Insanity at CALPERS

Pension funds are famous for being slow rollers, usually taking the safest of safest routes to preserve capital and slowly grow asset portfolios.

The people they serve, the pensioner, should be a microcosm of what the fund is about.

This would make sense since the capital in the first place comes from employees and is meant to fund these workers after retirement.

Many people don’t know that modern pension funds serve a dual mandate of, not only doling out monthly stipends to old people, but playing the role of trader on the active markets.

American states and sovereign countries usually have massive pension funds which can move markets.

The board usually hires qualified and credentialed management to oversee funds...or do they?

So one might ask, what on earth is going on with the largest pension fund in America, representing the state of California CALPERS?

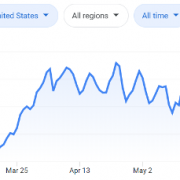

CALPERS increased its meme stock and movie theatre company AMC (AMC) stake this first quarter again.

Last year the institution loaded up on AMC and GameStop (GME).

During this time, the California Public Employees’ Retirement System (CALPERS) had sold an 11% stake in Palantir (PLTR).

CALPERS is betting the ranch on meme stocks, and that is scary news.

It obviously means that the bottom is not in since there is more dumb money flooding into the system.

Once we flush out the weak hands then it will signify rock bottom, but as long as we have CALPERS buying up meme stocks then it’s hard not to be bearish.

Even more baffling was the decision to sell an extreme amount of Netflix (NFLX) after colossal losses.

Netflix stock is down almost 69% this year-to-date and it dropped 38% in the first quarter of 2022 alone.

Taking a major loss in Netflix only to roll money into GameStop and AMC is seriously what the California state pension fund is doing.

This is no joke.

At least they don’t own cryptos like Dogecoin or Shiba Inu coin.

I am not sure exactly what their plan is but movie theatre watching is dead.

Perhaps, CALPERS plan to offer their retirees free movie tickets along with a depreciating amount of monthly pension.

Suspicion runs deep into who is making decisions at the helm and that is the CEO of CALPERS Marcie Frost.

She spent 30 years as a public servant in Washington state. Her early leadership roles were in human resources with an emphasis on employee benefit programs and information technology.

In 2013 Marcie was named cabinet lead by Washington State Governor Jay Inslee for the Results Washington performance and accountability system, where she served as an early creator and architect for the platform that tracks goals and progress in education, the state's economy, sustainable energy, healthy and safe communities, and efficient government.

Basically, she has no idea about the stock market yet she is CEO of the biggest pension fund in America.

Her role as tracking the “progress in education” is somehow supposed to transfer over to stock market overperformance.

This screams a breach of fiduciary duty and it could end up in tatters for CALPERS.

CALPERS has been infamous for terrible management decisions and Marcie’s predecessor breached conflict of interest mandates by investing in Los Angeles real estate that he has an interest in.

Clearly, the board of CALPERS favors crony capitalism as a management style.

Any 14-year-old student would know under no circumstance, should a pension fund choose to voluntarily speculate on high-risk assets.

Is it really a thirst for yield?

If CALPERS blows up and is forced to mass unwind, don’t forget this story.