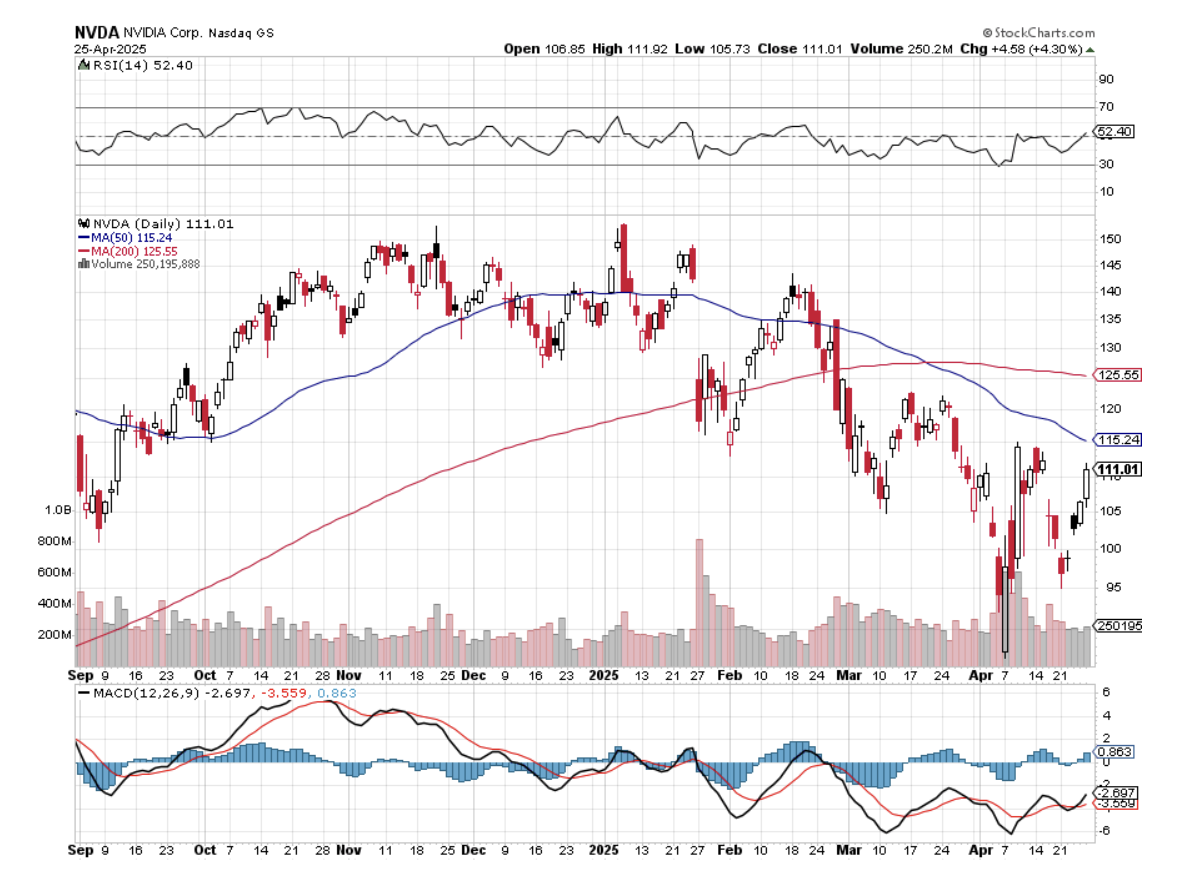

(NVDA) 6/$140-$145 put spread -10.00%

(AAPL) 6/$220-$230 put spread -10.00%

(TSLA) 6/$370-$380 put spread -10.00%

(QQQ) 6/$540-$550 put spread -10.00%

(TLT) 6/$80-$83 call spread -10.00%

(SH) 6/$39-$41 call spread -10.00%

Total Net Position -100.00%

Total Gross Position 100.00%

I love trade wars.

They shine brilliant spotlights on obscure, usually deeply hidden parts of the global economy, revealing almost impossible-to-find data points. And every single new data point enhances your understanding of the big picture.

My first real trade war was the 1973 Oil Shock. Saudi Arabia had cut off America’s oil supply because of our support for Israel in the Yom Kippur War. Huge lines formed at gas stations, and gasoline prices shot up from 25 cents a gallon to $3.00.

Ever the entrepreneur, I started a side business buying beat-up Volkswagen Beetles, the highest mileage car then available in the United States, driving them to Mexico, and getting them repainted and reupholstered in a day for $50. Then I resold them in LA for double the price.

I remember on my last run, I was in a hurry to catch a physics class, so I left a little early. The US customs office learned about the car and asked me if I had any work done while in Mexico. I answered “No.” As he walked away, I saw that his pants were covered with fresh green paint, which had not yet dried.

I drove away as fast as my green Beetle could go.

In the old days, hedge funds reaped huge trading advantages chasing down obscure data points. When satellite data became available to the public in the 1990s, my fund leased satellite time to track the progress of the US wheat crop.

Several successful trades in the commodities markets followed, until others caught on. You already know that I closely track container ship traffic not only in Los Angeles, but ports around the world. This is easy now through many cheap apps available through Apple’s App Store..

In the 2025 stock market, we have all had to become our own mini hedge fund managers. For a start, more money has been made on the short side than the long side, at least the few who participated in instruments like my many vertical bear put debit spreads in (NVDA), (SPY), (TSLA), (MSTR), and the (TLT). There were also nicely profitable plays in the (SH), the (SDS), and the many volatility plays out there, such as the (SVXY).

It's all been enough to help me achieve a welcome 32% profit this year. Those who took my advice to sit out 2025 and bought 90-day US Treasury bills yielding 4.2% are also profitable this year. Any positive return this year is a great accomplishment.

A whole new cottage industry that has gone viral on the internet, offering up more obscure data points about the economy than we could ever consume. We all know that forward-looking soft sentiment data is the worst ever recorded. Credit card balances held by low-income consumers are at all-time highs. But McDonald’s (MCD) and Taco Bell sales have been falling, while those at Domino's Pizza are rising.

What the heck is that supposed to mean?

Although this may sound arcane and deep in the weeds, the 2 year – 10 year spread recently turned positive and is now at 0.47%. That means the yield on two-year Treasury notes is higher than the yield on ten-year Treasury bonds. This has NEVER happened without a following recession. If you were looking for hard data, this is hard data.

Gold is the only asset class absent from volatility this year. That alone says a lot.

There are more than the usual number of binoculars focusing on the Port of Los Angeles these days (click here for the link). Traffic is now down a stunning 25% on the week. That means a supply chain disaster is imminent.

You learn in the Marine Corps that a 50-cent part can ground a $60 million aircraft. How much extra will you pay to get that 50-cent part to get the plane flying? $1.00, $10? $100? Certainly $1 million for a military aircraft in time of war.

This is the basis for some of the exponential inflation forecasts and supply chain disruptions on the scale last seen during the pandemic. Once started, inflation takes off like a rocket with merchants trying to outraise each other and it can take years to get under control, as we saw with the last pandemic.

By the way, I still wake up at 2:00 AM every morning expecting incoming missiles, even though I have been out of Ukraine for 18 months. It turns out that post-traumatic stress gets worse when you get older. Fortunately, my bedroom is now in the basement.

The Lucky One (it was a dud)

