Innovation Is The Savior

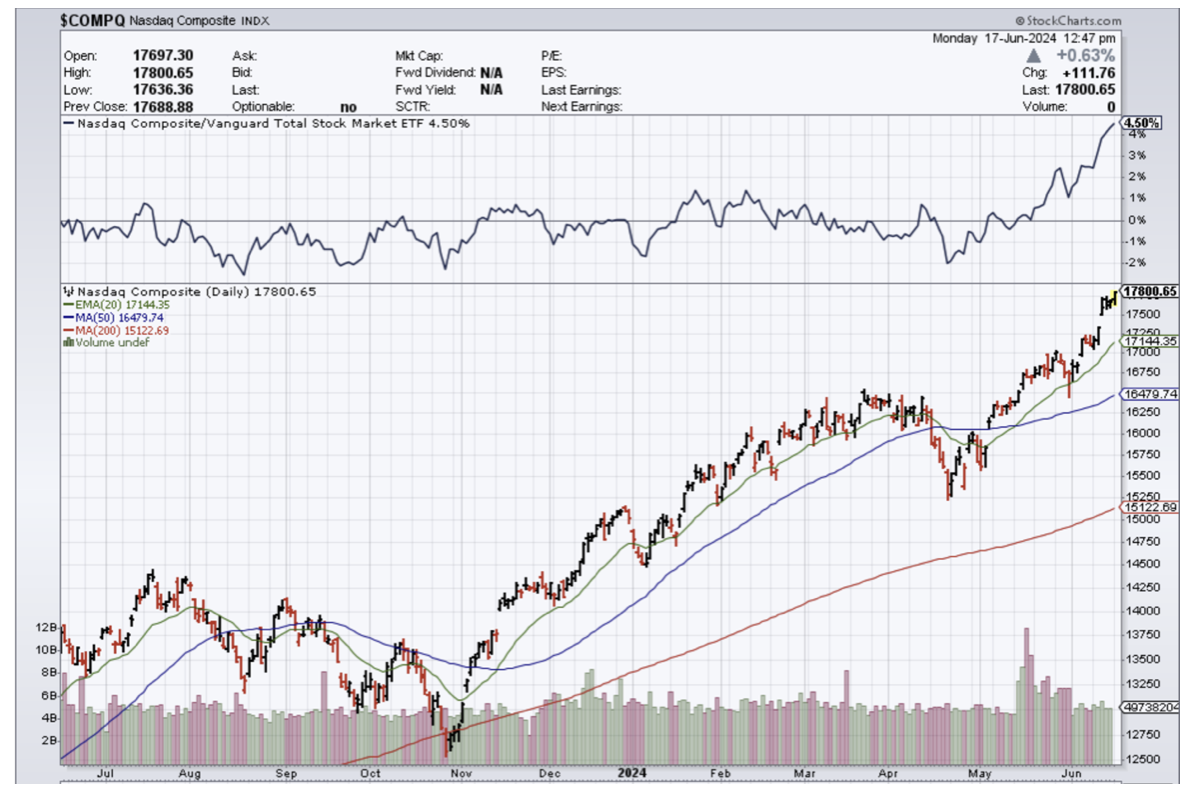

The only way out of the mountain of US Federal debt black hole is to innovate out of it via the tech sector ($COMPQ).

That is the only way.

A savior can only come in one form and that is it.

Nothing will forgive these trillions of debt and the pile is growing by the day.

The close to $35 trillion and counting will increasingly be a pain in the side of US businesses and that includes tech companies listed on the stock exchange.

Innovation leads to surging productivity manifesting in revenue gains that make it possible to dig ourselves out of this situation where interest expense drags us further down the rabbit hole.

Innovation has happened before to the US economy in the past like the gas-powered car and the creation of the internet.

It’s likely to happen again as well.

Instead of one big idea, it could come in the form of many solid yet meaningful gains.

