January 18, 2011 - All That is Gold Does Not Glitter

Featured Trades: (GOLD), (GLD), (DGZ), (GLL)

1) All That is Gold Does Not Glitter. In the wake of gold's panic inducing $30, one day sell off on Friday, players across the hedge fund universe are reassessing their relationship with the barbarous relic. What started out as a long term commitment is suddenly morphing into a short term fling, or maybe even a one night stand.

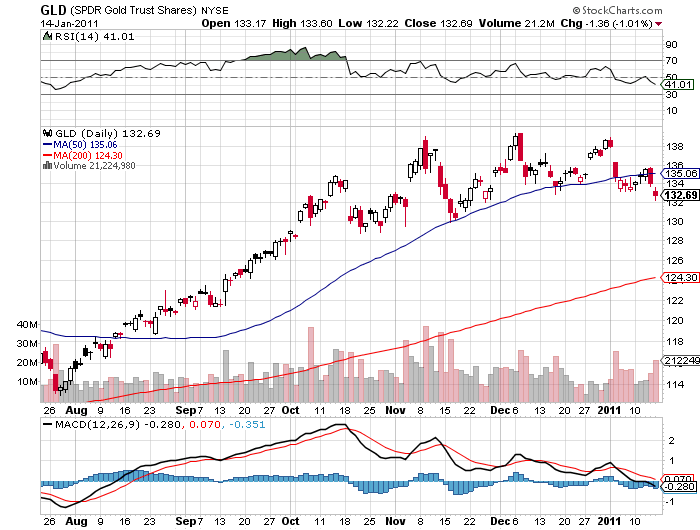

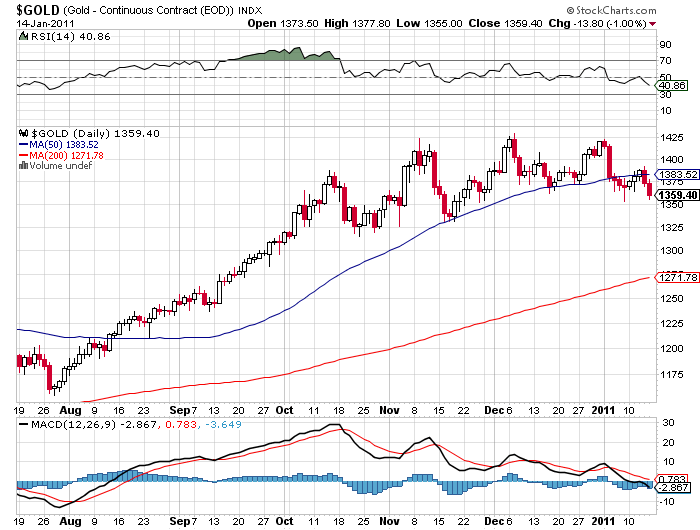

The yellow metal is now down $80 from its $1,450 peak set only two weeks ago. The technical analysts among you will recognize the chart as screaming a 'head and shoulders top', which bodes ill for short term price movements. It has definitively broken the 50 day moving average at $1,383, and you can bet that many traders spent the three day weekend gauging their tolerance for additional pain.

Gold is now facing some daunting challenges. High prices have cause scrapping of old jewelry to quadruple, unleashing fresh new supplies on to the market. Have you received a torrent of 'come ons' from websites offering to buy your old gold? That's what I'm talking about. Rising interest rates are also adding some tarnish, as gold yields nothing, and costs money to store and insure. A panoply of new gold related ETF's have diverted buying away from the physical metal towards paper surrogates.

It is no longer a secret that gold is one of a few places to protect your wealth from the coming surge in inflation that Ben Bernanke's printing presses assure. So by now, everybody and his brother are in on the trade with a big fat long position. I am a firm believer in the 'canoe' theory of investment management. If too many people bunch up on one side of the craft, the whole thing tips over. Finally, gold failed my 'cleaning lady' test. When Cecelia started asking me how to buy Mexican gold pesos, I knew it was time to start entertaining short plays.

Gold has been on a tear for the last seven months, rising by a thrilling 28% in a year, much of it powered hedge fund money of the hottest sort. So a serious bout of profit taking is way overdue. With US equities, particularly financials and tech stocks, the flavor of the day, you can count on many of them to take profits on the yellow metal and reallocate to paper assets. The fact that the world is now solidly in a 'RISK ON' mode also solidly favors some gold liquidation.

