January 3, 2024

(WE COULD SEE A SECULAR BULL MARKET FOR THE NEXT DECADE)

January 3, 2024

Hello everyone,

It’s the question on everyone’s lips – will this rally continue throughout 2024 and beyond?

One Bank seems to think so, and that bank is Deutsche. And they are not allowed in this bullish outlook.

Deutsche sees the S&P 500 rallying 11% to a record high next year and has a 2024 year-end target of 5,100 on the S&P500. It incorporates expectations of a mild, short recession that has been pulled forward.

In its most bullish case, Deutsche expects the S&P500 could climb to 5,500 or more than 20% above where the benchmark closed last.

The bank notes that the S&P 500 has been in a clear trend-up channel since the Great Financial Crisis. Jim Reid, London-based head of global economics and thematic research points out that after falling below last year, the rally in the first half this year took it back up to the bottom and it has been muddling along at the lower end since. A continued muddle through along the bottom implies 5300 by the end of 2024, while a move to the middle to 6000.

Deutsche expects markets have already priced in concerns around higher interest rates and geopolitical risks and argued that any sell-off from a possible recession would be short-lived and mild.

Historically, equities typically rally in the aftermath of a U.S. presidential election, set for next November. Reid expects a sizeable potential upside risk from tight labor markets may bolster productivity by encouraging the adoption of new technologies such as generative artificial intelligence.

The German bank remains neutral on mega-cap growth and technology stocks, citing elevated valuations after their rally this year. Going forward, the bank recommends overweight positions in financials and consumer cyclicals (AMZN, HD, TSLA, MCD, AAPL) that could bounce back after their recent weakness and remain neutral on energy while turning overweight on materials. It remains underweight in defensive stocks until it sees falling bond yields coupled with recession fears.

Deutsche Bank sees the rally this year continuing into 2024 and beyond and makes bold 2024 year-end targets.

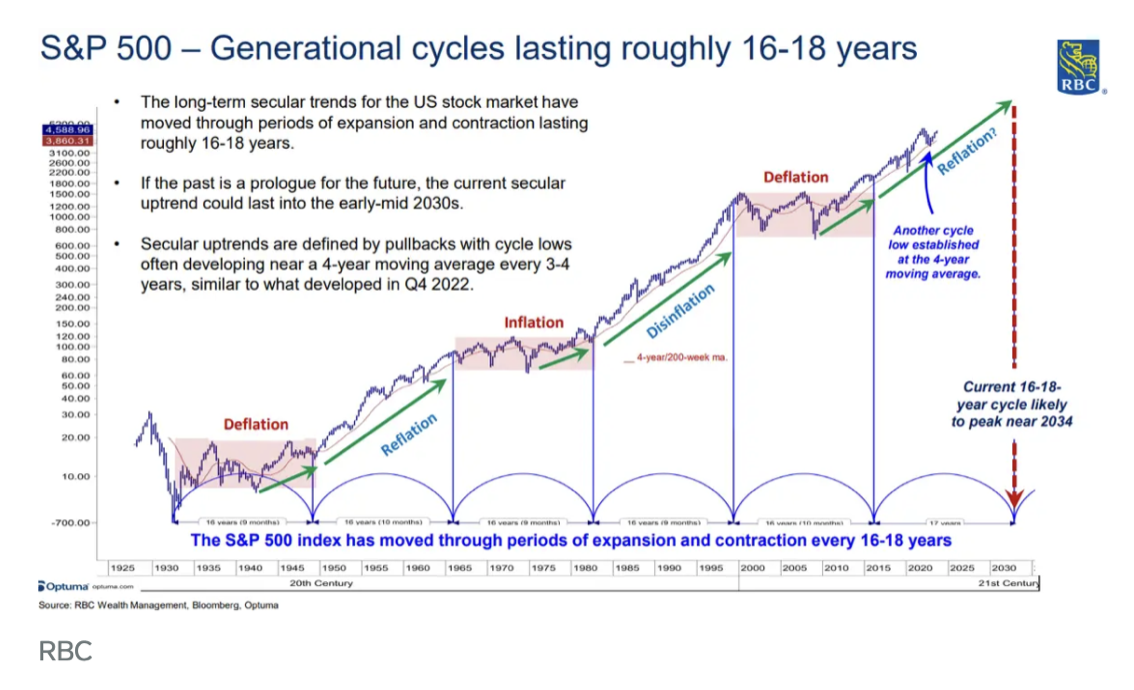

According to RBC technical analyst Robert Sluymer.

The stock market has surged nearly 20% this year, but the rally could be part of a larger secular bull market cycle that sends the S&P 500 to 14,000 by 2034.

Sluymer maintains and argues that the long-term secular trend for US equity markets remains positive with an underlying 16-to-18-year cycle supportive of further upside into the mid-2030s, potentially to S&P 14,000.

Sluymer’s forecast for the S&P 500 to trade as high as 14,000 by 2034 represents a potential upside of 209% from current levels or an average annualized gain of just under 10% over the next 11 years.