The Not So Lucky Ones

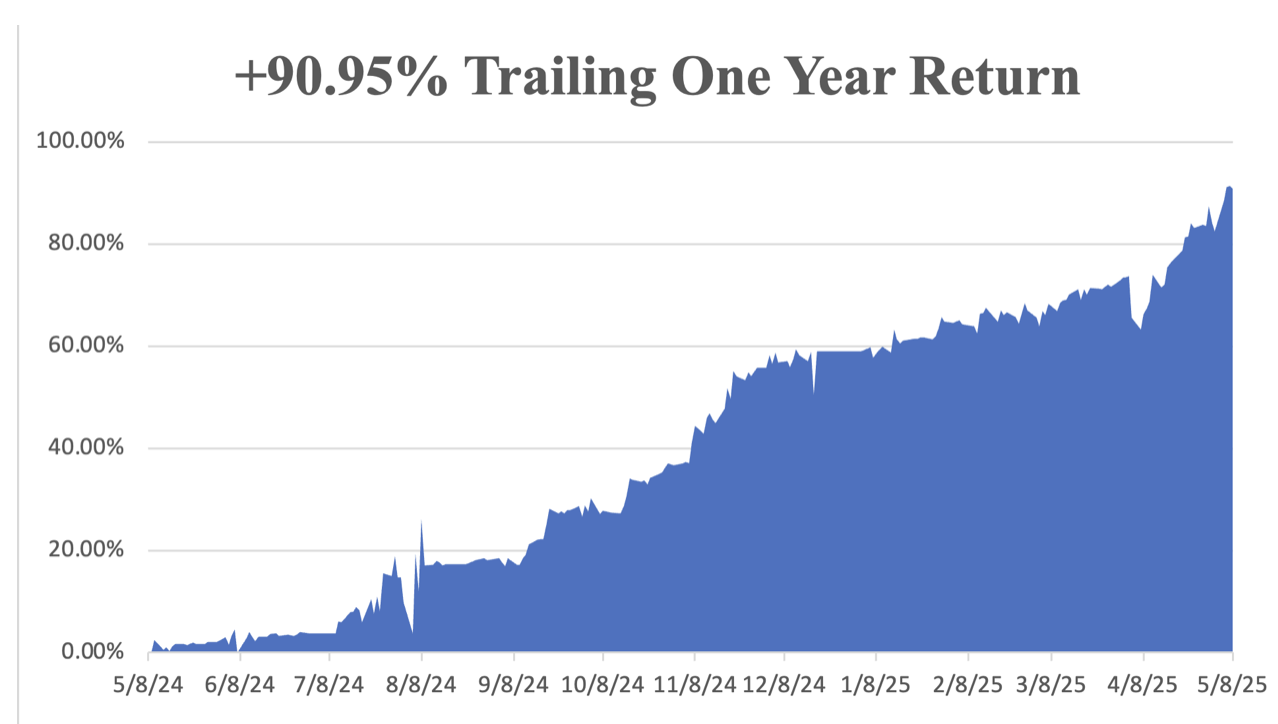

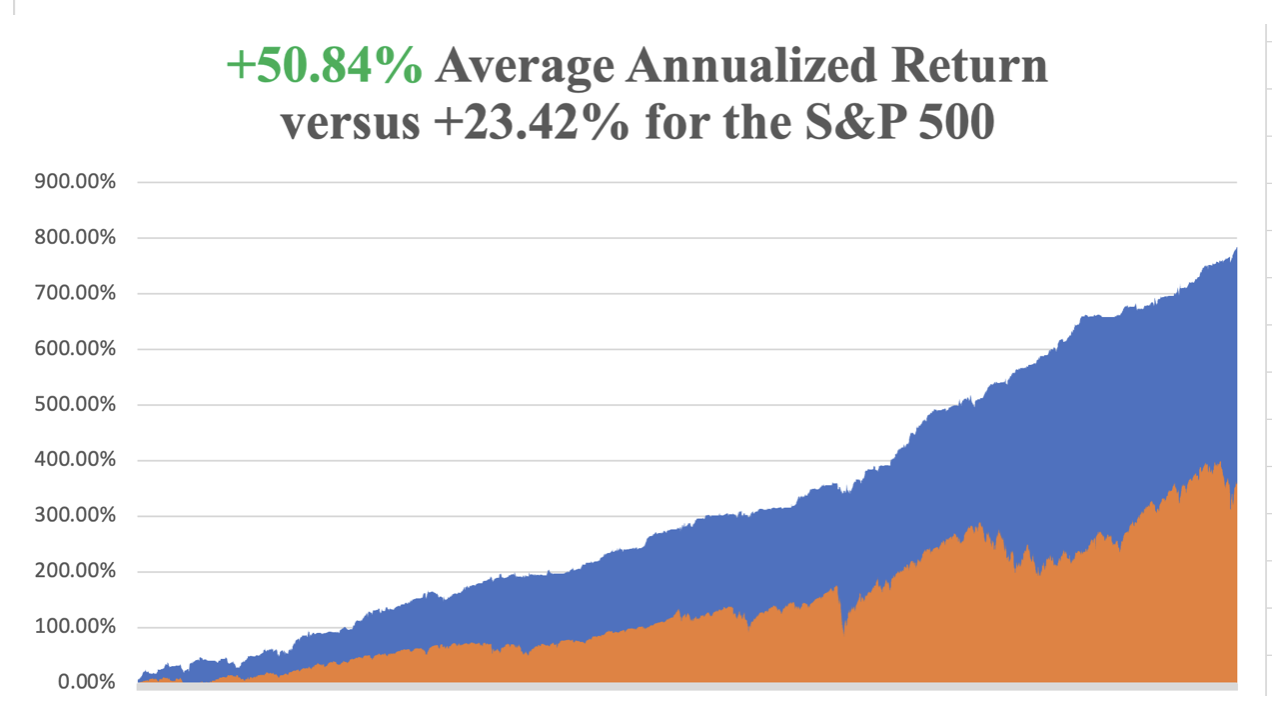

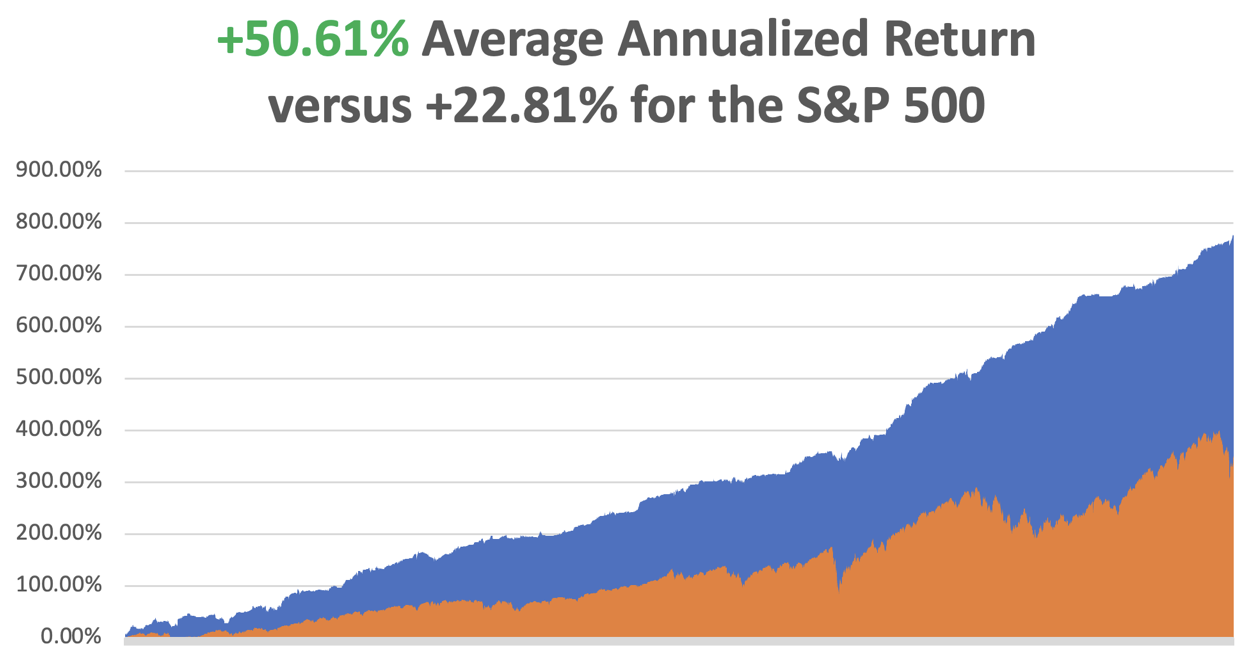

My May performance has reached +3.08%. That takes us to a year-to-date profit of +31.48% so far in 2025. My trailing one-year return stands at a record +90.95%. That takes my average annualized return to +50.84% and my performance since inception to +783.37%, a new all-time high.

It has been another wild week in the market. I took profits in longs in (MSTR) and (NVDA). I stopped out of a short in (SPY) for a small loss. I added a new long in (GLD) and (TLT), new shorts in (QQQ), (AAPL), and (TSLA). After the tremendous run we have just seen, I am moving towards a 100% short portfolio.

Some 63 of my 70 round trips in 2023, or 90%, were profitable. Some 74 of 94 trades were profitable in 2024, and several of those losses were really break-even. That is a success rate of +78.72%.

Try beating that anywhere.

The Stock Market is Headed for New Lows, even if the China tariffs drop from 145% to only 50%, says hedge fund guru and old friend Paul Tudor Jones. Trump’s rollout of the highest levies on imports in a century shocked the world last month, triggering extreme volatility on Wall Street. You have Trump, who’s locked in on tariffs. You have the Fed, which is locked in on not cutting rates. That’s not good for the stock market. We are the losers.

Fed Leaves Interest Rates Unchanged, at 4.25%-4.50%, supported by a consistently rising inflation rate. Stocks tanked and bonds rallied. In case you were wondering, the Fed ALWAYS prioritizes fighting inflation over unemployment because its mandate is to protect the value of the US dollar. It’s written into the 1913 law creating the Federal Reserve System. Don’t expect ANY rate cuts until year-end.

Apple Tanks on Falling Search Revenues. I bet you don’t get many short recommendations for Apple, but here’s a nice one. The implications for Apple were disastrous when a senior officer testified that artificial intelligence was demolishing their traditional search business. Of course, Alphabet (GOOGL) shares were trashed, down 7%. But Apple took a 5% hit as well because it earns an eye-popping $50 billion a year from its IOS operating system, referring all searches to Google. Apple shares have been trading rather feebly this month. While the S&P 500 rocketed 15%, (AAPL) managed to eak out an unimpressive 20% gain, while shares like Palantir (PLTR) doubled.

Bitcoin Recovers $100,000, for the first time since early February, bolstered by a dial down of the trade war in a sign that perhaps Trump is backing off his trade war. Overbought for now, sell Bitcoin rallies.

Nearly All US Exports are in Free Fall, reaching most ports across the U.S. and nearly all export market products as the trade impact of Trump’s tariffs worsens. Agriculture exports to China have been the hardest hit.

Oil Production has Peaked, thanks to the collapse in prices triggered by recession fears. Saudi Arabia is playing a market share game, and increasing production is another factor. Avoid all energy plays like the plague. We’re headed for $30 a barrel.

Warren Buffett Retires, handing over day-to-day management of Berkshire Hathaway (BRK/B) to Greg Abel. It’s a personal blow as Warren was one of the first subscribers to Mad Hedge Fund Trader. No one could ever match his investment performance, not even Warren himself, as stocks are so much more expensive now. Even if (BRK/B) shares dropped 99% from today, it would still be the top-performing S&P 500 stock since 1965. Listening to his annual shareholder summit, he’s still all there at age 94. I want to be Warren Buffett when I grow up.