The easy target here is the October support level of $1,320, down $40. If we get some good momentum going, traders will start throwing up on their shoes, and we could touch the 200 day moving average at $1,270. My friend, technical analyst to the stars, Charles Nenner, thinks that in a worst case scenario at gold could plunge to as low as $1,000 (click here for my radio interview).

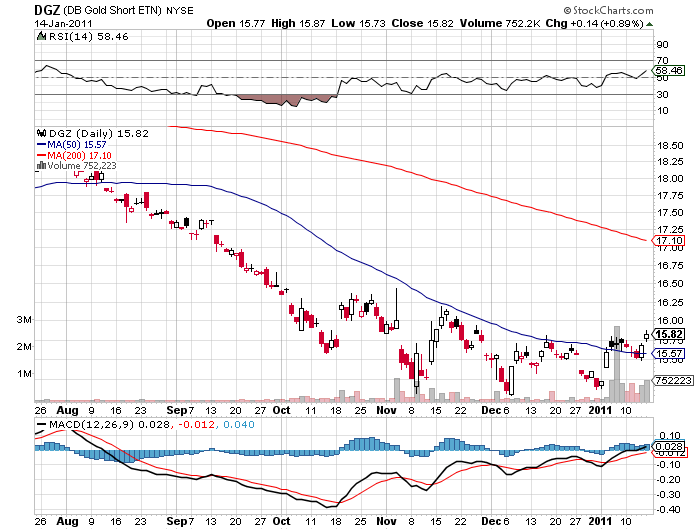

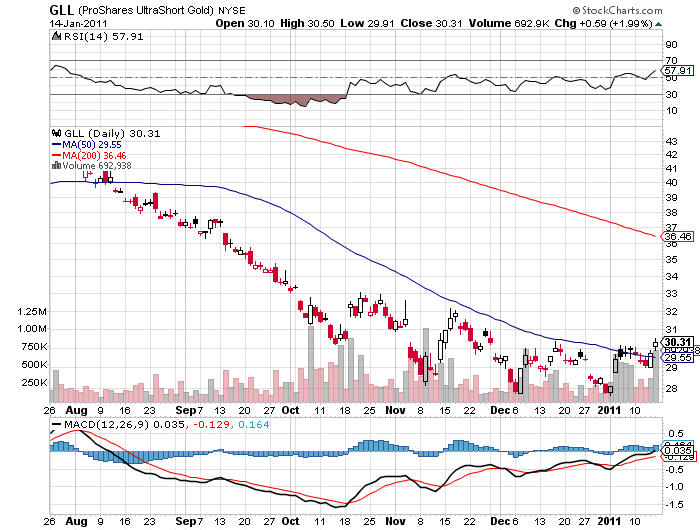

Thanks to the yellow metal's recent popularity, the are a profusion of instruments with which you can play the downside. You can buy the 1X bear gold ETF (DGZ), or the 2x version (GLL). You can short gold futures on the CME.

I am going to go for the easy money here and try to capture a $4 bite of the down move of the main gold ETF (GLD). With $57 billion in assets, it is the world's second largest ETF, right after the (SPY). It is ripe for some profit taking. Last week, it saw 16 tons of sales worth some over $700 million. It will be interesting to see if the ETF can handle liquidations on this scale, whether it might trigger a total melt down in gold, and how many camels you can fit through the eye of a needle.

The set up that best works here is the $132-$128 put spread. This involved buying the March $132 puts for $3.65 and going short an equal amount the $128 puts for $2.15 to cheapen my cost of admission. $128 in the (GLD) equates to the $1,320 October support for the spot physical metal. The position reaches maximum profitability with a print at or below $128 in the (GLD) on March 18. That would bring in a gain of $2.50, or a return of $166% in two months.

If the geopolitical situation suddenly worsens, and it's off to the races for gold again, then you lose your $1.50. The great thing about spreads like this is that your risk is quantifiable and limited, so you can sleep at night. No sudden black swans are going to wipe you out overnight, as outright short positions in the futures or the ETF can.

Mind you, I think gold is still going up long term, and that the old inflation adjusted high of $2,300 is a chip shot in a couple of years (click here for 'The Ultra Bull Case for Gold'). This is just a little counter trend scalp to keep me from falling asleep this afternoon that might be good for a few weeks or months.

-

-

Suddenly, Gold Has Acquired a Bitter Taste

-

-

-

The Gold Peso