I’m Taking Off for the Year

I need a vacation.

I have been working nonstop for decades and desperately need a break. It seems that the older I get, the more I know, and the more in demand I become.

You can tear up your Rolodex card for me, unfriend me on Facebook, designate my email address as SPAM, and block my Twitter account. It won’t do you any good.

If I don’t take some time off, I am going to start raving MAD!

Over the last 16 years, I have worked the hardest in my entire life. And in the last two months, I have had to work with a bullet wound in my hip courtesy of the Russian Army in Ukraine. Whenever I have free time, I go fight a war. That’s who you want calling your trades.

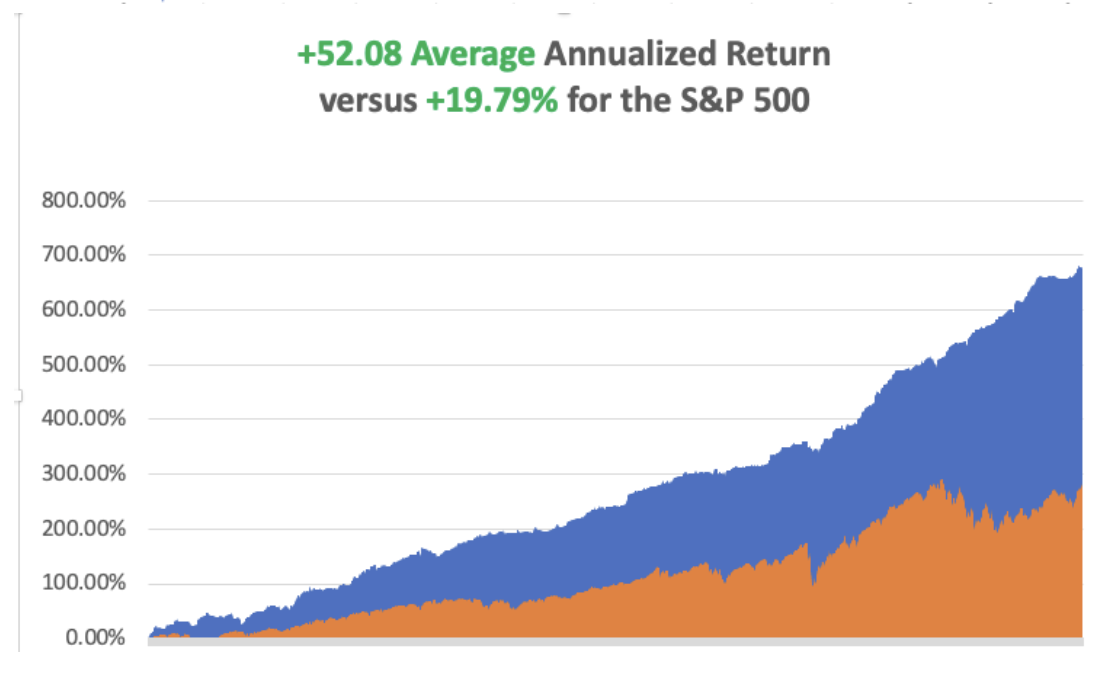

This year, I have brought in a total return of +79.44%, versus +24.32% for the S&P 500, far and away among the best of my life and almost certainly yours as well. If you got half of my performance, you beat virtually everyone else in the industry, even the best hedge funds. In other words, I underpromised and over-delivered….in spades.

If you wonder why I do this, it’s really very simple. Read my inbox and you would burst into tears.

Every day, I learn tales of mortgages paid off, student loans dealt with, college educations financed, and early retirements launched. I am improving lives by the thousands. That’s far better than any hedge fund bonus could offer me, although I wouldn’t mind owning the Golden State Warriors.

At this late stage in my life, the most valuable thing is to be needed and listened to. If that means becoming a cult leader, that’s fine with me. After all, the last guy to try this route got crucified.