Is Tesla the Next Boeing? By cutting production costs by 17% last year, has Musk also made the cars unsafe? That’s what happened to Boeing (BA), which prioritized raising dividends and share buybacks over quality and safety to the point where its aircraft started falling out of the sky. This year, (TSLA) shares have been matching (BA) downside one for one.

Jeff Bezos to Sell $4.7 Billion of Amazon Stock by May 2026. Time to free up some spending money. Jeff sold $13.4 billion worth of shares in 2024. Some of the money will go to finance his Blue Origin rocket hobby. Bezos still owns 9.56% of the $2 trillion company.

My Ten-Year View – A Reassessment

We have to substantially downsize our expectations of equity returns in view of the election outcome. My new American Golden Age, or the next Roaring Twenties, is now looking at multiple gale-force headwinds. The economy will completely stop decarbonizing. Technology innovation will slow. Trade wars will exact a high price. Inflation will return. The Dow Average will rise by 600% to 240,000 or more in the coming decade. The new America will be far more efficient and profitable than the old. My Dow 240,000 target has been pushed back to 2035.

On Monday, May 12, at 8:30 AM EST, the WASDE Report is announced, the World Agriculture Supply and Demand Estimate.

On Tuesday, May 13, at 7:30 AM, the Consumer Price Index, a key inflation read, is released.

On Wednesday, May 14, at 9:30 AM, EIA Oil Stocks are disclosed. No move is expected in the face of a rising inflation rate. A press conference follows at 1:30.

On Thursday, May 15, at 8:30 AM, the Weekly Jobless Claims are disclosed. We also get the Producer Price Index and Retail Sales.

On Friday, May 16, at 7:30 AM, we get Housing Starts and Building Permits. At 1:00 PM, the Baker Hughes Rig Count is published.

As for me, one of the many benefits of being married to a British Airways senior stewardess is that you get to visit some pretty obscure parts of the world. In the 1970s, that meant going first class for free with an open bar, and sometimes in the cockpit jump seat.

To extend out 1977 honeymoon, Kyoko agreed to an extra round trip for BA from Hong Kong to Colombo in Sri Lanka. That left me on my own for a week in the former British crown colony of Ceylon.

I rented an antiquated left-hand drive stick shift Vauxhall and drove around the island nation counterclockwise. I only drove during the day in army convoys to avoid terrorist attacks from the Tamil Tigers. The scenery included endless verdant tea fields, pristine beaches, and wild elephants and monkeys.

My eventual destination was the 1,500-year-old Sigiriya Rock Fort in the middle of the island, which stood 600 feet above the surrounding jungle. I was nearly at the top when I thought I found a shortcut. I jumped over a wall and suddenly found myself up to my armpits in fresh bat shit.

That cut my visit short, and I headed for a nearby river to wash off. But the smell stayed with me for weeks.

Before Kyoko took off for Hong Kong in her Vickers Viscount, she asked me if she should bring anything back. I heard that McDonald’s has just opened a stand there, so I asked her to bring back two Big Macs.

She dutifully showed up in the hotel restaurant the following week with the telltale paper back in hand. I gave them to the waiter and asked him to heat them up. He returned shortly with the burgers on plates surrounded by some elaborate garnish. It was a real work of art.

Suddenly, every hand in the restaurant shot up. They all wanted to order the same this, even though the nearest stand was 2,494 miles away.

We continued our round-the-world honeymoon to a beach vacation in the Seychelles, where we just missed a coup d’état, a safari in Kenya, apartheid South Africa, London, San Francisco, and finally back to Tokyo. It was the honeymoon of a lifetime.

Kyoko passed away in 2020 from breast cancer at the age of 50, well before her time.

Sigiriya Rock Fort

Kyoko

Good Luck and Good Trading,

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader|

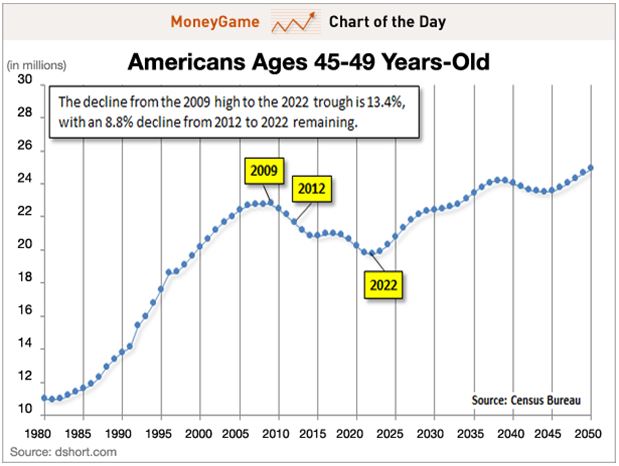

If demographics are destiny, then America’s future looks bleak. You see, they’re just not making Americans anymore.

At least that is the sobering conclusion of the latest Economist magazine survey of the global demographic picture.

I have long been a fan of demographic investing, which creates opportunities for traders to execute on what I call “intergenerational arbitrage”. When the number of middle-aged big spenders is falling, risk markets plunge.

Front run this data by two decades, and you have a great predictor of stock market tops and bottoms that outperforms most investment industry strategists.

You can distill this even further by calculating the percentage of the population that is in the 45-49 age bracket.

The reasons for this are quite simple. The last five years of child rearing are the most expensive. Think of all that pricey sports equipment, tutoring, braces, SAT coaching, first cars, first car wrecks, and the higher insurance rates that go with it.

Older kids need more running room, which demands larger houses with more amenities. No wonder it seems that dad is writing a check or whipping out a credit card every five seconds. I know, because I have five kids of my own. As long as dad is in spending mode, stock and real estate prices rise handsomely, as do most other asset classes. Dad, you’re basically one generous ATM.

As soon as kids flee the nest, this spending grinds to a juddering halt. Adults entering their fifties cut back spending dramatically and become prolific savers. Empty nesters also start downsizing their housing requirements, unwilling to pay for those empty bedrooms, which in effect, become expensive storage facilities.

This is highly deflationary and causes a substantial slowdown in GDP growth. That is why the stock and real estate markets began their slide in 2007, while it was off to the races for the Treasury bond market.

The data for the US is not looking so hot right now. Americans aged 45-49 peaked in 2009 at 23% of the population. According to US census data, this group then began a 13-year decline to only 19% by 2022.

You can take this strategy and apply it globally with terrific results. Not only do these spending patterns apply globally, but they also backtest with a high degree of accuracy. Simply determine when the 45-49 age bracket is peaking for every country, and you can develop a highly reliable timetable for when and where to invest.

Instead of poring through gigabytes of government census data to cherry-pick investment opportunities, my friends at HSBC Global Research, strategists Daniel Grosvenor and Gary Evans, have already done the work for you. They have developed a table ranking investable countries based on when the 34-54 age group peaks—a far larger set of parameters that captures generational changes.

The numbers explain a lot of what is going on in the world today. I have reproduced it below. From it, I have drawn the following conclusions:

* The US (SPY) peaked in 2001 when our first “lost decade” began.

*Japan (EWJ) peaked in 1990, heralding 32 years of falling asset prices, giving you a nice back test.

*Much of developed Europe, including Switzerland (EWL), the UK (EWU), and Germany (EWG), followed in the late 2,000’s, and the current sovereign debt debacle started shortly thereafter.

*South Korea (EWY), an important G-20 “emerged” market with the world’s lowest birth rate, peaked in 2010.

*China (FXI) topped in 2011, explaining why we have seen three years of dreadful stock market performance despite torrid economic growth. It has been our consumers driving their GDP, not theirs.

*The “PIIGS” countries of Portugal, Ireland (EIRL), Greece (GREK), and Spain (EWP) don’t peak until the end of this decade. That means you could see some ballistic stock market performances if the debt debacle is dealt with in the near future.

*The outlook for other emerging markets, like Indonesia (IDX), Poland (EPOL), Turkey (TUR), Brazil (EWZ), and India (PIN) is quite good, with spending by the middle-aged not peaking for 15-33 years.

*Which country will have the biggest demographic push for the next 38 years? Israel (EIS), which will not see consumer spending max out until 2050. Better start stocking up on things Israelis buy.

Like all models, this one is not perfect, as its predictions can get derailed by a number of extraneous factors. Rapidly lengthening life spans could redefine “middle age”. Personally, I’m hoping 72 is the new 42.

Emigration could starve some countries of young workers (like Japan), while adding them to others (like Australia). Foreign capital flows in a globalized world can accelerate or slow down demographic trends. The new “RISK ON/RISK OFF” cycle can also have a clouding effect.

So why am I so bullish now? Because demographics is just one tool in the cabinet. Dozens of other economic, social, and political factors drive the financial markets.

What is the most important demographic conclusion right now? That the US demographic headwind veered to a tailwind in 2022, setting the stage for the return of the “Roaring Twenties.” With the (SPY) up 27% since October, it appears the markets heartily agree.

While the growth rate of the American population is dramatically shrinking, the rate of migration is accelerating, with huge economic consequences. The 80-year-old trend of population moving from North to South to save on energy bills is picking up speed, and the Midwest is getting hollowed out at an astounding rate as its people flee to the coasts, all three of them.

As a result, California, Texas, Florida, Washington, and Oregon are gaining population, while Missouri, Iowa, Nebraska, Kansas, and Wyoming are losing it (see map below). During my lifetime, the population of California has rocketed from 10 million to 40 million. People come in poor and leave as billionaires, as Elon Musk did.

In the meantime, I’m going to be checking out the shares of the matzo manufacturer down the street.

We certainly are having to work hard for our crust of bread in the stock market this year. April brought us the fastest downturn in stocks in 16 years, immediately followed by the sharpest upturn in 21 years.

