Japan Downgrade Sends Yen Reeling

The next step has been taken in the coming Japan crisis. American ratings agency, Fitch, has downgraded Japanese government debt to A+, with a negative outlook. The move cut the knees out from under the country?s dubious currency, sending it down sharply.

Fitch expects the country?s debt to reach a nosebleeding 240% of GDP by year end, far and away the largest of any major country. That makes our own 100% debt to GDP look paltry by comparison. The Mandarins in Tokyo have been able to finance this enormous debt through a whole raft of financial regulations that limit local institutions to investing a large portion of their assets in Government bonds.

Regular readers of this letter are well aware that the asset base of these institutions is about to shrink dramatically due to the death through old age of the country?s primary savings generation. The problem is that there is not another generation of savers to follow them. An average growth rate of 1% for the last 22 years, and a ten year government bond yield that has hovered around 1% since 1995 mean that no one has accumulated new savings for a very long time. It is just a matter of time before the country runs out of money. In the meantime, government borrowing for perennial stimulus packages continues to skyrocket.

How long it will take this house of cards to collapse is anyone?s guess. My old friend, retired Japanese Vice Minister of Finance, Eisuke Sakakibara, otherwise known as ?Mr. Yen?, thinks that is still five years away. Hedge fund legend, Kyle Bass, says that it should have started in April. The timing of the onset of this looming financial crisis is now a subject of endless analysis by the hedge fund industry, and will be one of the big investment calls of the coming decade.

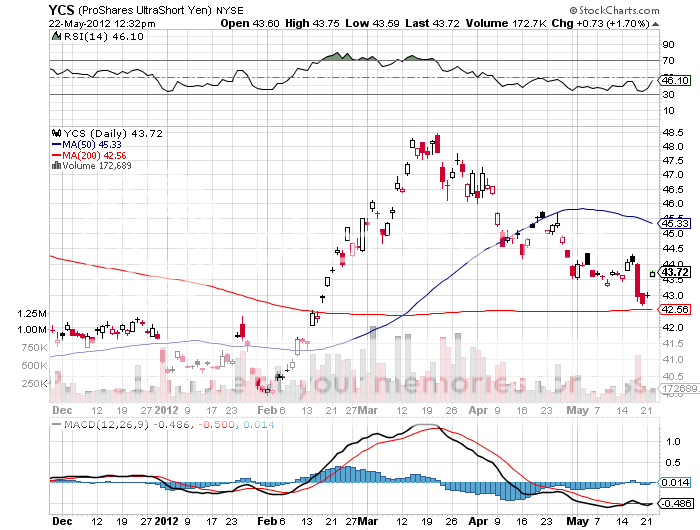

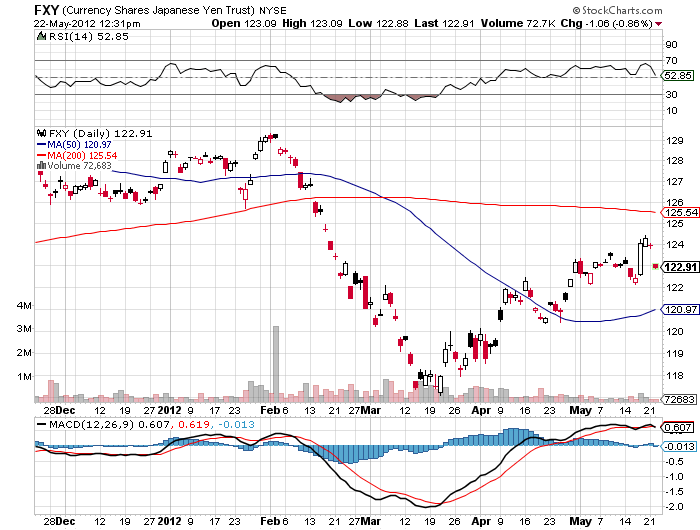

This is why I am running a major short position in the yen through the (FXY), and frequently am involved in the double short yen ETF (YCS). When the sushi hits the fan, you can count on this beleaguered currency to fall to ?90, then ?100, then ?120, and finally ?150. This gets you 200% potential gain on the (YCS). Us the recent ?RISK OFF? run to establish shorts in the yen at great prices.

Time to Sell the Yen?