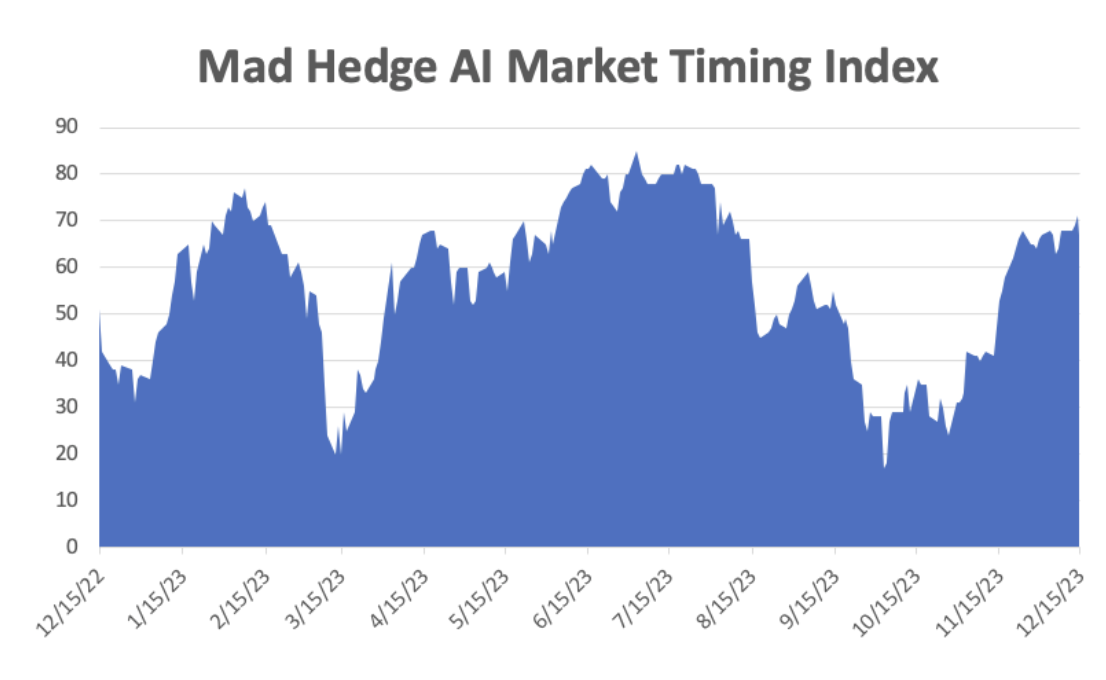

This year was challenging, to say the least. It started with a melt-up, then a banking crisis, then a snore, then a melt-up, then the biggest rally of all time, for both stocks and bonds. A $17 gain in (TLT) in a month? Really? I caught every move. We were all forced to become inveterate Fed watchers, much like 40 years ago.

When horrific uncontrollable wildfires broke out in California, I flew volunteer spotter planes for Cal Fire, holding the stick with one hand and a pair of binoculars with the other, looking for trouble and radioing in coordinates, and directing aerial tankers. Nobody can fly wildfires like I can.

I lost access to my Lake Tahoe house when the big fire hit right in the middle of a remodel. All the contractors disappeared chasing much higher-paying insurance work. At least we now have a 20-mile-wide fire break to the southwest of the house.

I have high hopes for next summer, starting with my seminar at sea on an Alaska cruise in June, another Matterhorn climb in July, client visits in Europe for August, flying Spitfires in England in September, and hiking the 170-mile Tahoe Rim Trail in October.

On top of all this, I was on speed dial at the Joint Chiefs and the US Marine Corps. A major? Really? And now I’m a major in two armies, the US and Ukraine. Seems you’re not the only one in desperate need of global macro advice.

The sanctions are working great by the way. Ukraine is winning, but slowly. The best compliment I received this year was when my commander in Ukraine told me I was the bravest man he ever met. I told him all Americans are like me. Whenever I enter the Marines Club in San Francisco, they call me a hero. In a building full of heroes, that is a big deal.

So, I will spend the next two weeks reading the deep research, speaking with old hedge fund buddies, the few still left alive, and trying to come up with a game plan for 2024. One thing is certain: we will likely make more money this year than next, the setup is so clear. We are at the beginning of a bull market that could last five or ten years.

Instead of sending out urgent trade alerts, emergency news flashes, and more research than you can read, I’ll be playing Monopoly and Risk, practicing my banjo, a catching up on some classic films.

I already have one trade-on: I’ll watch Elf for the millionth time if the kids watch Gary Cooper’s 1949 Task Force, The History of Naval Aviation (semper fi).

In the meantime, I’ll be running some of my favorite research pieces from the past over the next two weeks. Hot Tips will include the same.

We have had no snow at Tahoe so far. Pray for snow so I can use my senior season ski pass.

So, everyone please have some great holidays, spend your trading profits well, and get well rested.

We have some serious work to do in 2024.

Merry Christmas and Happy New Year,

John Thomas

CEO and Publisher

The Diary of a Mad Hedge Fund Trader

Selling Christmas Trees for the Boy Scouts