It's like running for a treadmill heart test, but a sadistic doctor keeps raising the angle of incline.

Still, I was able to deliver the best trading profits since December 2023, up 14.57%. The harder I work, the luckier I get. Buying when everyone else is throwing up on their shoes is certainly a winning strategy, proven yet again.

The truly disappointing thing about this rally is that it has made stocks expensive once again. In valuation terms, we are now back at February’s peak earnings multiple of 22X for the S&P 500, up from 18X a month ago. This is happening because the growth rate of earnings is falling while share prices are rising.

We are now facing record-high share prices in an economy going into a recession, DOGE cutting chunks of government spending, with rising unemployment and inflation, and a budget deficit for 2025 that is likely to hit $4-$5 trillion.

It doesn’t sound like a great bargain to me. Maybe that’s why only 26% of investors are currently bullish.

We are in fact now at the top of a $4,800-$5,800 range while also bumping up against a solid ceiling at the 200-day moving average. If this bothers anyone, please raise your hand.

Looking at the grim, almost apocalyptic data that is marching our way, I think we are much more likely to next hit an earnings multiple of 16X than 23X. There are a lot of great shorts out there right now, but being up 28.45% so far this year, I am being very cautious when to pull the trigger.

One of the countless fascinating experiences in my life was spending a summer living with a Nazi family in West Berlin in 1968. There was a huge housing shortage in Berlin at the time, and I had to take what I could get. Besides, the apple strudel for dessert was fantastic.

And even though WWII had been over for 23 years, they never shed their extremist political beliefs. Over many dinner discussions I was exposed to the full Nazi philosophy. However, they loved Americans, as it were, they who saved them from the Bolsheviks in 1945.

You know, whenever you get a shot, the nurse always squeezes a little bit of the liquid out of the needle first before sticking it into your arm? This is to prevent an air bubble from getting into your heart, creating an airlock, and stopping it dead. One of the many torments the German Gestapo used to inflict on prisoners was to inject them with air bubbles. Then it was just a matter of minutes before the prisoner died or had a stroke.

I mention all of this because the US economy has just been injected with a big air bubble. If you’re looking for a recession, you can see it with a good set of binoculars off the California coast.

I’m watching the movement of this air bubble on a daily basis.

First, there were the prices for an eastbound 40-foot container shipped from China to the US, down from $8,000 to as low as $1,500 each. About 60 very large container ships carrying 1.2 million containers have gone missing.

Then there is congestion at the Port of Los Angeles, where 200 ships are stranded offshore, unable to unload. Truck drivers are now getting laid off because importers can’t afford to pay the 145% tariffs and are abandoning them, clogging warehouses. Store shelves will start to go bare from mid-May onward, with discount electronics going first.

Any positive growth we see in Q1 will be the result of a rush of post-election over-ordering to front-run the Trump tariffs. That creates a big air bubble in the system for Q2 and onward, maybe for years, even if the trade war ends tomorrow. That’s because shutting down and then restarting a massively complex international trade network takes at least a year.

It certainly was a confusing week for economic data. We saw a succession of very weak employment reports from the ADP Private Employment Report, JOLTS Jobs Openings, and Weekly Jobless Claims, which one might expect from trade war-induced economic collapse. Then, out of the blue, we got a somewhat respectable April Nonfarm Payroll Report at 177,000. Something in these disparate things does not compute.

We haplessly slogging away in the economic forecasting industry are constantly thwarted by constantly conflicting data. You’re probably all sick of hearing the words “on the one hand” and “on the other hand.” But could the unimaginable be happening? One thing I know for sure. You are definitely not going to see strong employment figures for health care (51,000) and Transportation and Warehousing (29,000) in May that we saw in April, once the trade war really starts to bite.

It’s not just the jobs figures that are going haywire. You can count on ALL economic data to be disrupted for at least the next year as the trade war unfolds, retreats, and does whatever it is going to do. It all makes my job so much harder. But then, I always love a challenge.

You may have noticed that I have started making a lot of money from Bitcoin plays like MicroStrategy (MSTR). This is not because I have suddenly become a died in the wool crypto acolyte, a mindless true believer, a guzzler of the Kool-Aid at every opportunity. I firmly believe that Bitcoin has another 95% decline ahead of it sometime in the future and that it is nothing more than a Ponzi scheme.

As I watch the many crypto “experts” wax lyrical about their $1 million upside targets, I can’t help but notice that most aren’t even old enough to be my grandchildren. The president has recently pardoned several crypto robber barons convicted of looting customer accounts of billions of dollars. Another term for “anti-regulation” is “pro-stealing.” The SEC has morphed from securities regulation to crypto promotion.

Nevertheless, I DO know what a chart is, downside support and upside resistance, and above all, euphoria and momentum. All of these started screaming “BUY” at me three weeks ago, and I started picking up crypto play with both, and if not three. I merely did what Mr. Market was begging me to notice.

Yes, sometimes even I have to trade charts for a living. But it is definitely a position I am only dating, not marrying. I’ll only be in crypto as long as there are more buyers than sellers and the suckers keep being born. I have a feeling that, at the end of the day, all crypto has really done is to pay for some very expensive parties in Miami and Dubai.

As far as I’m concerned, I’m hoping for the stroke and not the heart attack.

My April performance closed out at a spectacular +14.57%. That takes us to a year-to-date profit of +28.40% so far in 2025. My trailing one-year return stands at a spectacular +89.79%. That takes my average annualized return to +50.61% and my performance since inception to +780.29%, a new all-time high.

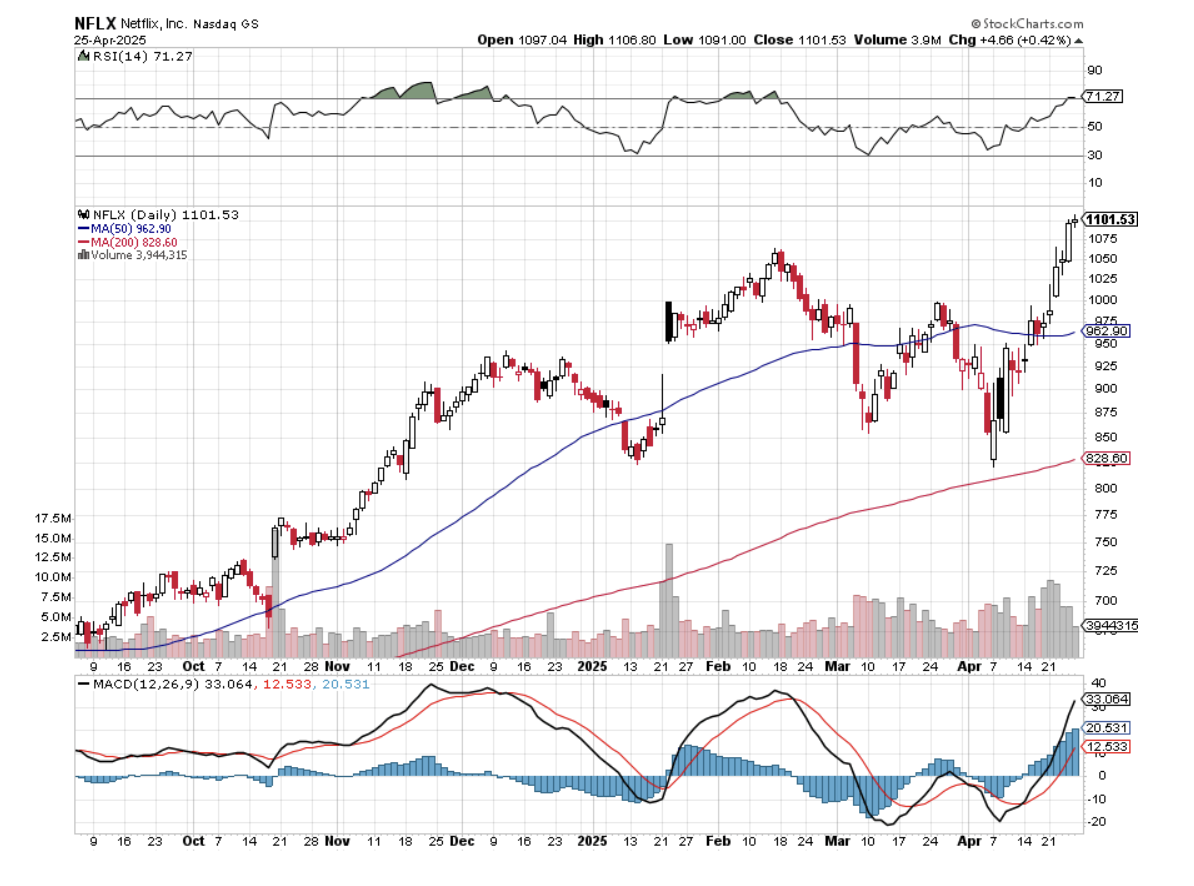

It has been another wild week in the market, with the stock market up every day. I used a brief $25 dip in (TSLA) to take profits in my short play there. That leaves me 40% long, with a double position in (MSTR), and longs in (NVDA) and (NFLX). I have 20% short in (SPY) and a “risk off” position in (GLD), and 40% cash. I’m just waiting for this rally to burn out before topping up my shorts, not a bad idea in the wake of the biggest run-up in 21 years.

Some 63 of my 70 round trips in 2023, or 90%, were profitable. Some 74 of 94 trades

were profitable in 2024, and several of those losses were really break-even. That is a success rate of +78.72%.

Try beating that anywhere.

