How the Cost of Energy is Going to Zero

A key part of my argument for a new Golden Age to take place during the coming Roaring Twenties is that the price of energy is going to zero.

It may not actually make it to zero. I’ll settle for a 90%-95% decline, which is good enough for me.

Take a look at the charts below.

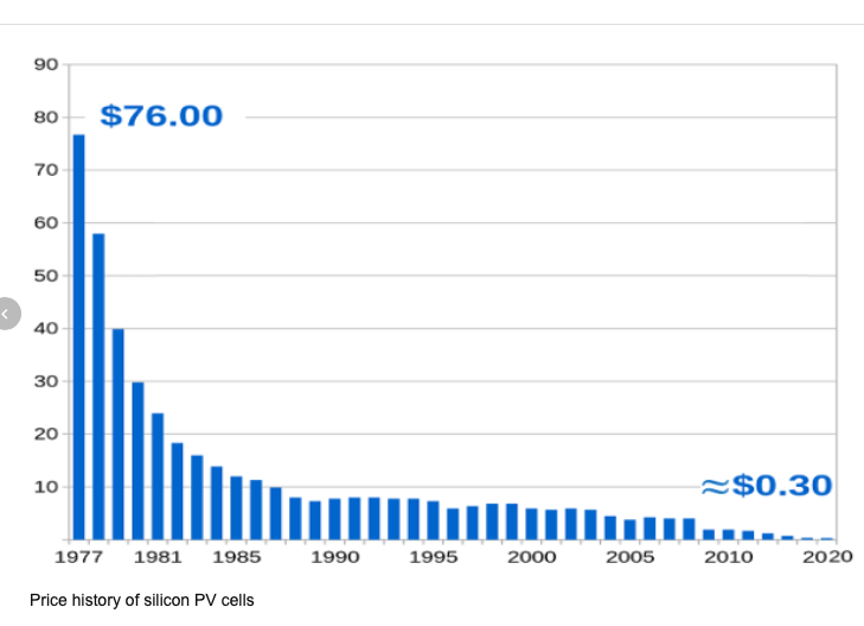

The first one shows how the price of a watt of solar-generated electricity has plunged by 99.60% since 1977, from $76.67 to $0.30.

Just in the past six years, retail prices for completed solar panels dropped by a staggering 80%.

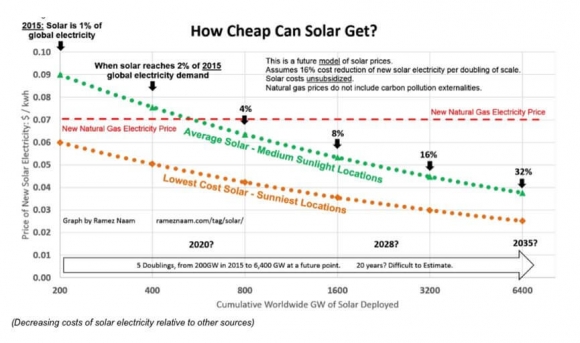

That is cheaper than electricity supplies generated by new natural gas plants, which now cost 7 cents per kWh.

Squeezing efficiencies out of our existing solar technology through improved software, production methods, chemistry, and design are nearly unlimited, and are expected to drive solar costs by half down to 3 cents per kWh by 2035.

And here is the great shortcoming of all these wonderful predictions. Technology NEVER stays the same.

My own SunPower (SPWR) panels with their Maxeon solar cell technology deliver an efficiency of 22.7%, the best on the market available 18 months ago. That means that convert 22.7% of the solar energy they receive into electricity.

SunPower is now producing 25.1% efficiency panels in the lab. Another research lab in Germany, Fraunhofer, is getting 44.7%.

And my friends at the Defense Department tell me they have functioning solar cells delivering 70% efficiencies. Whether they are economic and scalable is anyone’s guess.

(Warning: most cheap Chinese-made solar cells have only lowly 15% efficiencies, so don’t be tricked by any great “deals”).

And this is how most long-term predictions fall short.

Not only do they assume that technology doesn’t change, they fail to account for dramatic improvements in other related fields.

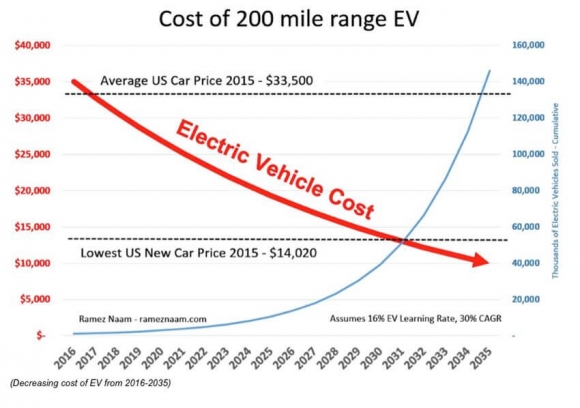

Electric car technology is a classic example. Battery costs are currently falling off a cliff.

When I bought the first Nissan Leaf offered for sale in California in 2010, the battery cost $833 per kilowatt. In 2012, I purchased a high-performance Tesla (TSLA) P85 Model S-1 at $353 per kilowatt. My last purchase in 2018 of a Tesla Model X P100D further dropped the cost to $150.

Efficiencies gained through the economies of scale from the Sparks, Nevada Gigafactory could take that down to under $100. From $833 down to $100, not bad.

However, that is not the end of the story.

The car industry will start to move towards carbon fiber in five years, which has five times the strength of steel at one-tenth the weight. The only issue now is mass production cost.

Some 67% of the weight of a Tesla S-1 is in the body, with the four motors at 13%, and the 1,200-pound lithium-ion battery at 20%.

What happens when the body weight falls by 90%? The battery weight, and cost decline by two-thirds. That cuts the effective cost of the battery to $66/kilowatt.

Add up all of this, and it is easy to see how energy costs can plunge by 90% or more. And it will happen must faster than you expect.

This has been the experience with memory costs, processor speeds, and hundreds of other technologies over the past half-century I have been following them.

I could go on and on.

This is why the State of California has mandated to get 50% of its energy from alternative sources by 2030. Some researchers believe an 80% target could be achieved. And it is doing this while closing its two remaining nuclear power plants.

To say that free energy would be a game-changer is a huge understatement.

The elimination of energy as a cost has enormous consequences for all companies. You can start with the energy-intensive ones in transportation, steel, and aluminum, and work your way down the list.

My bet is that you won’t recognize the car industry in 20 years. At a $66/kilowatt effective battery cost, it will make absolutely no sense to build internal combustion engines in new cars. Too bad Detroit is a decade behind in this technology.

Lose transportation, and you lose 50% of US oil consumption, or about 10 million barrels a day. Guess what that does to oil prices.

Goodbye Middle East and Russia.

The profitability and efficiency of the entire economy will take a great leap forward, much like we saw with the mass industrialization that was first made possible by electricity during the 1920s.

Share prices of all kinds will go ballistic.

Since energy costs will eventually fall effectively to zero, that wipes out the present business model of the entire electric power, coal, oil, and gas industries, about 10% of US GDP.

Their business models will be reduced to trying to sell something that is free, like air.

Dow 240,000 anyone?

For more about the economic rationale behind these predictions, please read my book, Stocks to Buy for the Coming Roaring Twenties.

Getting Ready for the 2020s

Enough Batteries to Operate Grid-Free Forever!