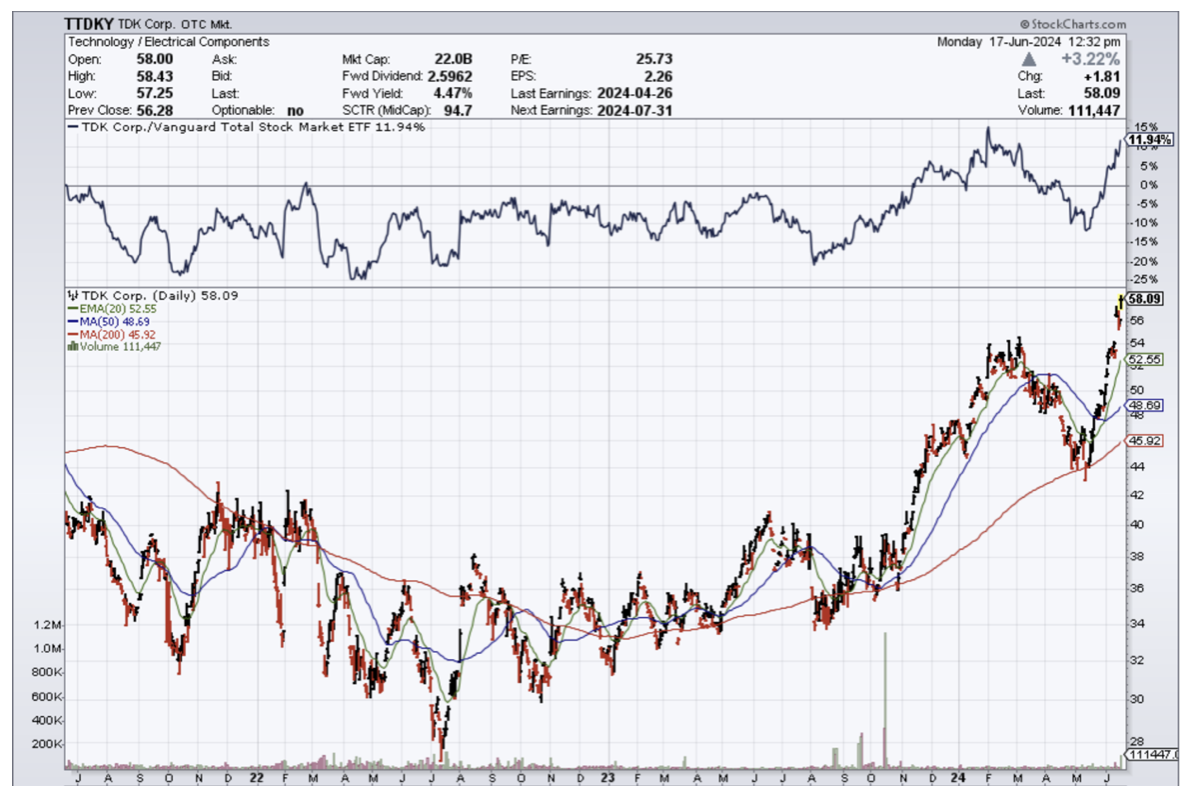

One just came in that could truly improve the productivity of American tech and that is from Japan’s TDK (TTDKY) which boasted a breakthrough in materials used in its small solid-state batteries.

The batteries set to be produced will be made of an all-ceramic material, with oxide-based solid electrolyte and lithium alloy anodes.

The high capability of the battery to store electrical charge, TDK said, would allow for smaller device sizes and longer operating times, while the oxide offered a high degree of stability and thus safety.

The breakthrough is the latest step forward for a technology industry experts think can revolutionize energy storage, but which faces significant obstacles on the path to mass production, particularly at larger battery sizes.

Solid-state batteries are safer, lighter, and potentially cheaper and offer longer performance and faster charging than current batteries relying on liquid electrolytes. Breakthroughs in consumer electronics have filtered through to electric vehicles, although the dominant battery chemistries for the two categories now differ substantially.

The most significant use case for solid-state batteries could be in electric cars by enabling greater driving range.

TDK, which was founded in 1935 and became a household name as a top cassette tape brand in the 1960s and 1970s, has lengthy experience in battery materials and technology.

The US federal debt is annualizing at a loss of $2 trillion at a time of full employment.

Imagine the devastation if we need to do quantitative easing again while already burning $2 trillion per year.

The number needed to pull us out of a recession could be $8-$15 trillion and that will come with a nasty set of inflationary outbursts.

The number of full-time jobs has fallen off a cliff and tech firms have cut the bloat.

It will be the ingenuity of tech companies like Japan’s TDK that will infuse the US economy will much-needed productivity.

I believe if the tech sector can keep peppering us with these breakthroughs in productivity, progress can supersede the out-of-control fiscal spending that has launched an uncontrollable bout of inflation in the US.

Remember that the top tech stocks in the world have been shielded from inflation only because they have hopped on the generative AI train.

For the rest of tech, inflation is hitting them like a sledgehammer between the eyes.

The biggest beneficiaries of cutting-edge innovation would be the share prices of the best tech stocks.

As it stands, tech will keep grinding higher in the current conditions, but better-than-expected innovation would shoot tech stocks to the moon and include a wide breadth of participation while putting a cap on inflation.