100 Years of S&P 500 Earnings Multiples

My Ten-Year View – A Reassessment

We have to substantially downsize our expectations of equity returns in view of the election outcome. My new American Golden Age, or the next Roaring Twenties, is now looking at multiple gale-force headwinds. The economy will completely stop decarbonizing. Technology innovation will slow. Trade wars will exact a high price. Inflation will return. The Dow Average will rise by 600% to 240,000 or more in the coming decade. The new America will be far more efficient and profitable than the old. My Dow 240,000 target has been pushed back to 2035.

On Monday, May 5, at 8:30 AM EST, the S&P Global Composite PMI is announced.

On Tuesday, May 6, at 3:30 AM, the Balance of Trade is released.

On Wednesday, May 7, at 1:00 PM, the Federal Reserve announces its interest rate decision. No move is expected in the face of a rising inflation rate. A press conference follows at 1:30.

On Thursday, May 8, at 8:30 AM, the Weekly Jobless Claims are disclosed.

On Friday, May 9, at 12:00 PM, the Baker Hughes Rig Count is published.

I’m Always Cautious When Pulling the Trigger

Microsoft Goes Ballistic, with the second 10% move in a month. Indications are that AI spending is continuing unabated, taking the entire tech space up with it.

ISM Manufacturing Index Says the Recession is Here. Economic activity in the manufacturing sector contracted in April for the second month in a row, following a two-month expansion preceded by 26 straight months of contraction, say the nation's supply executives in the latest Manufacturing ISM Report On Business®. Manufacturing in high-cost America has been in a structural decline for three years now and is accelerating to the downside.

US Q1 GDP Crashes in Q1, down 0.3%, thanks to the massive front-running of imports to beat the Trump tariffs. This quarter will certainly be worse as almost all international trade has ceased, giving us a second negative quarter that officially constitutes a recession. A three-quarter recession gives us an S&P 500 of 4,500, four quarters, 4,000.

JOLTS Job Openings Report was Weak in March at 7.1 Million, said the U.S. Bureau of Labor Statistics. Over the month, hires held at 5.4 million, and total separations changed little at 5.1 million. Within separations, quits (3.3 million) were unchanged, and layoffs and discharges (1.6 million) edged down.

Consumer Confidence Collapses, hitting a 15-Year Low, according to the Conference Board. The Index fell to 86 on the month, down a hefty 7.9 points from its prior reading and below the Dow Jones estimate for 87.7. The board’s Expectations Index, which measures how respondents look at the next six months, tumbled to 54.4, a decline of 12.5 points and the lowest reading since October 2011.

New Homes are Now Cheaper than Existing Homes, for the first time. A 30% rise in existing inventories has made the difference. New home builders can more easily discount with free upgrades and offer loan buy-downs. Some 40% of homes on the market have seen price drops, and time on the market is growing.

Weekly Jobless Claims Rocket by 18,000. First-time filings for unemployment insurance totaled a seasonally adjusted 241,000 for the week ended April 26, up 18,000 from the prior period and higher than the estimate for 225,000. Continuing claims, which run a week behind and provide a broader view of layoff trends, rose to 1.92 million, up 83,000 to the highest level since Nov. 13, 2021.

General Motors to take $5 Billion Hit on Tariffs. GM on Thursday lowered its 2025 earnings guidance to include a possible $4 billion to $5 billion impact as a result of President Donald Trump’s auto tariffs. GM said its new guidance includes adjusted EBIT of between $10 billion and $12.5 billion, down from $13.7 billion to $15.7 billion. GM released first quarter results Tuesday that beat Wall Street’s expectations but delayed its investor call and updated guidance details amid expected changes to the auto tariffs.

S&P Case-Shiller National Home Price Index Slows to 3.9% YOY, in February, a sharp slowdown. Home prices are increasingly untenable to potential home buyers. Waning consumer confidence, heightened insecurity over economic uncertainties, and the future of household budgets are impacting the consumer housing market. New York (+7.7%), Chicago (+7.0%), and Cleveland (+6.6%) show the biggest gains, while Tampa showed a (-1.4%) loss. Expect real estate to remain a major drag on the US economy, with mortgage rates at 7.0%.

Bitcoin ETF’s Suck in $3.5 Billion Last Week, as the “Sell America” trade expands. Exchange-traded funds tracking Bitcoin and Ether attracted more than $3.2 billion last week, with the iShares Bitcoin Trust ETF (IBIT) alone seeing a nearly $1.5 billion inflow — the most this year.

Crude Oil Drops on Global Recession Fears. Brent crude futures were down $1.09, or 1.63%, at $65.78 a barrel. West Texas Intermediate crude fell $1.15, or 1.82%, to $61.87 a barrel. The U.S.-China trade war is dominating investor sentiment in moving oil prices, superseding nuclear talks between the U.S. and Iran, and discord within the OPEC+ coalition. Markets have been rocked by conflicting signals from the U.S. over what progress was being made to de-escalate a trade war that threatens to sap global growth.

As for me, by the 1980s, my mother was getting on in years. Fluent in Russian, she managed the CIA’s academic journal library from Silicon Valley, putting everything on microfilm.

That meant managing a team that translated over 1,000 monthly publications on topics as obscure as Arctic plankton, deep space phenomena, and advanced mathematics. She often called me to ascertain the value of some of her findings.

But her arthritis was getting to her, and all those trips to Washington, DC were wearing her out. So I offered Mom a job. Write the Thomas family history, no matter how long it took. She worked on it for the rest of her life.

Dad’s side of the family was easy. He was traced to a small village called Monreale above the Sicilian port city of Palermo, famed for its Byzantine church. Employing a local priest, she traced birth and death certificates going all the way back to an orphanage in 1820. It is likely he was a direct illegitimate descendant of Lord Nelson of Trafalgar.

Grandpa fled to the United States when his brother joined the Mafia in 1915. The most interesting thing she learned was that his first job in New York was working for Orville Wright at Wright Aero Engines (click here). That explains my family’s century-long fascination with aviation.

Grandpa became a tail gunner on a biplane in WWI. My dad was a tail gunner on a B-17 flying out of Guadalcanal in WWII. As for me, you’ve all heard plenty of my own flying stories, and there are many more to come.

My Mom’s side of the family was an entirely different story.

Here ancestors first arrived to found Boston, Massachusetts in 1630 during the second Pilgrim wave on a ship called the Pied Cow, steered by Captain Ashley (click here for the link).

I am a direct descendant of two of the Pilgrims executed for witchcraft in the Salem Witch Trials of 1692, Sarah Good and Sarah Osborne, where children’s dreams were accepted as evidence (click here). They were later acquitted.

When the Revolutionary War broke out in 1776, the original Captain John Thomas, whom I am named after, served as George Washington’s quartermaster at Valley Forge, responsible for supplying food to the Continental Army during the winter.

By the time Mom completed her research, she had discovered 17 ancestors who fought in the War for Independence, and she became the West Coast head of the Daughters of the American Revolution. It seems the government still owes us money from that event.

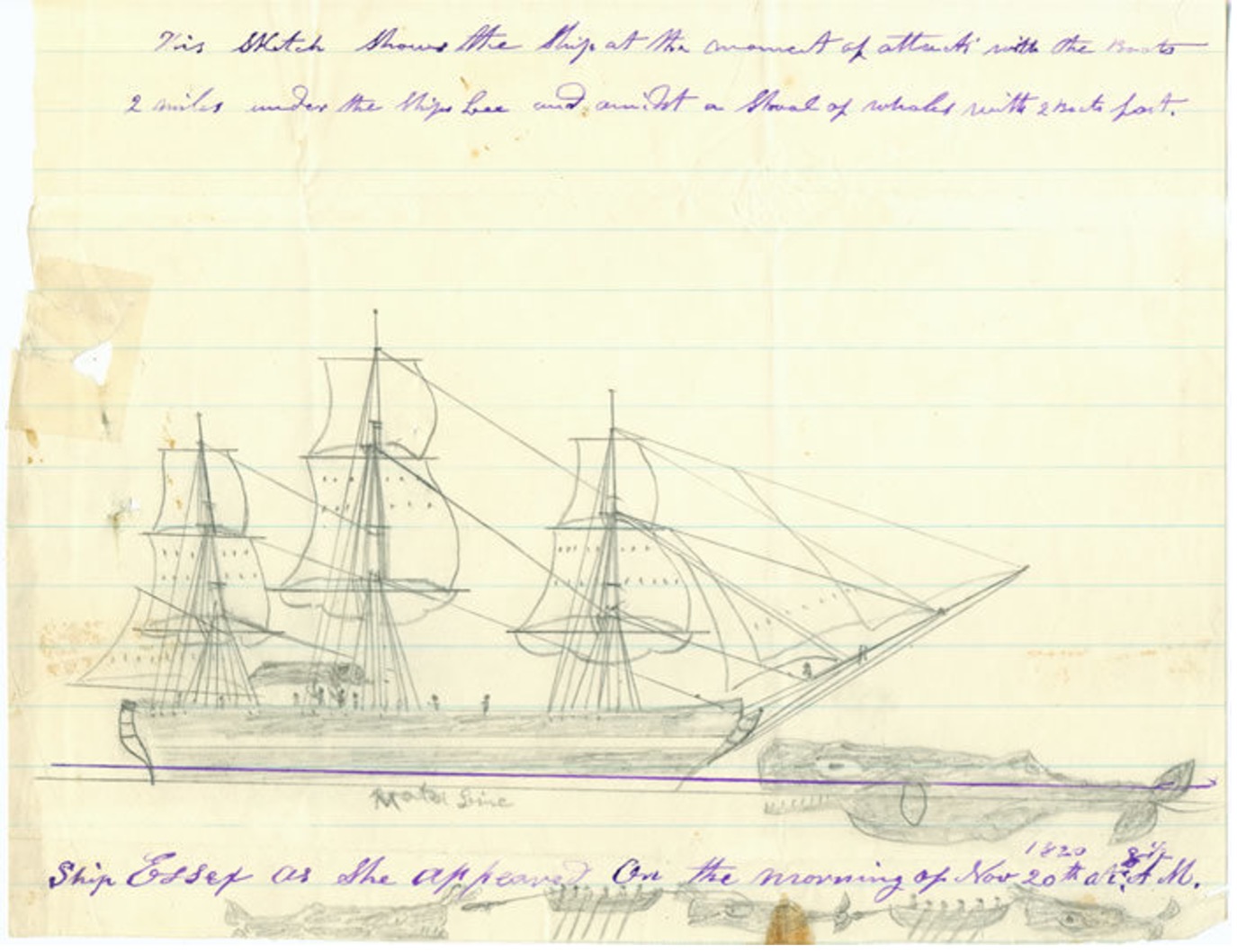

Fast forward to 1820 with the sailing of the whaling ship Essex from Nantucket, Massachusetts, the basis for Herman Melville’s 1851 novel Moby Dick. Our ancestor, a young sailor named Owen Coffin signed on for the two year voyage, and his name “Coffin” appears in Moby Dick seven times.