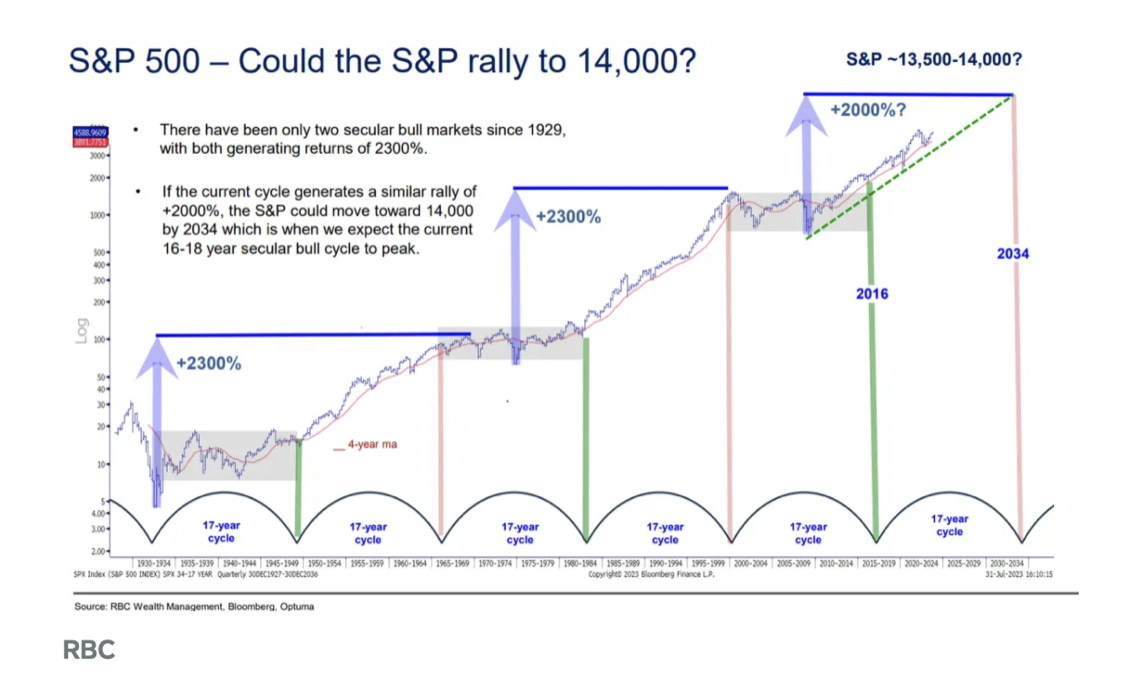

Sluymer looked at a long-term chart of the S&P 500 going all the way back to the Great Depression in 1929. Since then, there have only been two secular bull markets, with one occurring during the 1950s and 1960s, and another occurring during the 1980s and 1990s.

Both generated total returns of about 2,300%.

Sluymer points out that if the current cycle generates a similar rally of +2000% the S&P could move toward 14,000 by 2034 which is when we expect the current 16-to-18-year secular bull cycle to the peak.

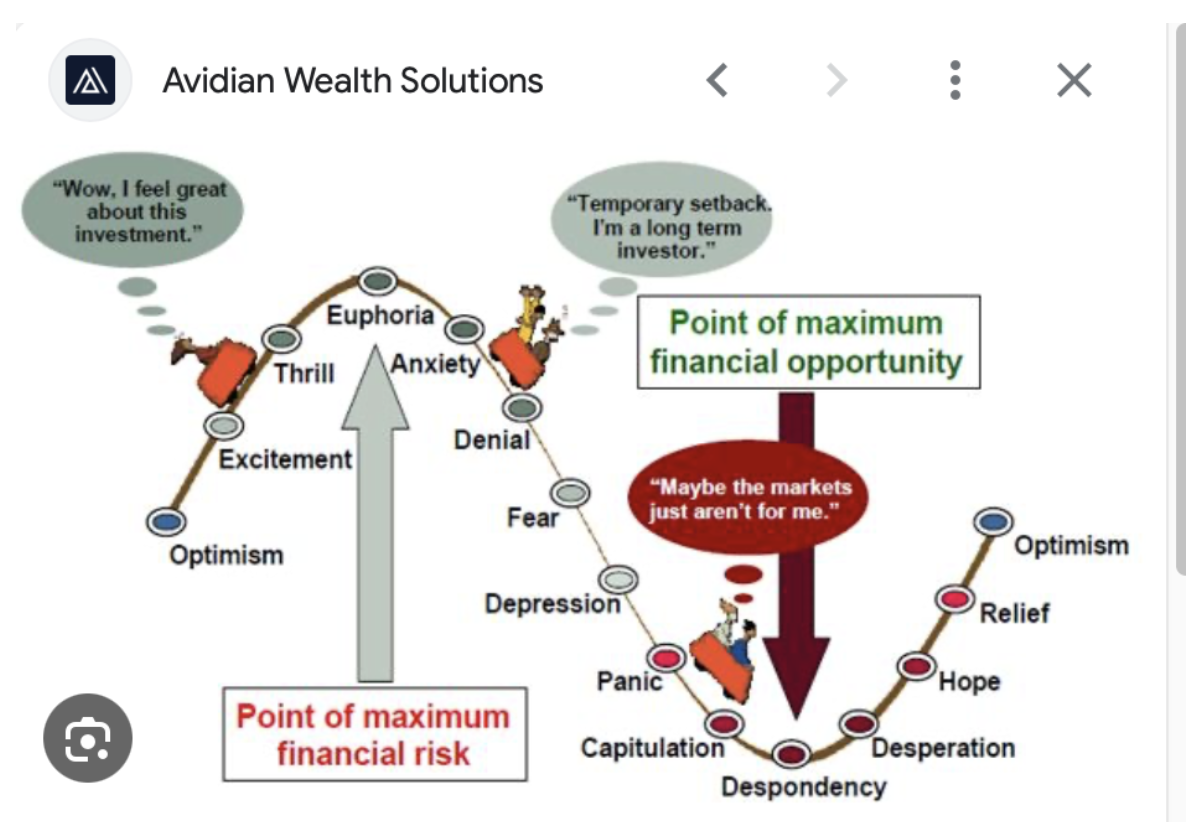

Between now and 2034, Sluymer advises long-term oriented investors to lean bullish and view selloffs in the stock market as opportunities to increase exposure to secular and cyclical growth stocks, including industrials.

In a nutshell, Sluymer recommends long-term investors stay the course and remain optimistic.

Cheers,

Jacquie