Inflation Could Affect Tech Stocks

Either way, accelerating inflation is coming back.

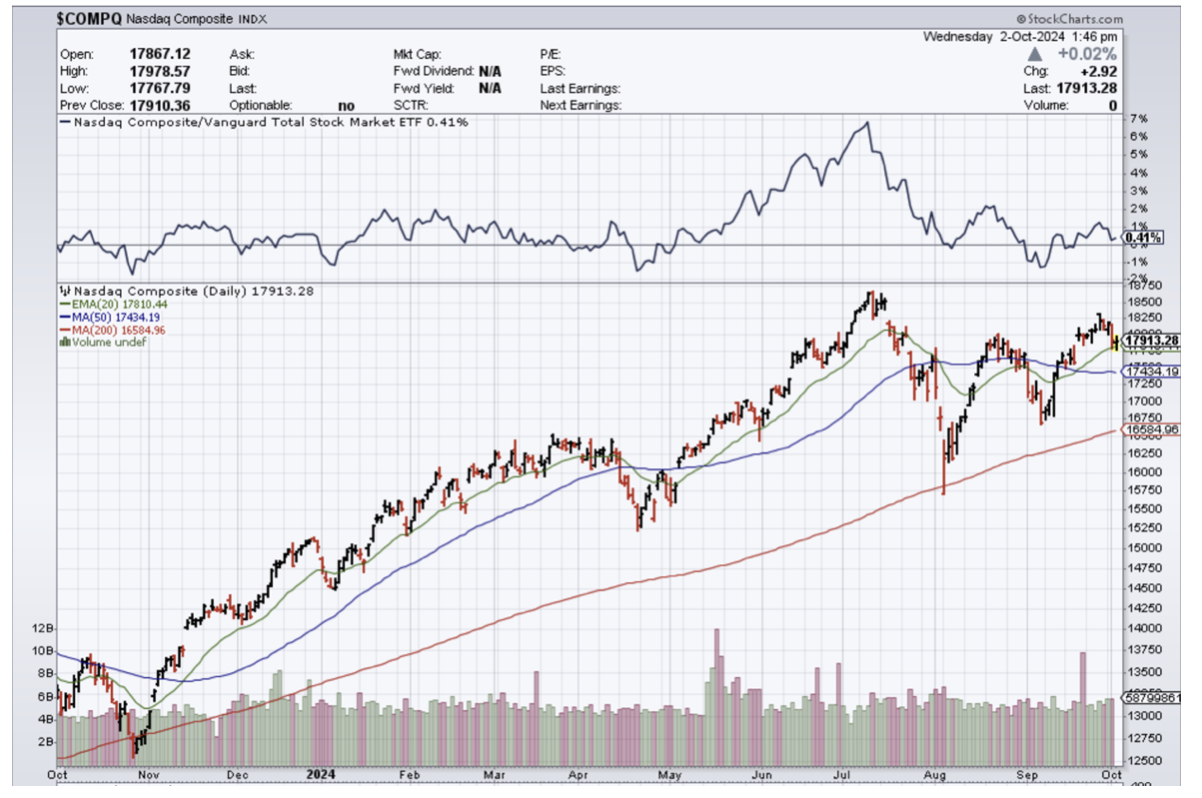

What does that mean for your tech portfolio ($COMPQ)?

It is complicated is the simple answer, and prices threaten to escalate because of the economic disruption ahead caused by the International Longshoremen's Association (ILA) protesting at 14 major ports along the East and Gulf coasts, halting container traffic from Maine to Texas.

This fight is first about pay but more about rejecting automation.

The action marks the first such shutdown in almost 50 years.

On Monday, USMX (United States Maritime Alliance) said it had increased its offer, which would raise wages by almost 50%, triple employers' contributions to pension plans, and strengthen health care options.

USMX has accused the union of refusing to bargain, filing a complaint with labor regulators that asked them to order the union back to the table.

The union wants to see per-hour pay increase by five dollars per year over the life of the six-year deal, which he estimated amounted to about 10% per year.

Imports in the US surged over the summer as many businesses took steps to rush shipments ahead of the strike.

She said more than 100,000 people could find themselves temporarily out of work as the impact of the stoppage spreads.

That would hit consumers and businesses which tend to rely on so-called "just-in-time" supply chains for goods, he added.

In case you are wondering, it takes an estimated 4-8 years to convert a port to full automation and between $500 million to $2B.

For reference, Shanghai’s Yangshan port took about 4-6 years from conception to full operations.

Yangshan’s port barely needs humans to operate, and it mostly down by a handful of IT guys behind computers.

They don’t need 50,000 people to do the job.

Clearly, the amount of job destruction is something that the longshoremen association is aware of and is actively fighting against modernization.

What it does mean is that Americans will pay higher prices.

Higher inflation will result in rising bond yield, which will strengthen the dollar.

Last time, the US dollar skyrocketed, tech prices rose during covid, and the rest of the equity market sank relative to big tech except energy stocks.

The USMX is fighting against any and all automation, shows the gaining power of unions in the United States.

Tech firms have been cutting staff in bunches and automating as fast as possible with AI.

With the possibilities of another covid-style shortage of many everyday goods, price inflation could return instantly, and that is very bad news for the S&P and Dow index.

The tech-heavy Nasdaq has proven that it fights calamities quite well and is durable in times of catastrophe, albeit if the electricity and keyboard are still functioning.

Ultimately, I see chaos happening and, at best, agreed on wage hikes that are not insignificant that will be passed on to the consumer.

From what I can understand, each time chaos rears its ugly head in the United States, tech somehow is unscathed in the aftermath and benefits.

If crazy wage increases are agreed on, get ready for another tech rally, and even if there is a long work stoppage, tech will gain over any other sector.

With interest rates dropping, it is hard not to see tech stocks experiencing a melt-up going into yearend, even if bond yields spike higher because of external events outside the realm of tech.

Automation is coming for all industries, and the longshoremen are trying to kick the can down the road at the expense of the end customer.

I am bullish tech going into Christmas.