In the South Pacific, 2,000 miles west of South America, they harpooned a gigantic sperm whale. Enraged, the whale turned around and rammed the ship, sinking it. The men escaped to whale boats. And here is where they made the fatal navigational errors that are taught in many survival courses today.

Captain Pollard could easily have just ridden the westward currents, where they would have ended up in the Marquesas Islands in a few weeks. But these islands were known to be inhabited by cannibals, which the crew greatly feared. They also might have landed in the Pitcairn Islands, where the mutineers from Captain Bligh’s HMS Bounty still lived. So the boats rowed east, exhausting the men.

At day 88, the men were starving and on the edge of death, so they drew lots to see who should live. Owen Coffin drew the black lot and was immediately shot and devoured. The next day, the men were rescued by the HMS Indian within sight of the coast of Chile and returned to Nantucket by the USS Constellation.

Another Thomas ancestor, Lawson Thomas, was on the second whaleboat that was never seen again and presumed lost at sea. For more details about this incredible story, please click here.

When Captain Pollard died in 1870, the neighbors discovered a vast cache of stockpiled food in the attic. He had never recovered from his extended starvation.

Mom eventually traced the family to a French weaver 1,000 years ago. Our name is mentioned in England’s Domesday Book, a listing of all the land ownership in the country published in 1086 (click here for the link). Mom died in 2018 at the age of 88, a very well-educated person.

There are many more stories to tell about my family’s storied past, and I will in future chapters. This week, being Thanksgiving, I thought it appropriate to mention our Pilgrim connection.

I have learned over the years that most Americans have history-making swashbuckling ancestors, but few bother to look.

I did.

Good Luck and Good Trading,

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader

USS Essex

Below, please find subscribers’ Q&A for the April 30 Mad Hedge Fund Trader Global Strategy Webinar, broadcast from Incline Village, NV.

Q: Why is the Australian dollar not moving against the US dollar as much as the other currencies?

A: Australia is too closely tied to the Chinese economy (FXI), which is now weak. When the Chinese economy slows, Australia slows. Australia is basically a call option on the Chinese economy. So they're not getting the ballistic moves that we've seen in, say, the Euro and the British pound, which are up about 20%. Live by the sword, die by the sword. If you rely on China as your largest customer for your export commodities, you have to take the good and the bad.

Q: I see we had a terrible GDP print on the economy this morning, down 0.3%. When are we officially in a recession?

A: Well, the classical definition of a recession is two back-to-back quarters of negative GDP growth. We now have one in the bank. One to go. And this quarter is almost certain to be much worse than the last quarter, because the tariffs basically brought all international trade to a complete halt. On top of that, you have all of the damage to the economy done by the DOGE cuts in government spending. Approximately 80% of the US states, mostly in the Midwest and South, are very highly dependent on Washington spending for a healthy economy, and they are going to really get hit hard. So the question now is not “do we get a recession?”, but “how long and how deep will it be?” Two quarters, three quarters, four quarters? We have no idea. Even if trade deals do get negotiated, those usually take years to complete and even longer to implement. It just leaves a giant question mark over the economy in the meantime.

Q: Is SPDR Gold Trust (GLD) the best way to play gold, or is physical better?

A: I always go for the (GLD) because you get 24-hour settlement and free custody. With physical gold, you have to take delivery, shipping is expensive, and insurance is more expensive. Plus, then you have to put it in a vault. Private vaults have a bad habit of going bankrupt and disappearing with your gold. You keep it in the house, and then if the house burns down, all your gold is gone there. Plus, it can get stolen. There's also a very wide dealing spread between bid and offer on physical gold coins or bars; usually it's at least 10%, often more. So I often prefer the ease of trading with the GLD, which owns futures on physical gold, which is held in London, England. So that is my call on that.

Q: Is ProShares Ultra Silver (AGQ) the leveraged silver play?

A: It absolutely is, but beware: (AGQ) is only good for short, sharp rises because the contango and the storage operating costs of any 2x are very, very high—like 10% a year. So, good if you're doing a day trade, not good for a one-year hold. Then you're just better off buying silver (SLV).

Q: What is more important with the Fed's mandate—unemployment or fear of inflation?

A: That's an easy one. Historically, the number one priority at the Fed has been inflation. That is their job to maintain the full faith and credit of the U.S. Dollar, and inflation erodes the value, or at least the purchasing power of the US dollar, so that has always historically been the priority. Until we see inflation figures fall, I think the chance of them cutting interest rates is zero, and we may not see actual falls until the end of the year, because the next influence on prices is up because of the trade war. The trade war is raising prices everywhere, all at the same time. So that will at least add 1 or 2% to inflation first before it starts to fall. You can imagine how if we get a 6% inflation rate, there's no way in the world the Fed can cut rates, at least for a year, until we get a new Fed governor. So that has always historically been the priority.

Q: Do you think the 10-year yield is going down to 5%?

A: You know, we're really in a no-man's-land here. Recession fears will drive rates down as they did yesterday. I haven't even had a chance to see where the bond market is this morning because. So, rates are rising on a recessionary GDP, which is the worst possible outcome. Rates should be falling on a recessionary GDP print. Of course, Washington’s efforts to undermine the U.S. dollar aren't helping. Threatening to withhold taxes on interest payments to foreign owners is what caused the 10% down move in bonds in one week—the worst move in the bond market in 25 years. So, the mere fact that they're even thinking about doing something like that scares foreign investors, not only from the bond market, but all US investments period. And certainly, we've seen some absolutely massive stock selling from them.

Q: Why won't the market go down to 4,000 in the S&P 500?

A: Absolutely, it could; that is definitely within range. That would put us down 30% from the February highs, it just depends on how long the recession lasts. If you just get a two-quarter shallow recession, we could bounce off 4800 for the (SPX) until we come out. If the recession continues for several quarters, and it's looking like it will, then 4,000 is definitely within range. So, it's all about the economy. And remember, stocks are expensive. They don't get cheap until we get a PE multiple of 16, and even then, that alone, just a multiple shrinkage would take us down to 4,000.

Q: Would it be a good idea to buy the S&P 500 (SPY) as it falls?

A: I'm getting emails from readers asking if it's time to buy Nvidia (NVDA) or time to buy Tesla (TSLA). What I've noticed is that investors are constantly fighting the last battle. They're always looking for what worked last time, and that does not succeed as an investment strategy. As long as I'm selling rallies, I'm not even thinking about what to buy on the bottom. The world could look completely different on the other side. The MAG-7 may not be the leadership in the future, especially with the Trump administration trying to dismantle four out of seven companies through antitrust, and the rest are tied up in the trade wars. So, tech is still expensive relative to the main market, and we're going to need to look for new leaders. My picks are going to be mining shares, gold, and banking. Those are the ones I'm looking to buy on dips, but right now, cash is king unless you want to play on the short side. Being paid 4.3% to stay away sounds pretty good to me, especially when your neighbors have 30% losses. You know, I've heard of people having all of their retirement funds in just two stocks: Nvidia and Tesla, and they're getting wiped out. So, you don't want to become one of them.

Q: After a tremendous run in Gold, is Silver a better risk-reward right now?

A: I would say yes, it is. Silver has been lagging gold all year because central banks, the most consistent buyers for the past decade, buy gold—they don't buy silver. But what we may be in store for here now is a prolonged sideways move in gold while the technicals catch up with it. And in the meantime, the money goes elsewhere into silver and Bitcoin. That's my bet.

Q: Is Apple (APPL) a no-touch now?

A: I’d say yes. The trade war is changing by the day, and Apple probably does more international trade than any other company in the world. Also, Apple gets hit with recessions like everybody else. There was a big front run to buy Apple products ahead of tariffs—my company bought all its computer and telephone needs for the whole year ahead of the tariffs. We're not buying anything else this year. And I would imagine millions more are planning to do the same, so you could get some really big hits in Apple earnings going forward.

Q: Should I sell my August Proshares Short S&P 500 (SH) LEAPS?

A: No, I would keep them. If the (SPX) IS trading between 5,000 to 5,800, your $4-$42 SH LEAPS should expire at max profit in August, so I'm hanging on to mine. Next time we take a run at 5,000, you should be able to get out of your SH LEAPS at 80% to 90% of the max profit.

Q: What car company stock will do the best in a high-tariff global economy?

A: Tesla (TSLA), because 100% of their cars are made in the US with 90% US parts (the screens come from Panasonic in Japan). Their foreign components are only about 10%, so they can eat that. For General Motors (GM), it's more like 30% of all components are made abroad, and they can't eat that; their profit margins are too low. (GM) expects to lose $5 billion because of tariffs. By the way, the profit margins on Tesla have fallen dramatically from 30% down to 10% in two years, so it's not like they're in great shape either. Also, Tesla hasn’t had a CEO for ten months, which is why the board is looking for a replacement.

Q: Is it a good time to buy the dip in oil (USO)?

A: Absolutely not. Oil is the most sensitive sector to recessions, because if you can't sell oil, you have to store it, very expensively. It costs 30 to 40% a year to store oil—that's the contango; and once all the storage is full, then you have to cap wells, which then damages the long-term production of the wells. I think at some point you will expect an announcement from Washington to refill the Strategic Petroleum Reserve, which was basically sold by Biden at $100 a barrel. You can now get it back for $60. That may not be a bad idea if you're going to have a strategic petroleum reserve. What's better is just to quit using oil completely, which we were on trend to do.

Q: Will interest rates drop by year-end?

A: They may drop by year-end once unemployment runs up to 5% or 6% —which is likely to happen in a recession—and inflation starts to decline, even if it declines from a higher level. Even if they don't cut by year end, they'll still cut in a year when the president can appoint a new Fed governor. What the Trump really needs to do is appoint Janet Yellen as the Fed governor. She kept interest rates near zero for practically all of her term. We need another Yellen monetary policy.

Q: The job market here seems to be slowing quite fast. Is there any way this will rebound and stave off recession?

A: No, there is not. Companies are going to be looking to cut costs as fast as they can to offset the shrinkage in sales, but also to help cope with tariffs. So no, the job market is actually surprisingly strong now. That means future data releases are probably going to get a lot worse. In April, we saw job gains in Health care, adding 51,000 jobs. Other sectors posting gains included transportation and warehousing (29,000), financial activities (14,000), and social assistance. I highly doubt any of these sectors will show gains next month.

Q: What about nuclear energy plays?

A: I like them, partly because people are buying stocks like Cameco Corp (CCJ) as a flight to safety commodity play, like they're buying gold, silver, and copper. But also, this administration is supposed to be deregulation-friendly, and the only thing holding back nuclear (at least new modular reactors) is regulation. That and the fact that no one wants to live next door to a nuclear power plant, for some strange reason.

Q: What do I think about natural gas (UNG)?

A: Don't touch. Don't buy the dip. All energy plays look terrible right here, going into recession.

Q: What are your thoughts on manufacturing returning to the U.S? And how will that affect the stock market?

A: I think there's zero chance that any manufacturing returns to the U.S. Companies would rather just shut down than operate money-losing businesses. You know, if your labor cost goes from $5 to $75 an hour, there's no chance anyone can make money doing that, and no shareholders are going to want to touch that stock. That is the basic flaw in having a government where no one is actually running a manufacturing business anywhere in the government. They don't know how things are actually made. They're all real estate or financial people.

To watch a replay of this webinar with all the charts, bells, whistles, and classic rock music, just log in to www.madhedgefundtrader.com , go to MY ACCOUNT, click on GLOBAL TRADING DISPATCH, then WEBINARS, and all the webinars from the last 12 years are there in all their glory.

Good Luck and Good Trading

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader

A significant proportion of my Mad Hedge subscribers are either retired or are about to do so. I have therefore gained from them a lot of valuable information about how retirees can best manage their financial resources, as well as the worst mistakes they commit, which I thought I might pass on.

I have also learned a lot by researching my own retirement, not that it will ever happen, but it’s nice to know what choices are out there. So, let me get on with the show.

1) Spend Like There’s No Tomorrow

Because there might not be a tomorrow. We all had parents who suffered through the Great Depression, so Baby Boomers (Those born between 1946 and 1962) are inveterate savers. They continue saving well after they retire, beyond any need to do so.

The cruel fact is that after the age of 80, it becomes physically impossible to do any expensive international travel. If you don’t believe me, try slinging some 50-pound suitcases onto a train in the three-minute window you’re allowed in Europe to board in the midst of a teeming mass of other passengers.

This is where the “4% Rule” kicks in. You should be spending, not saving 4% of your assets every year to support your lifestyle. If you don’t retire until the mandatory Social Security payout year of 72, that’s enough to last until you’re 97. After that, you become the responsibility of your children, your grandchildren, your great-grandchildren, or the state. Note: You have only a 2.68% actuarial chance of making it to 97.

I had four aunts who lived to over 105. Believe me, it’s no fun. You can’t see or hear, taste your food, or have sex. You need full-time care. And your kids start to die off. That’s not for me. I have told my own kids that if I ever reach that stage, take me on a long walk on a short pier and then pour my ashes into Lake Tahoe.

2) Invest Like a Retiree, not a 25-Year-Old

I have seen a number of my friends and clients completely change their investment styles once they quit work. When they have all the time in the world to trade, they become more aggressive and overtrade. They take on more risk than they can handle.

They also subscribe to other newsletters that lead them into disastrous strategies, like naked put selling at market tops. As a result, they morph from money makers to money losers, right when they can least afford to do so.

3) Not Claiming Social Security

Incredible as it may seem, some retirees don’t claim the Social Security benefits they deserve. This happens because they think that the amounts will be too small to be worth the trouble, they forget, or they think Social Security is already bankrupt, a common Internet conspiracy theory.

Social Security will allow you your senior moment and let you apply for benefits up to the age of 72 ½ and still get your full benefits. In my case, I applied at the last possible moment, and the Feds promptly sent me a check for $18,000. After that, you will lose them. Assuming you paid the maximum amount in Social Security taxes during your life, you should receive around $36,000 a year. This is indexed for inflation, with the 2023 payout rising by a generous 8.7%. Add this up over 20 years of compounding, and the total benefits can reach millions of dollars. As I tell my friends, you paid for it and deserve it, so take it.

4) Borrowing

One of the dumbest things I have seen retirees do is take out high-interest loans when they don’t need to. They do this by running up big credit card balances at 27% a year, coddling the above errant kids, buying the above-mentioned boat or plane, or picking up a second home where the fire or flood insurance is higher than the mortgage payment.

The best investment you can make is to pay off your own debt, reduce your leverage, and eliminate nontax-deductible interest payments. As a retiree, your life is about getting simpler, not more complex. My sole exception to this rule is if you are one of the millions who received a Covid-era 30-year government-subsidized loan with an interest rate near the long-term average inflation rate of 3%. I don’t mind going to the grave (or the lake) owing the government a few bucks.

5) Don’t Coddle Your Children

While I was in New York working for Morgan Stanley during the 1980s, I had a lot of free time on my hands during the day because the Tokyo market didn’t open until 8:00 PM local time. So, the higher-ups handed me a lot of odd jobs to make me look busy. I taught an international economics course at Princeton, where I met Game Theory Nobel Prize winner John Nash. I took clients from obscure places like Kansas and Arkansas (The Walls of Wal-Mart fame) to lunch at Windows of the World at the top of the old World Trade Center.

I was also called in to help out the kids of our largest clients. It seems becoming a billionaire takes a lot of time, and there is certainly no time to raise your own kids. They tried to atone for this lapse by giving their kids anything they wanted when they attained adulthood.

I ended up arranging cushy jobs, setting up meetings with politicians in Washington DC, scouting out Manhattan penthouse apartments, obtaining the best theater tickets, and even bailing some out of jail. I drew the line at buying drugs.

Over time, I observed that this excess coddling ruined these kids’ lives. They never developed careers, at best picking up expensive hobbies (like racing cars or falconry). They never learned financial responsibility, often investing in the failing startups of college buddies. Not a few died of drug overdoses.

The best favor you can do your kids is to train them well, invest in their education, provide a good role model, and let them stand on their own two feet. I have told my own kids that I plan to spend every penny I have and hope that the check to the undertaker bounces. If there’s any money left over, it’s an accident.

6) Dial Back Your Lifestyle

Remember that you are not Jeff Bezos or Elon Musk, the richest men in the world. Match your lifestyle to your income. A friend of mine once told me that when he retired, suddenly everything became expensive. Writing this from Florida, I can’t help but notice the vast number of boats, which a friend described as “A hole in the water you throw money into.” Many of these are parked in long-term moorings with barnacle-encrusted hulls because the owners can’t afford to sail them. I was a victim for many years of aircraft ownership, a “Hole in the sky you throw money into.” At least I could write these off as unreimbursed business expenses and claim the accelerated depreciation. The best case is to have a rich friend and borrow his boat. They’re usually unused.

7) How much is Enough?

I have surveyed many of my hedge fund friends as to the minimal amount of money needed to retire comfortably, and the number of $10 million keeps coming up. That covers 20% of any surprise medical expenses that Medicare won’t pay, $50,000 in the case of open-heart surgery. Sure, you could go to Mexico or Belize for much cheaper health care, as I have seen many do, but that wouldn’t be MY first choice.

Other surveys put the minimum retirement number at $1.46 million, and 40% more if you live in California. But remember, even if you own your home outright, home ownership costs are skyrocketing, such as for insurance, association fees, utilities, amenity associations, and repairs. The world is changing, and you need to bank for the unexpected.

Send me Your Suggestions

I have great confidence in the ability of my subscribers to make mistakes and blow money. After all, I make them, so why shouldn’t they? So, if you have any additional suggestions for the above, I’m all ears. Please email them in. I can make this a recurring piece that I update for the next 25 years.

Good Luck and Good Trading

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader

A Friend’s Boat

I like to start out my day by calling readers on the US east coast and Europe, asking how they like the service, are there any ways I can improve the service, and what topics would they like me to write about.

After all, at 5:00 AM Pacific time, they are the only ones around.

You’d be amazed at how many great ideas I pick up this way, especially when I speak to industry specialists or other hedge fund managers.

Even the 25-year-old day trader operating out of his mother’s garage has been known to educate me about something.

So when I talked with a gentleman from Tennessee in the morning, I heard a common complaint.

Naturally, I was reminded of my former girlfriend, Cybil, who owns a mansion on top of the levee in nearby Memphis overlooking the great Mississippi River.

As much as he loved the service, he didn’t have the time or the inclination to execute my market-beating Trade Alerts.

I said, “Don’t worry. There is an easier way to do this.”

Only about a quarter of my followers actually execute my Trade Alerts, and a lot of them are professionals. The rest rely on my research to correctly guide them in the management of the IRA’s 401(k)’s, pension funds, or other retirement assets.

There is also another, easier way to use the Trade Alert service. Think of it as “Trade Alert light.” Do the following.

1) Only focus on the four best of the S&P 500’s 101 sectors. I have listed the ticker symbols below.

2) Wait for the chart technicals to line up. Bullish long-term “Golden crosses” will set up for several sectors, as with precious metals now.

3) Use a macroeconomic tailwind.

4) Shoot for a microeconomic sweet spot, companies and sectors that enjoy special attention.

5) Increase risk when the calendar is in your favor, such as from November to May.

6) Use a modest amount of leverage in the lowest risk bets, but not much. 2:1 will do.

7) Scale in, buying a few shares every day on down days. Don’t hold out for an absolute bottom. You will never get it.

The goal of this exercise is to focus your exposure on a small part of the market with the greatest probability of earning a profit at the best time of the year. This is what grown-up hedge funds do all day long.

Sounds like a plan. Now, what do we buy?

(ROM) – ProShares Ultra Technology 2X Fund – Gives you a double exposure to what will be the top-performing sector of the market for the next six months, and probably the rest of your life. Click here for details and the largest holdings.

(UXI) – ProShares Ultra Industrial Fund 2X – Is finally rebounding off the back of a dollar that will slow down its ascent once the first interest rate hike is behind us. Onshoring and incredibly cheap valuations are other big tailwinds here. For details and the largest holdings, click here.

(BIB) – ProShares Ultra NASDAQ Biotechnology 2X Fund – With technology, this will be the other hyper-growth sector in the stock market for the next 20 years. How much is a cancer cure worth to stock valuations? Oh, about $2 trillion. A basket approach favors this notoriously volatile sector by rotating in new winners to replace losers.

(UYG) – ProShares Ultra Financials 2X Fund – Yes, after six years of false starts, interest rates are finally going up, with a December rate hike by the Fed a certainty. My friend, Janet, is handing out her Christmas presents early this year. This instantly feeds into wider profit margins for financials of every stripe. For details and the largest holdings, click here.

Of course, you’ll need to keep reading my letter to confirm that the financial markets are proceeding according to the script. We all know that sectors can rotate rapidly, as they have just done.

You will also have to read the Trade Alerts, as we include a ton of deep research in the Updates.

You can then unload your quasi-trading book with hefty profits in the spring, just when markets are peaking out. “Sell in May and Go Away?” I bet it works better than ever in 2024.

A huge new buyer may eventually enter the gold market.

That could be a year off, maybe two, or three at the most.

I’ll give you a hint who: your taxes will pay for it.

If true, it could send the price of the barbarous relic soaring above $5,000, or even $50,000 an ounce, a target long led by the tin hat Armageddon crowd.

When I spoke to a senior official at the Federal Reserve the other day, I couldn’t believe what I was hearing.

If the American economy moves into the next recession with rising inflation, a near certainty, its hands will be tied. It dare not cut rates for fear of further fanning the flames.

At that point, our central bank’s primary tool for stimulating US businesses will become utterly useless, ineffective, and impotent.

What else is in the tool bag?

How about large-scale purchases of Gold (GLD)?

You are probably as shocked as I am by this possibility. But there is a rock-solid logic to the plan. As solid as the vault at Fort Knox.

The idea is to create asset price inflation that will spread to the rest of the economy. It already did this with great success from 2009-2014 with quantitative easing, whereby almost every class of debt securities was hoovered up by the government.

“QE on steroids” would involve large-scale purchases of not only gold, but stocks, government bonds, and exchange-traded funds as well.

If you think I’ve been smoking California’s largest cash export (it’s not almonds), you would be in error. I should point out that the Japanese government is already pursuing QE to this extent, at least in terms of equity-type investments.

And, as the history buff that I am, I can tell you that it has been done in the US as well, with tremendous results.

If you thought that President Obama had it rough when he came into office in 2009, it was nothing compared to what Franklin Delano Roosevelt inherited.

The country was in its fourth year of the Great Depression. US GDP had cratered by 43%, consumer prices had crashed by 24%, the unemployment rate was 25%, and stock prices had vaporized by 90%.

Mass starvation loomed.

Drastic measures were called for.

FDR issued Executive Order 6102 banning private ownership of gold, ordering citizens to sell their holdings to the US Treasury at a lowly $20.67 an ounce.

He then urged Congress to pass the Gold Reserve Act of 1934, which instantly revalued the government’s holdings at $35.00, an increase of 69.32%. These and other measures caused the value of America’s gold holdings to leap from $4 to $12 billion.

Since the US was still on the gold standard back then, this triggered an instant dollar devaluation of more than 50%. The high gold price sucked in massive amounts of the yellow metal from abroad creating, you guessed it, inflation.

The government then borrowed massively against this artificially created wealth to fund the landscape-altering infrastructure projects of the New Deal.

It worked.

During the following three years, the GDP skyrocketed by 48%, inflation eked out a 2% gain, the unemployment rate dropped to 18%, and stocks jumped by 80%. Happy days were here again.

However, in the 21st-century version of such a gold policy, it is highly unlikely that we would see another gold ownership ban.

Instead, the Fed would most likely move into the physical gold market, sitting on the bid for years, much like it did in the 2010s Treasury bond market for five years. Gold prices would increase by a multiple of current levels.

It would then borrow against its new gold holdings, plus the 4,176 metric tonnes worth $40 billion at today’s market prices already sitting in Fort Knox, to fund a multibillion-dollar tax cut.

Yes, this all sounds like a fantasy. But negative interest rates were considered an impossibility only a few years ago.

The Fed’s move on gold would be only one aspect of a multi-faceted package of desperate last-ditch measures to resuscitate the economy at some point in the future. The time to start buying gold is RIGHT NOW!

Persistent urban legends and Internet rumors claim that the vault is actually empty or filled with fake steel bars painted gold.

That is, until Treasury Secretary Steven Mnuchin visited the vault on his way to view the solar eclipse at government expense in August 2017.

He says the gold is still there. But only if you believe Steve Mnuchin. A lot don’t.

We’ll never know for sure. Visitors are not allowed.

Last week, a concierge customer asked me an excellent question. Having correctly called the top in this market to the hour, what would it take for me to go all in on the long side and get maximum bullish?

With everyone now laser-focused on downside risks, which was really a last February game, I thought I’d take the opportunity this morning to examine the upside possibilities, if there are any at all.

Let’s say that the trade war ends before the ninety-day deadline is up on July 9, and the Chinese tariffs are reduced from a trade embargo of 145% to, say, only 20%. Markets will instantly rally 10%, with possibly half of that move happening at a market opening, so you can’t participate.

That is in effect, as what happened last week, with investors willing to look through the trade war to a less onerous business environment sometime in the future. A 20% tariff still takes the US growth rate down to zero, but it at least takes a recession off the table. Problem number one: Zero-growth economies don’t command high earnings multiples.

The problem with that scenario is that we hit a wall of selling above 5,800, where the late entrants came in but are now trying to get out, at close to cost. To get above that level, we need a really powerful fundamental bull case, which is now nowhere on the horizon. That’s why it’s unlikely that the stock market will see any positive returns for 2025.

The reality is that the trade war is not the only place where the economy has been driven off the rails. Even a 20% tariff brings substantially higher prices. International trade is falling off a cliff. Massive cuts in government spending are highly deflationary. Deporting large numbers of immigrants reduces demand and shrinks the labor supply. Unless Congress can pass a budget bill soon, we are on track to see an automatic $5 trillion tax increase by yearend. The budget deficit will hit a new record for this year.

Needless to say, companies will continue to sit on their hands with this amount of uncertainty and wait for the many unknowns to play out. None of these commands higher multiples for equities, let alone the near record S&P 500 multiple at 20X that prevails now.

To really get maximum bullish like I was for most of the last 15 years, the economy would have to return to the conditions that took stocks to record highs like we had until three months ago. That would be a globalized free-trading economy with the US playing a dominant role. That’s an economy that deserves high earnings multiples.

We won’t see that for at least four more years, but markets may start to discount it in only three years as we run up to the next presidential election in 2028. Imagine a future presidential candidate who campaigns on a zero-tariff regime and a return to globalization.

To get a sustainable multi-year bull market in stocks, it would help a lot if we started from a much lower base first. New bull markets don’t start at 20X multiples. A 16X multiple is much more likely, or 20% lower than we are now. We may get that.

The government is currently trying to break up three of the Magnificent Seven with antitrust actions, which led the march to higher stock markets for years. Corporate earnings are now rapidly shrinking, but we won’t see the hard numbers until August. Until then, we only get forecasts. Lower earnings command much lower multiples. That leaves on the table my 4,500 forecast low for the (SPX).